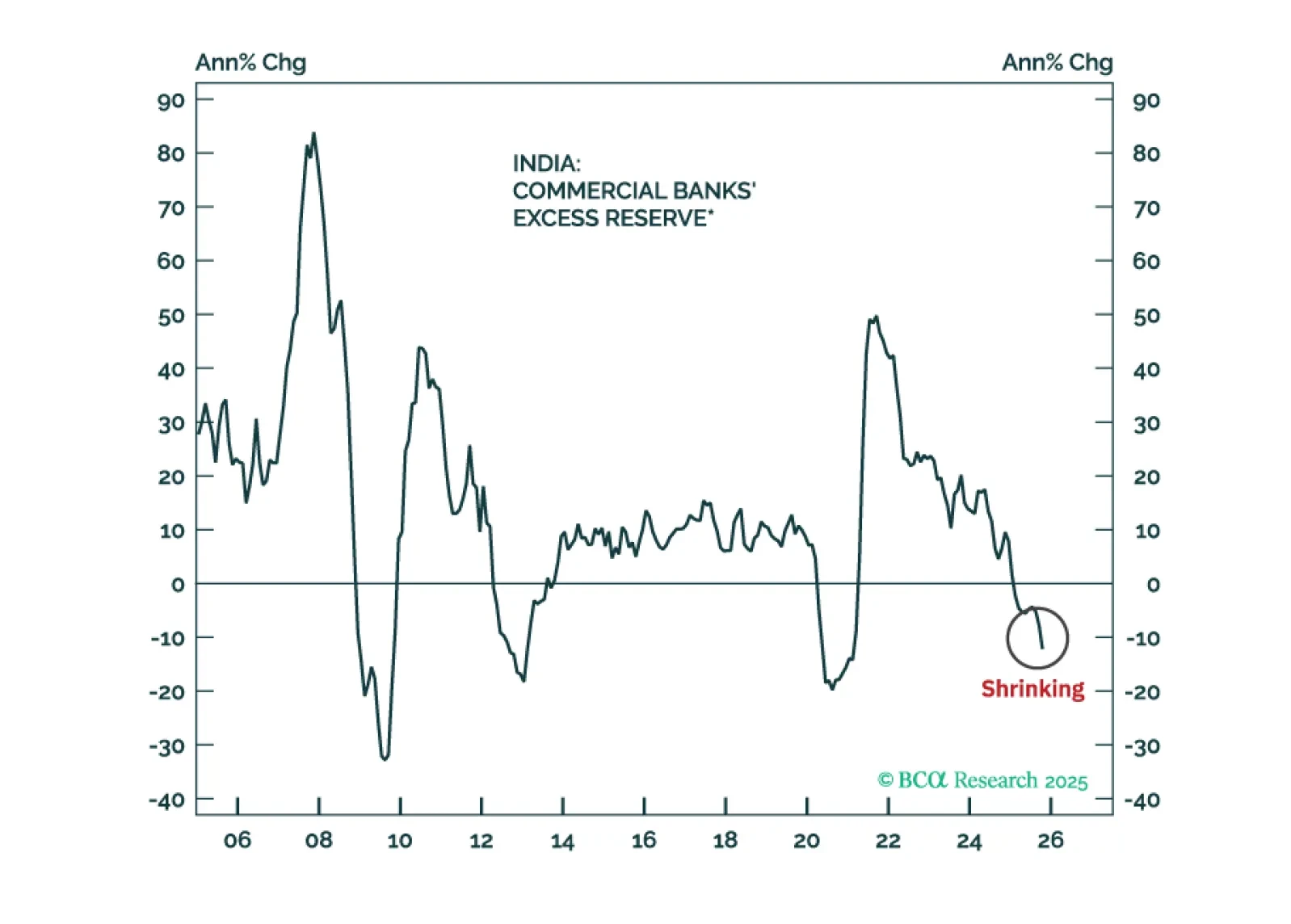

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

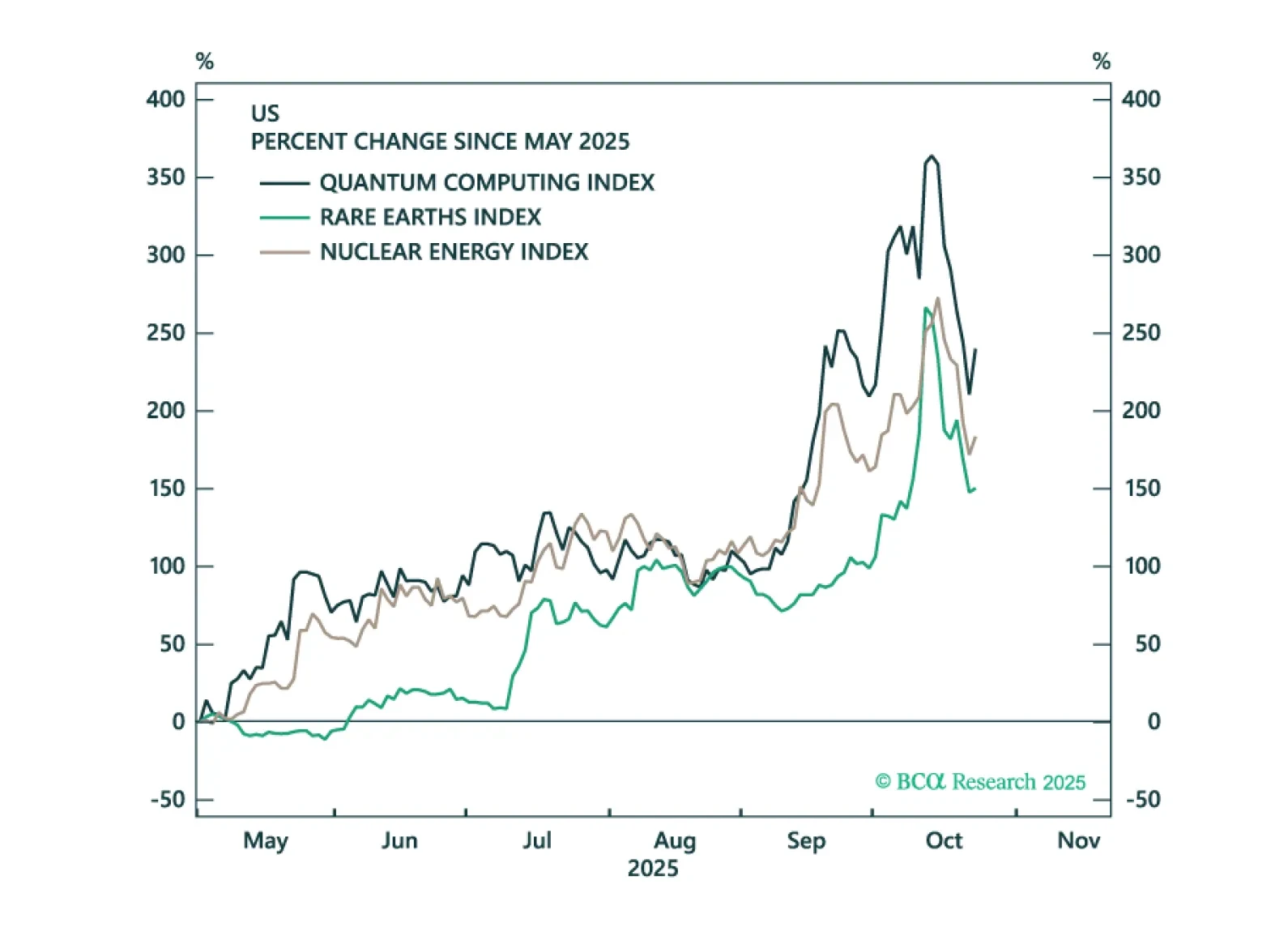

Precious metals, corporate credit, and tech stocks are all showing signs of late-cycle euphoria. We identify various trigger points that investors should monitor to turn more bearish.

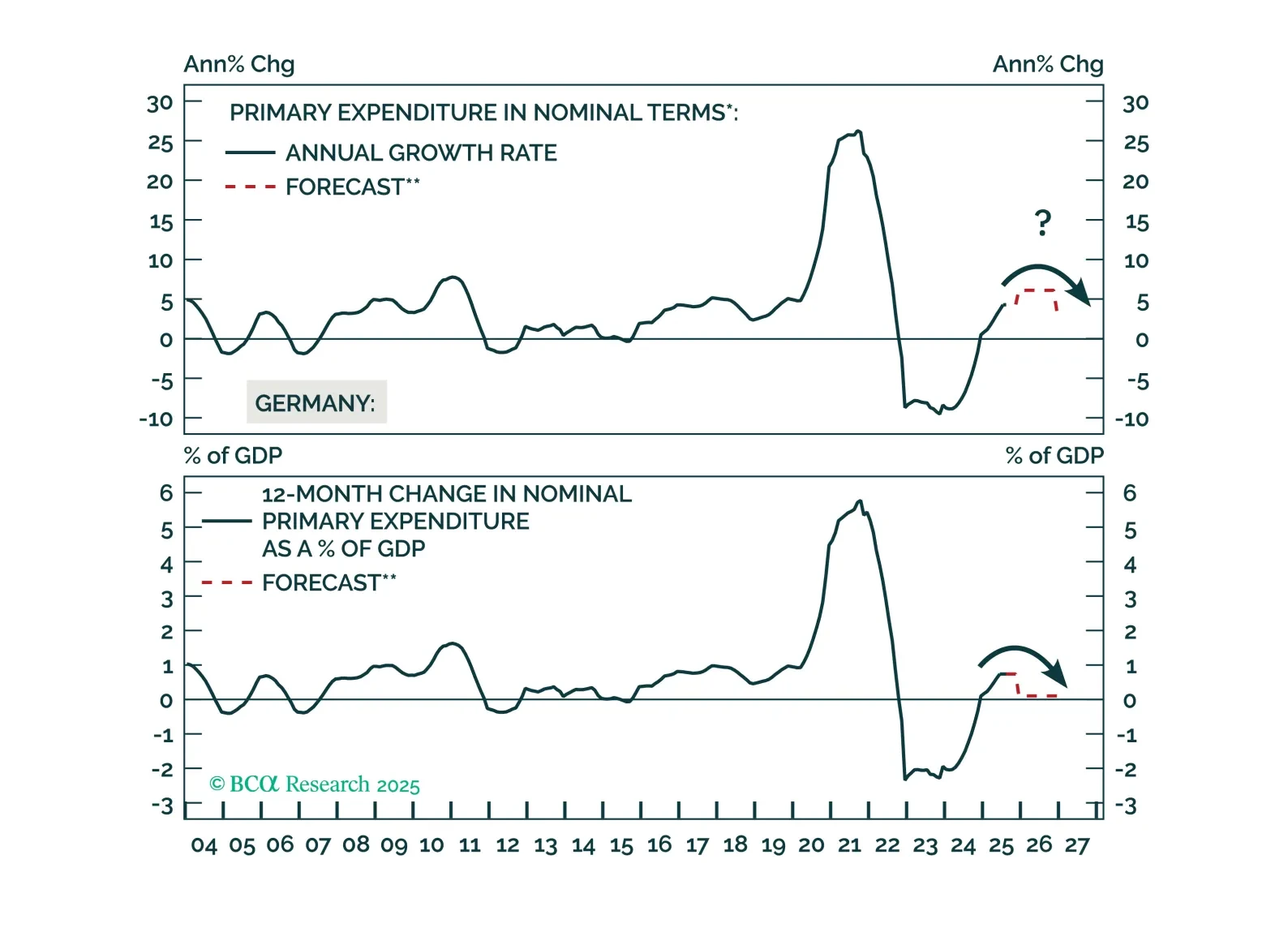

Core Europe’s industrial sector will relapse in the coming months due to US tariffs and a strong euro. Investors can play the imminent deflationary shock by being long Central European bonds. They should, however, hedge the…

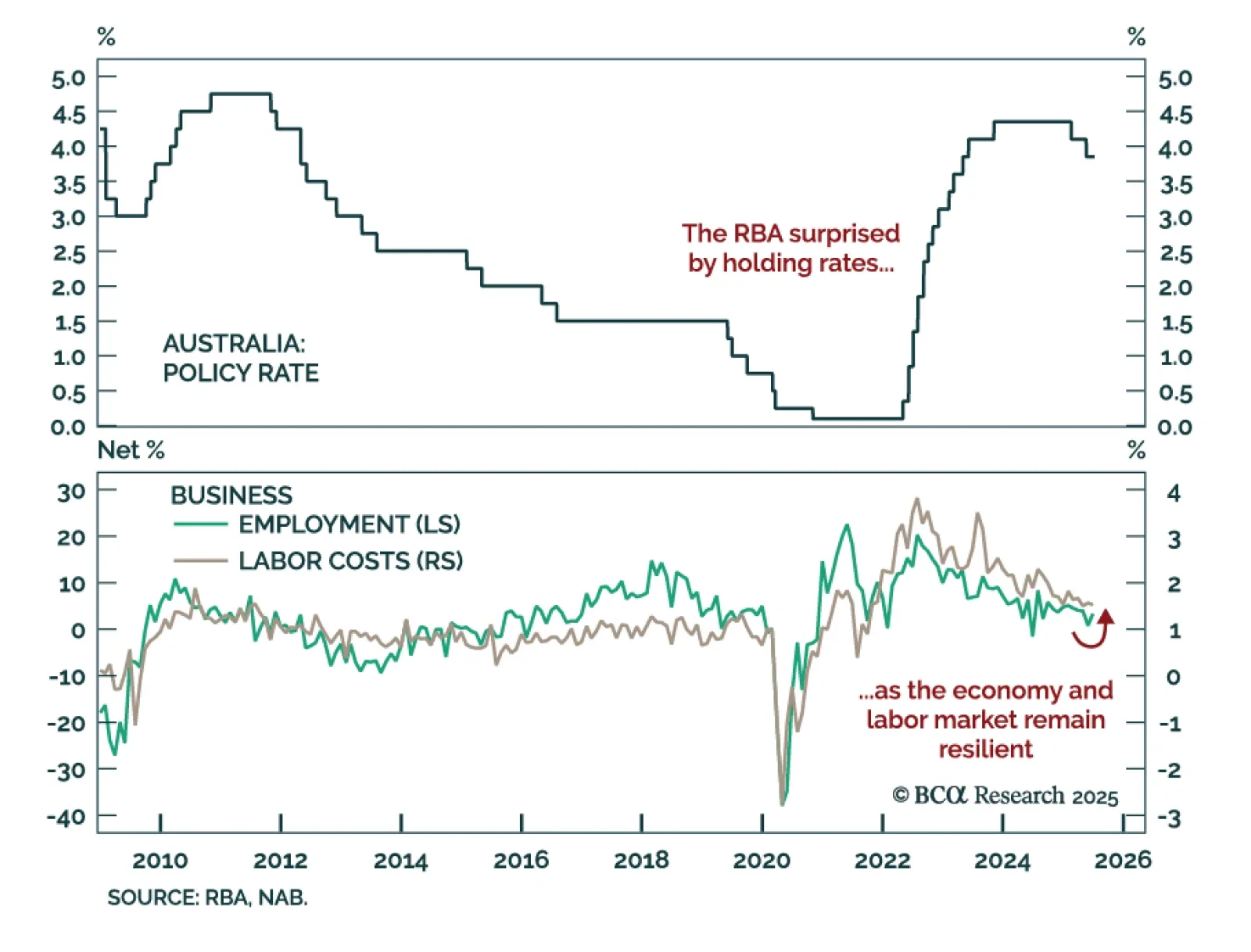

The RBA’s surprise hold reinforces a slower easing path, warranting an underweight on Australian bonds. Markets had priced in a 25 bps cut, but the central bank opted to keep rates at 3.85%. Governor Bullock characterized the…

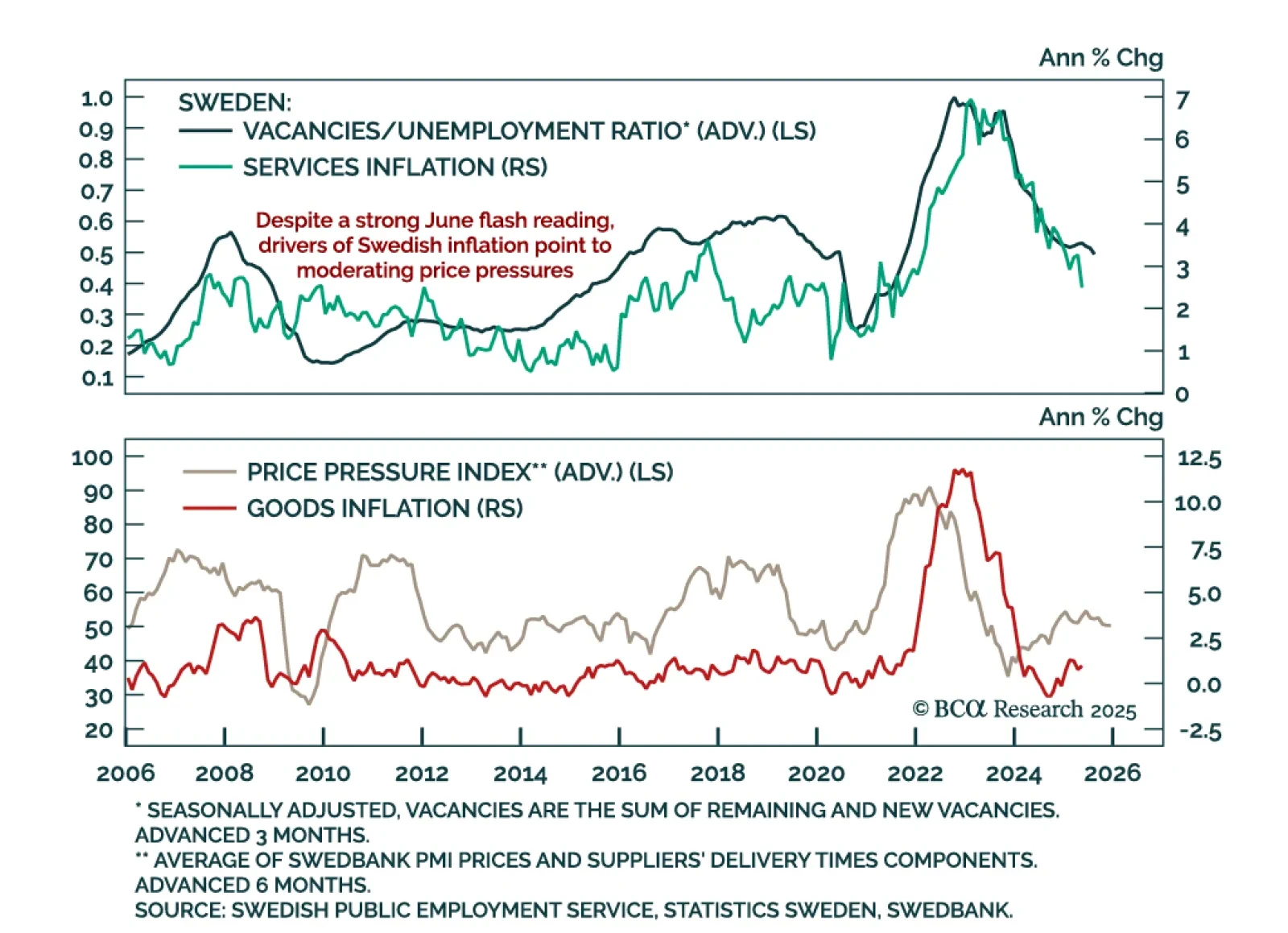

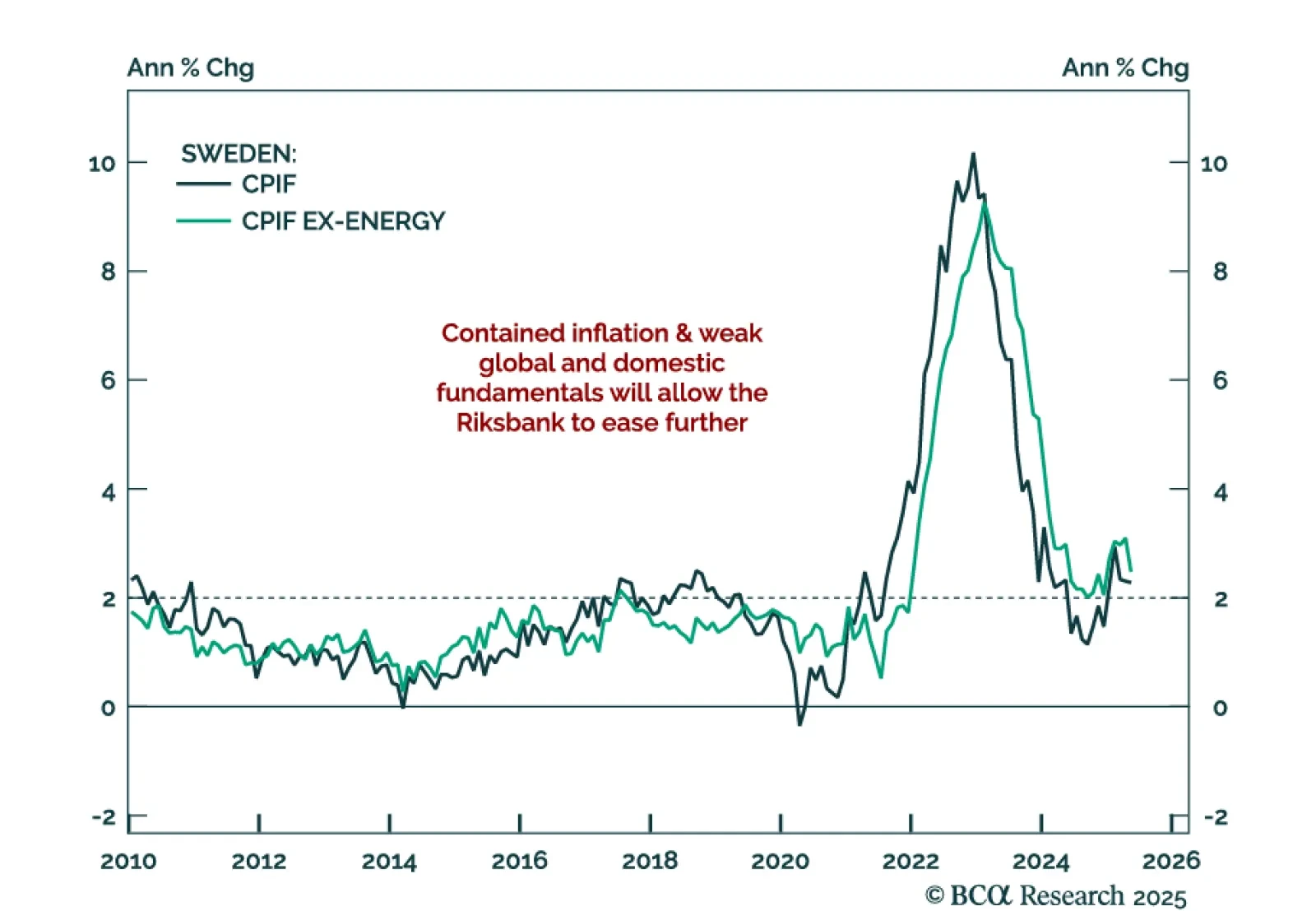

Stronger-than-expected June inflation will likely keep the Riksbank on hold in August, despite soft underlying trends. Headline inflation accelerated more than expected to 0.5% m/m (0.8% y/y), while CPI ex-housing rose to 2.9% y/y…

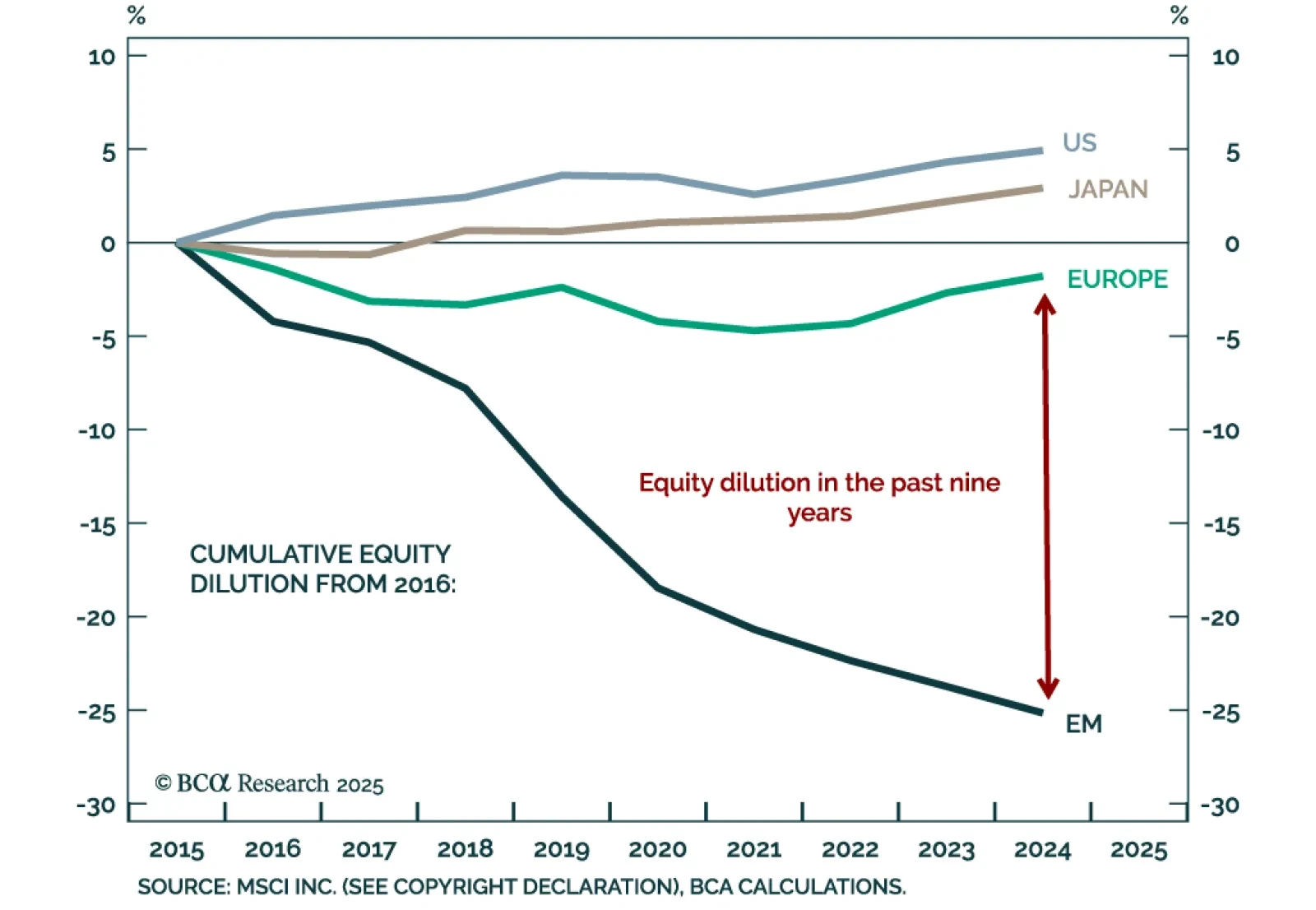

Our Emerging Markets strategists highlight that systematic equity dilution has meaningfully eroded EM shareholder returns, explaining the long-term disconnect between profit growth and EPS. Over the past 18 years, EM companies have…

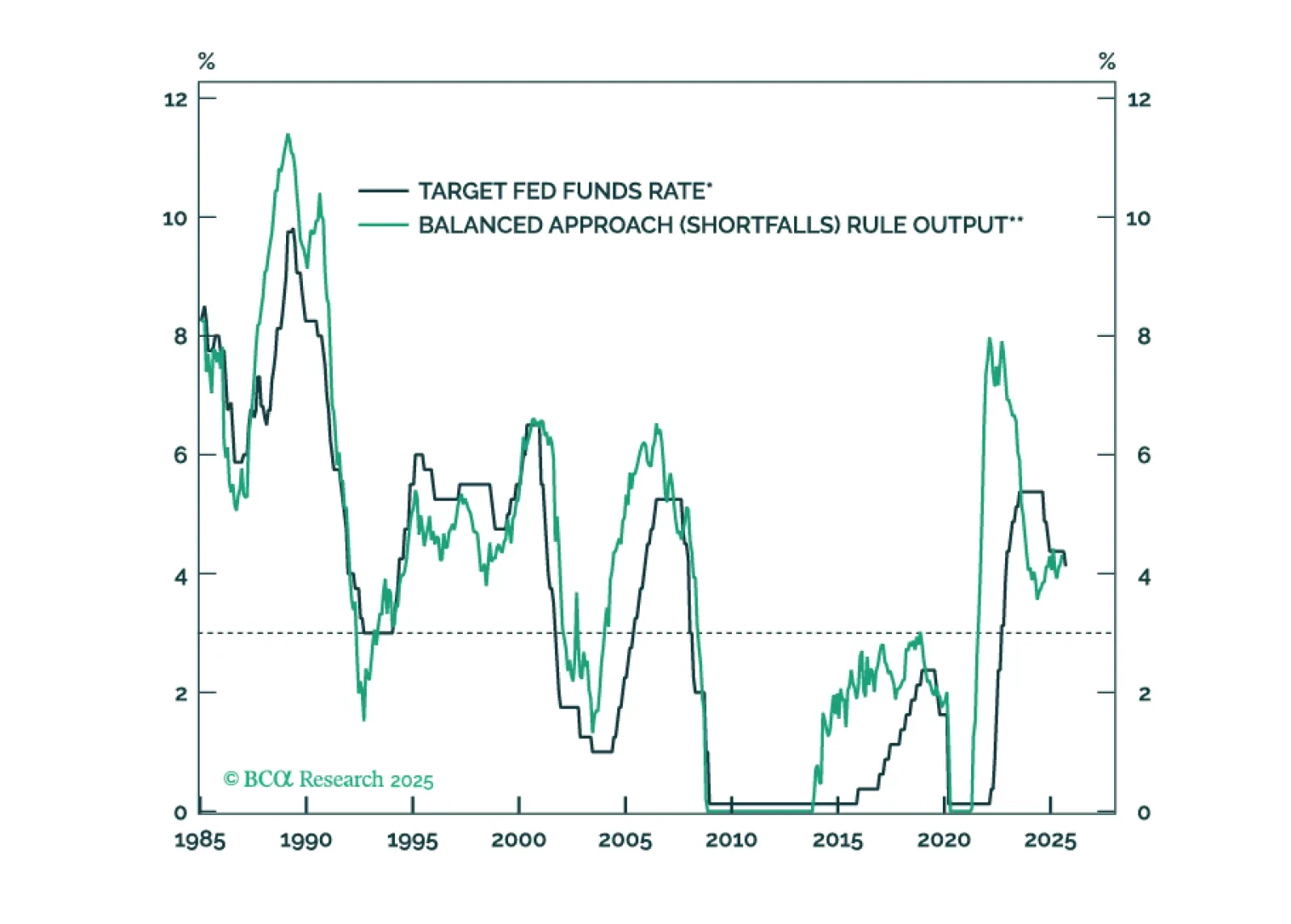

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

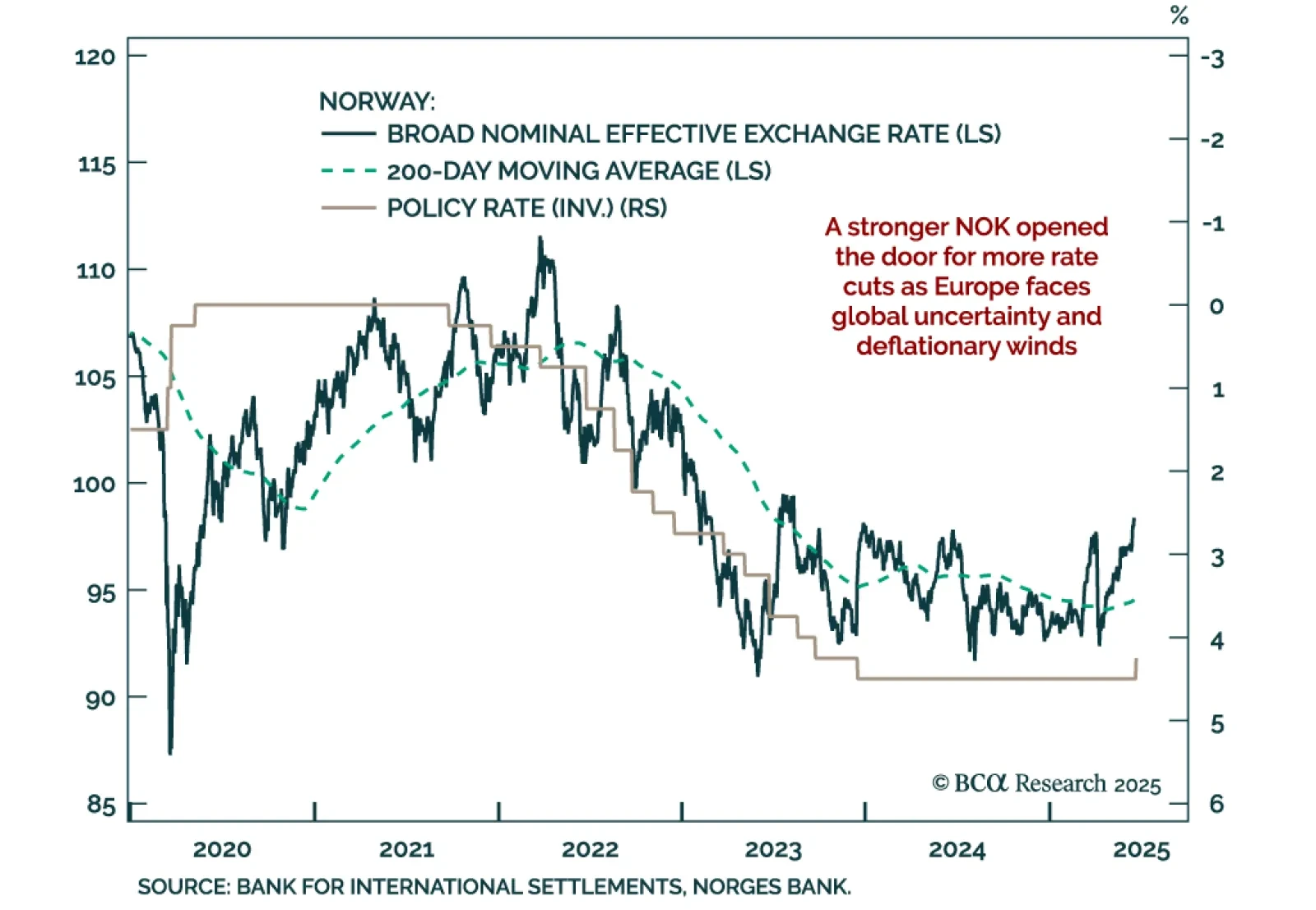

A stronger Norwegian krone has opened the door to more rate cuts, making Norwegian government bonds more attractive. Our Chart Of The Week comes from Jeremie Peloso, European Strategist. With its surprise 25 basis point cut, the…

Sweden’s economic fragility and disinflation support further easing, reinforcing our long SEK rates and NOK/SEK trades. The Riksbank cut rates by 25 bps to 2.0% and projected an additional cut, consistent with prior OIS pricing.…