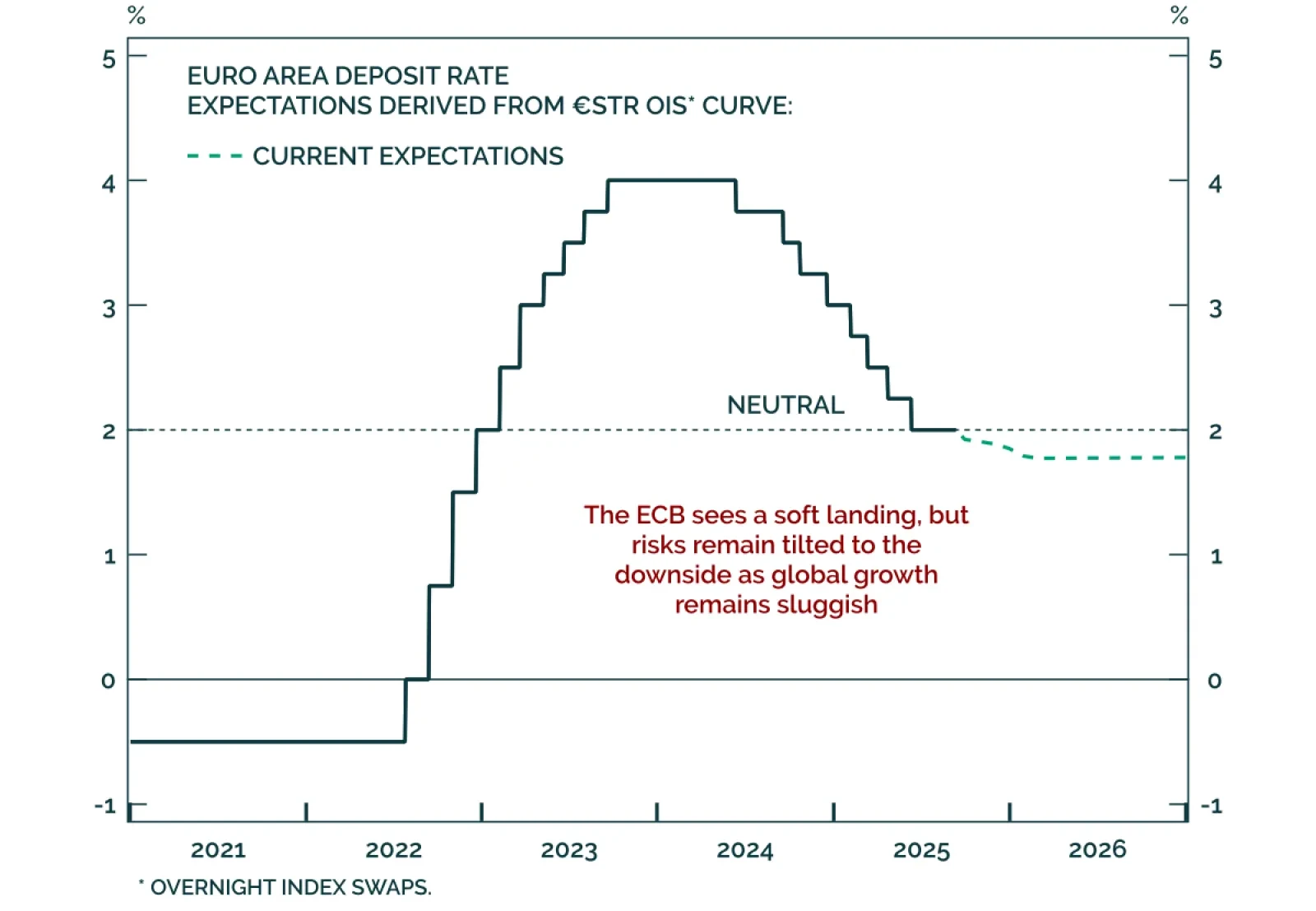

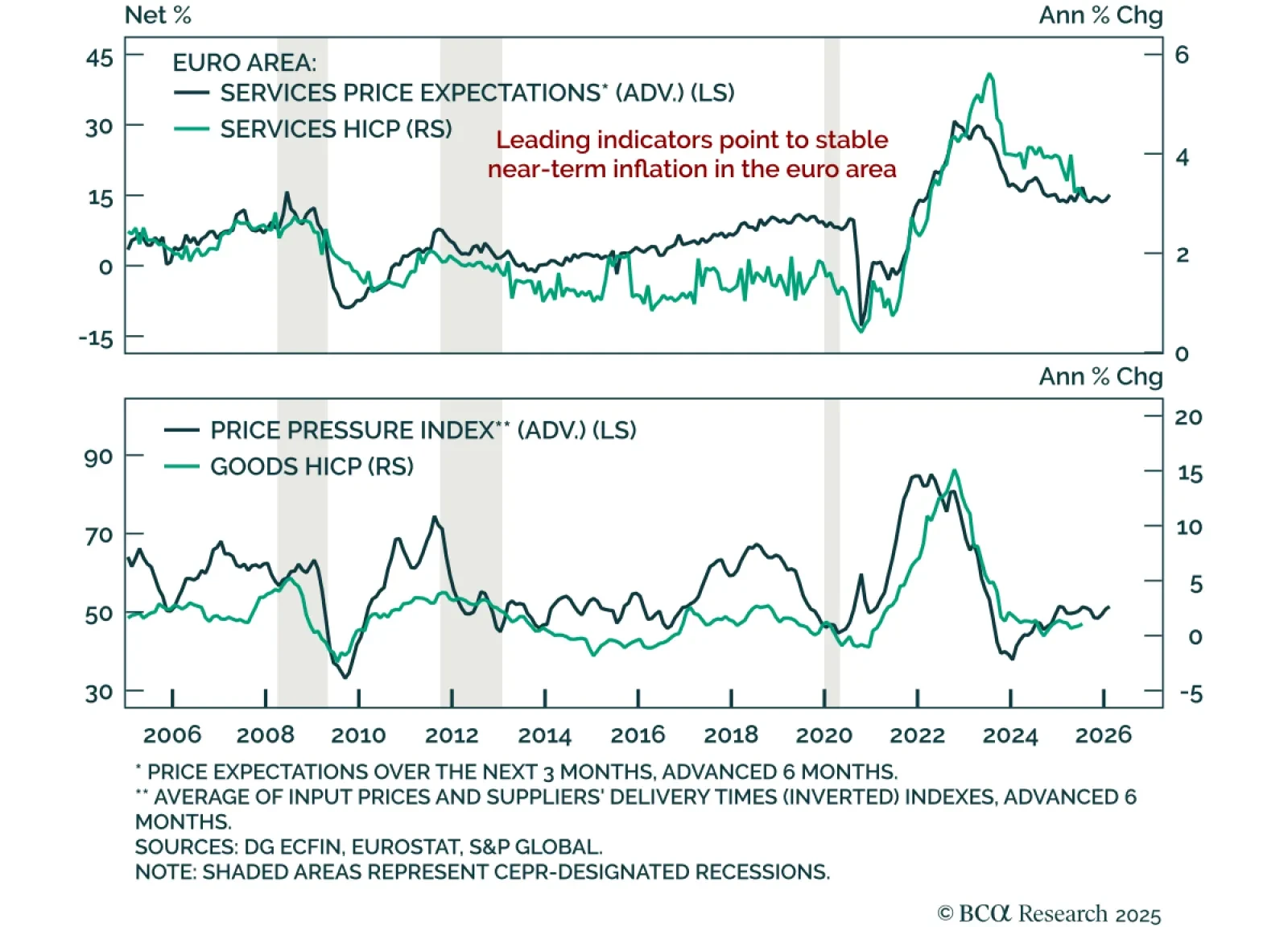

The ECB left policy unchanged in September, reiterating a data-dependent stance and signaling no urgency to ease. Markets barely reacted, consistent with a fully discounted decision. The Governing Council appears confident in a soft…

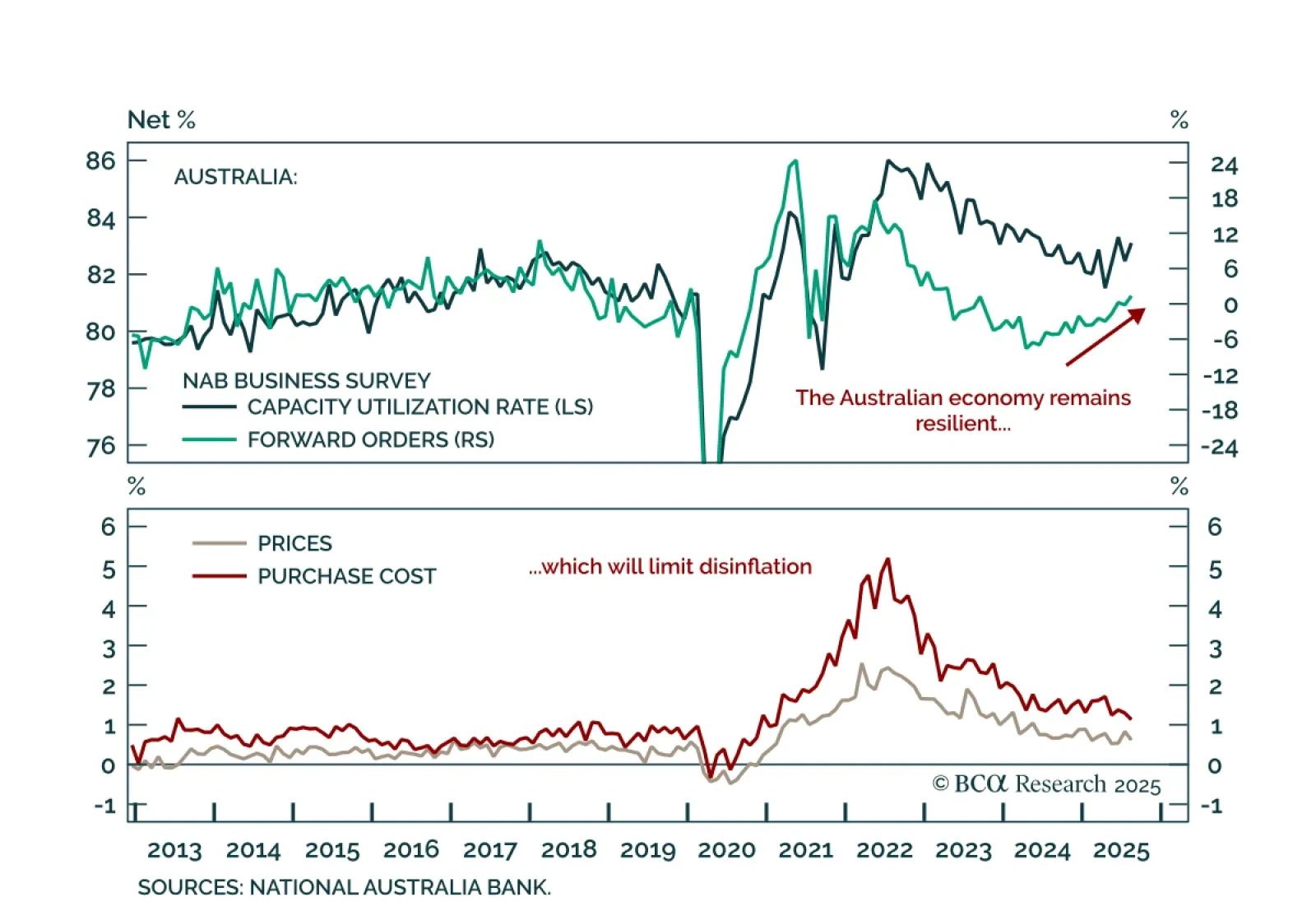

Australia’s NAB survey shows underlying resilience, reinforcing our underweight on ACGBs and the case for AUD flatteners vs. CAD steepeners. The August survey was mixed, with current conditions improving to 7 from 5, while business…

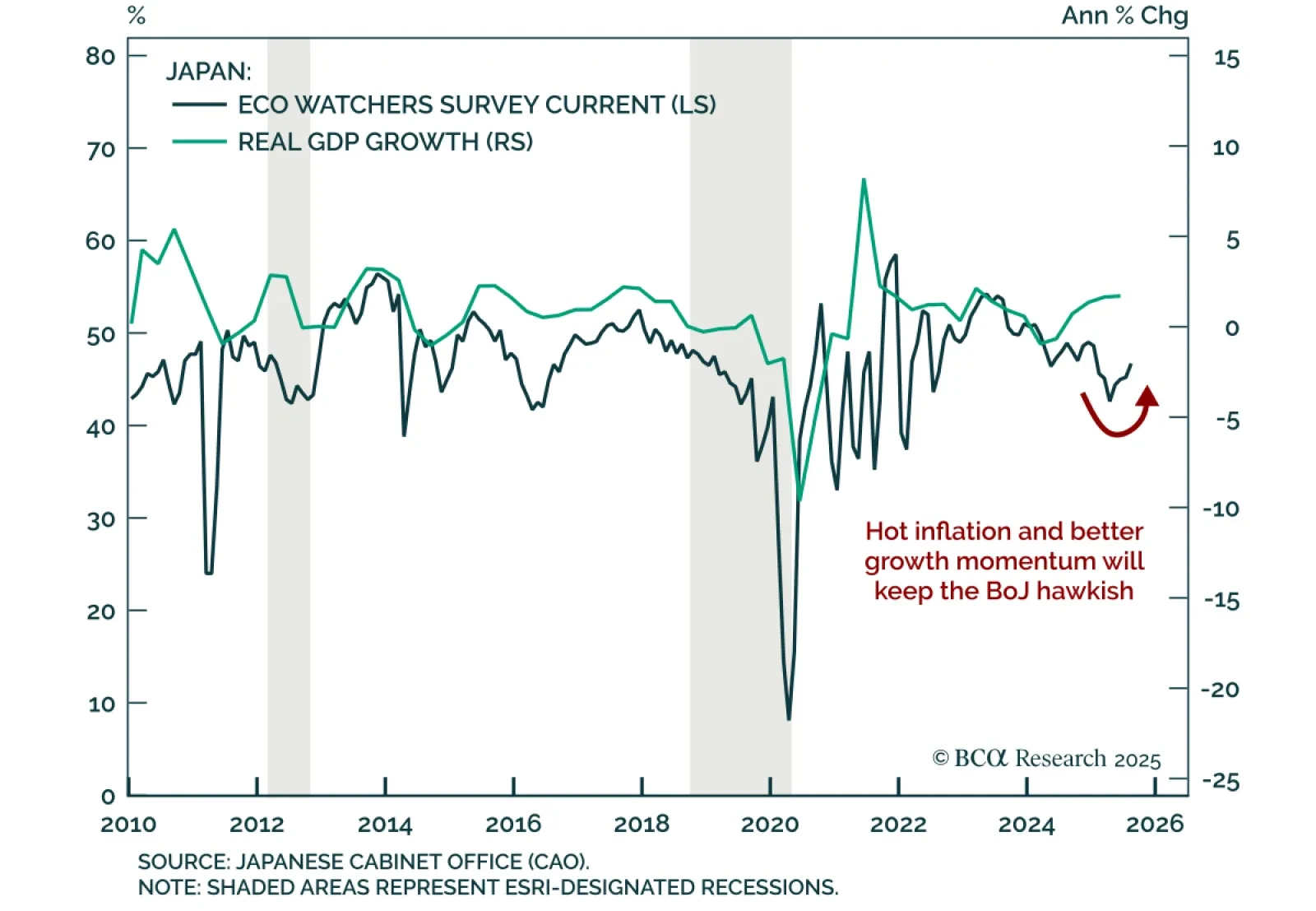

Japan’s Eco Watchers Survey points to stabilization; JGBs remain unattractive and the yen’s near-term setup is less favorable versus USD. The August survey modestly beat expectations, with the current component rising to 46.7…

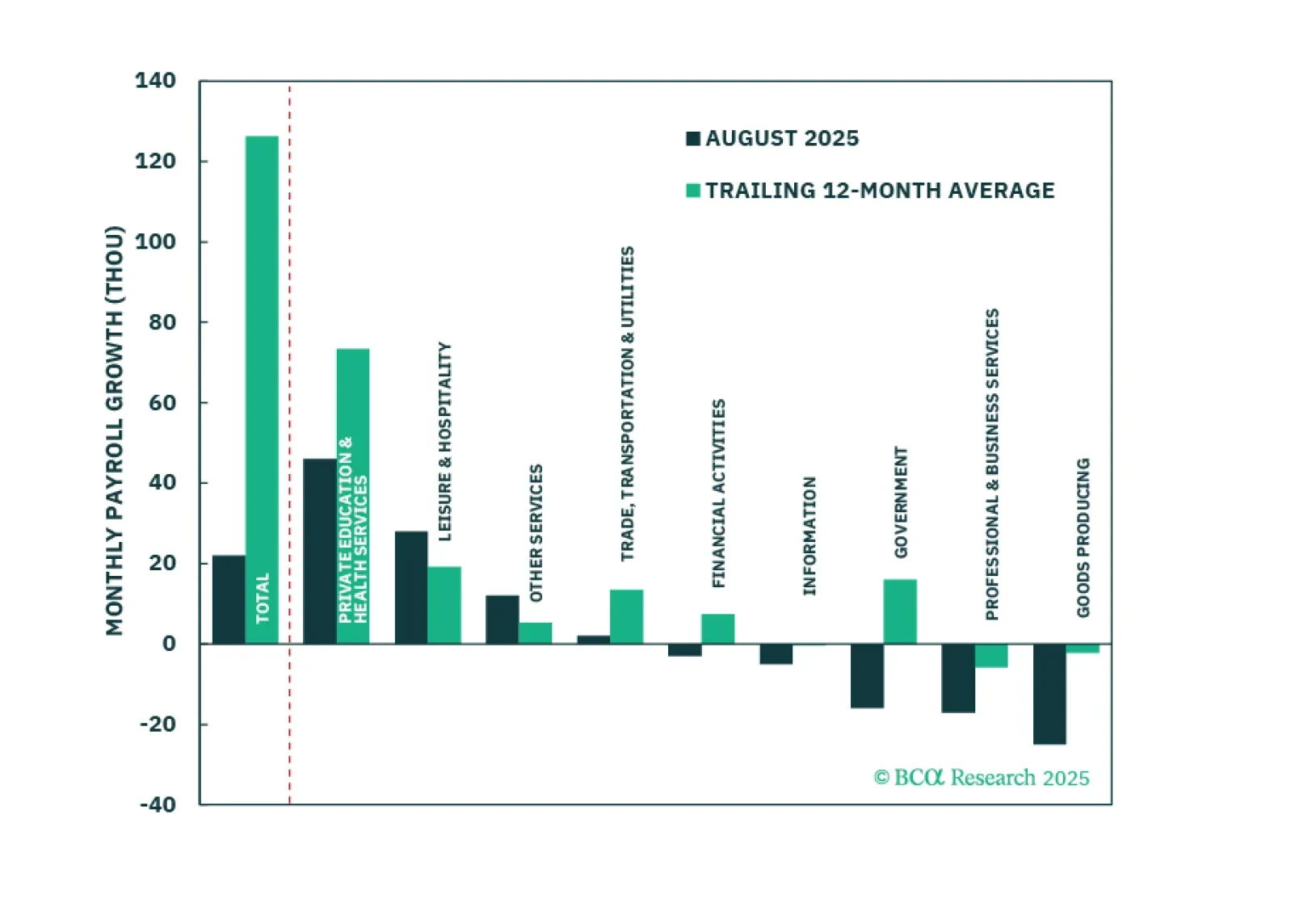

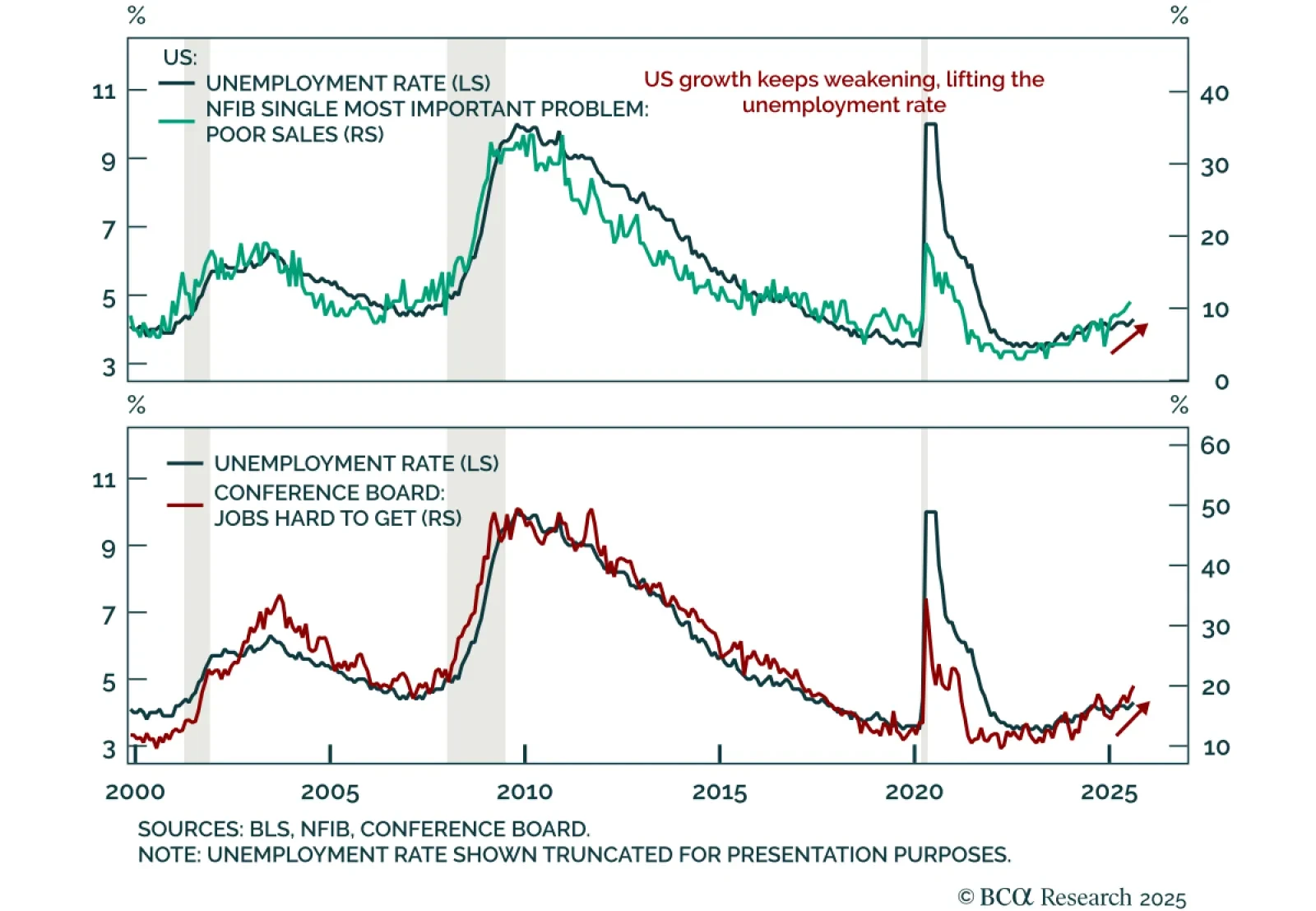

The August US employment report confirmed a significant labor market deceleration, keeping us modestly defensive. Nonfarm payrolls rose just 22k after 79k in July, while net revisions subtracted 21k from prior months. The 3-…

The August employment report showed a modest increase in labor market slack, enough to cement a 25-basis-point rate cut this month.

Euro area August flash HICP was slightly hotter than expected, reinforcing the case for the ECB to stay put in September. Headline inflation rose to 2.1% y/y from 2.0%, with the monthly print surprising at 0.2% m/m. Core inflation…

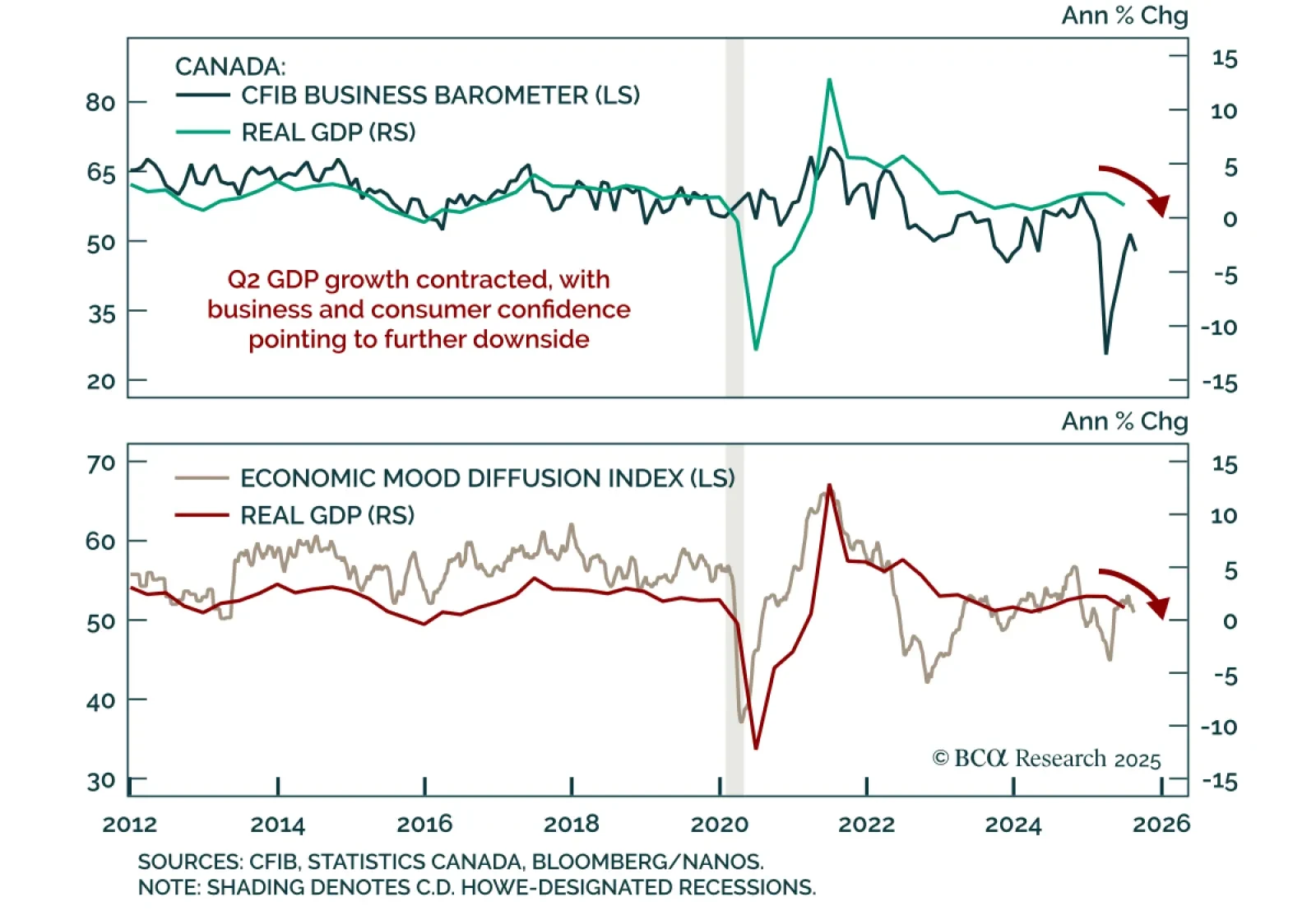

Canada’s Q2 GDP contraction underscores a fragile backdrop where growth risks will outweigh inflation, supporting further BoC easing. Real GDP contracted at an annualized 1.6% after expanding 2.2% in Q1, consistent with survey data…

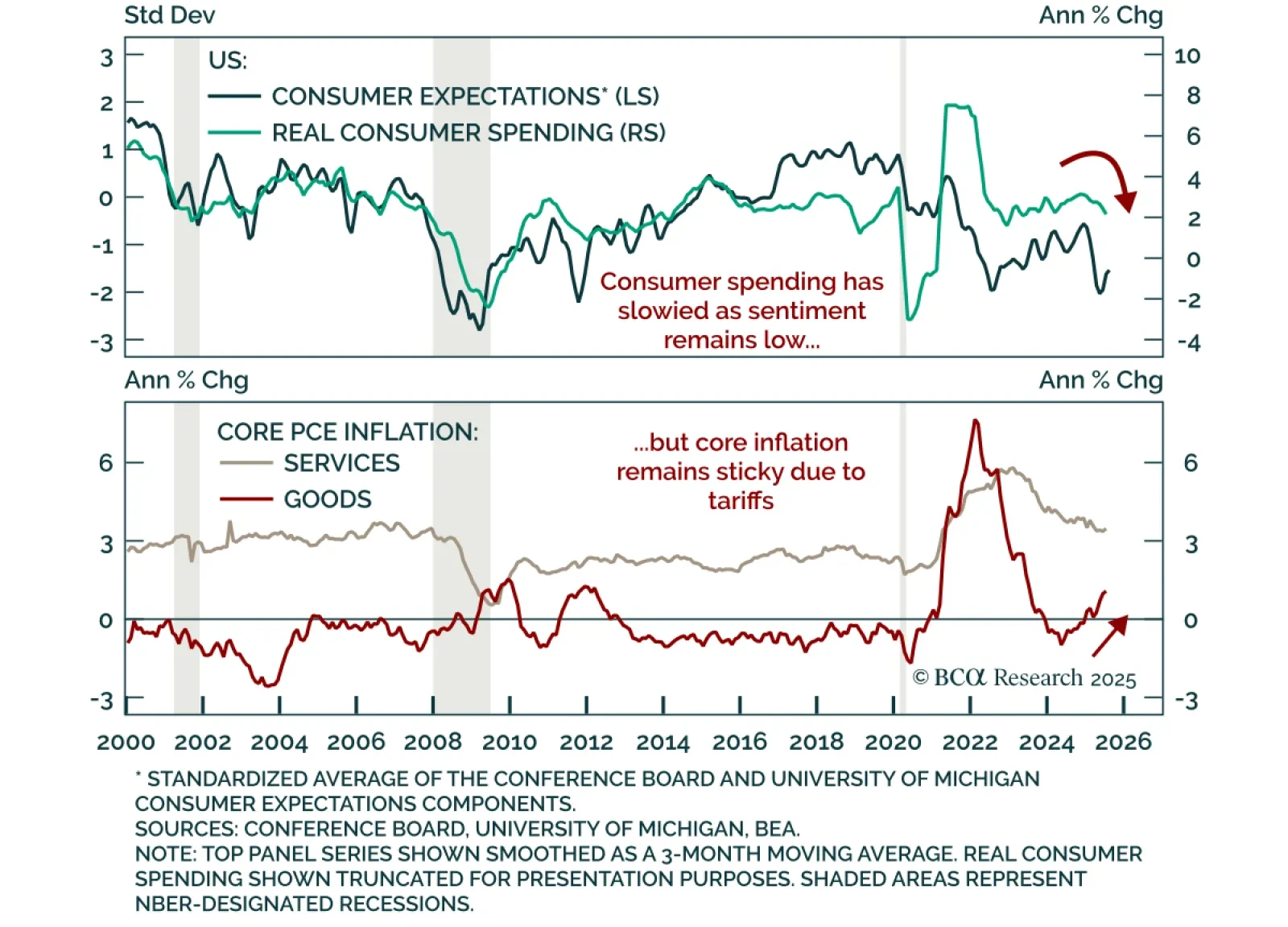

July income and spending data confirmed resilient consumption and sticky inflation, however, slowing labor momentum keeps us defensive. Real personal spending increased 0.3% m/m. Personal income rose 0.4% m/m, with real income…

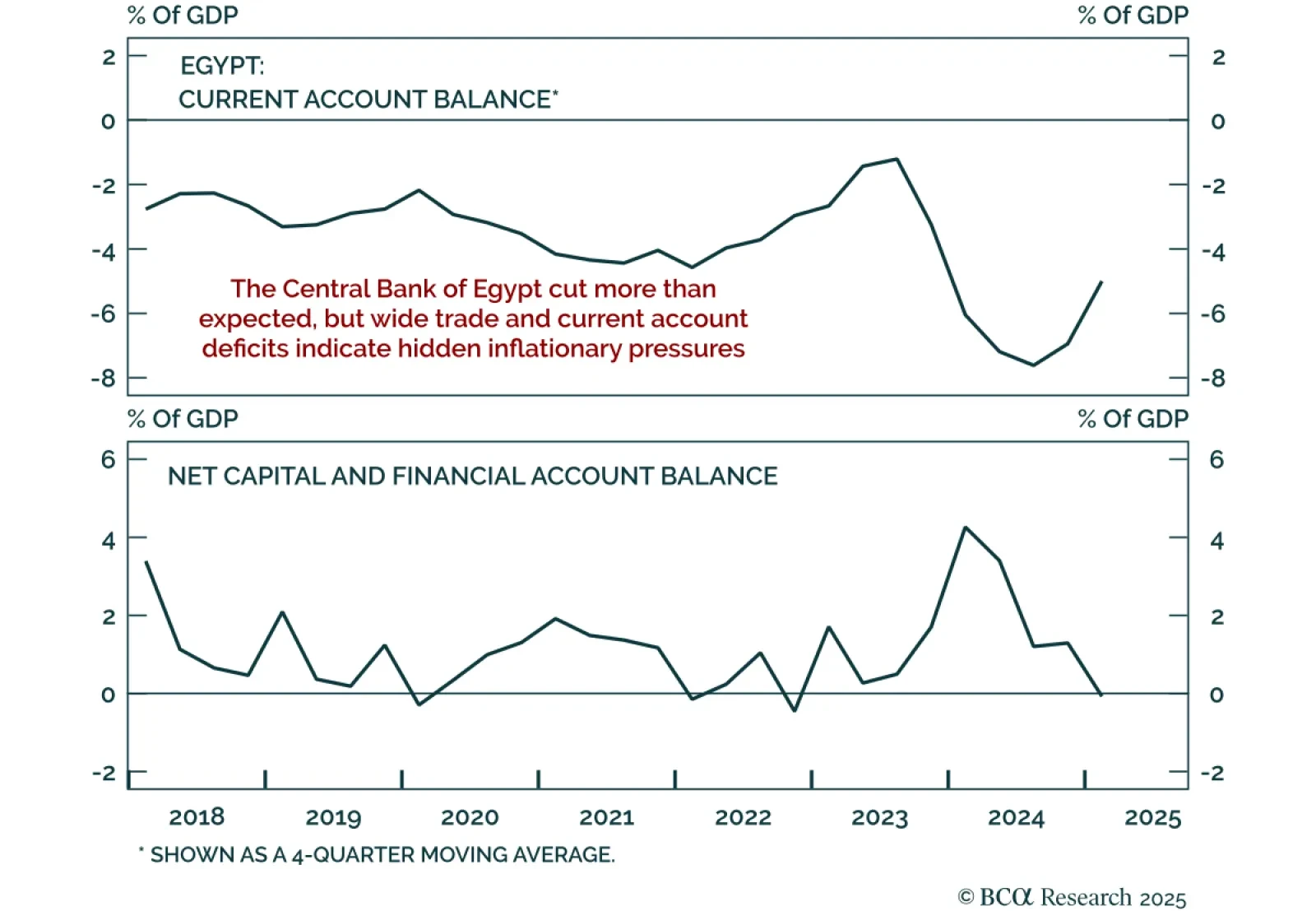

Egypt’s surprise 200 bps rate cut raises risks of re-accelerating inflation and currency pressure. The Central Bank of Egypt lowered the overnight lending rate to 23%, a larger-than-expected move. Our Emerging Markets strategists…