Trade tensions muddy the outlook for global central banks. The 2010s were an era of low growth and low inflation that called for easy monetary policy. The post-COVID era has been marked by overheating and high inflation calling for…

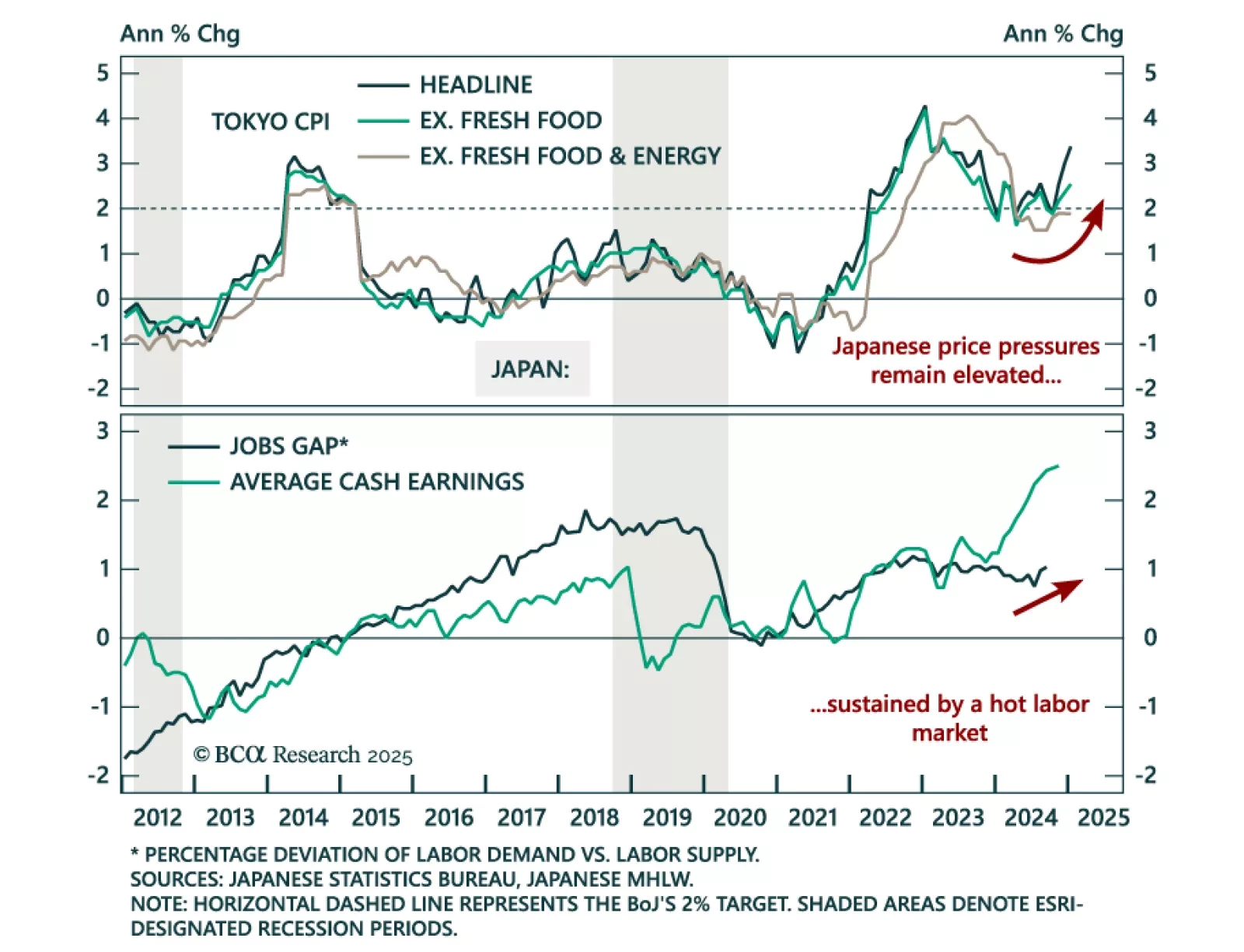

The January Tokyo CPI came in stronger than expected, with headline inflation accelerating to 3.4% y/y from 3.0%, and “core core” (ex. fresh food and energy) accelerating to 1.9% from 1.8%. The jobless rate also decreased 0.1% to 2.4…

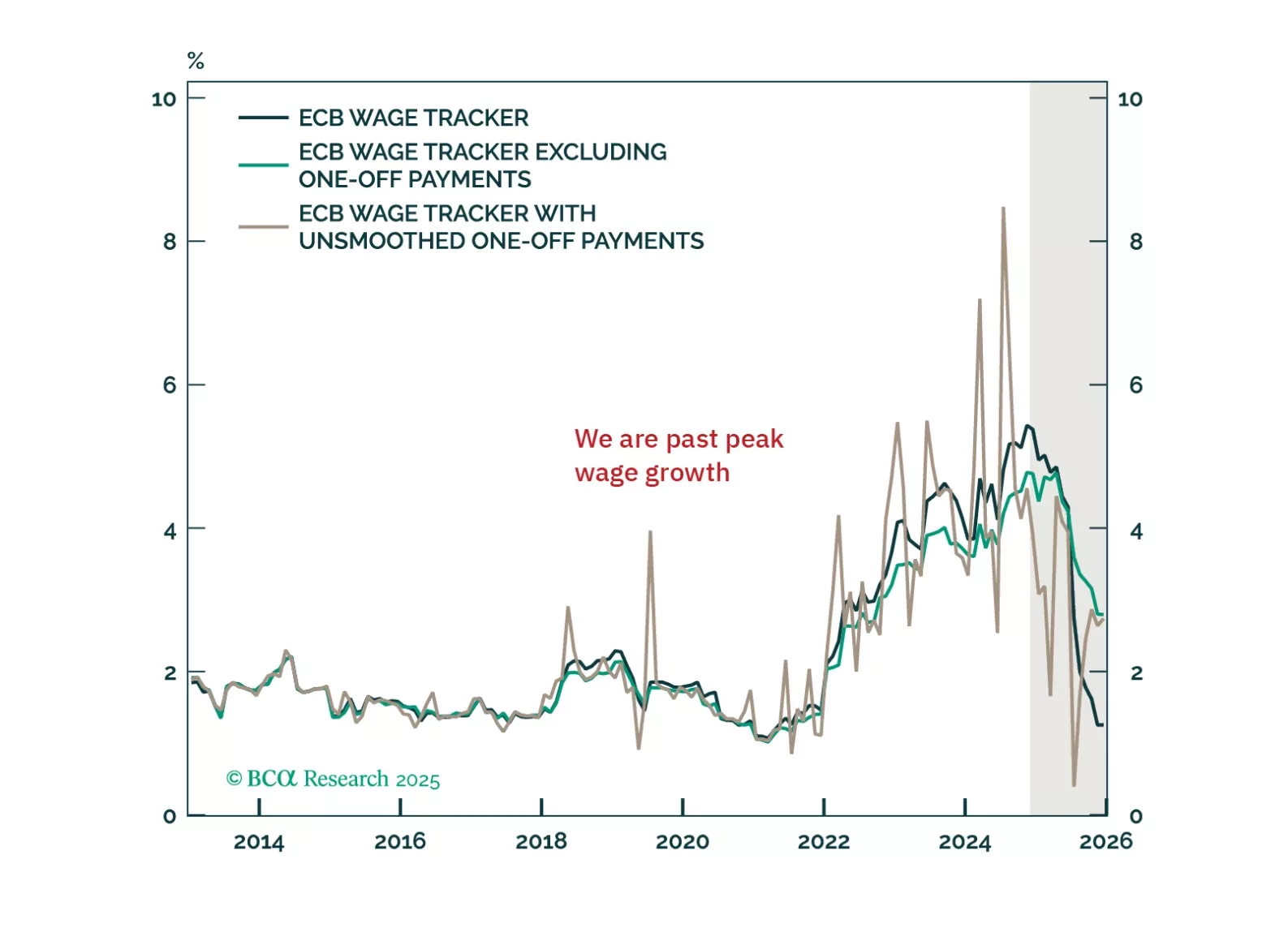

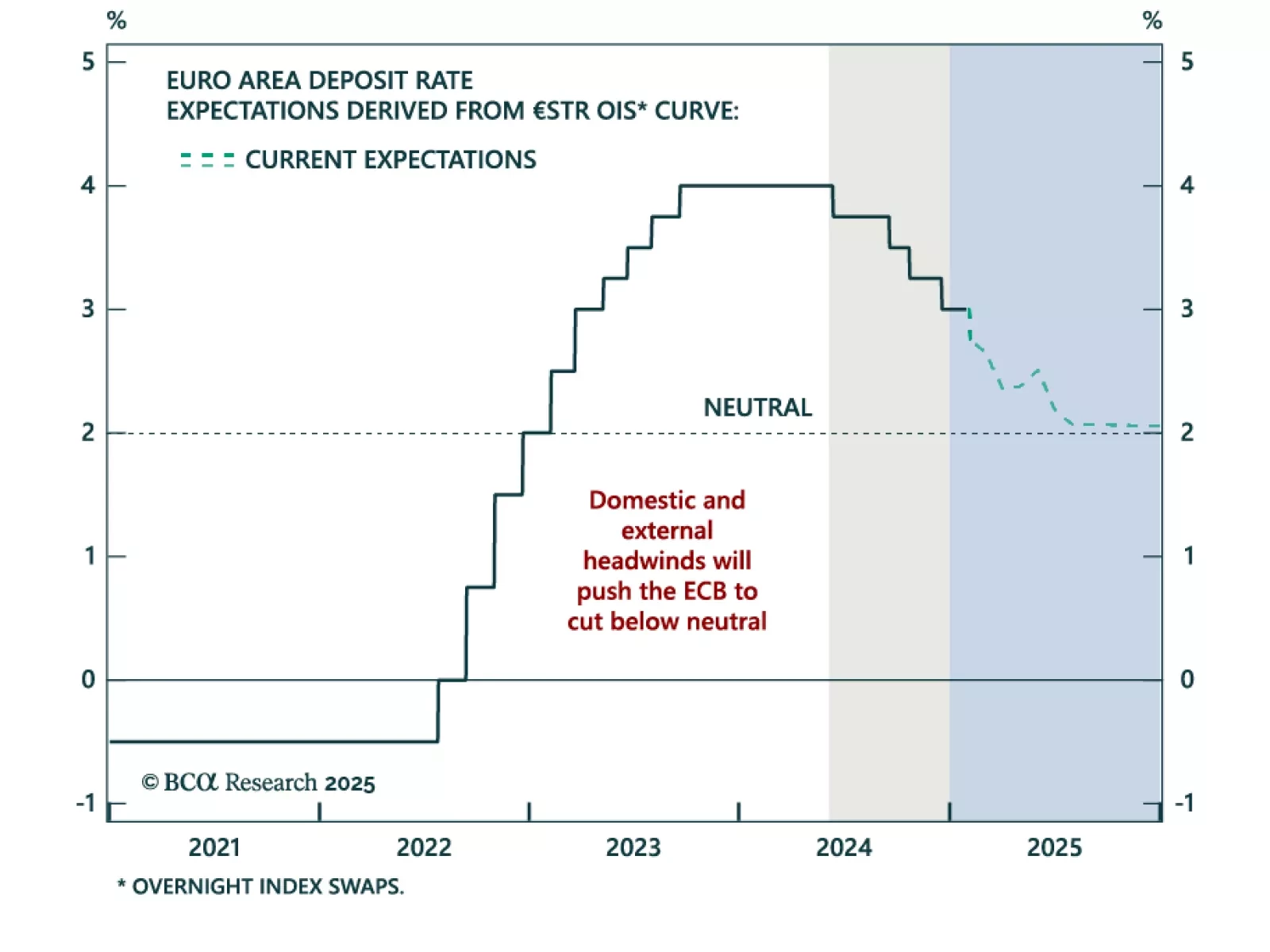

The ECB cut its deposit rate to 2.75%, as was widely anticipated. President Christine Lagarde did not provide any fireworks, but the Governing Council’s message was clear: Policy is restrictive, and inflation will fall further. As a…

The ECB cut by 25 bps as expected, bringing the deposit facility rate to 2.75%. Despite avoiding committing to a path for policy, President Lagarde reiterated the disinflationary process is “well on track”, and did not push against…

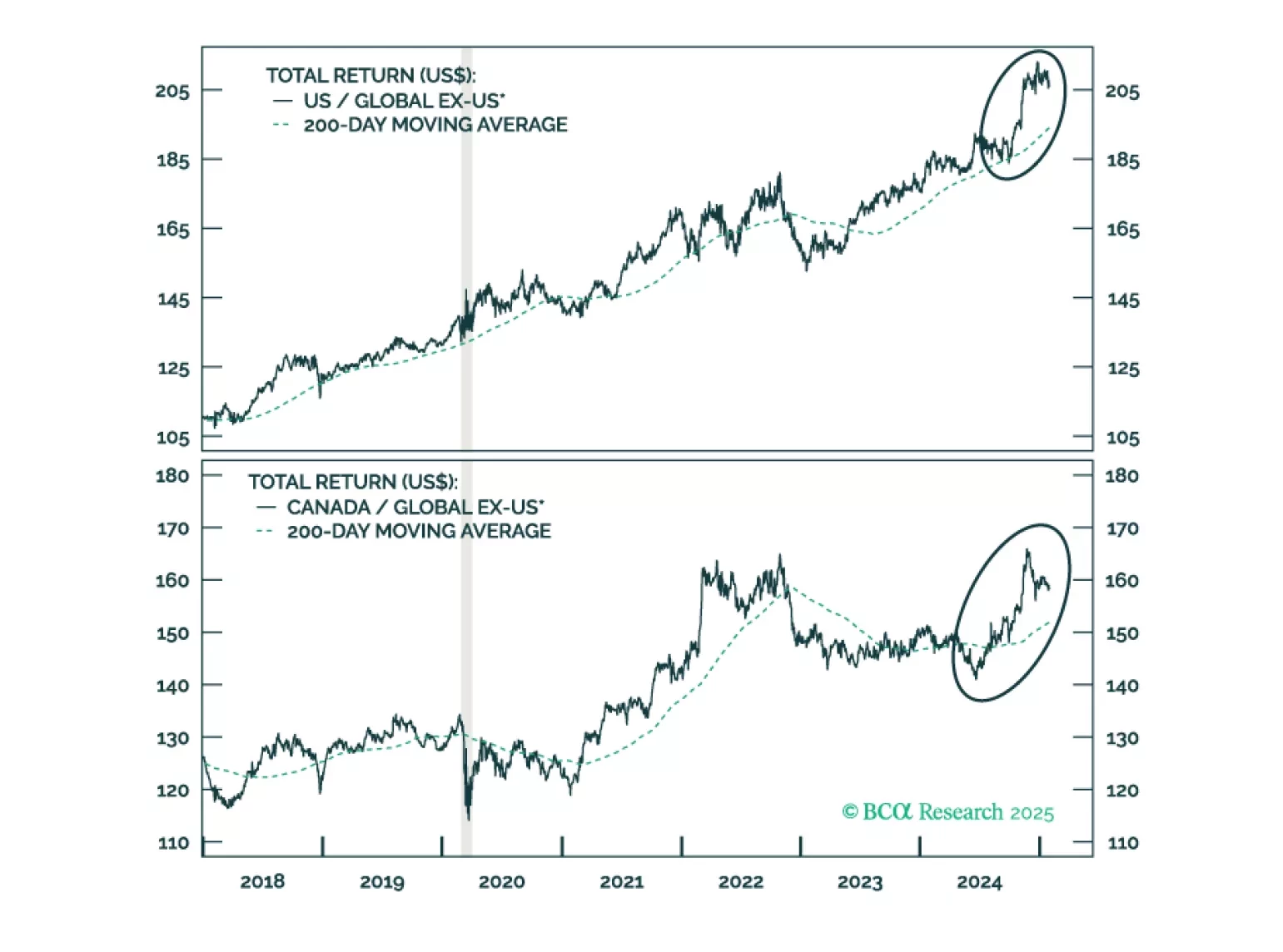

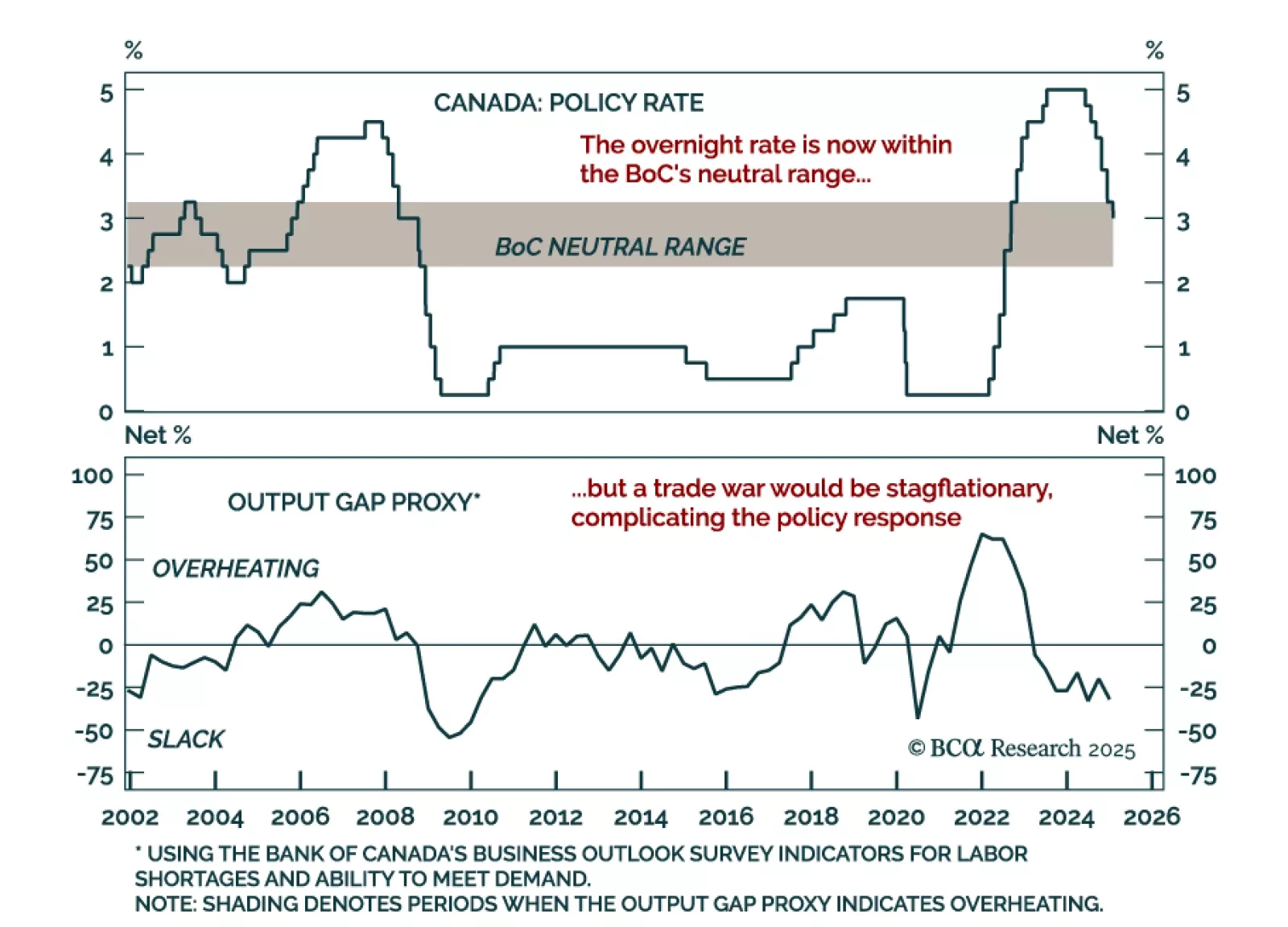

The Bank of Canada cut by 25 bps to 3% as expected, and announced the end of quantitative tightening. This sixth consecutive cut brings the policy rate further into neutral territory, estimated to be in the 2.25%-to-3.25% range.…

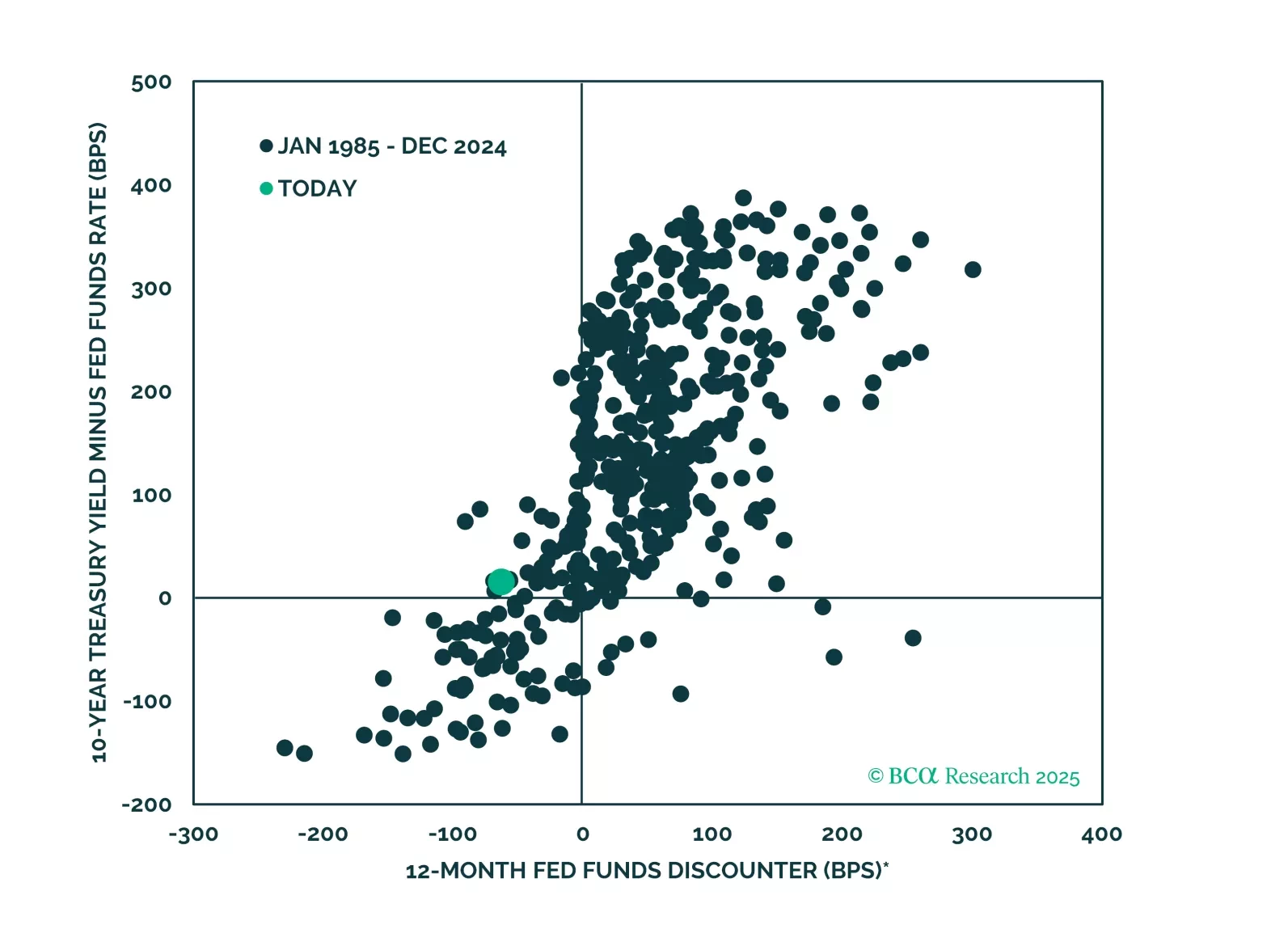

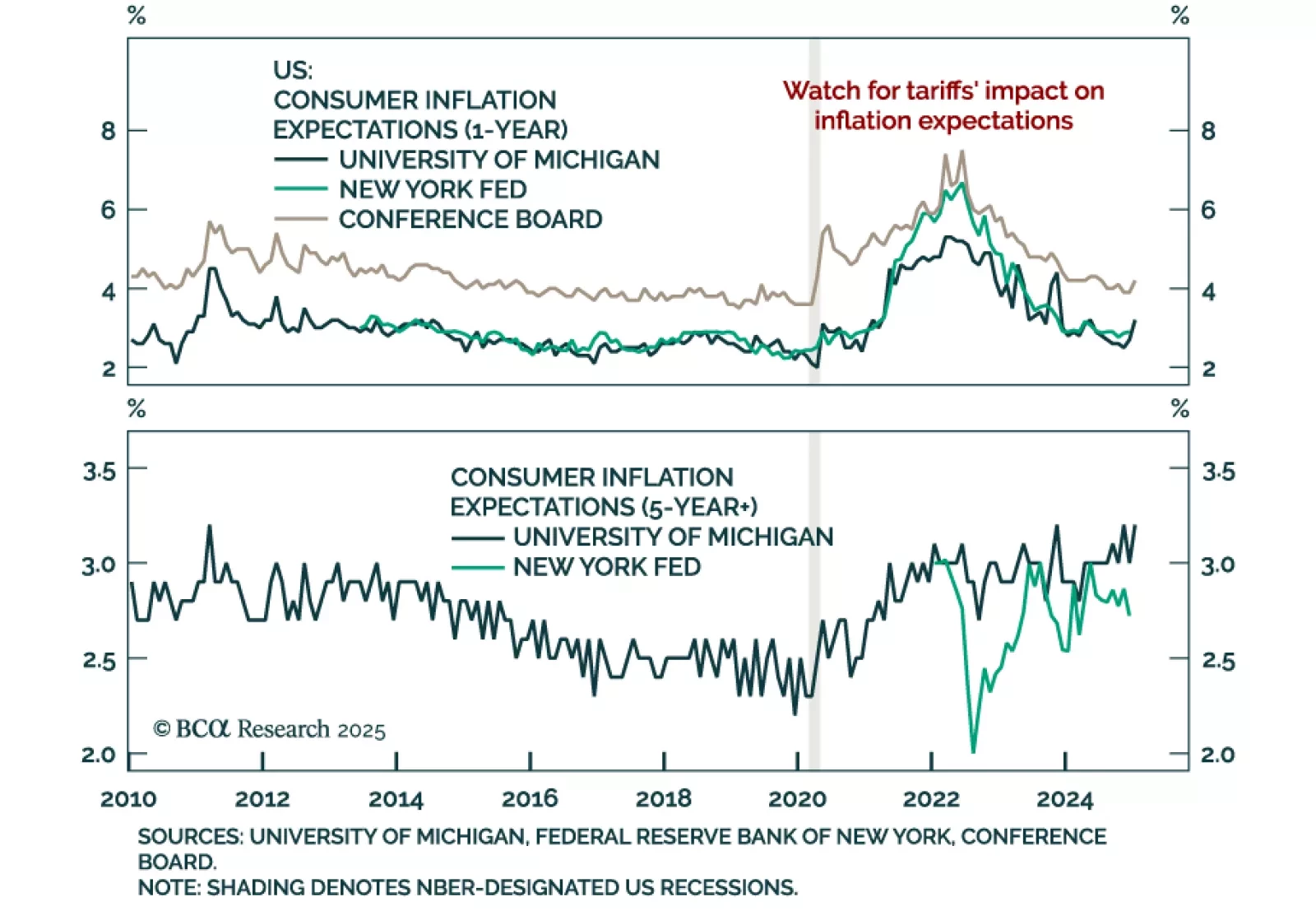

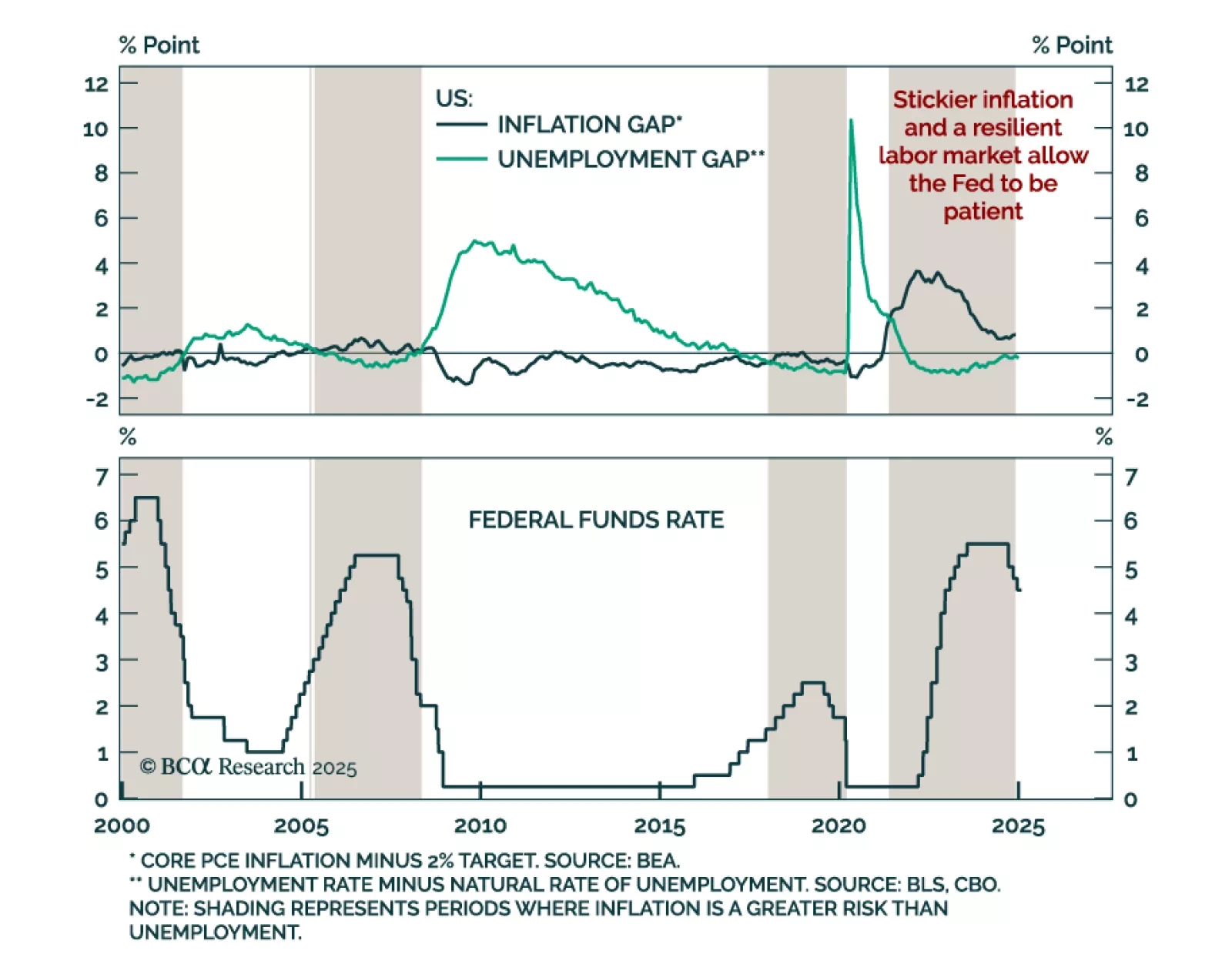

The Federal Reserve kept rates on hold in its 4.25%-to-4.5% range, as expected. The main change in the statement was the removal of the reference to progress towards the Fed’s 2% target, leaving instead a simple mention that…

Jay Powell didn’t say much at this afternoon’s FOMC press conference, and monetary policy will continue to take a back seat to fiscal for the next few months.

The January Ifo Business Climate index for Germany beat estimates, increasing to 85.1 vs. 84.7 in December. The increase came from the survey’s current assessment component, which increased a full point, as the expectations component…