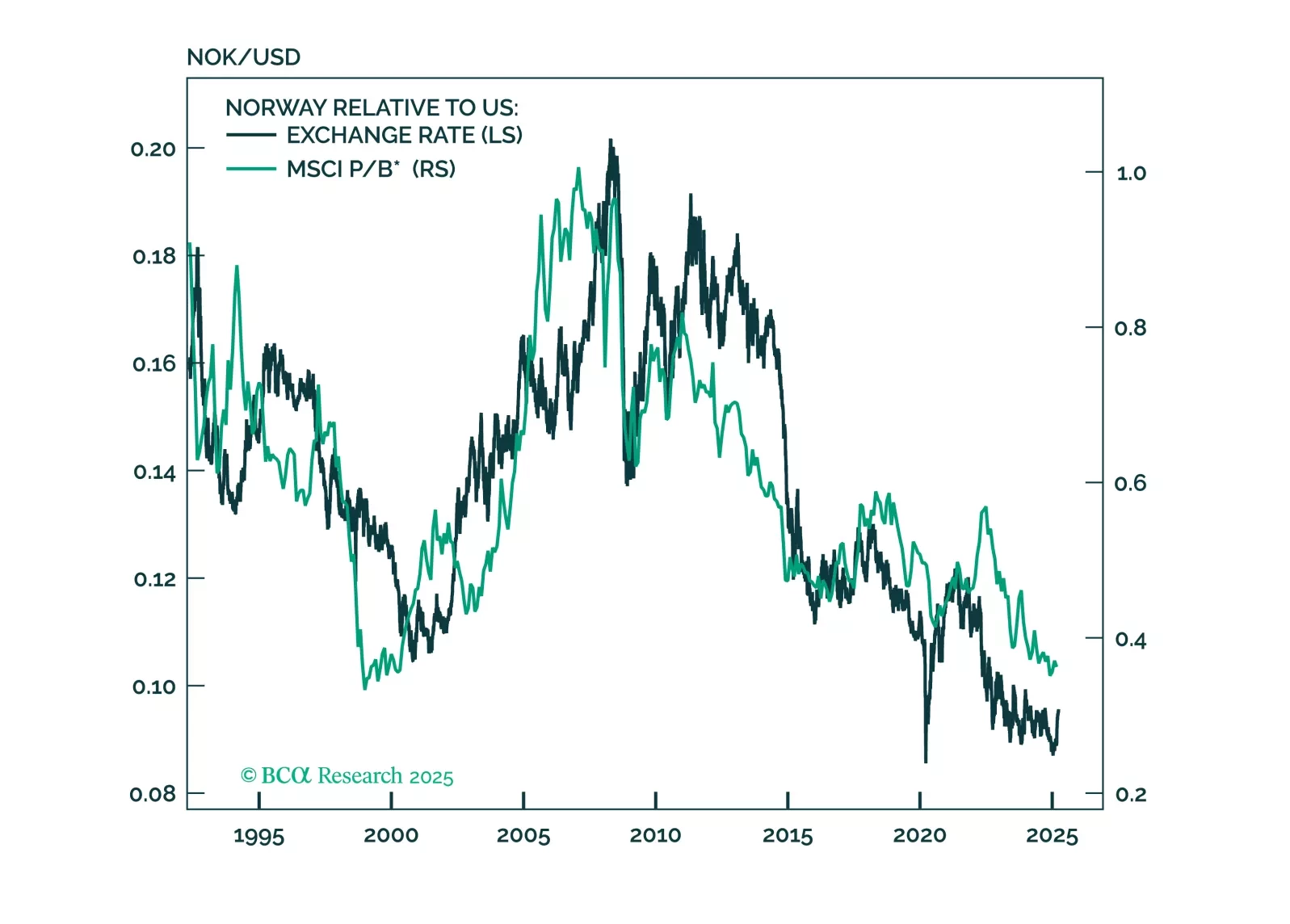

This report looks at investment implications, for Norwegian assets, given the recent meeting, from the Norges Bank.

This report is a quick take on our views on UK bonds and FX, given the recent budget.

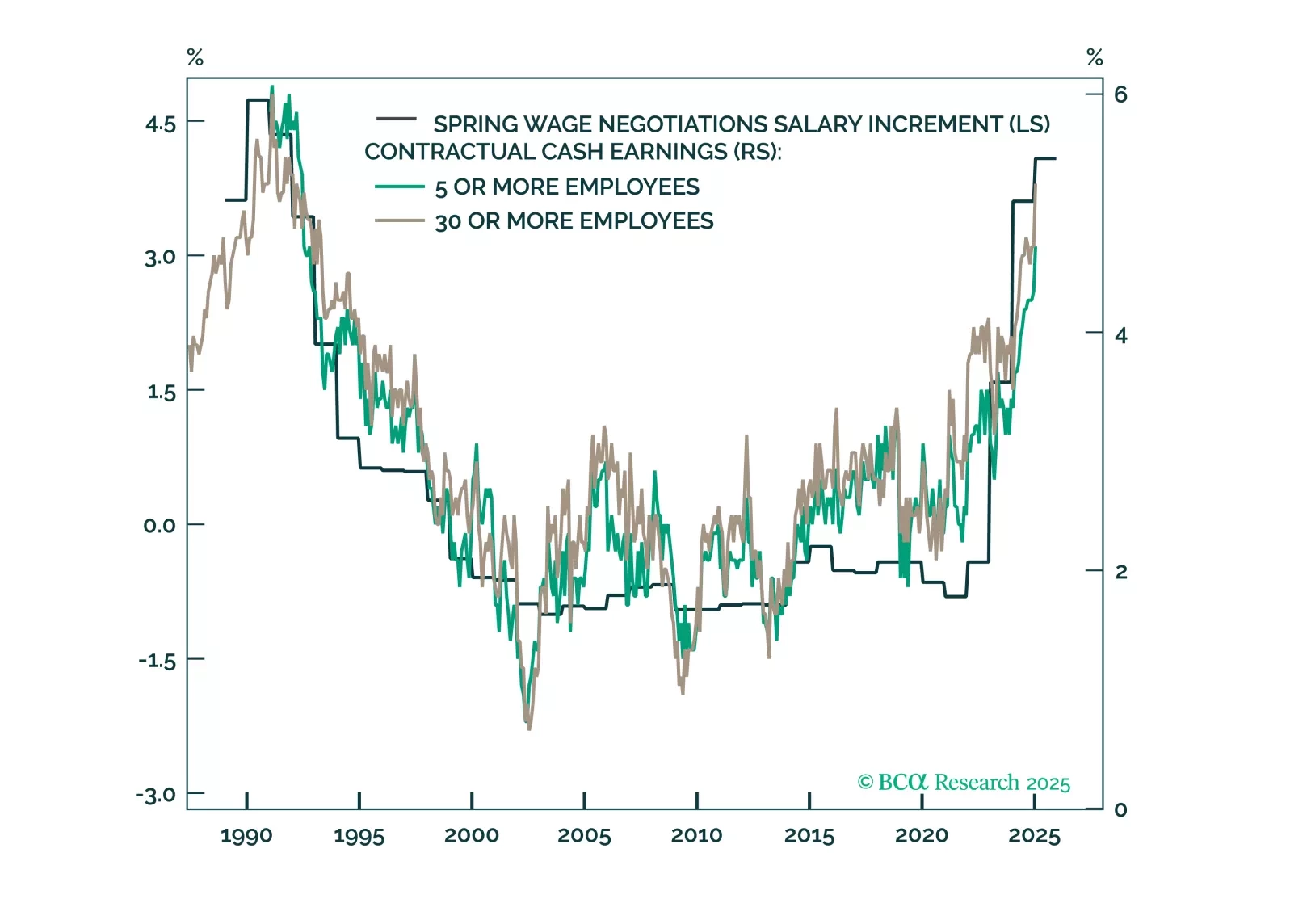

Given the meetings between the Bank of Japan, the Bank of England, and the Swiss National Bank, our highest convictions views are:Overweight UK Gilts. It is also time to sell sterling. We are short sterling, as of 1.30. …

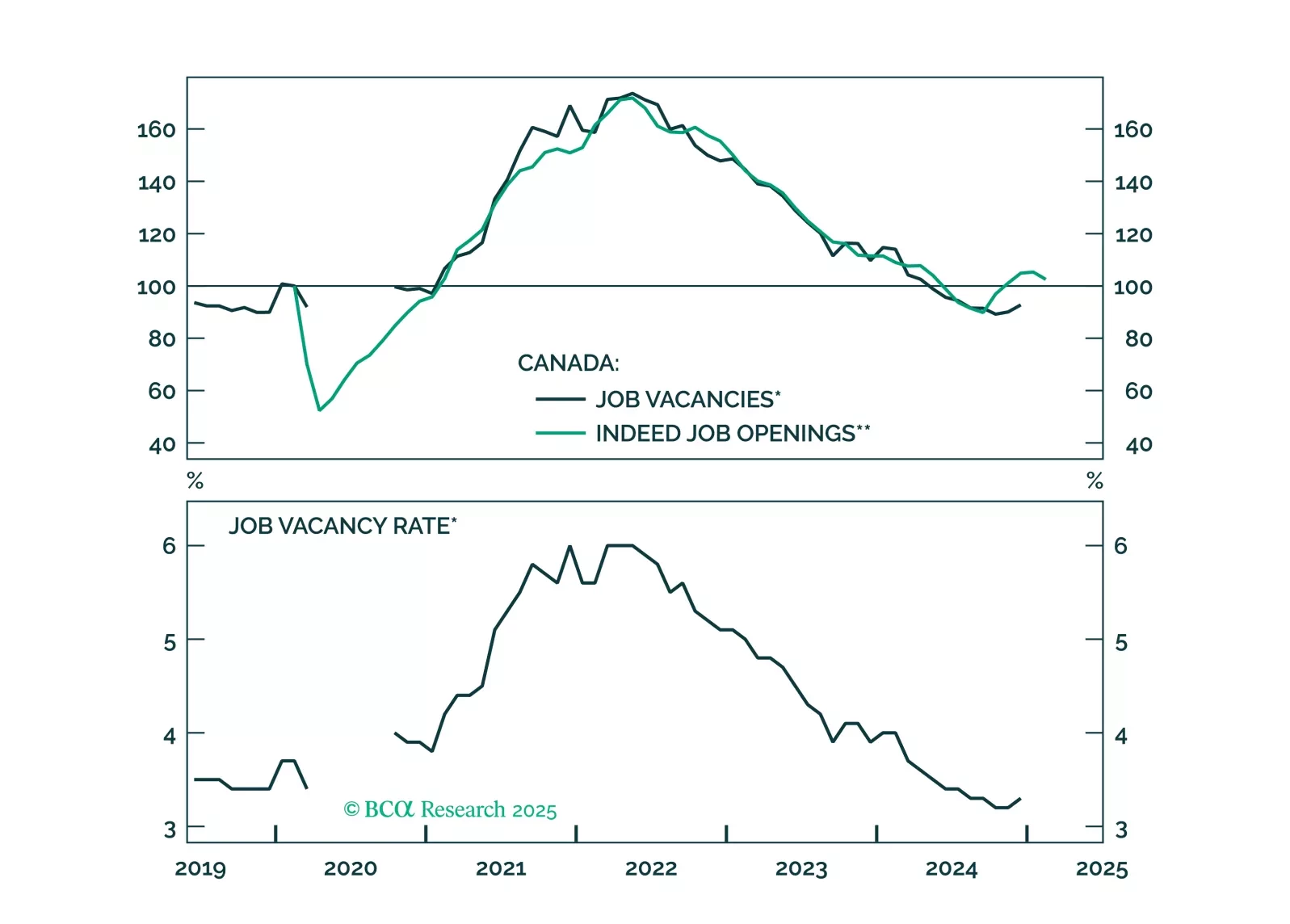

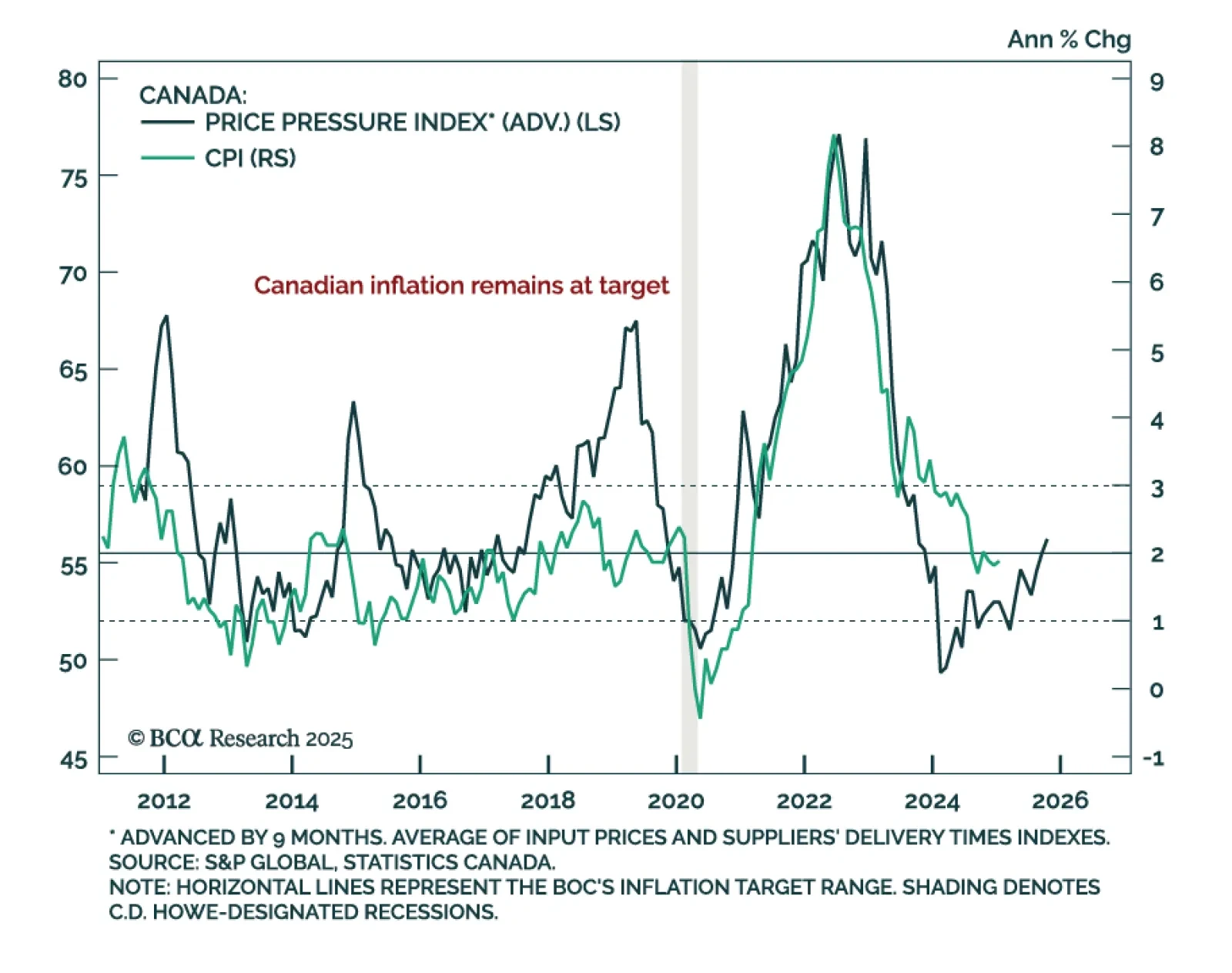

The trade war complicates the Bank of Canada’s task to achieve stable inflation. But the bottom line is that rising uncertainty, which will dampen business sentiment, will cause the BoC to cut rates by at least what is priced in the…

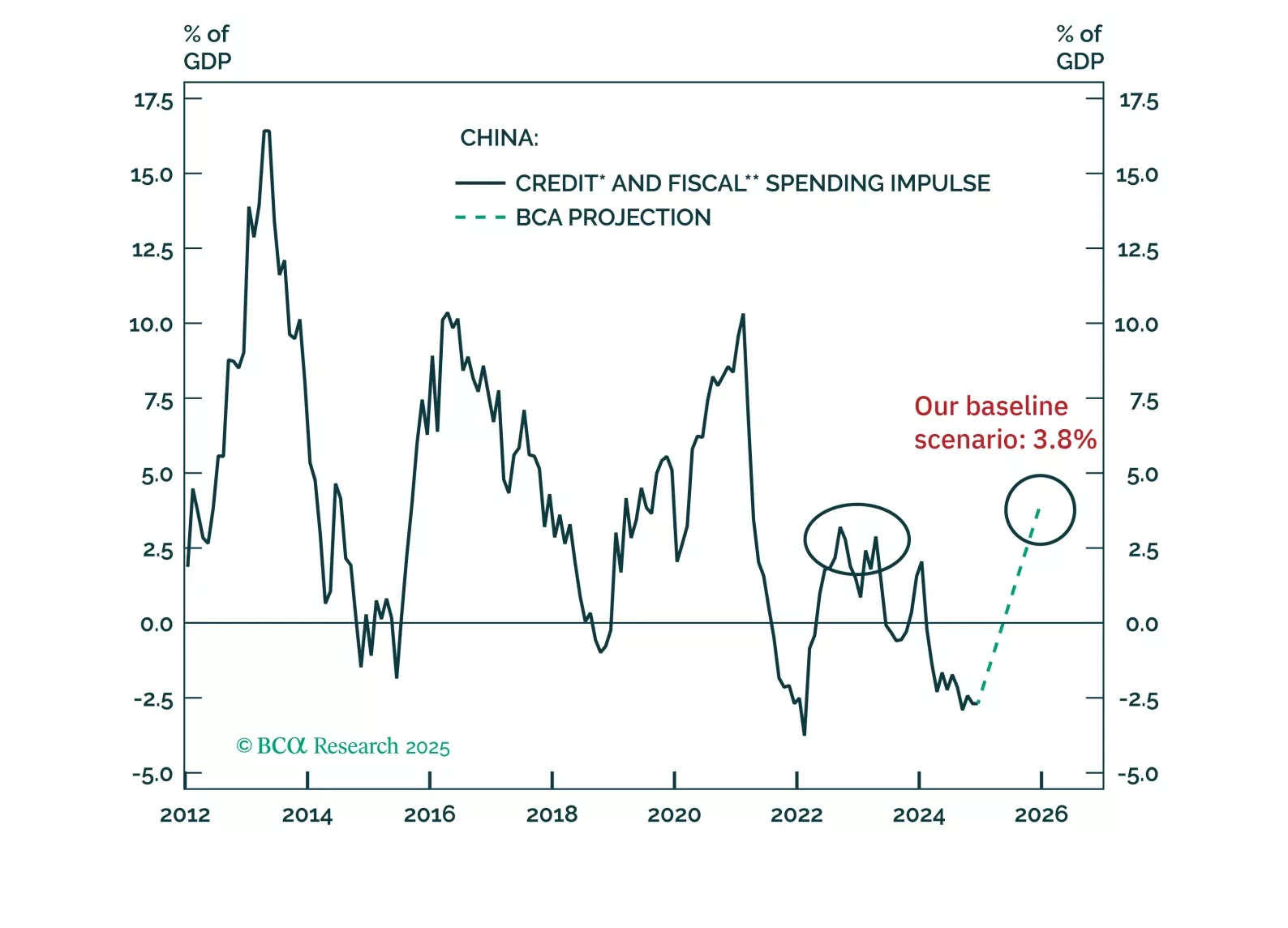

The fiscal stimulus announced at this year’s National People’s Congress is only slightly larger than last year’s. Notably, the details of the measures suggest that it will be challenging for fiscal stimulus to effectively…

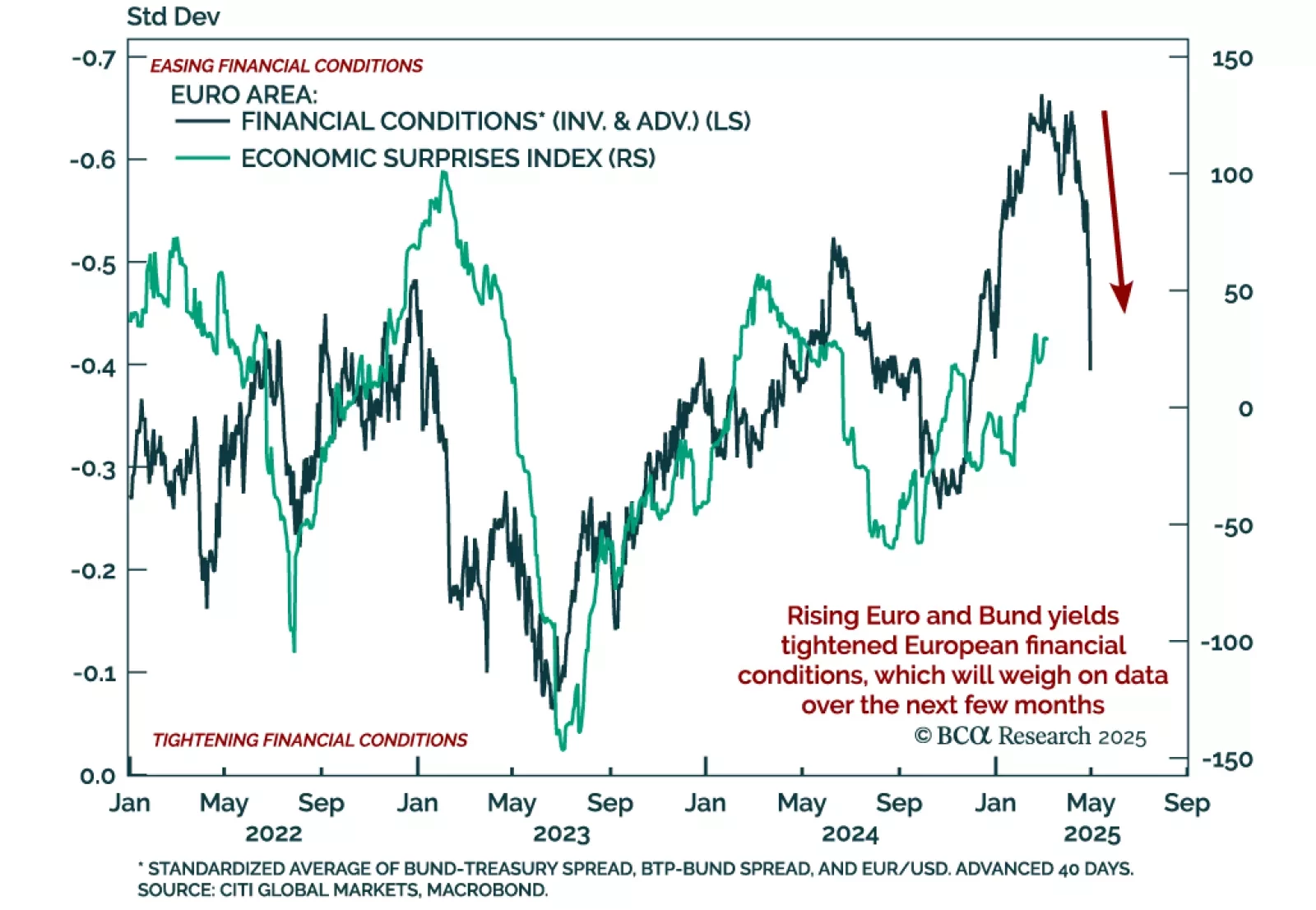

The ECB cut 25 bps as expected, bringing the deposit facility rate to 2.5%. President Lagarde reiterated the disinflationary process is “well on track” and described the policy stance as “meaningfully less restrictive”, signalling…

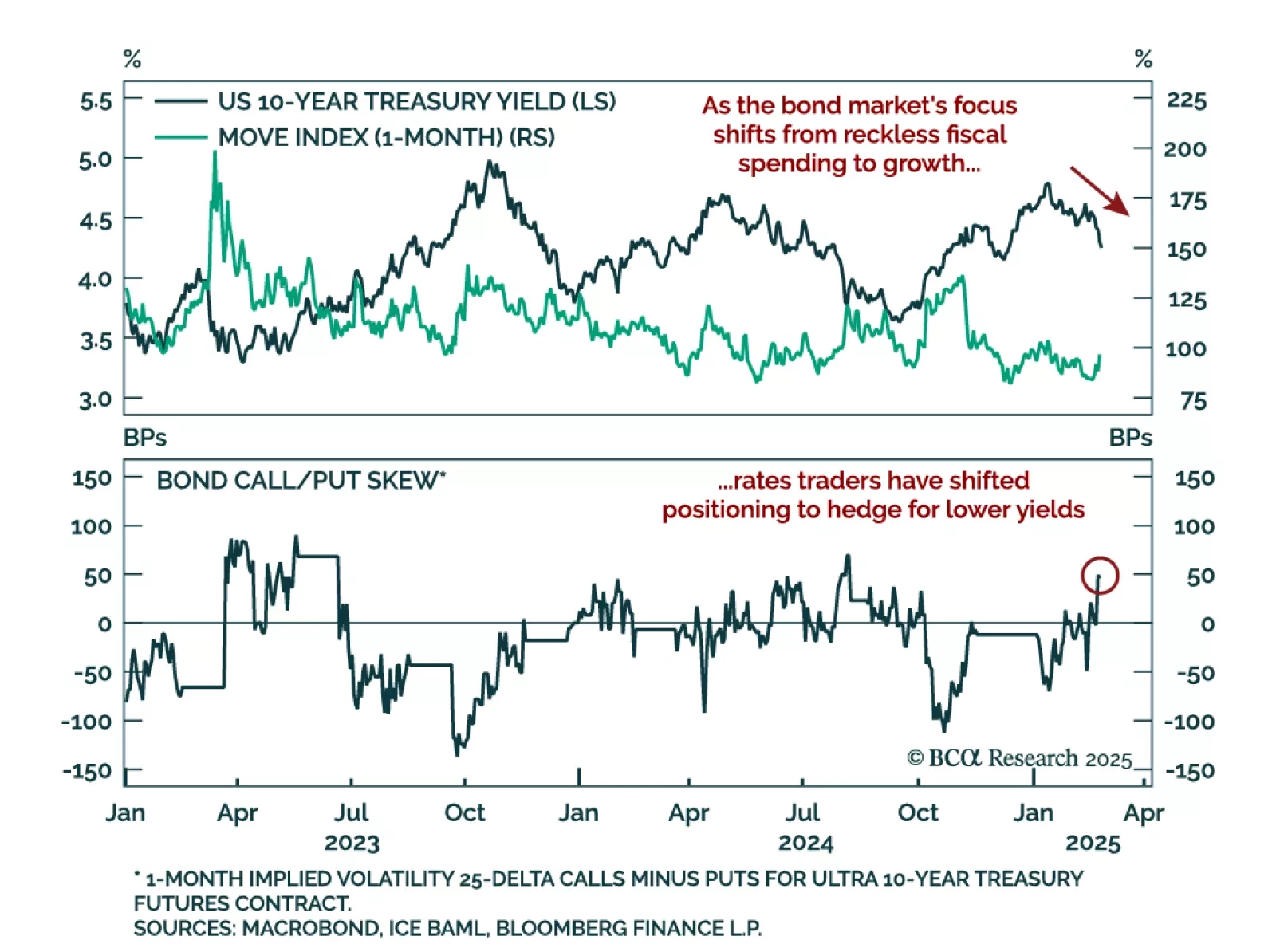

The House of Representatives passed a Budget Resolution bill that adds $2.8tn to the deficit by 2034. Our Geopolitical strategists highlighted during our BCA Live & Unfiltered meeting that the Senate is likely to modify it by…

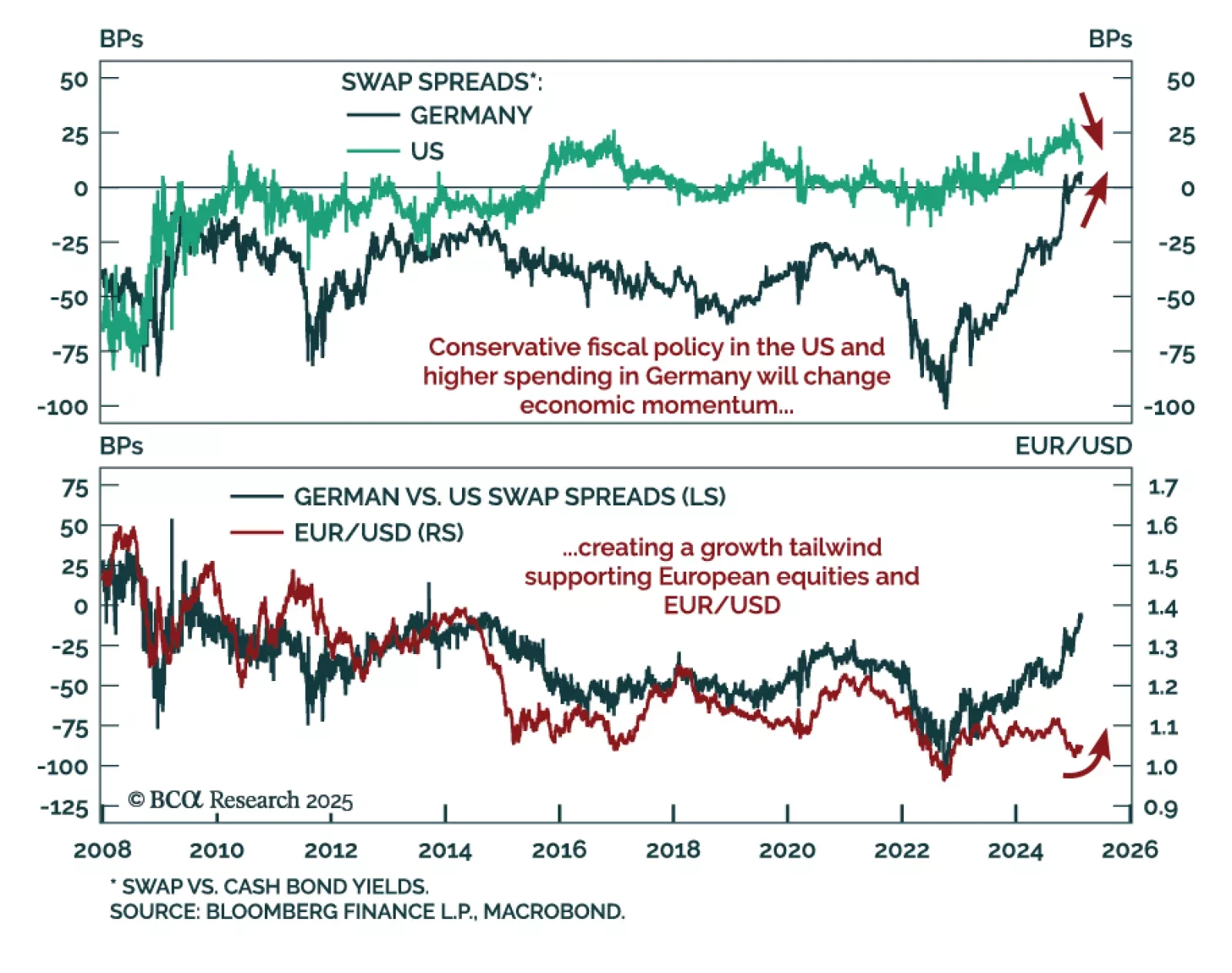

German election results were roughly as expected, but Europe’s biggest economy suddenly just got more interesting. While the details of the governing coalition have yet to be finalized, Chancellor Merz has floated options to ease the…

January Canadian headline inflation was in line with estimates at 1.9% y/y. The Bank of Canada’s core measures were slightly hotter than expected, rising to 2.7%, near the top of the Bank of Canada’s 1%-to-3% target range. …

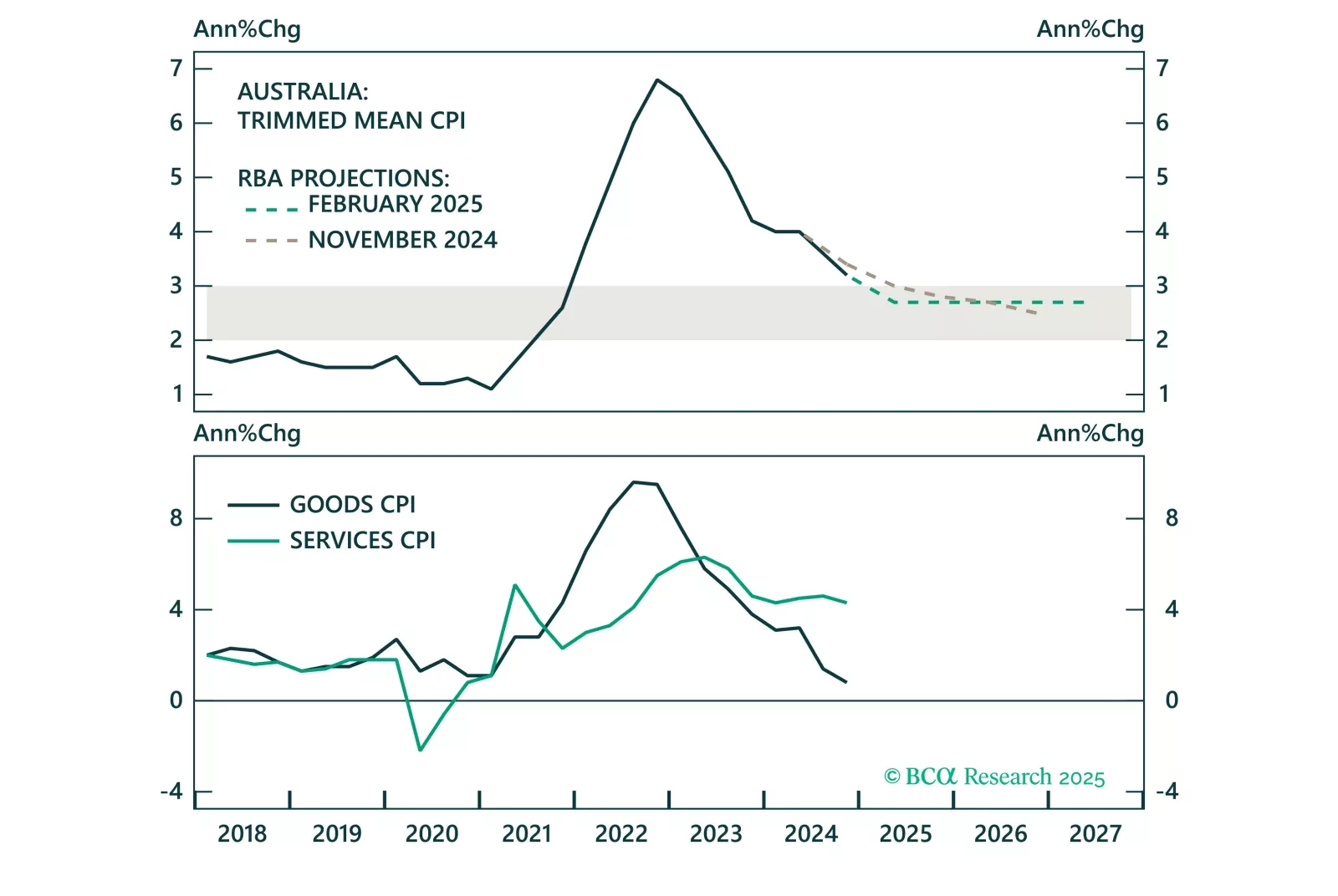

Overnight, the RBA cut the cash target rate for the first time since 2022, marking the beginning of the policy easing cycle in Australia. However, the RBA will proceed cautiously with further rate cuts, given a tight labor market and…