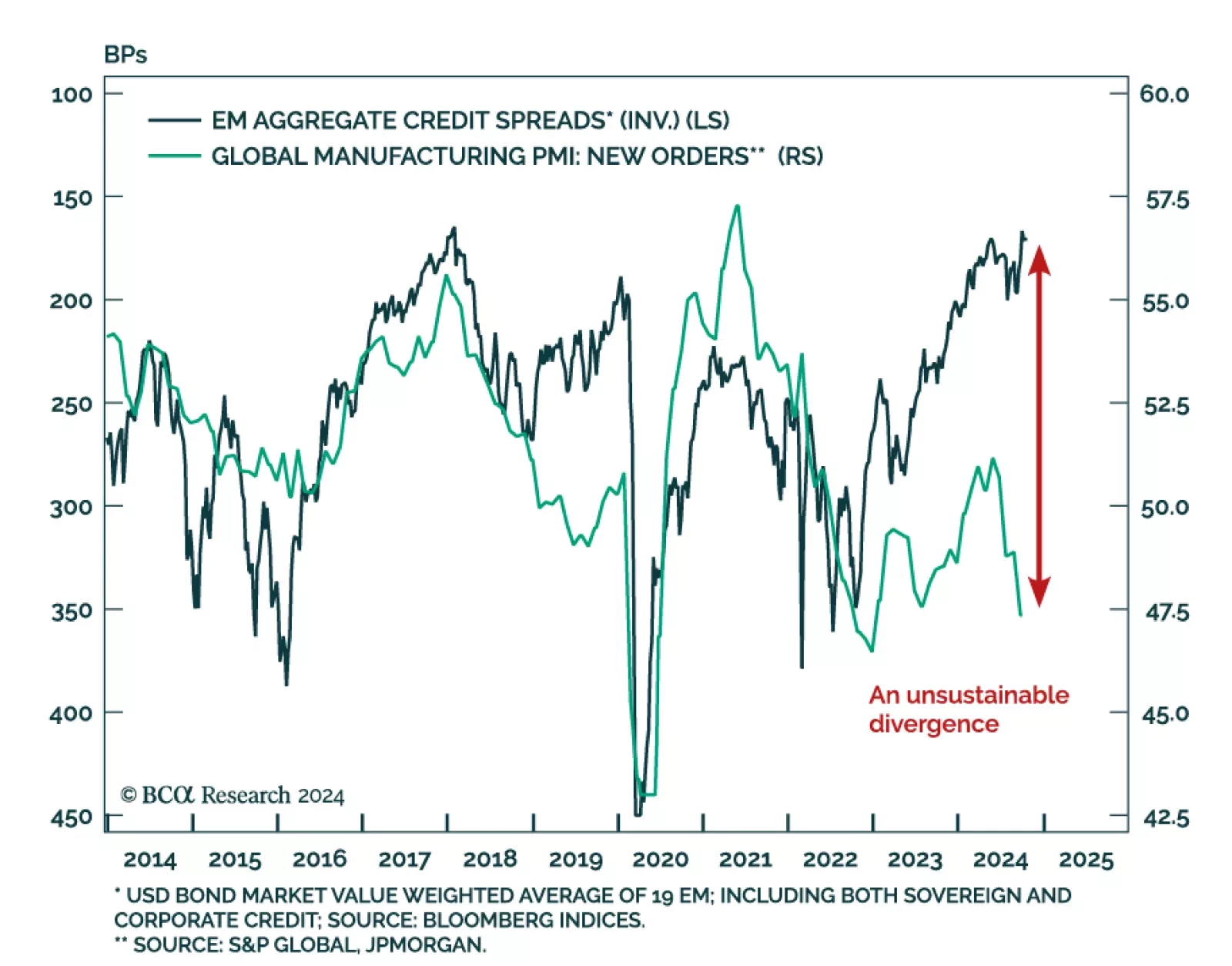

EM credit markets have recently defied the selloffs in EM equities, currencies, local currency bonds, and commodities. According to our Emerging Markets Strategy colleagues, such a decoupling is unusual. A potential Trump re-…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

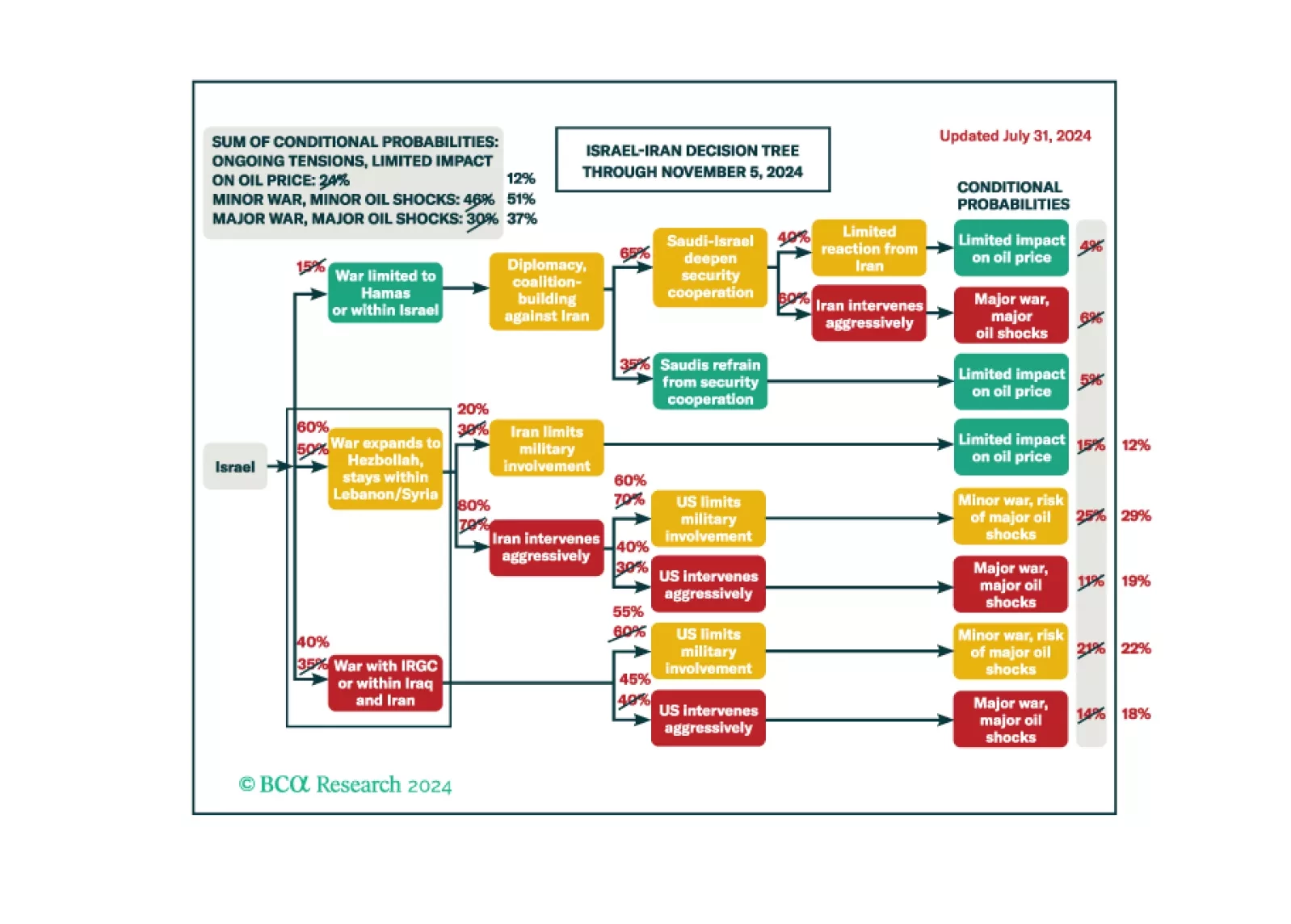

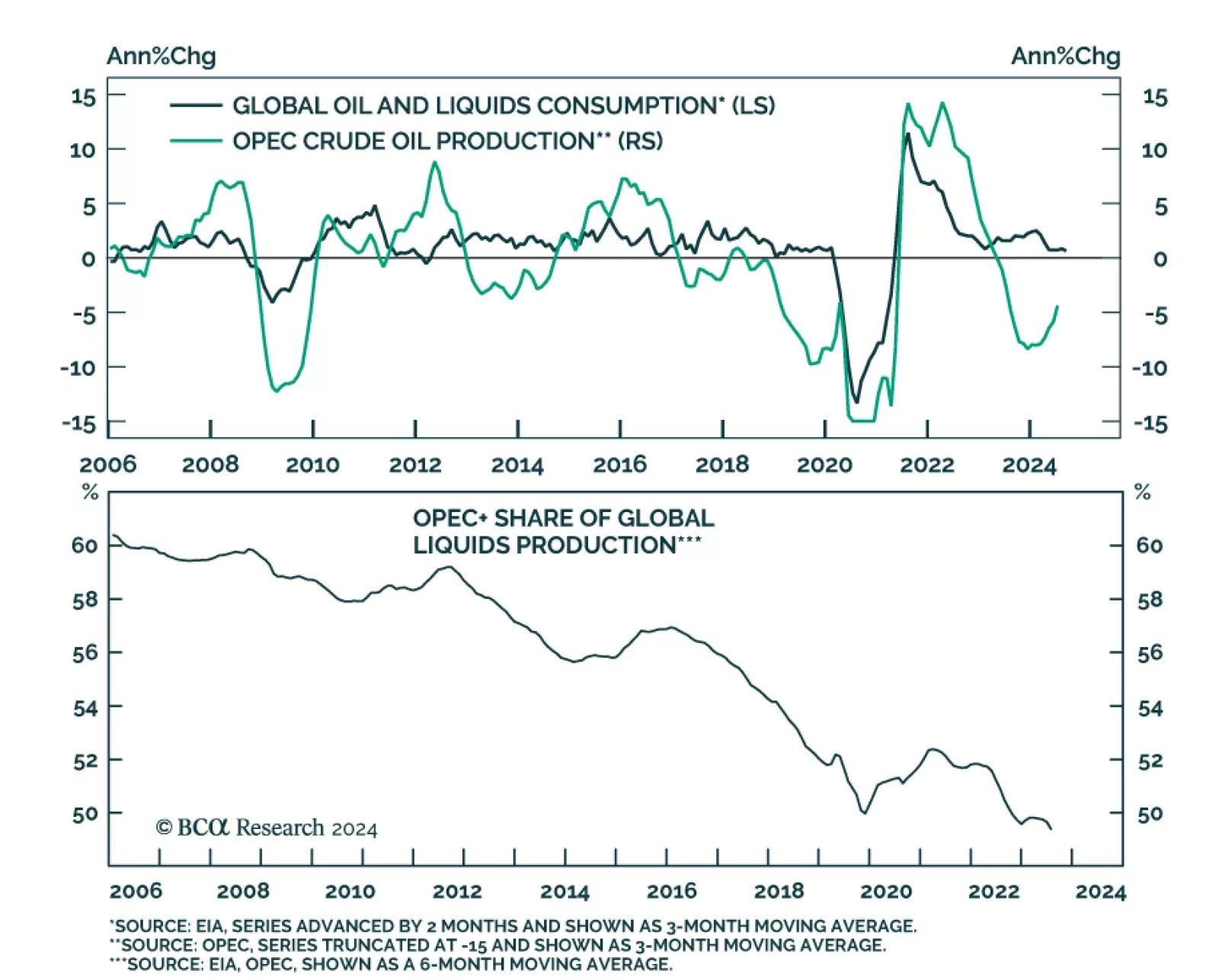

We maintain 37% odds of a major recessionary oil shock, 51% odds of minor shocks, and 12% odds of no shocks.

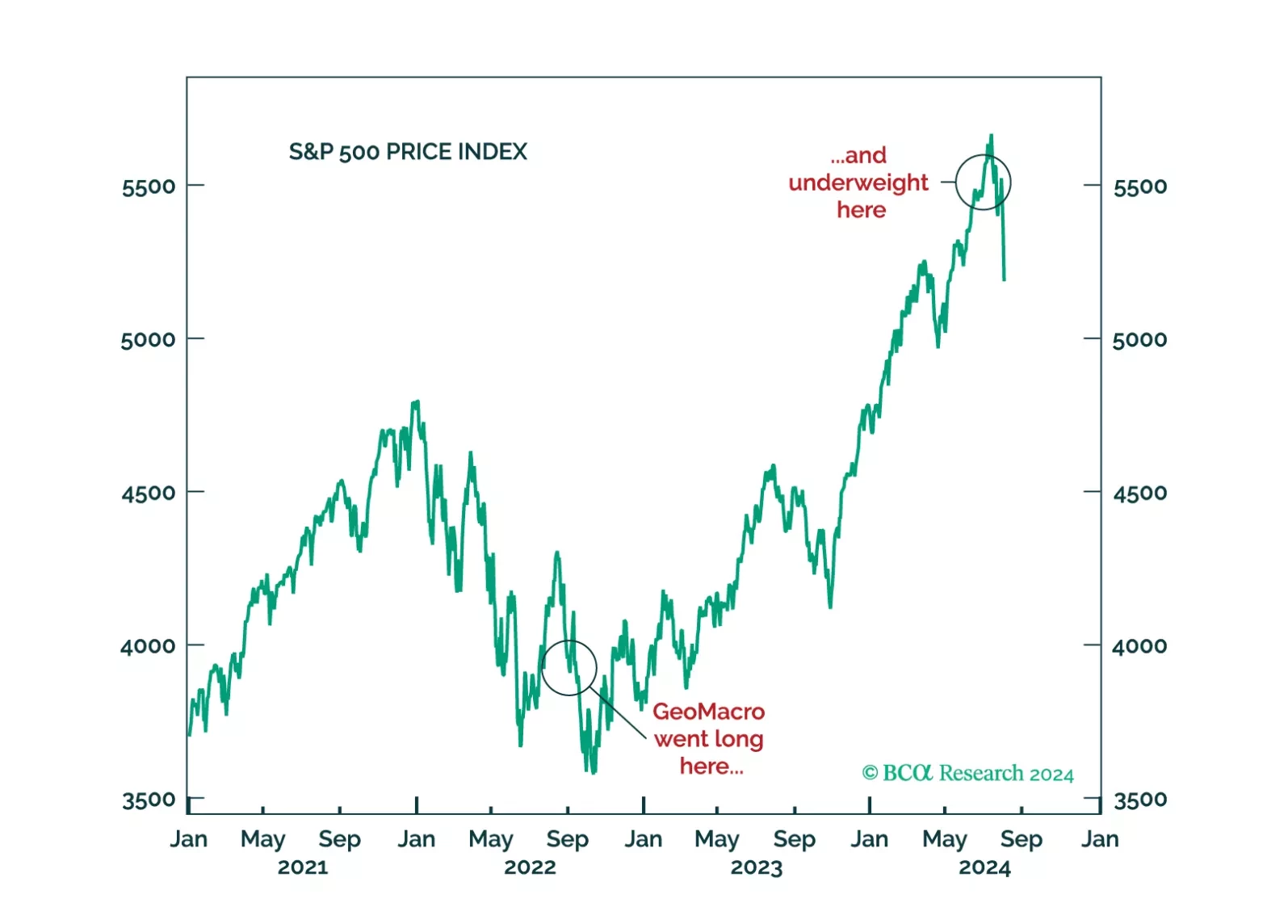

October seasonality tends to be negative for stocks in an election year. That is the only thing that has stayed our hand from shifting out of our tactical underweight on US equities, initiated – poorly – in July.

But the big macro…

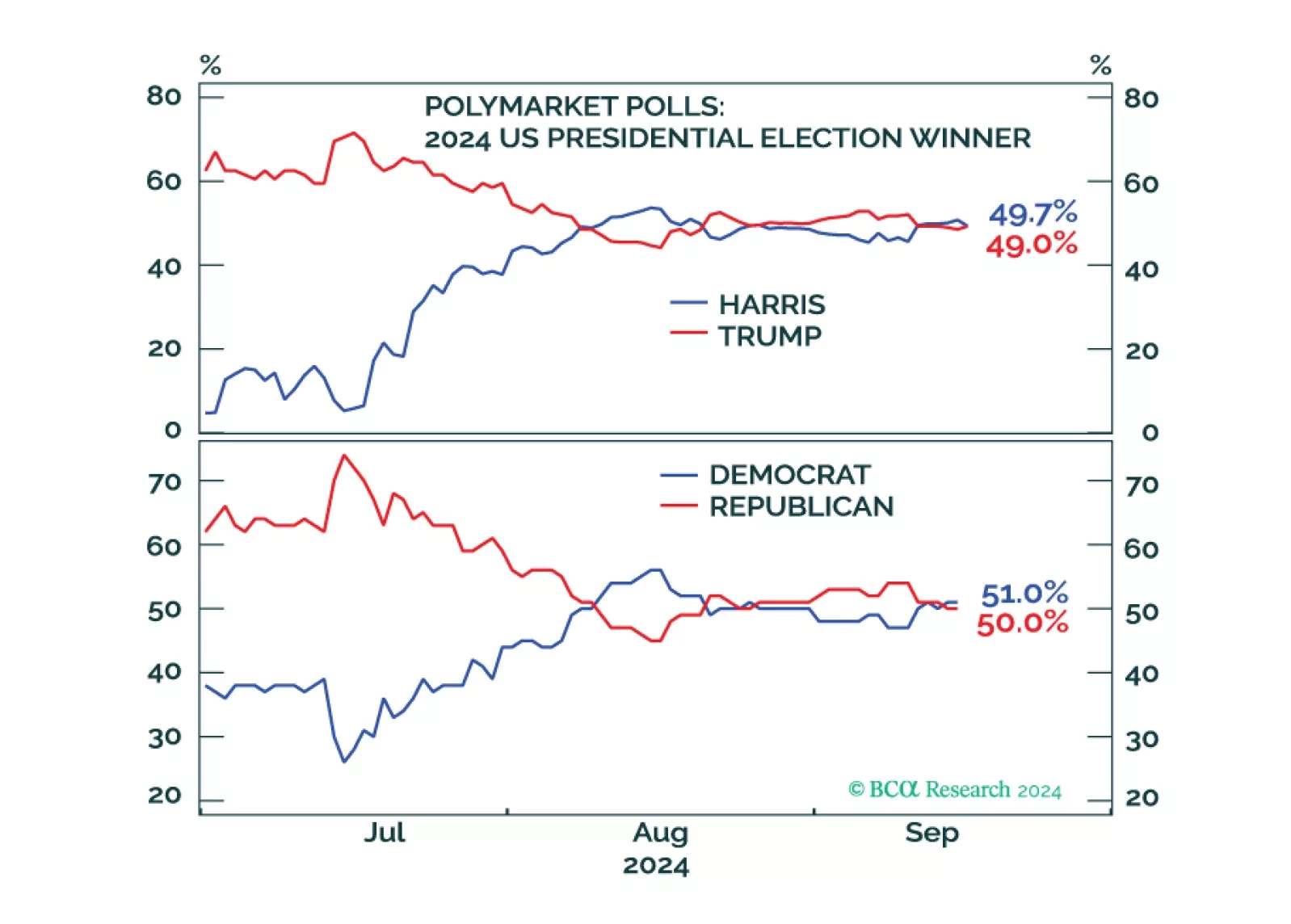

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

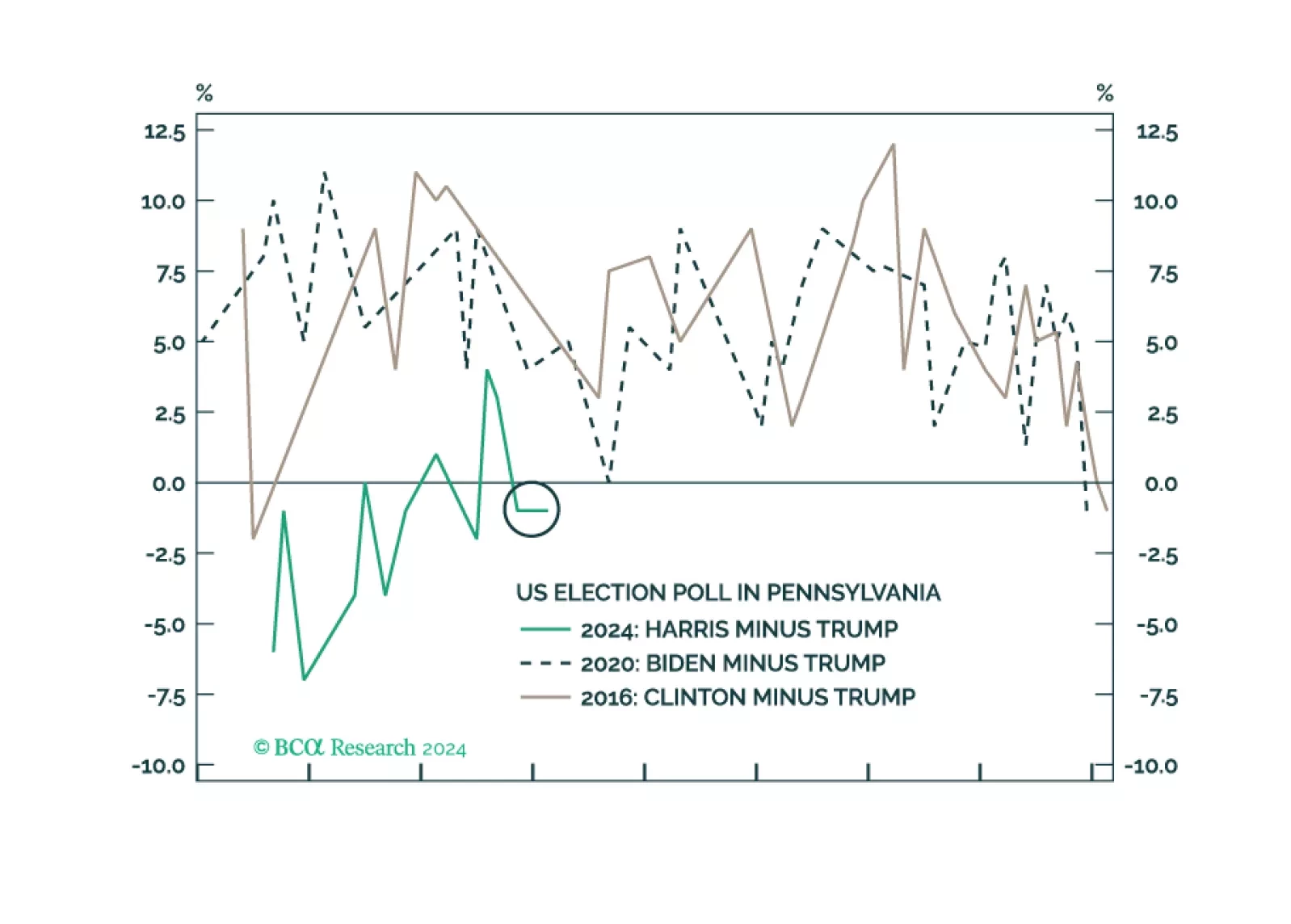

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

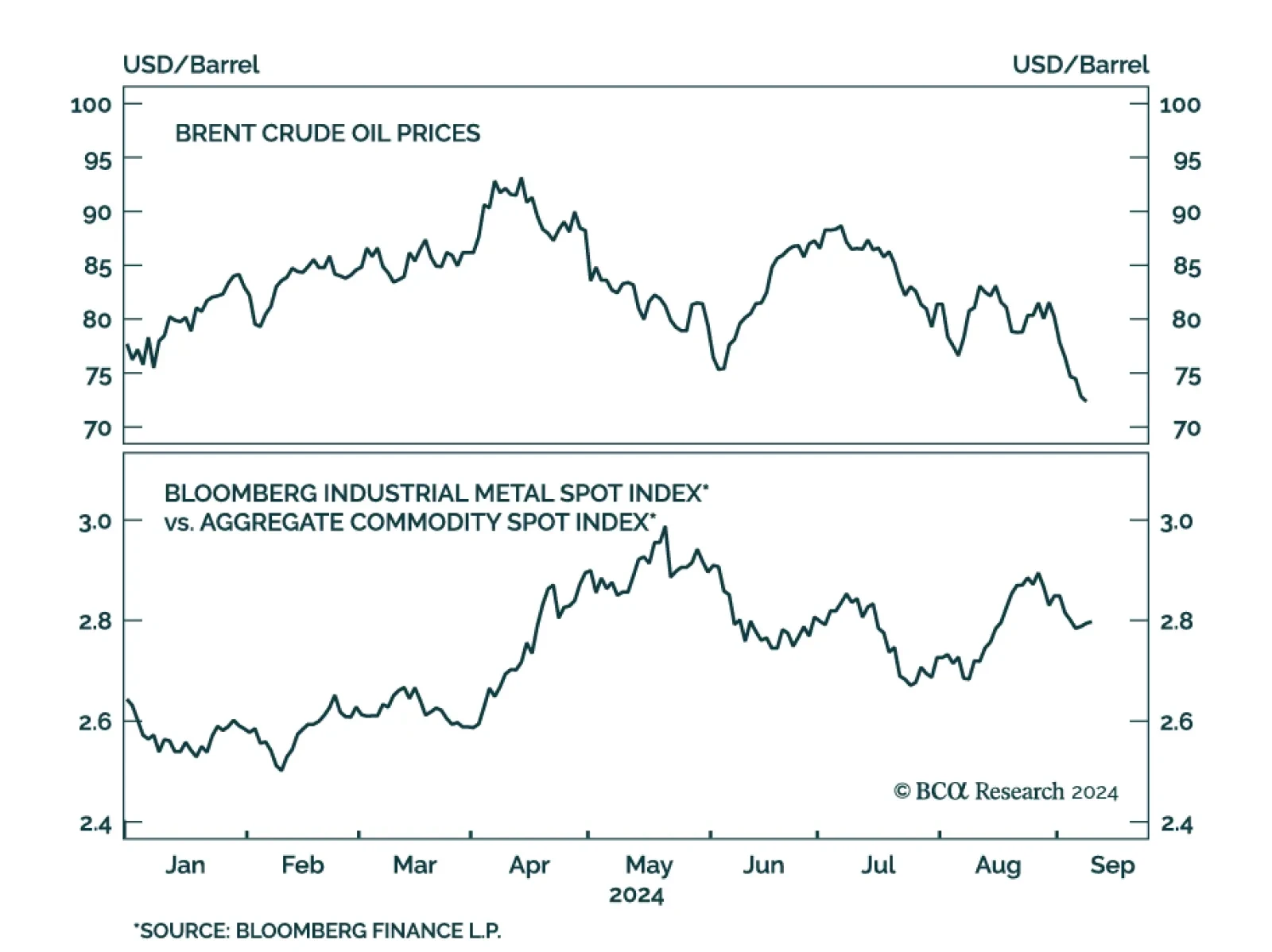

The decline in oil prices accelerated this month. Although Wednesday’s moves reversed Tuesday’s sharp daily declines, Brent and WTI have fallen 11% and 10% so far in September, and 30% and 33% from their April peaks…

Investors should buy protection against further volatility. The shakeup in early August was a taste of things to come. The US election is a pivotal moment in modern history that will drive up uncertainty, while other countries take…

According to BCA Research’s Commodity and Energy Strategy service, soft oil demand growth raises the likelihood that OPEC+ will back down from its plan to begin unwinding some of its production cuts later this year. However…

The decision by GeoMacro team on July 2 to short USDJPY and underweight equities has proven to be prescient. We still do not like the market setup from here on out. A recession would, obviously, be negative for risk assets. But even…