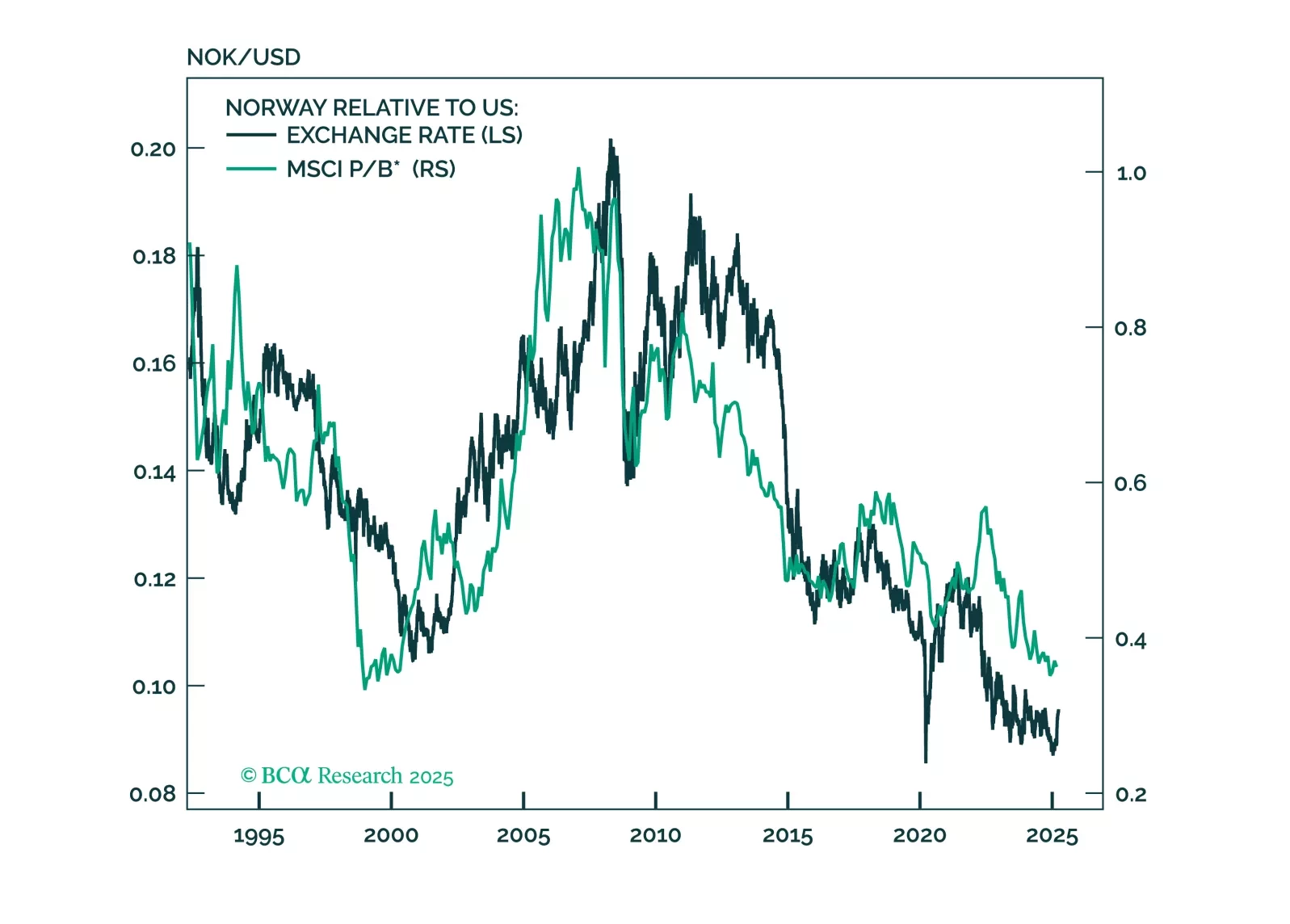

This report looks at investment implications, for Norwegian assets, given the recent meeting, from the Norges Bank.

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

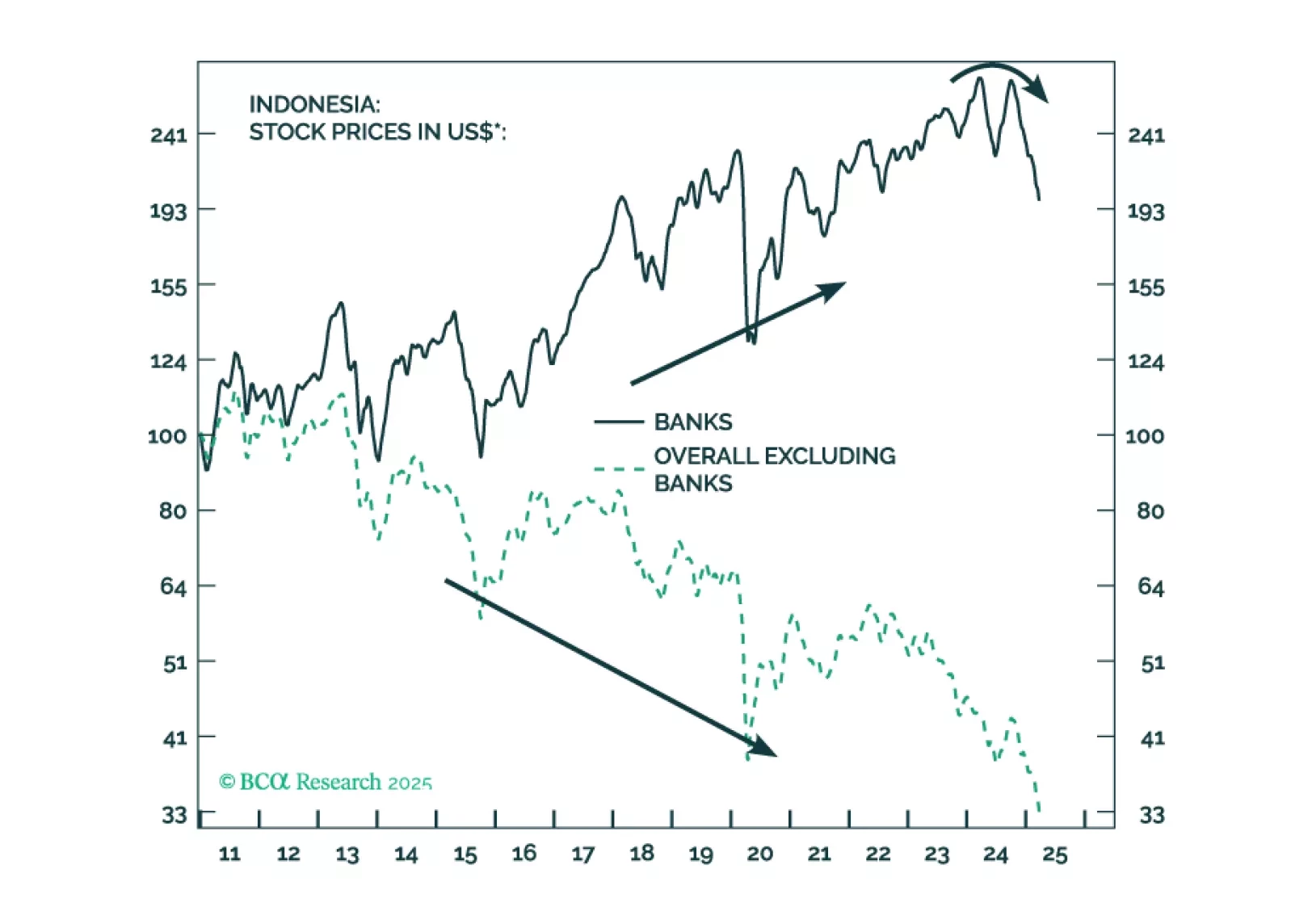

There is an ongoing regime shift in Indonesia: SOEs will be used to drive economic growth. Bank loans will accelerate, but their profit margins will shrink. Despite higher nominal growth, Indonesian equity prices in US dollar terms…

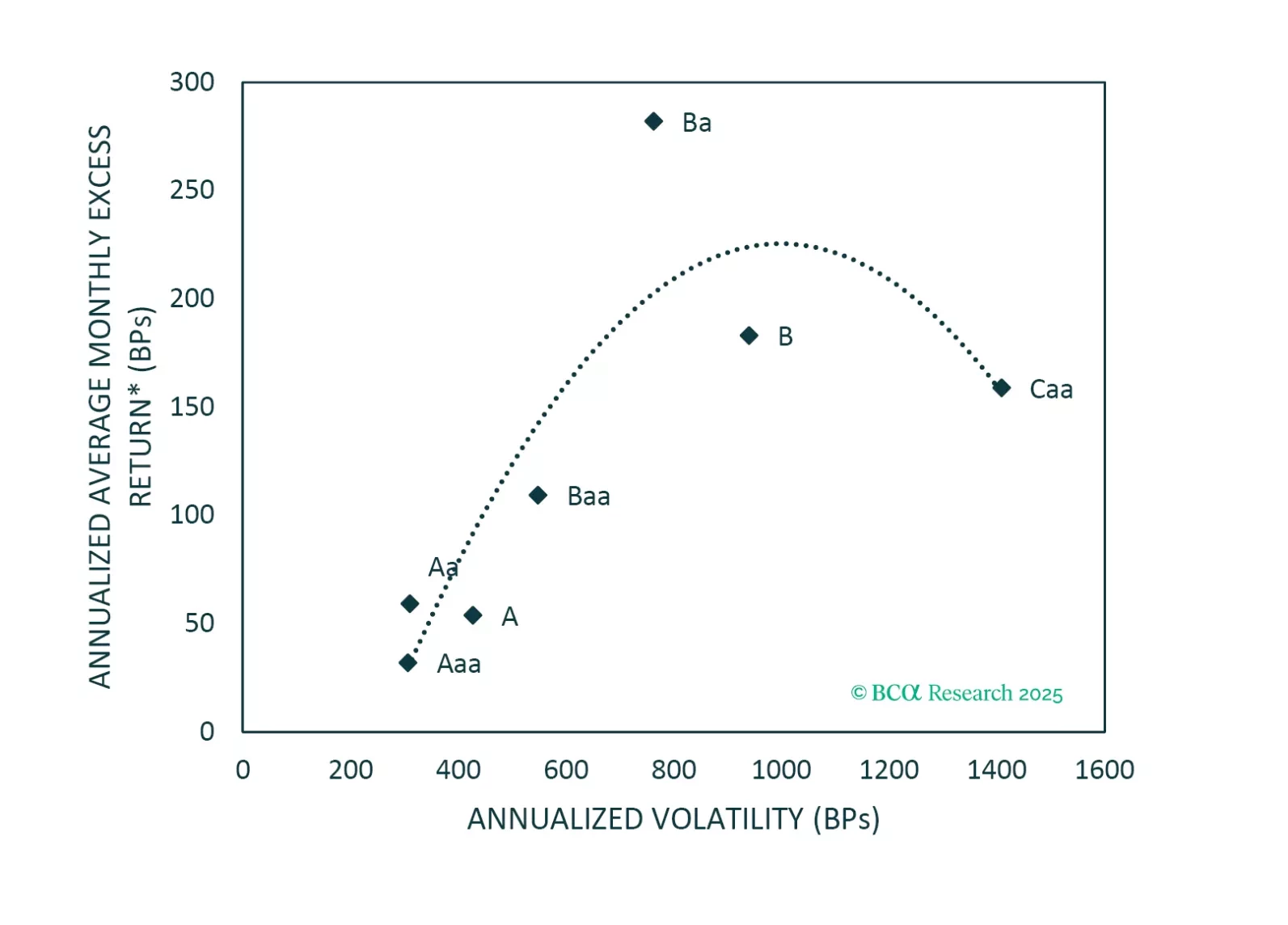

An analysis of historical data shows that Ba-rated bonds outperform other corporate credit tiers in the long-run on a risk-adjusted basis. That said, today’s fragile macro environment warrants a more cautious allocation.

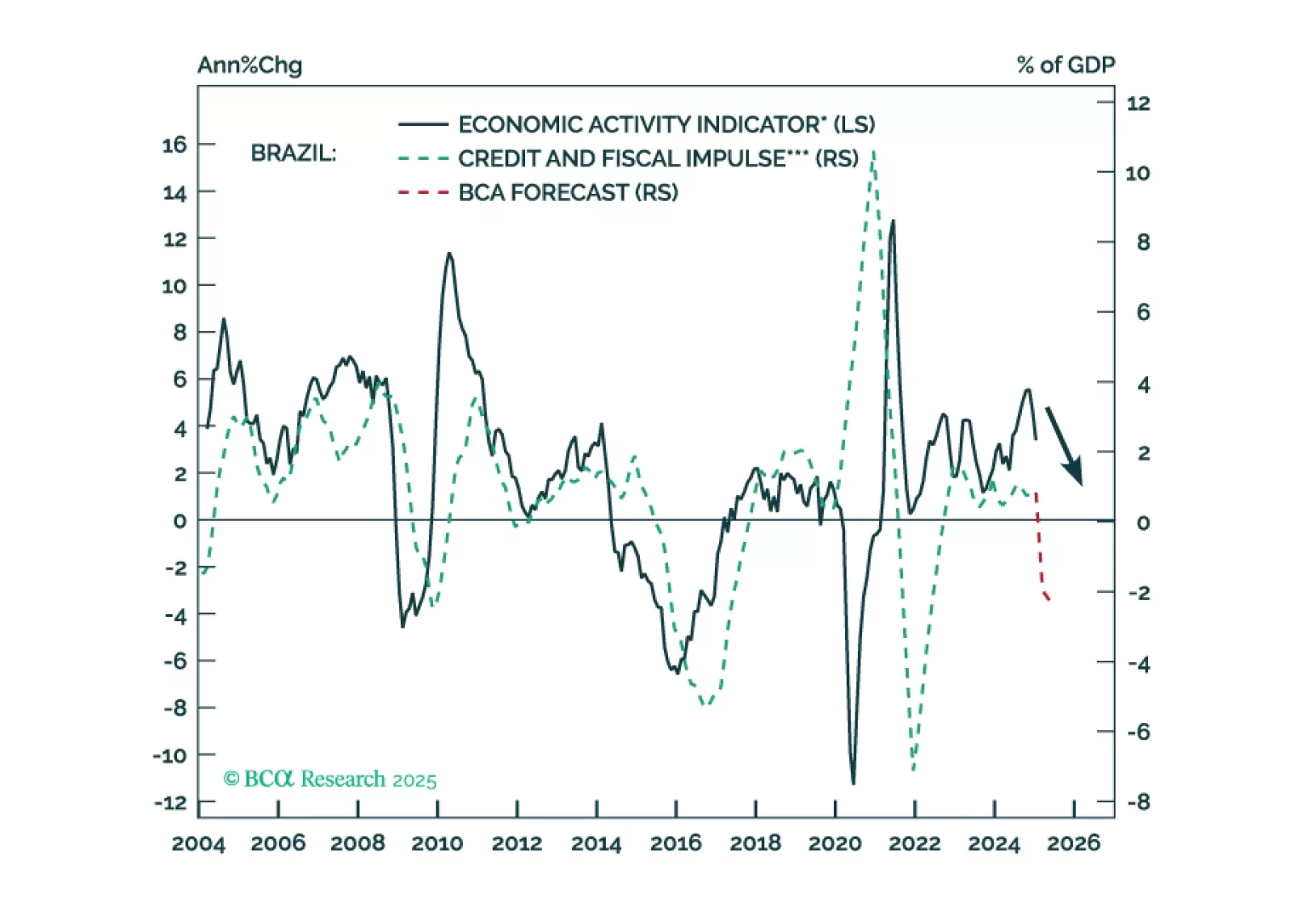

Brazilian policymakers are stuck between a rock and a hard place. There is no combination of fiscal and monetary policies that can assure decent growth, on-target inflation, a stable exchange rate, and public debt sustainability. We…

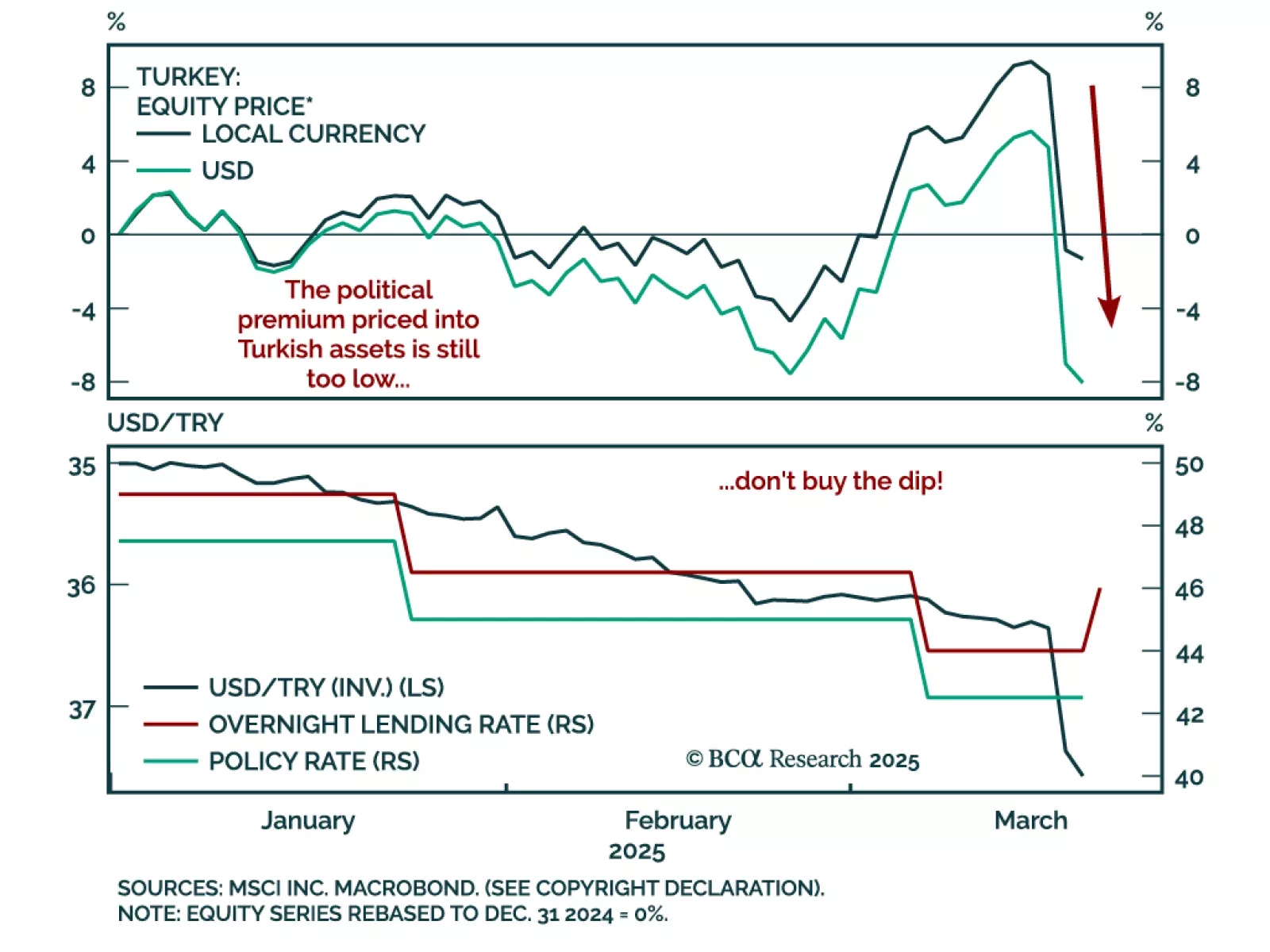

After a period of relative stability and progress towards policy orthodoxy, politics are again haunting Turkish assets. President Erdogan jailed Istanbul mayor Ekrem Imamoglu, a political rival from the opposition party gaining…

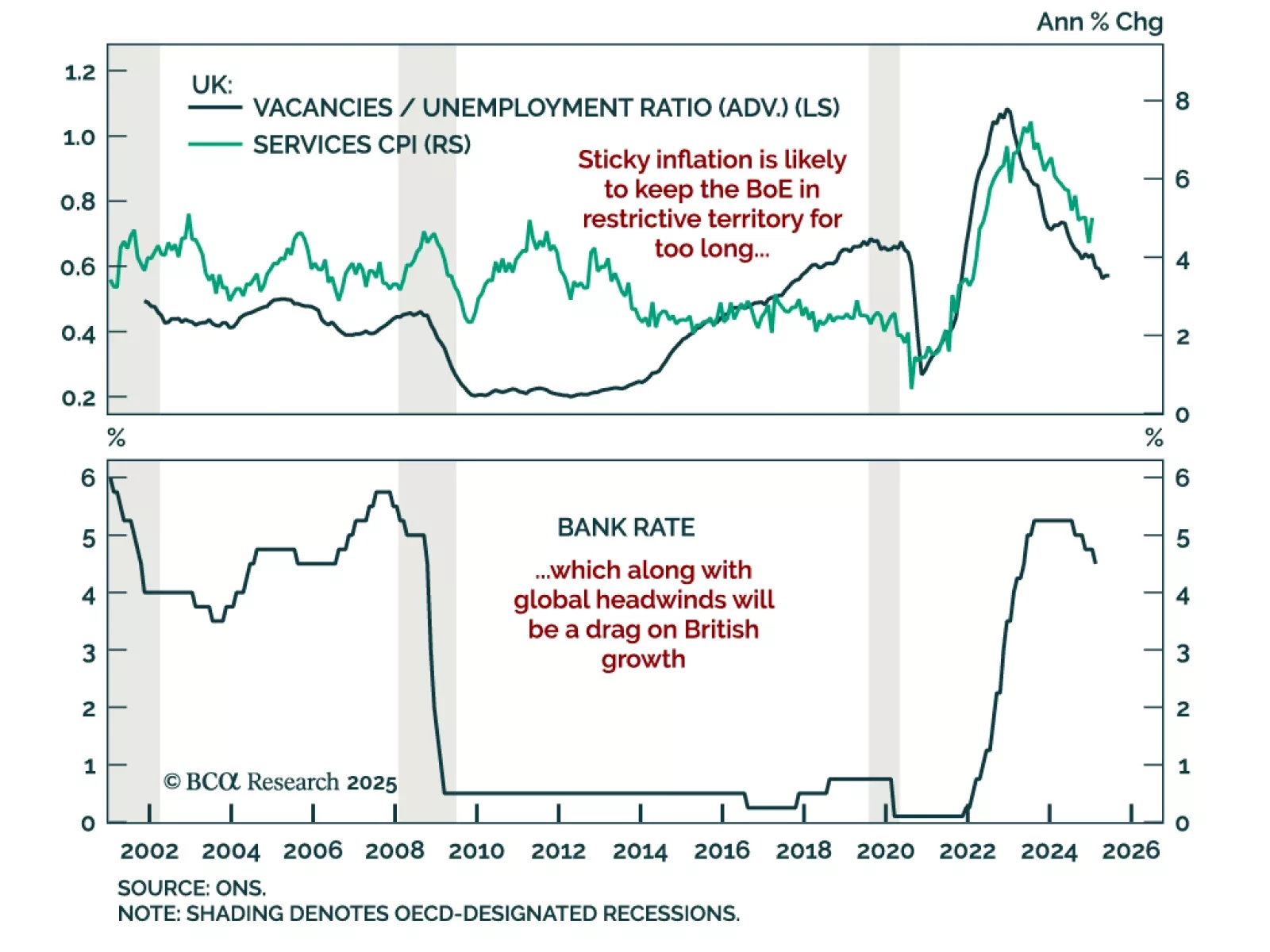

The Bank of England held its policy rate at 4.5%, with only one MPC member dissenting to cut 25 bps. The BoE signaled a slower pace of easing, as inflation remains elevated while global growth becomes increasingly uncertain. …

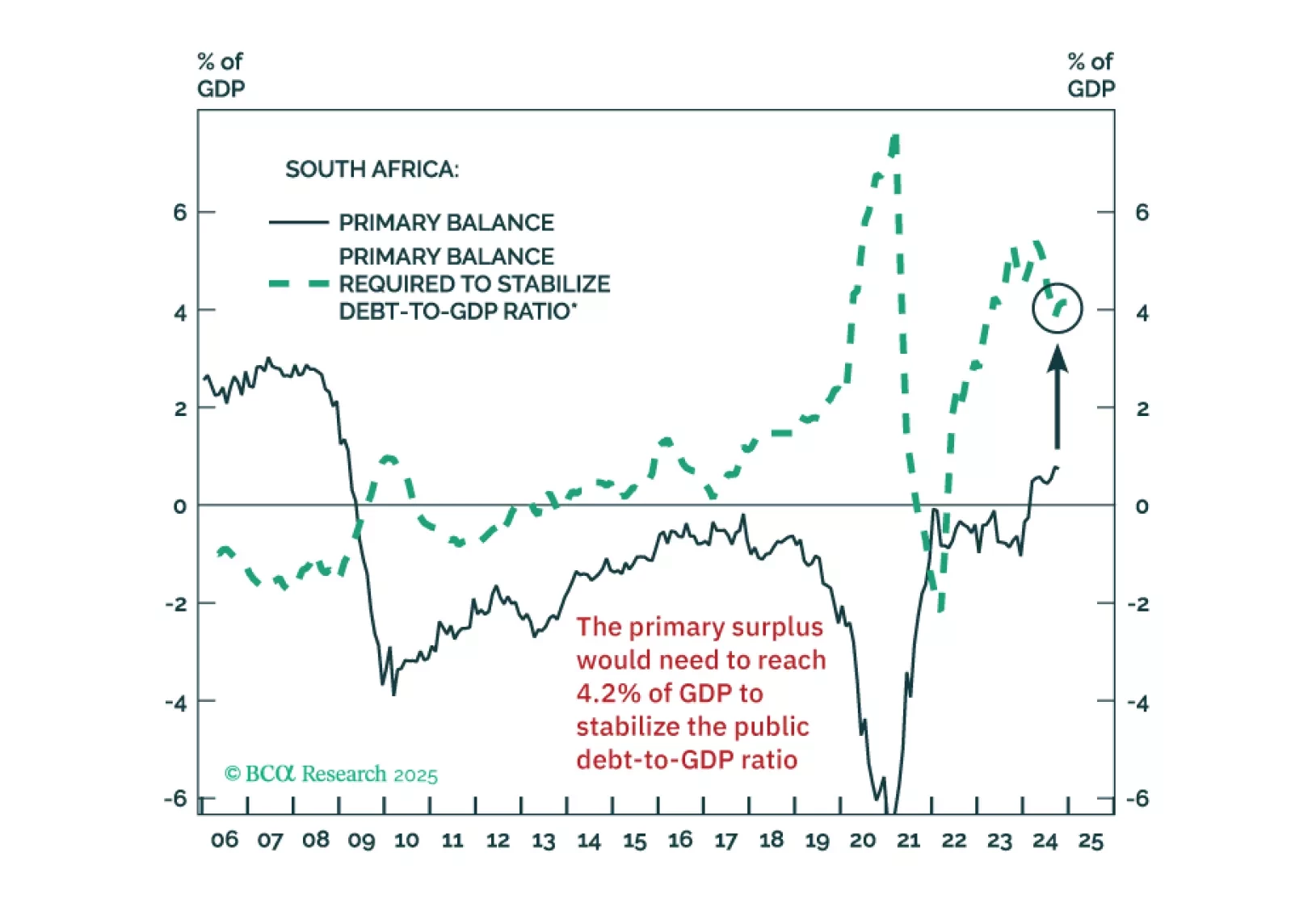

The South African government seems to believe that some fiscal retrenchment can stabilize the public debt-to-GDP ratio. But that’s a misconception. The country will need draconian spending cuts to achieve this.

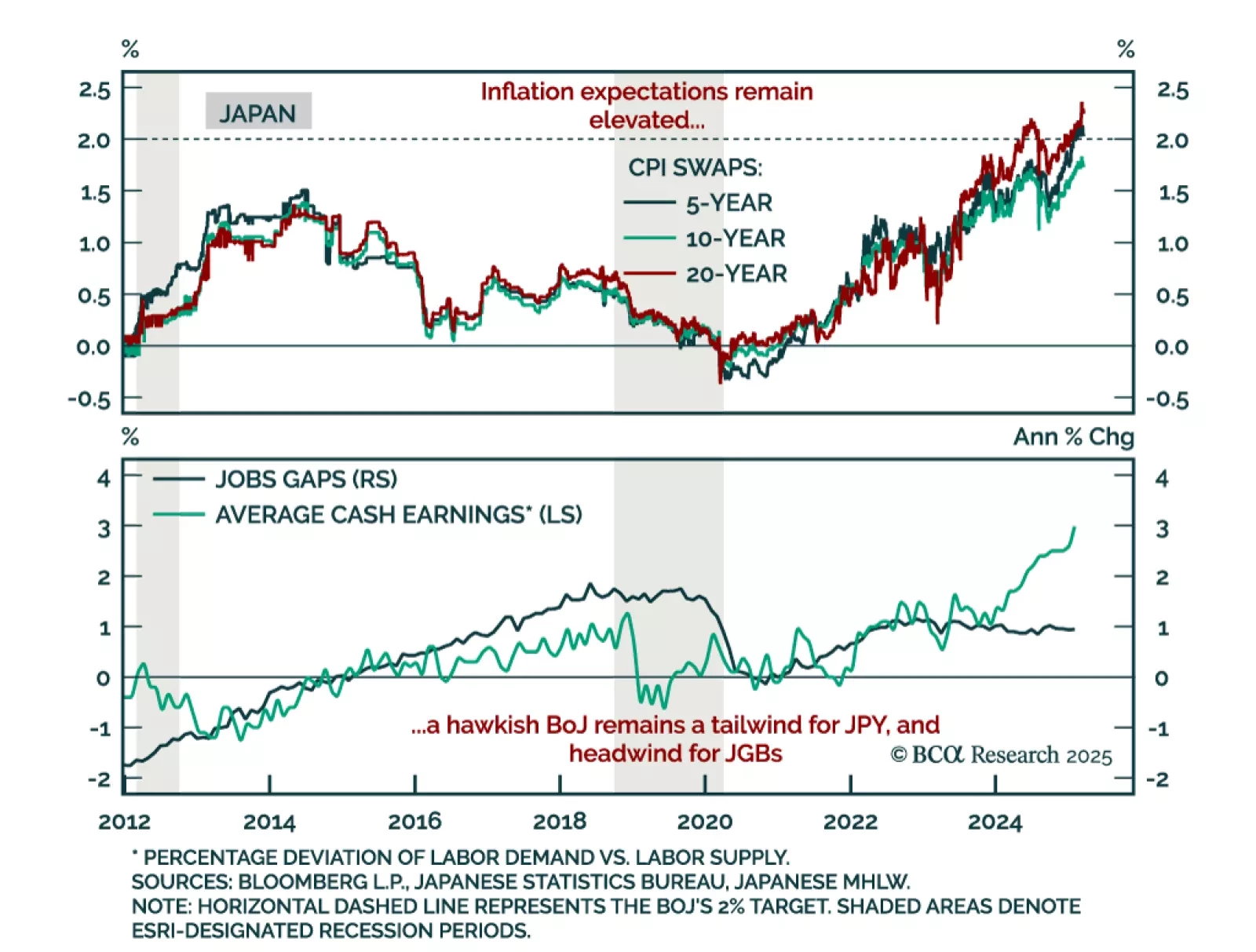

The Bank of Japan left rates unchanged at 0.50%, but maintained a hawkish bias, making it the only G10 central bank in a hiking cycle, as the hot labor market creates sustained domestic price pressures. More rate increases are…

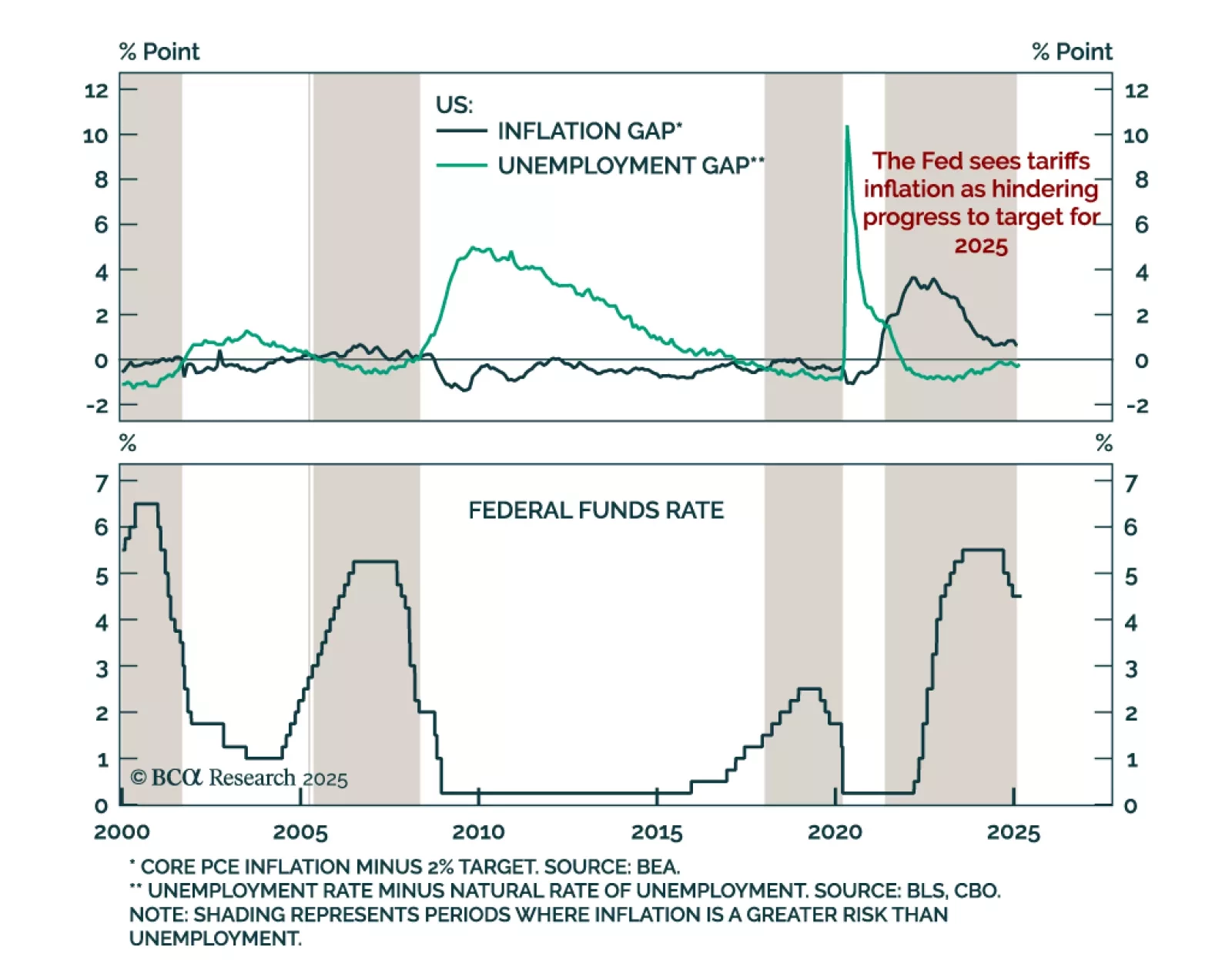

The Federal Reserve held rates at 4.25%-to-4.5% as expected, and slowed down the pace of quantitative tightening. The FOMC remains comfortable waiting and assessing the impact of recent and upcoming policy changes. The dots reflected…