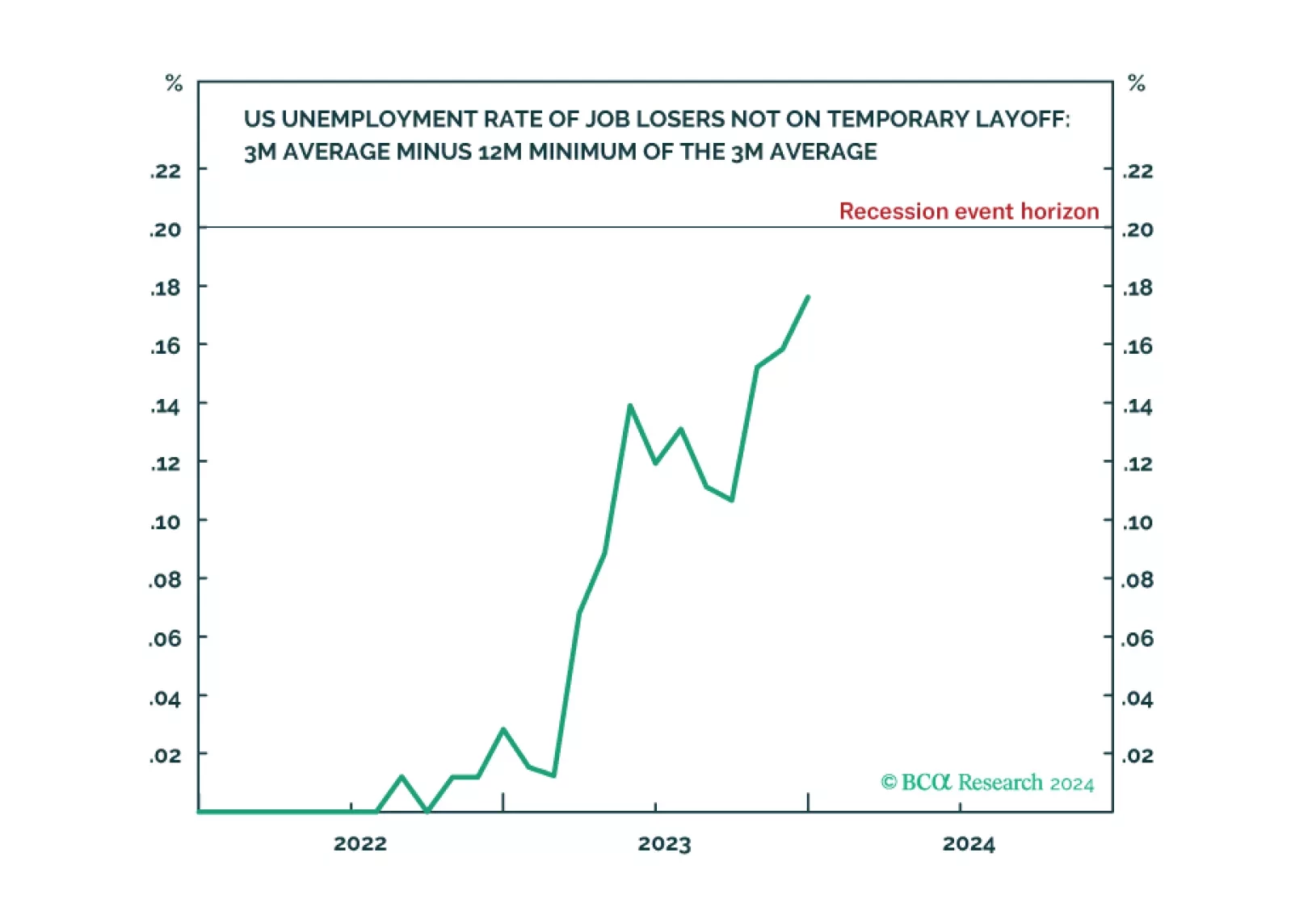

Following today’s US jobs data release, the Joshi rule real-time US recession indicator inched up to 0.18 and is now just a whisker from its recession event-horizon of 0.20.

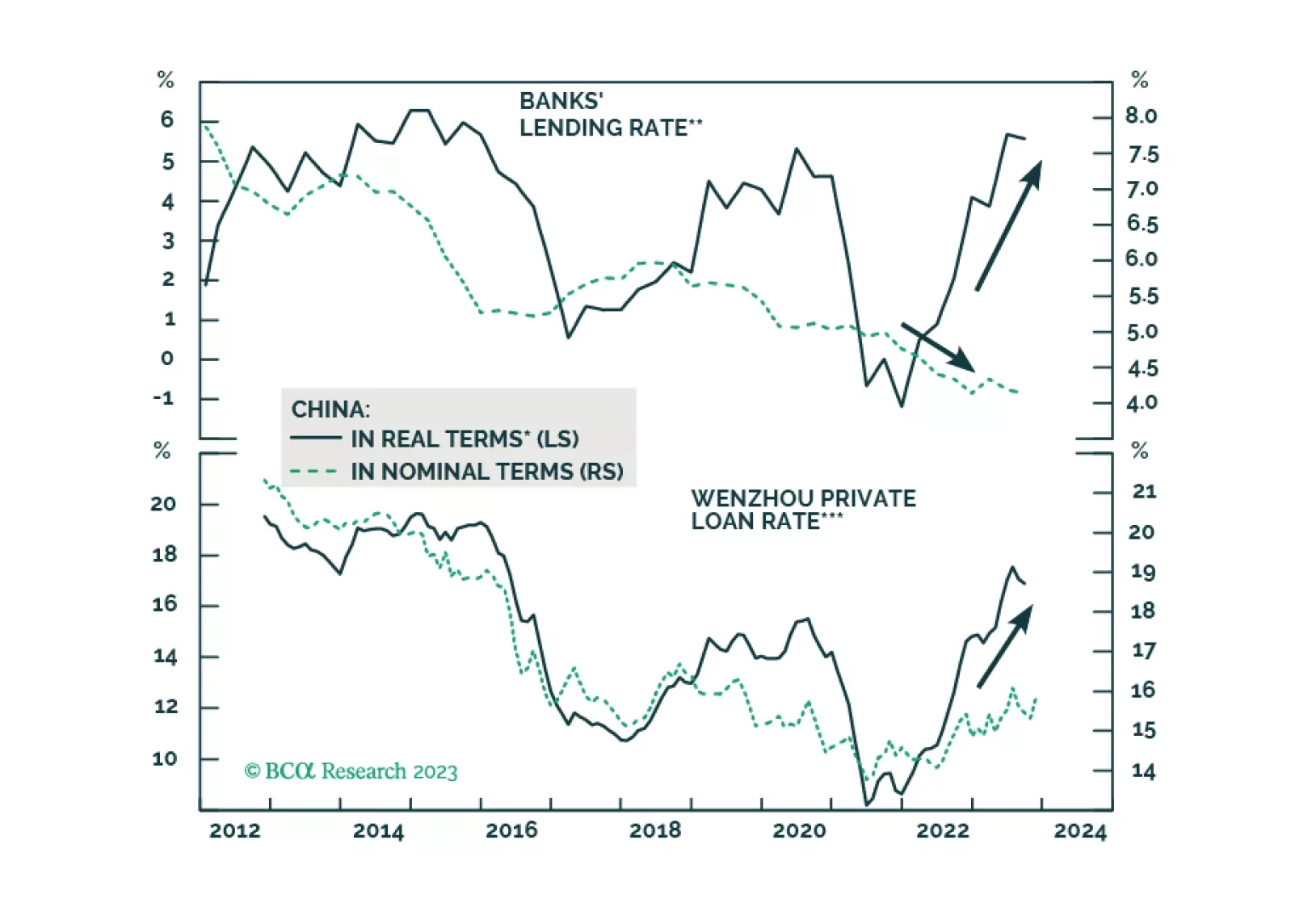

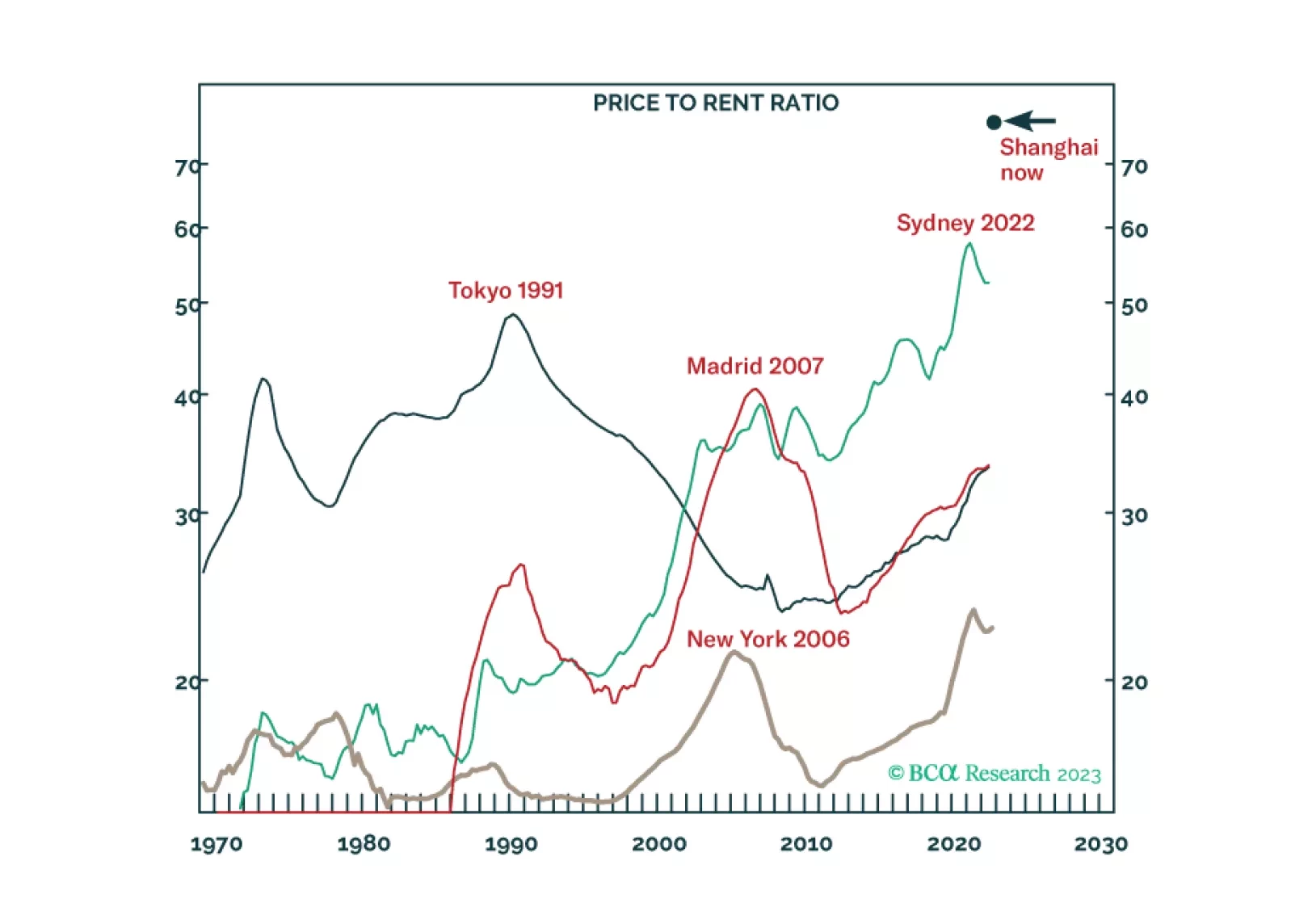

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

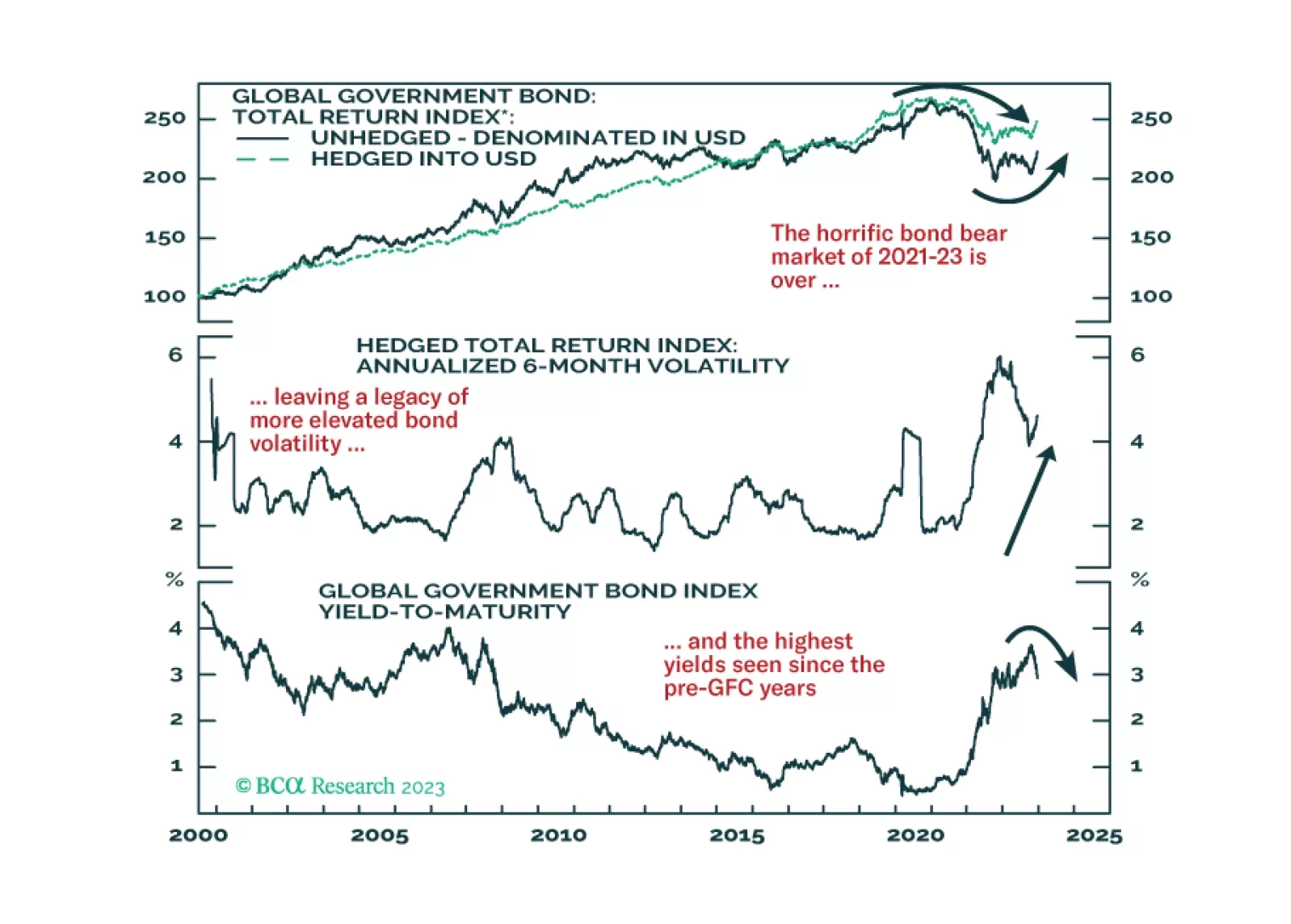

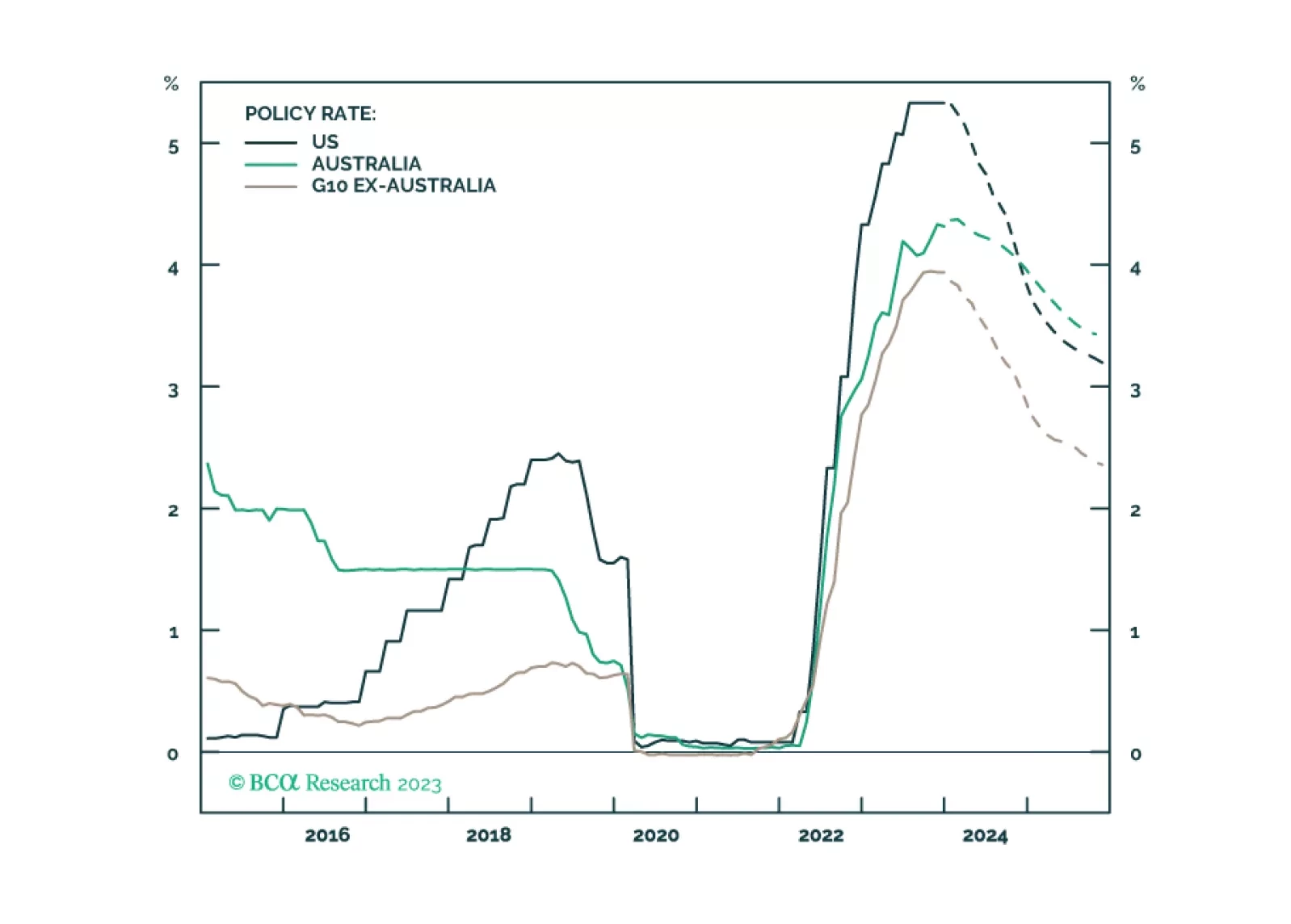

Our US bond team’s thoughts on this afternoon’s FOMC meeting and yesterday’s CPI release.

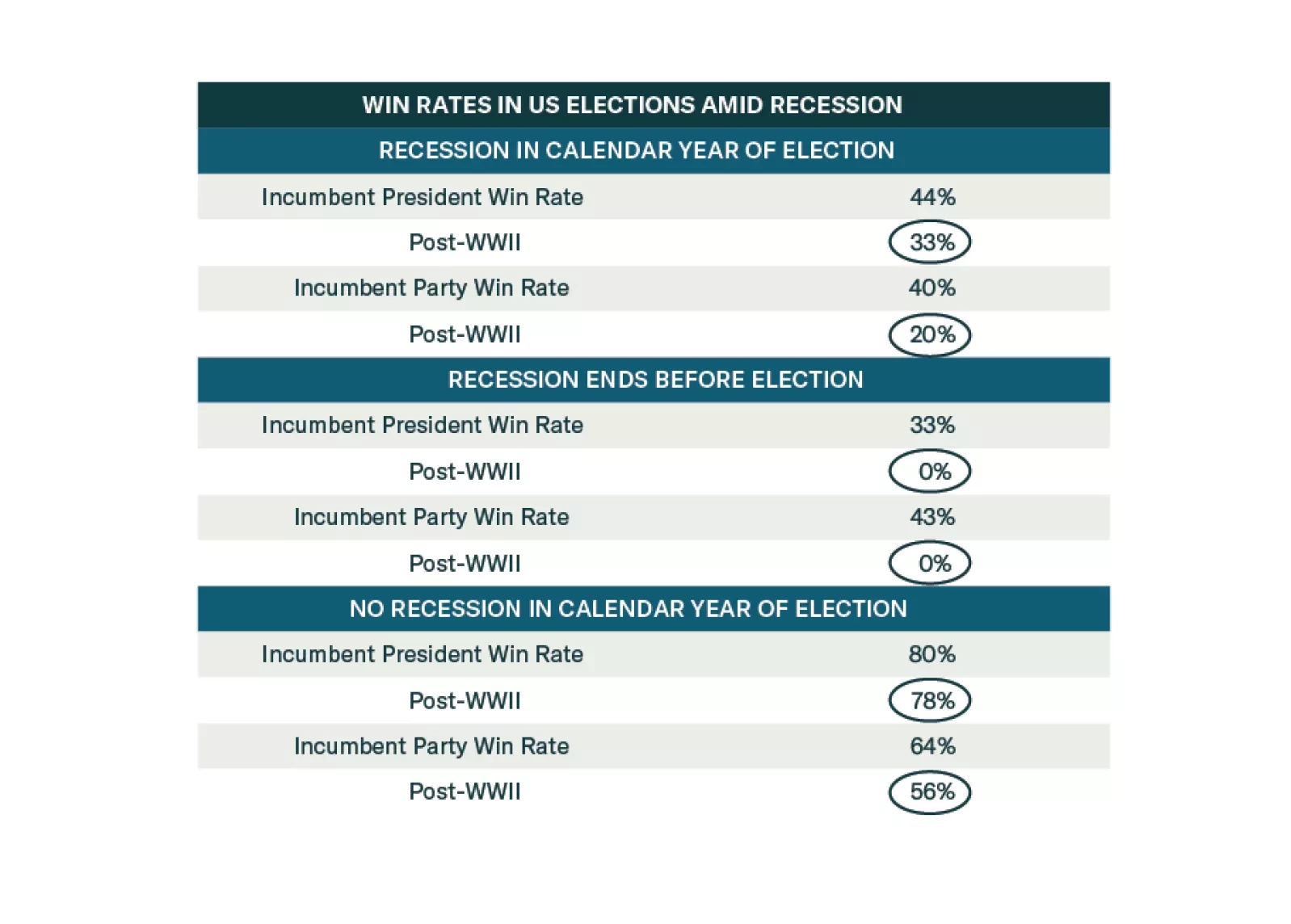

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

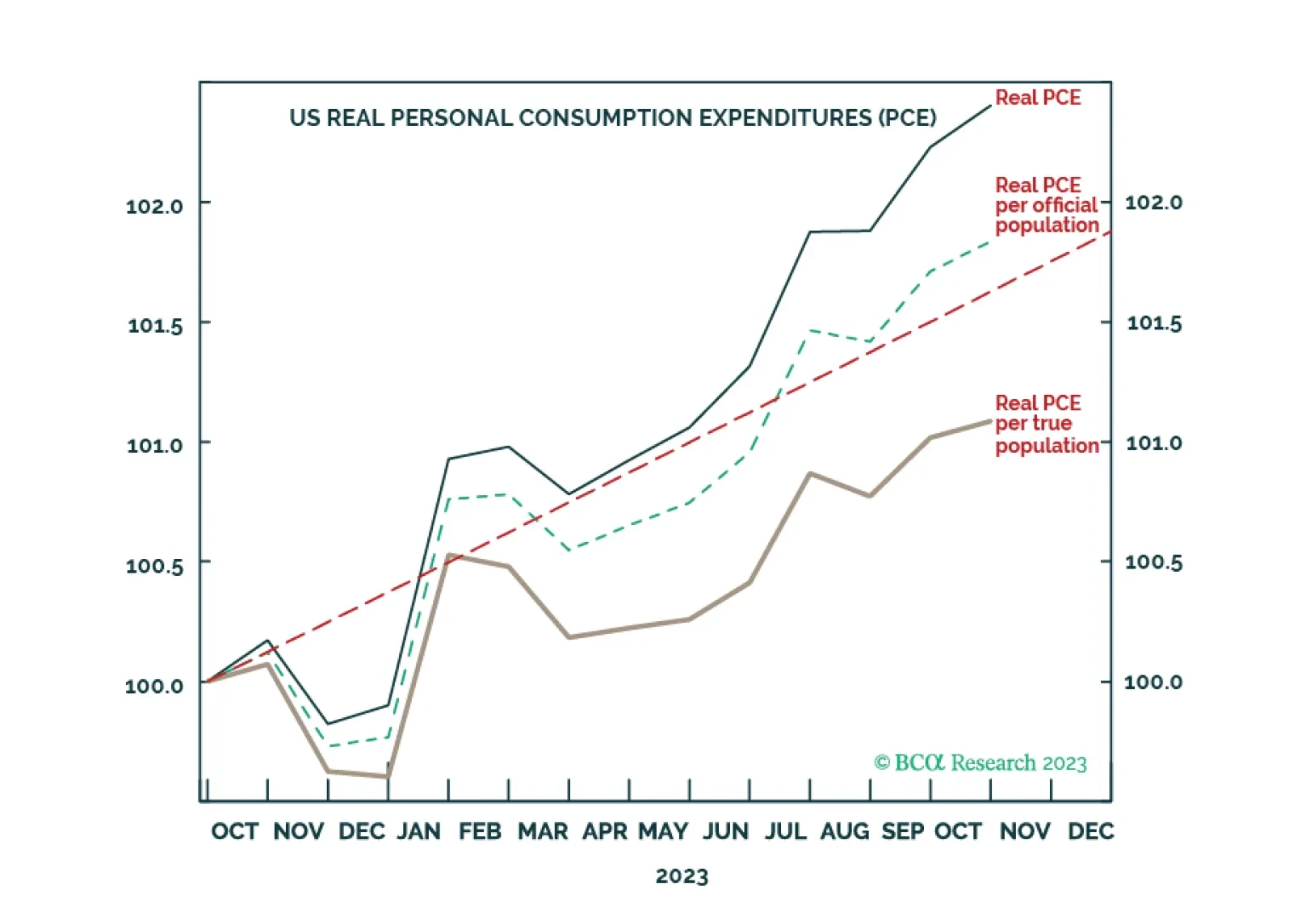

Illegal immigration into the US has skyrocketed to record levels. Correctly accounting for this, US real consumption growth on a per head basis is already fragile. Meanwhile, the real bond yield is only now approaching the pain point…

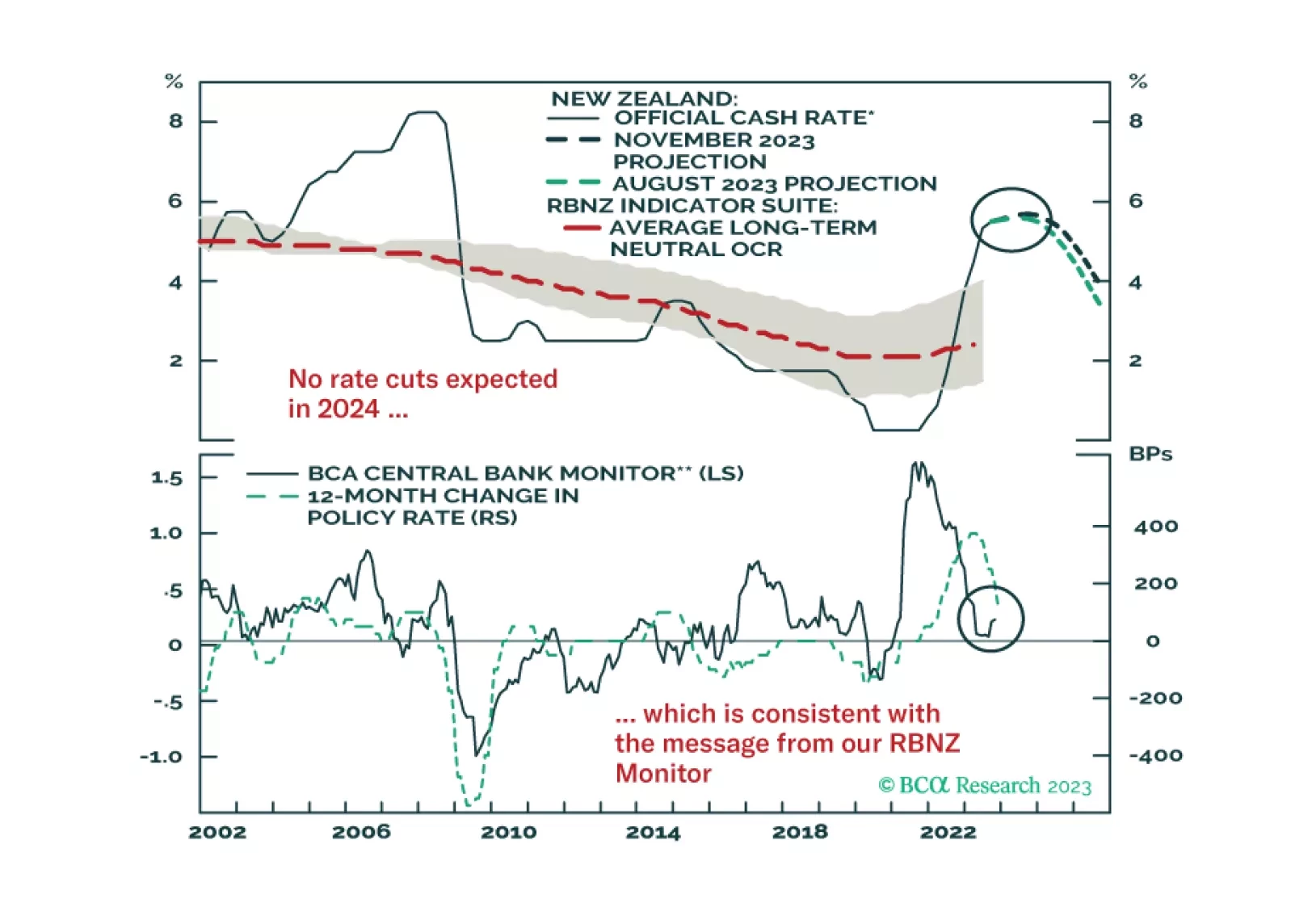

In this Insight, we discuss the outlook for monetary policy in New Zealand after this week’s RBNZ policy meeting, and introduce related fixed income and currency trade ideas.