Highlights 2019 was a good year for our constraint-based method of political analysis. Trump was impeached, the trade war escalated, and China (modestly) stimulated – all as predicted. Nevertheless Trump caught us by surprise…

Highlights OPEC 2.0 agreed to cut output by another 500k b/d at its Vienna meeting last week, bringing the total official cuts by the producer coalition to 1.7mm b/d. Saudi Arabia added 400k b/d of additional voluntary cuts, bringing…

Highlights The Fed is the usual culprit for killing business cycles — but the Fed is on hold. This makes geopolitics the likeliest candidate to kill the cycle. The key geopolitical risks are US political turmoil, China’s…

Highlights A 400k b/d addition to OPEC 2.0’s official production cut of 1.2mm b/d will have little effect on actual supplies. The market already has seen ~ 2.0mm to 2.5mm b/d of output removed from the market via excess voluntary…

Highlights Lingering weakness evident in fundamental supply-demand data will fade next year, and with it the downward pressure on oil prices. Price risk is skewed to the upside: Continued monetary accommodation from systematically…

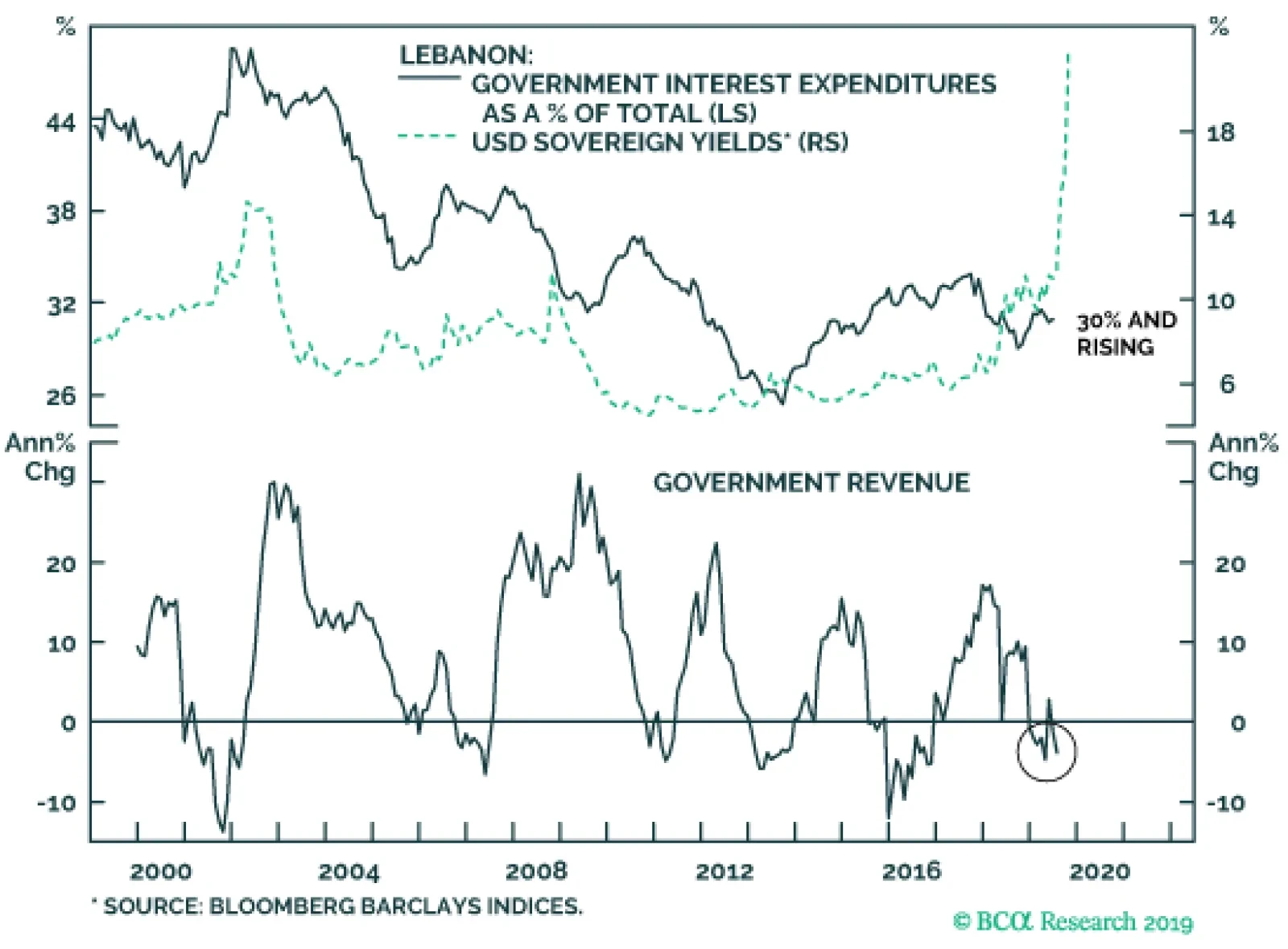

Lebanese commercial banks are not only being squeezed by capital outflows and deposit withdrawals, they are also about to face a public debt default. Commercial banks own 37% of outstanding government debt. This will come on top…

Feature Chart I-1Lebanese Bond Yields Have Surged To Precarious Levels In a May 2018 Special Report, we warned that a devaluation and government default were only a matter of time in Lebanon. The country's sovereign US…

Highlights Lebanon and Iraq – the two countries most entrenched in Iran’s sphere of influence – are experiencing mass unrest. Protesters in both states are calling for the dismantling of sectarian based political…

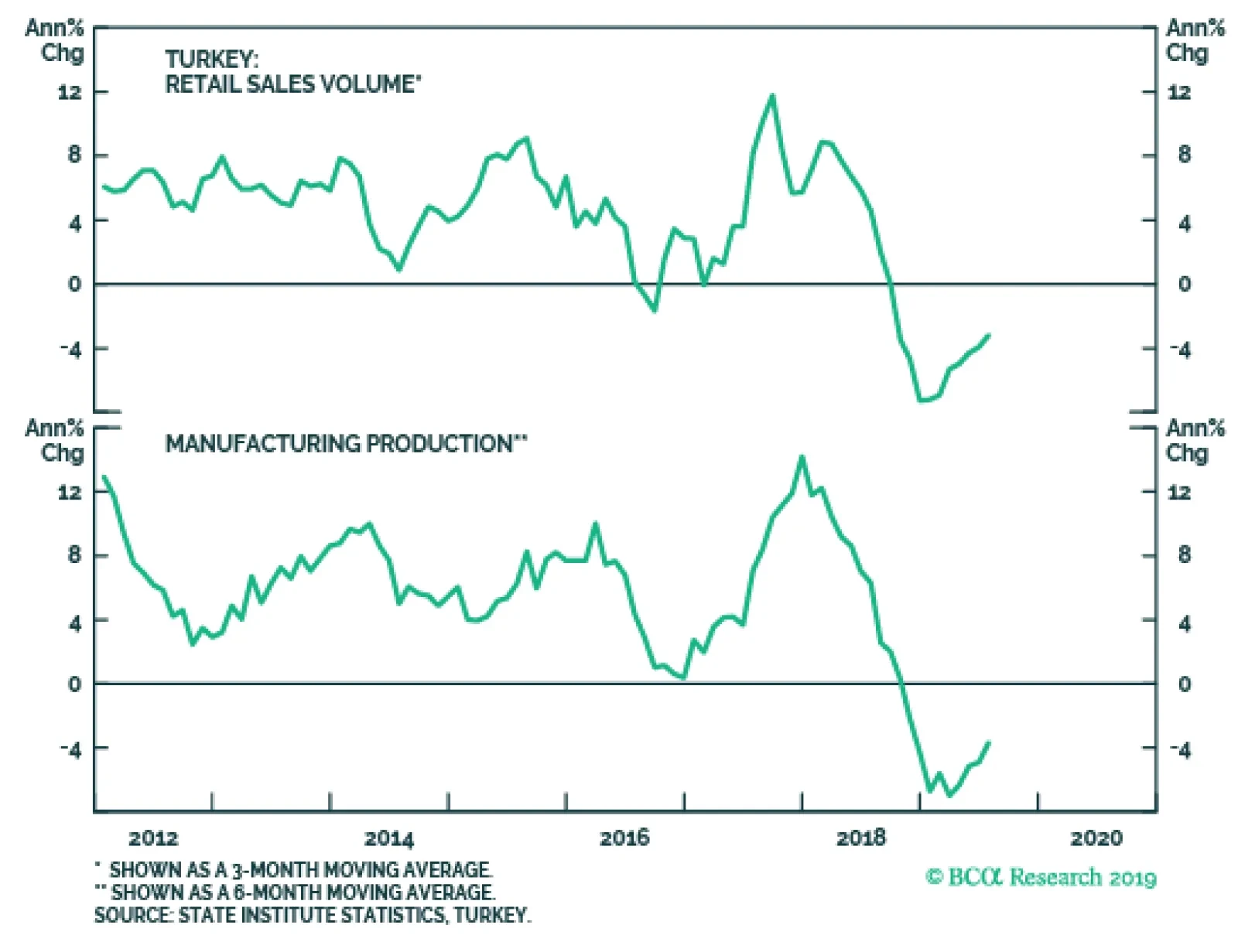

Turkey’s incursion into Syria is an attempt by President Erdogan to confront the battle-hardened Syrian Kurds and prevent a Kurdish-controlled continuous border with Syria, and to distract from his weakened domestic position…