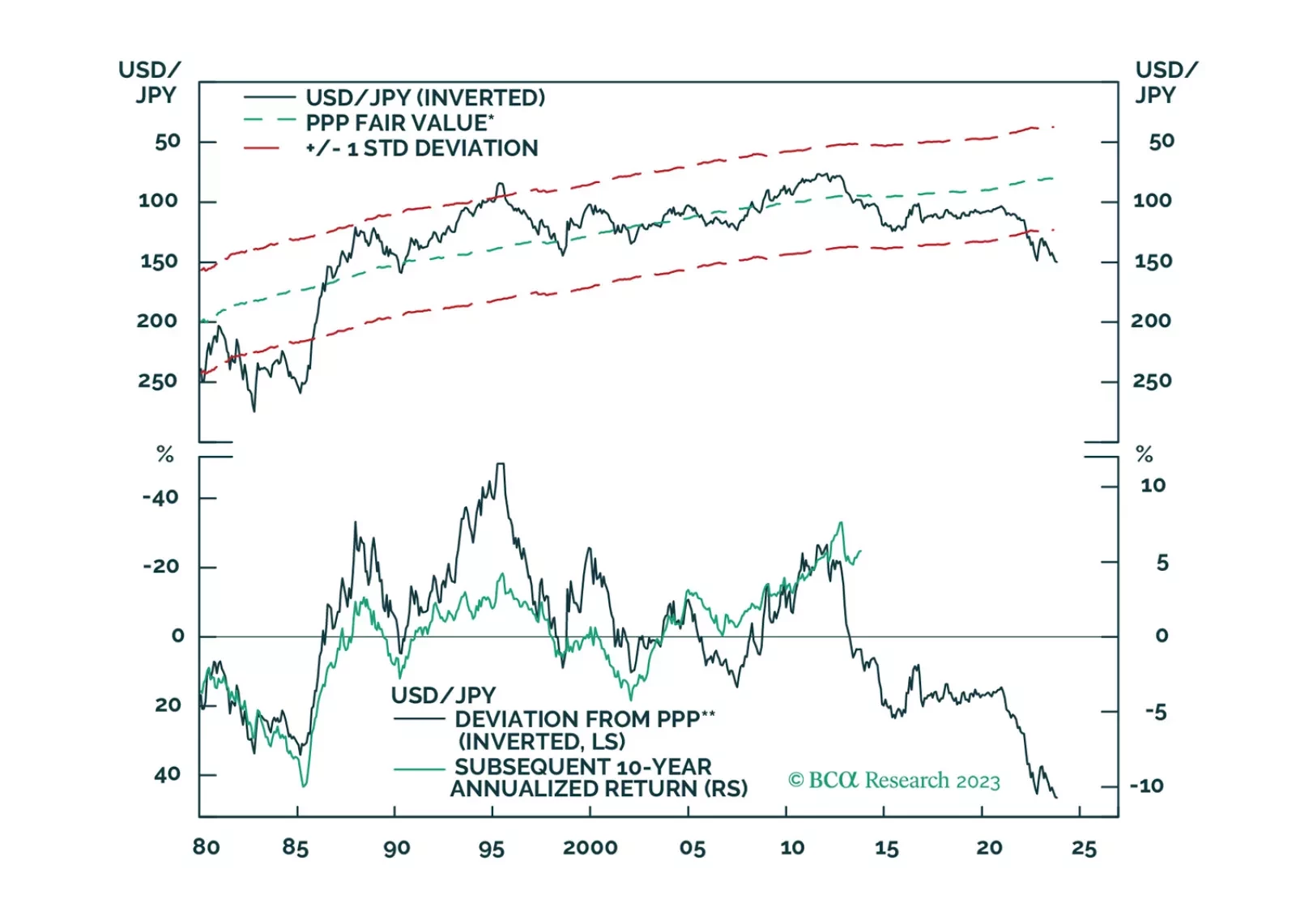

There is a high probability that the global economy will tip into recession in the second half of 2024. A long yen position is an excellent hedge against that risk.

The Hamas attack against Israel, timed almost 50 years to the day after a similar surprise attack on Yom Kippur of 1973, has evoked parallels with the 1970s. Parallels not only with Middle Eastern geopolitics then and now, but also…

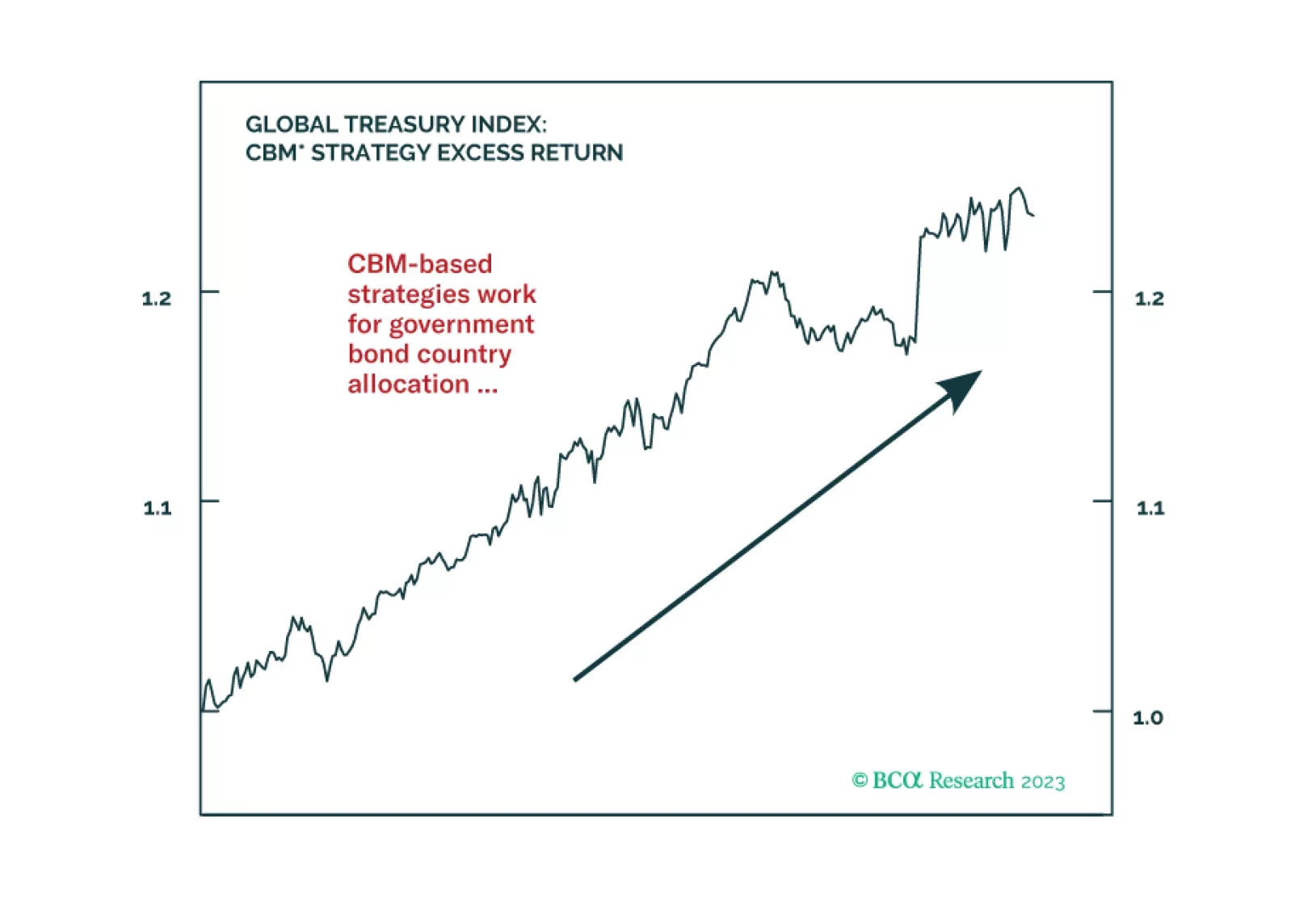

In this report, we present the quarterly review of the Global Fixed Income Strategy Model Bond Portfolio. The portfolio remains positioned for slower global growth momentum over the next 6-12 months, favoring government bonds over…

US monetary policy is restrictive, as evidenced by a falling jobs-workers gap. The reason that unemployment has not risen is because labor demand still exceeds supply. That will change in the second half of 2024 when the US economy…

The sharp sell-off in long duration bonds (ticker TLT) has reached the collapsed 130-day complexity that implies a probable and playable rebound. More strategically, long-duration bonds yielding close to 5 percent are an excellent…

The market has been held hostage by surging rates. Zombie companies are “alive” and are multiplying – they are highly sensitive to surging borrowing costs. Underweight Utilities to reduce portfolio duration. Maintain neutral…

Downside risks to equities are building. Rates, the dollar, and energy prices will remain elevated into yearend. This trifecta makes a soft landing less likely than before and hurts corporate profits and multiples. However, high cash…

The bear market in US bonds will likely end with a bang rather than a whimper. Even during the secular US bond bull market of 1982-2021, cyclical bond bear markets ended only after an eruption of financial turmoil. It would be…

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…