In this report, we dissect which markets have broken out and which ones have not, and reflect what this entails for our global macro view. Also, we analyze how the S&P 500 has been taking its cues from a change in the inflation…

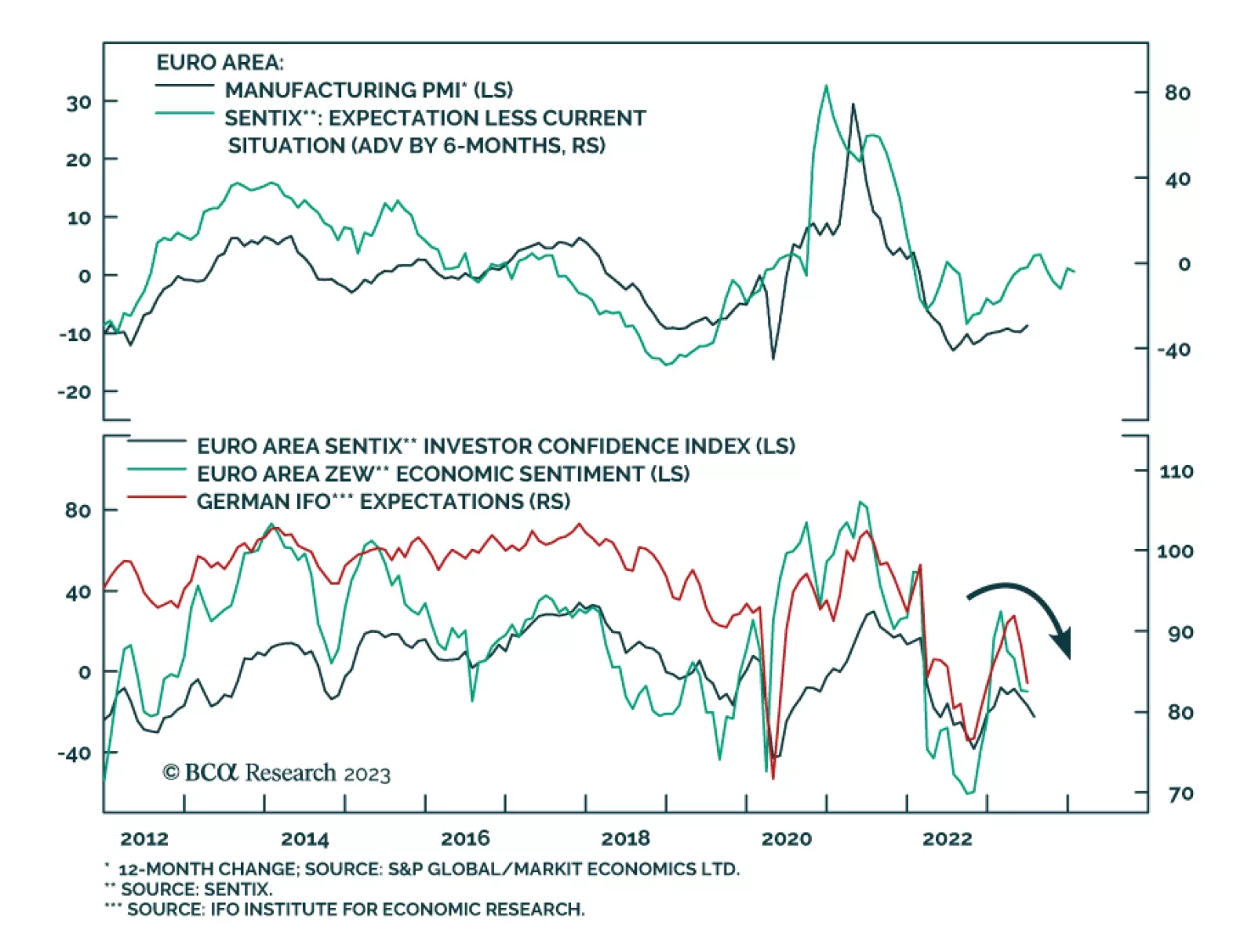

On Monday, the Eurozone Sentix sent a pessimistic signal about investor confidence in the Eurozone economy. The headline index dropped from -17.0 to -22.5 in July, significantly below expectations of a more muted deterioration to…

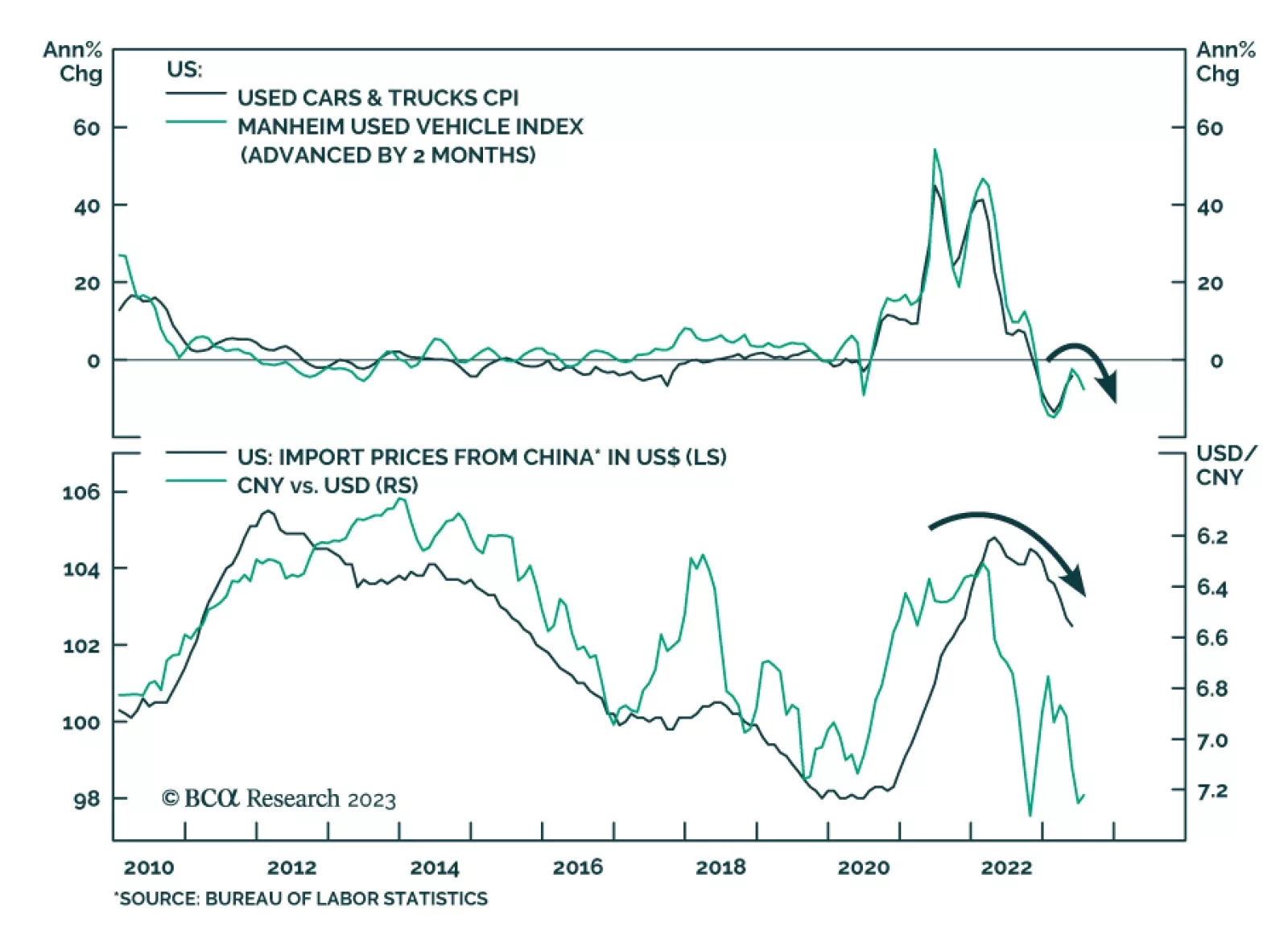

The latest update of the Manheim Used Vehicle Price Index provides a positive signal for US goods inflation. It shows used car prices fell by -4.2% m/m (-10.1% y/y) in June – its third consecutive monthly decline following…

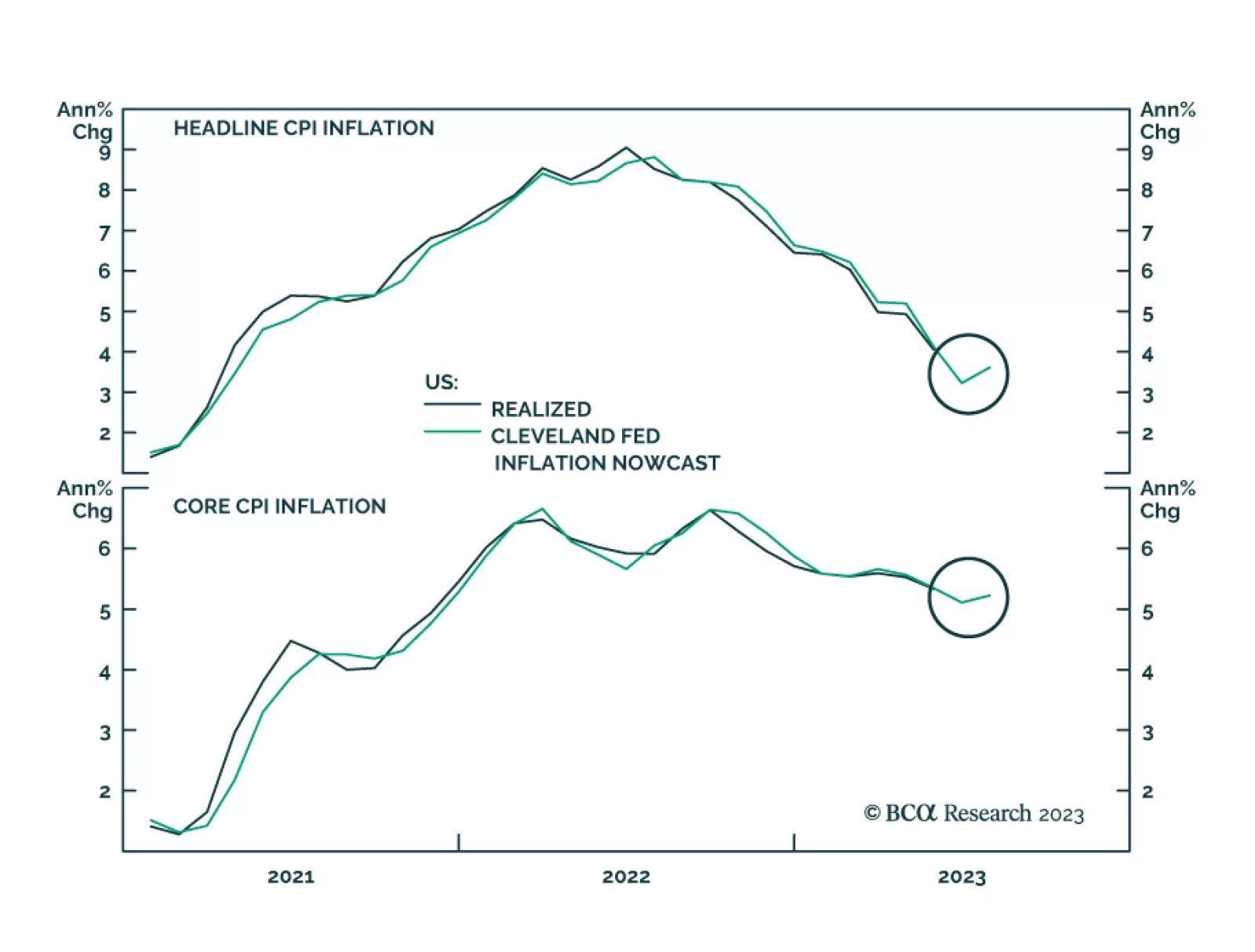

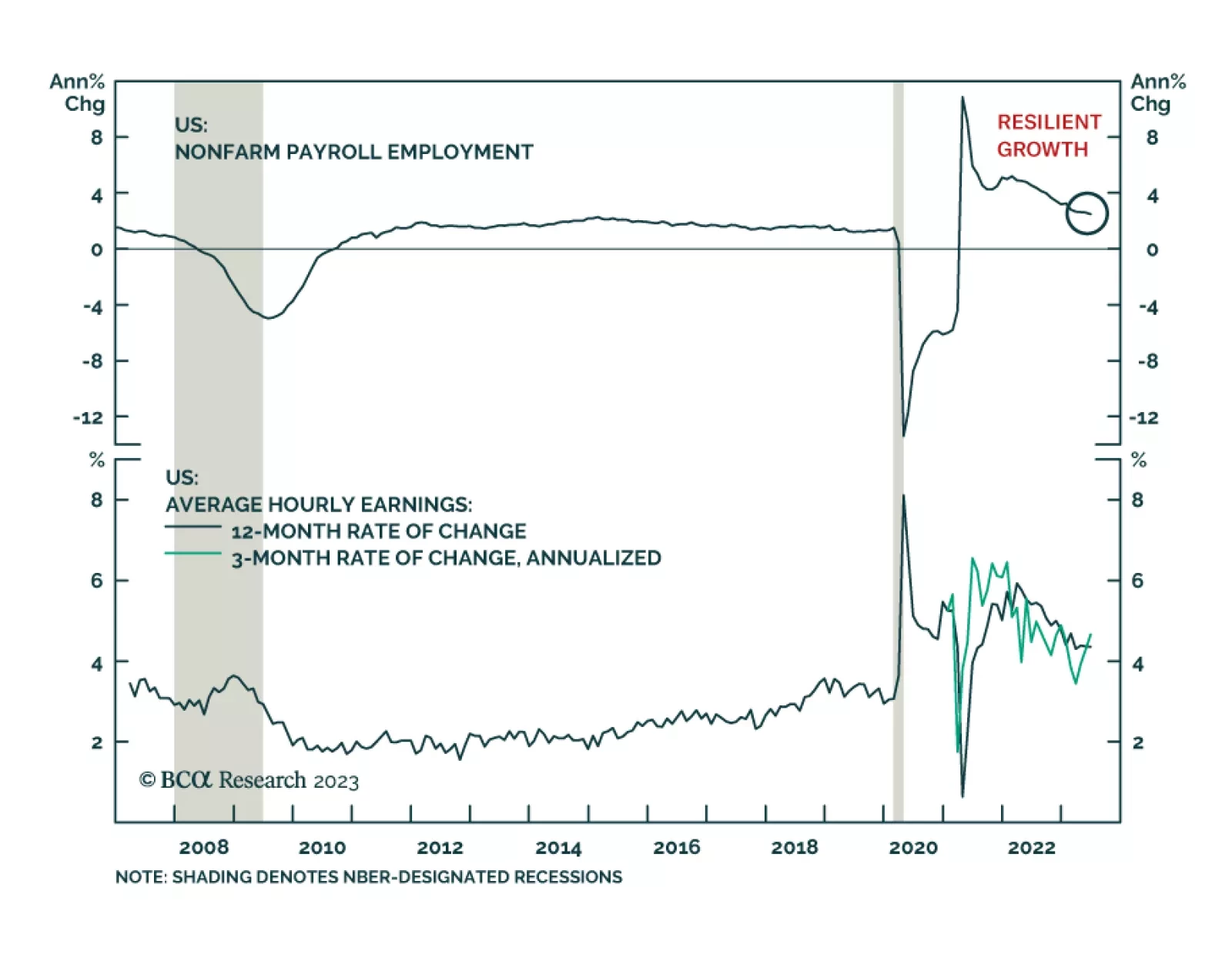

Last week’s labor market data signal that US employment conditions remain strong – solidifying the case for a 25 bps rate hike at the Fed’s next meeting later this month (see The Numbers). Yet in order for…

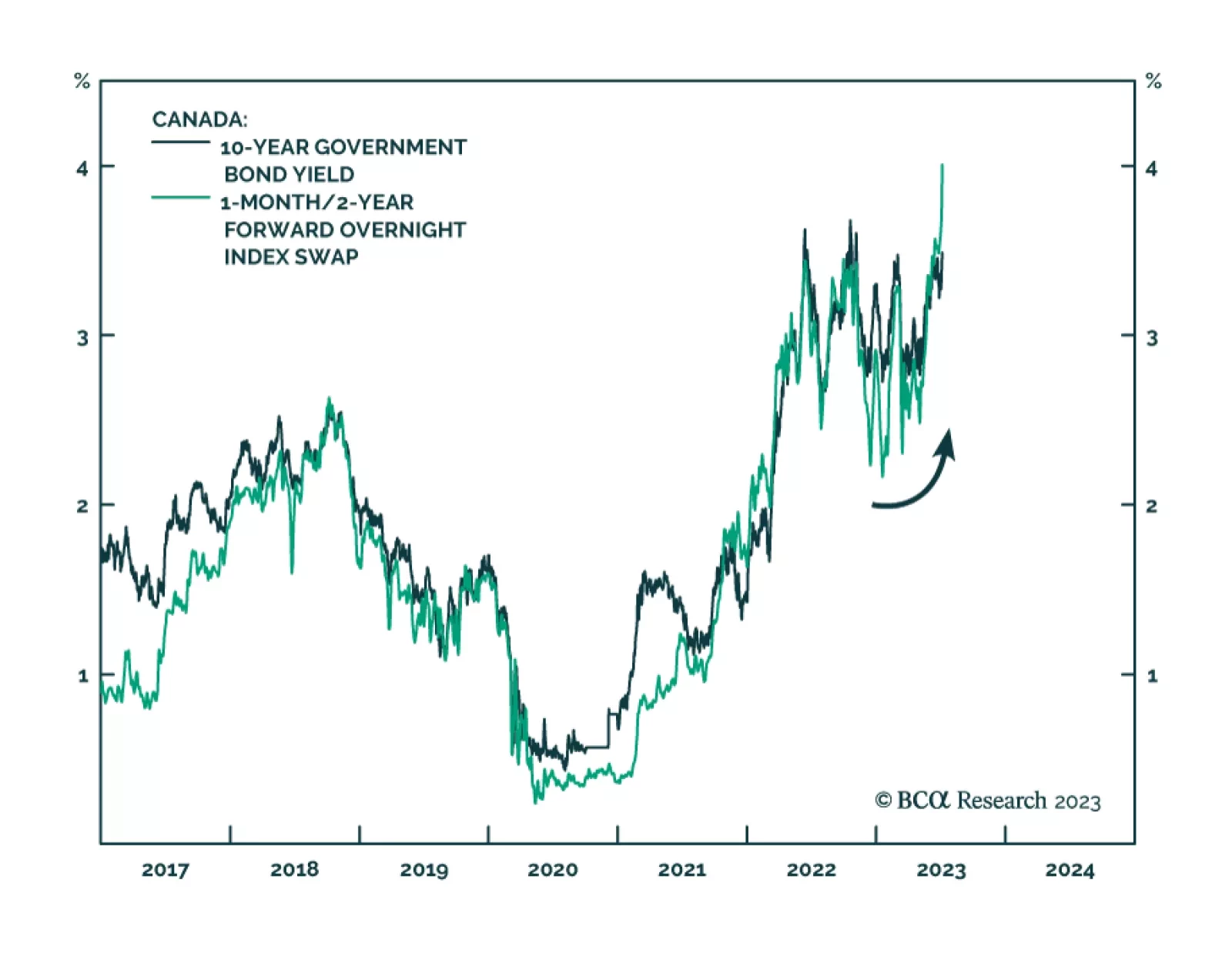

Canadian hiring surprised to the upside in June. The 60 thousand increase in employment last month – the highest since January – came in triple expectations of a 20 thousand rise and follows a 17 thousand decline in…

On the surface, the lower-than-anticipated job gains suggest that US labor market conditions softened last month. Friday’s jobs report revealed that the increase in nonfarm payrolls slowed from a downwardly revised 306…

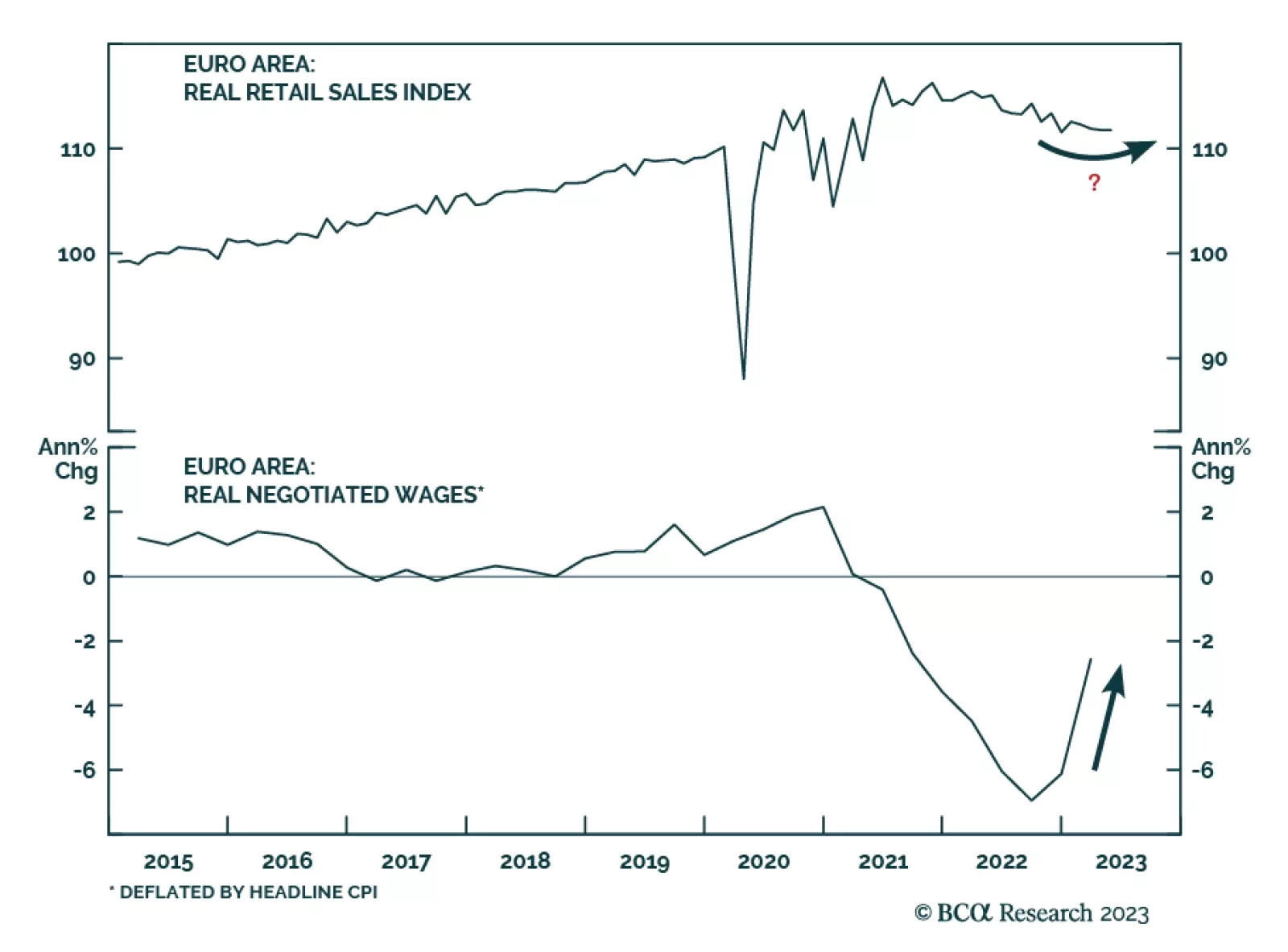

Yesterday we highlighted that falling producer prices foreshadow lower CPI inflation in the Eurozone and argued that this dynamic is positive for the bloc’s consumption outlook. Easing price pressures will ultimately lift…

Global stocks fell and sovereign bond yields surged on Thursday following the release of stronger-than-anticipated US labor market data. Data released by Challenger, Gray, & Christmas showed job cuts declined to 40,709…

On one hand, China will be exporting deflation to the rest of the world. On the other hand, core inflation is sticky in the US, making the Fed err on the hawkish side. Altogether, these crosscurrents are creating a toxic mix for risk…

Markets continue to be tossed to and fro by central-bank policy, and risks of higher commodity prices. These are due to fiscal stimulus and exogenous weather and war-related risk, which could send food and energy prices higher this…