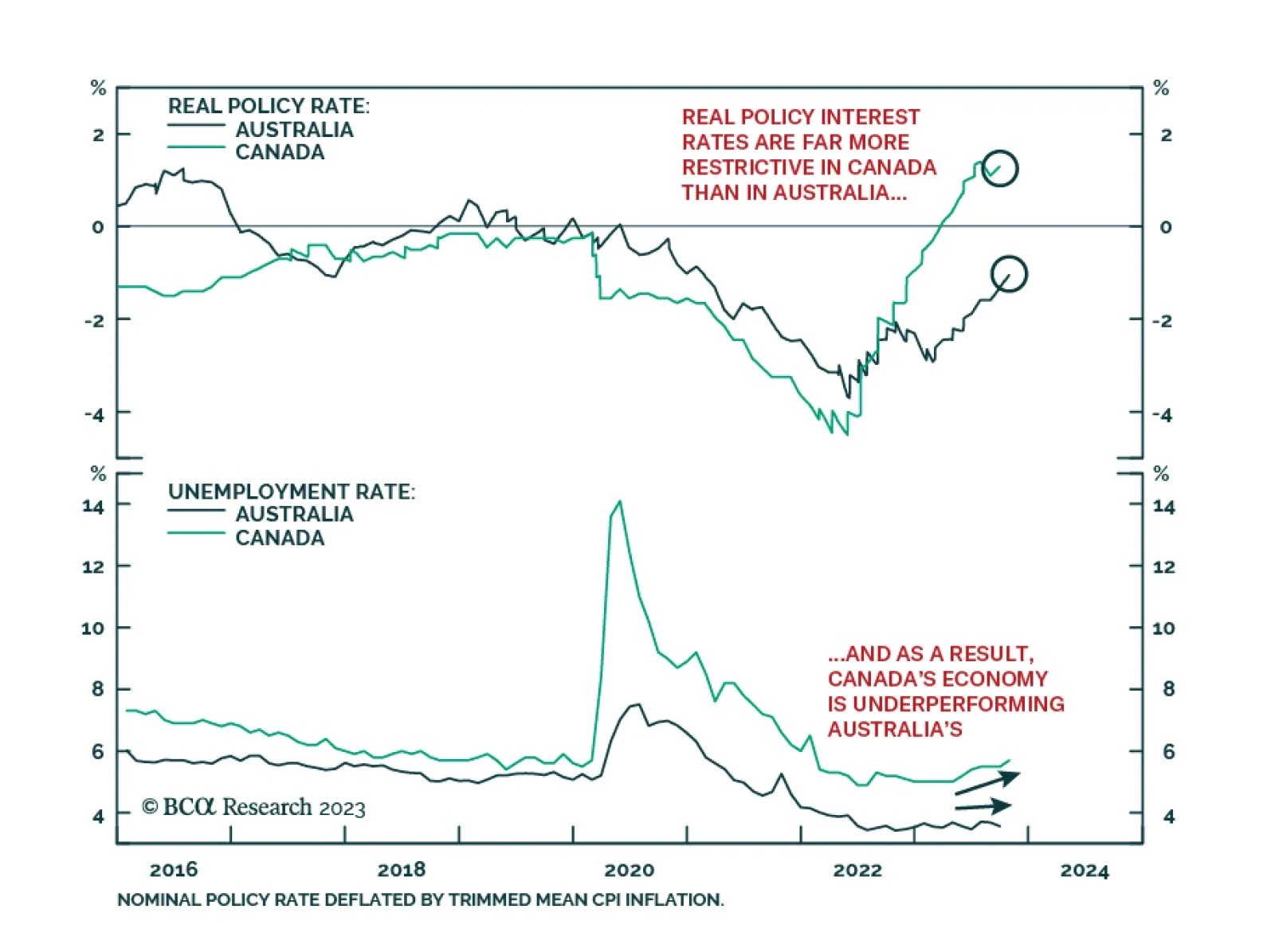

The economies of Canada and Australia share many similarities. Both nations are major commodity exporters, but with overvalued housing markets and highly indebted consumers. Lately, however, a notable gap has appeared…

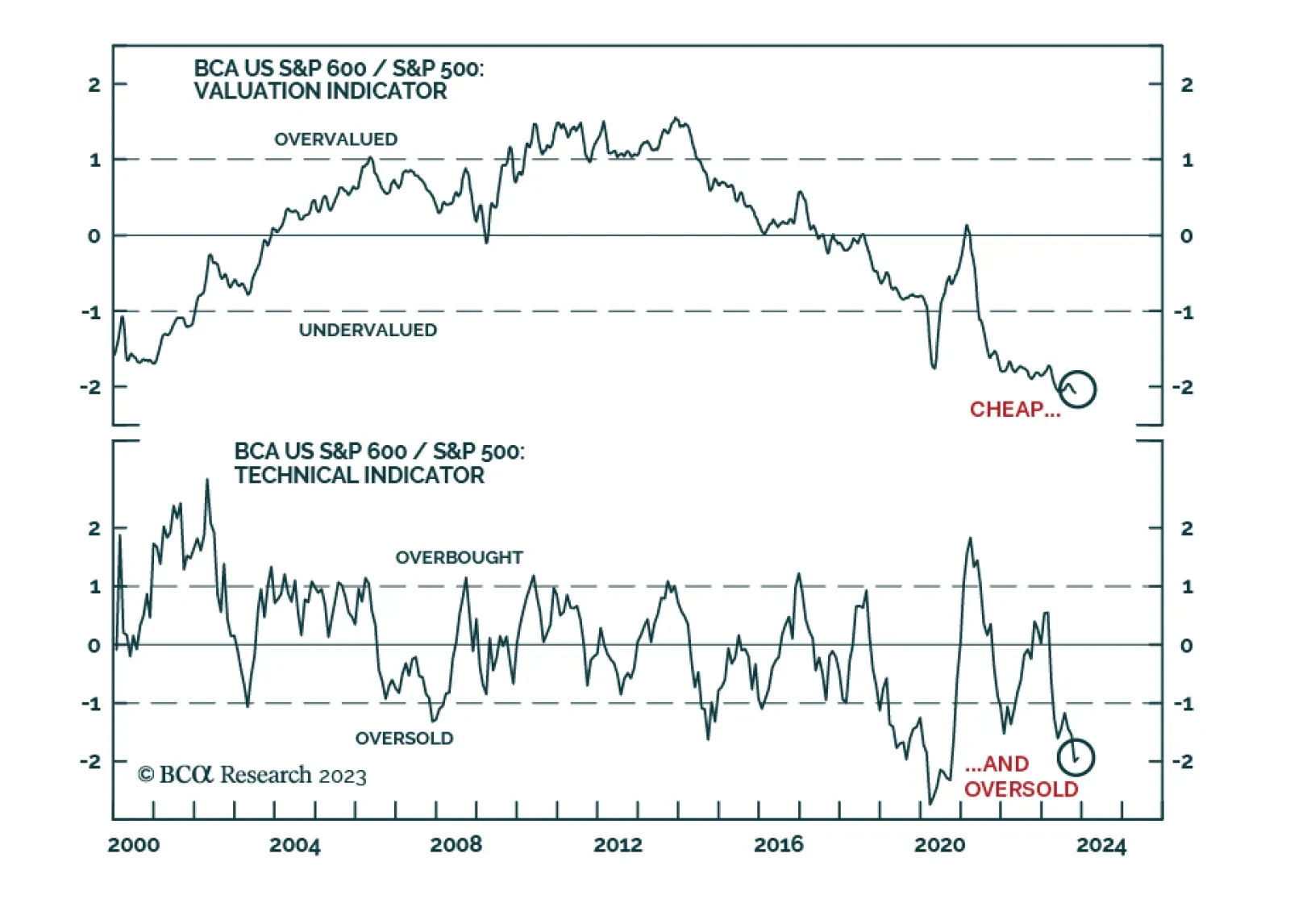

US small-cap stocks have underperformed significantly this year. While the S&P 500 price index is up 14.0% year-to-date, the S&P 600 has lost 2.5%. However, this underperformance has not been a straight line down. Small…

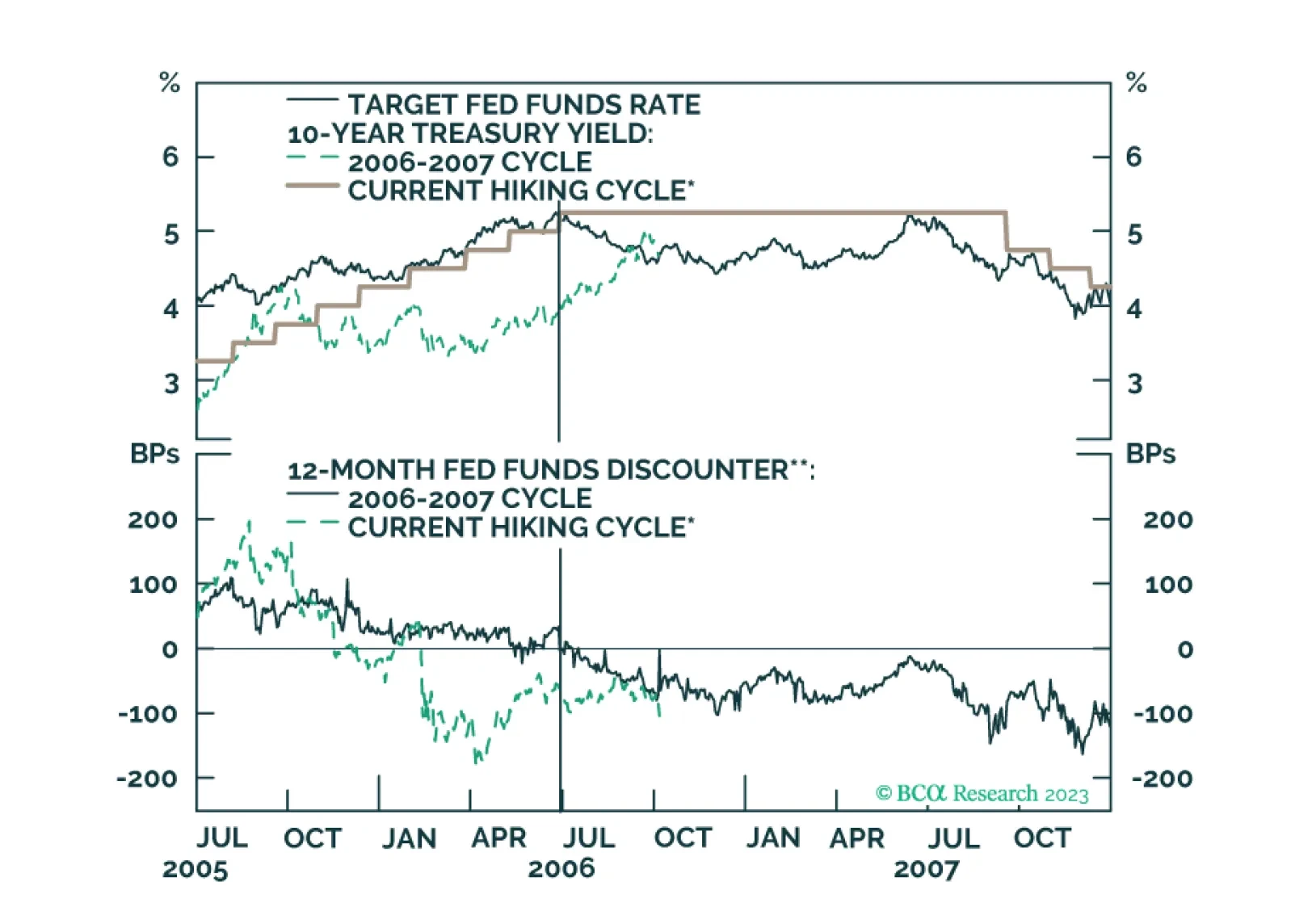

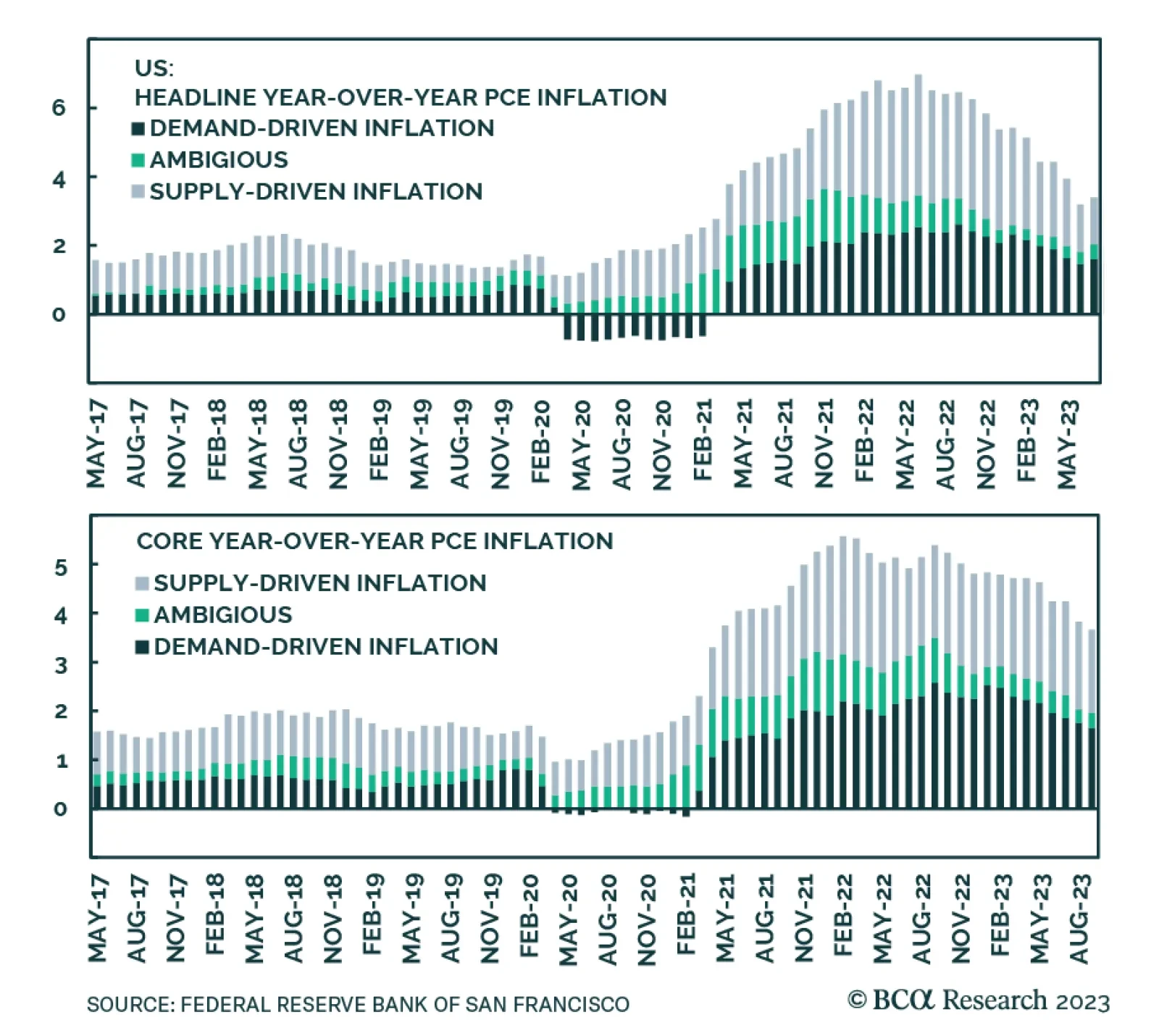

The US disinflationary trend remains intact. The core PCE deflator continued its downtrend in September, falling to 3.7% y/y from a peak of 5.6% in February 2022. Alternative measures of underlying price pressures such as the…

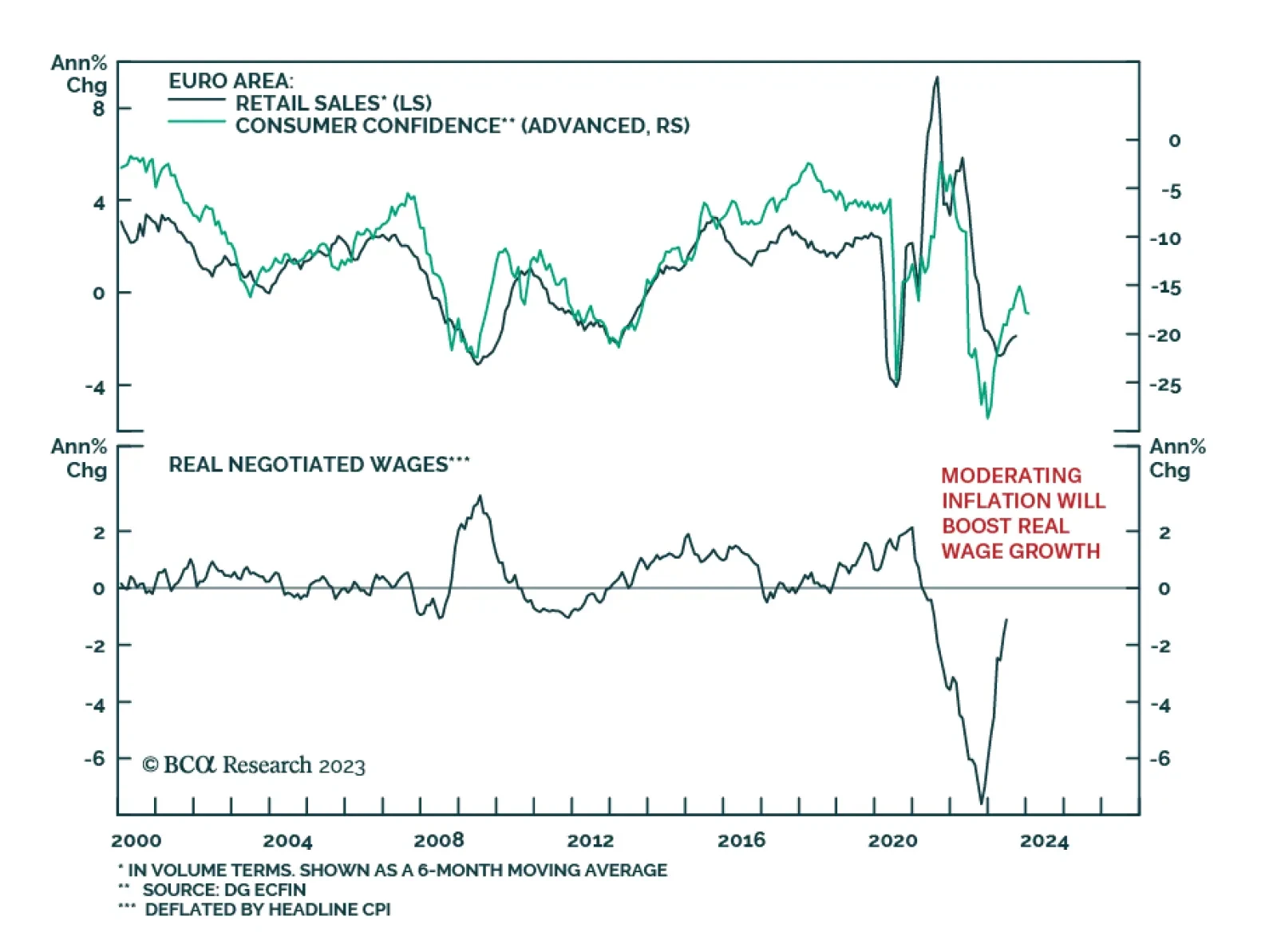

As expected, Euro Area retail sales continued to decline on both a month-over-month and a year-over-year basis in September. The 0.3% m/m drop is slightly below expectations of -0.2% m/m while the 2.9% y/y decline is not as bad…

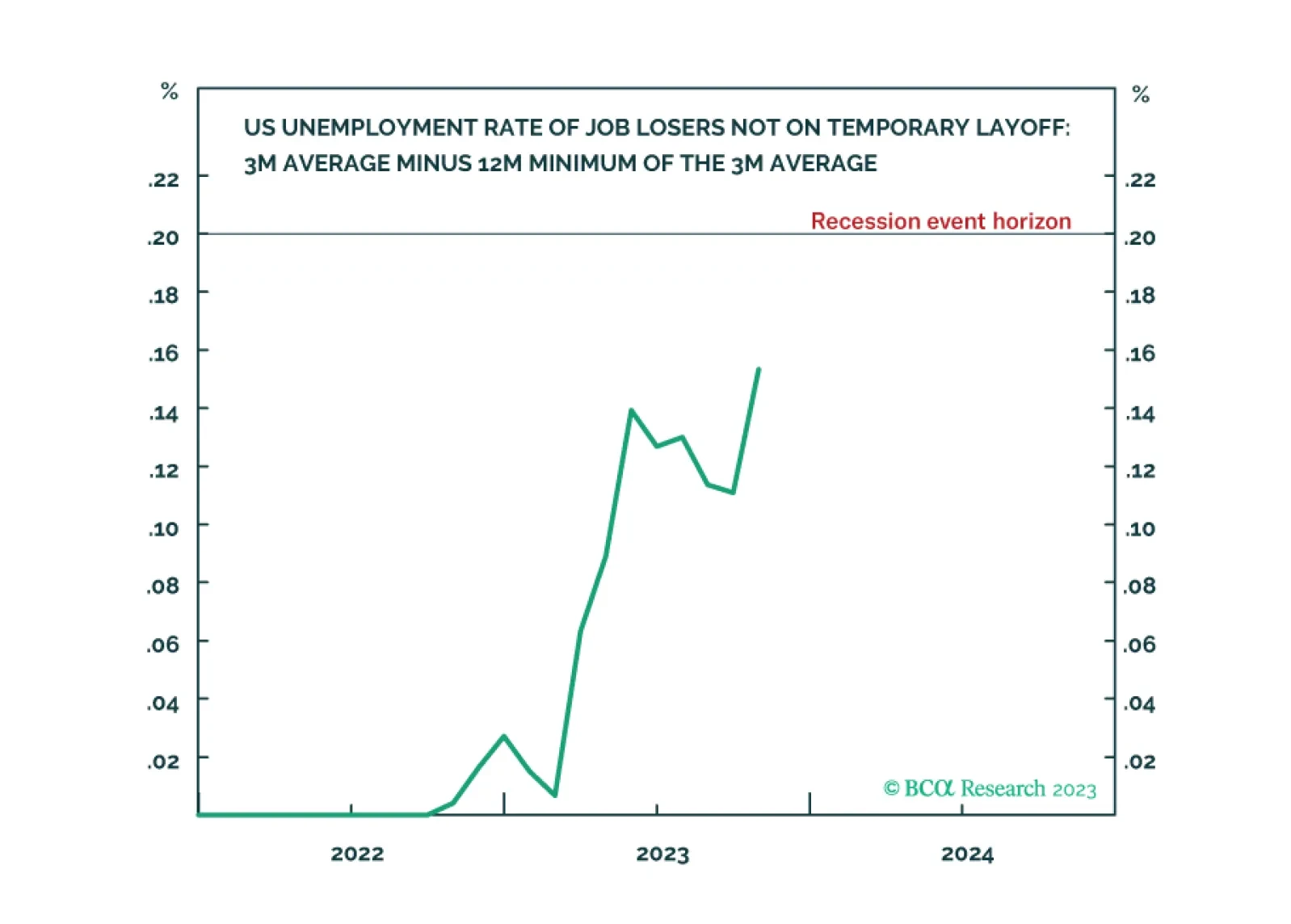

Following the October US jobs data, the ‘Joshi rule’ real-time US recession indicator increased from 0.11 to 0.15, meaning that it is fast approaching its event horizon of 0.20. We go through the investment implications. We also…

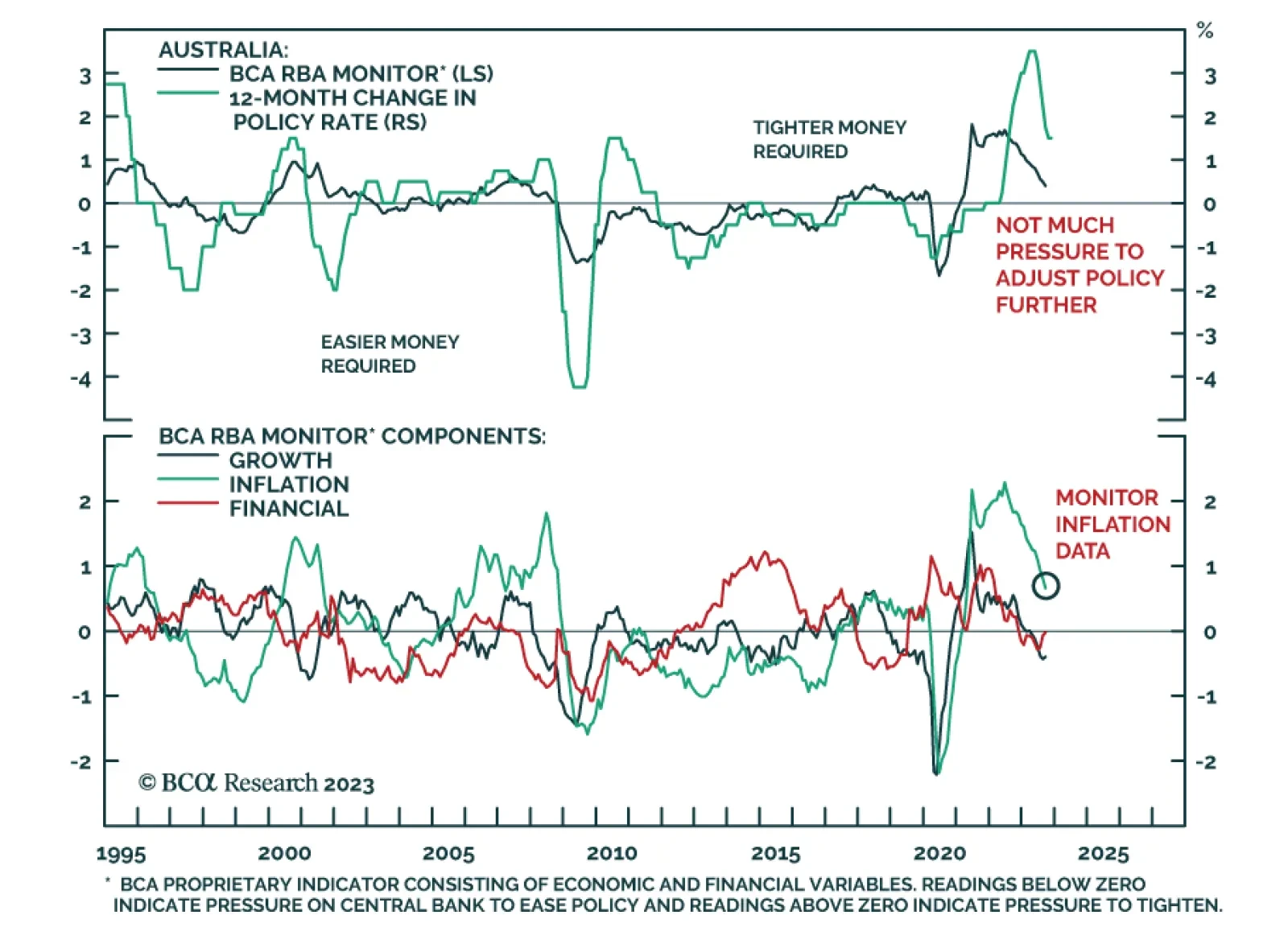

The Reserve Bank of Australia lifted the cash rate by 25 bps to a 12-year high of 4.35% on Tuesday, in line with consensus expectations. Governor Michele Bullock's post meeting statement underscored that although inflation is…

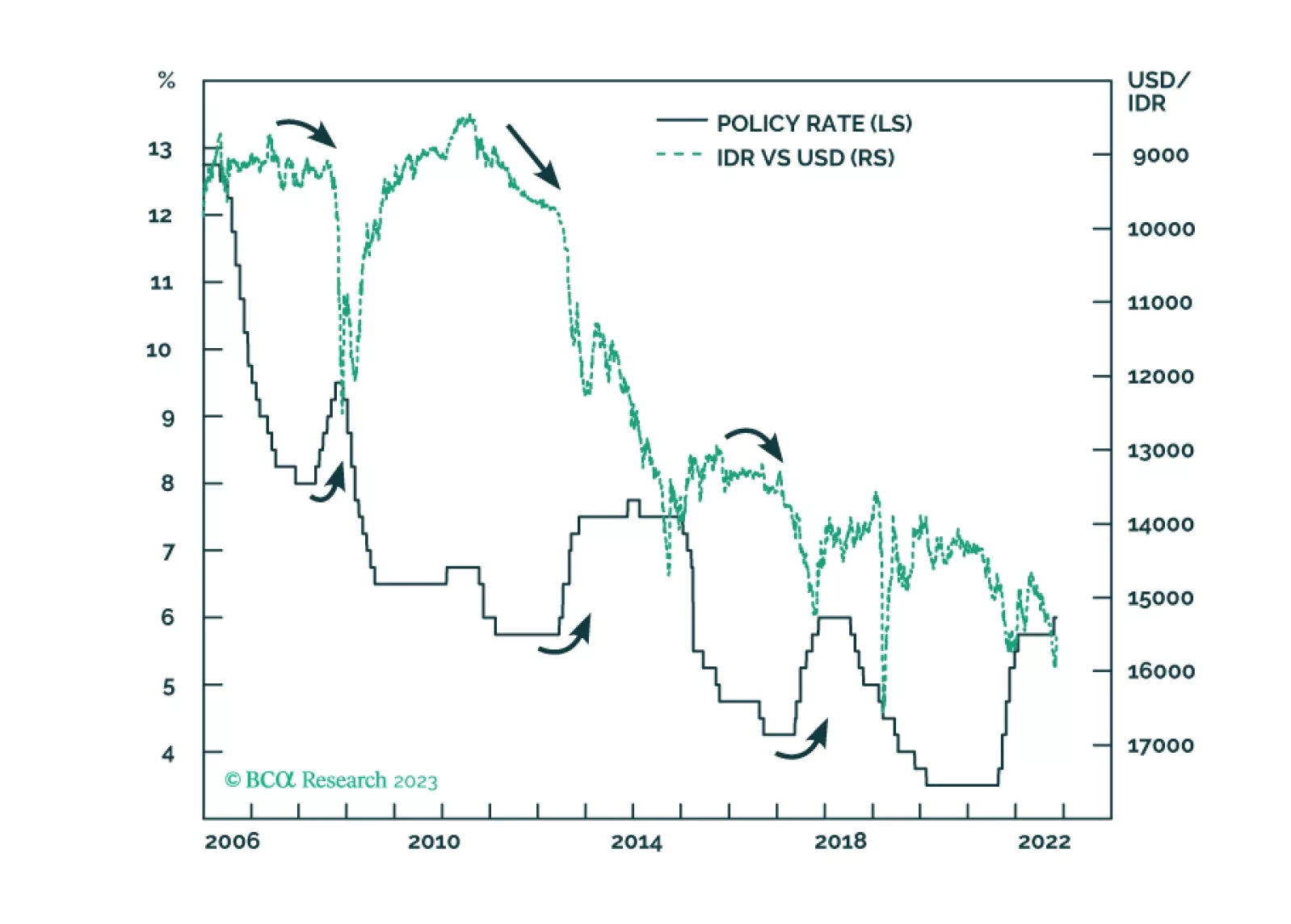

Despite very low inflation, Bank Indonesia raised its policy rates last month to support the currency. The strategy did not work before and will not work now. Stay short the rupiah.

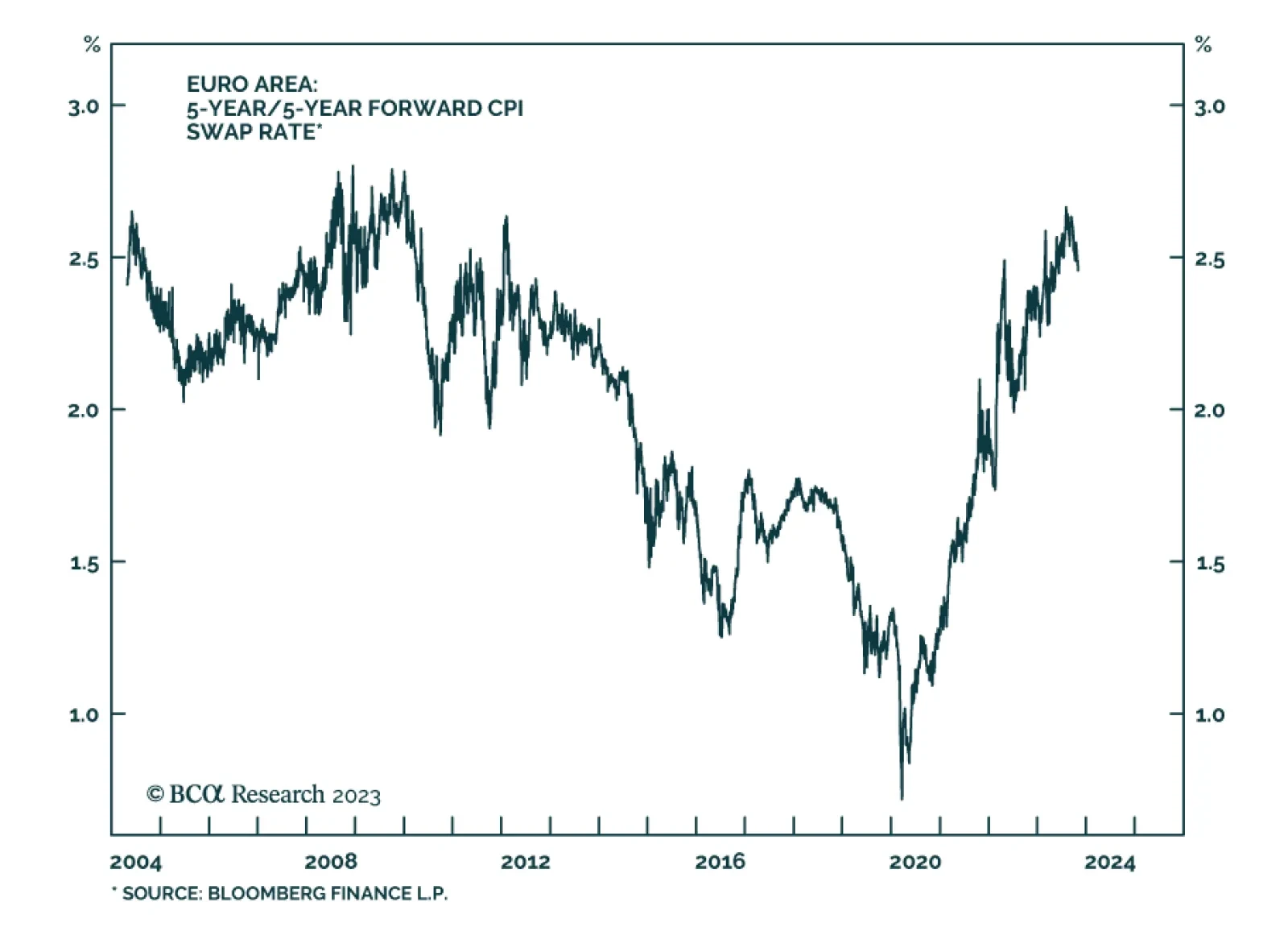

According to BCA Research’s European Investment Strategy service, German yields will fall toward 2% as market-based inflation expectations dip. For now, the deceleration in Eurozone core CPI can be attributed to the…

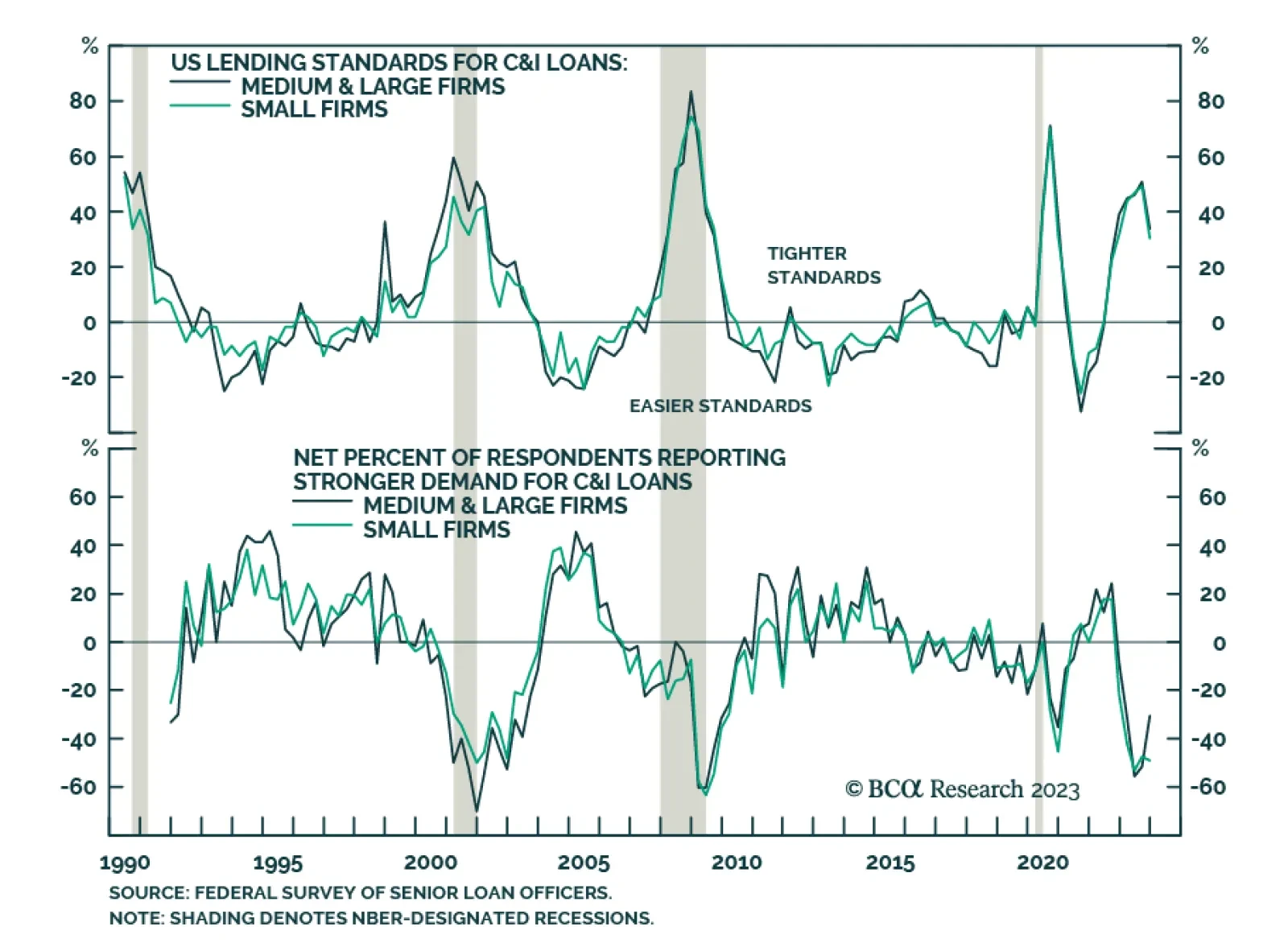

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) reveals that US banks continued to tighten lending standards for commercial and industrial (C&I), commercial real estate (CRE), residential real estate (RRE)…

Our Portfolio Allocation Summary for November 2023.