Highlights The EU’s €750 billion fiscal package, along with another round of US stimulus likely exceeding $1 trillion, will support global oil demand. On the supply side, OPEC 2.0’s production discipline likely holds,…

Highlights The bull market in US-Iran tensions was never resolved, and now a series of suspicious explosions in Iran raises the possibility that tensions will re-escalate. Iran’s interest lies in waiting out Trump so that a…

Highlights In the short run, extreme policy uncertainty is problematic for risk assets. In the long run, gargantuan fiscal and monetary stimulus continues to support cyclical trades. Equity volatility always increases in the…

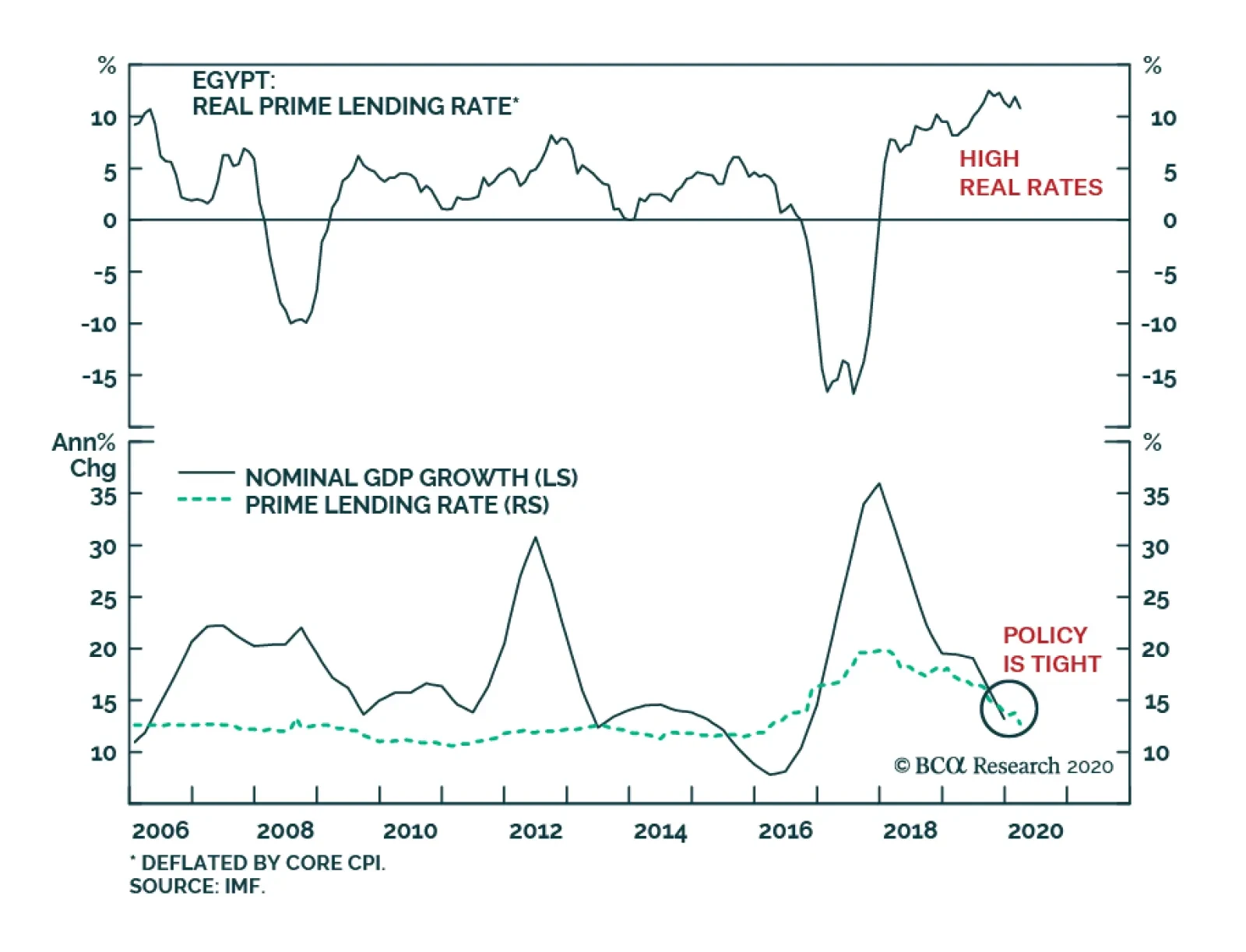

BCA Research's Emerging Markets Strategy service believes that the Central Bank of Egypt (CBE) will allow the currency to depreciate and will cut interest rates materially. A Devaluation would offer an attractive opportunity…

Highlights The collapse in oil prices supercharges the geopolitical risks stemming from the global pandemic and recession. Low oil prices should discourage petro-states from waging war, but Iran may be an important exception. Russian…

Highlights A World Organization of the Petroleum Exporting Countries (WOPEC) looks set to emerge after today’s OPEC 2.0 video conference to discuss production cuts in the wake of the COVID-19 pandemic, and the market-share war…