In this Insight, we review the latest Bank of Canada and Reserve Bank of New Zealand meetings, and suggest the appropriate bond and currency strategies.

In this Insight, we review the latest Bank of Canada and Reserve Bank of New Zealand meetings, and suggest the appropriate bond and currency strategies.

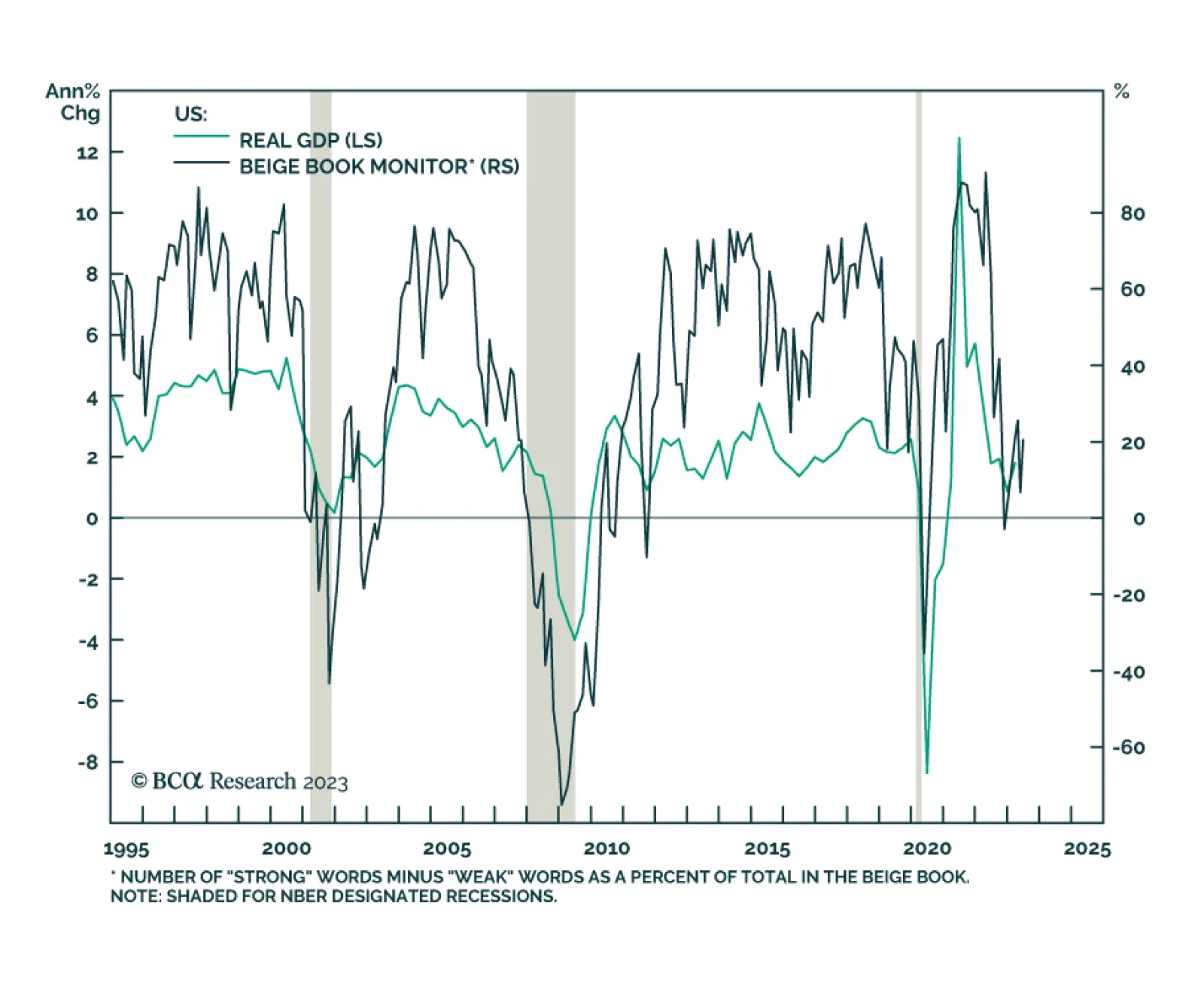

The Fed’s latest Beige Book reveals that economic activity rose slightly in recent weeks. The results are based on surveys and interviews conducted across 12 districts through June 30. In particular, two of the districts…

In this report, we explore Brazil’s inflation and monetary policy outlook, the Lula administration’s back-and-forth between pragmatism and populism, and how these factors will affect Brazilian financial markets going forward. All in…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

According to BCA Research’s China Investment Strategy team, China’s fiscal support will be limited due to political and economic factors. China has heavily relied on government expenditure support to sustain its…

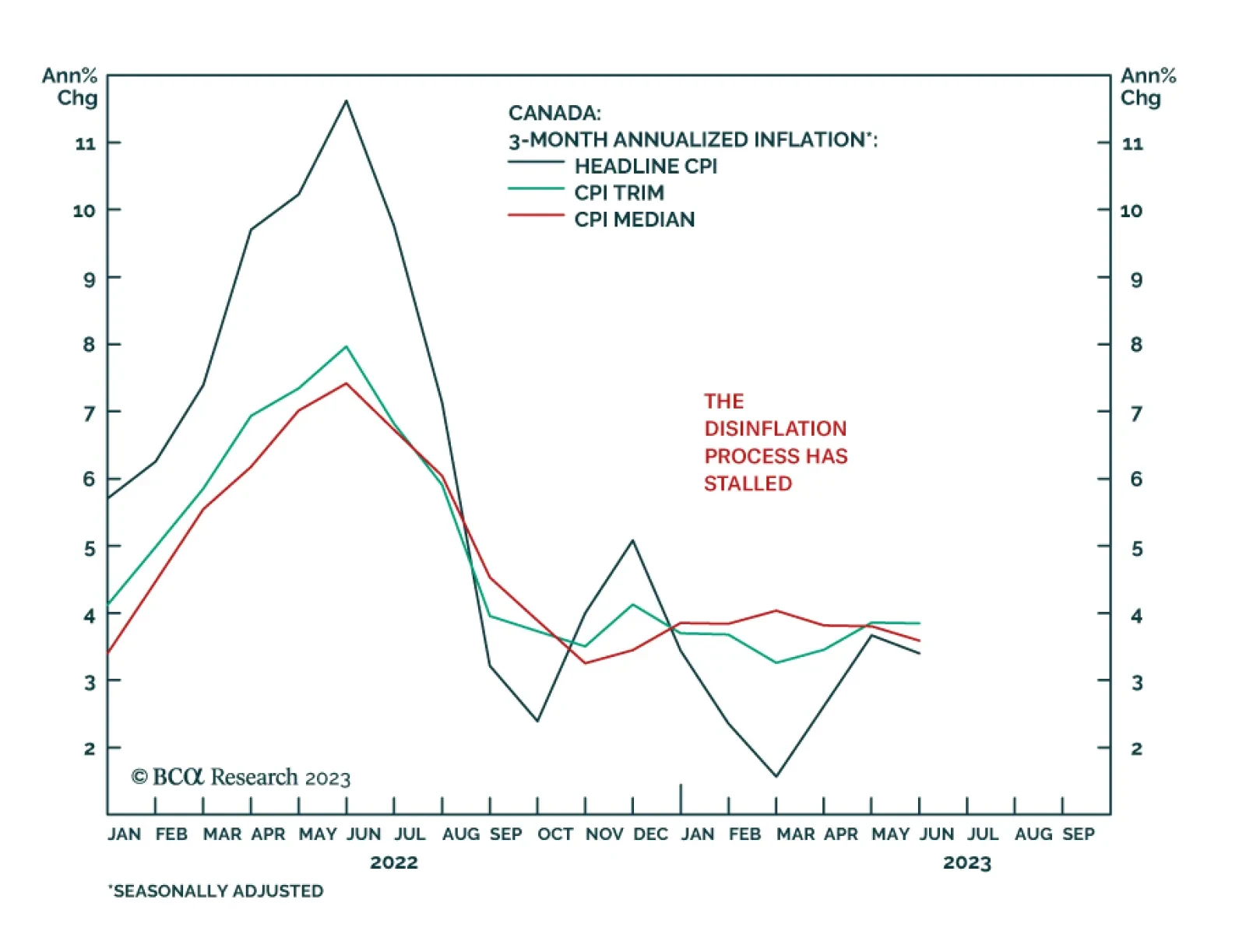

As expected, the Bank of Canada raised interest rates for the second consecutive month after restarting its tightening campaign last month. At 5.0%, the policy rate now stands 4.75 percentage points above where it was at the…

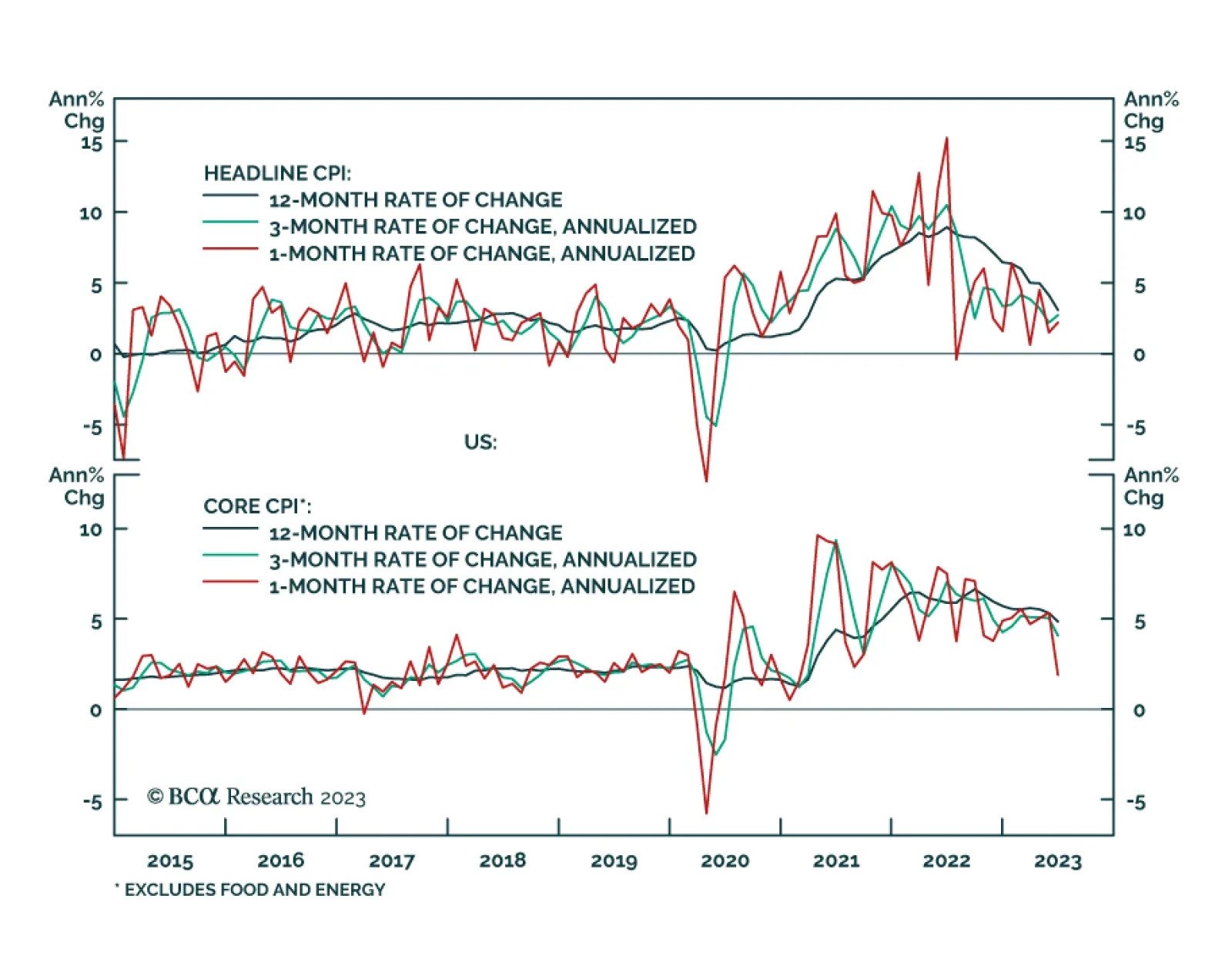

The June US CPI release showed inflationary pressures cooled last month. The headline index moderated from 4.0% y/y to 3.0% y/y – slightly below expectations of 3.1% y/y. Similarly, core CPI growth eased from 5.3% y/y to 4.…

An outlook for inflation and Fed policy following this morning’s CPI report.

The Politburo meeting in late July will set the course for economic policy for 2H23. We think China will only resort to "irrigation-style" stimulus if something breaks in the economy and/or financial markets. Furthermore, the gradual…