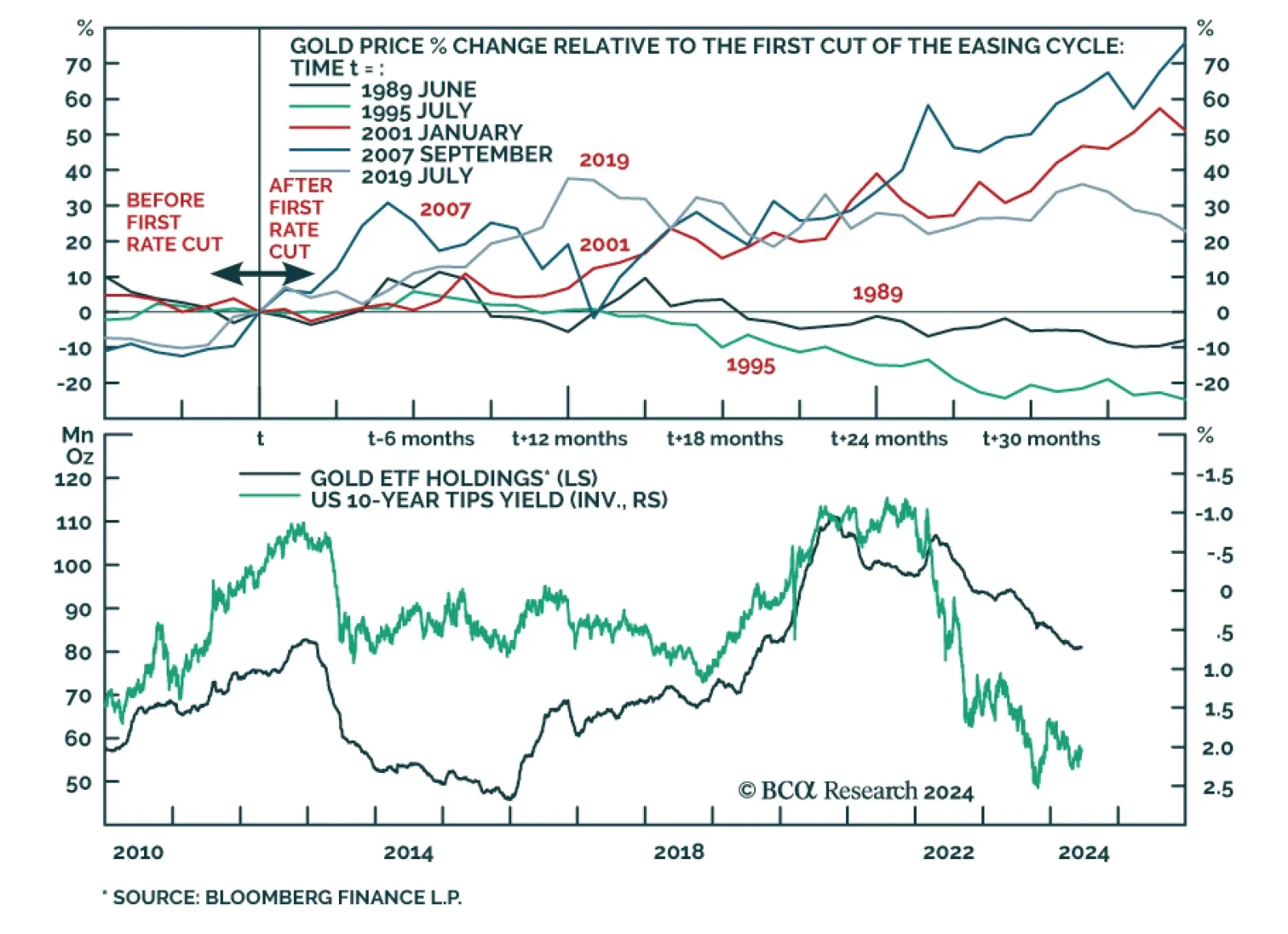

According to BCA Research’s Commodity & Energy Strategy service, a Fed pivot to rate cuts will provide gold prices with a tailwind. At first blush, the historical evidence is mixed. While gold rallied in the three…

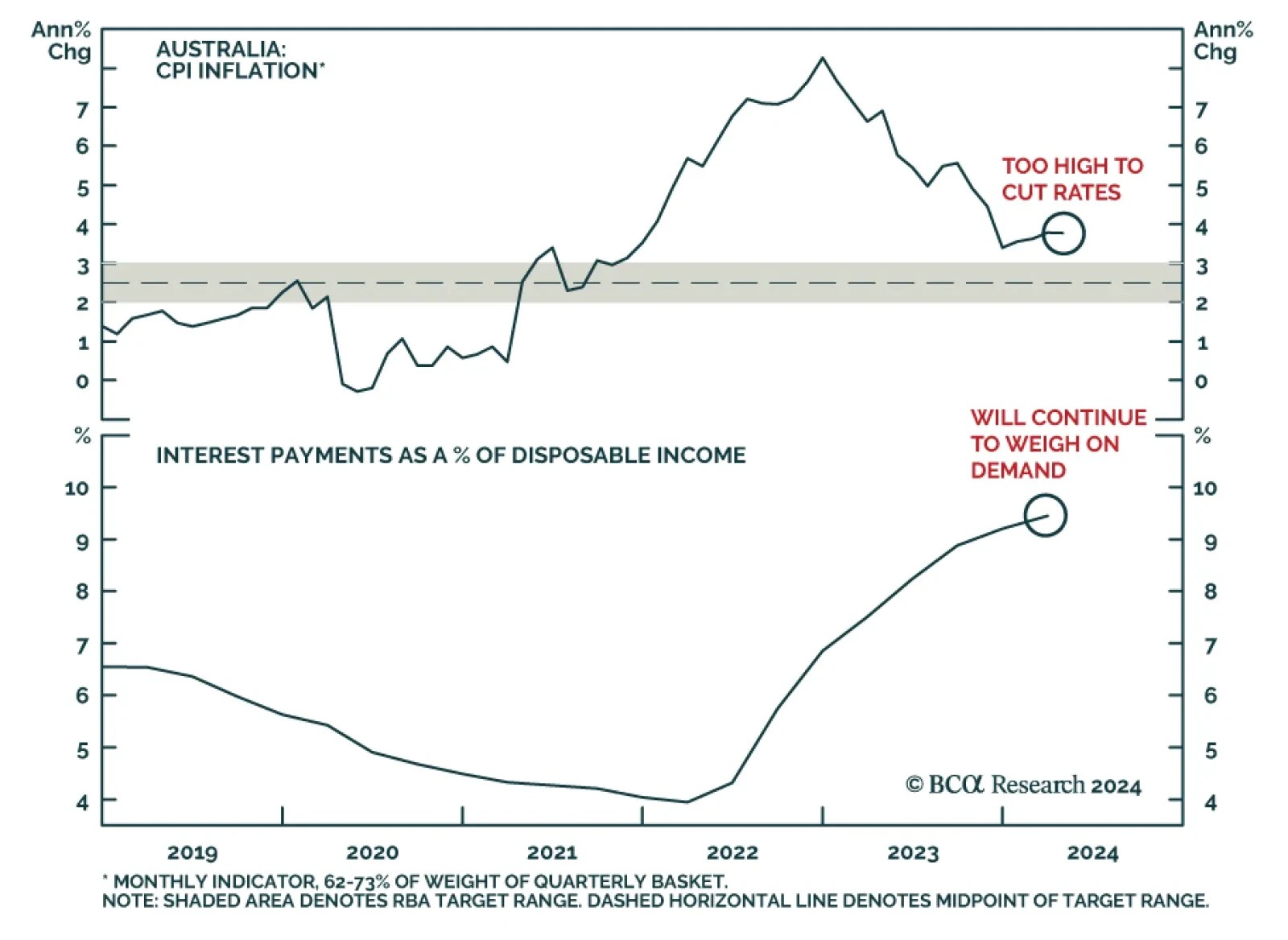

The Reserve Bank of Australia kept its cash rate at 4.35% at its policy meeting on Tuesday, in line with market expectations. Australia’s monthly measure of headline inflation came in at 3.6% in April, still considerably…

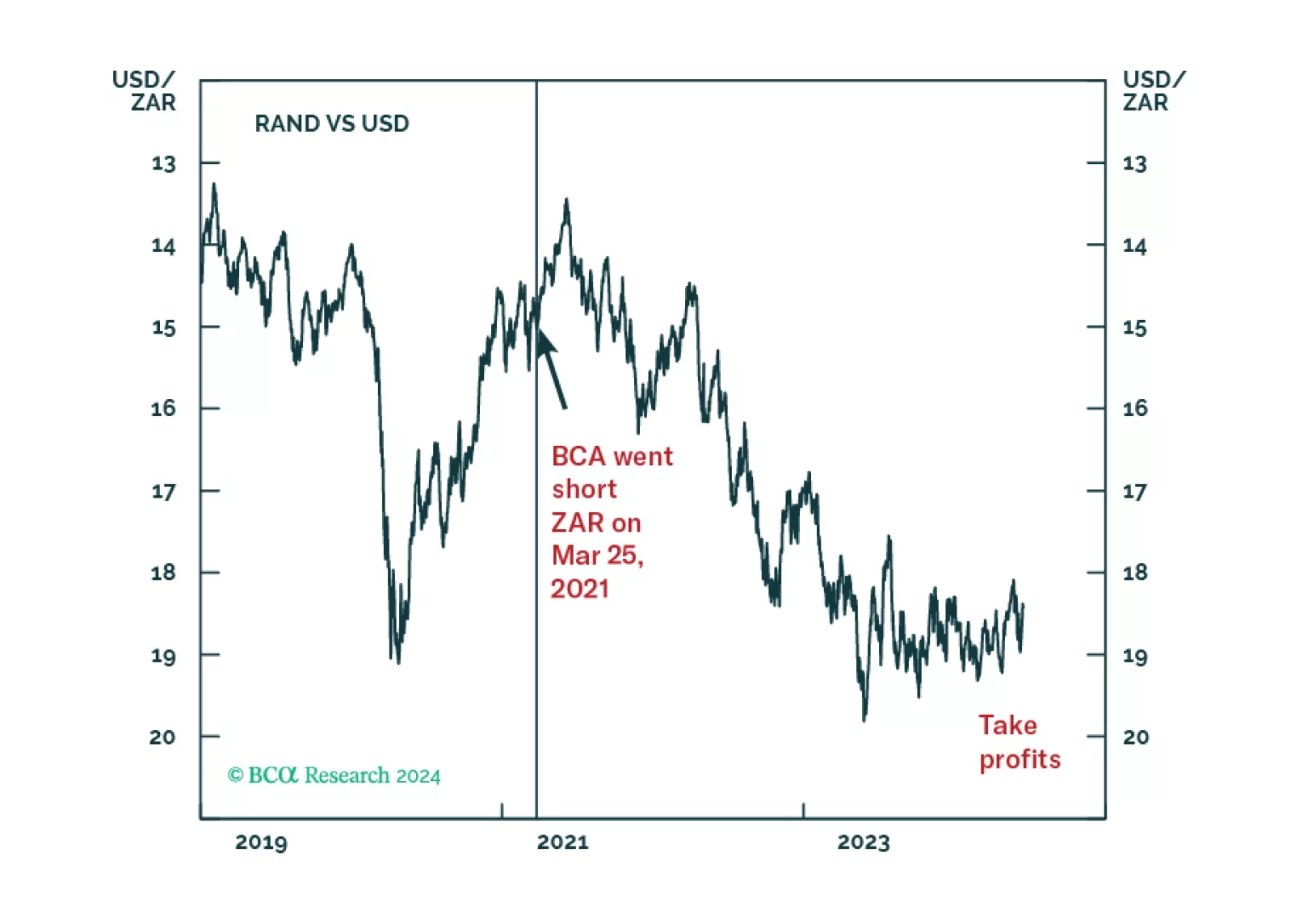

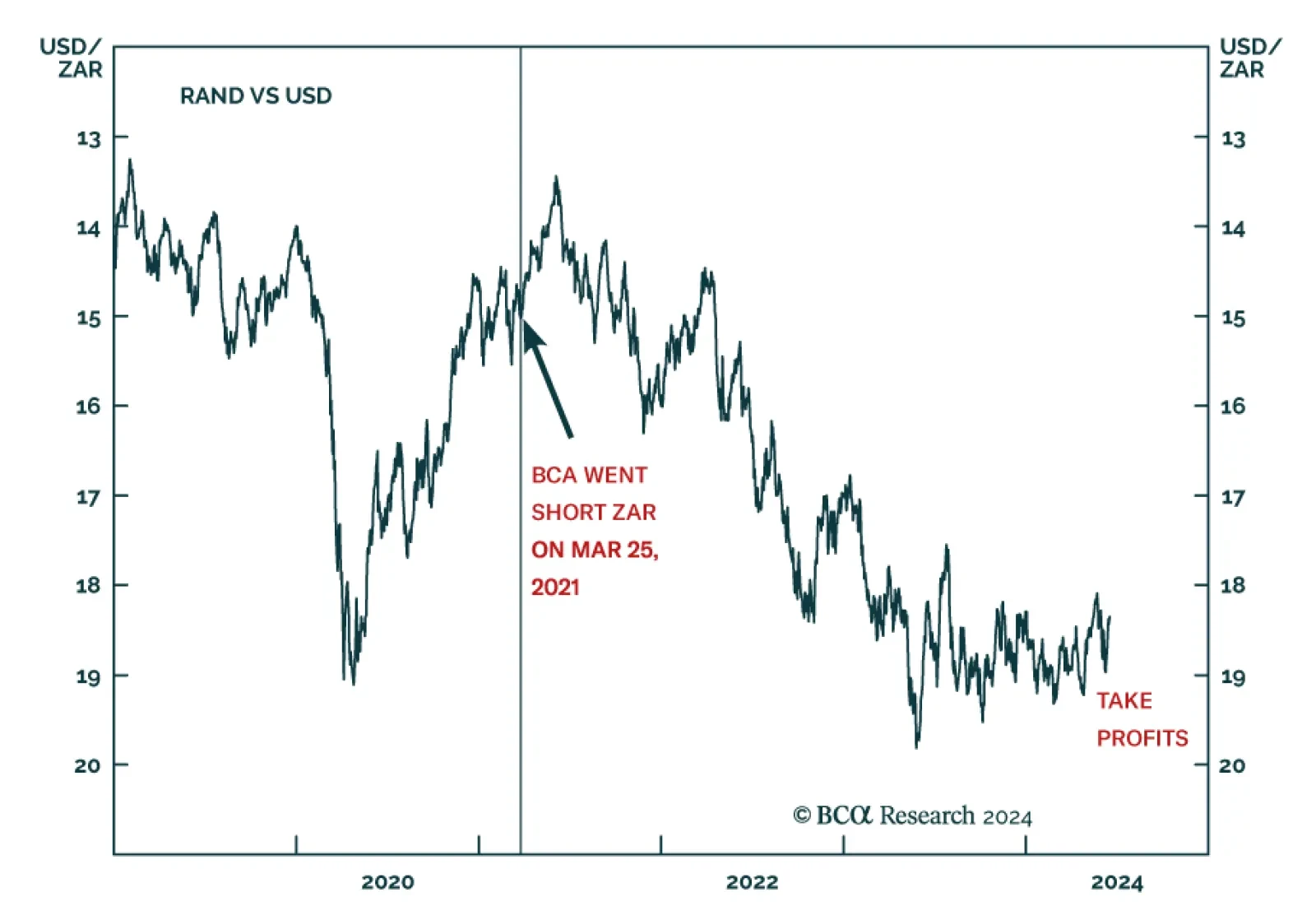

According to BCA Research’s Geopolitical Strategy service, the South African election presents a window of opportunity for productivity-boosting structural reforms, such as privatization, to coincide with monetary and…

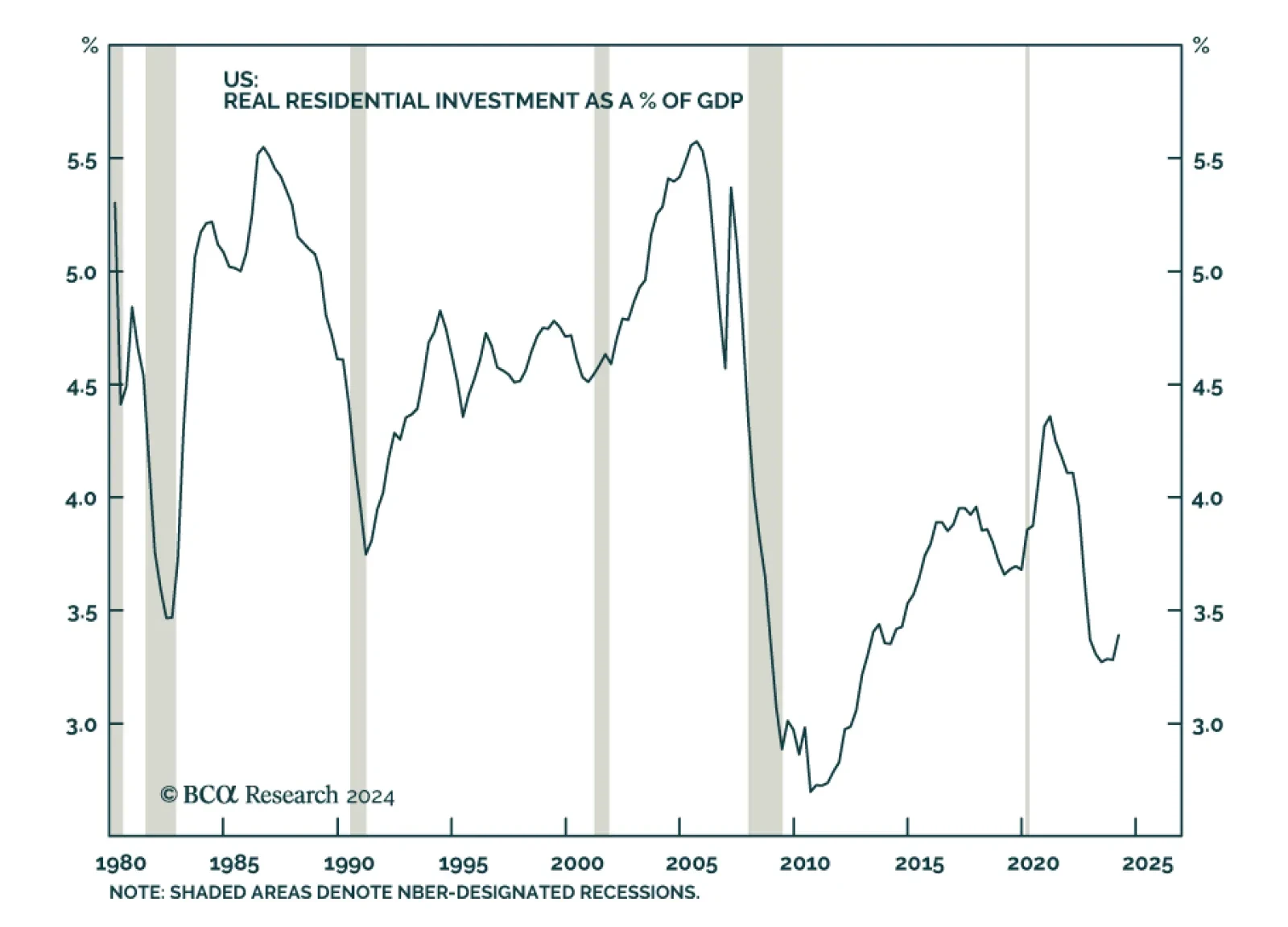

Housing is the most interest-rate-sensitive sector of the economy. Yet, the very aggressive monetary tightening cycle has only had a muted effect on home prices. While recent housing market data have been mixed, prices have not…

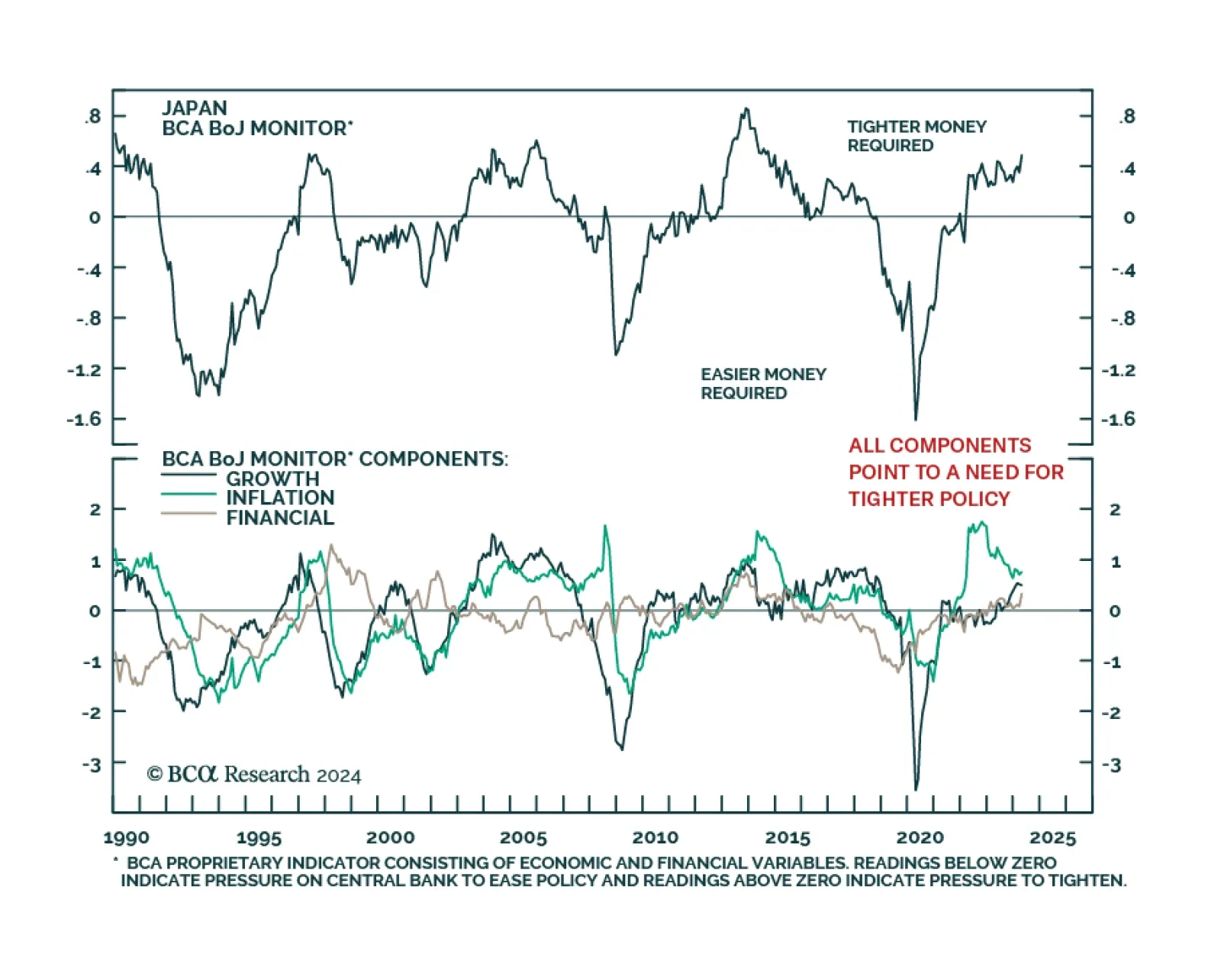

In this insight, we update our thinking on the recent BoJ move in terms of positioning for the yen and JGB yields.

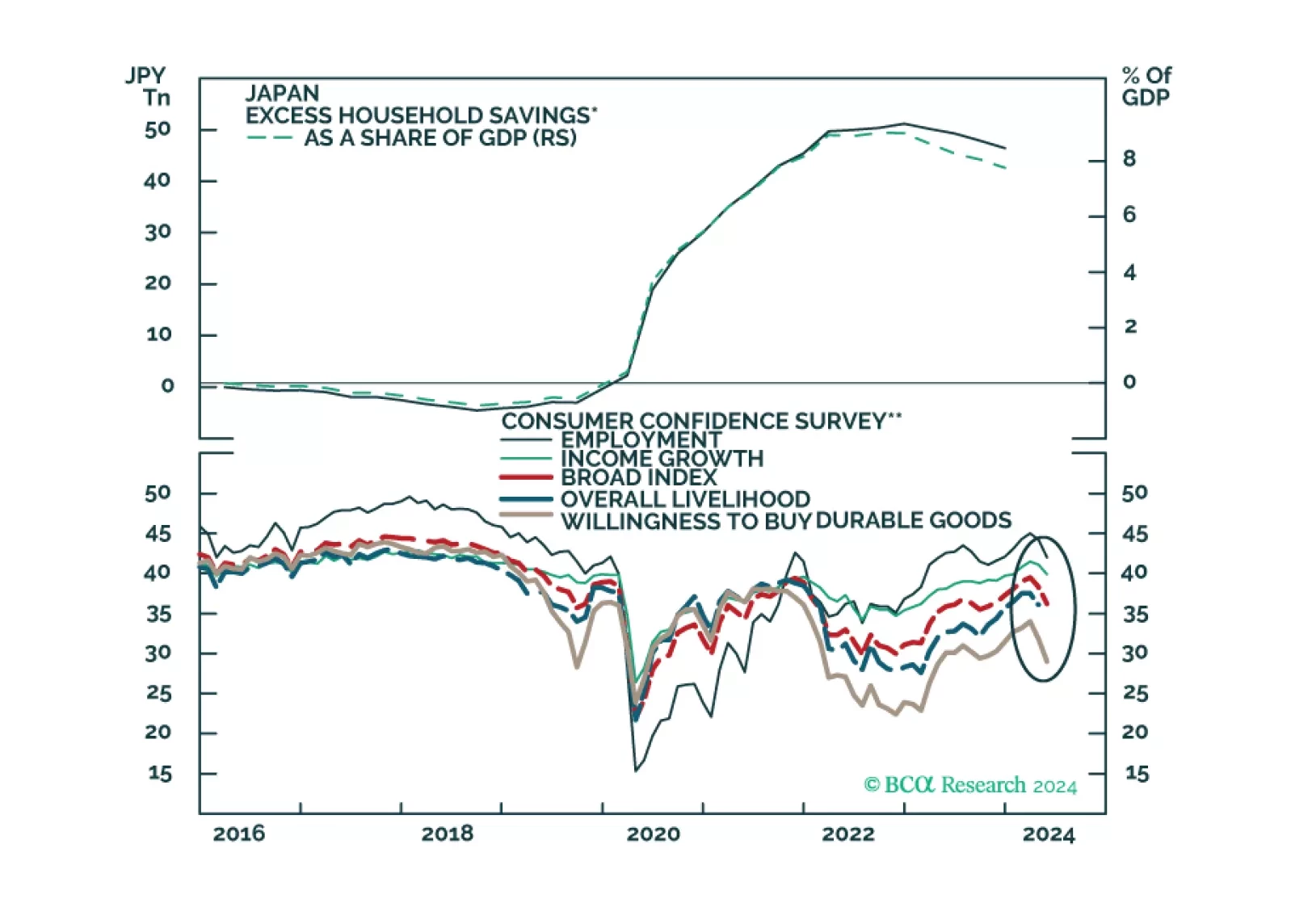

In a largely expected move, the Bank of Japan kept its policy rate unchanged at 0-0.1% in June. It maintained the pace of bond buying at JPY 6tr per month but signaled it would lay out a plan to reduce its balance sheet next…

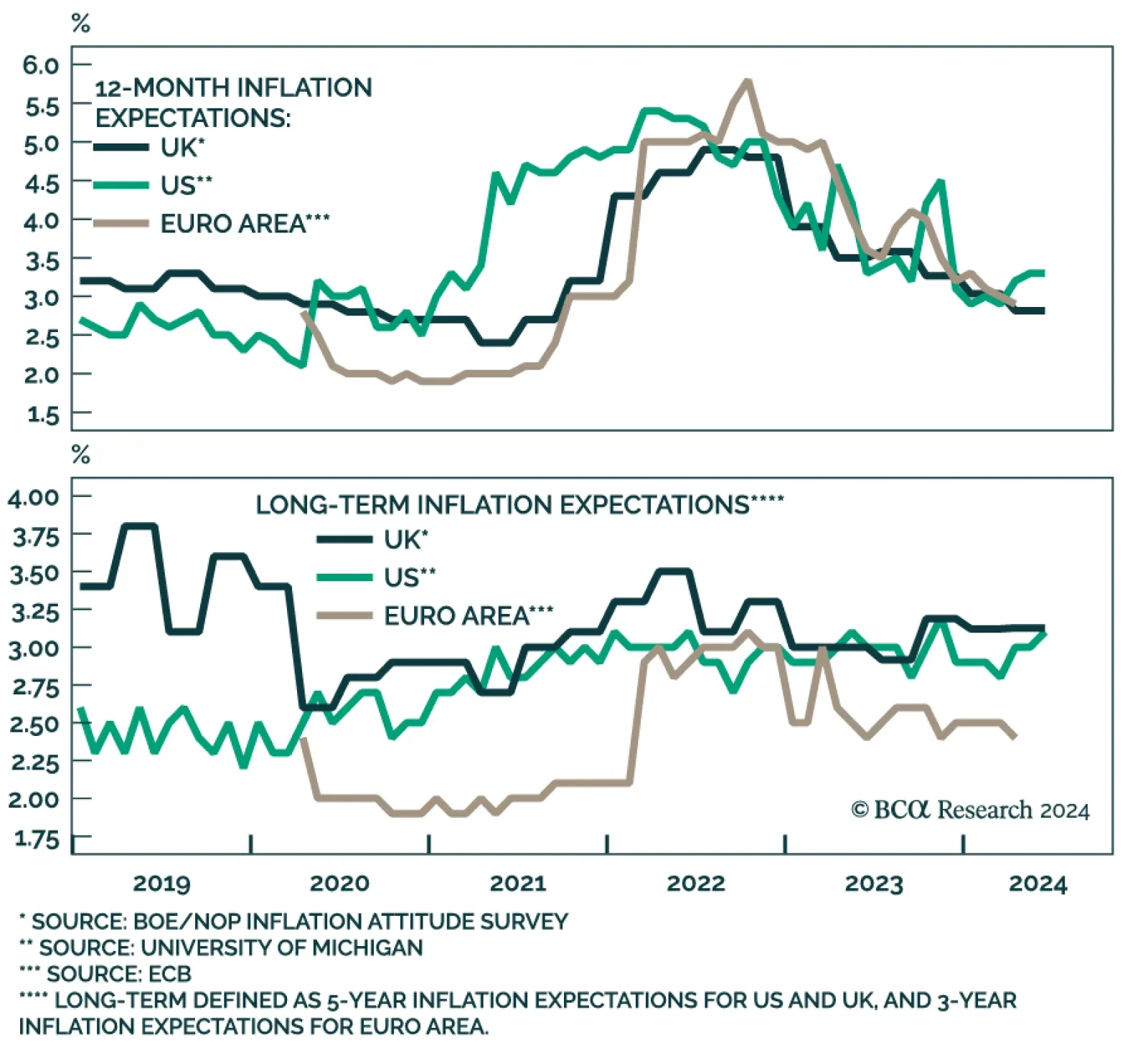

The BoE had to deal with a stagflationary headache in the second half of 2023. Inflation was stickier and growth was weaker in the UK than in many of its DM peers. This trend turned around earlier this year with a late-cycle…

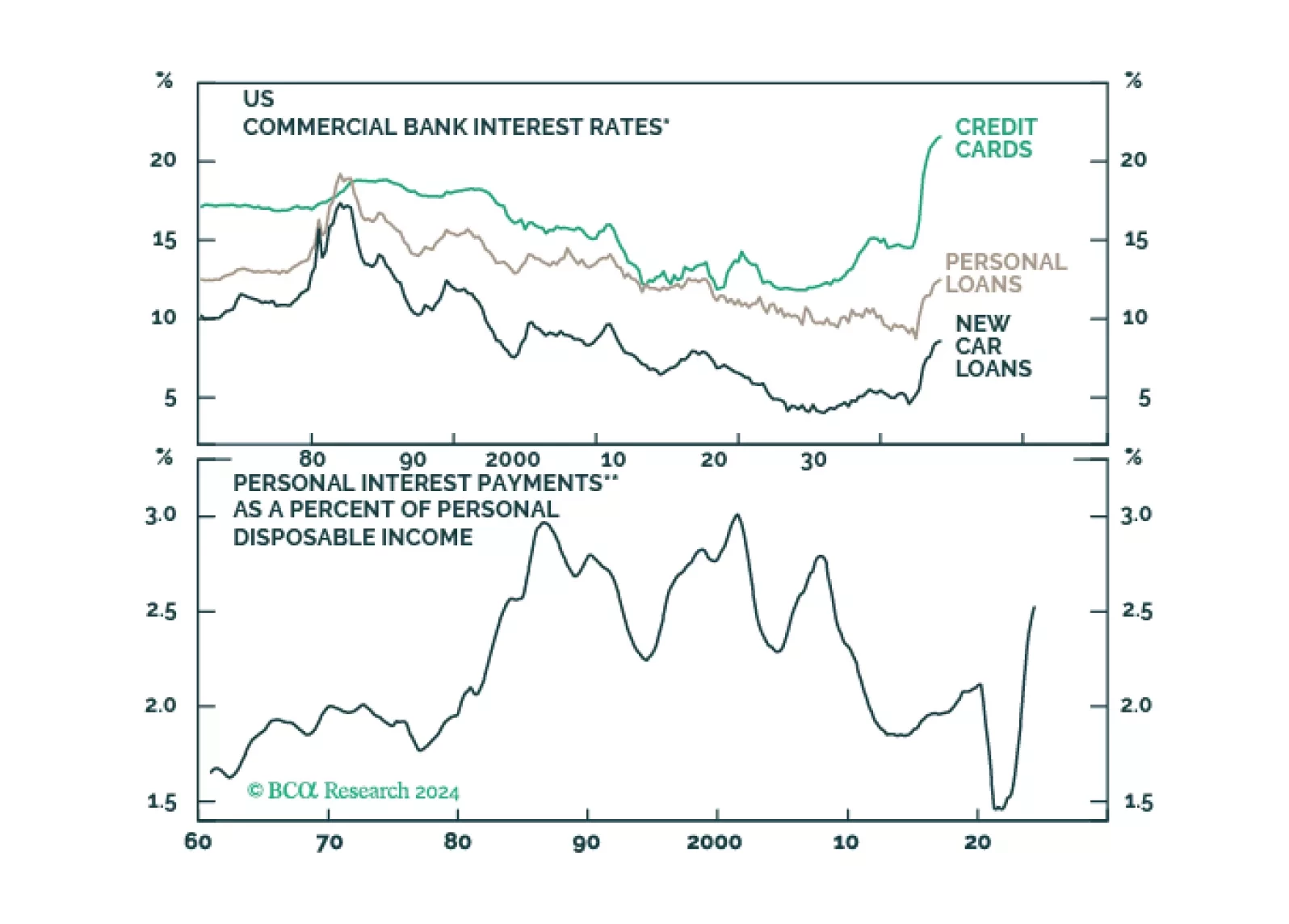

Global consumer spending is likely to slow over the coming quarters, culminating in a major economic downturn in late 2024 or early 2025. Investors should maintain benchmark exposure to equities for now but look to turn more…

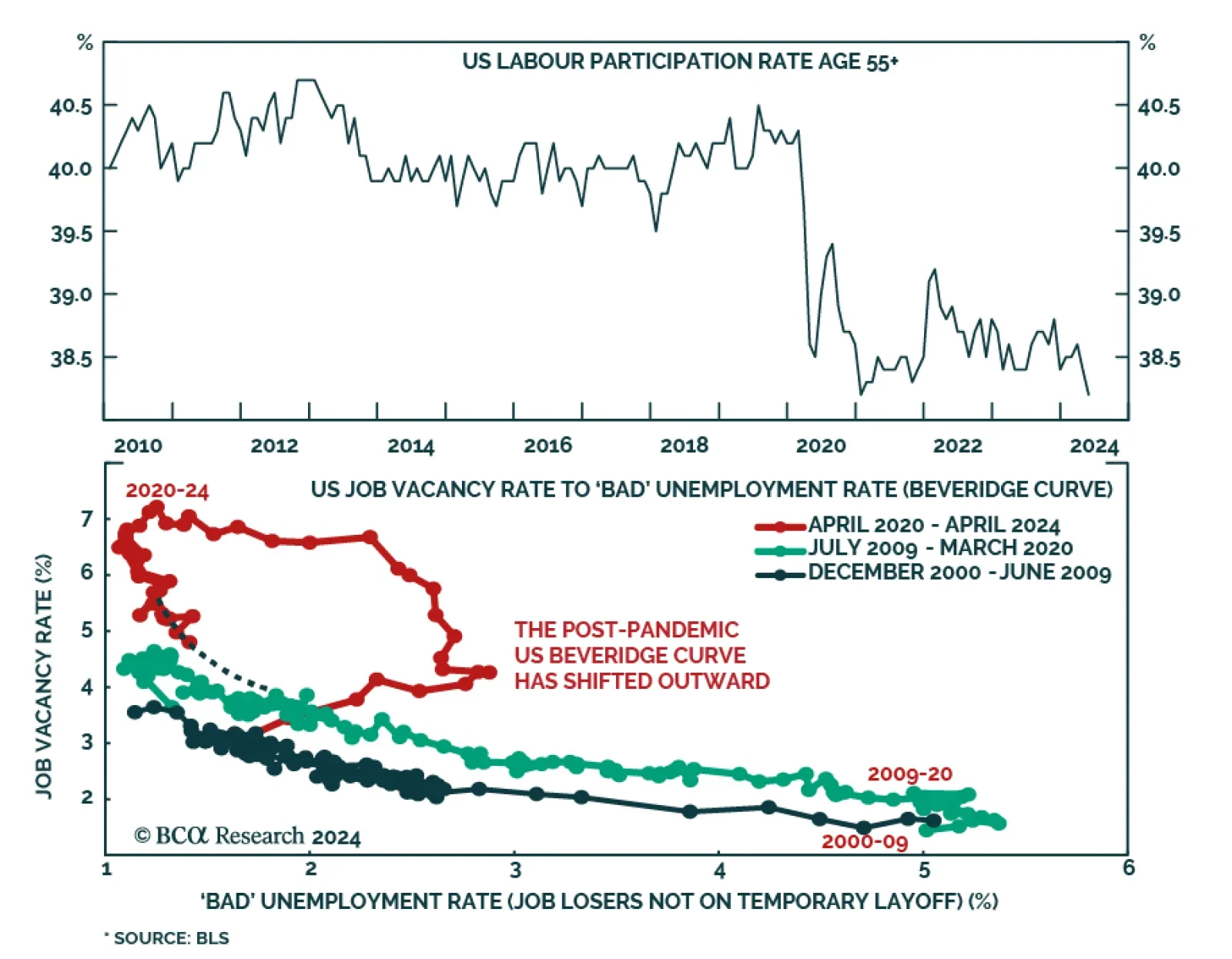

According to BCA Research’s Counterpoint service, job losers not on temporary layoff (‘bad’ unemployment) will need to rise further for the Fed to reach its 2 percent inflation target. Although prime-age…