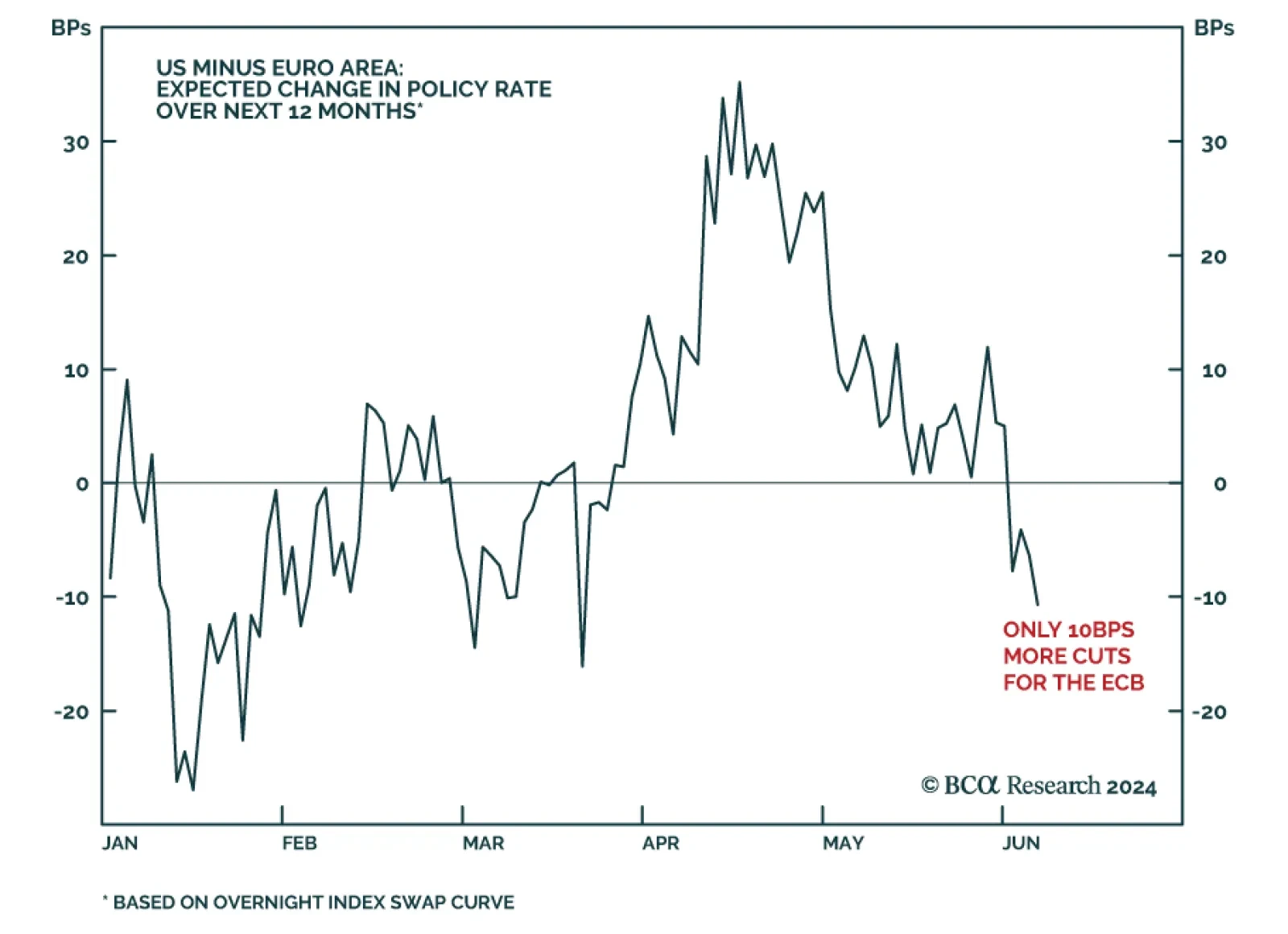

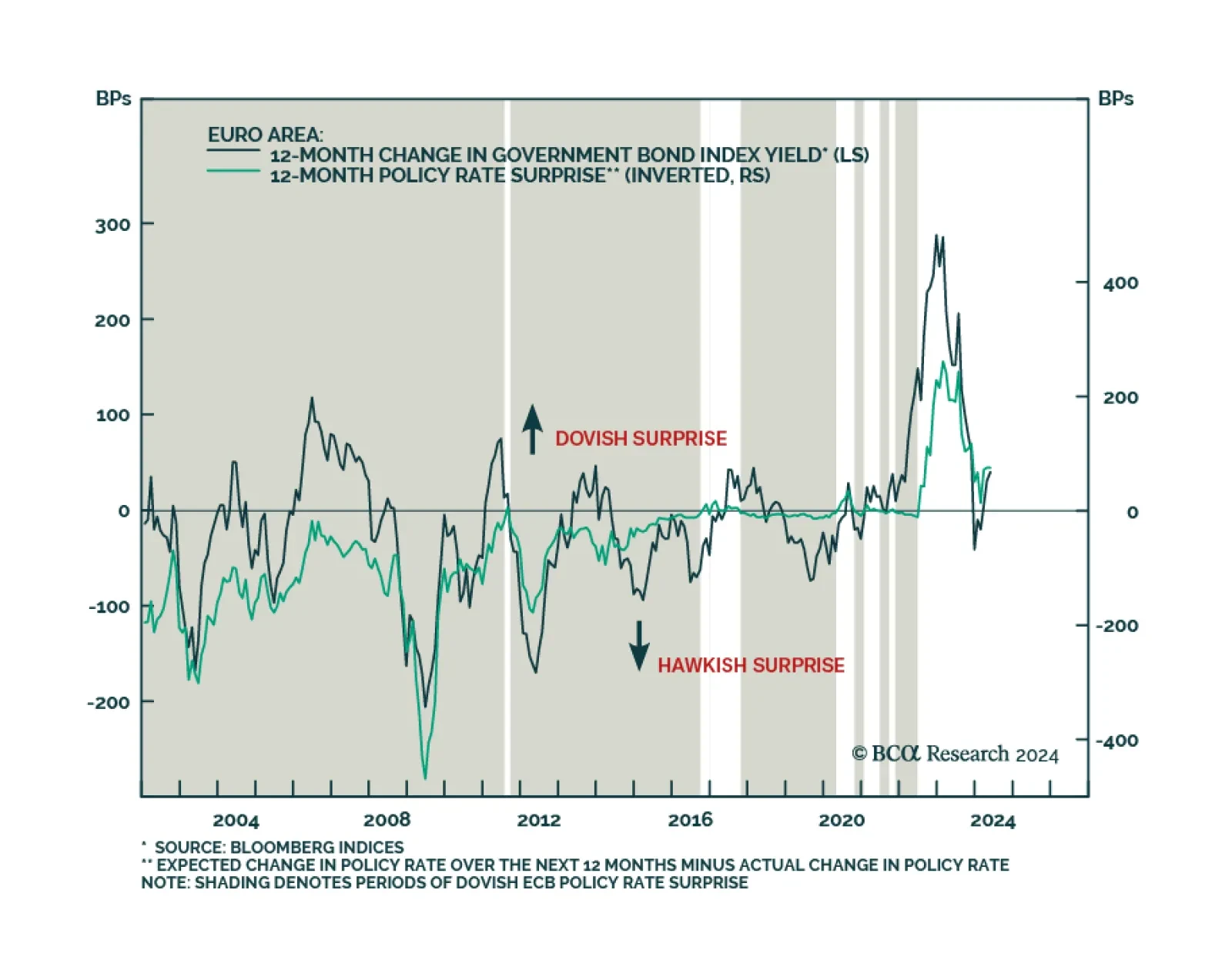

After holding rates steady over the past nine months, the ECB delivered on its widely expected rate cut on Thursday. The Governing Council lowered all three key ECB interest rates by 25 bps, bringing the refinancing, marginal…

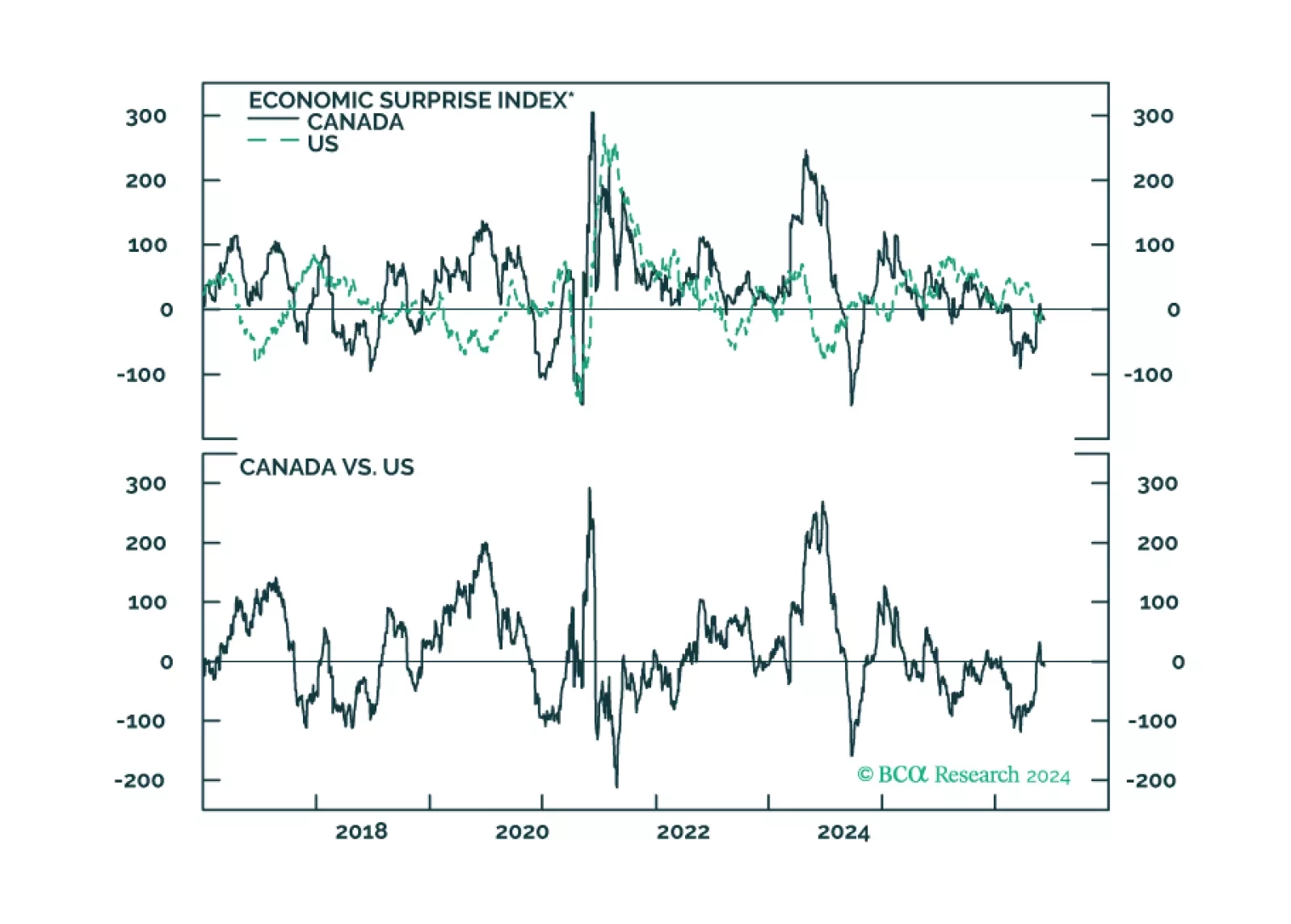

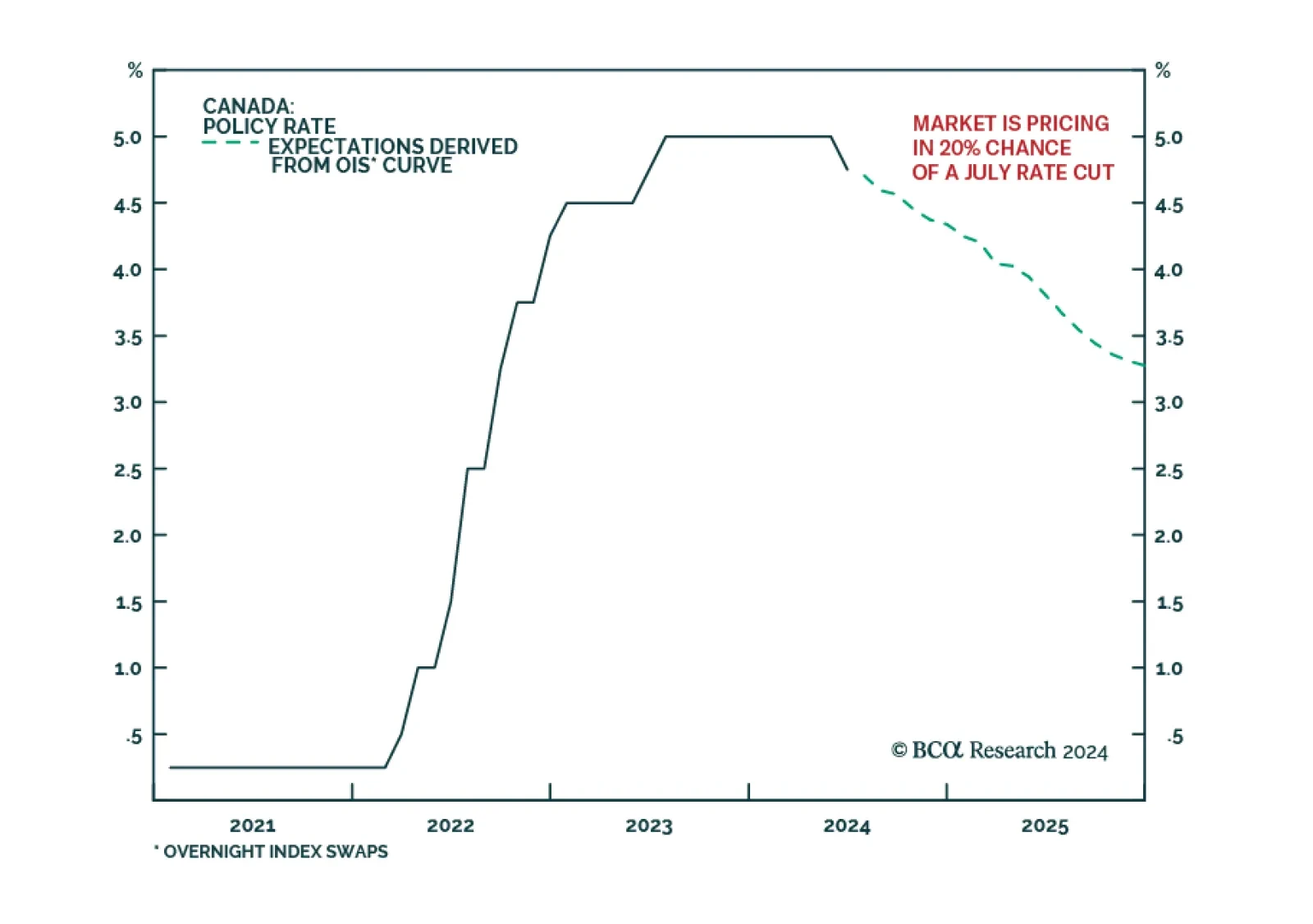

In this insight, we provide an update on the Canadian economy, given yesterday’s rate cut, and implications for Canadian assets.

The Bank of Canada reduced its policy rate by 25 basis points from 5% to 4.75% on Wednesday, in line with the market consensus. Headline inflation and the BoC’s preferred measures of core inflation are within the BoC’…

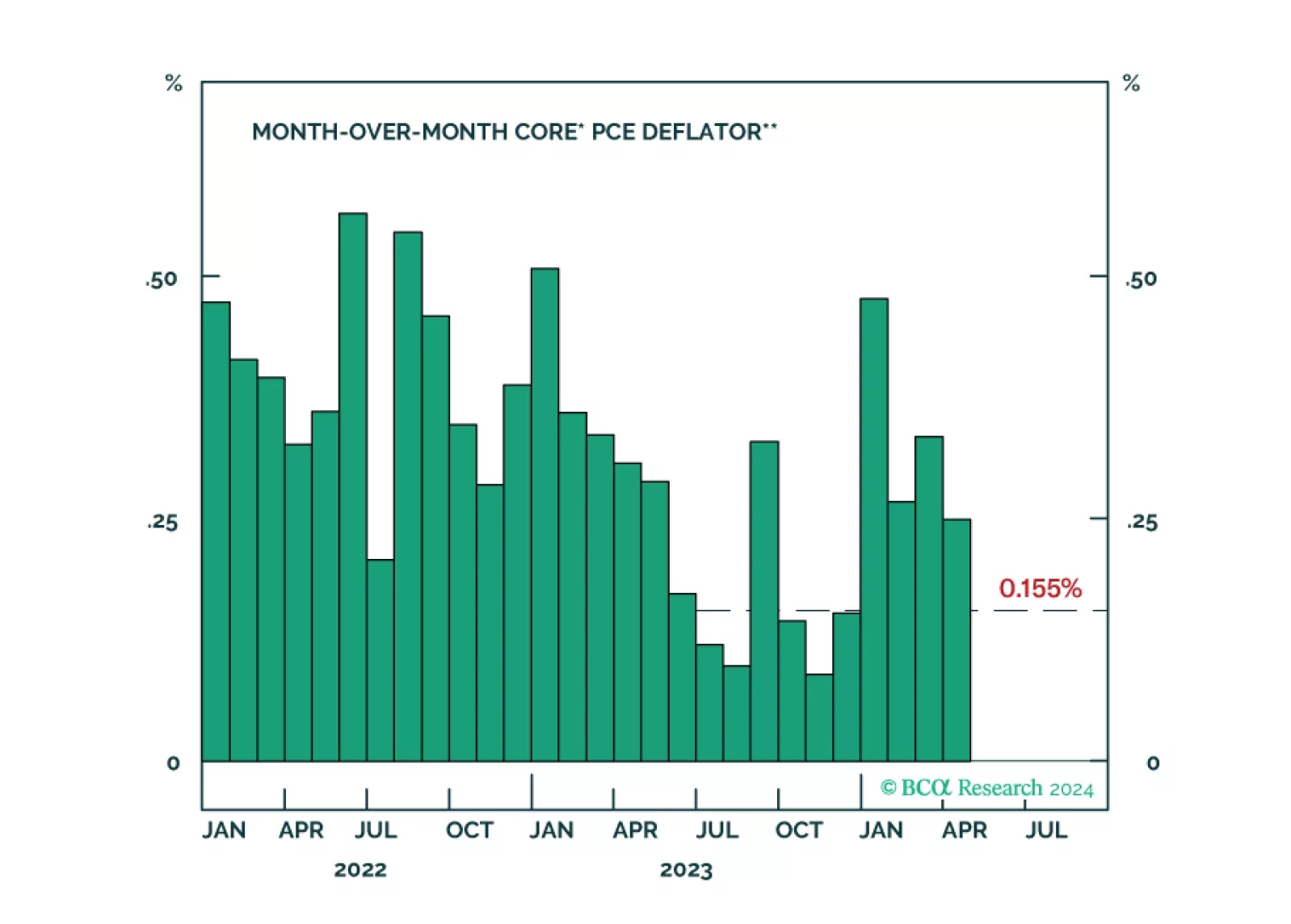

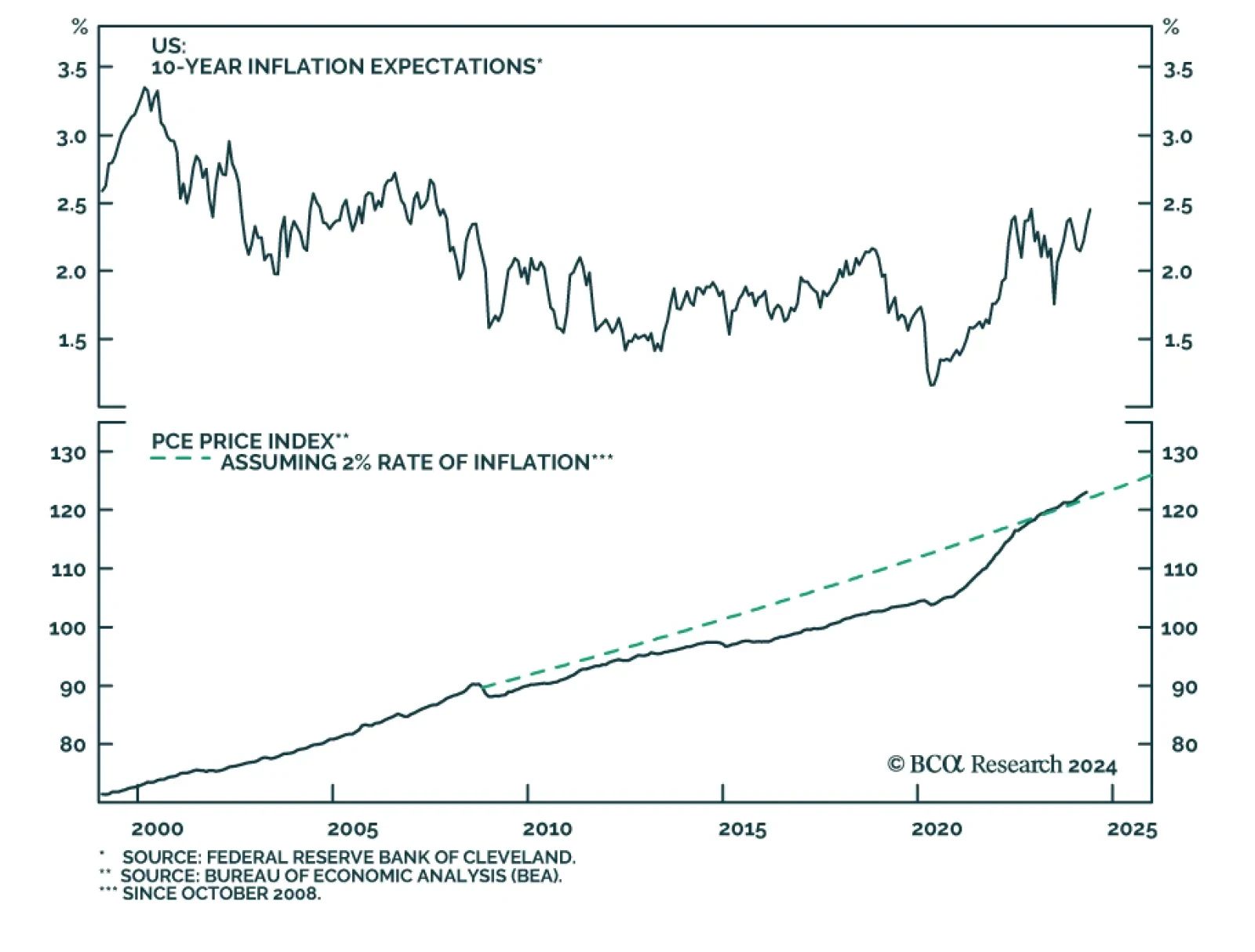

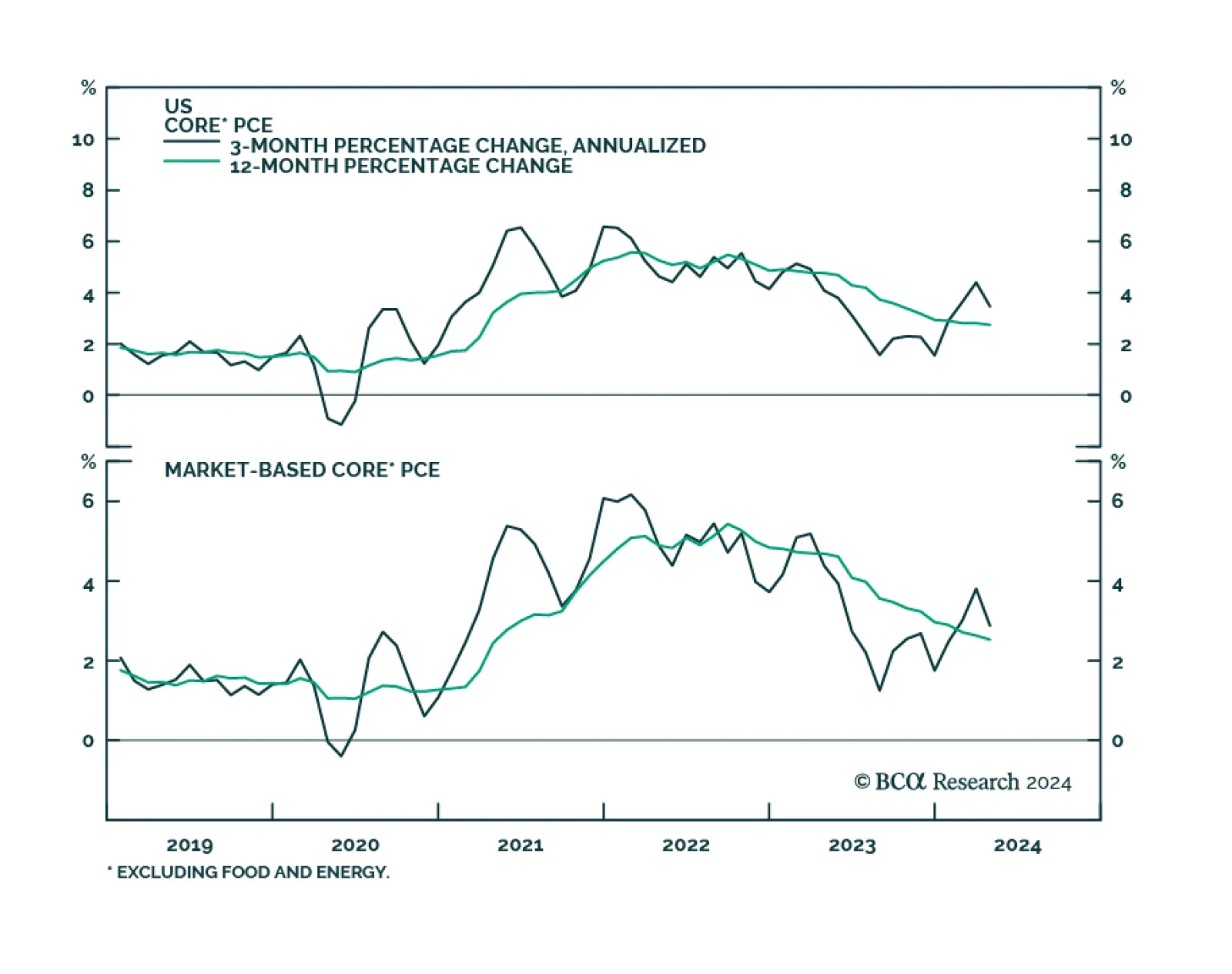

The moderation in core PCE in April was a step in the right direction towards a Fed easing. Our Global Investment Strategists also highlighted that outside of a few pandemic-related “catch-up” categories such as…

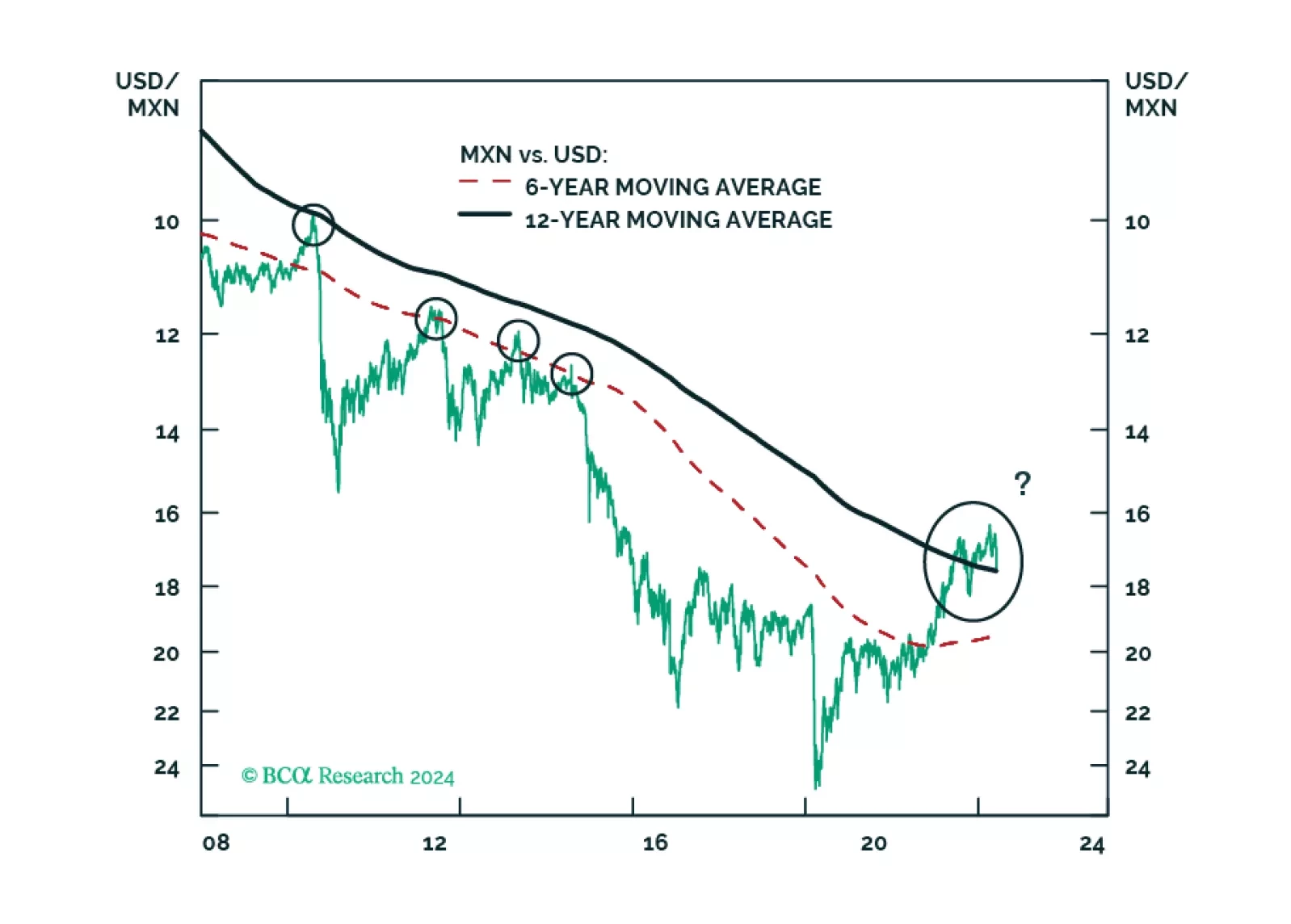

MORENA has once again swept the Mexican election: Claudia Sheinbaum will be president, with little to no constraint in Congress. All in all, Mexican politics will remain stable and overall supportive of markets. In the medium term,…

Our Portfolio Allocation Summary for June 2024.

Euro Area CPI accelerated for the first time this year from 2.4% y/y to a faster-than-expected 2.6% y/y in May. Preliminary estimates also suggest that core CPI accelerated from 2.7% y/y to 2.9% y/y, against expectations of a…

US nominal personal income growth decelerated from 0.5% m/m to 0.3% m/m in April, in line with expectations. However, nominal personal spending surprised to the downside, and contracted 0.1% m/m in real terms. Core PCE –…

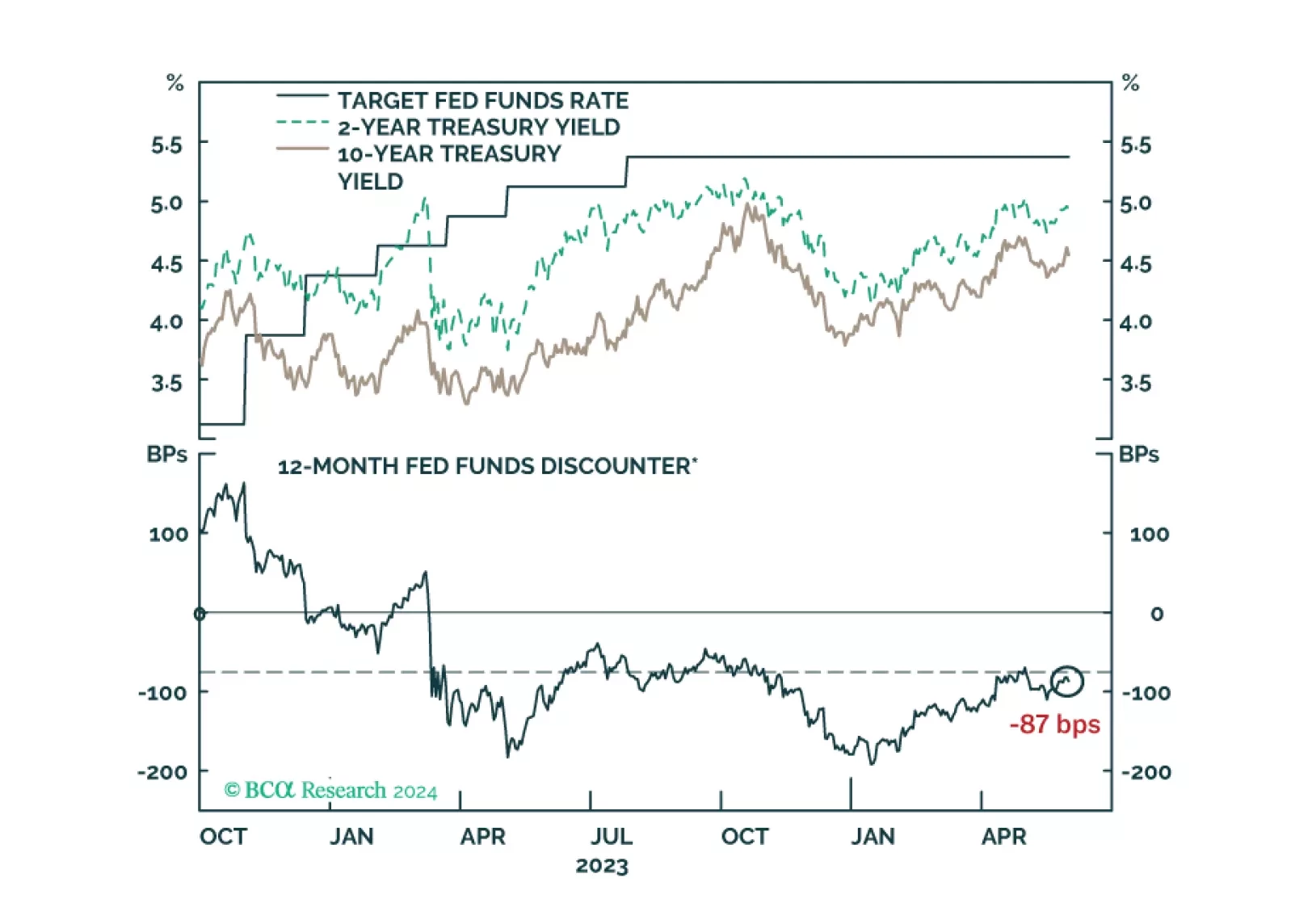

We comment on whether Treasury market valuation is sufficiently attractive to get long bonds and consider some of the common arguments for why yields may yet make new highs.

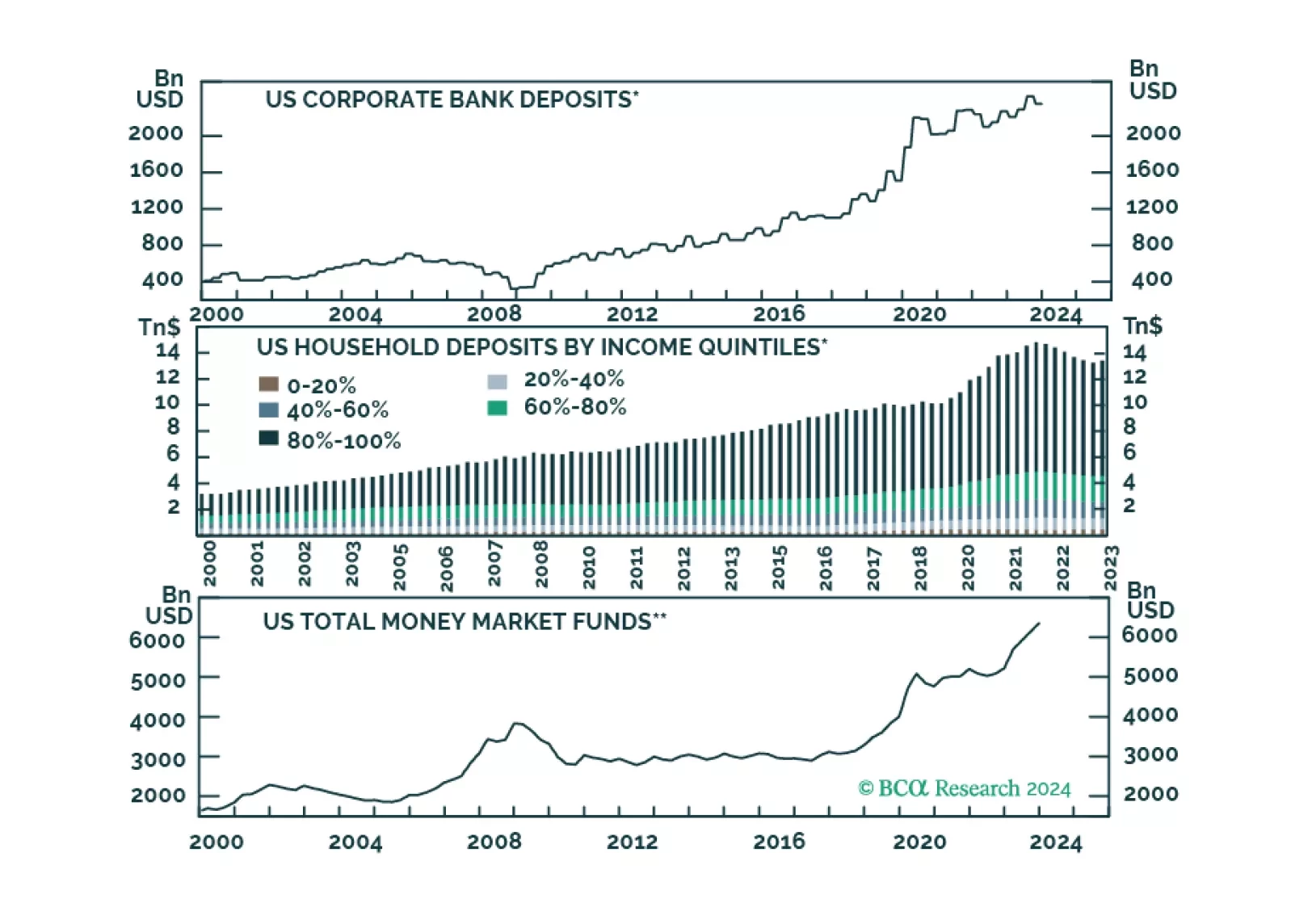

Looking at economic activity, global monetary policy seems restrictive, however, the behavior of financial markets tells a different story. What gives?