China is facing a risk of deflation. Marginal interest rate cuts and targeted stimulus will be insufficient to boost China’s growth given the current deflationary mindset and the danger is that the economy may be entering a liquidity…

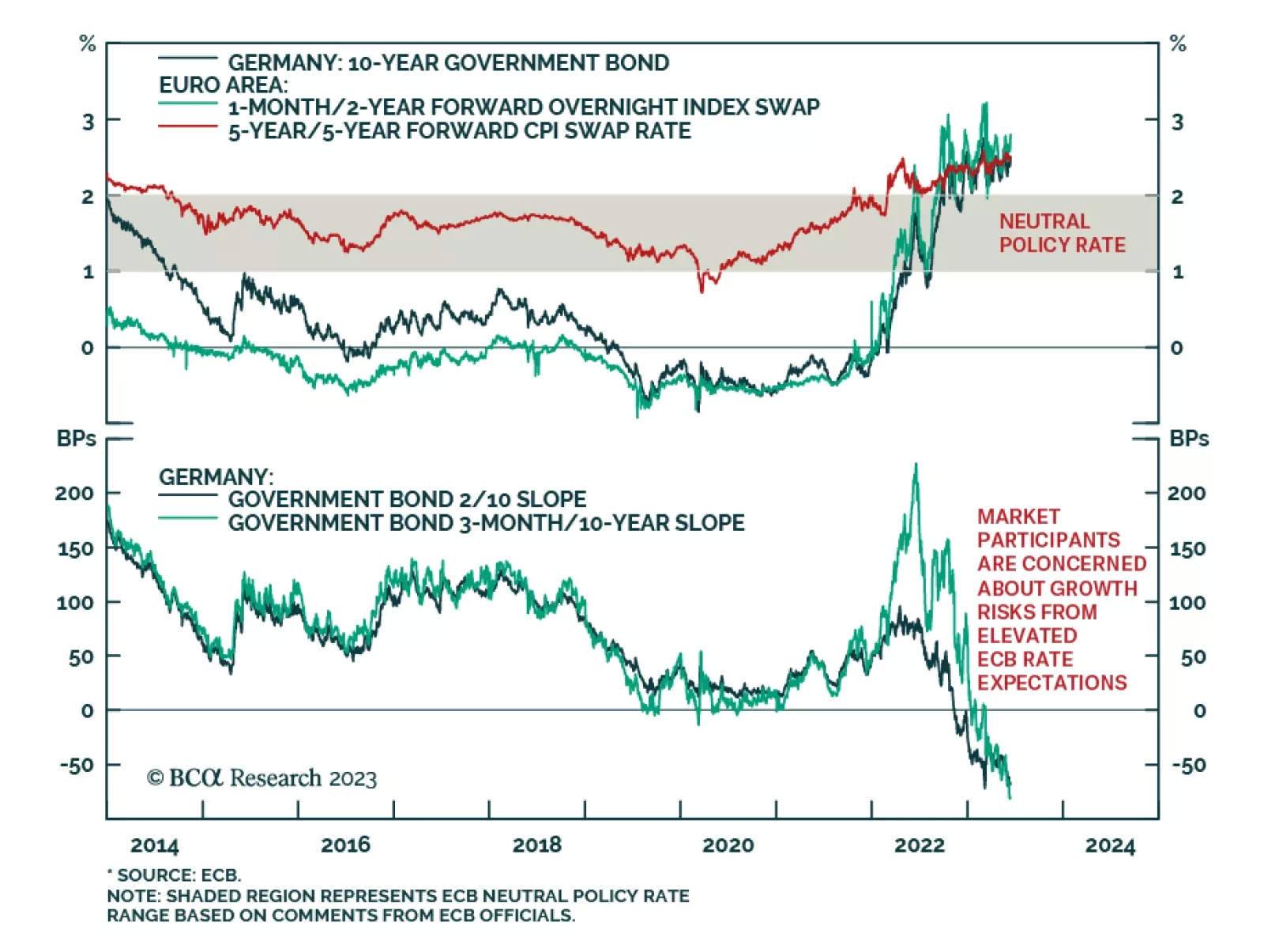

In this Insight, we discuss the currency and bond market implications of last week’s ECB and Bank of Japan policy meetings. The conclusion: the ECB is on a path to an overly hawkish policy mistake, while the Bank of Japan’s dovish…

In this Insight, we discuss the currency and bond market implications of last week’s ECB and Bank of Japan policy meetings. The conclusion: the ECB is on a path to an overly hawkish policy mistake, while the Bank of Japan’s dovish…

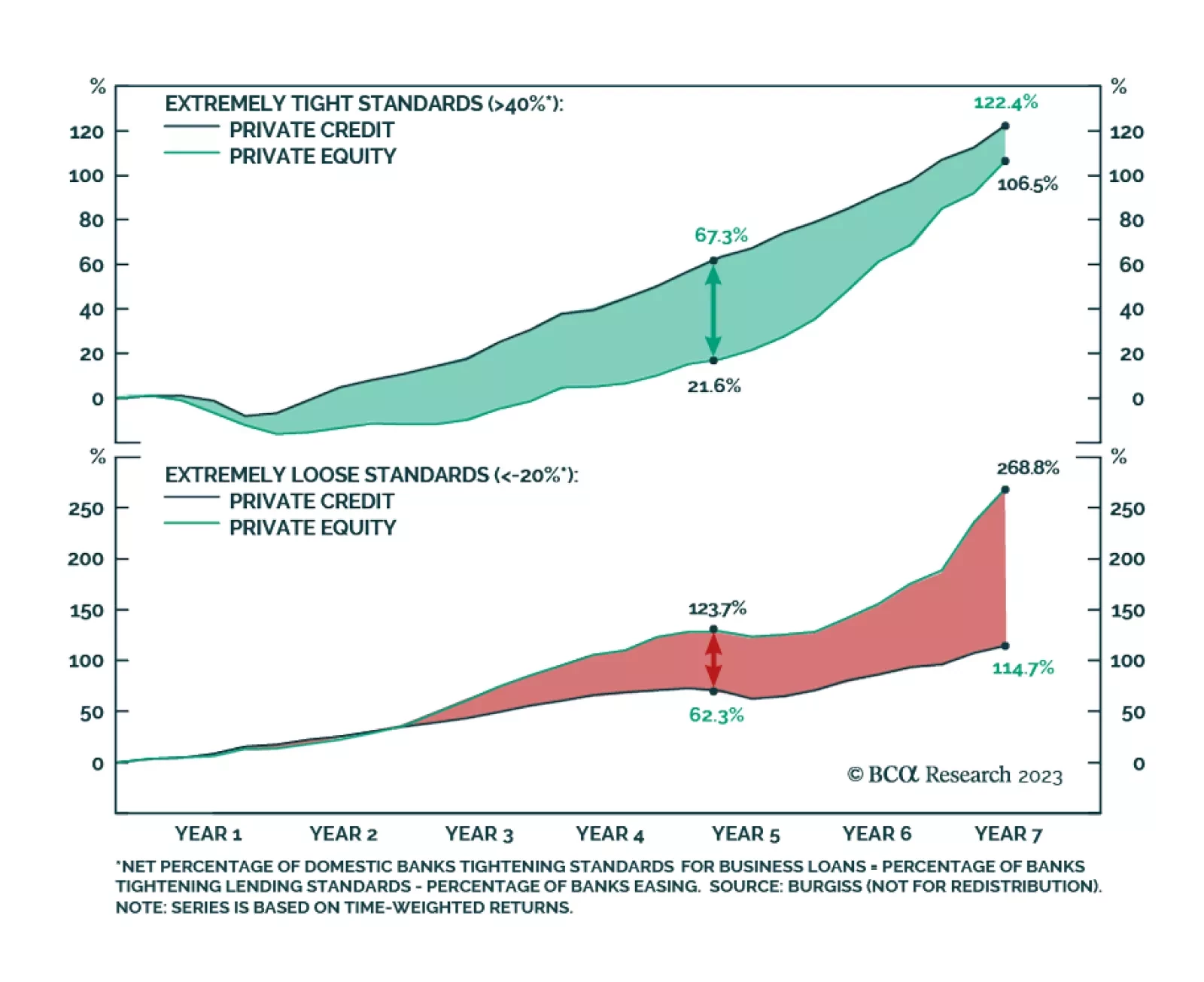

According to BCA Research’s newly launched Private Markets & Alternatives service, the present moment in the business cycle appears to be favorable for Private Credit relative to Private Equity. The current…

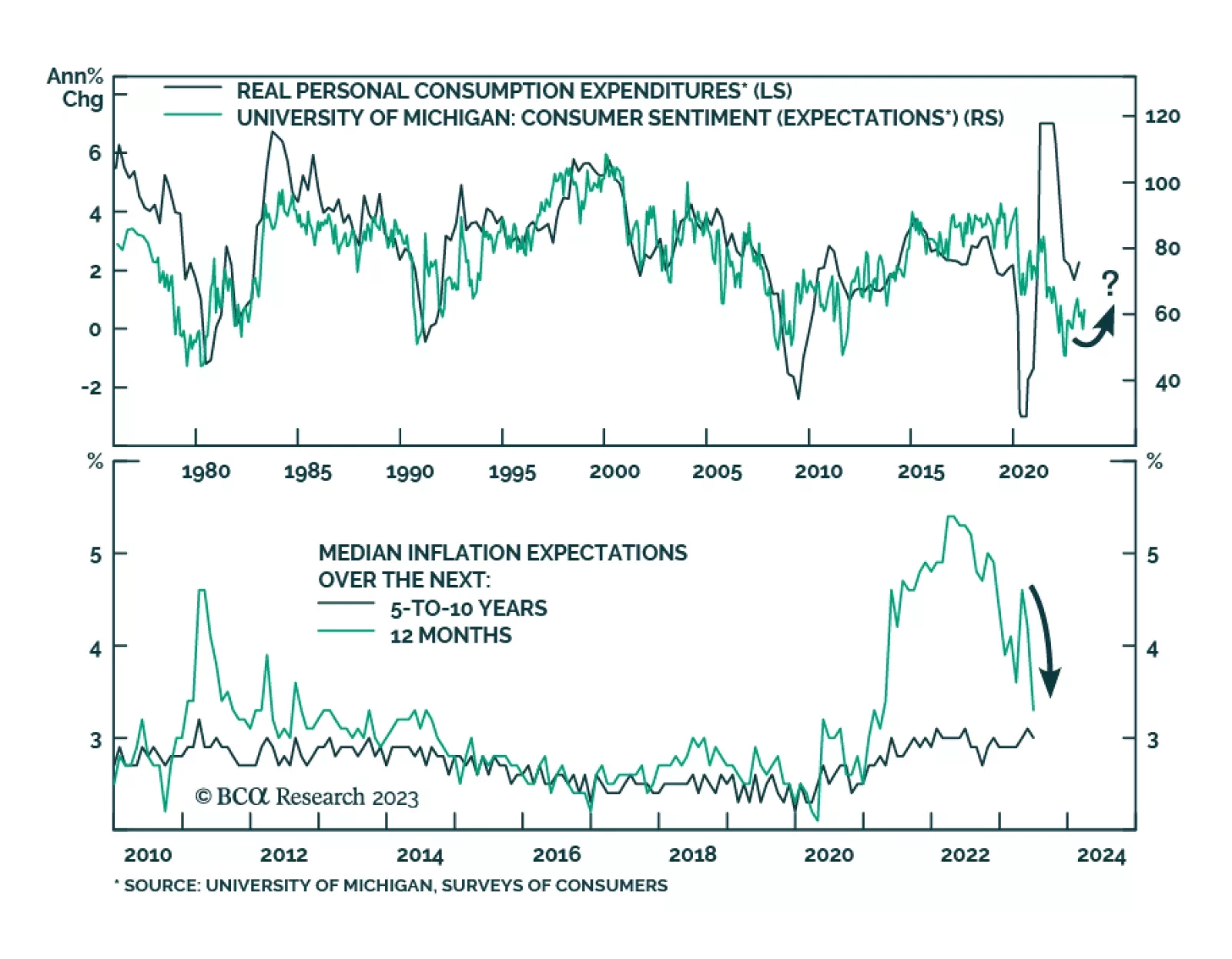

Preliminary results of the University of Michigan Consumer Sentiment survey sent a positive signal about household morale in June. The Sentiment index rose by a greater-than-anticipated 4.7 points to 63.9 on the back of…

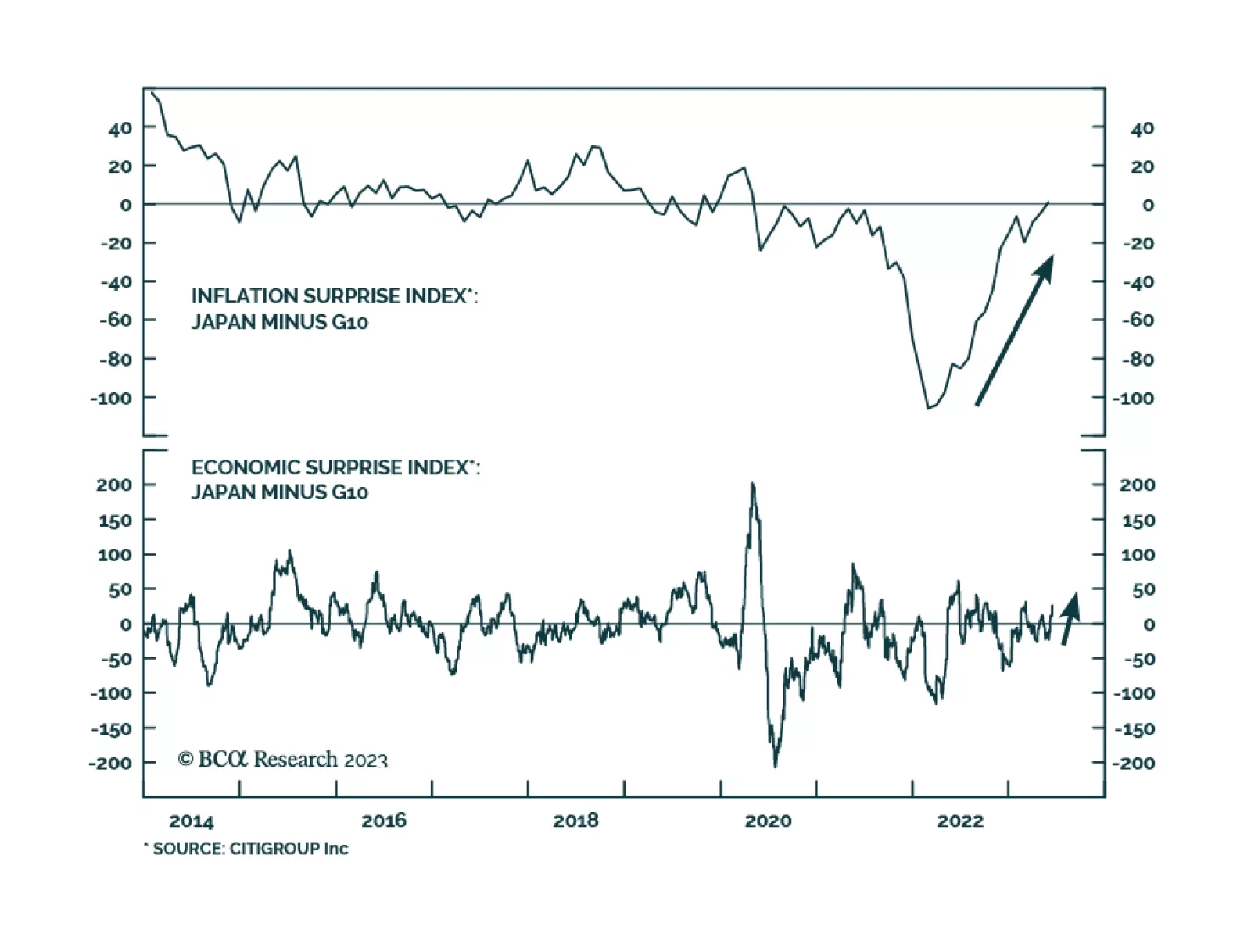

The Japanese yen was the worst performing major currency on Friday. The weakness followed news that the BoJ kept its policy rate untouched at -0.1% – as widely expected – and did not make any changes to its yield…

As expected, the European Central Bank (ECB) delivered a 25bps rate hike on Thursday, raising the policy rate to 3.5% — the highest since August 2001. Moreover, the central bank maintained a hawkish bias, signaling…

The normalization of oil storage markets in the Northern Hemisphere; strong demand, aided by China stimulus this year; and continued production discipline supports our view Brent prices likely have bottomed, and will move higher from…

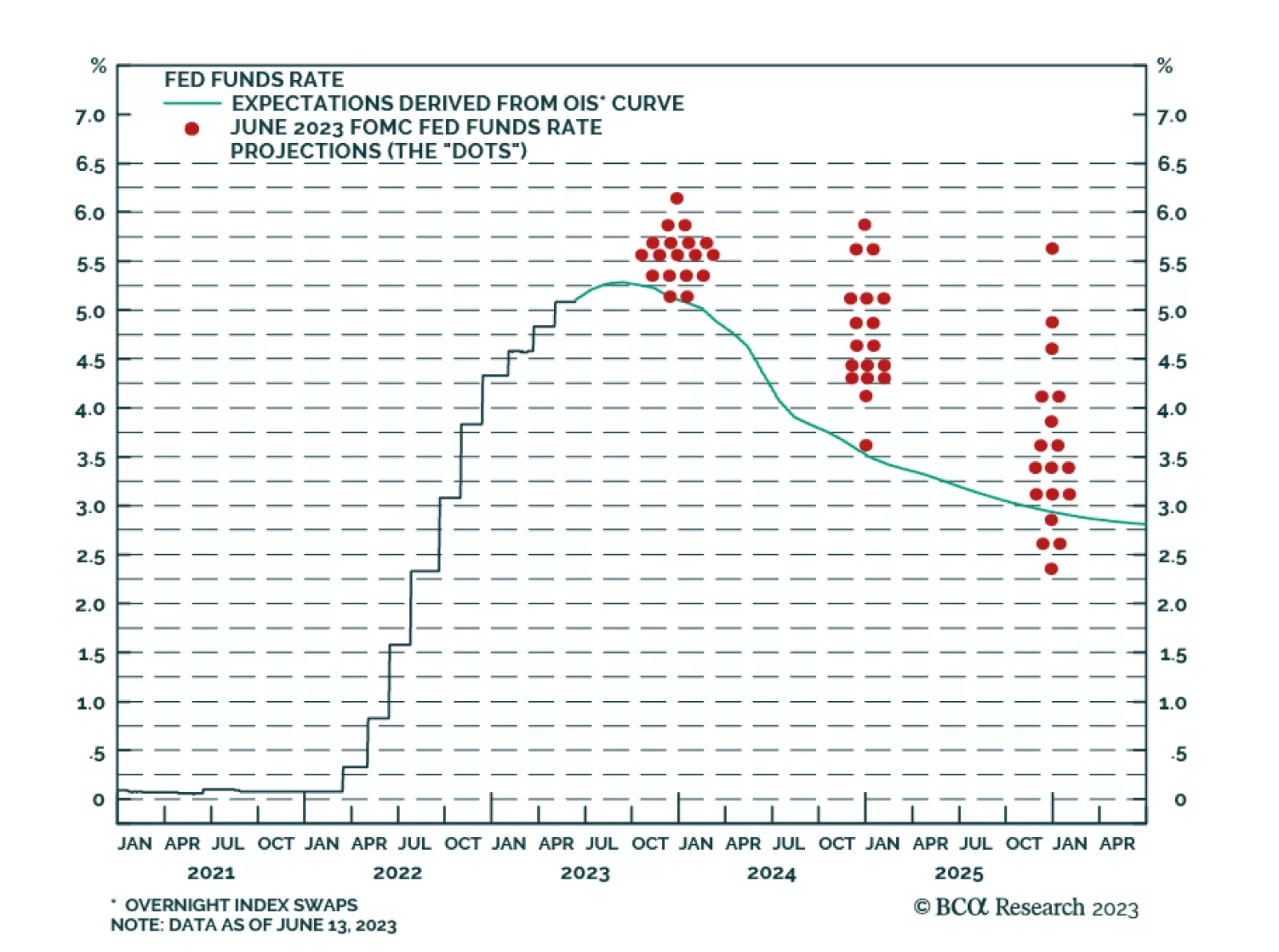

This Strategy Insight discusses the bond market and currency implications of the Fed’s “hawkish pause”.

As expected, the Fed kept interest rates unchanged on Wednesday in order to give policymakers time to assess the impact of the aggressive tightening cycle. Chair Powell indicated that the decision to pause is consistent with…