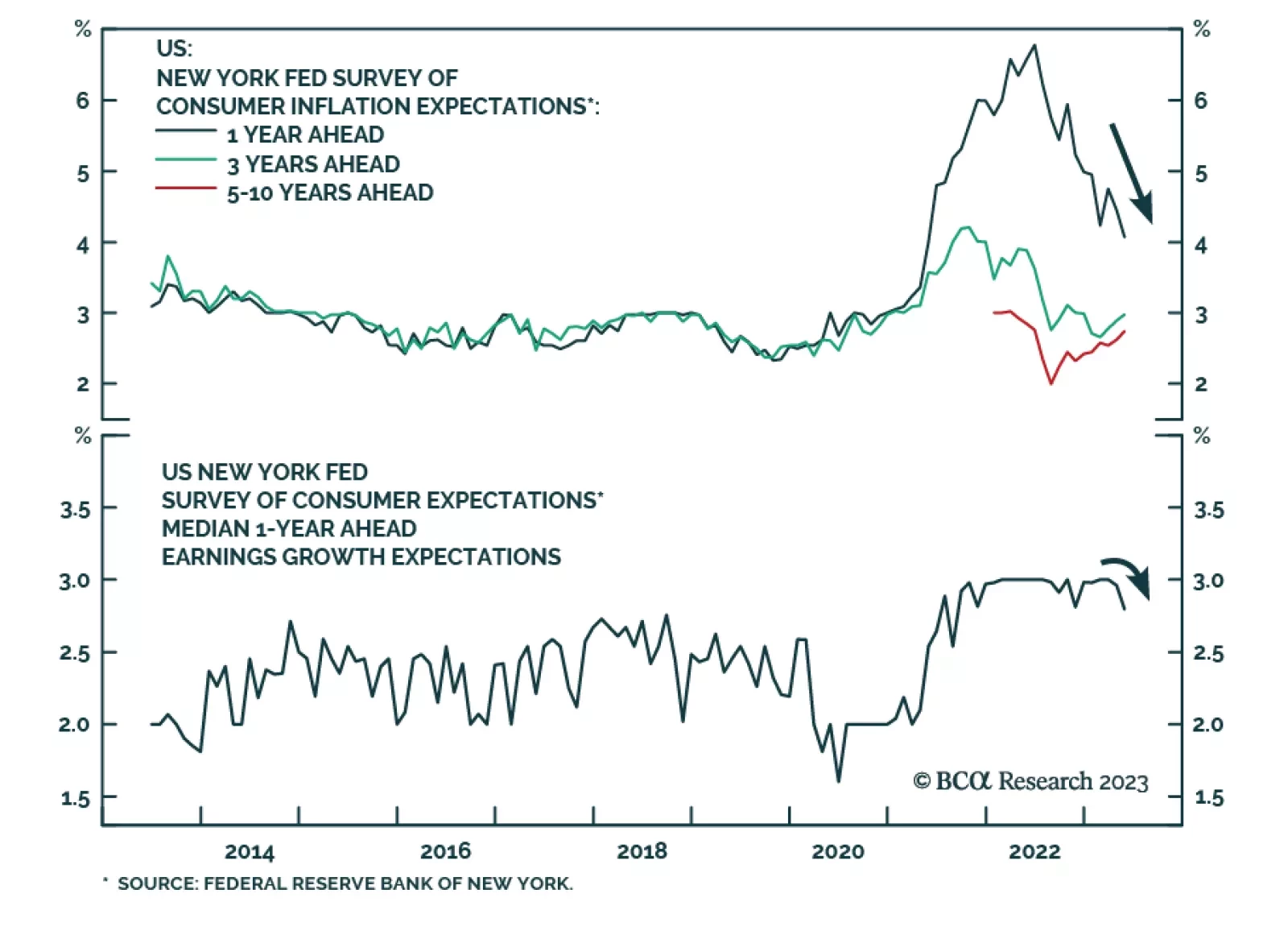

Results of the New York Fed’s Survey of Consumer Expectations sent a positive signal about short-term inflation expectations. Median one-year-ahead inflation expectations dropped by 0.3 percentage point to a two-year low of…

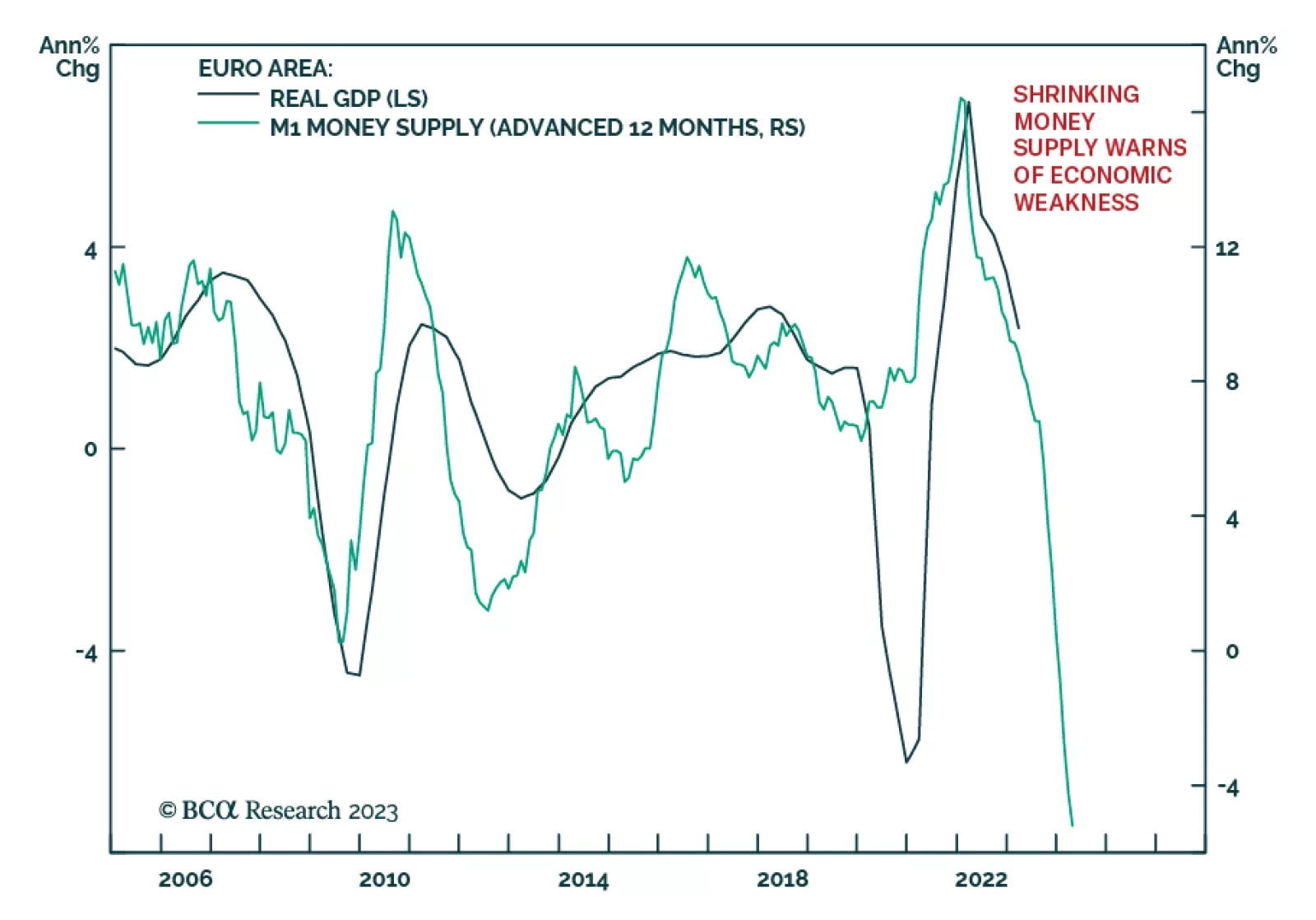

The final Q1 GDP release shows the Euro Area economy contracted by 0.1% q/q last quarter, a downwards revision from estimates of a 0.1% expansion. To the extent that this follows a 0.1% q/q decline in Q4 2022, the revised numbers…

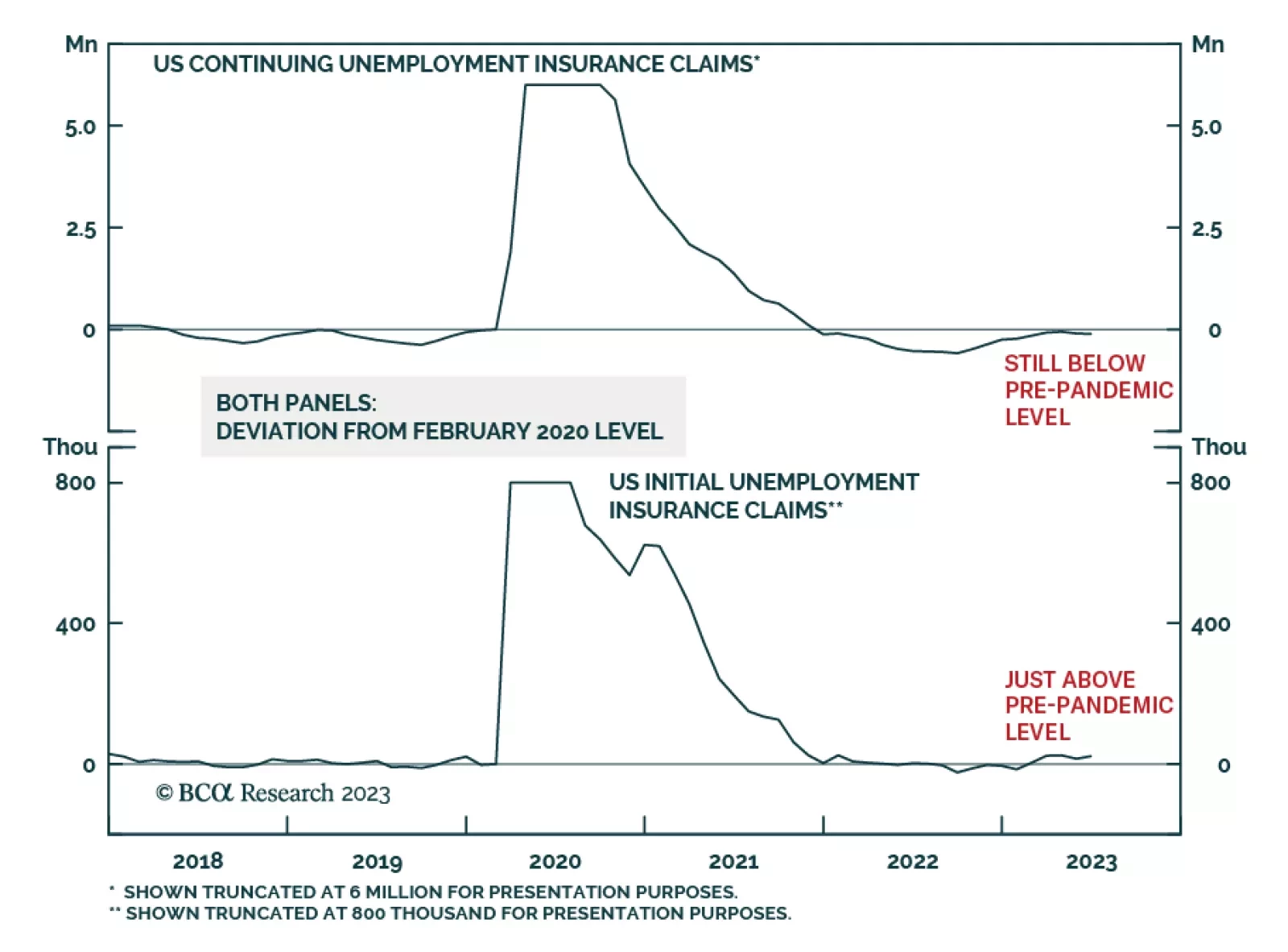

The latest increase in US weekly jobless claims came in above consensus estimates. Initial jobless claims jumped to 261 thousand in the week ended June 3 – above expectations of a 235 thousand increase. This marks the…

A benign disinflation will support equities over the next few quarters. Stocks will fall next year as a recession begins when investors least expect it.

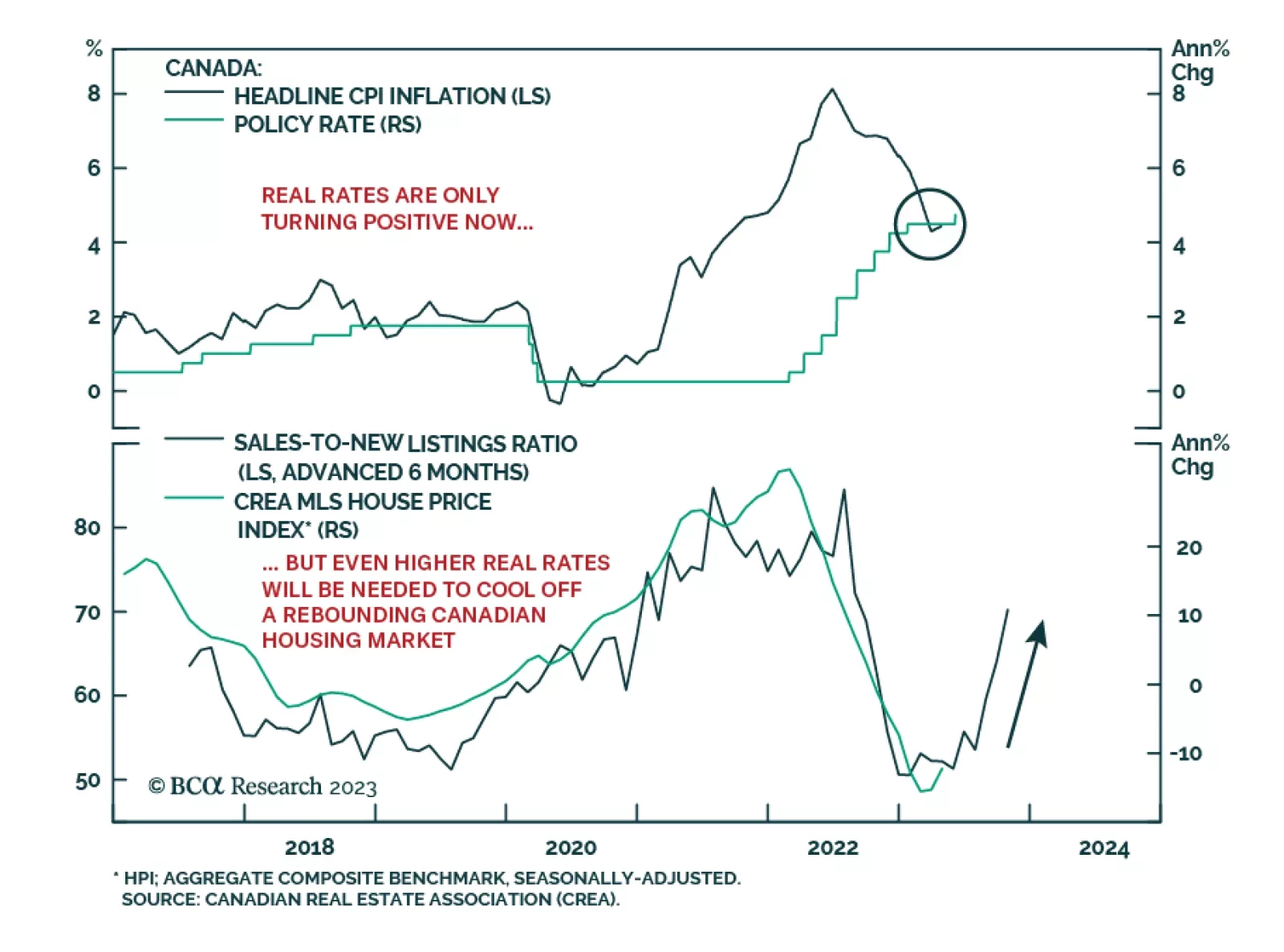

The Bank of Canada (BoC) surprised markets with a 25bp hike yesterday, bringing the policy rate up to a 22-year high of 4.75%. This ended the pause on rate hikes announced back in March, which only ended up lasting two meetings.…

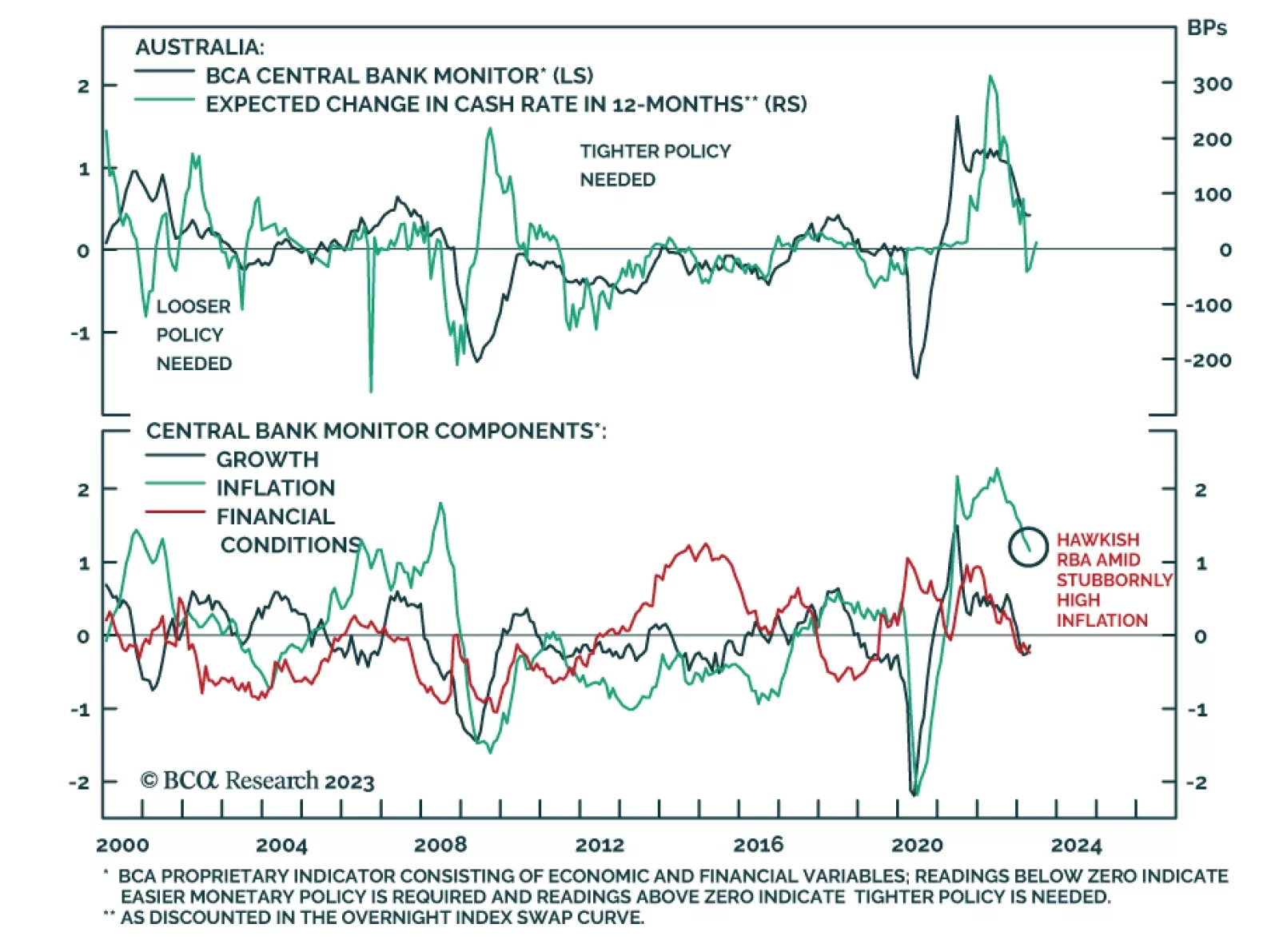

The Reserve Bank of Australia surprised markets with a 25 basis point rate hike on Tuesday, bringing the Cash Rate up to 4.1%. This marks the second consecutive rate increase following a pause in April. The post-meeting…

In this report, we follow up on the upgrade to our US duration stance from last week with a review of our rates views and government bond allocations outside the US. We conclude that while we now find US Treasuries to be more…

Symptoms of a liquidity trap for Chinese households are appearing. Our proprietary indicators for the marginal propensity to spend among households and enterprises continue falling. There has been a paradigm shift in Beijing’s…

The Reserve Bank of New Zealand hiked rates this week to 5.5%. There are many reasons to expect that to be the last rate hike for this cycle – a development that is positive for New Zealand bonds but bearish for the New Zealand…

The Reserve Bank of New Zealand hiked rates this week to 5.5%. There are many reasons to expect that to be the last rate hike for this cycle – a development that is positive for New Zealand bonds but bearish for the New Zealand…