This Strategy Insight discusses the bond market and currency implications of the Fed’s “hawkish pause”.

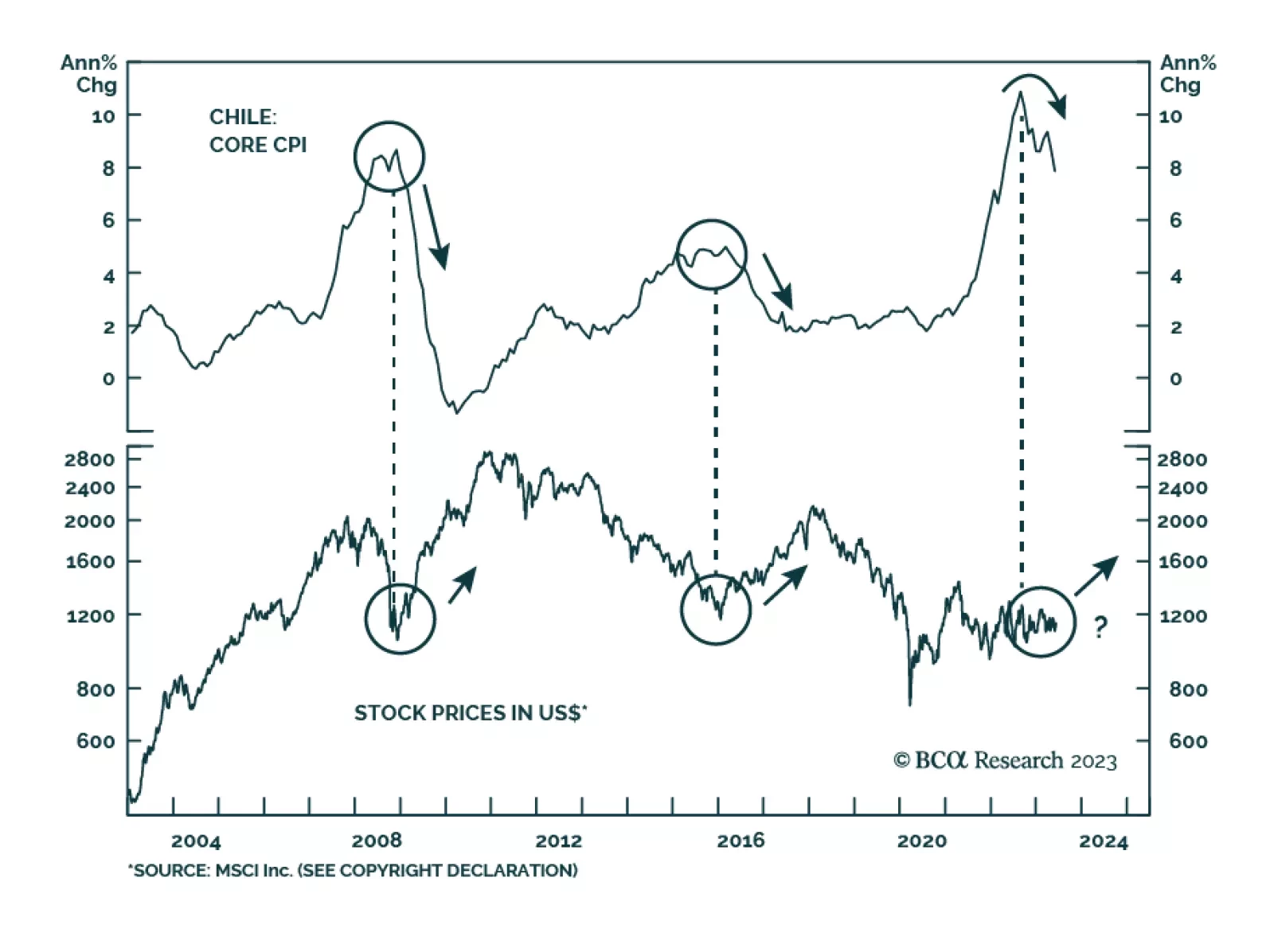

The Chilean economy is entering a recession. After two years of tightening fiscal and monetary policies, real economic growth is beginning to contract and inflation is tumbling. Our Emerging Markets strategists expect the…

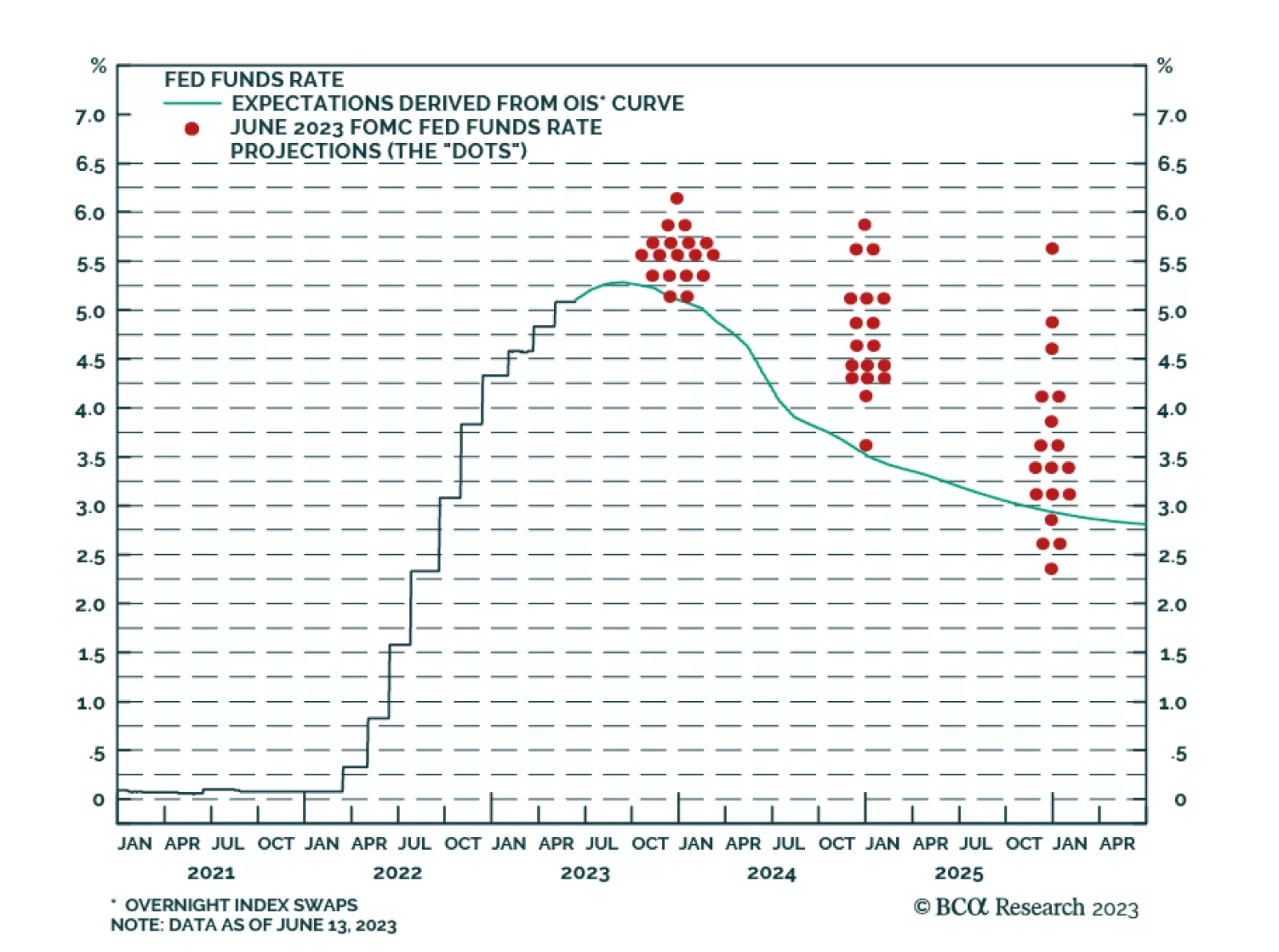

As expected, the Fed kept interest rates unchanged on Wednesday in order to give policymakers time to assess the impact of the aggressive tightening cycle. Chair Powell indicated that the decision to pause is consistent with…

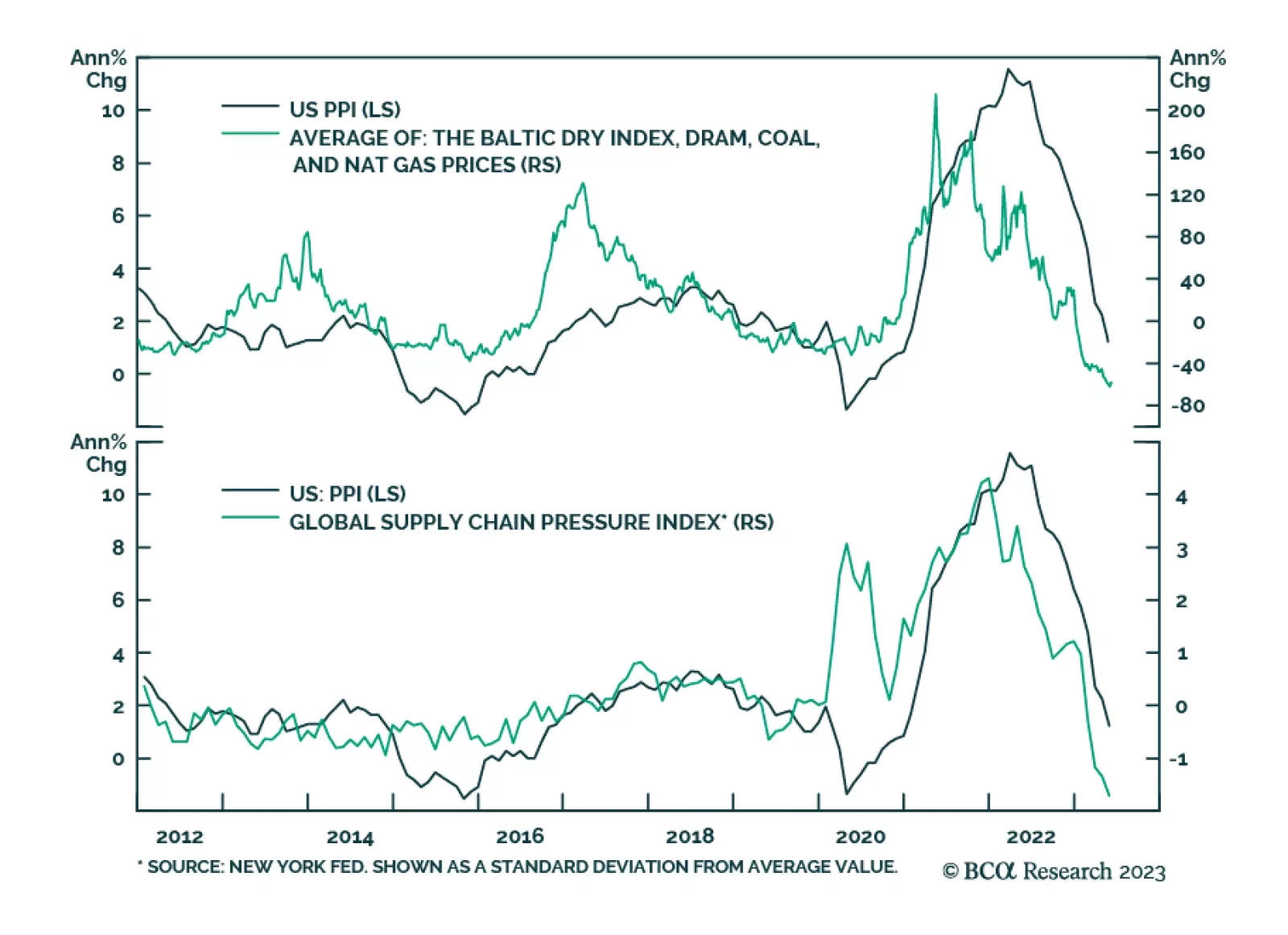

The US May PPI report indicates that pipeline inflationary pressures are cooling. Headline PPI inflation fell from 2.3% y/y to 1.1% y/y – below expectations of 1.5% y/y and the lowest since December 2020. PPI for final…

As the major central banks once again mull their policy options, they face a daunting task. They must phase-transition inflation back to imperceptible, without phase-transitioning unemployment to perceptible. This report explains why…

This Strategy Insight discusses the bond market and currency implications of the Fed’s “hawkish pause”.

Policymakers will likely continue to stimulate domestic demand via targeted measures and piecemeal stimulus. Yet, the economy will disappoint unless Beijing provides “irrigation-style” stimulus. The latter is not our base case…

Policymakers will likely continue to stimulate domestic demand via targeted measures and piecemeal stimulus. Yet, the economy will disappoint unless Beijing provides “irrigation-style” stimulus. The latter is not our base case…

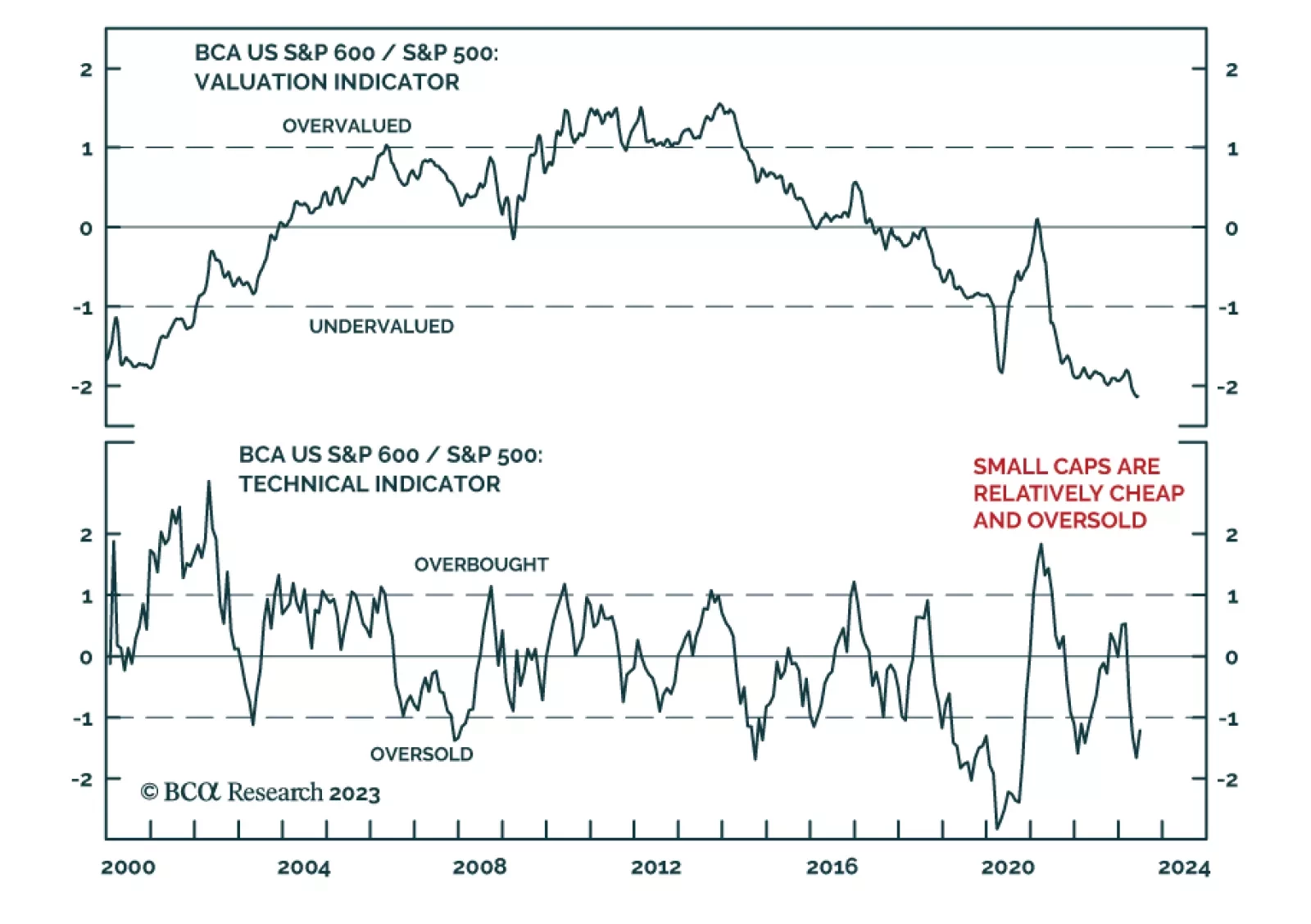

US equity market moves have recently shifted in favor of small caps. After underperforming the S&P 500 by 16% between the start of March and beginning of June, the S&P 600’s recent 6% gain is greater than its large-…