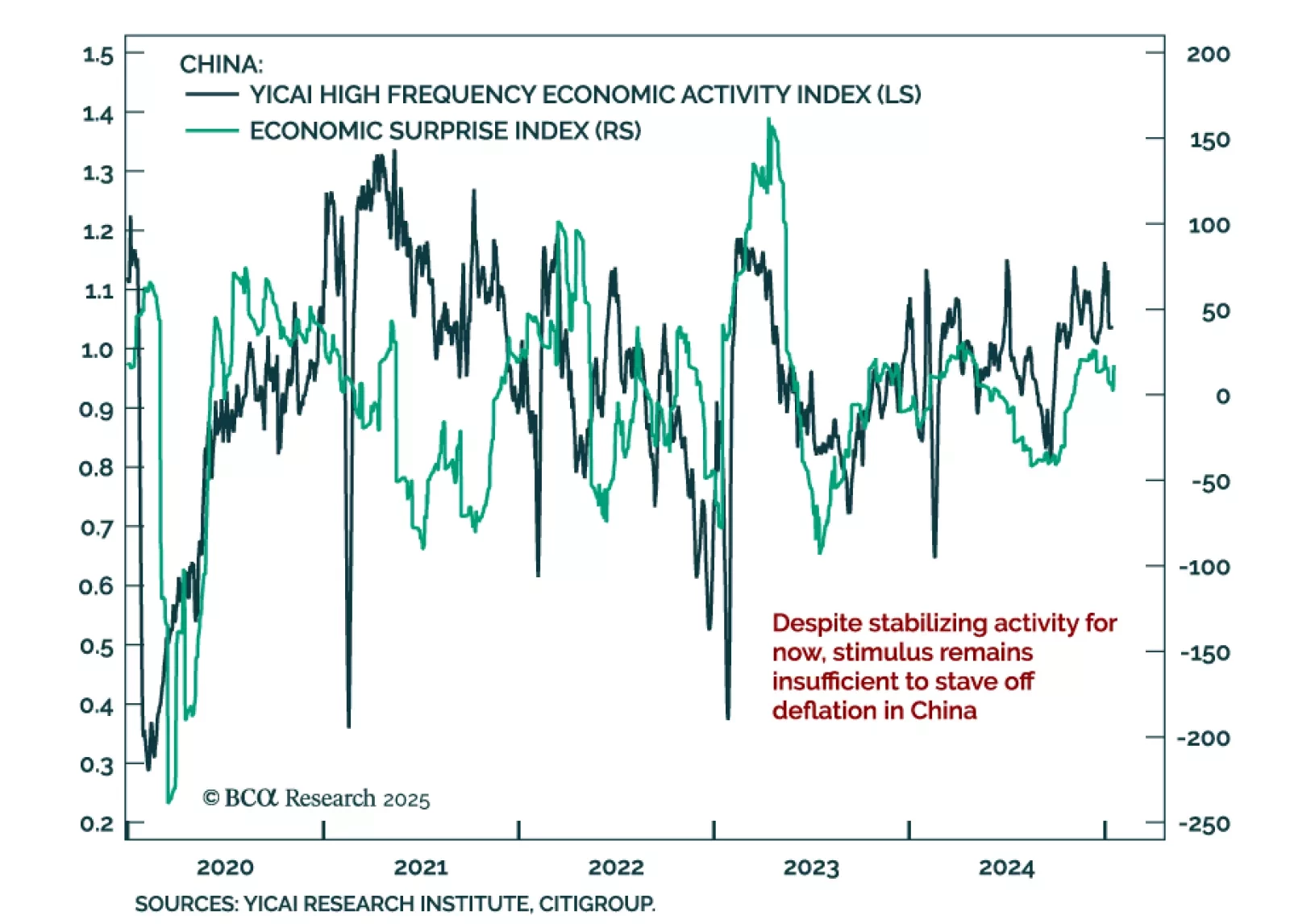

Chinese activity was decent in December, with GDP growth topping the 5% target for 2024. Industrial production growth ticked up to 6.2% y/y from 5.4% in November. Retail sales also picked up, increasing to 3.7% from 3.0% a month…

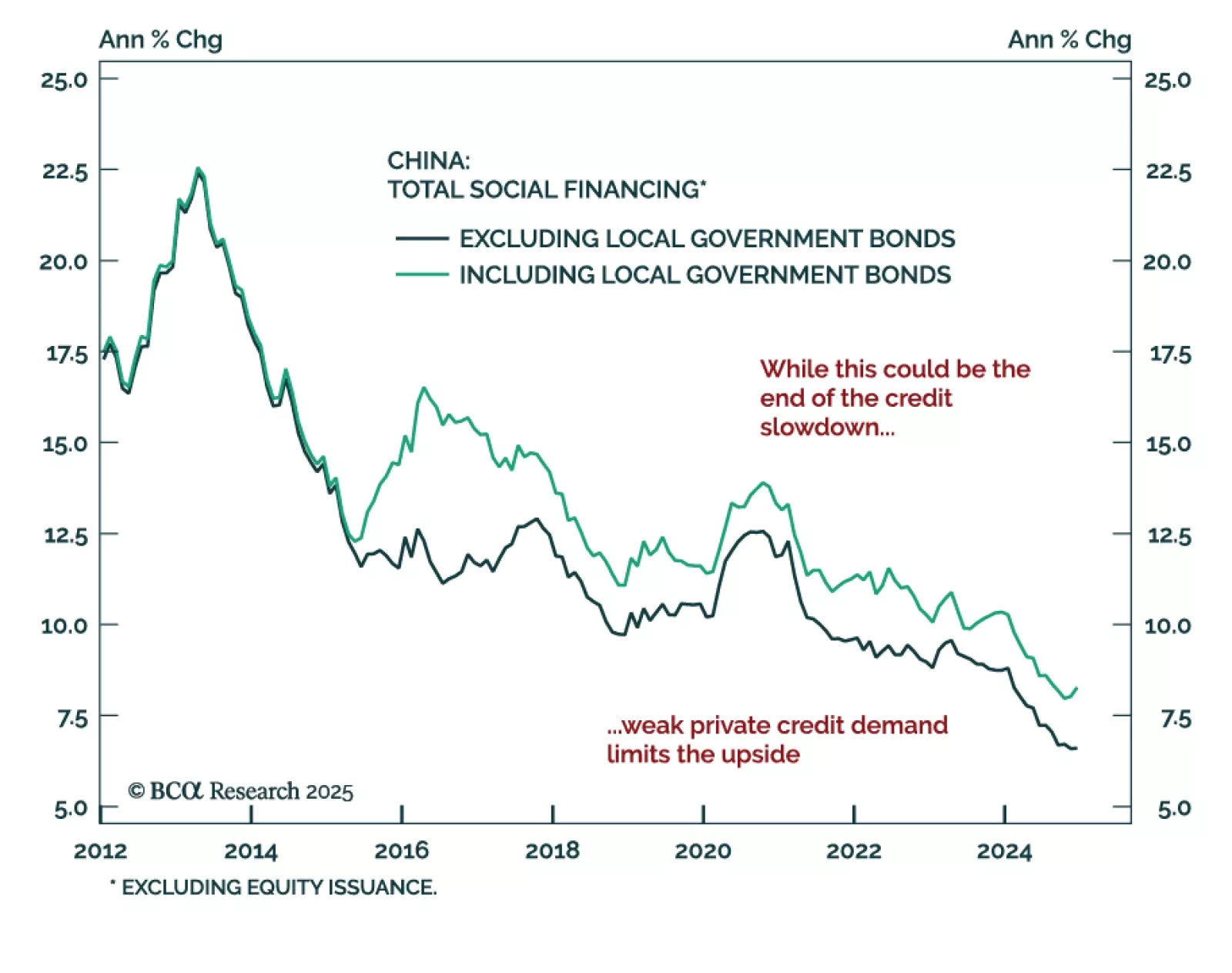

China’s monetary and credit data was relatively strong. New yuan loans increased more than expected, as did aggregate financing. M2 met estimates at 7.3% y/y. As was the case for trade in December, seasonality plays a big role…

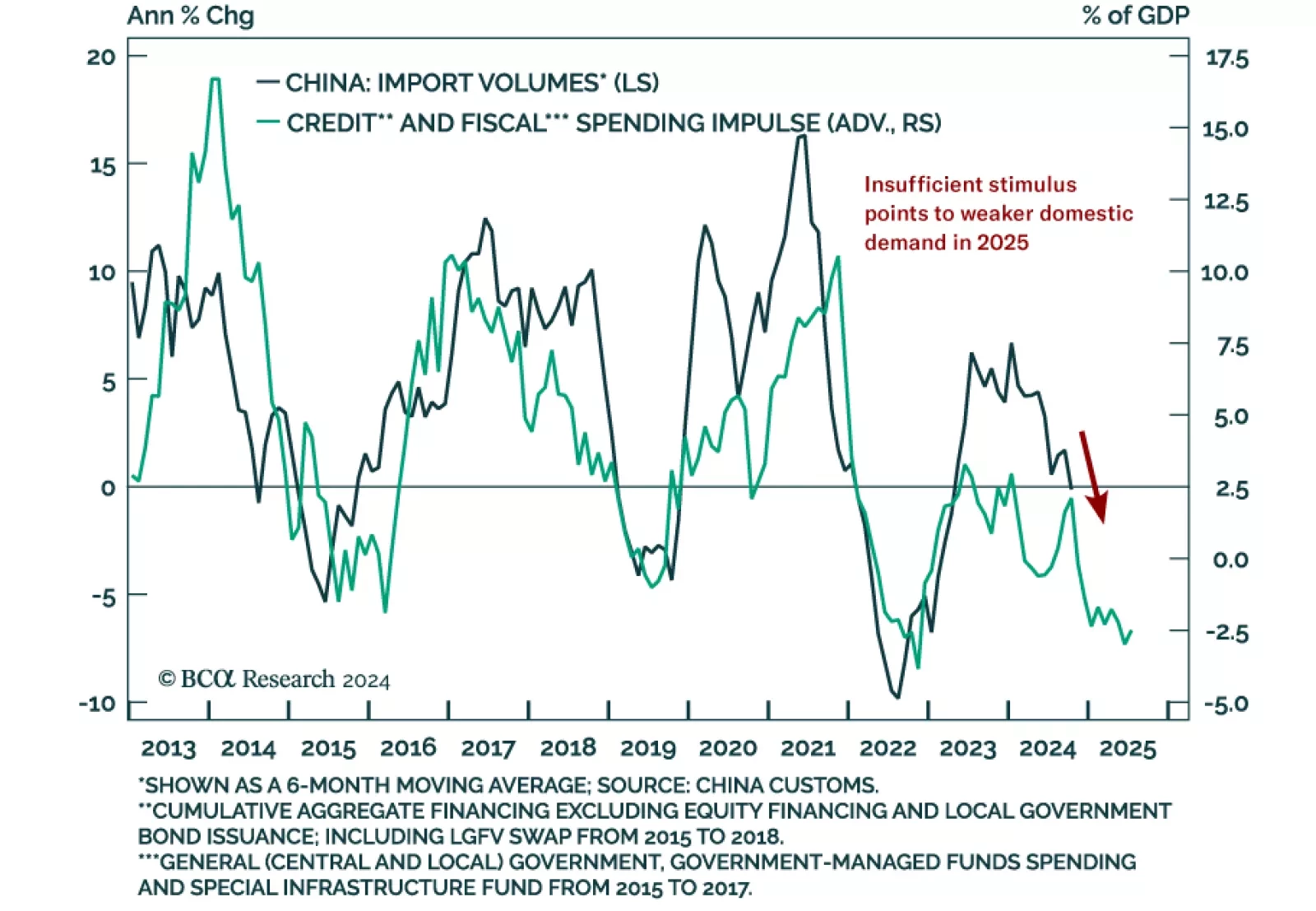

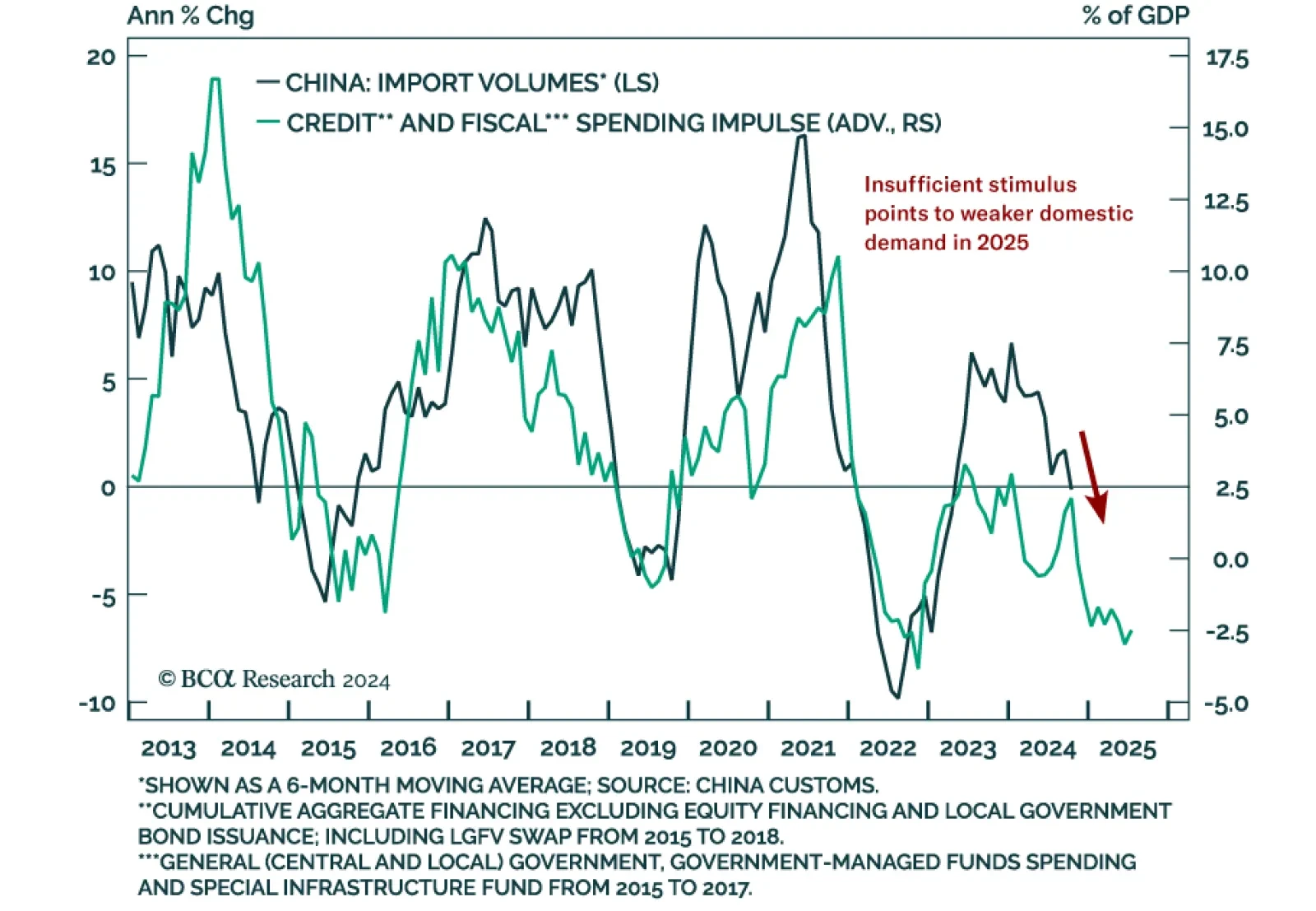

China’s November monetary and credit data were disappointing. New yuan loans increased by 580 bln, nearly half the expected amount. Total social financing rose by 2.3 tln instead of the expected 2.7 tln. Finally, M2 growth slowed to…

China’s November monetary and credit data were disappointing. New yuan loans increased by 580 bln, nearly half the expected amount. Total social financing rose by 2.3 tln instead of the expected 2.7 tln. Finally, M2 growth…

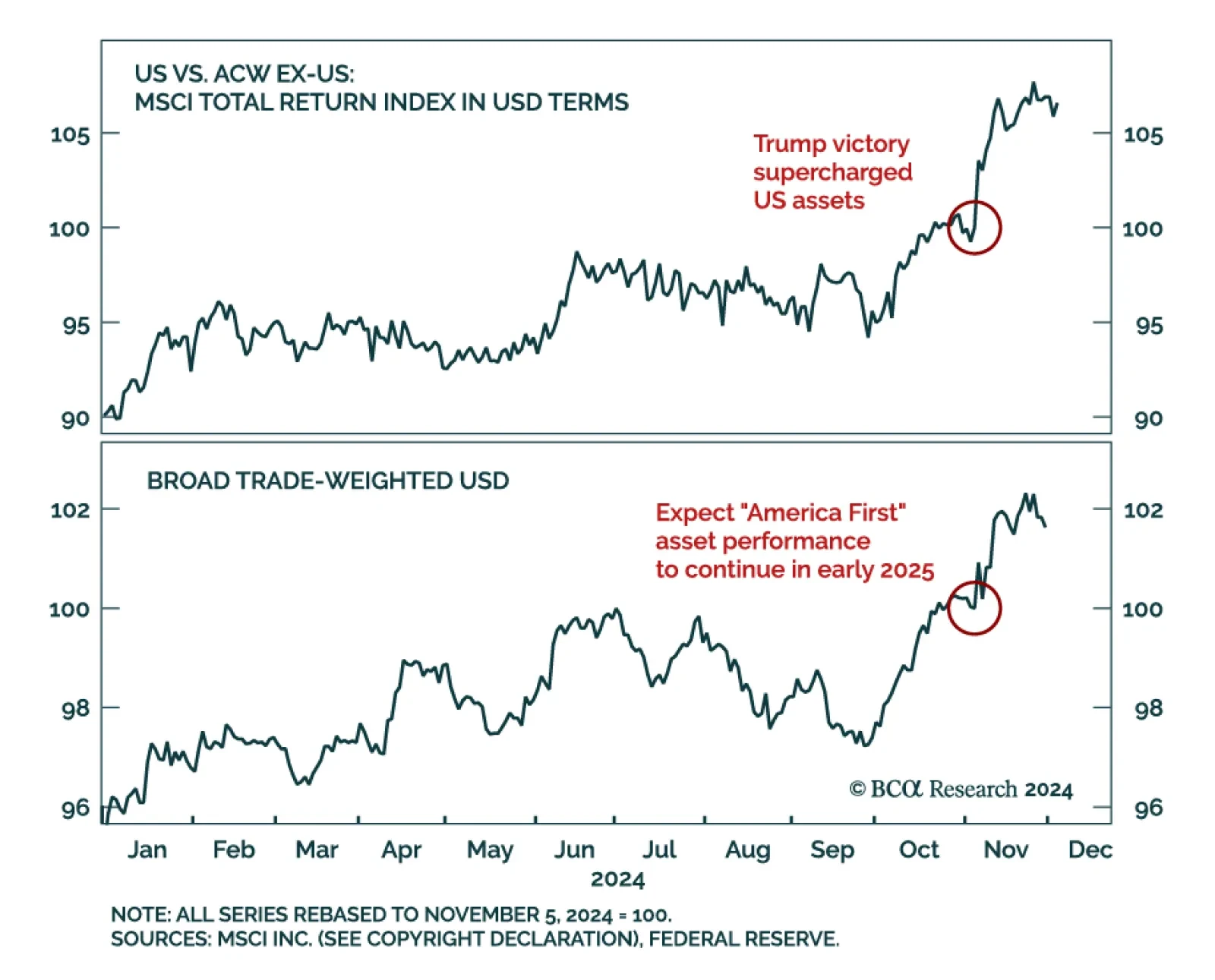

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

Our GeoMacro Strategy service published their 2025 outlook, and they see three peaks shaping the year: Peak fiscal, peak-deglobalization, and peak geopolitical risk. In 2024, our colleagues’ bullish economic outlook…

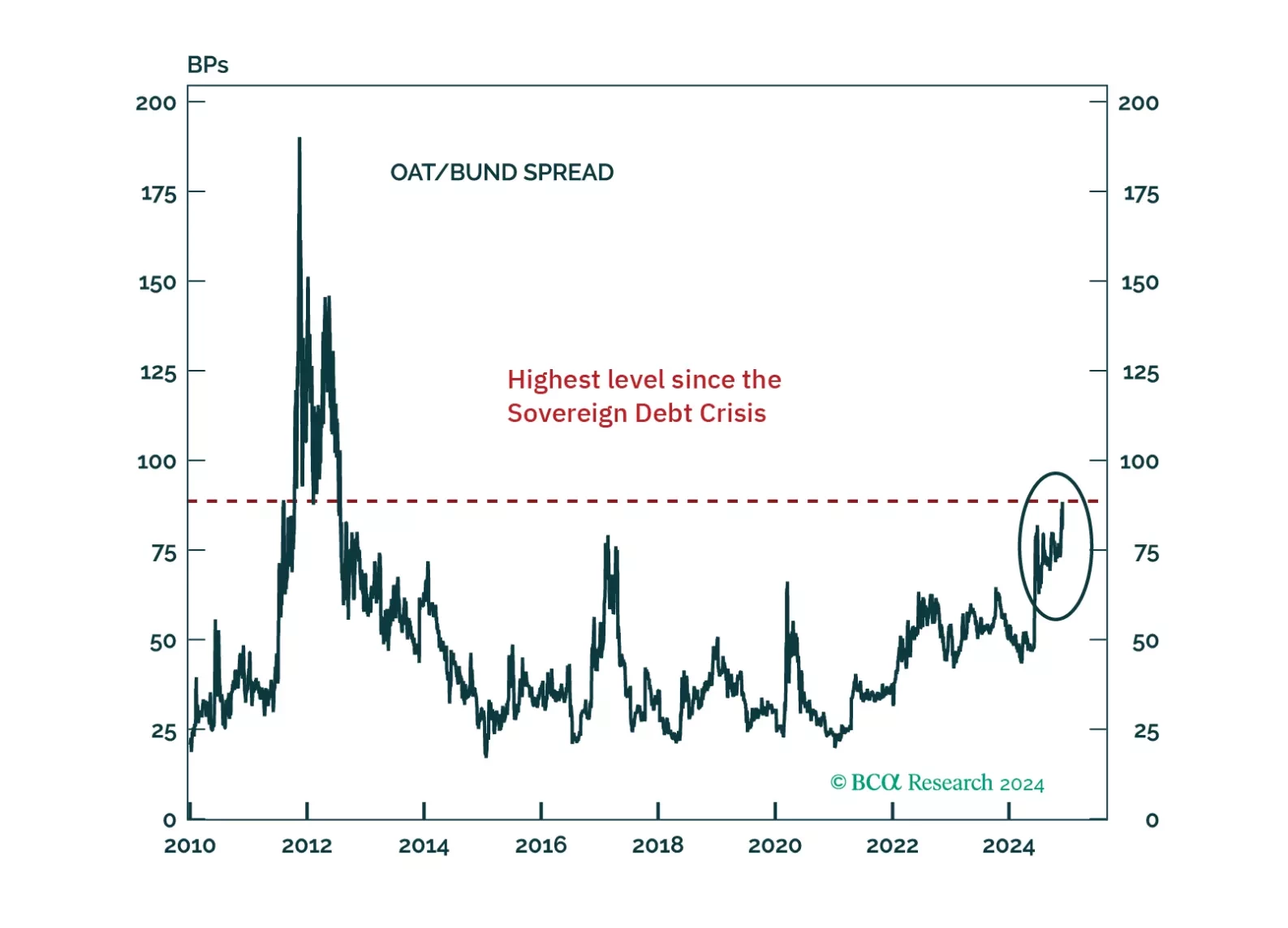

France finds itself in a unique, thorny situation. Can it heave itself out of it? And what does it mean for investors?

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…