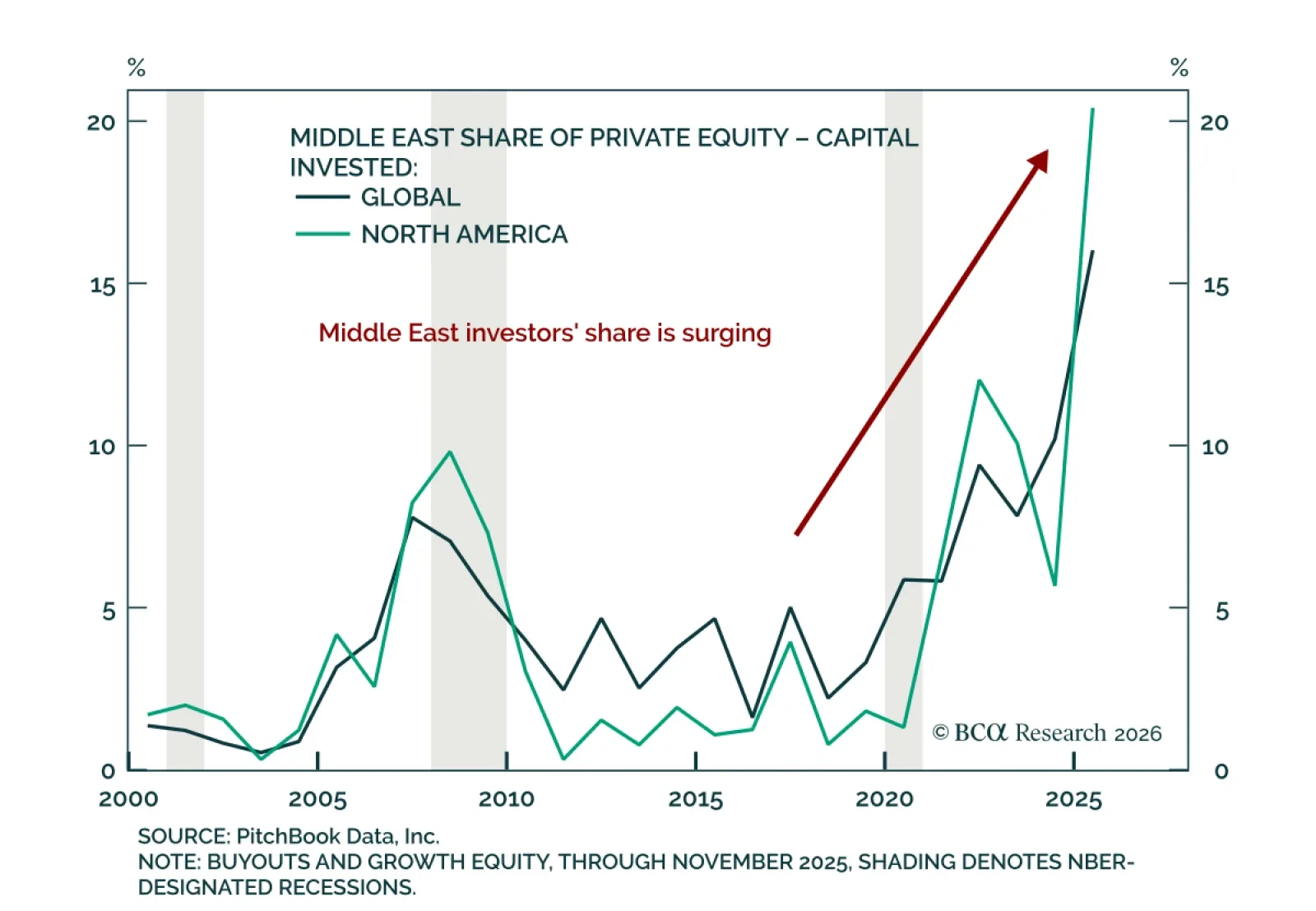

Our Private Markets & Alternatives strategists are turning more constructive on Private Equity heading into 2026, citing an increasingly supportive environment for new commitments. Entry pricing is expected to improve, and…

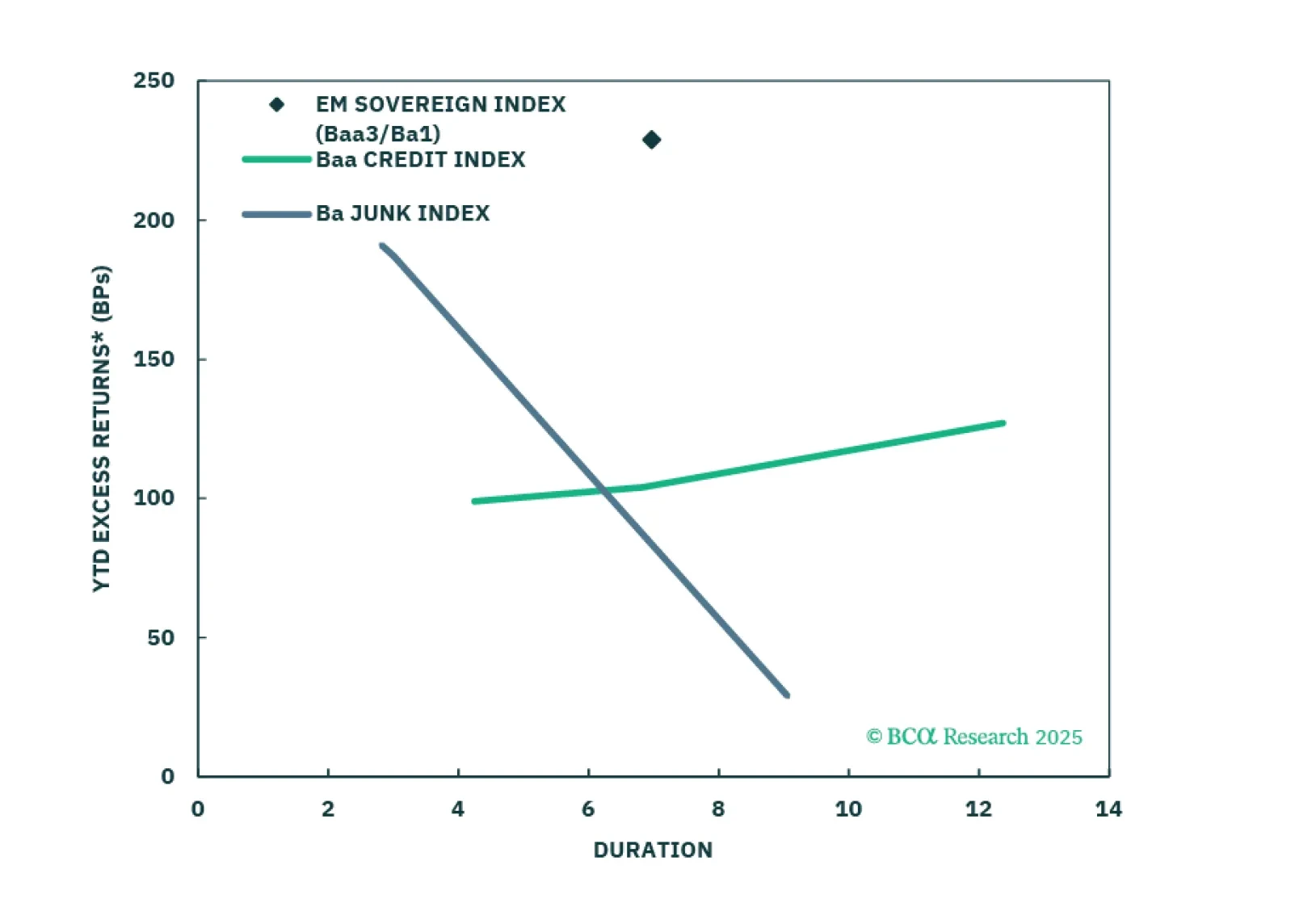

USD-denominated Emerging Market bonds have been outperforming US corporates for the past year. We don’t think the rally is exhausted yet.

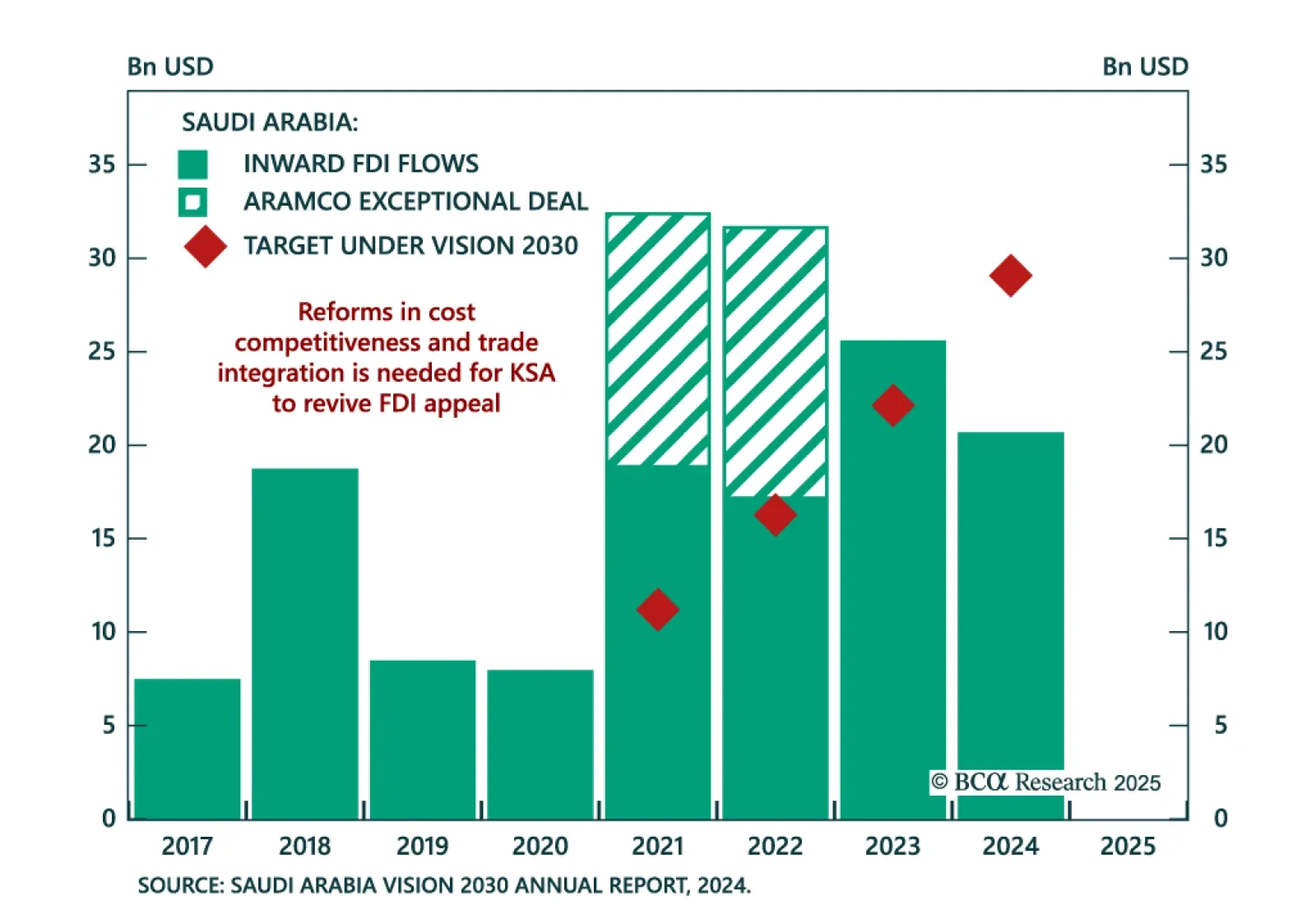

BCA’s GeoMacro strategists argue that Saudi Arabia must reopen to trade and reallocate capital to hit its Vision 2030 FDI targets. The Kingdom ranks mid-table in the FDI Attractiveness Index, weighed down by low trade openness, an…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

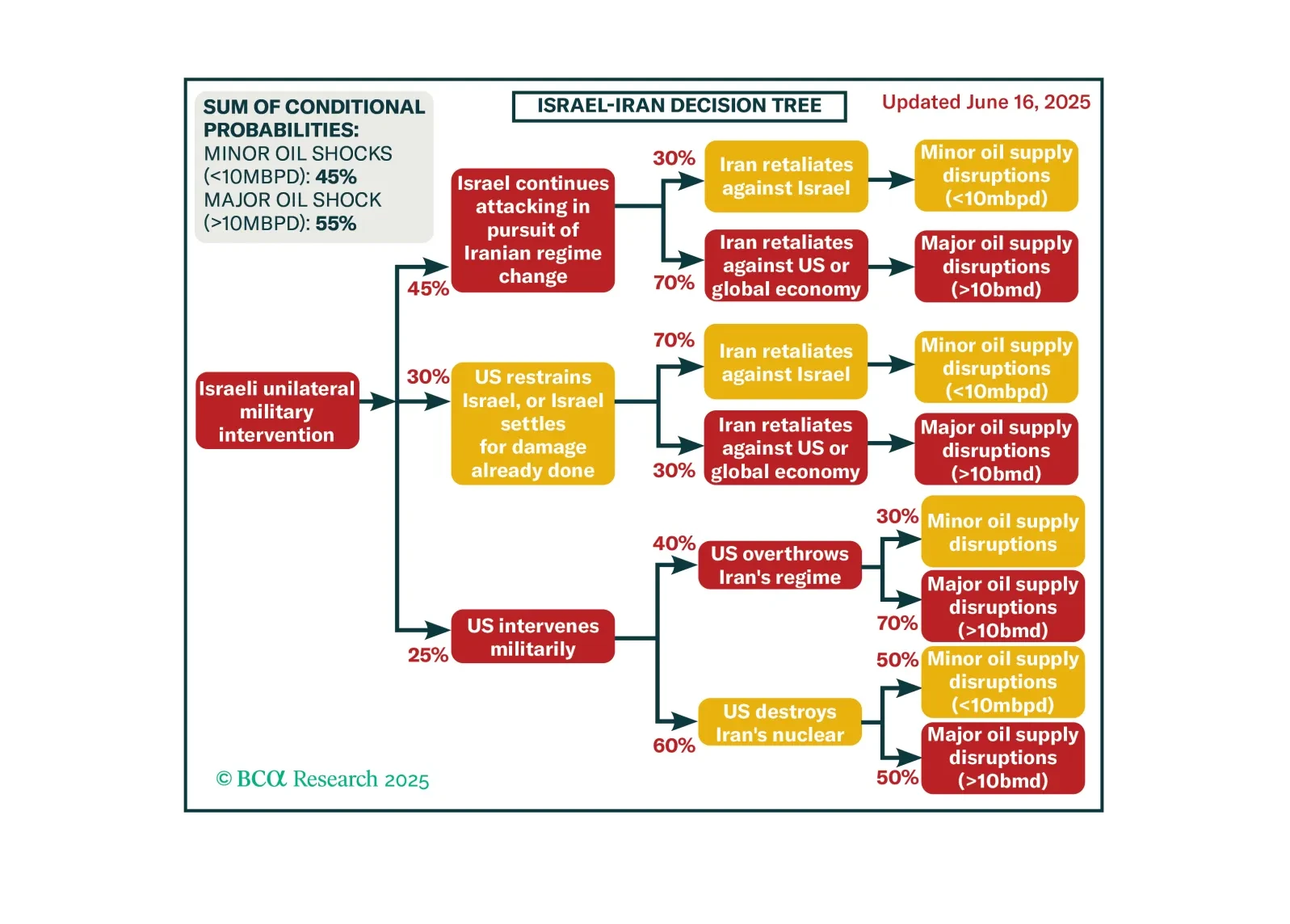

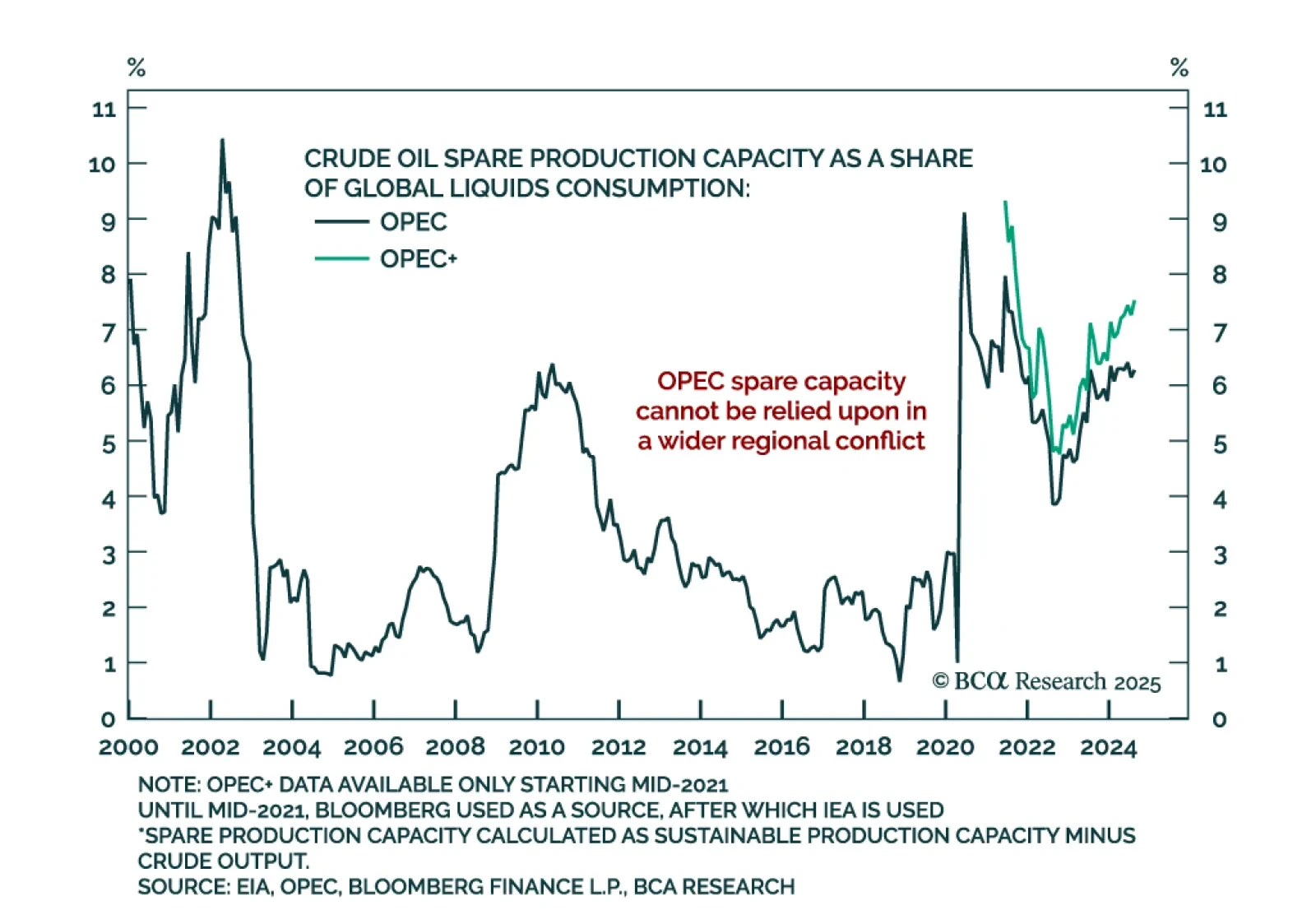

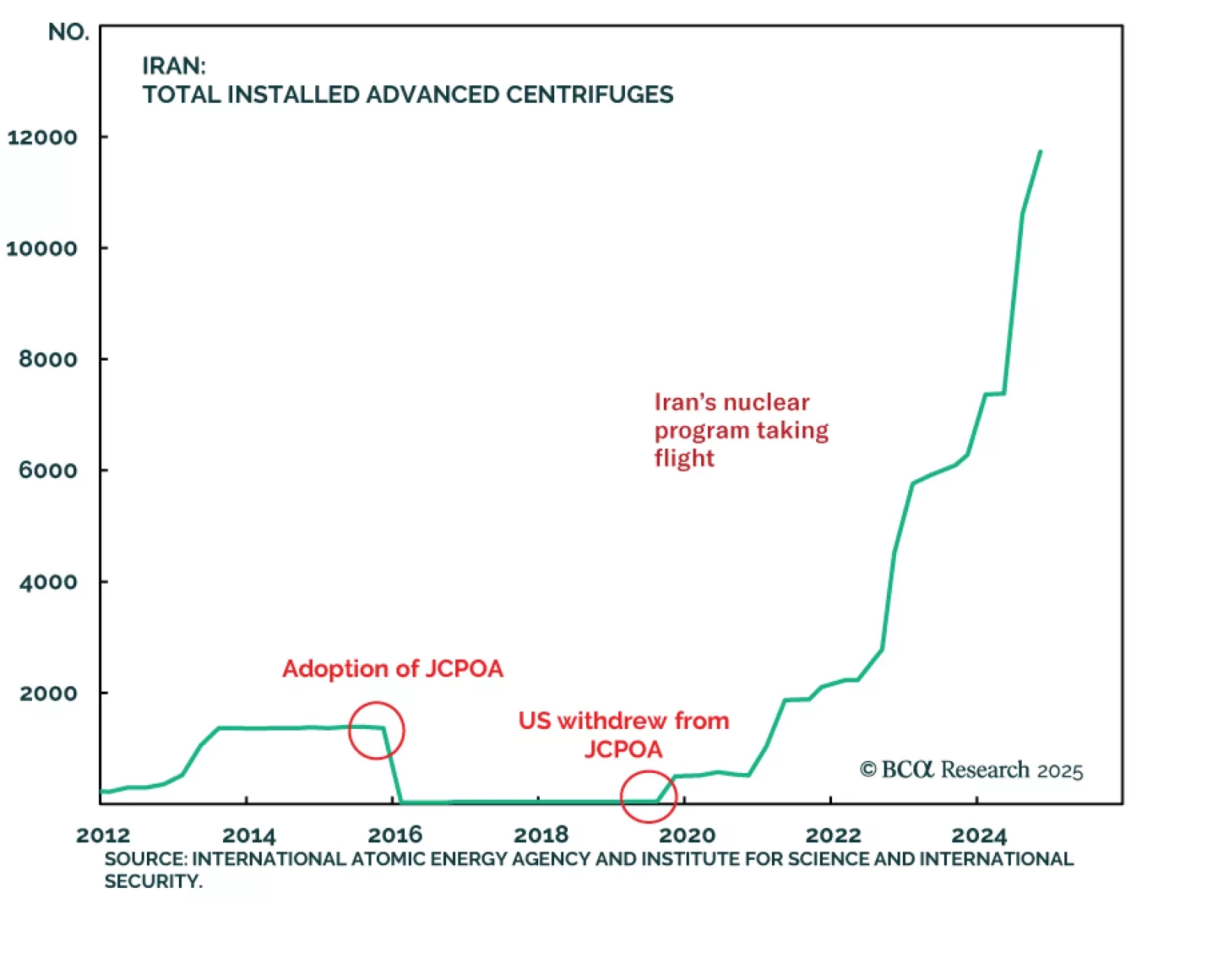

Israel’s attacks on Iran will continue until Iran is forced to strike regional oil supply to get the US to restrain Israel. That may not work. Investors should prepare for a broader economic impact of the conflict.

The Israel-Iran conflict is escalating, raising the odds of a major oil supply shock and reinforcing the case for cash, US equity overweight, and tactical energy exposure. Our Chart Of The Week comes from Matt Gertken, Chief…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

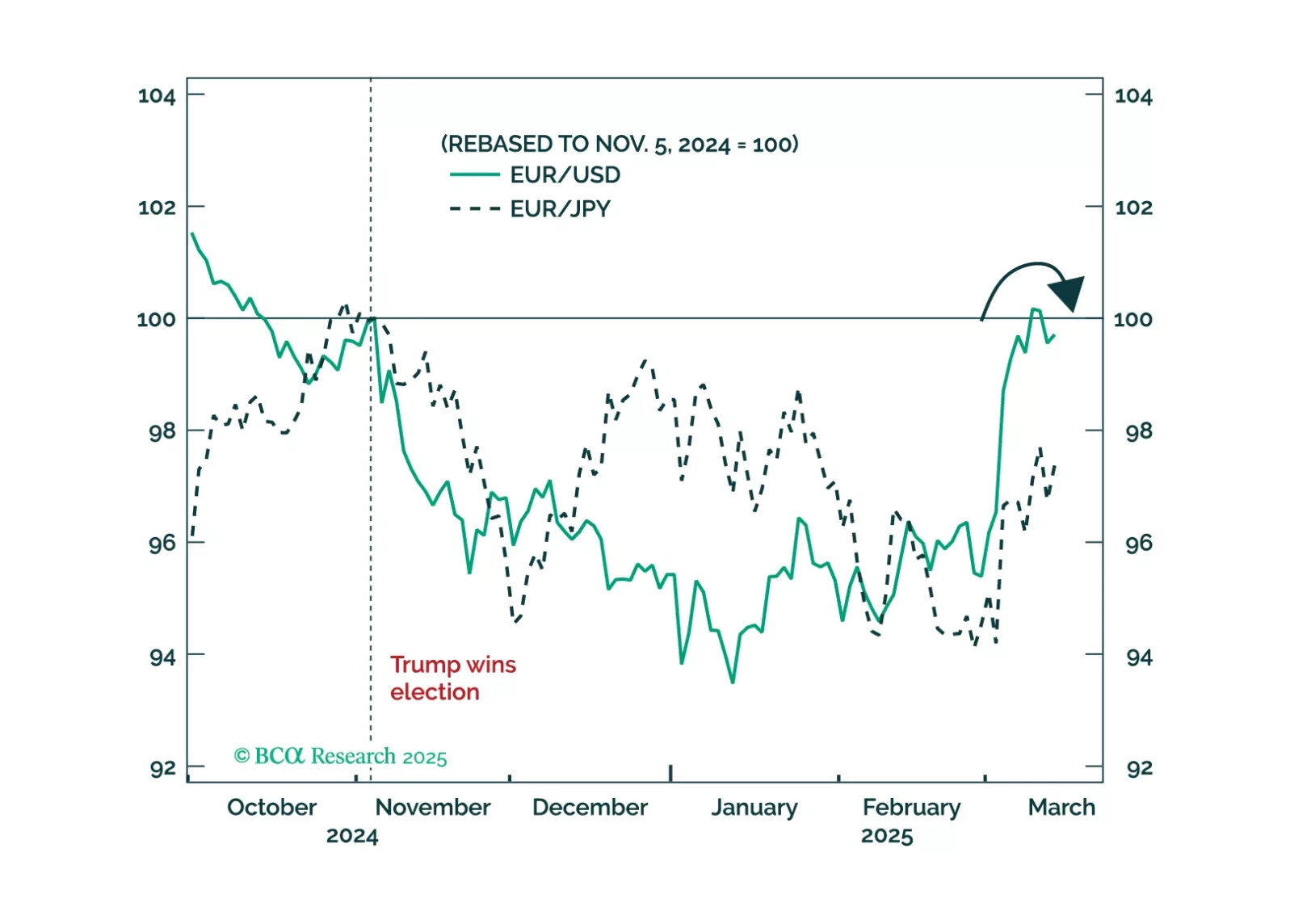

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

Our Geopolitical Strategy colleagues published their annual “Black Swan” report, where they outline low-odds scenarios that could have a major impact on financial markets. Here is the 2025 edition: China’s Policy Reversal: A…