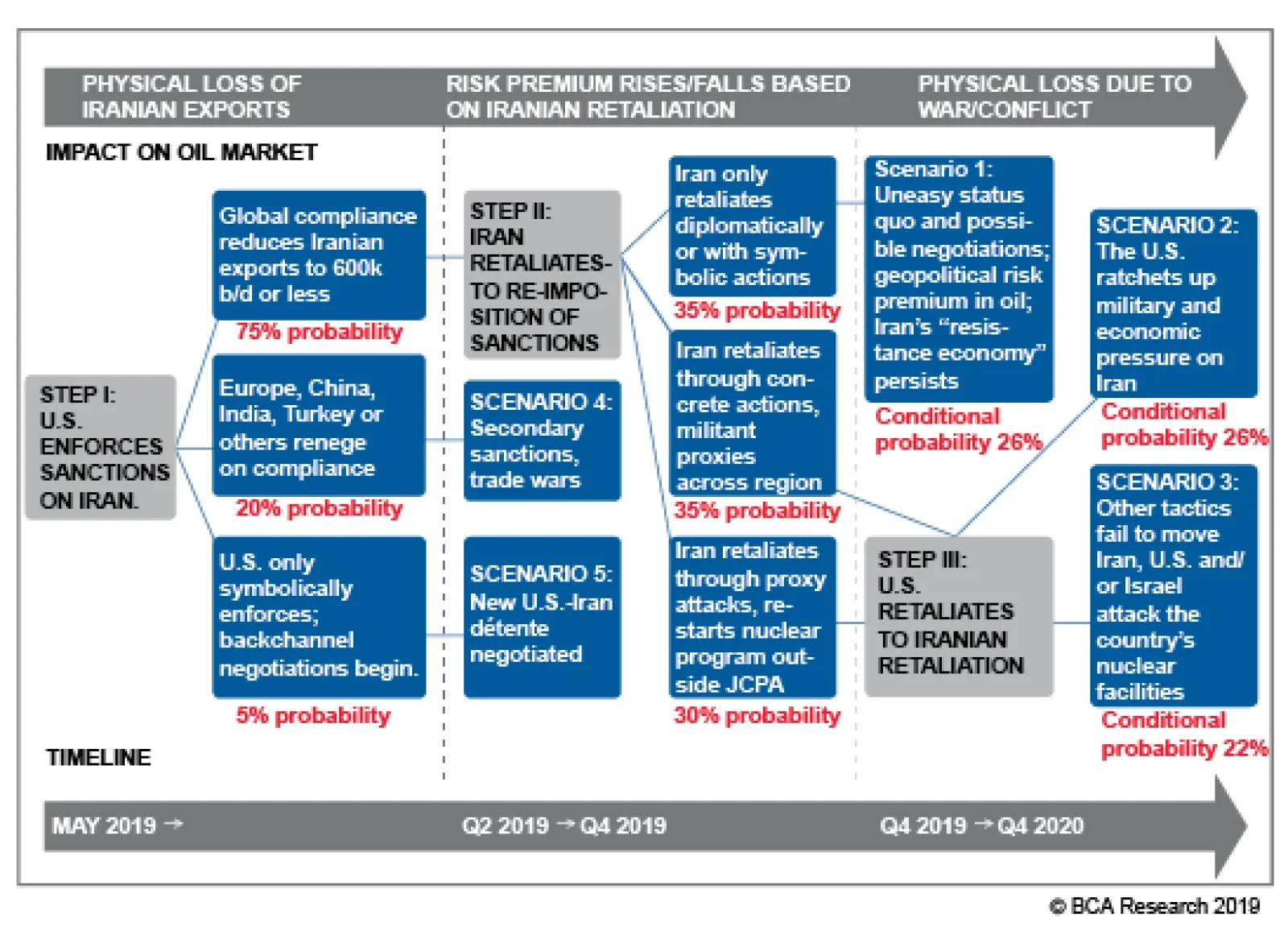

The Iranians, for their part, are unlikely to leap to the most aggressive forms of retaliation immediately – such as fomenting unrest in Iraq – because of their economic vulnerability. Small acts of sabotage or…

Given its gloomy economic outlook, Iran is looking to expand ties with its neighbors in an attempt to soften the blow from the sanctions. Earlier this year president Hassan Rouhani and Iraqi prime minister Adel Abdul Mahdi signed…

Highlights In Indonesia, investors are ignoring the weakness in global growth, which is an important driver of the country’s financial markets. The Indonesian currency, equities and local currency bonds all remain vulnerable. We…

Highlights So what? Quantifying geopolitical risk just got easier. Why? In this report we introduce 10 proprietary, market-based indicators of country-level political and geopolitical risk. Featured countries include…

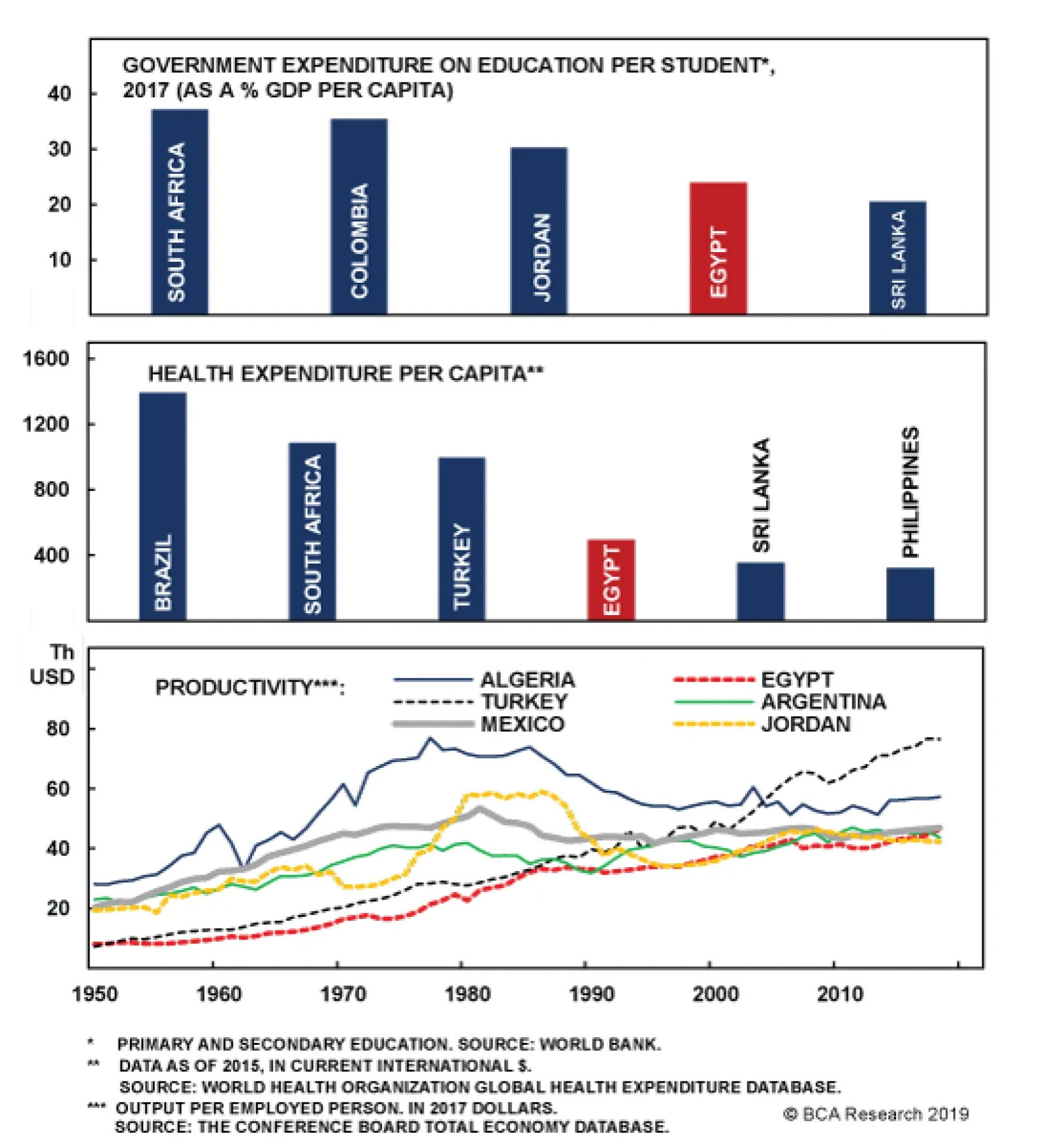

For one, Egypt remains heavily reliant on its external environment. This environment has been largely cooperative throughout Sisi’s term in office, but a global or EM downturn could cause investment to collapse. Meanwhile,…

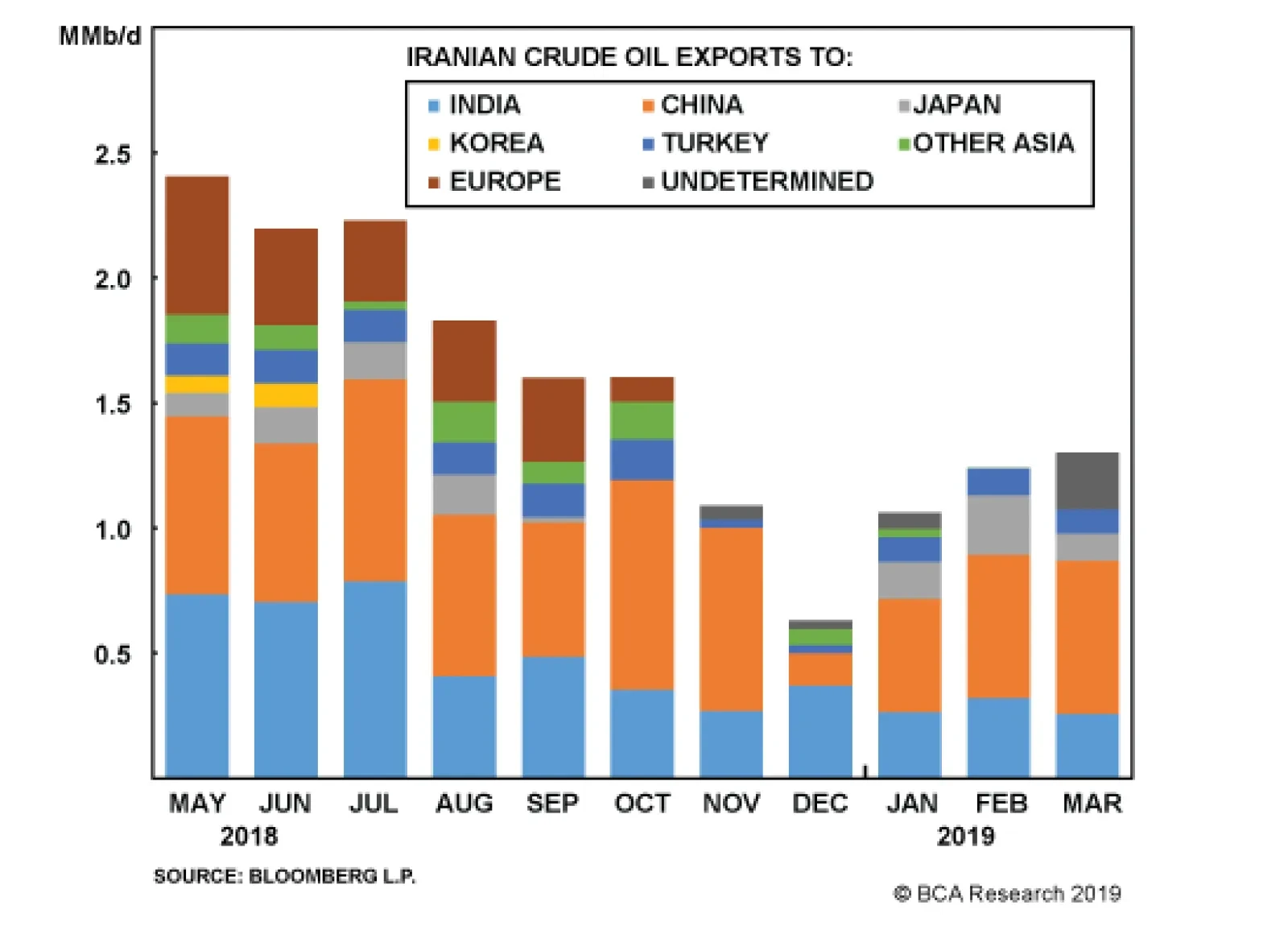

KSA has indicated it sees a need to extend OPEC 2.0’s production-cutting deal into 2H19, when the coalition’s ministers meet in June. Of late, Khalid al-Falih, KSA’s oil minister, is indicating no further cuts…

Highlights OPEC 2.0 will meet in June to decide whether to continue its production cuts into 2H19. Once again, the leaders are sending conflicting signals – KSA is subtly indicating OPEC 2.0’s 1.2mm b/d of production cuts…

Political economy – i.e., the interplay between critical nation states’ policies and markets – often trumps straightforward supply-demand analysis in oil. This is because policy decisions affect production and…