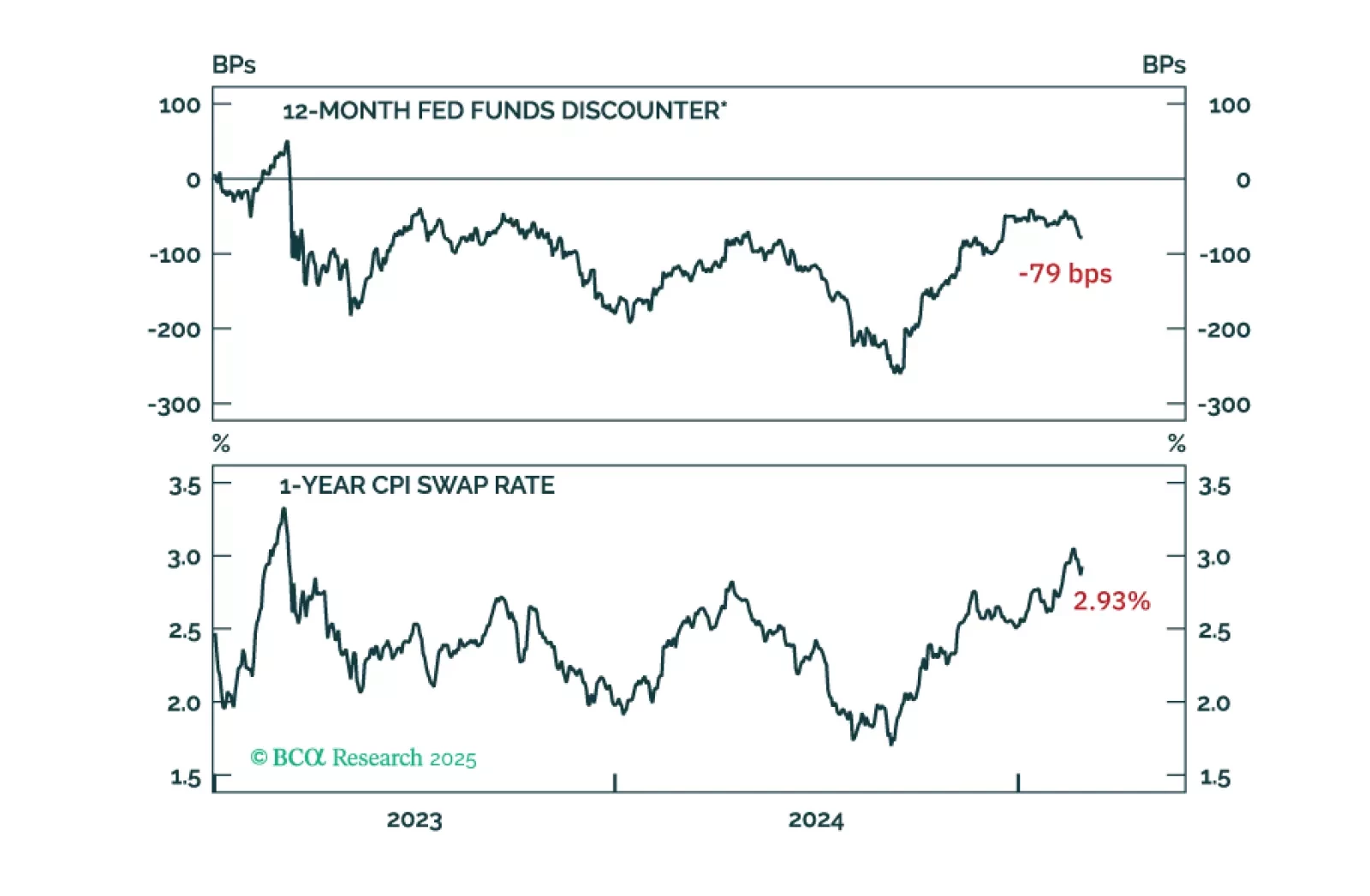

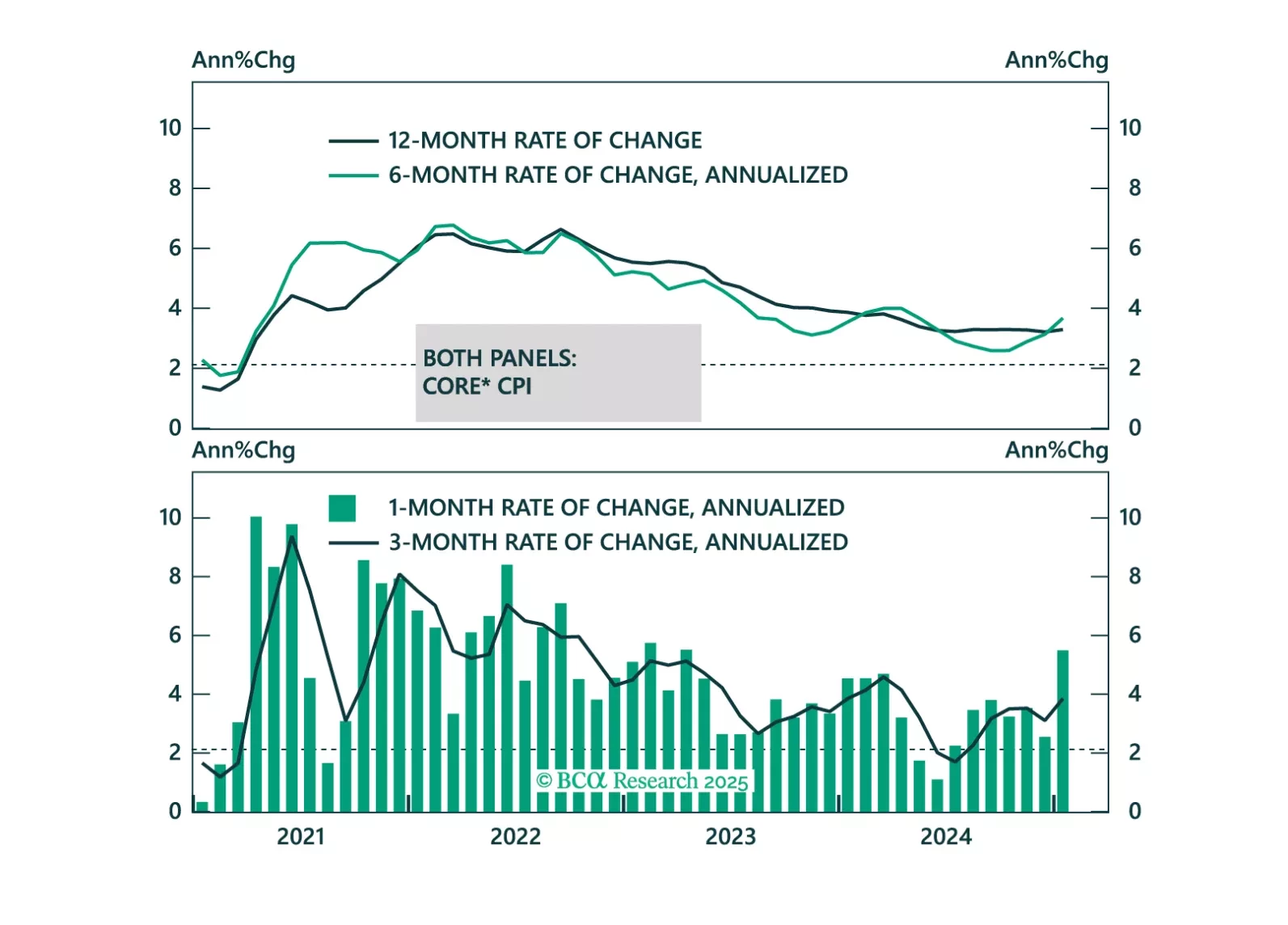

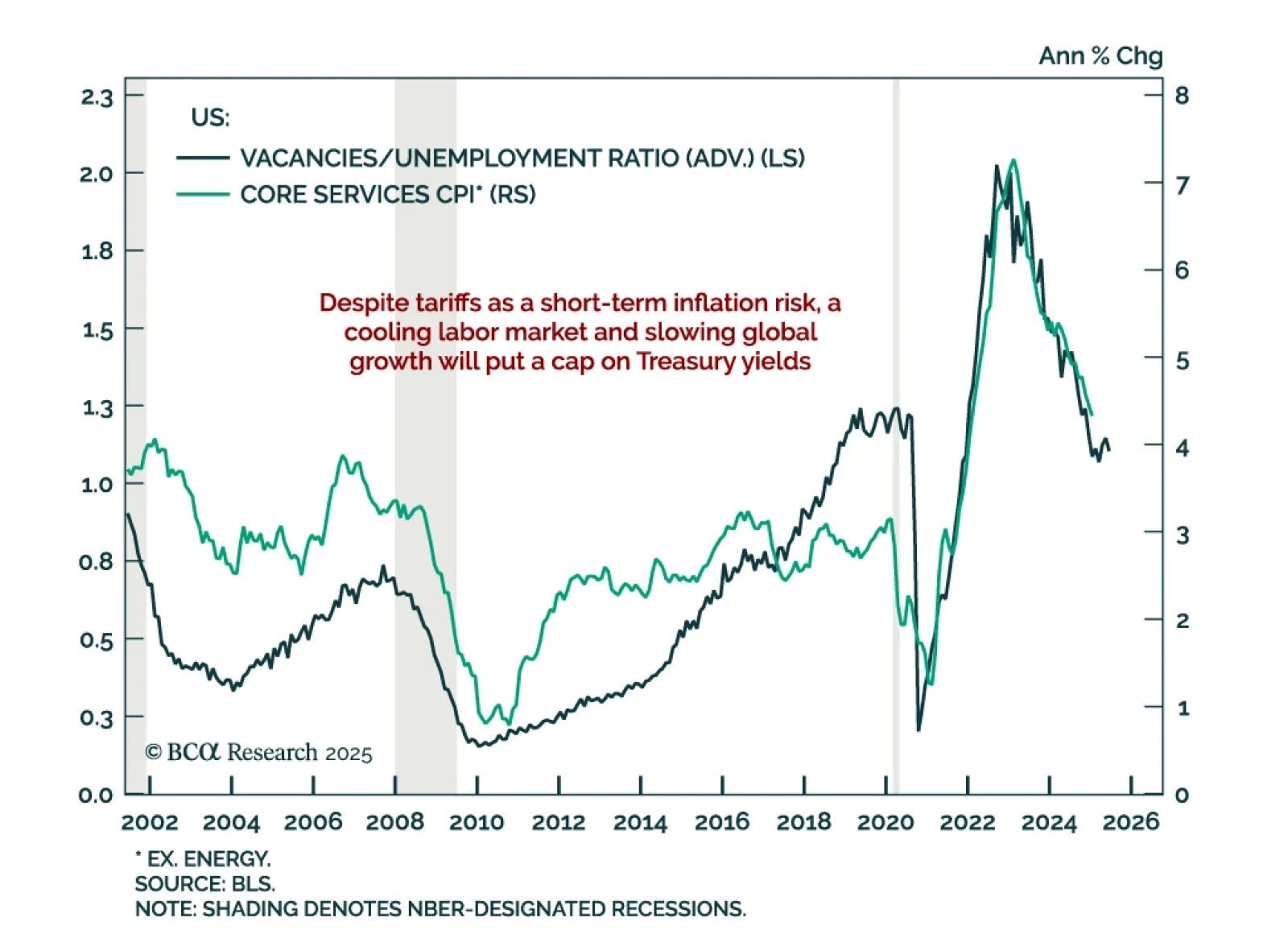

Core PCE inflation was tame this morning, but with large tariffs looming we anticipate loftier inflation readings in the months ahead.

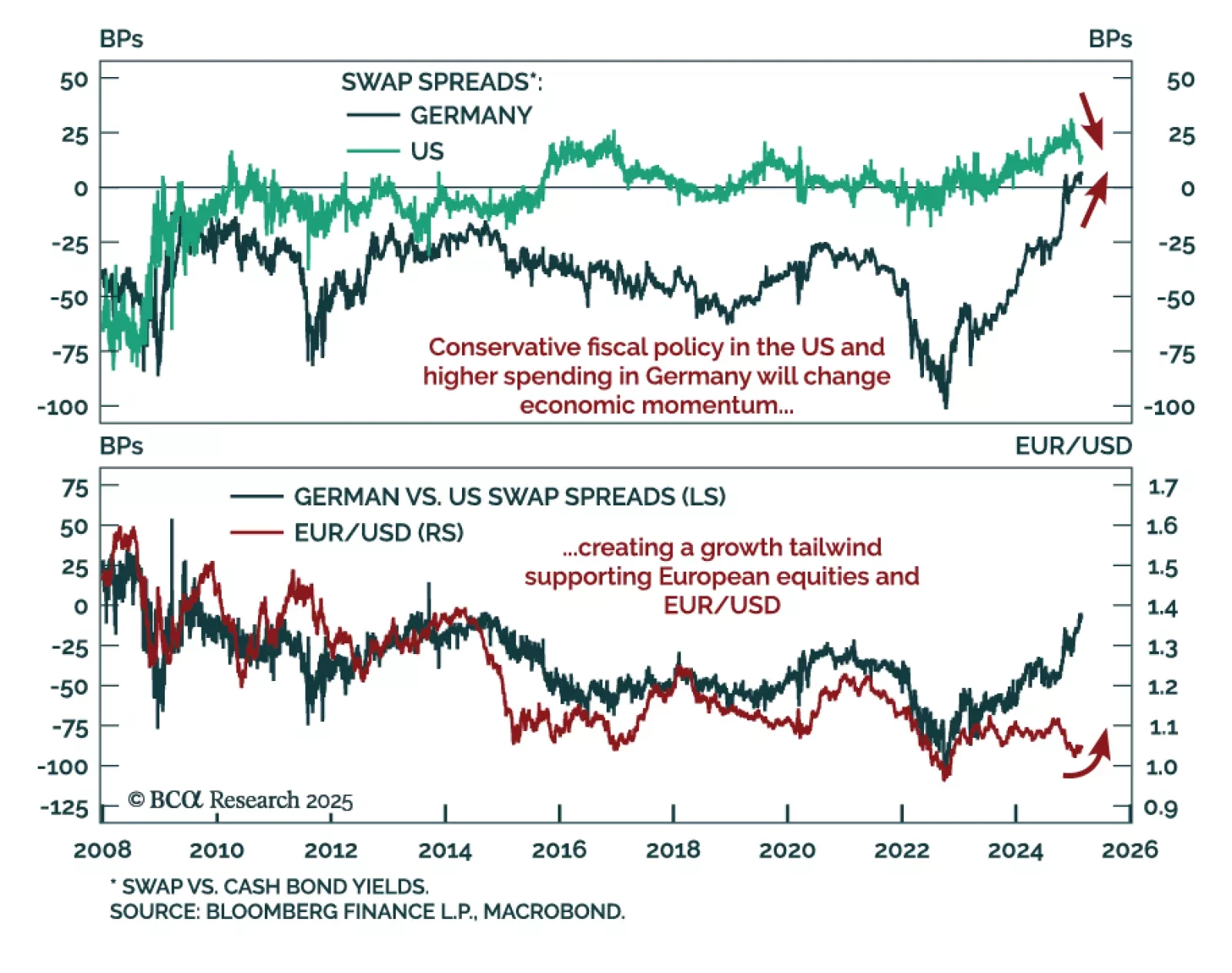

German election results were roughly as expected, but Europe’s biggest economy suddenly just got more interesting. While the details of the governing coalition have yet to be finalized, Chancellor Merz has floated options to ease the…

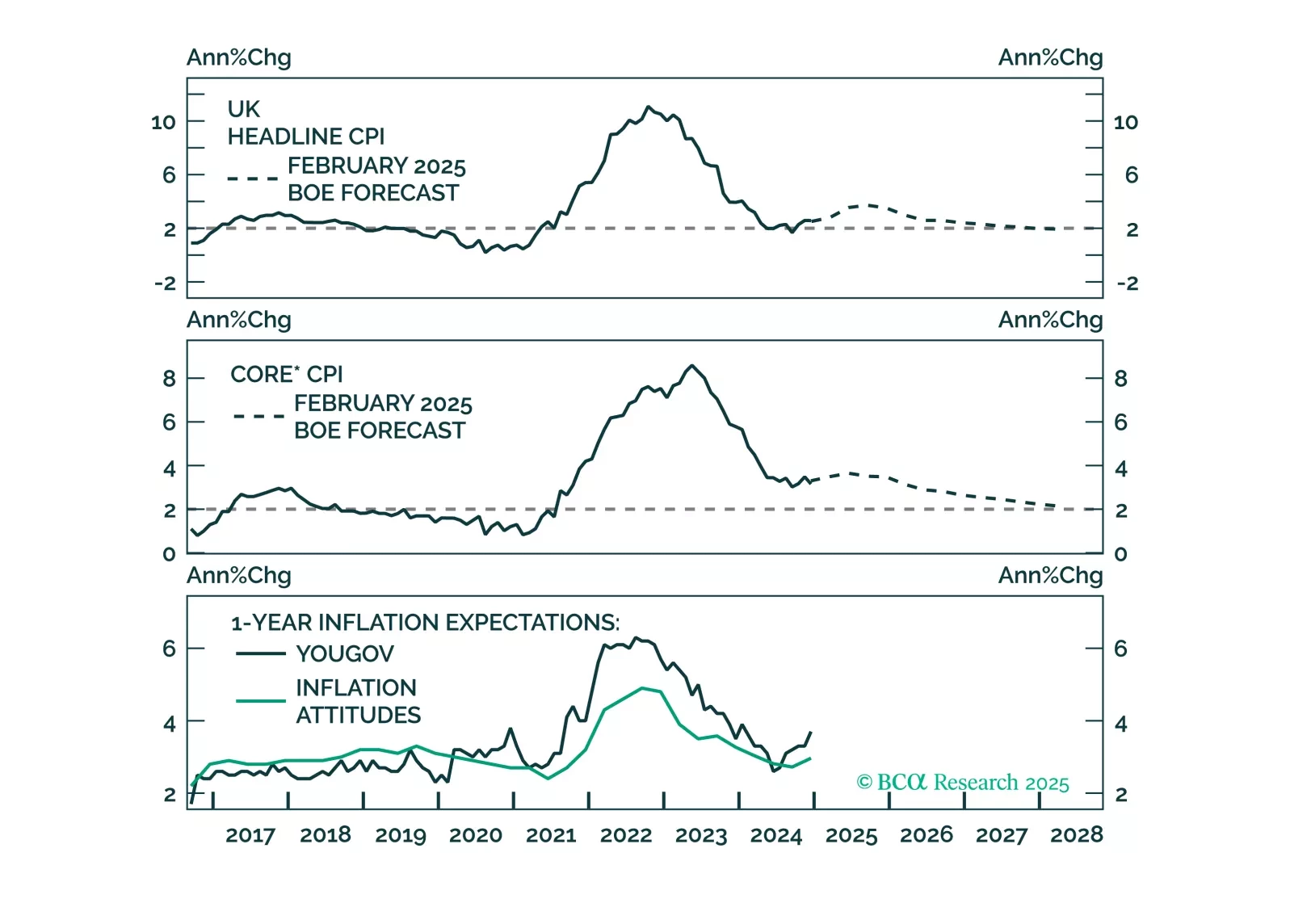

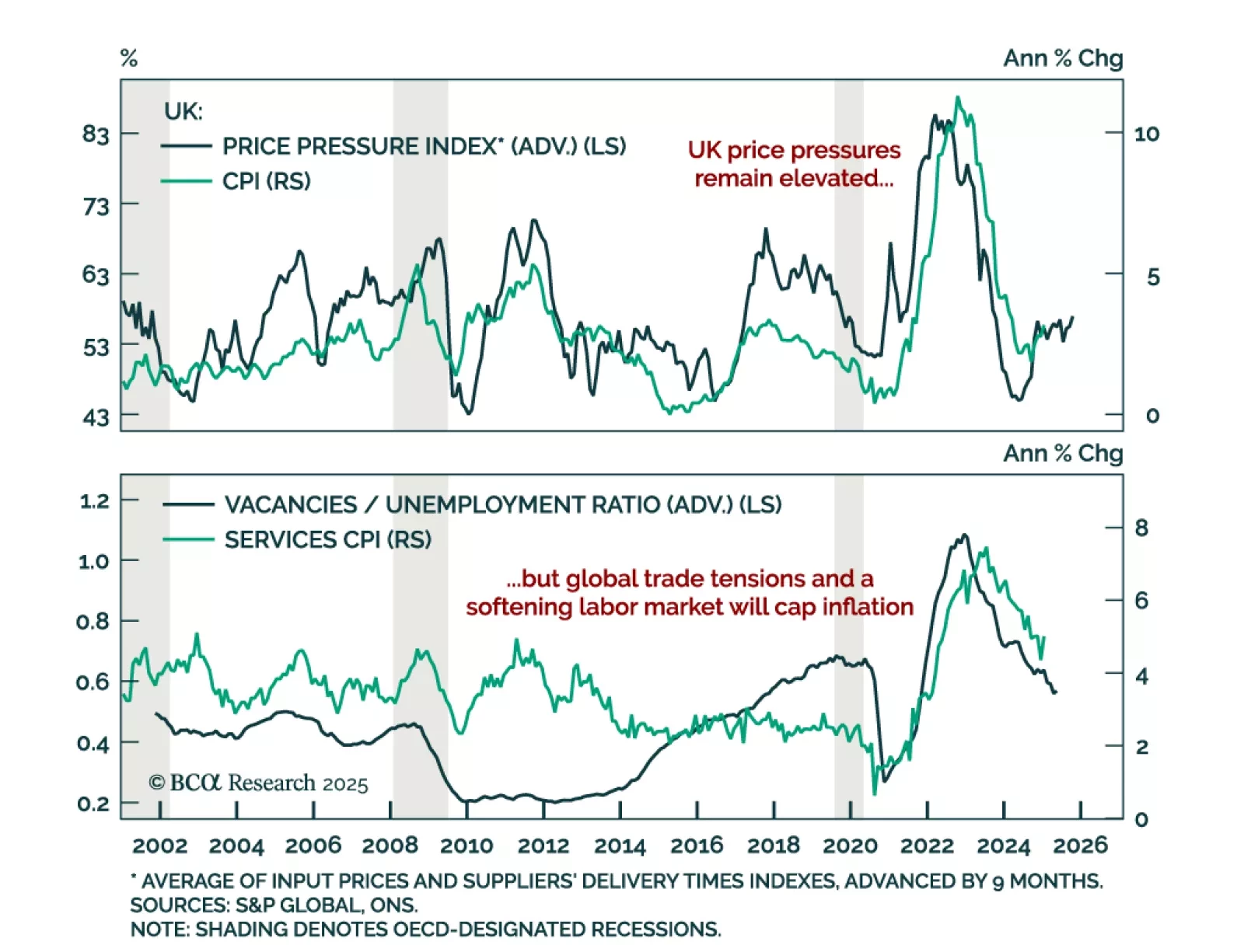

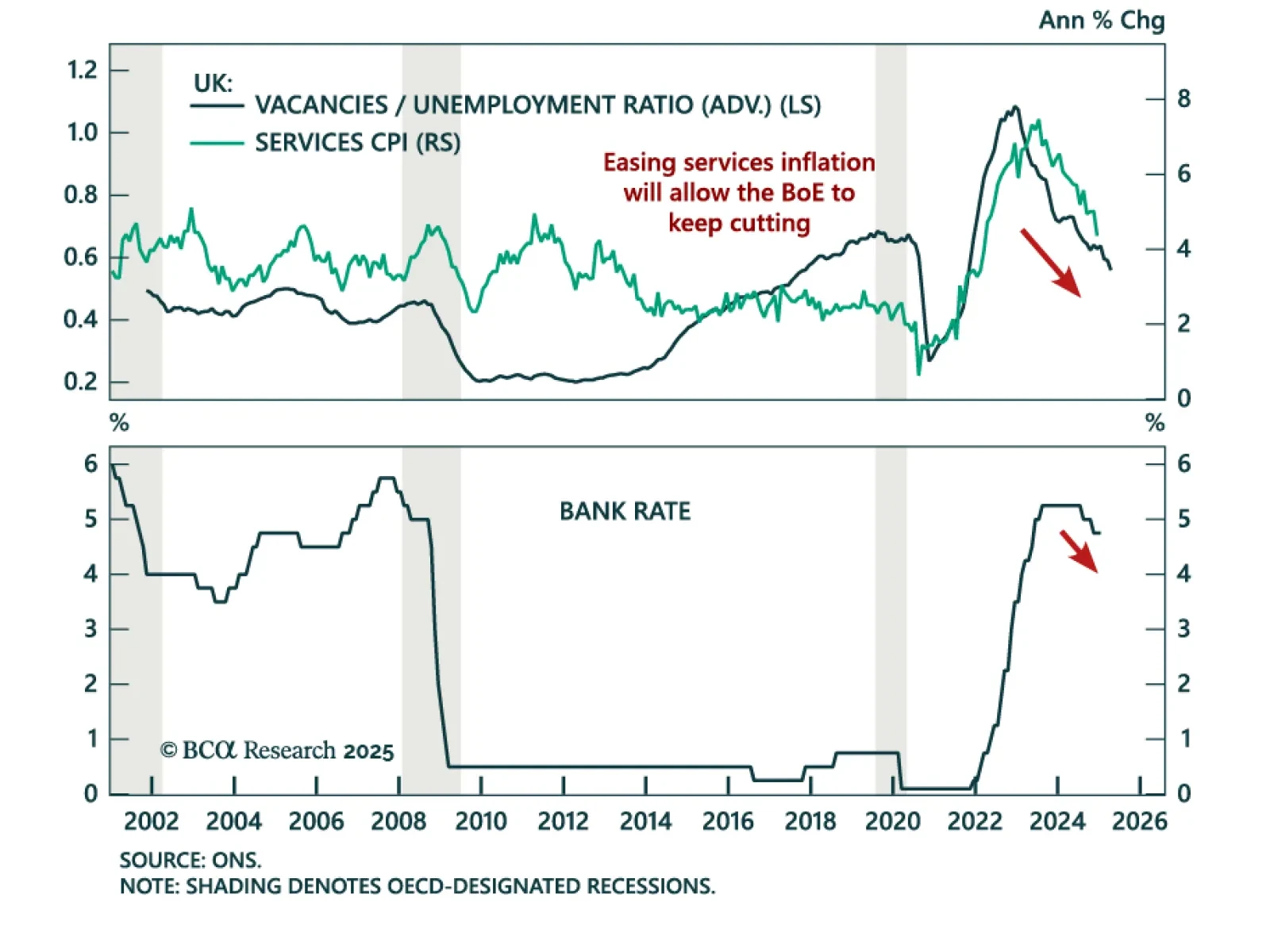

The January UK CPI was slightly hotter than expected. Headline inflation beat estimates, rising to 3.0% y/y from 2.5% in December. Core inflation also jumped but was in line with expectations at 3.7%. Services were strong, albeit…

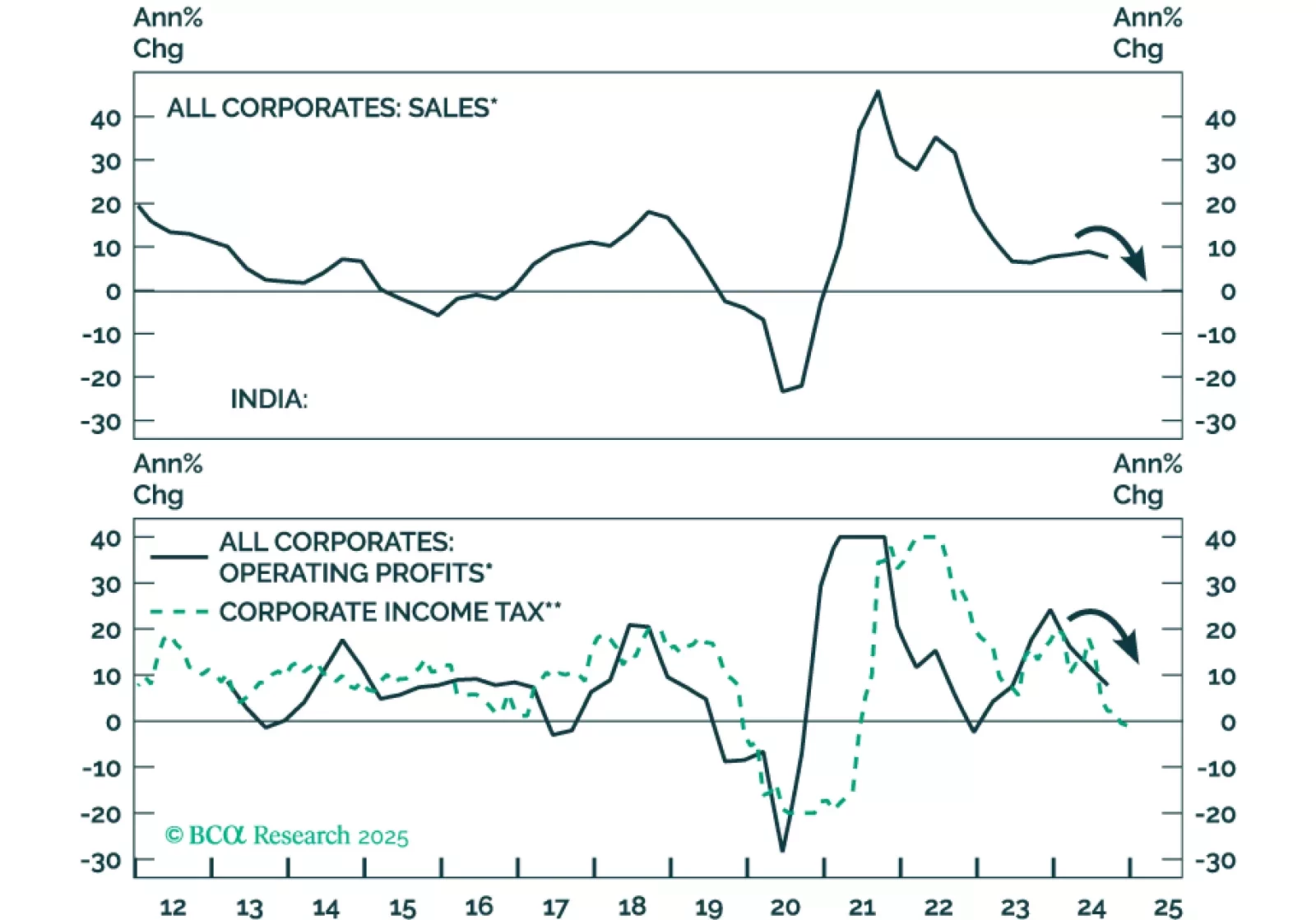

In its budget plans last week, the Indian fiscal authorities announced major tax cuts for households – the equivalent of about US$12 billion, 0.3% of GDP – to boost consumer spending. Soon thereafter, the central bank cut its policy rates…

The January US CPI came in hotter than expected. Headline inflation accelerated to 0.5% m/m (3.0% y/y), and core to 0.4% m/m (3.3% y/y). Core goods and services inflation also moved higher, with the latter boosted by a sharp increase…

Some thoughts on this morning’s CPI report and its implications for the Fed and Treasury yields.

Our Emerging Market strategists published a follow-up piece to their Bessenomics note where they assess the new Treasury Secretary plan’s impact on markets. Lower interest rates are central to Bessenomics. The Trump…

The Bank of England cut its policy rate by 25 bps to 4.5%, with two members of the MPC voting to cut 50 bps instead. The BoE acknowledged “substantial progress on disinflation”, driven by a tight policy stance and stabilized…

Following today’s Bank of England’s policy meeting, at which the policy rate was cut by 25 bps, we discuss our outlook for monetary policy in the UK. We expect the gradual easing to continue and discuss the investment implications…