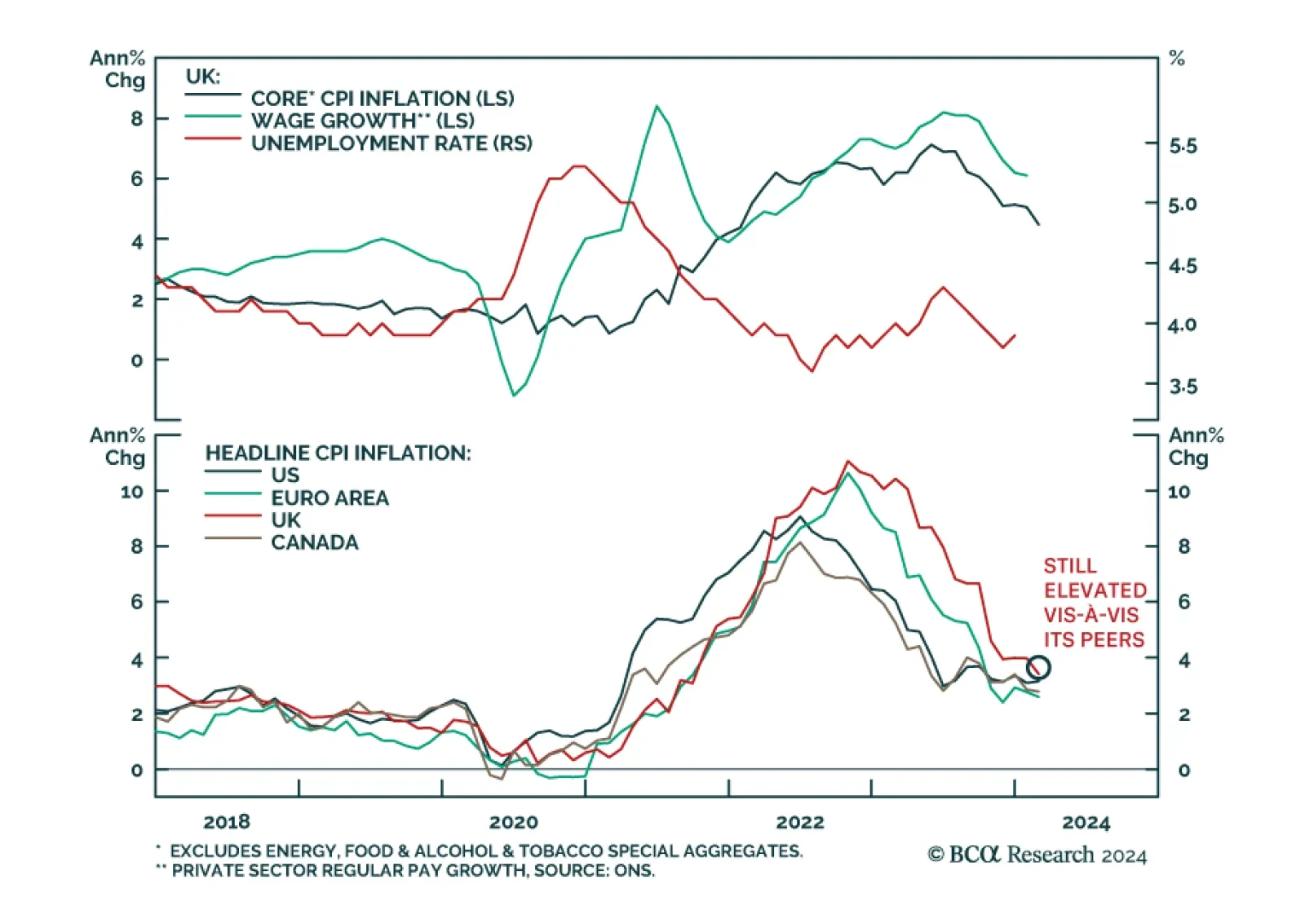

The UK CPI report showed inflation eased by more than anticipated in February. Headline CPI inflation dropped from 4.0% y/y to 3.4% y/y – below consensus estimates of 3.5% y/y and the weakest increase since September 2021.…

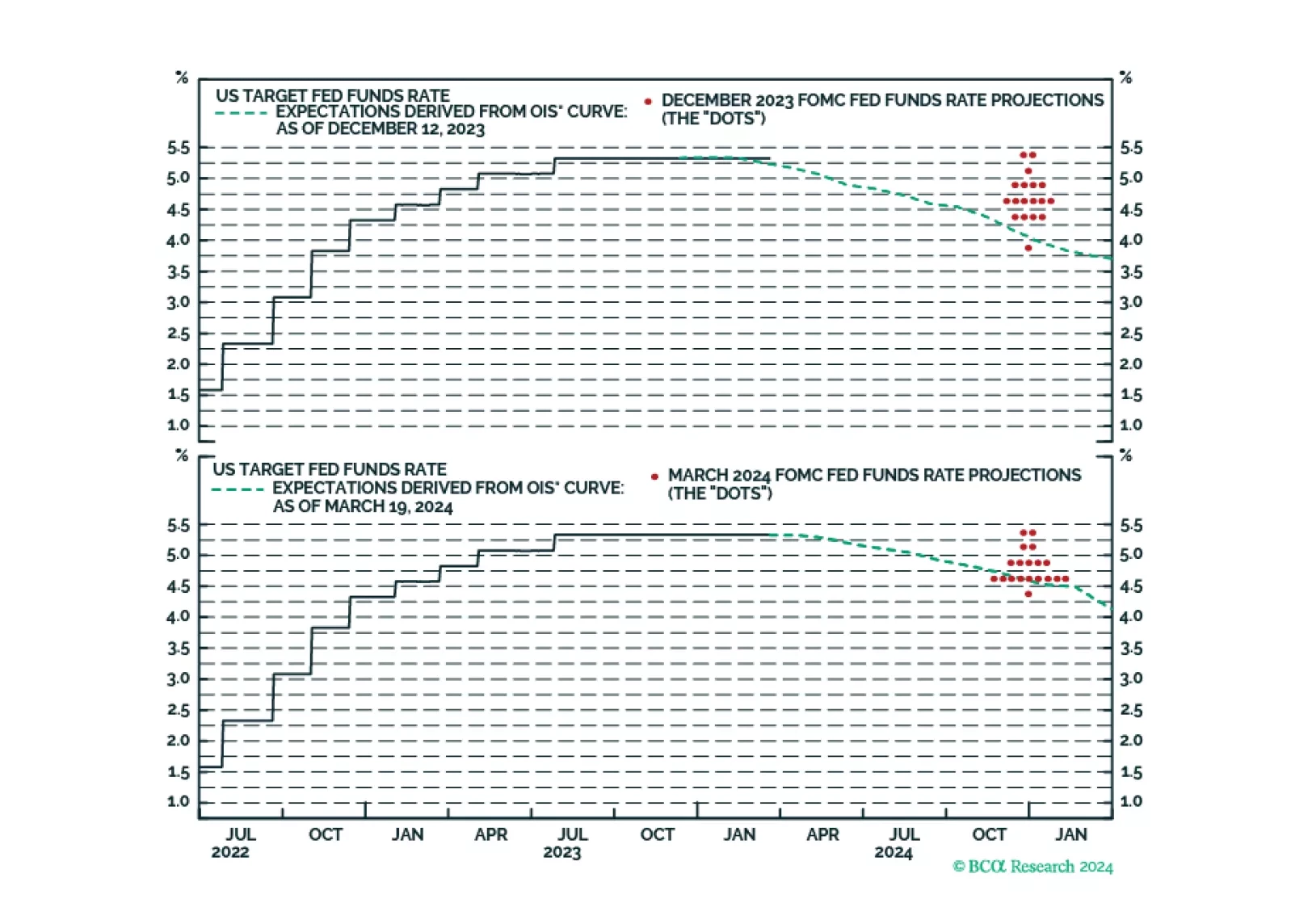

Our takeaways from this afternoon’s FOMC meeting.

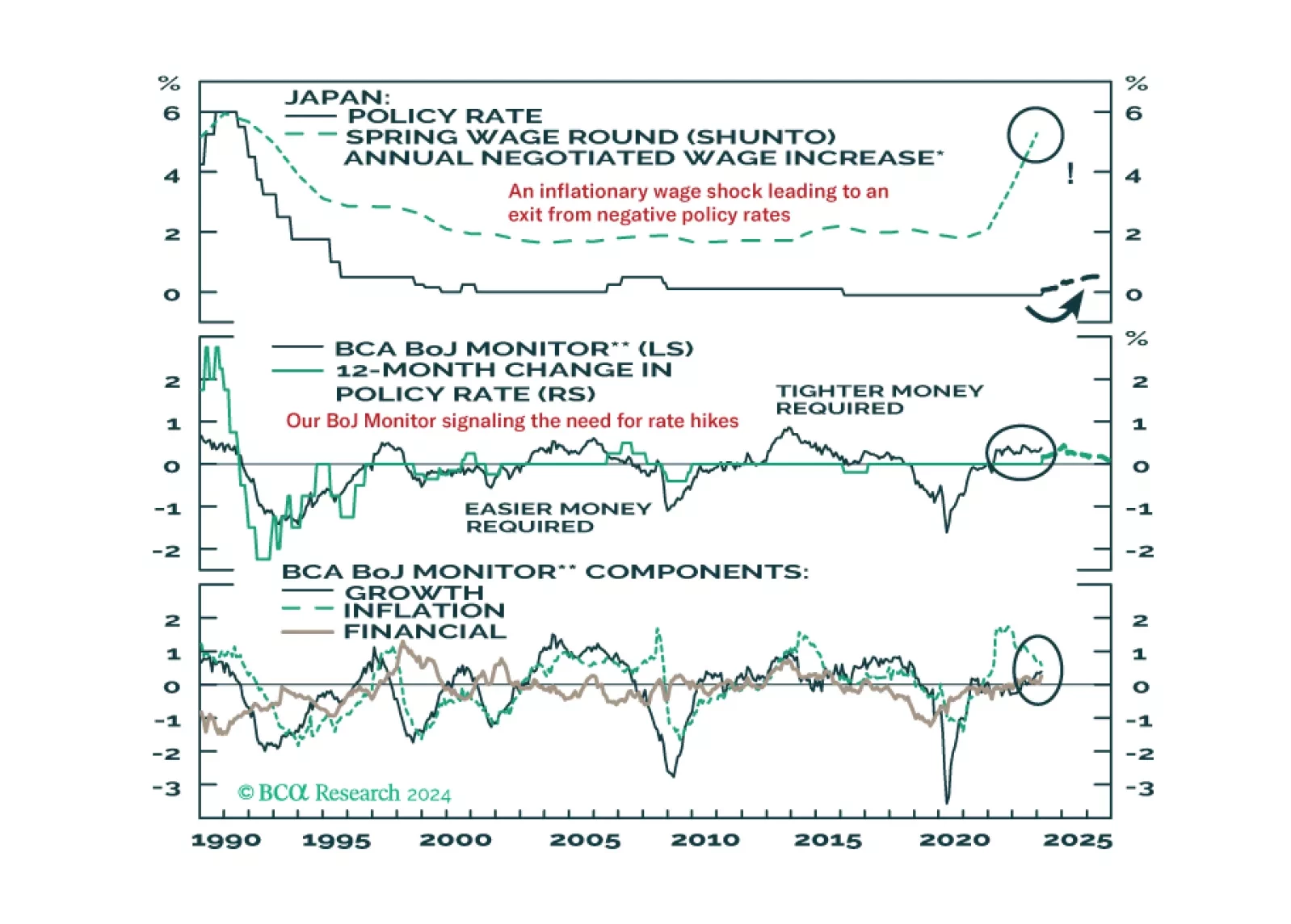

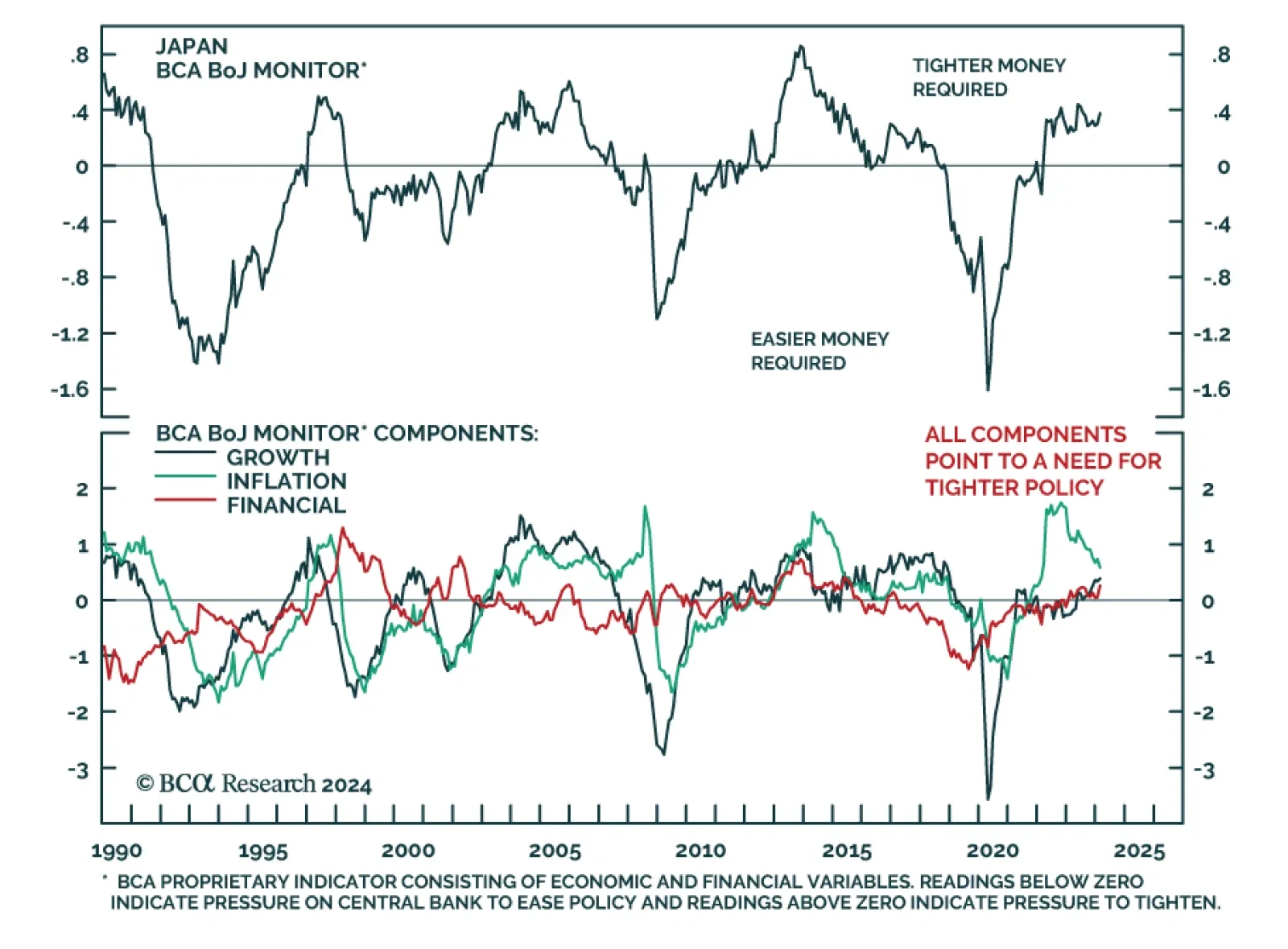

The Bank of Japan delivered a historic policy adjustment this week, ending both negative interest rates and Yield Curve Control. In this Insight, BCA’s global fixed income and currency strategists discuss the immediate implications…

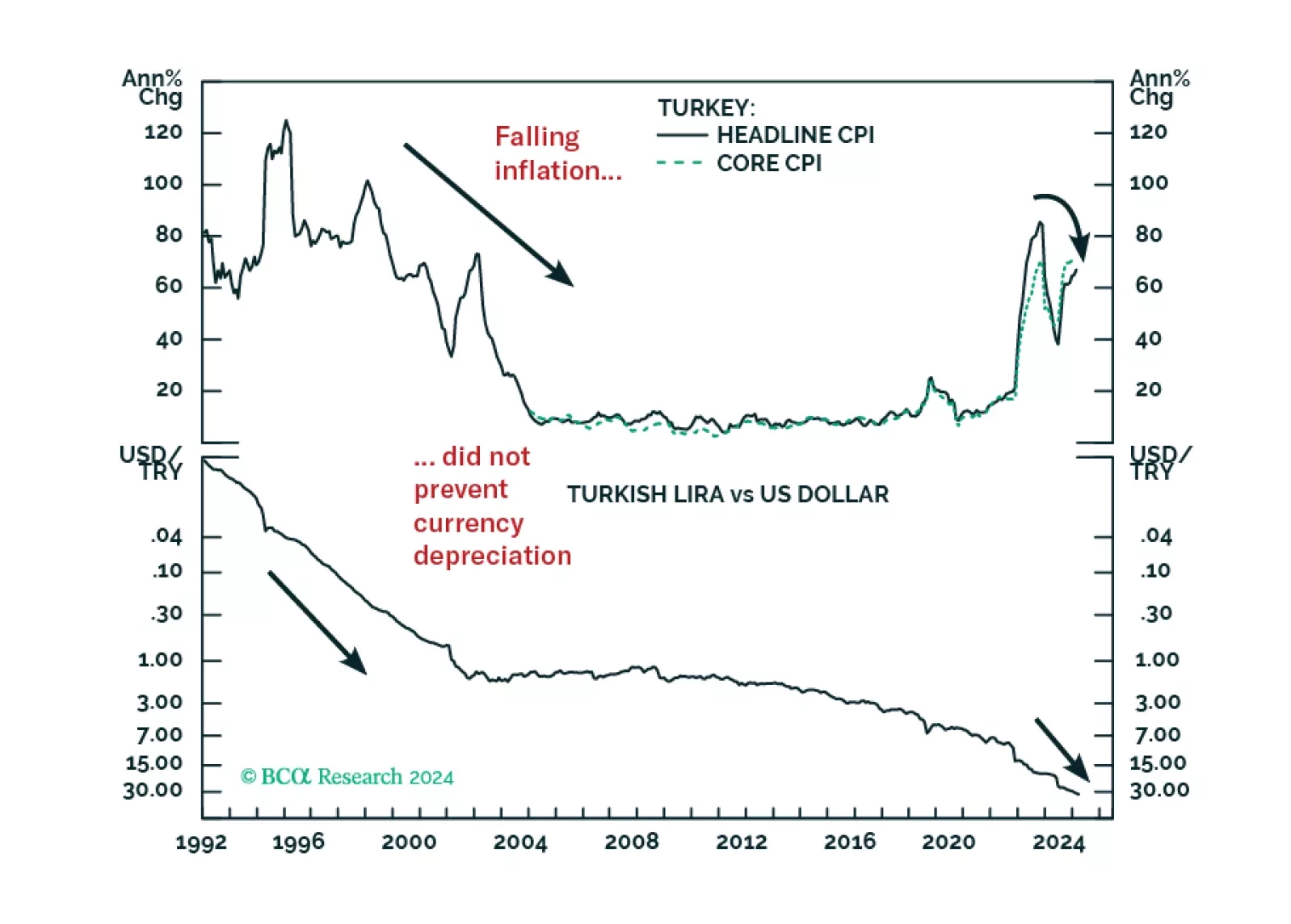

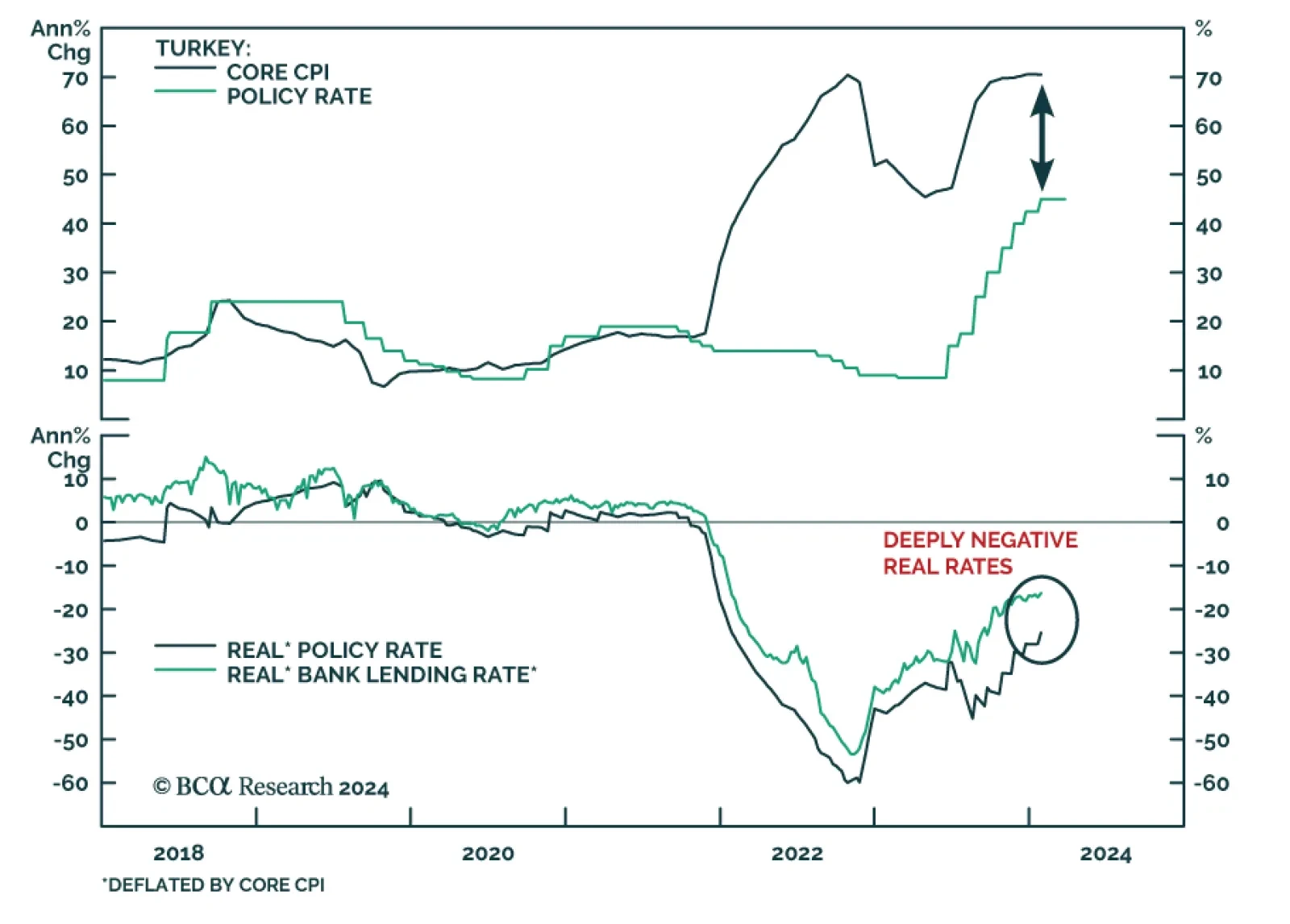

According to BCA Research’s Emerging Markets Strategy service, investors should stay cautious with respect to all Turkish assets. Over the past year, the Turkish Central Bank raised the policy rate significantly, from 8.…

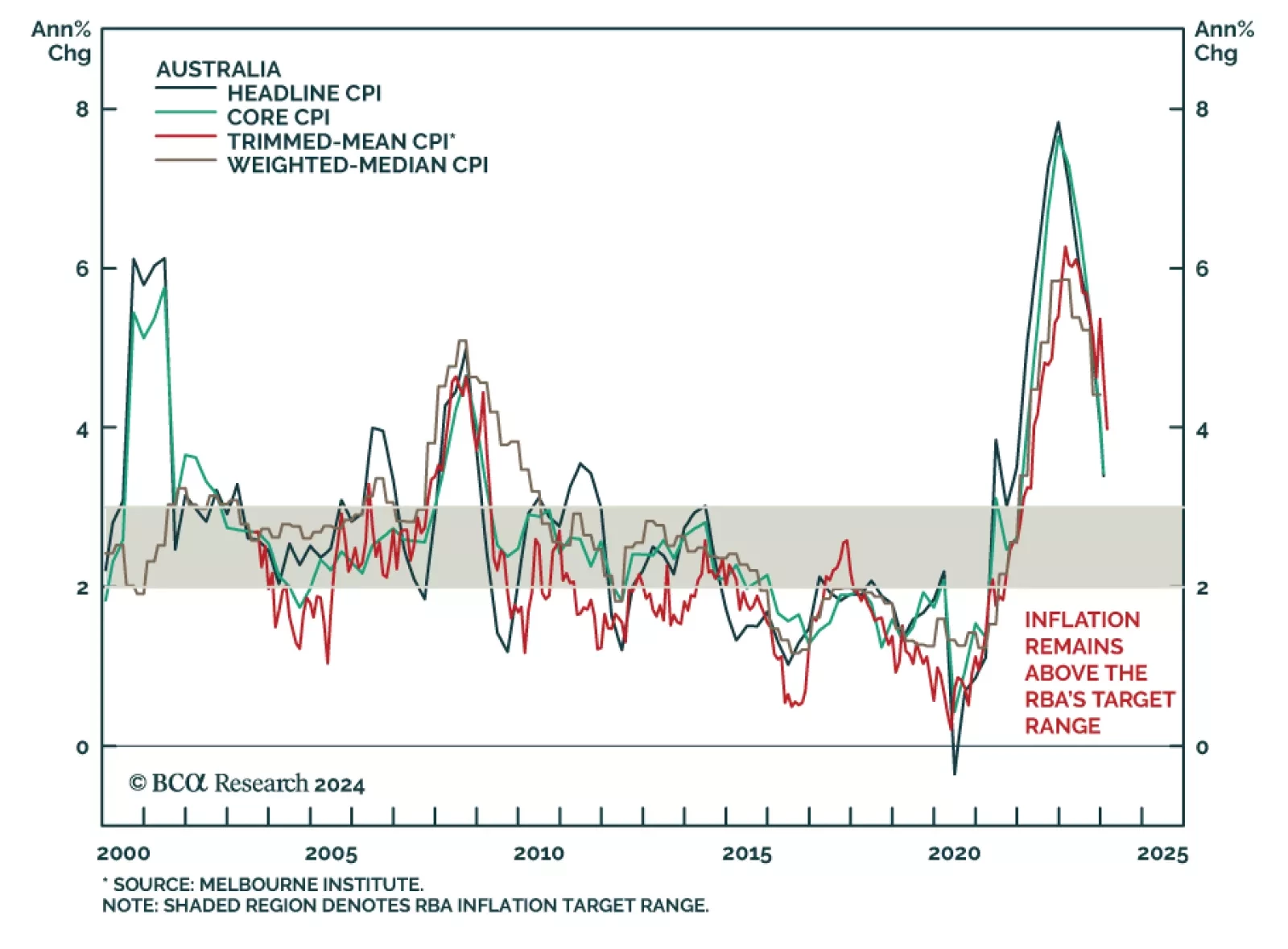

The Aussie dollar was among the worst performing G10 currencies on Tuesday on the back of a shift in tone in the Reserve Bank of Australia’s post-meeting statement. Specifically, the RBA replaced the hawkish bias that…

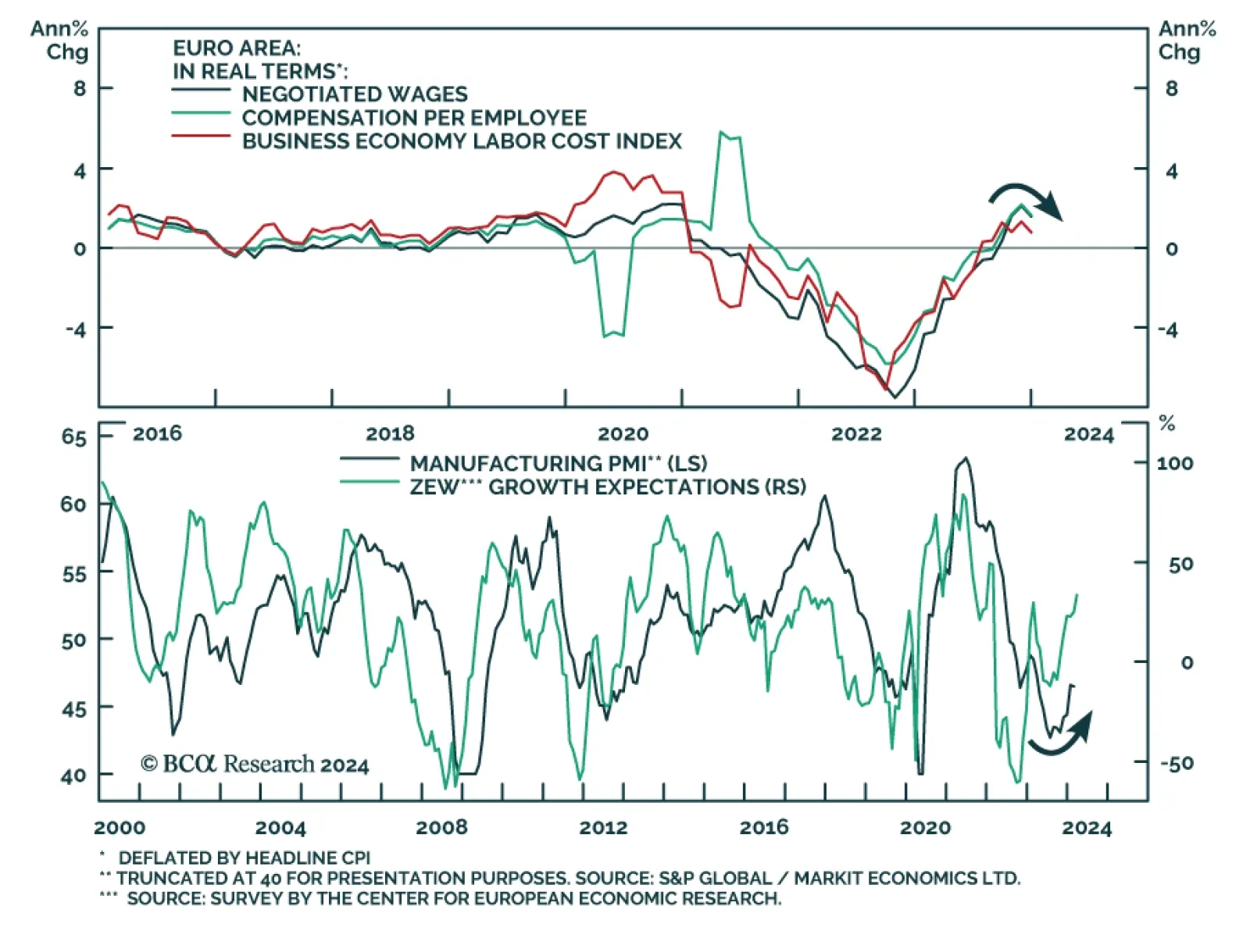

Various indicators of Eurozone wage growth have cooled off in recent months. Notably, the labor costs index eased sharply from a downwardly revised 5.2% y/y to 3.4% y/y in 2023Q4 – the slowest pace of increase since…

The Bank of Japan pulled its policy rate out of negative territory with a 10-basis point rate hike on Tuesday that brings the BoJ’s overnight interest rate to a range of 0% to 0.1%, ending over a decade of ultra-accommodate…

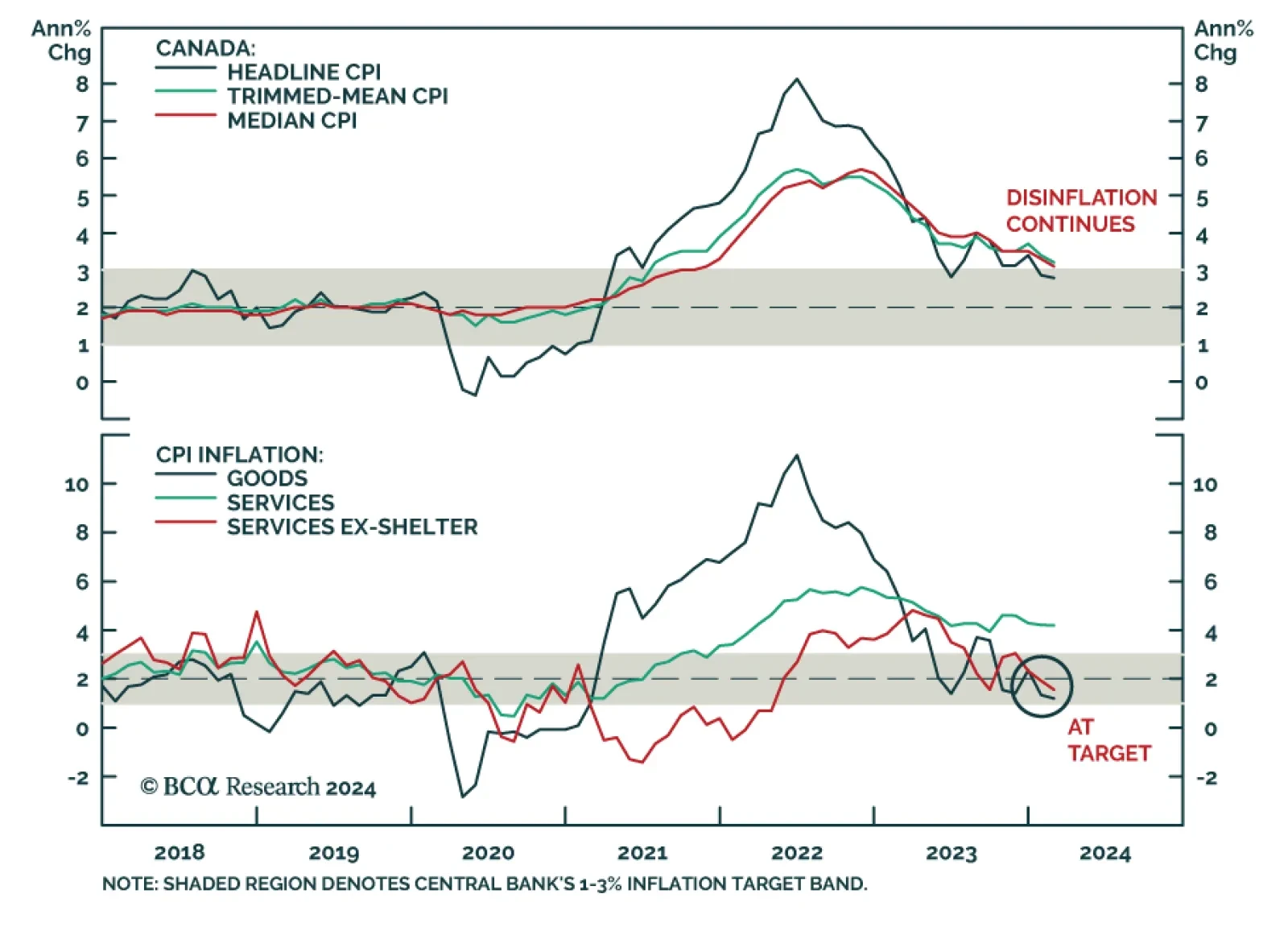

Canada’s CPI release for February shows price pressures continue to ebb with the various measures of inflation all falling below consensus estimates. In particular, headline inflation decelerated from 2.9% y/y to 2.8% y/y…

Turkey’s macro policy stance can hardly be called orthodox. And yet, corporate profit margins will contract meaningfully this year. The lira can also fall massively even if inflation eases from the extremely high levels – just as it…

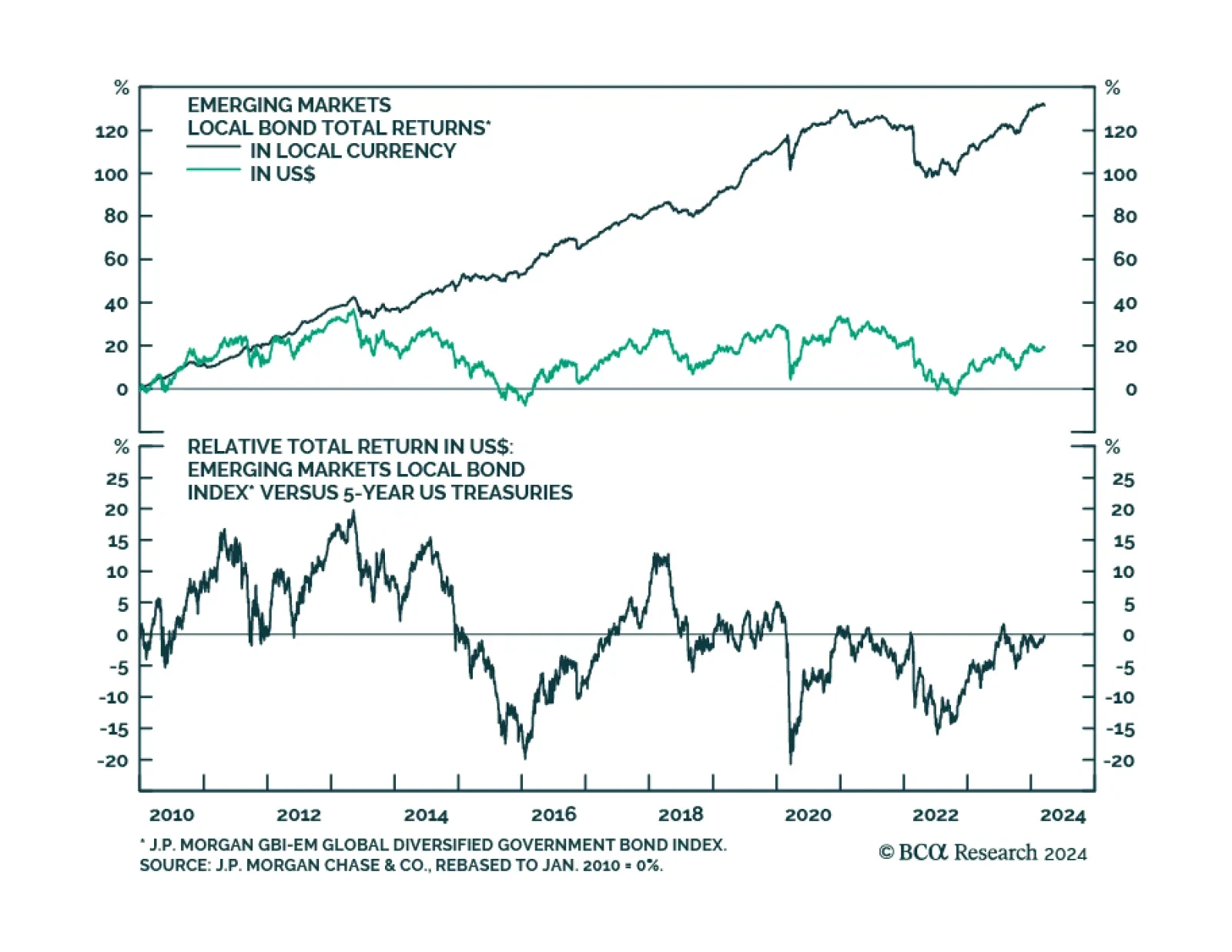

According to BCA Research’s Global Asset Allocation service, the impact of the global savings glut is among the four structural trends that will drive EM debt going forward. As an asset traditionally further out on the…