Australia’s June monthly CPI release shows inflationary pressures continue to moderate. Headline CPI inflation receded to 5.4% y/y -- in line with expectations – following a downwardly revised 5.5% y/y in May. To the…

A brief recap of the July FOMC meeting and its investment implications.

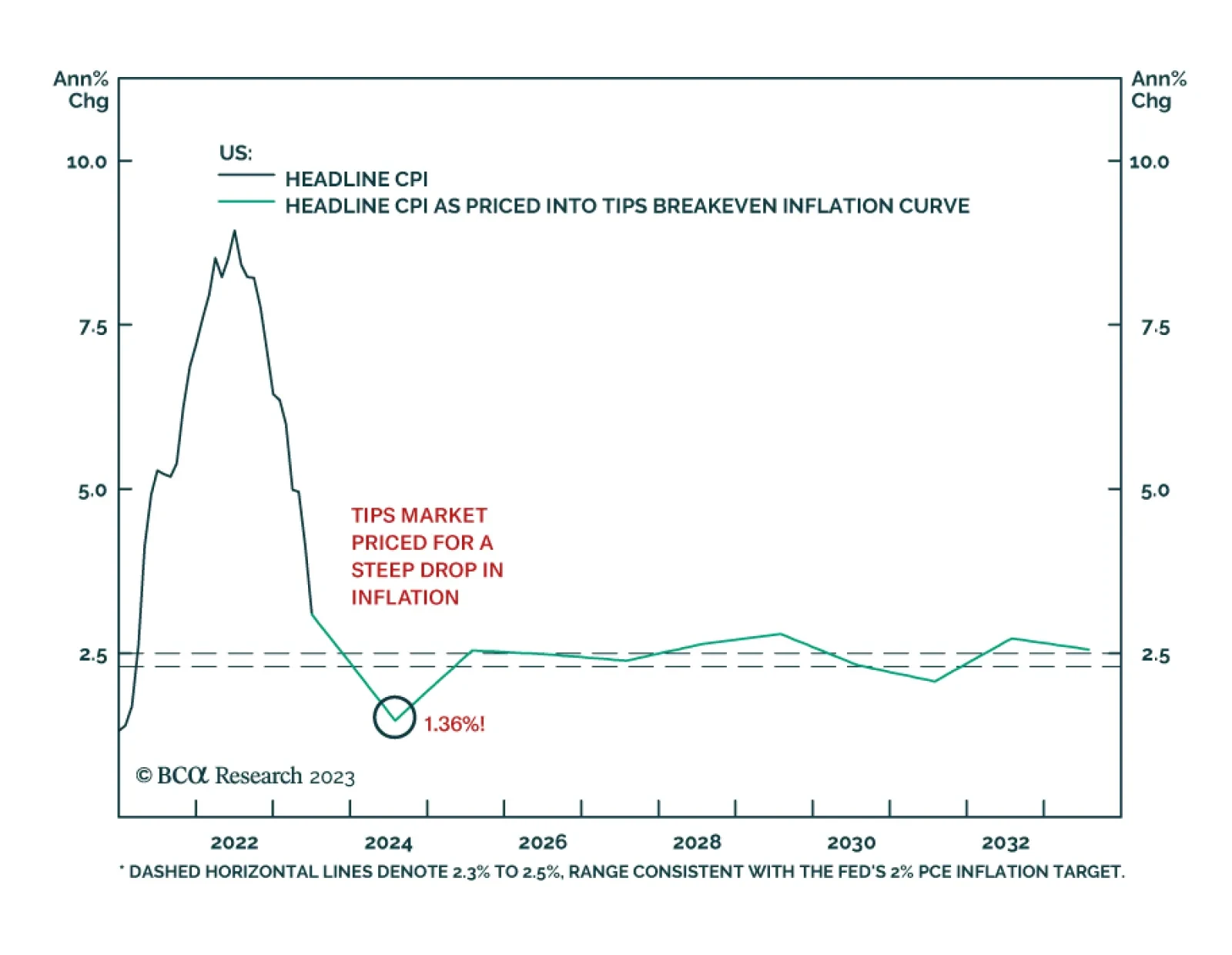

According to BCA Research’s US Bond Strategy service, inflation will fall during the next 12 months, but not by as much as markets expect. Investors should take advantage of this valuation opportunity by entering 2-year/10-…

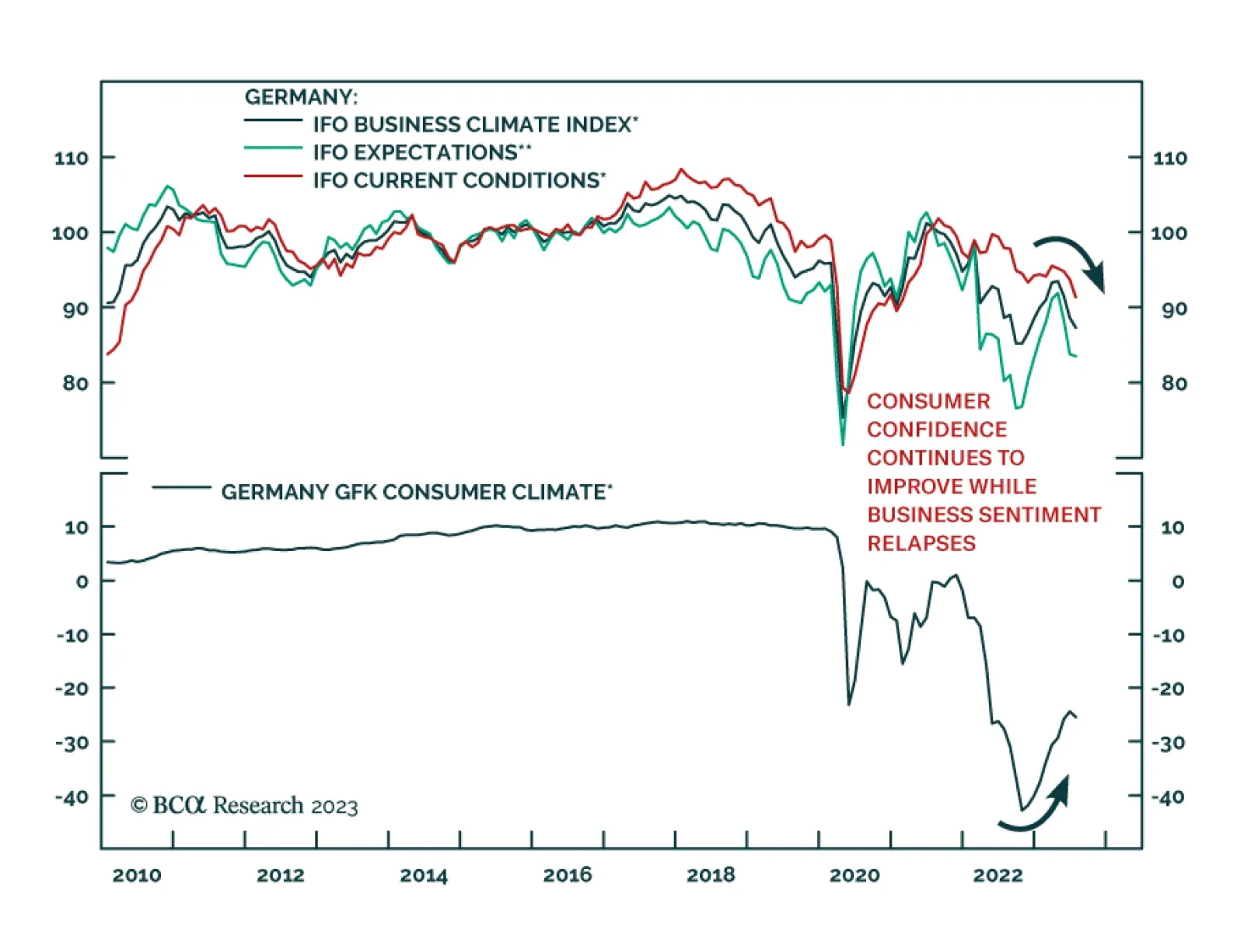

Tuesday’s German IFO survey corroborates the downbeat message from Monday’s flash PMI estimate highlighting weak economic conditions. The headline Business Climate Index dropped 1.3 points to 87.3 in July –…

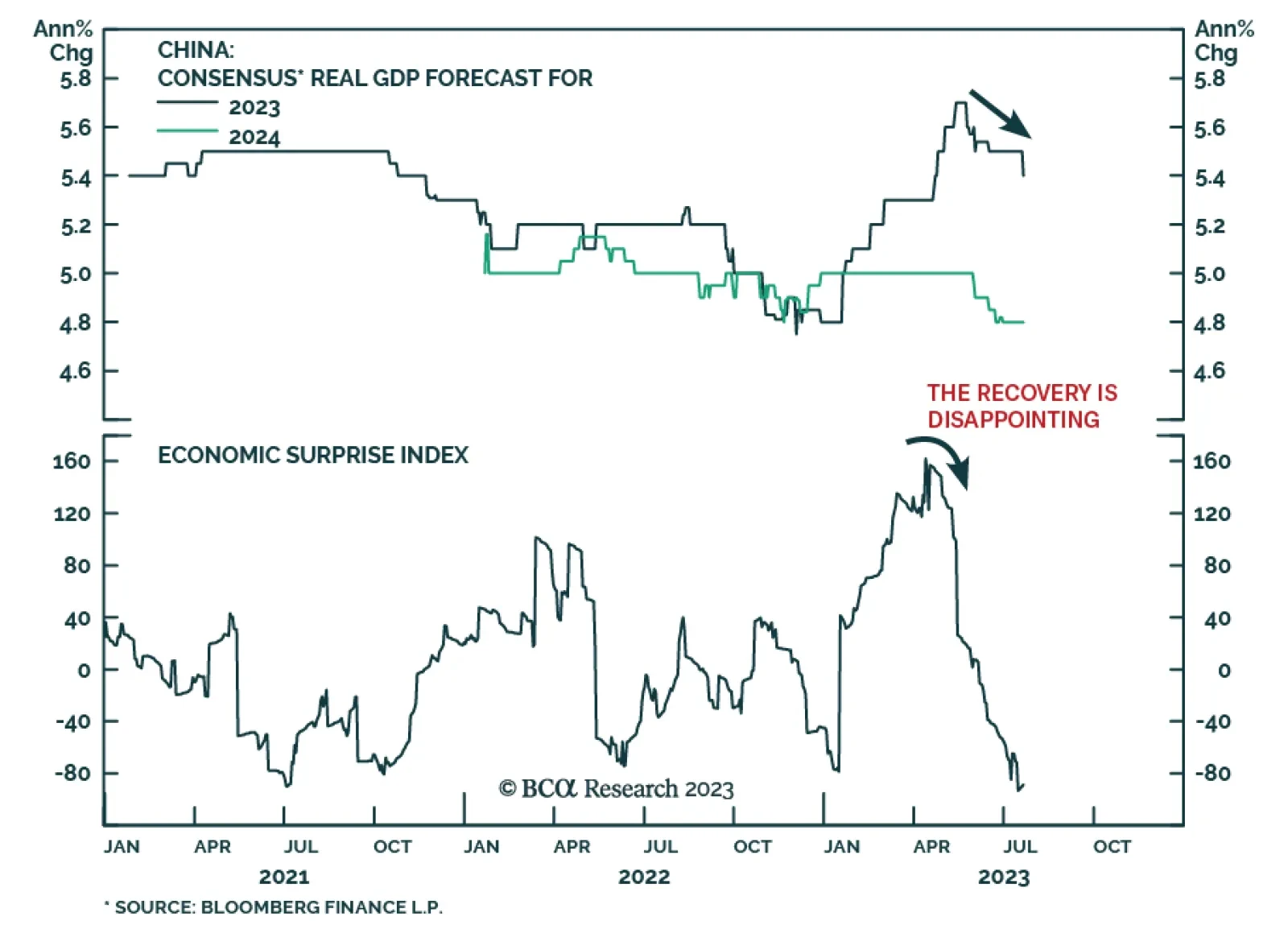

Stay cautious on Chinese stocks. Equity investors should use any rebound in onshore stock prices to downgrade A-shares from overweight to neutral within global and EM equity portfolios. Remain underweight Chinese investable/offshore…

China’s Politburo meeting delivered a disappointing signal about Beijing’s willingness to deliver meaningful stimulus. Although policymakers pledged support for domestic demand, consumer sentiment, and risk prevention…

This week we preview the July FOMC meeting, provide an update on the Fed’s balance sheet and recommend a new TIPS trade.

In this report, we present our performance review of the BCA Research Global Fixed Income Strategy (GFIS) model bond portfolio for the Q2/2023, and the outlook and scenario analysis for the next six months. The portfolio return…

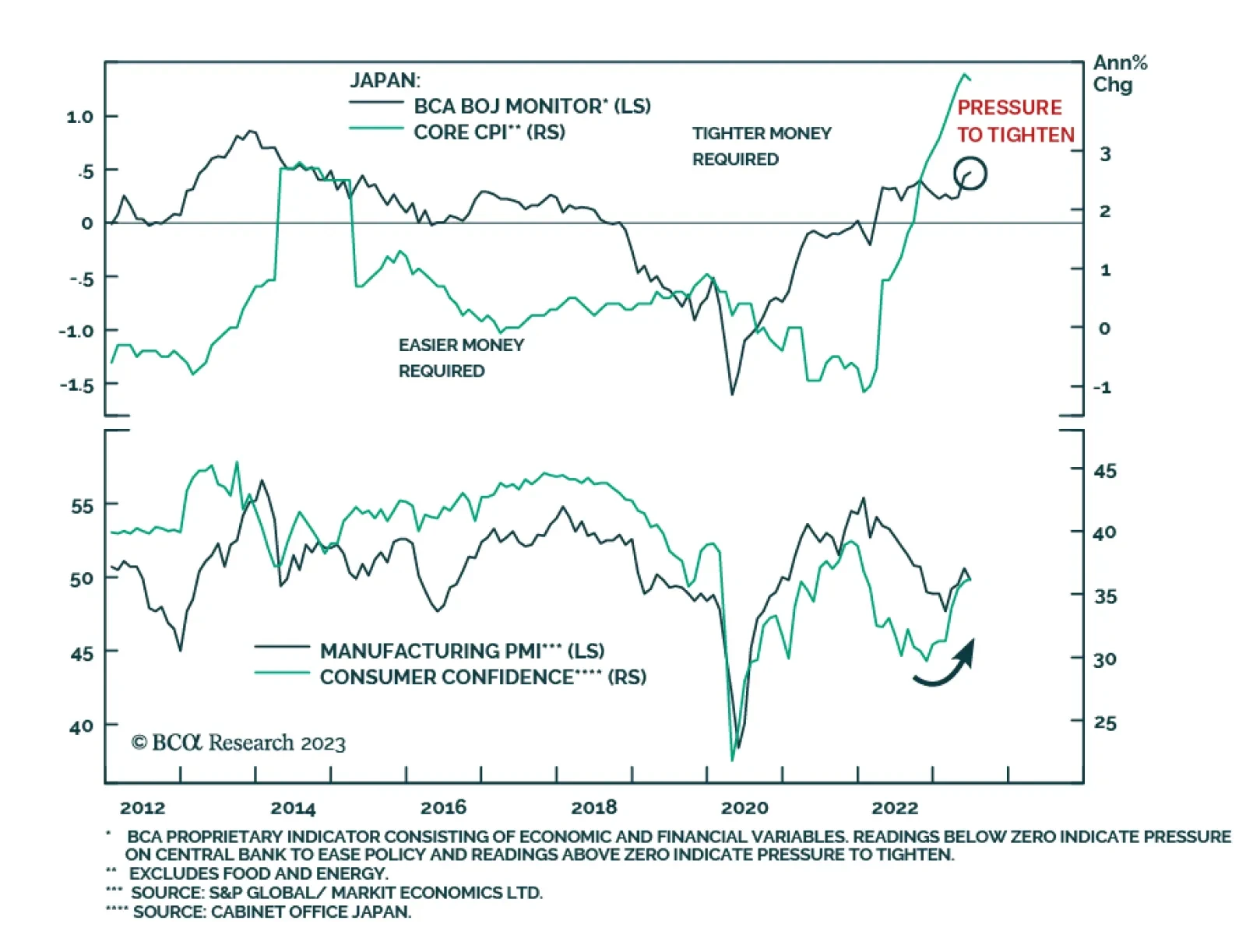

The Japanese yen slid by 2.1% vis-à-vis the US dollar last week, reversing the prior week’s rally. This latest bout of weakness comes on the back of speculation that the Bank of Japan will keep policy unchanged at…

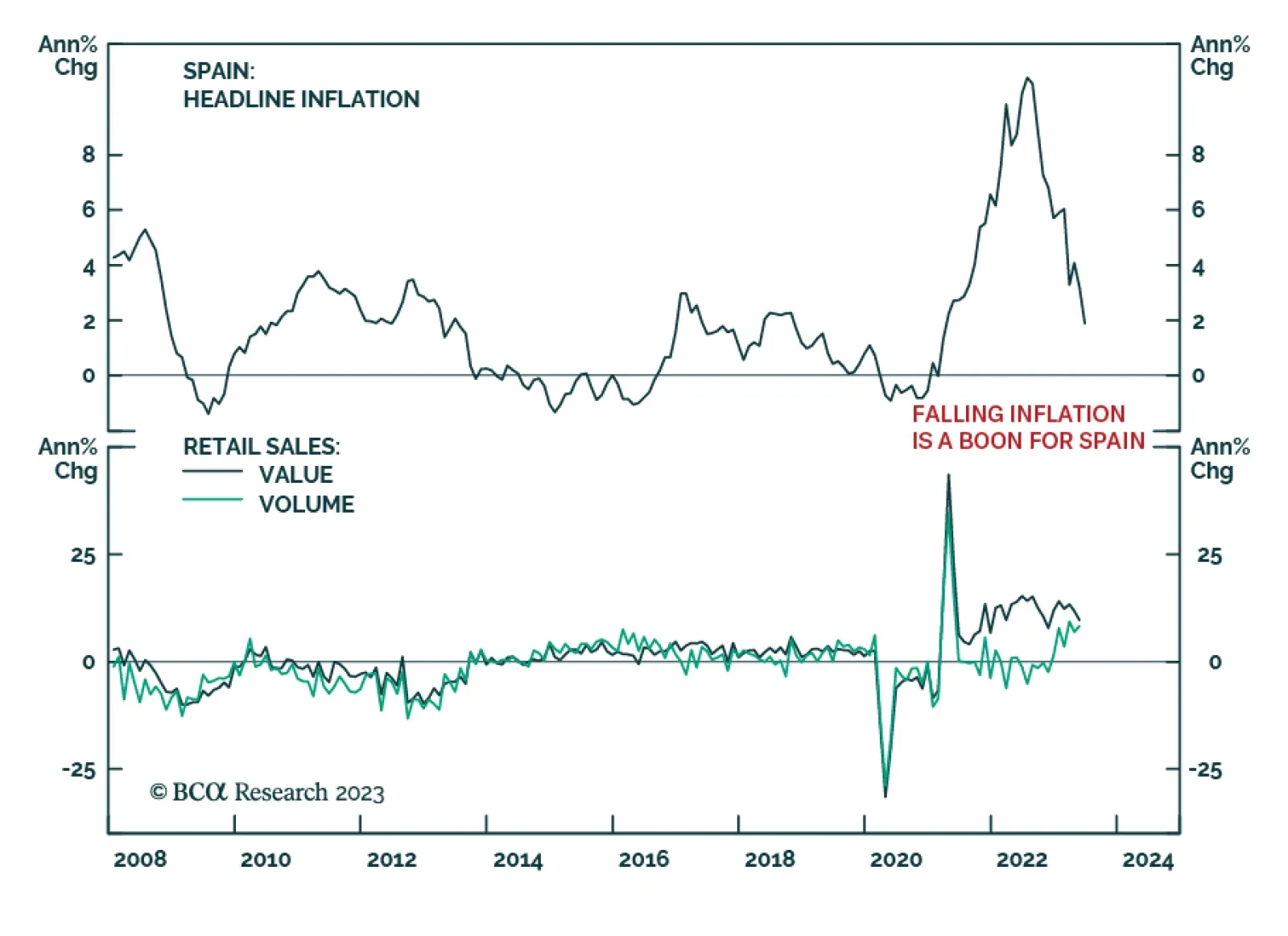

According to BCA Research’s Geopolitical Strategy and European Investment Strategy services, Spain’s economy is outperforming that of the Eurozone thanks to lower inflation and exploding tourism activity. These trends…