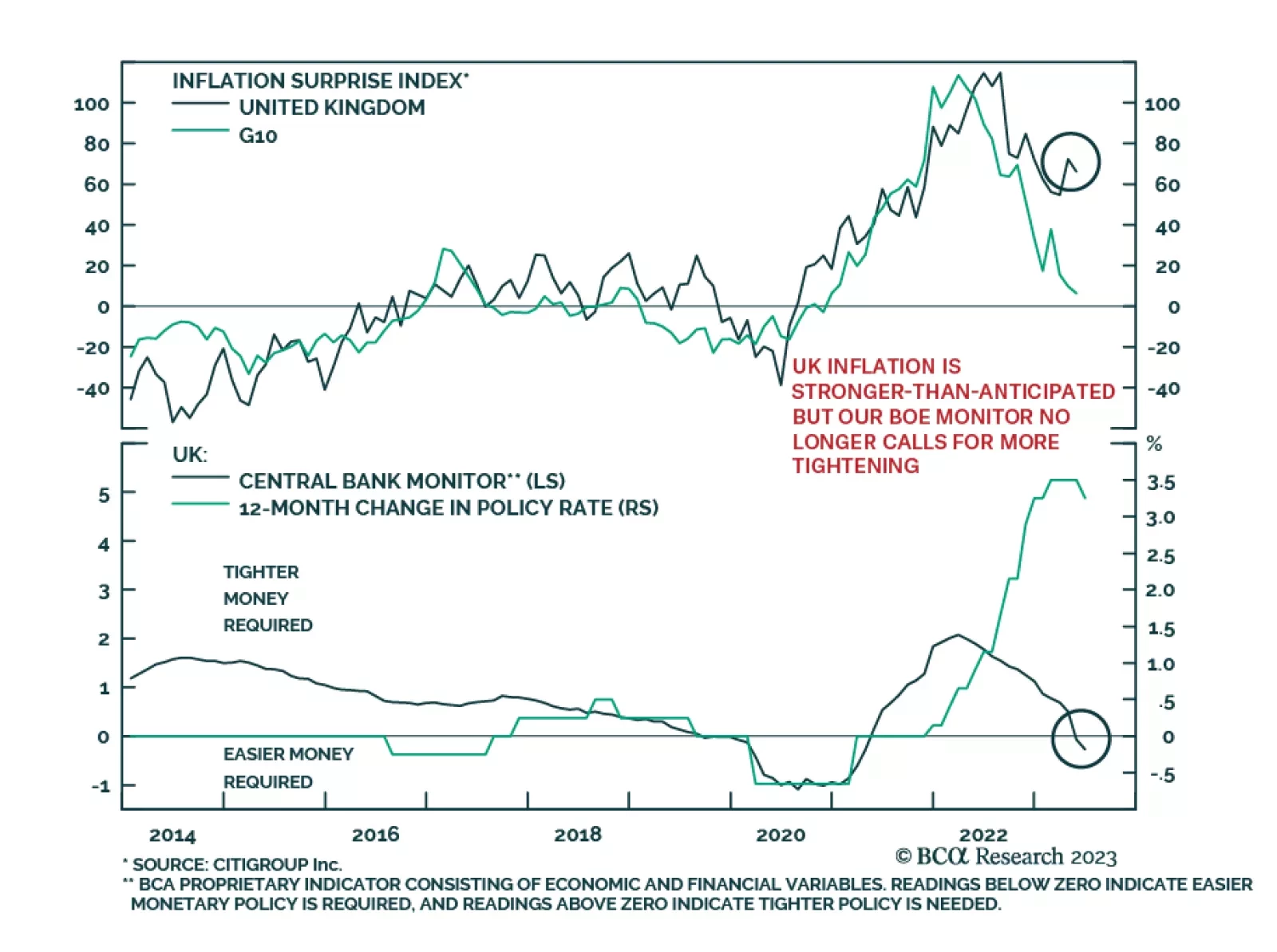

UK gilts have sold off sharply over the past month, particularly at the short end of the yield curve. The two-year yield has risen by over 100bps since mid-May, while 10-year yields have increased by just over 70bps –…

As the major central banks once again mull their policy options, they face a daunting task. They must phase-transition inflation back to imperceptible, without phase-transitioning unemployment to perceptible. This report explains why…

This Strategy Insight discusses the bond market and currency implications of the Fed’s “hawkish pause”.

Policymakers will likely continue to stimulate domestic demand via targeted measures and piecemeal stimulus. Yet, the economy will disappoint unless Beijing provides “irrigation-style” stimulus. The latter is not our base case…

Policymakers will likely continue to stimulate domestic demand via targeted measures and piecemeal stimulus. Yet, the economy will disappoint unless Beijing provides “irrigation-style” stimulus. The latter is not our base case…

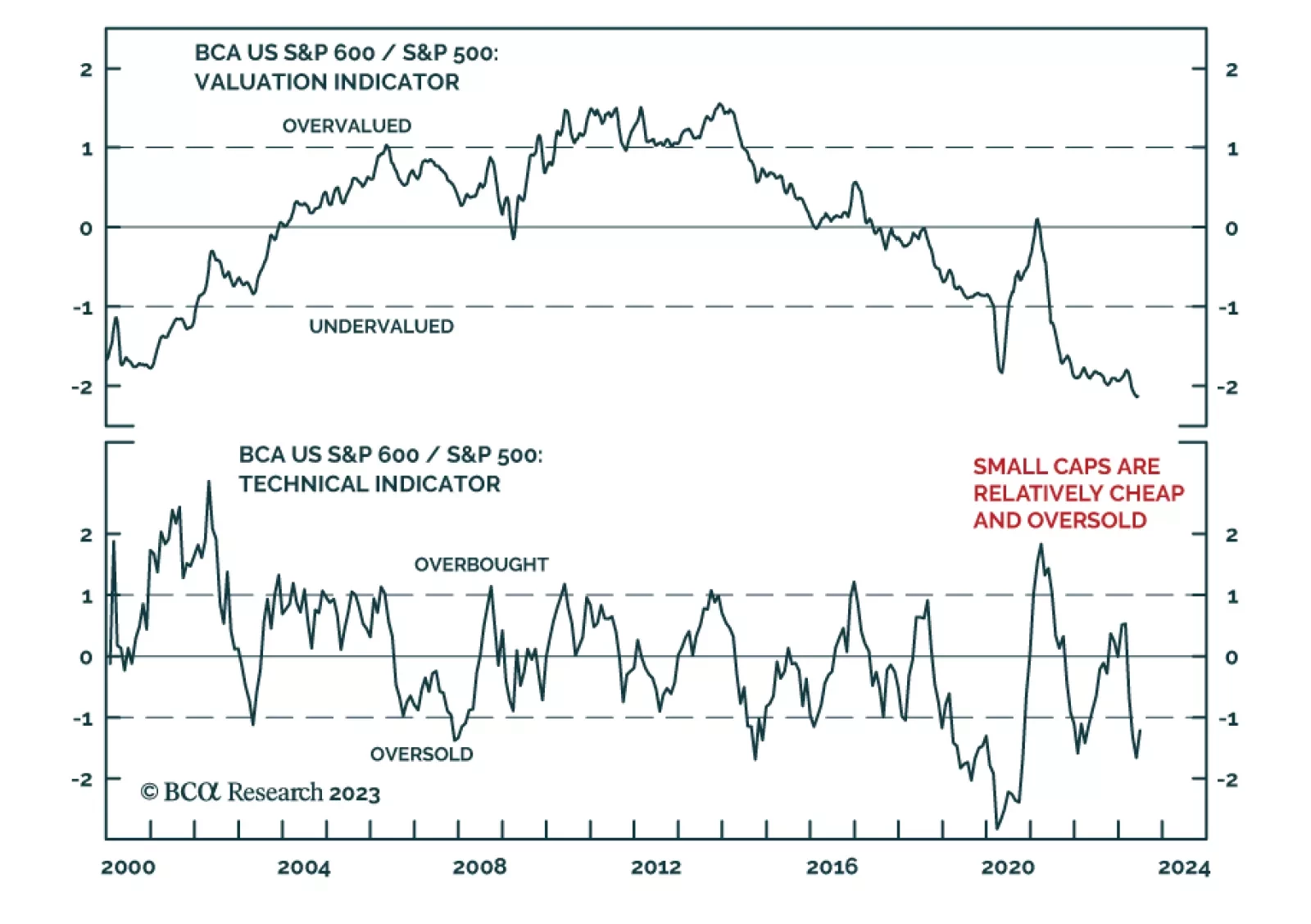

US equity market moves have recently shifted in favor of small caps. After underperforming the S&P 500 by 16% between the start of March and beginning of June, the S&P 600’s recent 6% gain is greater than its large-…

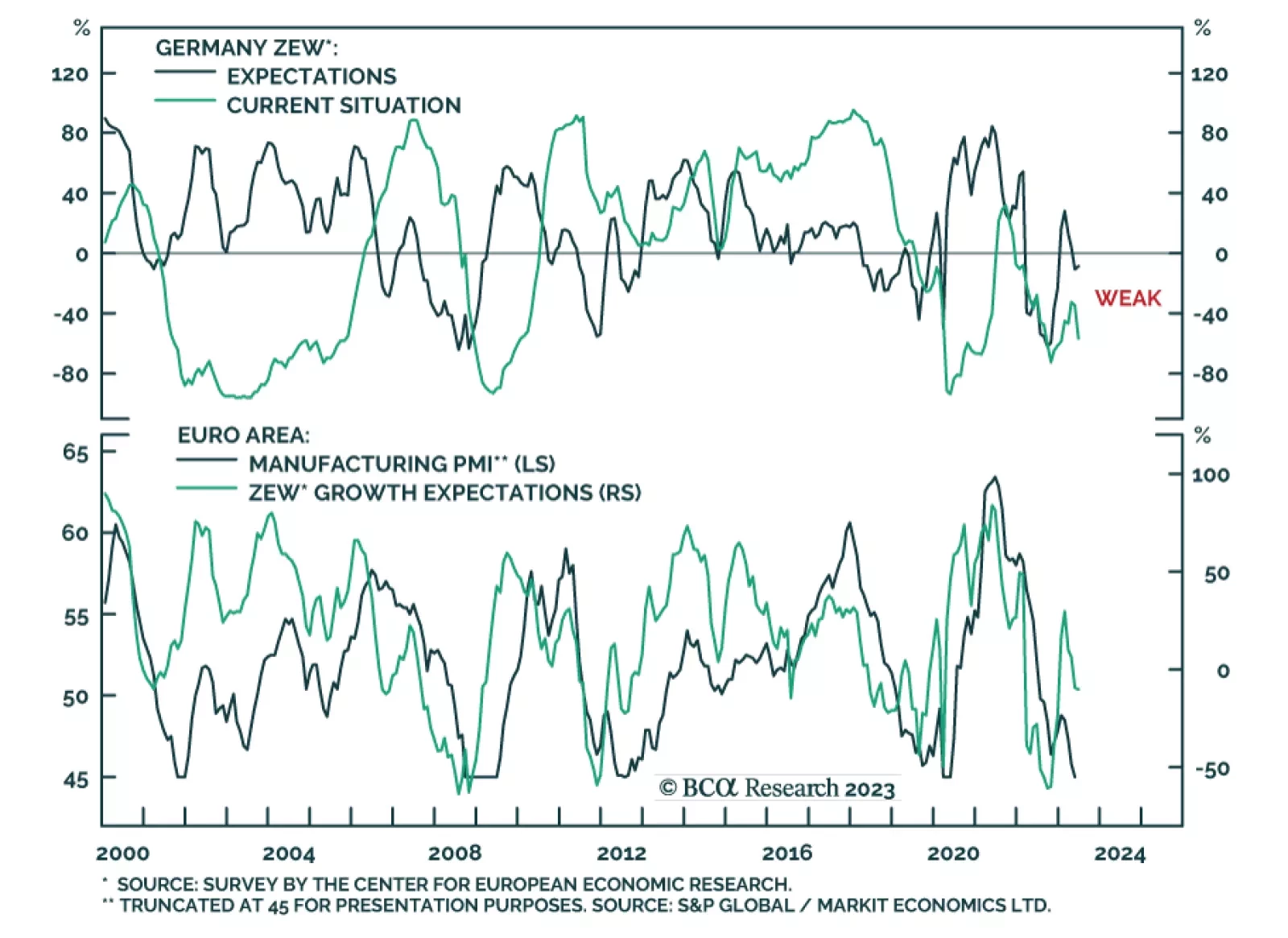

The message from the ZEW economic research institute’s June survey was mixed. On the one hand, the German Indicator of Economic Sentiment unexpectedly ticked up from -10.7 to -8.5. While the negative reading indicates that…

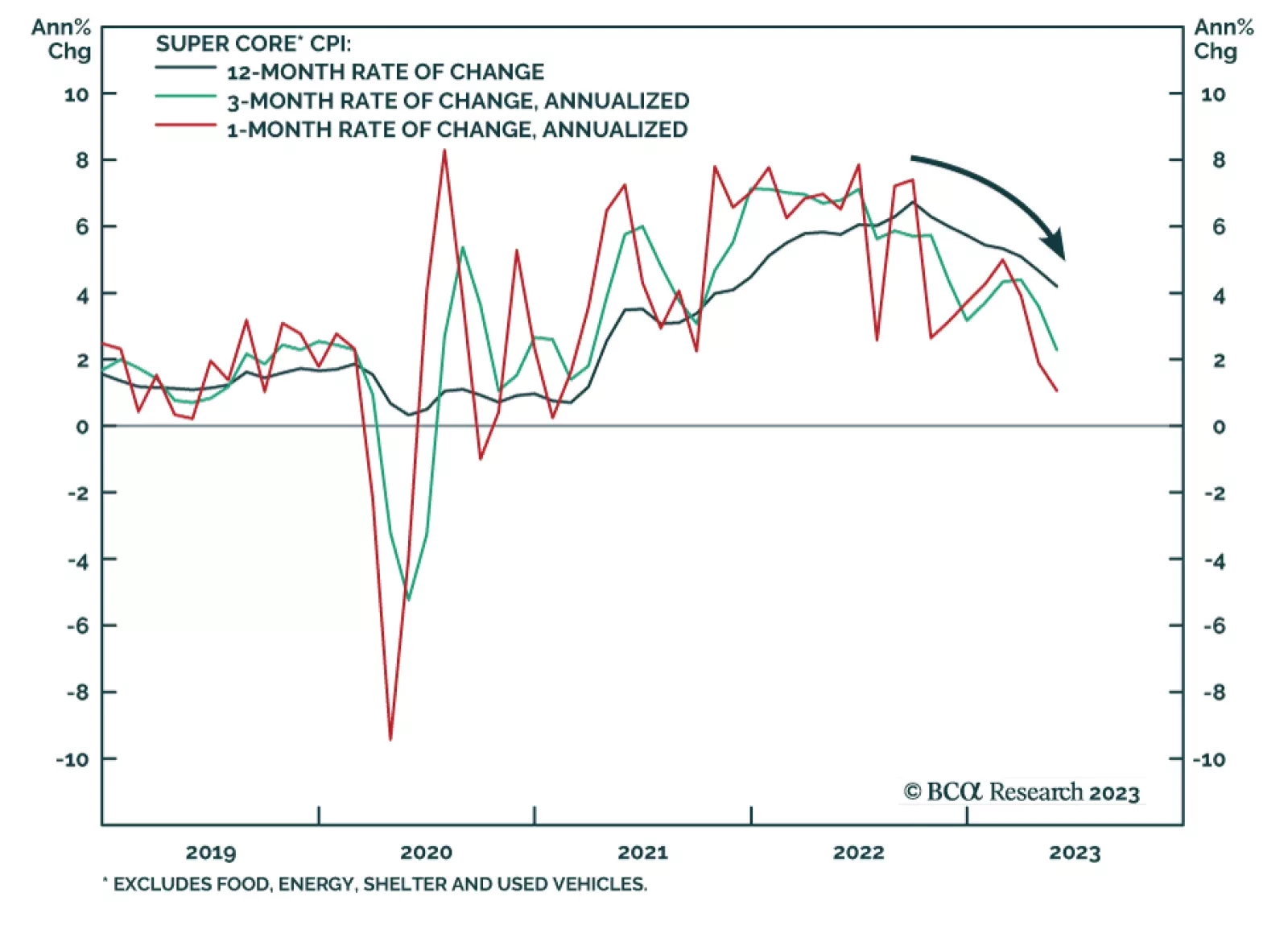

With the 1-year CPI swap rate trading at 2.3%, the market was already priced for a significant drop in inflation heading into yesterday’s May CPI release. The results of the report should only reinforce those expectations…

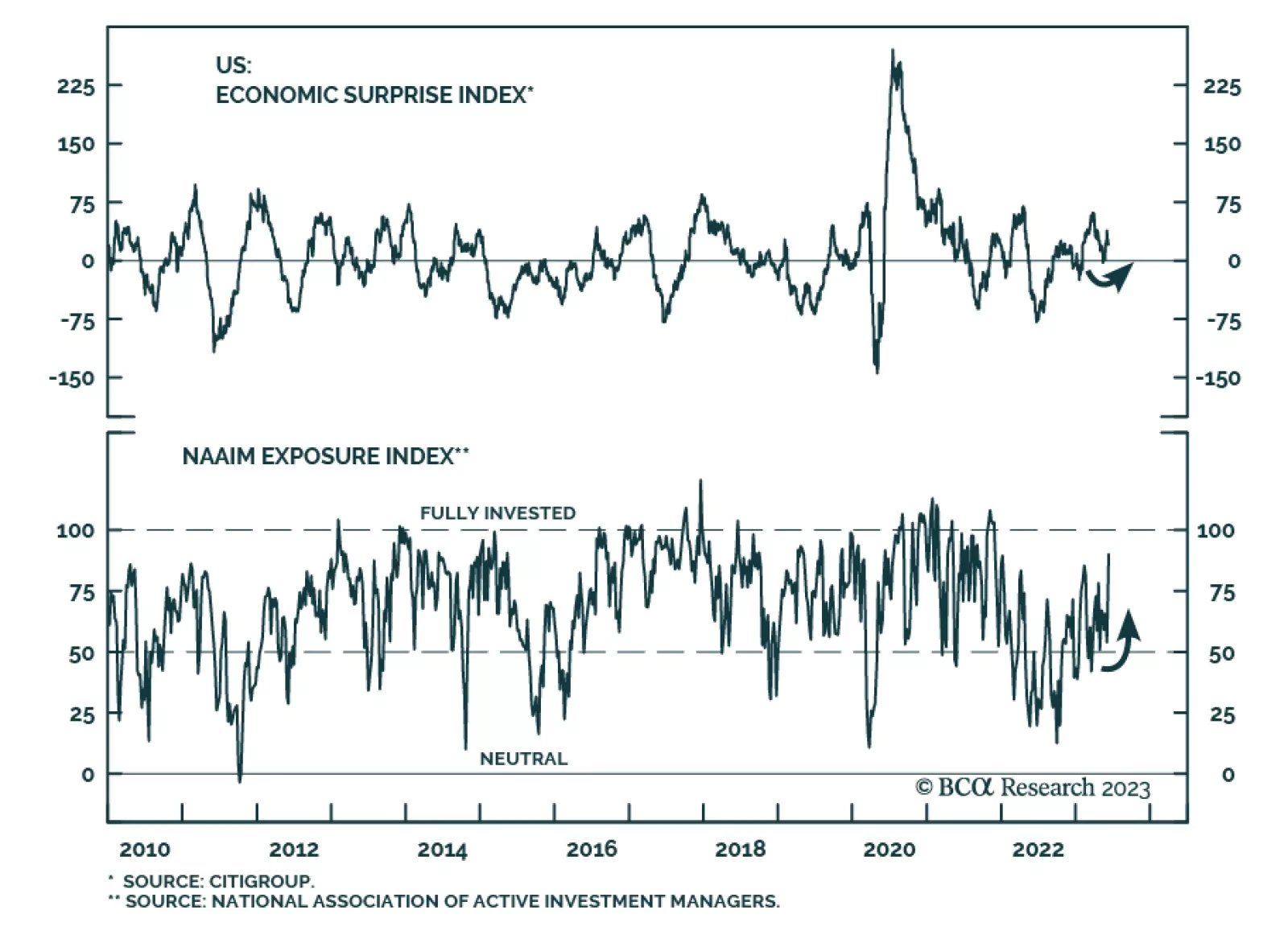

According to the Exposure Index compiled by the National Association of Active Investment Managers (NAAIM), active risk managers are increasing their net exposure to equities. The range of responses to the weekly survey…