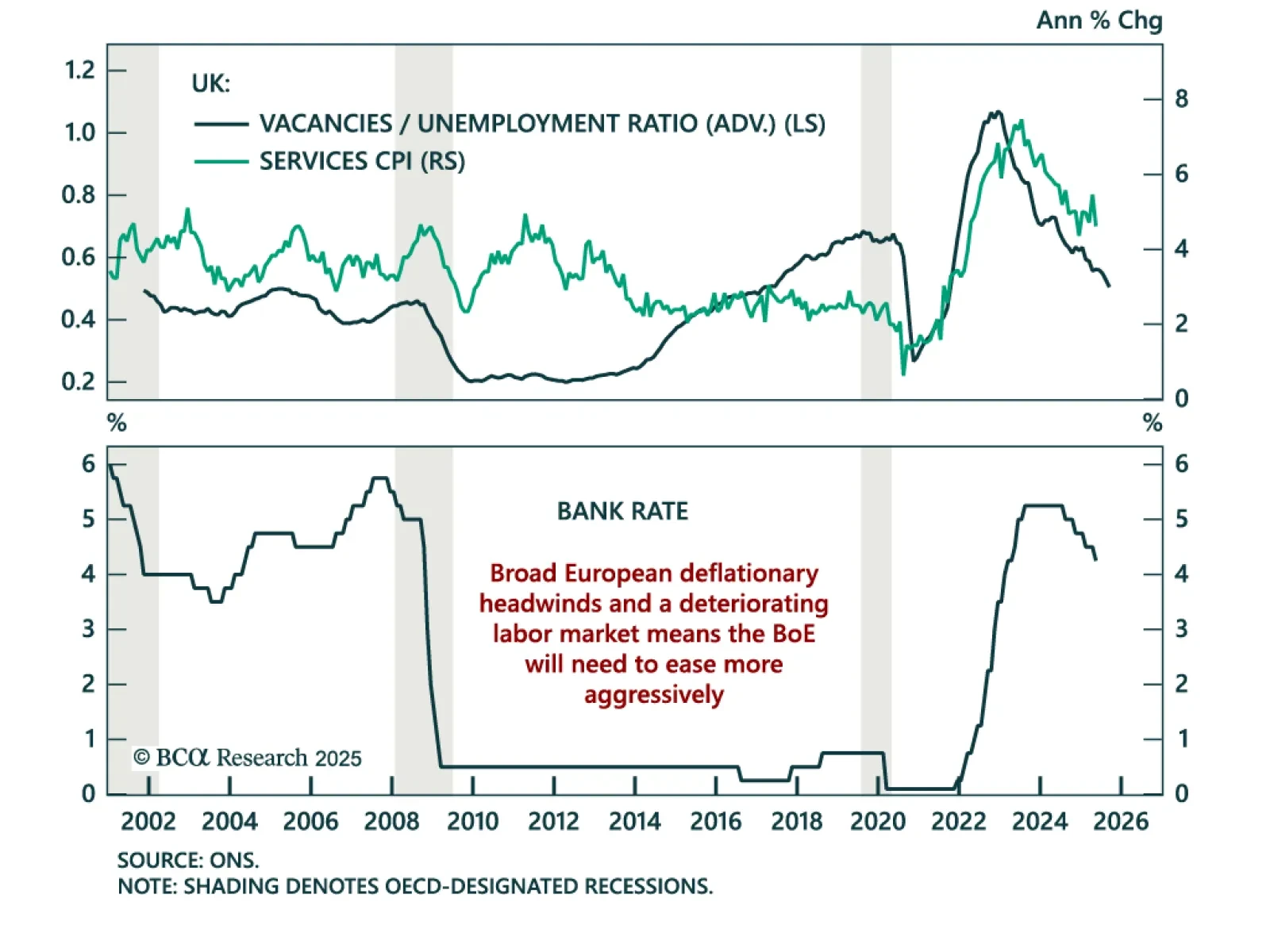

European central banks are pivoting quickly amid deflationary pressure, reinforcing our long UK Gilts and short GBP trades. The Norges Bank surprised with a 25 bps cut to 4.25%, abandoning its hawkish stance. The Swiss National Bank…

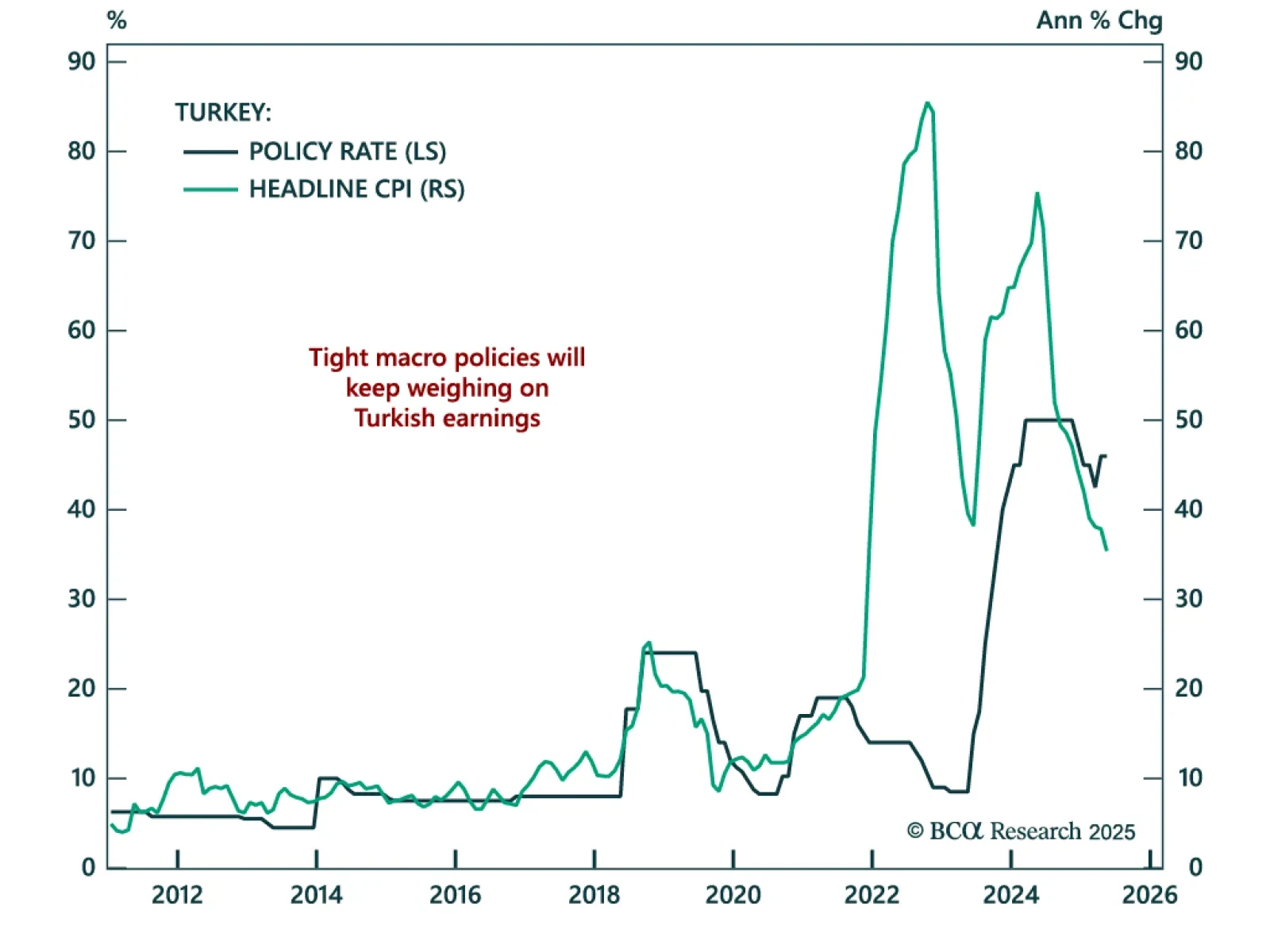

Turkey’s tight policy stance will weigh on growth and earnings, reinforcing our bearish view on Turkish equities. The central bank held rates at 46% and maintained a hawkish bias, consistent with efforts to bring inflation down from…

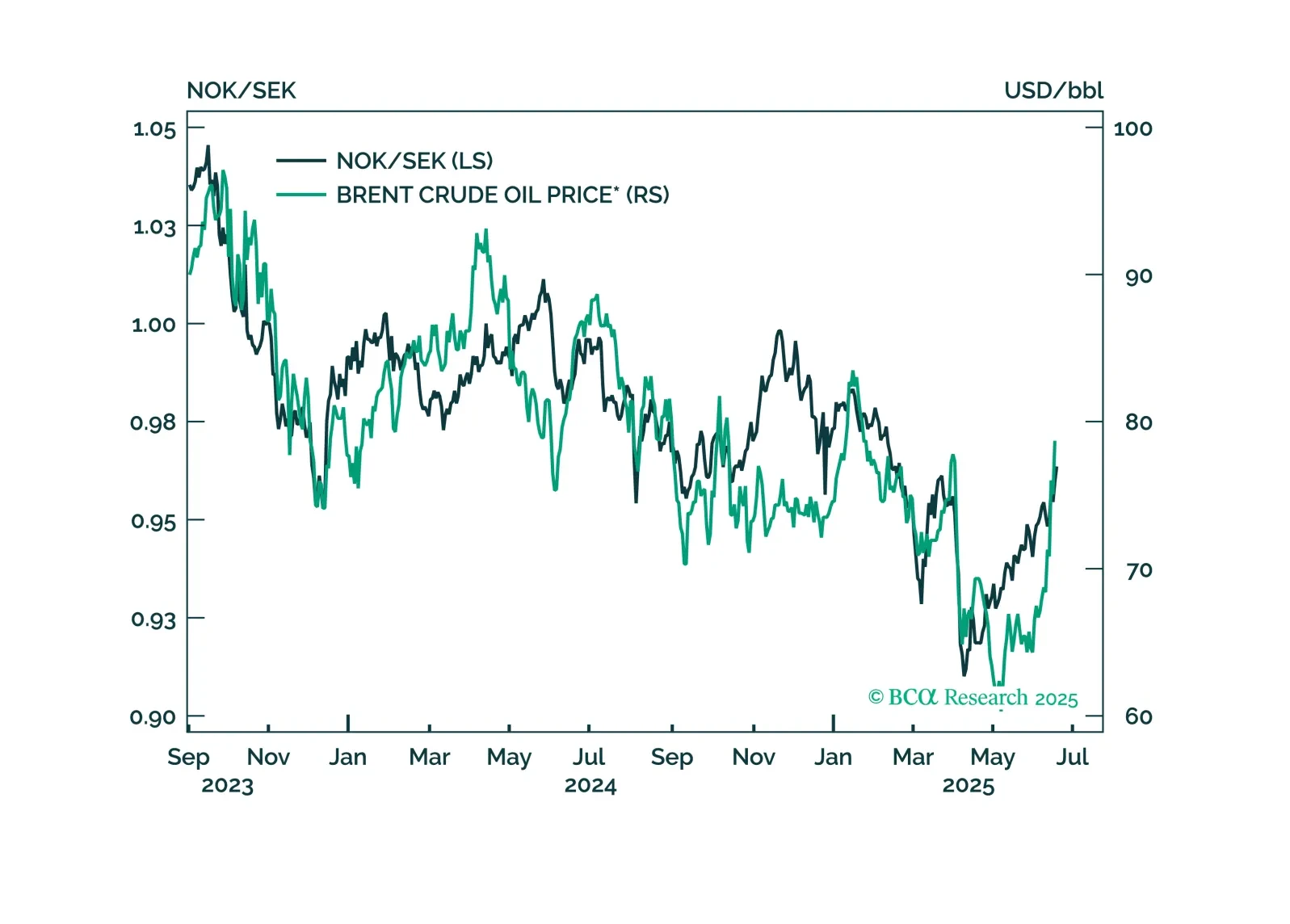

In this Insight, we look at the best trade idea from the recent rate cut by the Riksbank.

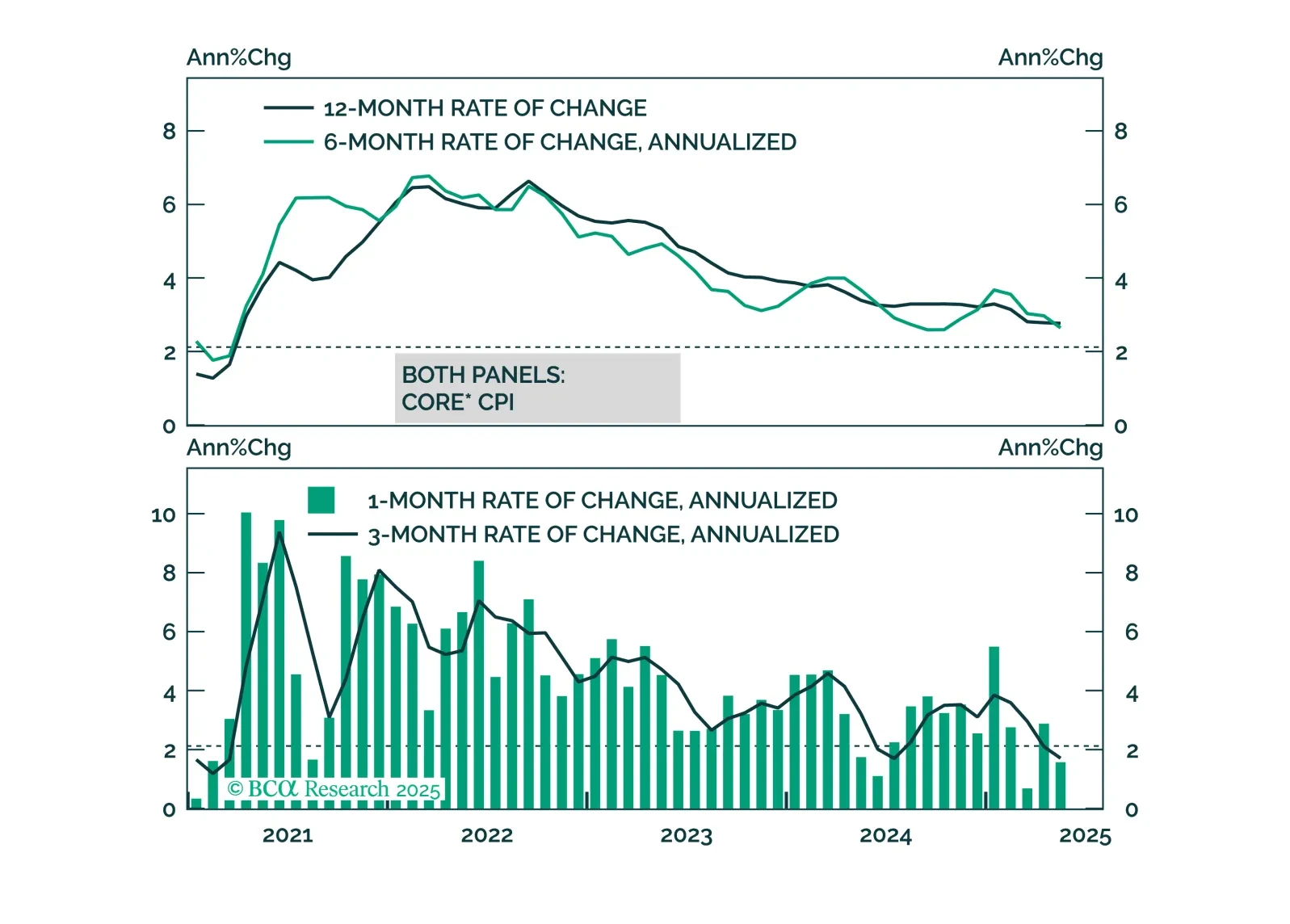

While we anticipate higher inflation in June, it looks increasingly likely that the price impact from tariffs will be less aggressive and long-lasting than many feared.

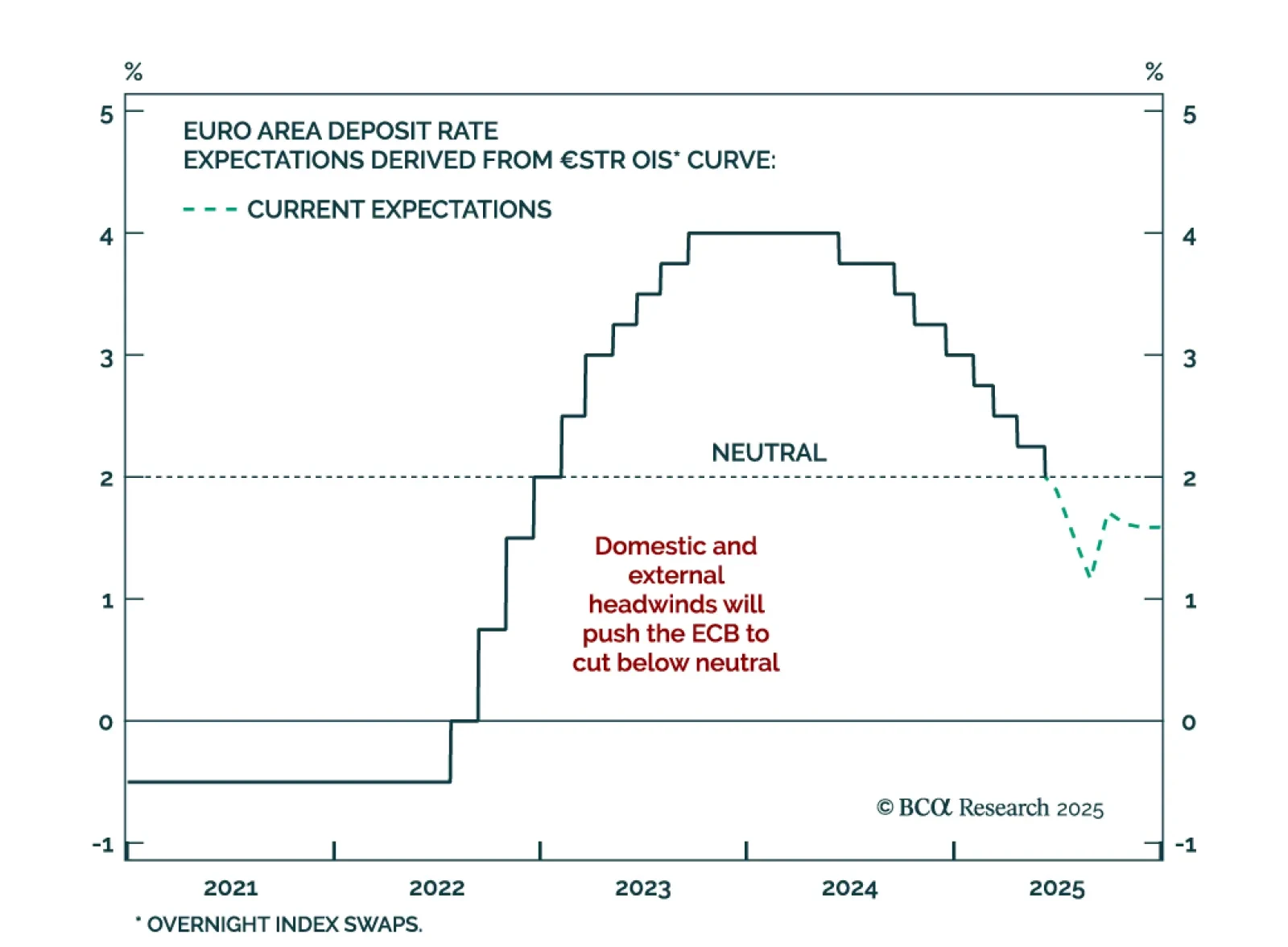

The ECB’s expected rate cut to 2% marks a slower easing phase, capping Bund yields. The shift to a quarterly pace of cuts, barring surprises, confirms a more gradual approach despite ongoing disinflation and weak growth. Staff…

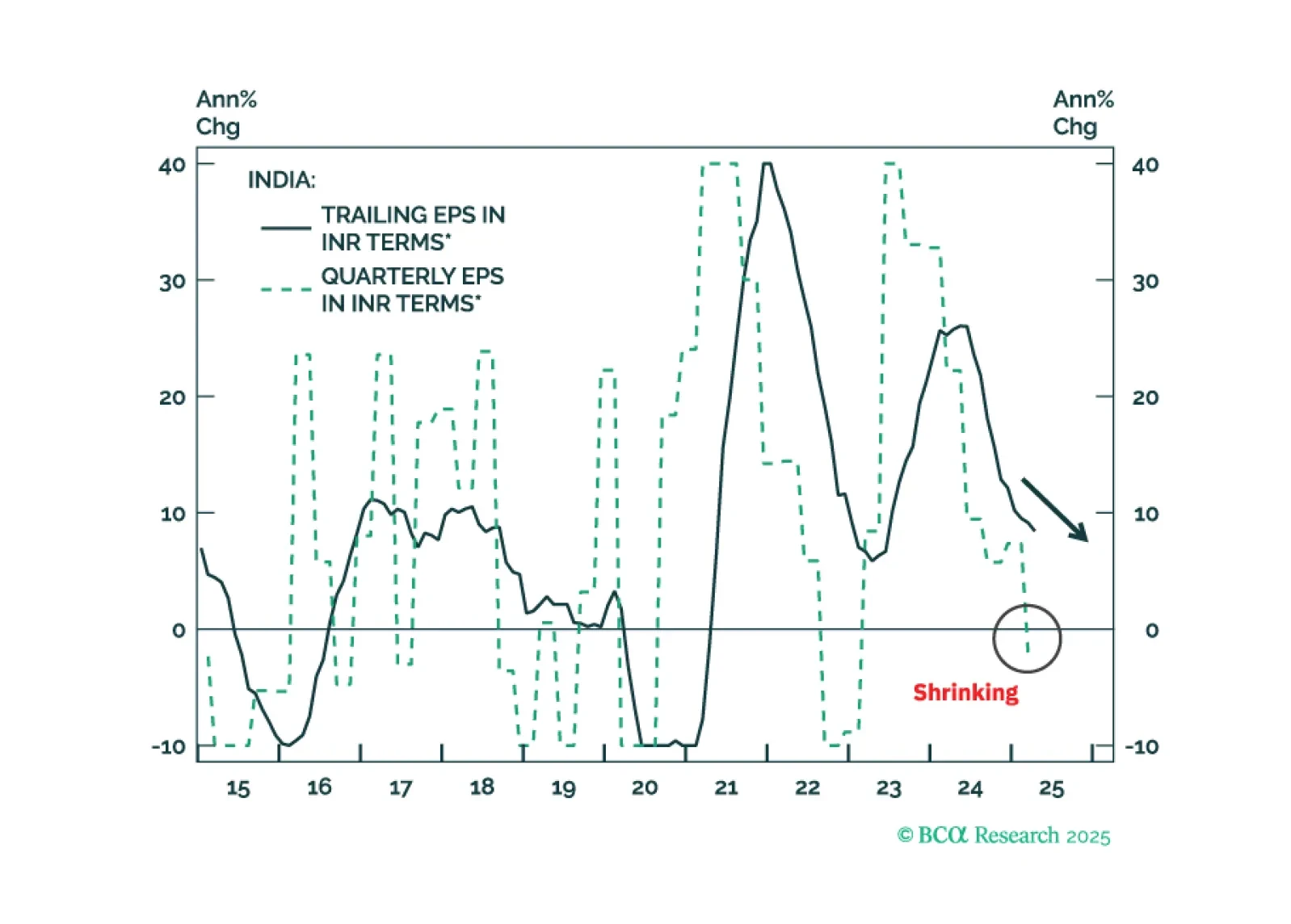

India's IT service exports have been booming and will continue to do so despite wider AI usage. Indian IT stocks, however, will not benefit from it as the expanding Global Capability Centers (GCCs) in India compete with the nation’s…

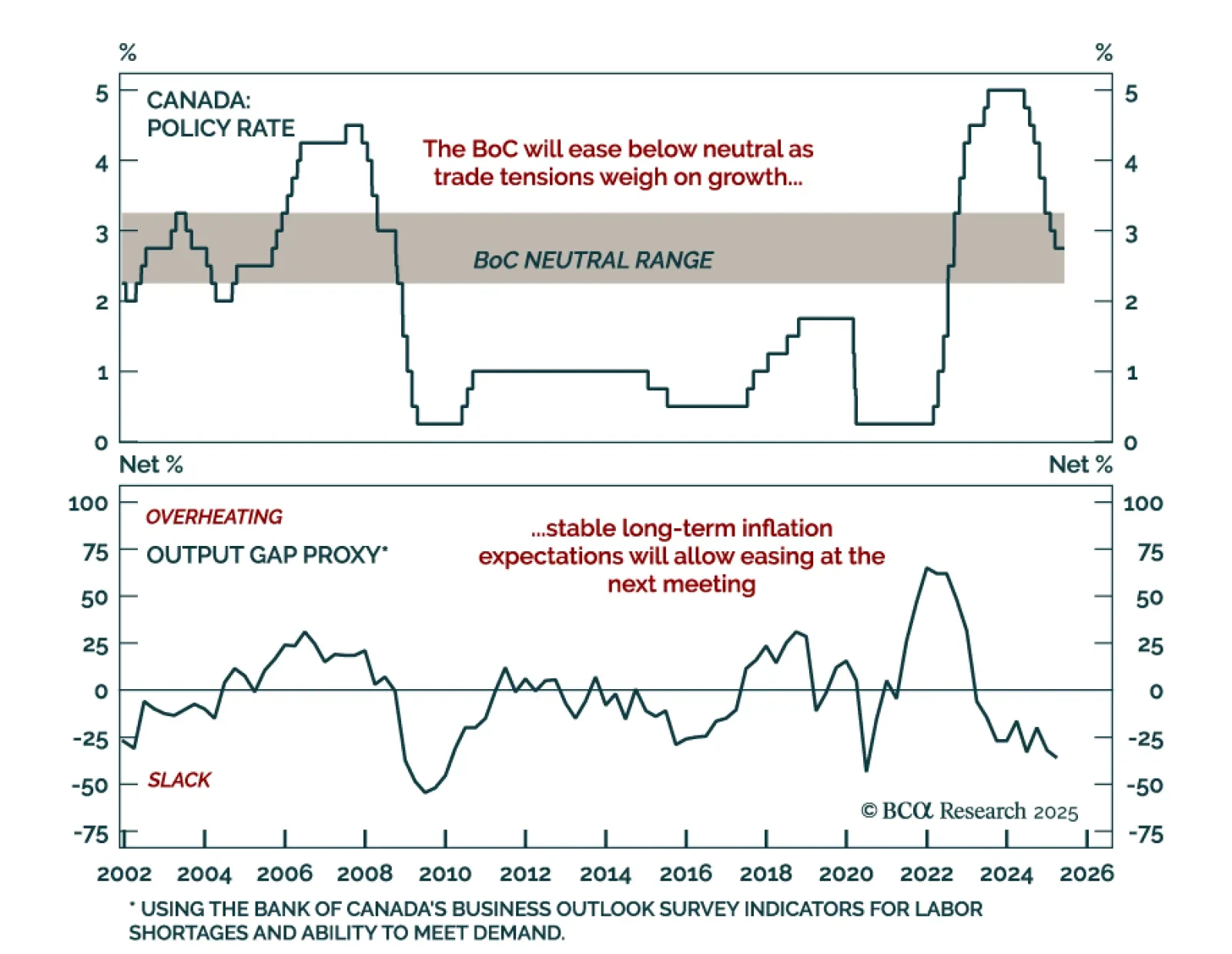

The Bank of Canada held rates at 2.75% but signaled a dovish shift, pushing us to overweight Canadian government bonds and go long CORRA futures. The policy rate remains within the BoC’s neutral range, allowing the Bank to wait for…

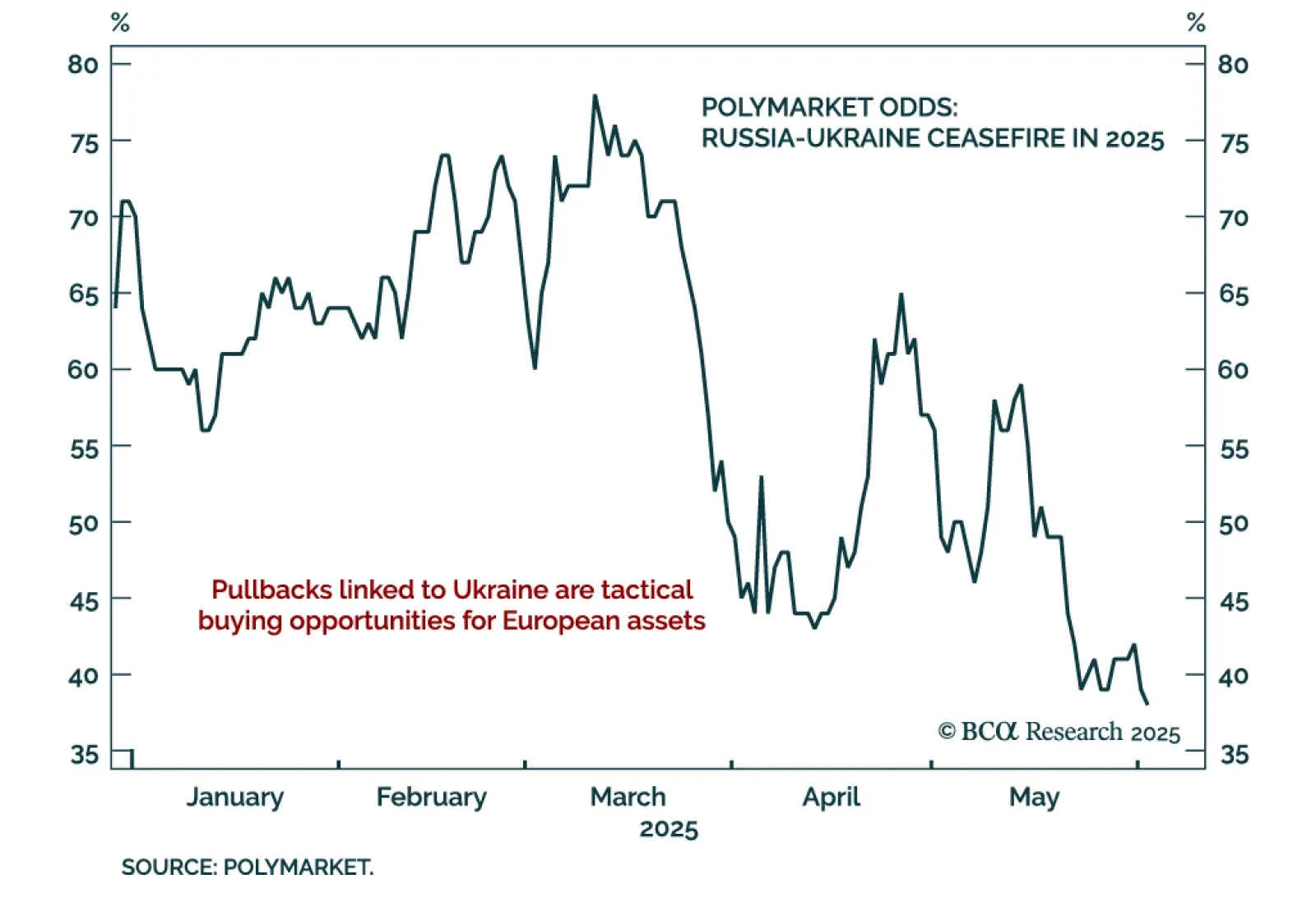

Ongoing military tensions between Ukraine and Rusia and renewed US-EU trade friction reinforce tactical opportunities to add European exposure on dips. Ukraine’s drone strike on Russian air assets and the limited outcome of the…

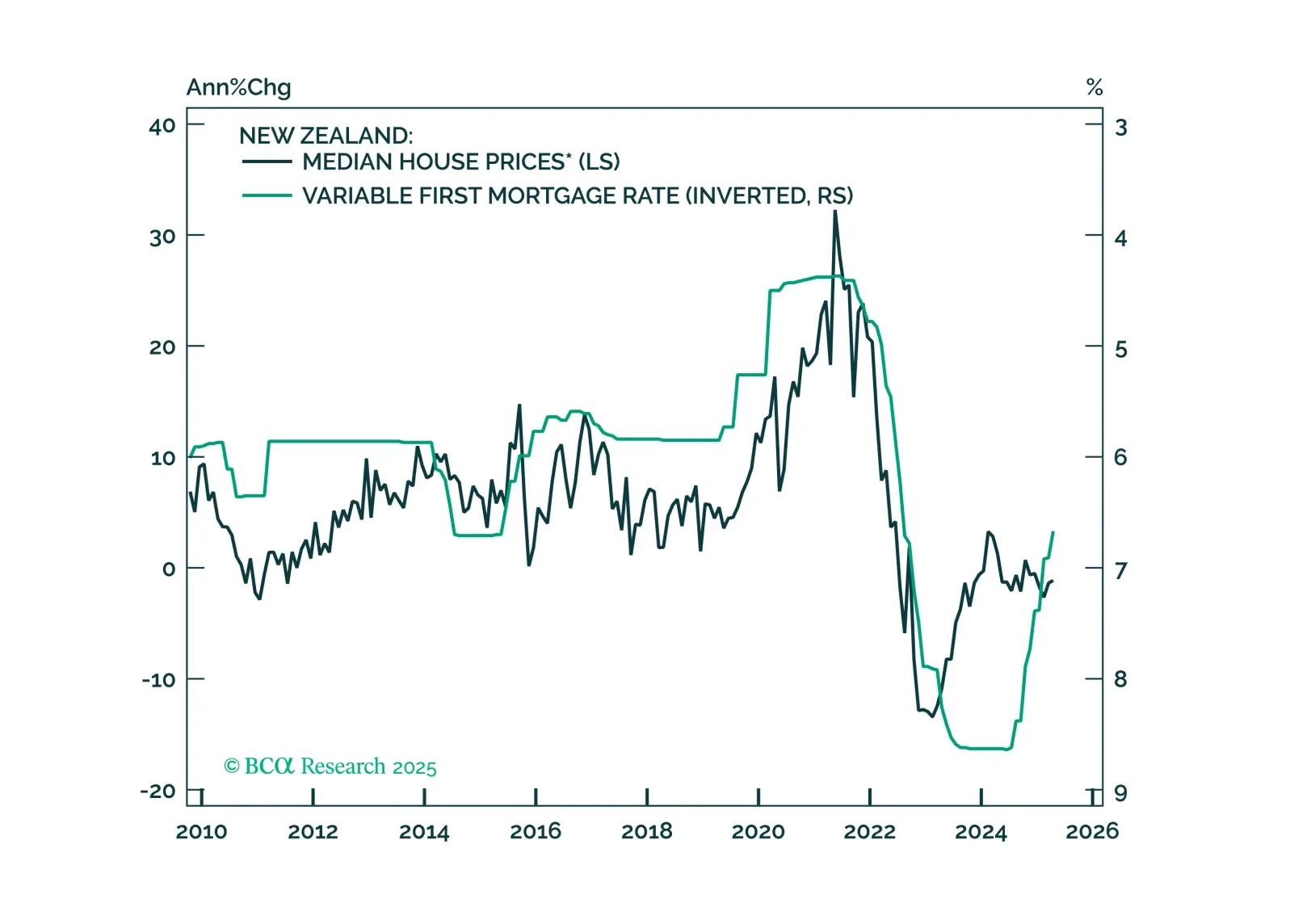

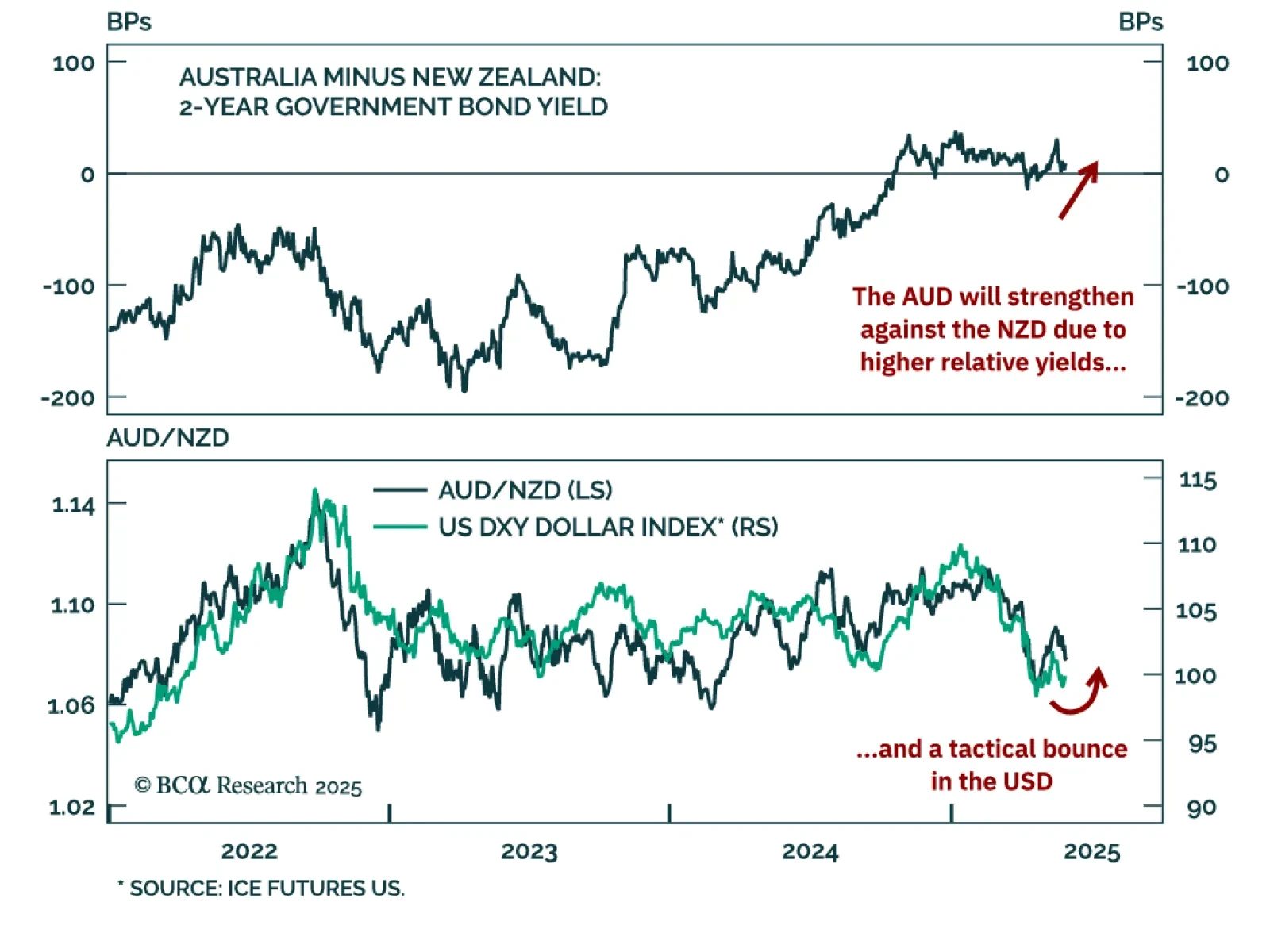

The RBNZ’s dovish stance will weigh on bond yields and the currency. The Reserve Bank of New Zealand cut rates by 25 basis points to 3.25%, building on 225 basis points worth of easing since August 2024. New Zealand’s…

This Insight looks at the implications of the RBNZ’s rate cut on New Zealand assets.