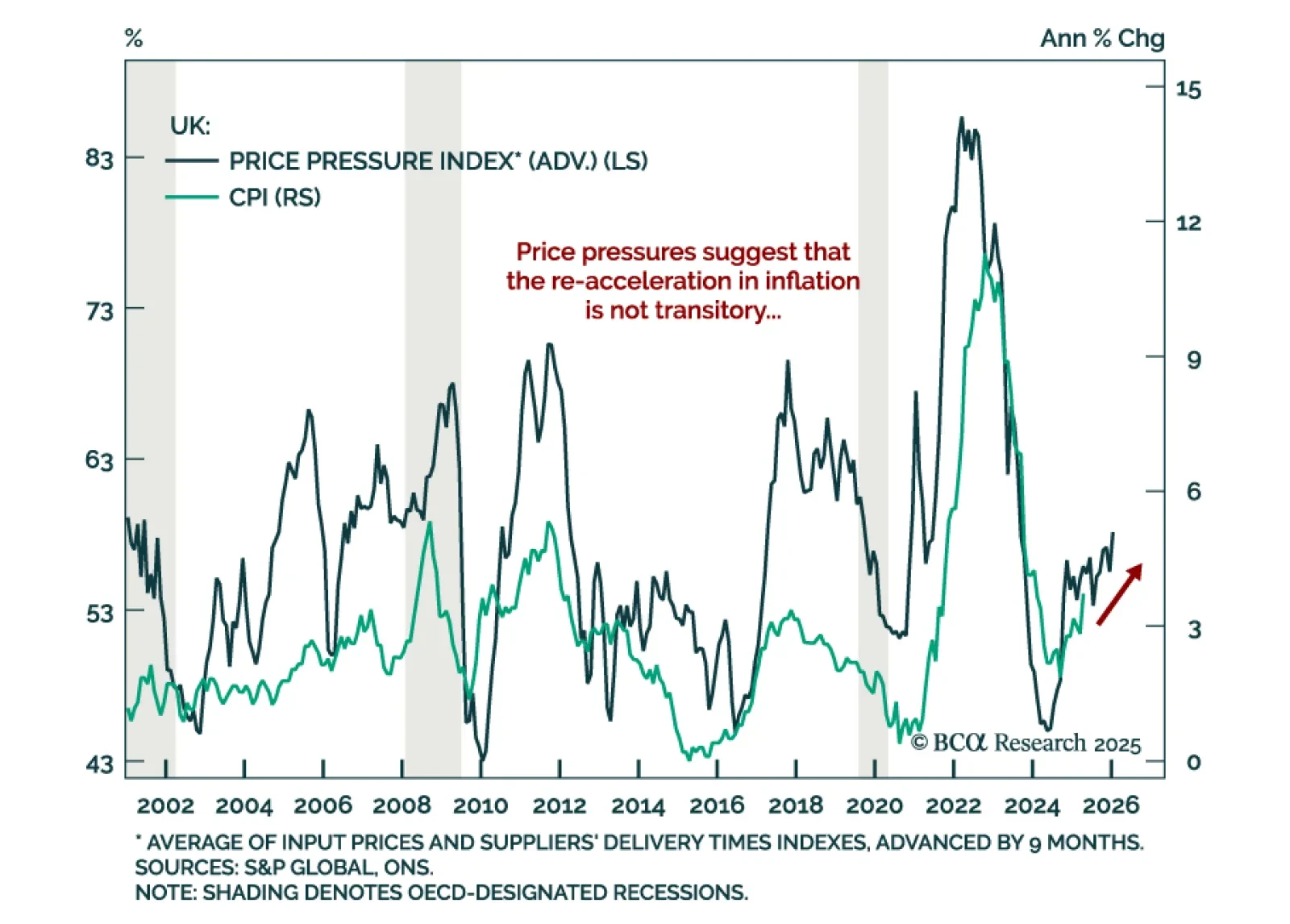

UK inflation surprised to the upside in April. Headline inflation rose to a 15-month high of 3.5%, from 2.6% the month before. Core inflation also surprised above estimates, printing 3.8% vs. 3.4% in March. Services inflation climbed…

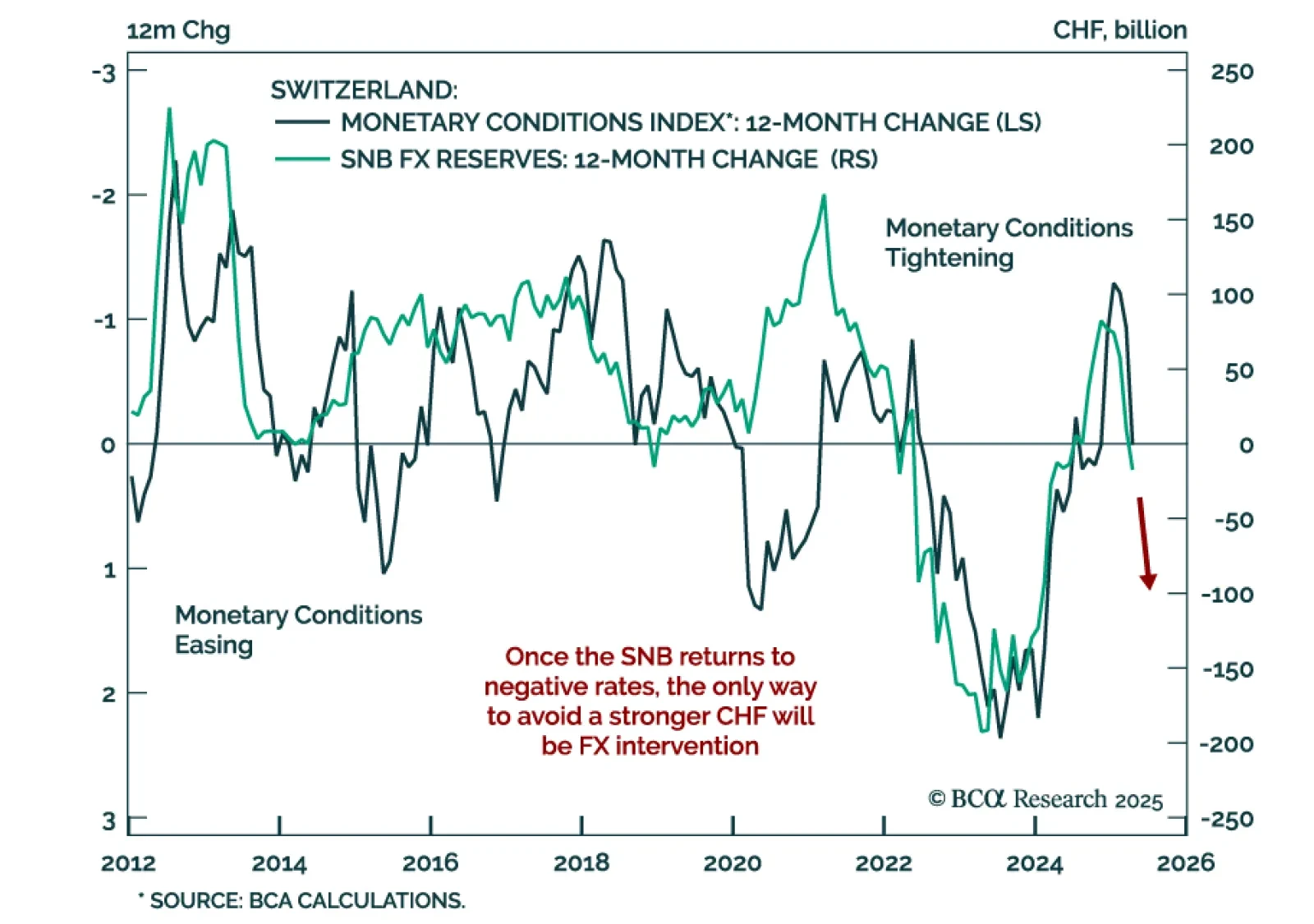

Swiss National Bank will have to resort to negative interest rates and FX intervention before year-end. Swiss inflation fell to 0% year-over-year in April, or the lower end of the SNB’s 0%-2% target range, and the continued…

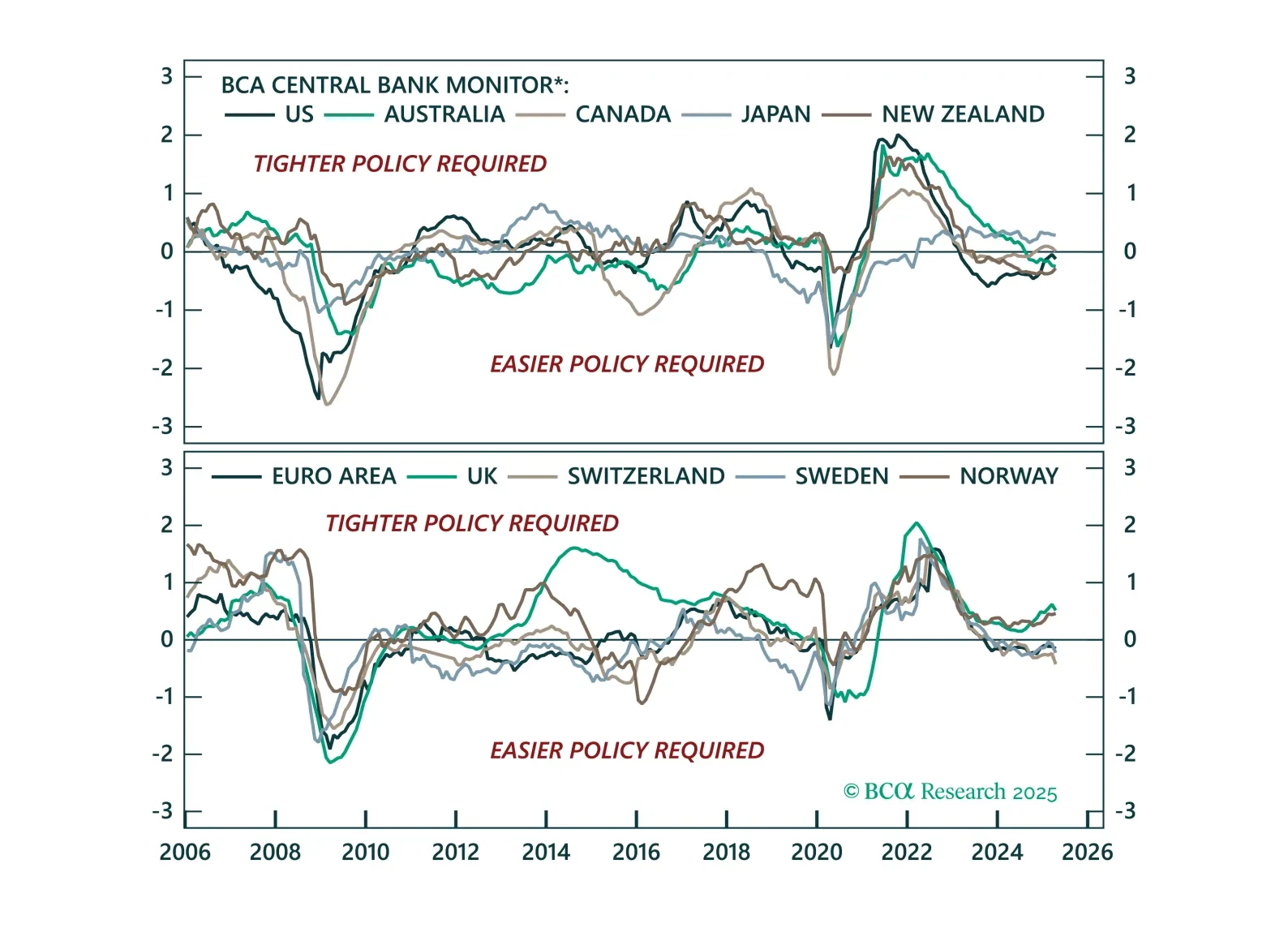

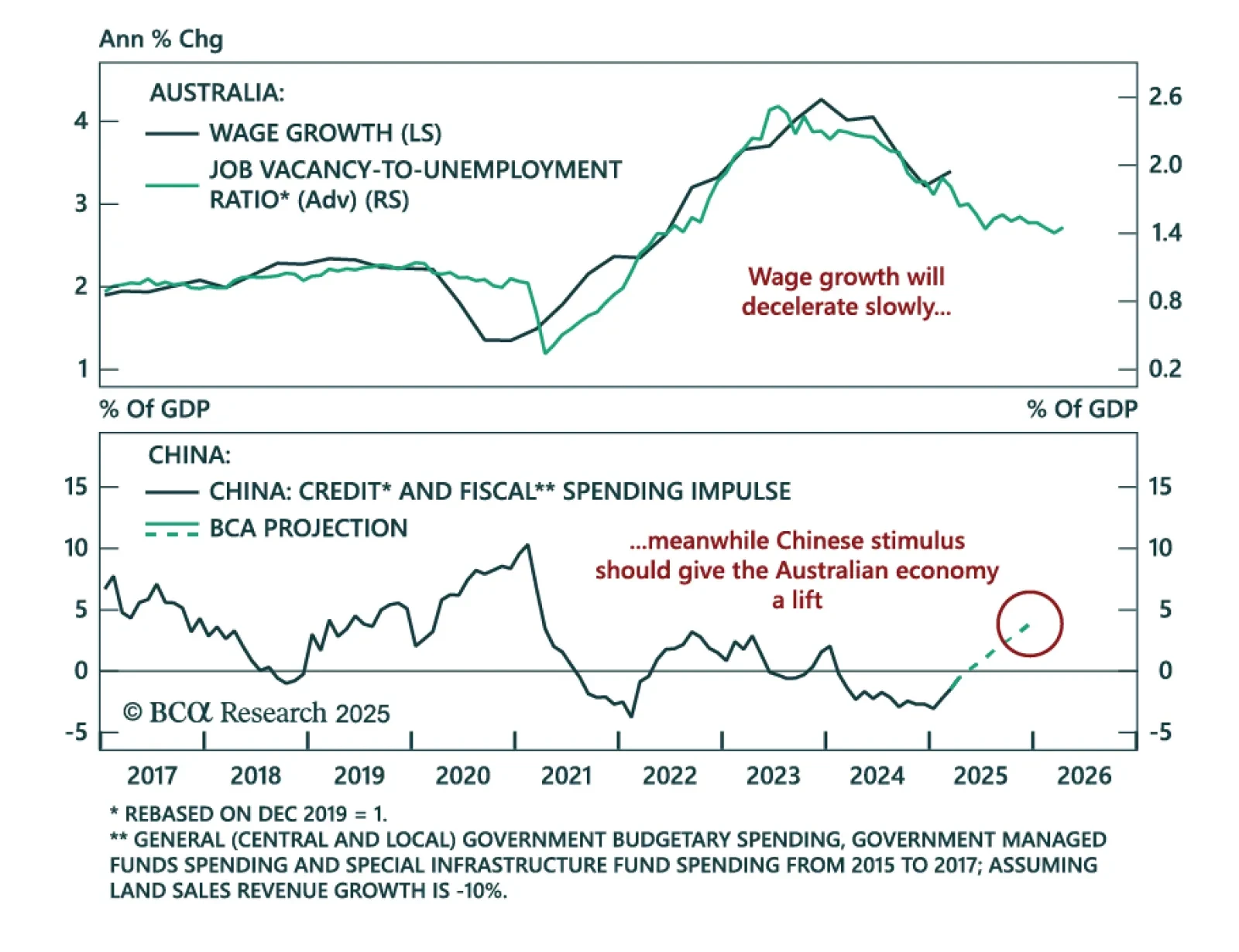

Overnight, the Reserve Bank of Australia (RBA) cut the cash rate target by 25bps to 3.85%, as widely expected. After this cut, the market still prices in about 50bps of easing over the next six months. According to our Global…

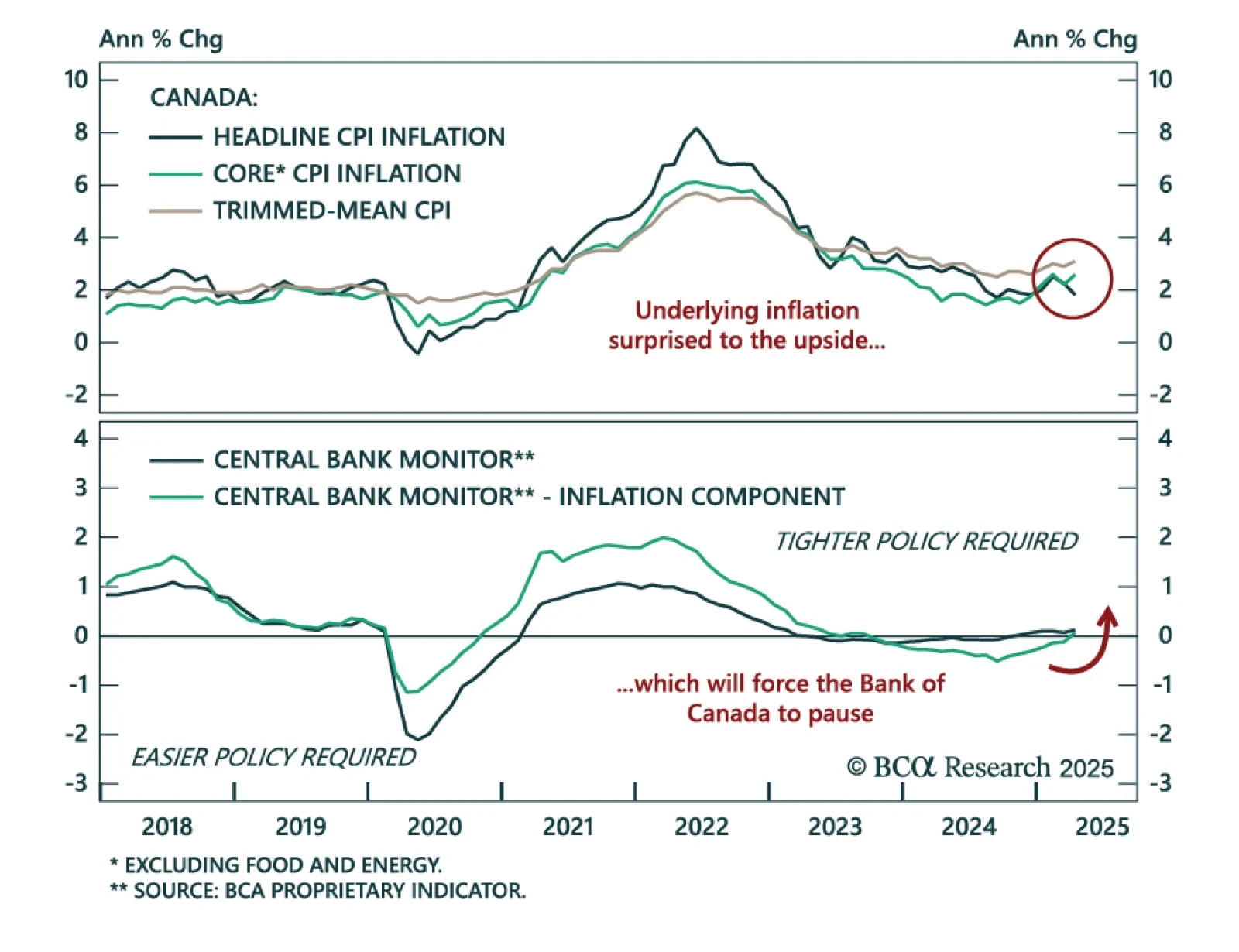

Although Canada’s headline CPI slowed to 1.7% y/y from 2.3% on Tuesday, most measures of underlying inflation surprised to the upside, thus raising the likelihood that the Bank of Canada (BoC) will stay put at its next meeting in…

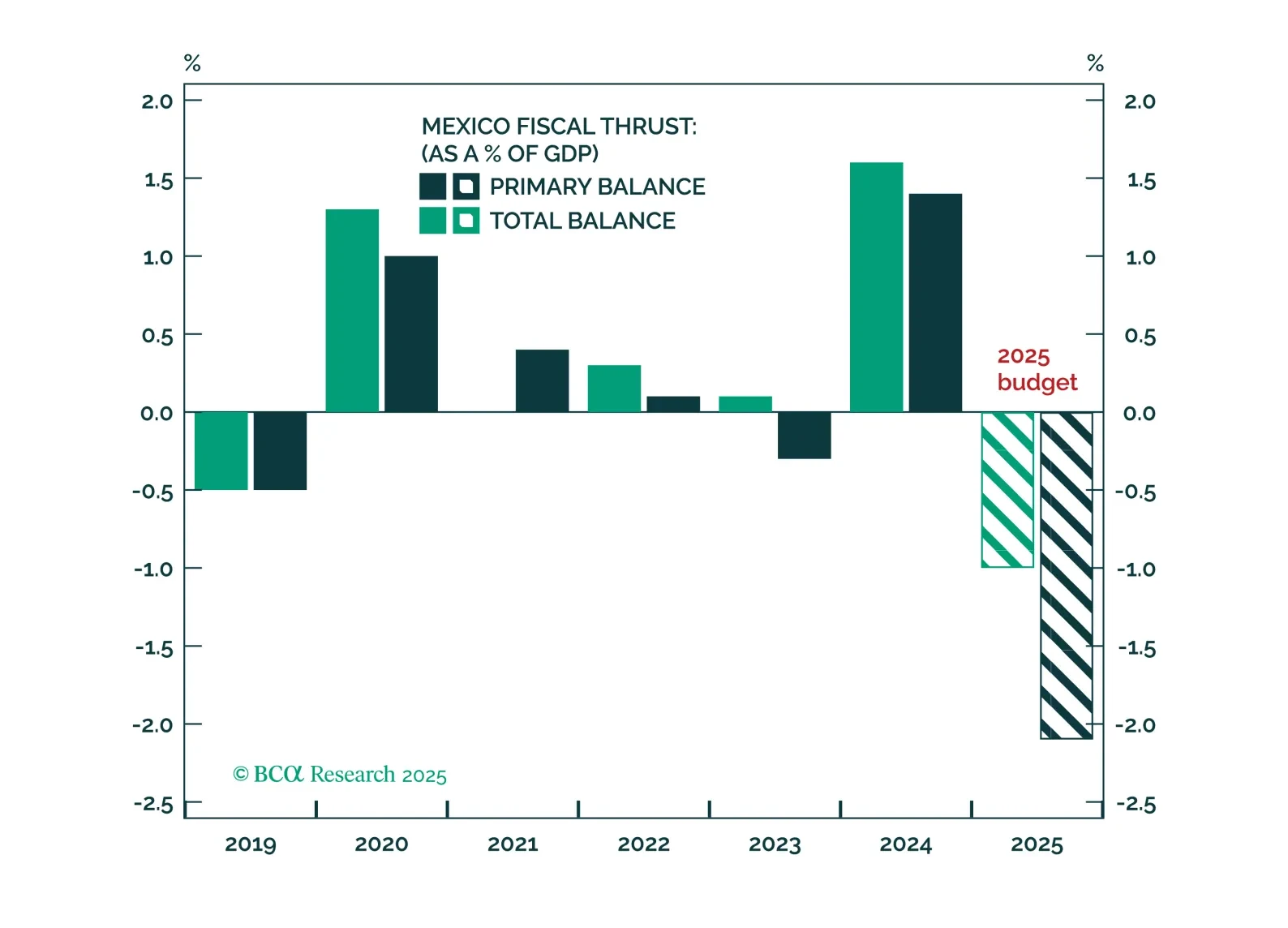

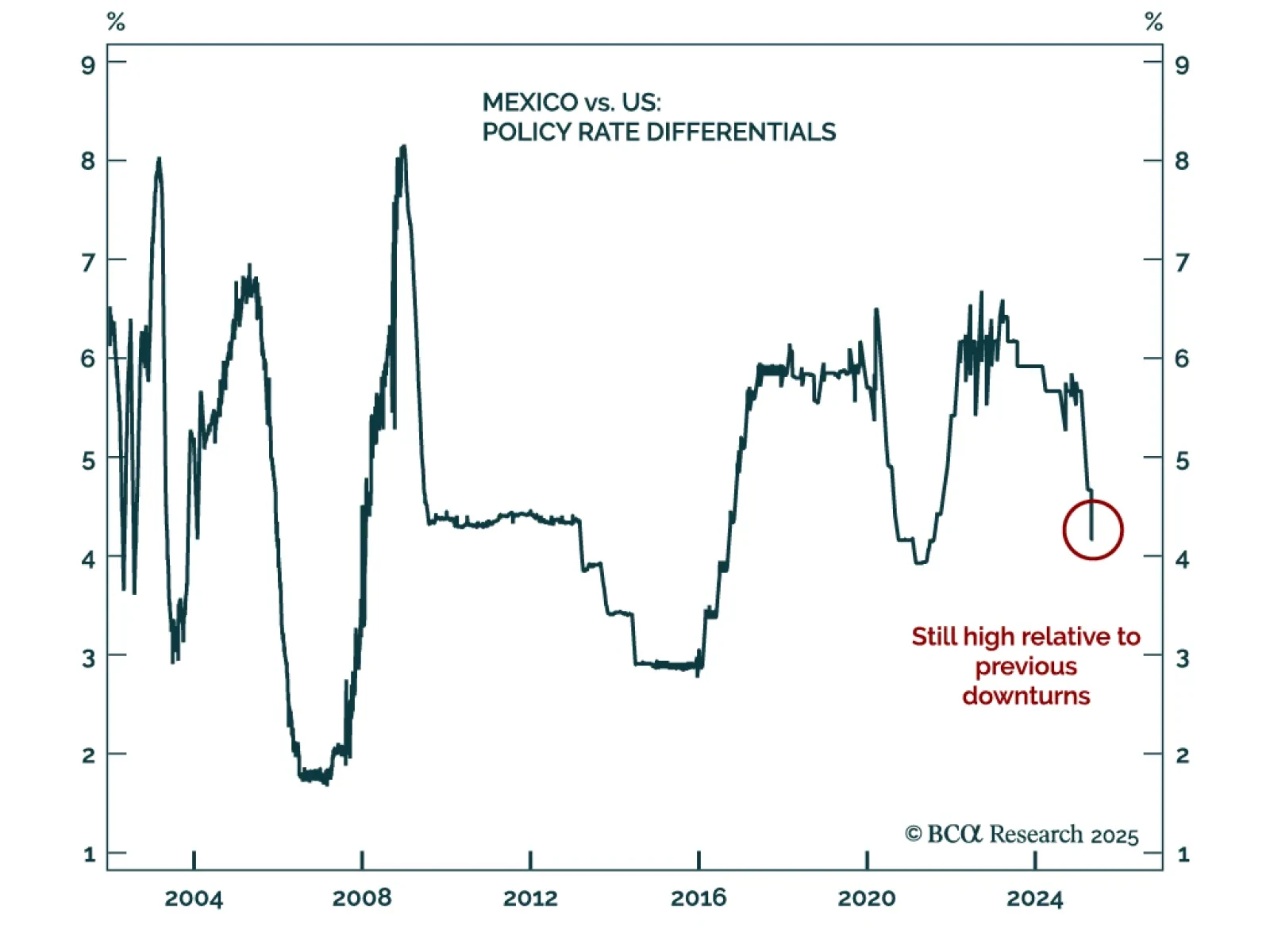

Banxico’s 50 bps rate cut reinforces our bullish view on Mexican bonds, with easing likely to continue as inflation falls and growth slows. The central bank unanimously lowered its policy rate to 8.5%, and we expect further cuts…

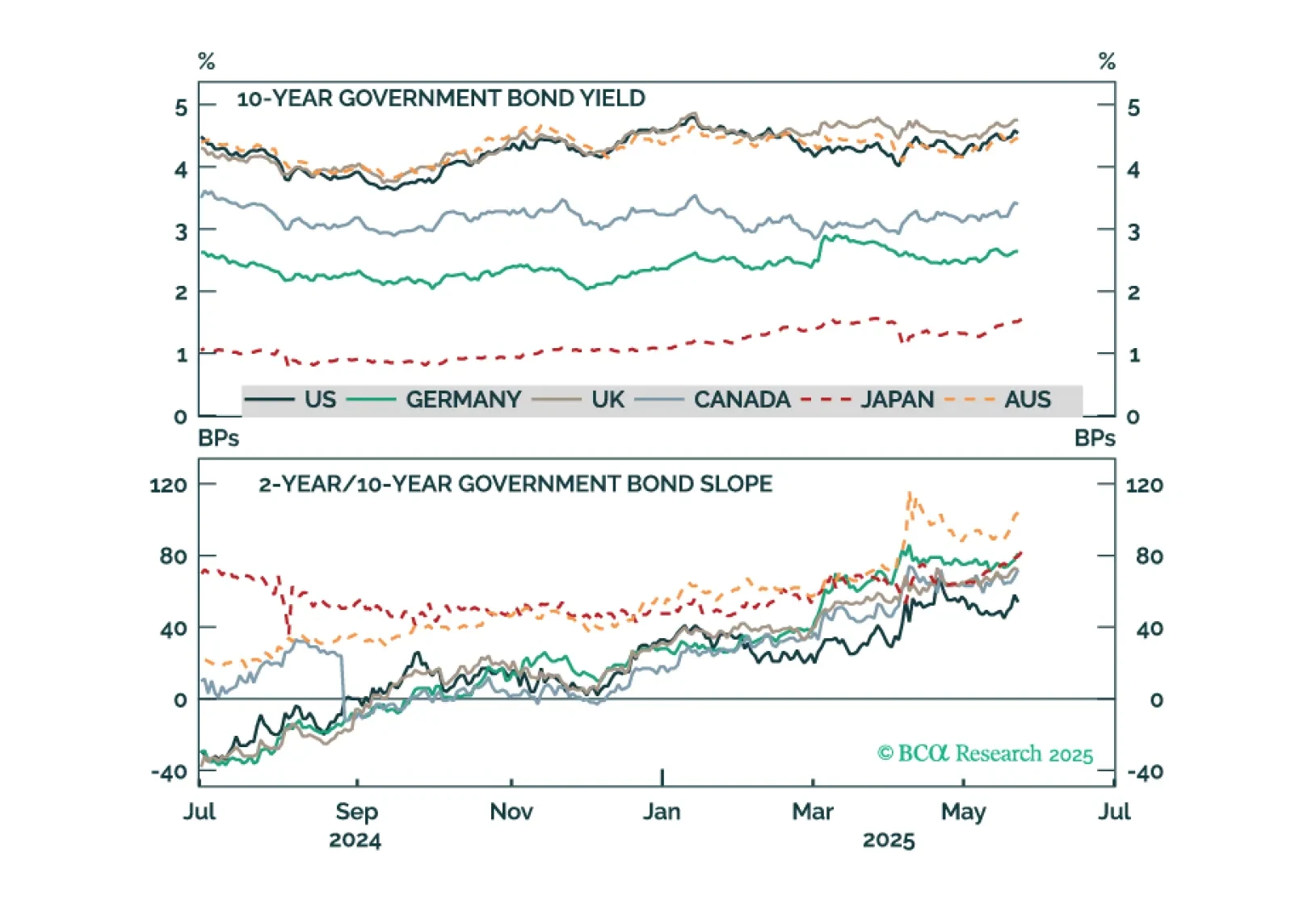

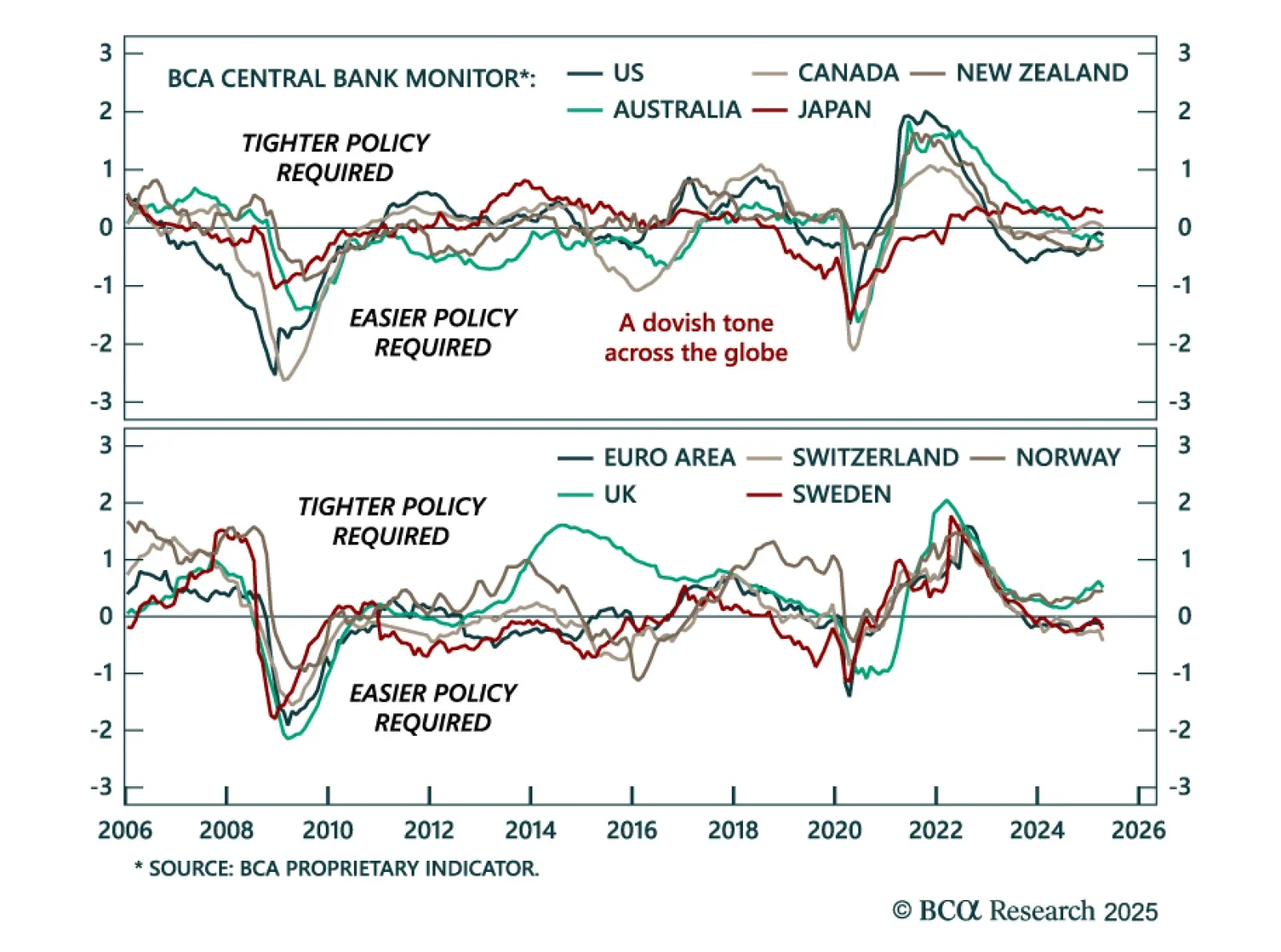

Expect broad-based dovish surprises from major central banks, and stay overweight UK and euro area government bonds. Our Global Fixed Income, European, and FX strategists published a joint update of BCA’s Central Bank Monitors. They…

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

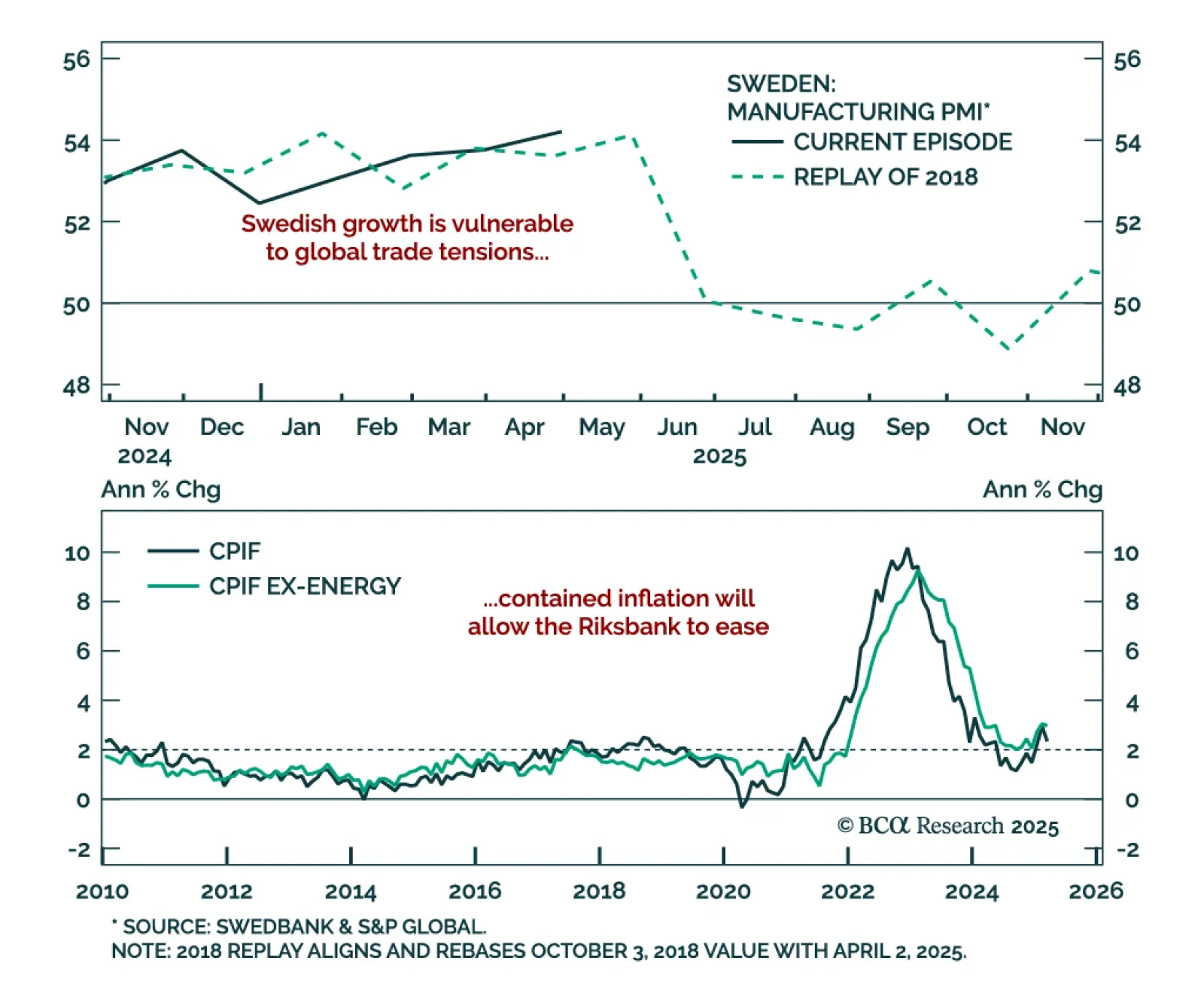

The Riksbank’s cautious stance sets up a dovish pivot, reinforcing our long Swedish bonds view and SEK fade vs. USD. The central bank held rates at 2.25% for the second time this year, with Governor Thedéen describing policy as well-…