Highlights Rapidly changing news flows are forcing oil markets to recalibrate supply-demand fundamentals continuously. This will keep volatility at or close to recent record highs (Chart of the Week). The demand shock from COVID-19…

Feature We closed our short position in EM equities last week but still maintain our short recommendation on EM currencies. Going forward we will be looking for signs of a durable bottom in risk assets. The clash between forthcoming…

Highlights As the global economy moves toward shut-down, the Kingdom of Saudi Arabia (KSA) and Russia will be forced to end their market-share war and focus on shoring up their economies and tending to their populations’ welfare…

Highlights Our short EM equity index recommendation has reached our target and we are booking profits on this trade. The halt to economic activity will produce a global recession that will be worse than the one that took place in late…

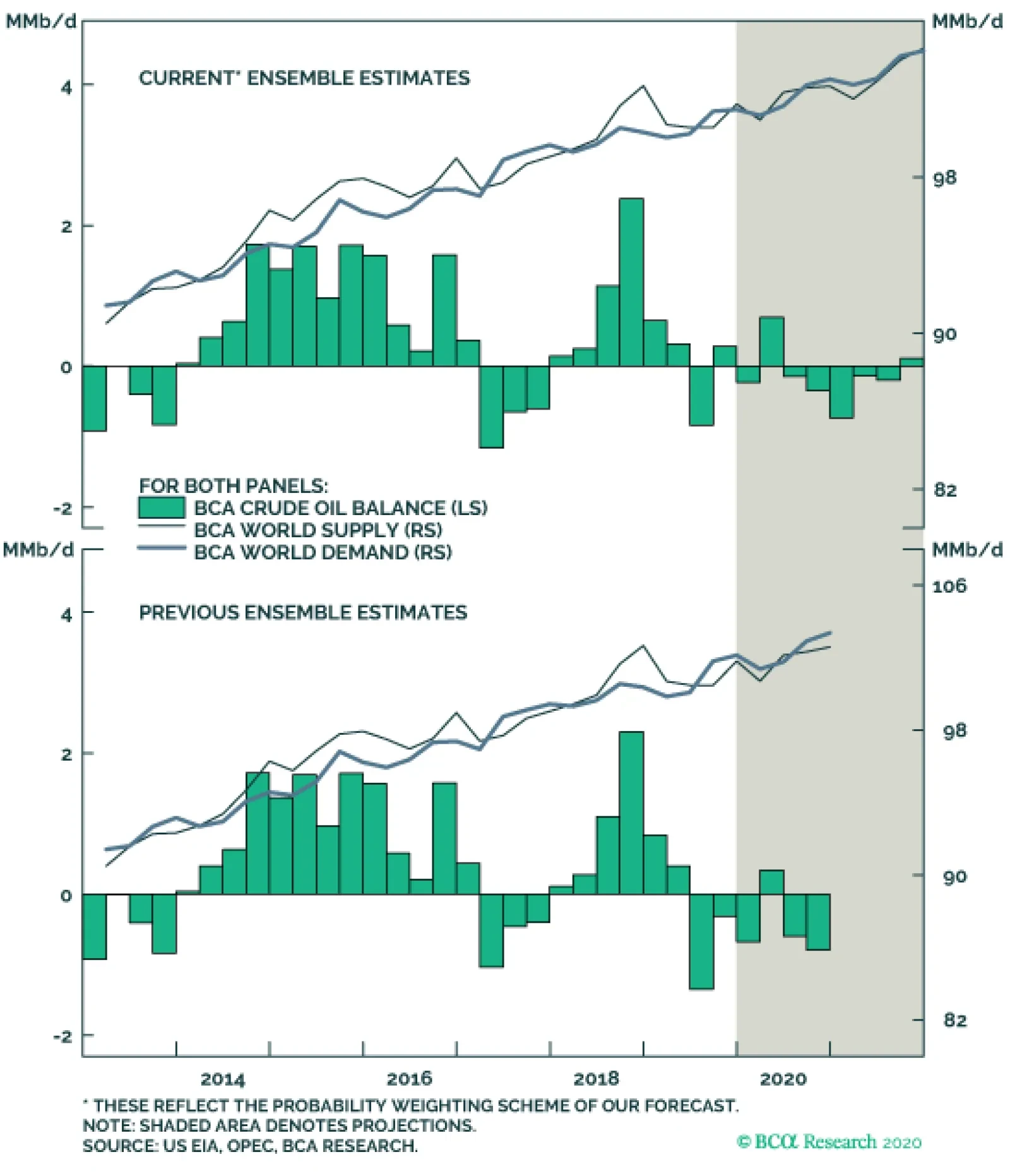

Crude oil fundamentals continue to favor higher prices. We continue to expect demand to grow 1.4mm b/d this year. For 2021, we expect growth of just under 1.5mm b/d, reaching 103.65mm b/d globally. For its part, the EIA is…