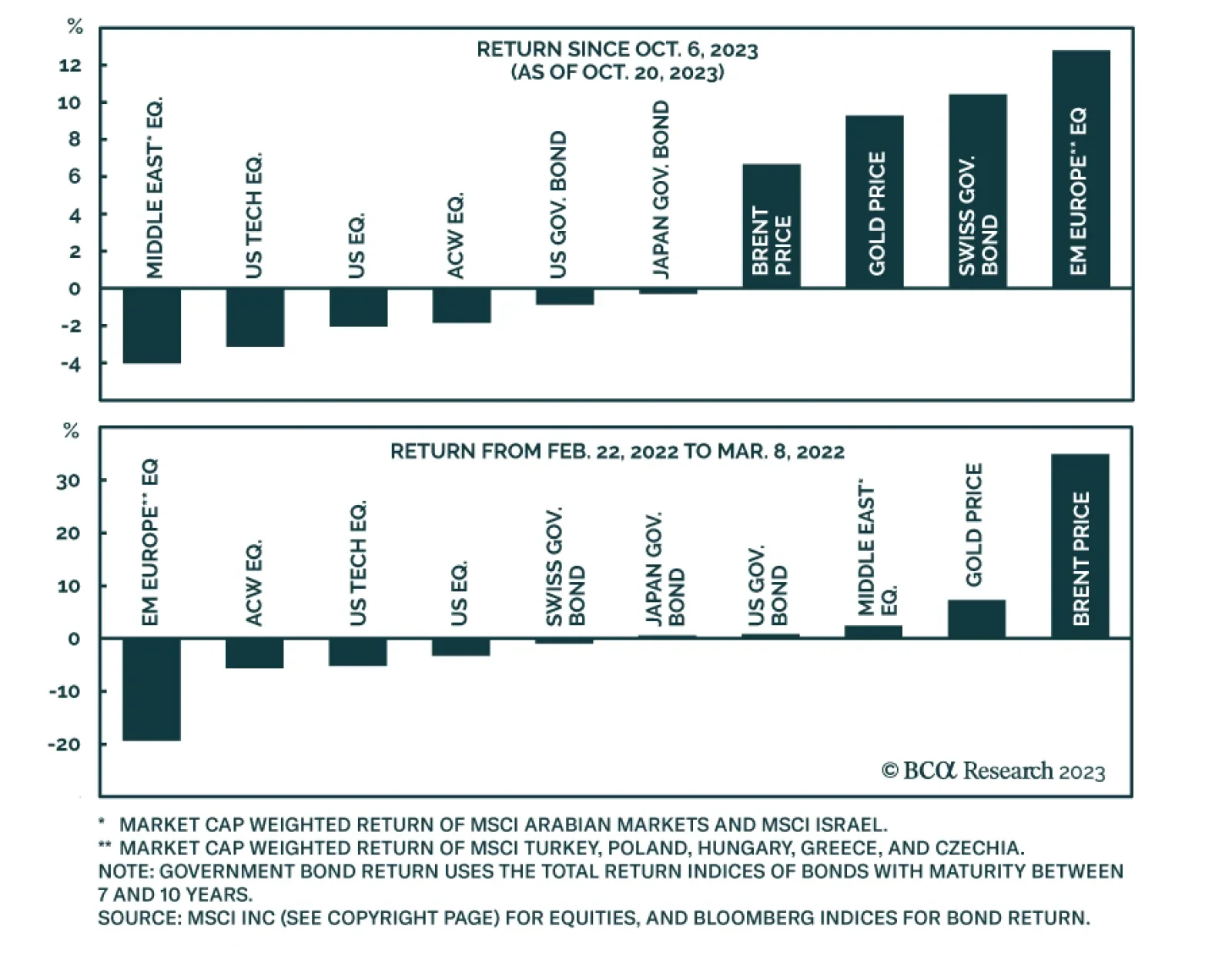

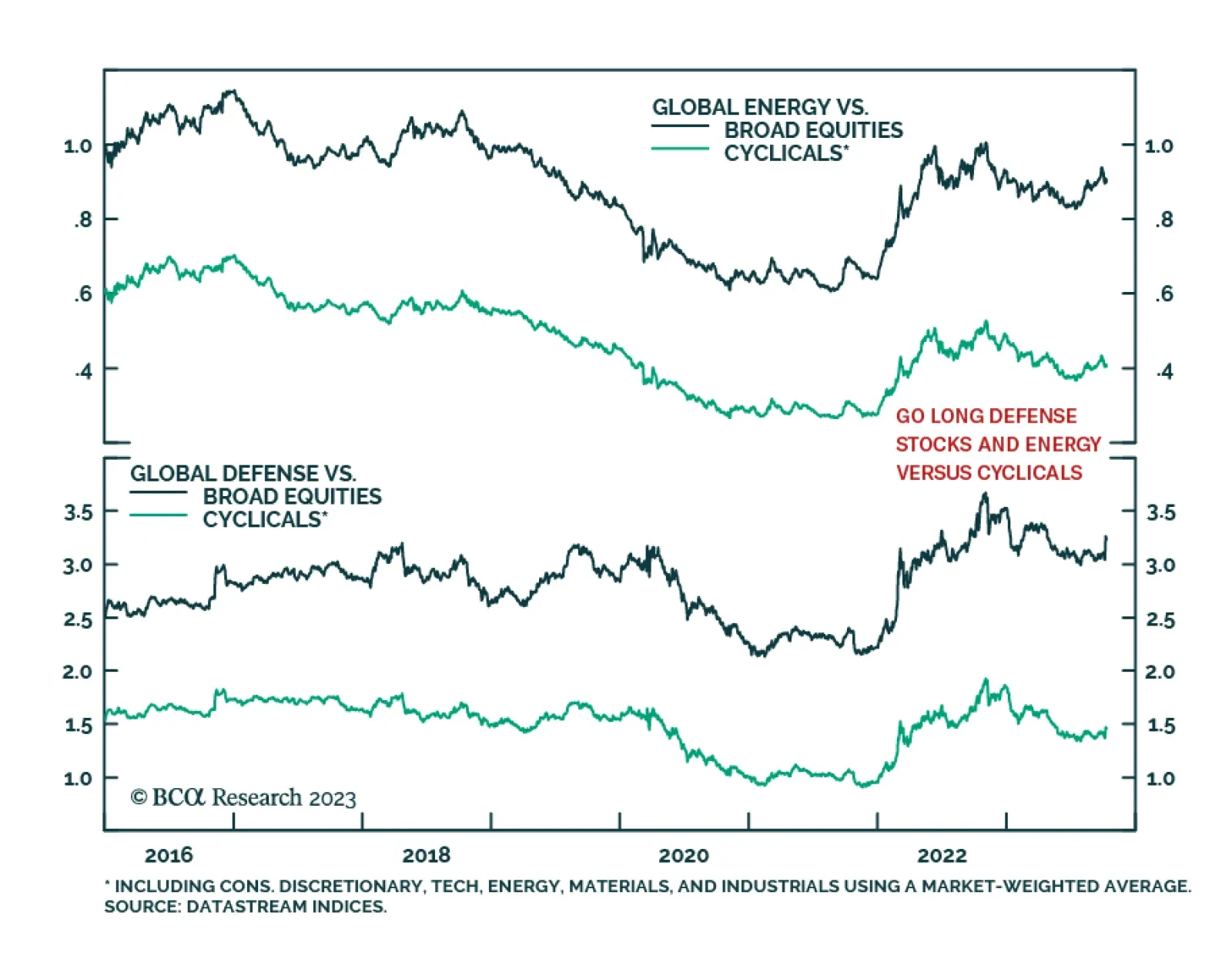

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.

Geopolitical risk is returning to the market after a hiatus for most of 2023. Global investors are now realizing what our geopolitical strategists have argued all year: that the rise in geopolitical risk is a secular trend…

According to BCA Research’s Geopolitical Strategy service, Israel’s retaliation against Hamas has a 70% chance of expanding beyond Gaza in some form over the coming 12 months. The team’s scenarios and…

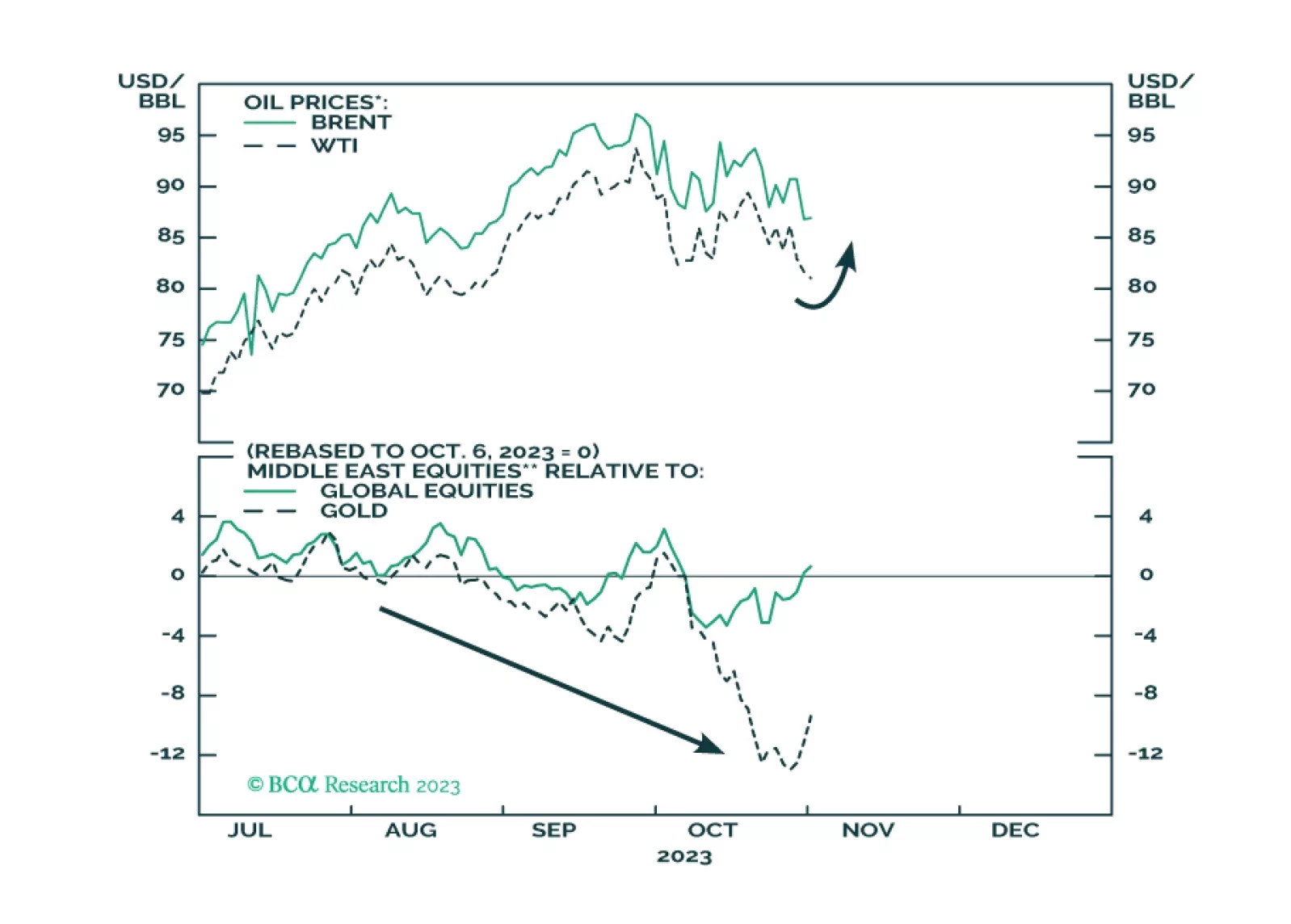

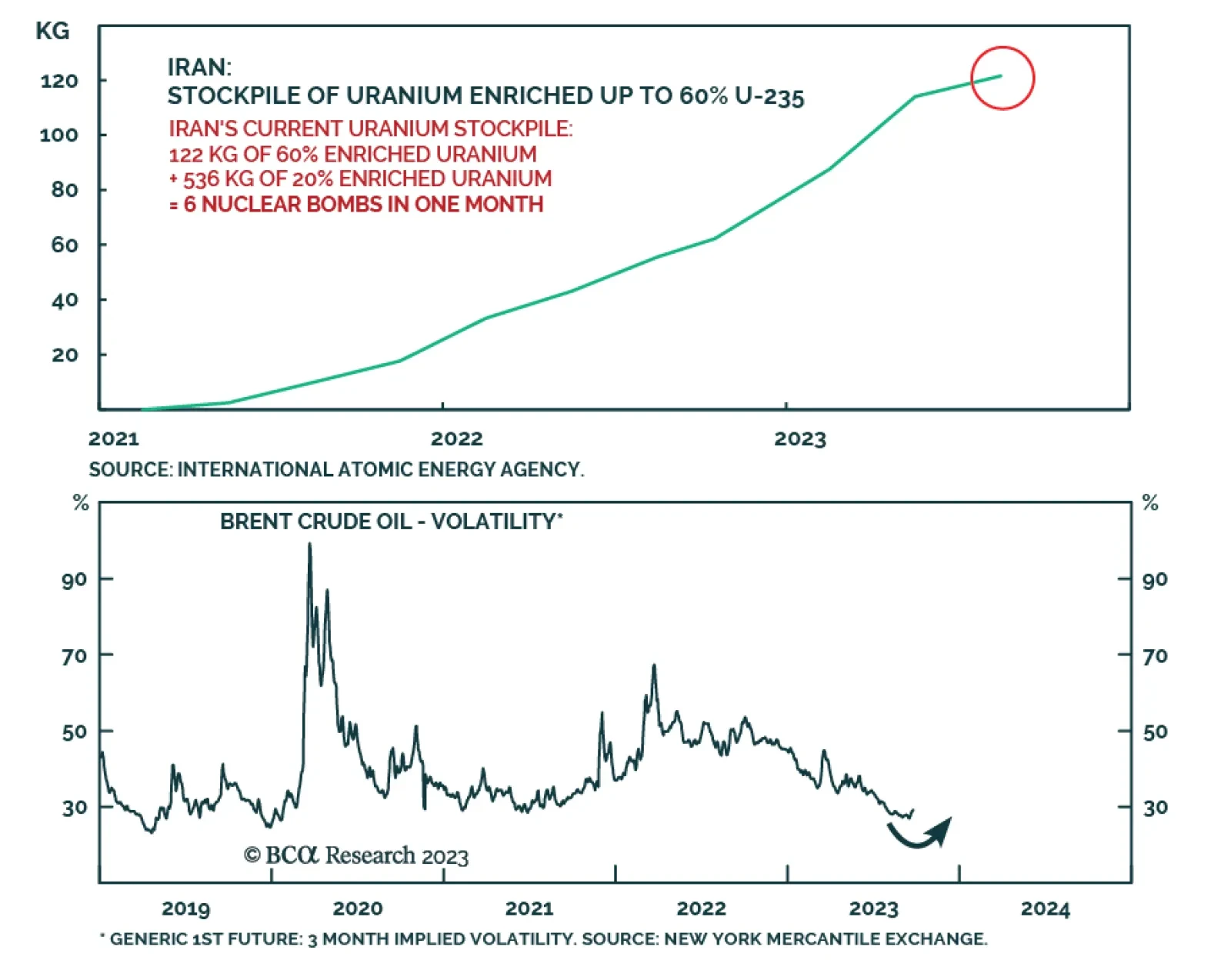

According to BCA Research’s Geopolitical Strategy service, volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. Everything depends on whether…

Volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. The risk of a major oil supply shock has gone up, but meanwhile supply constraints will remain at…

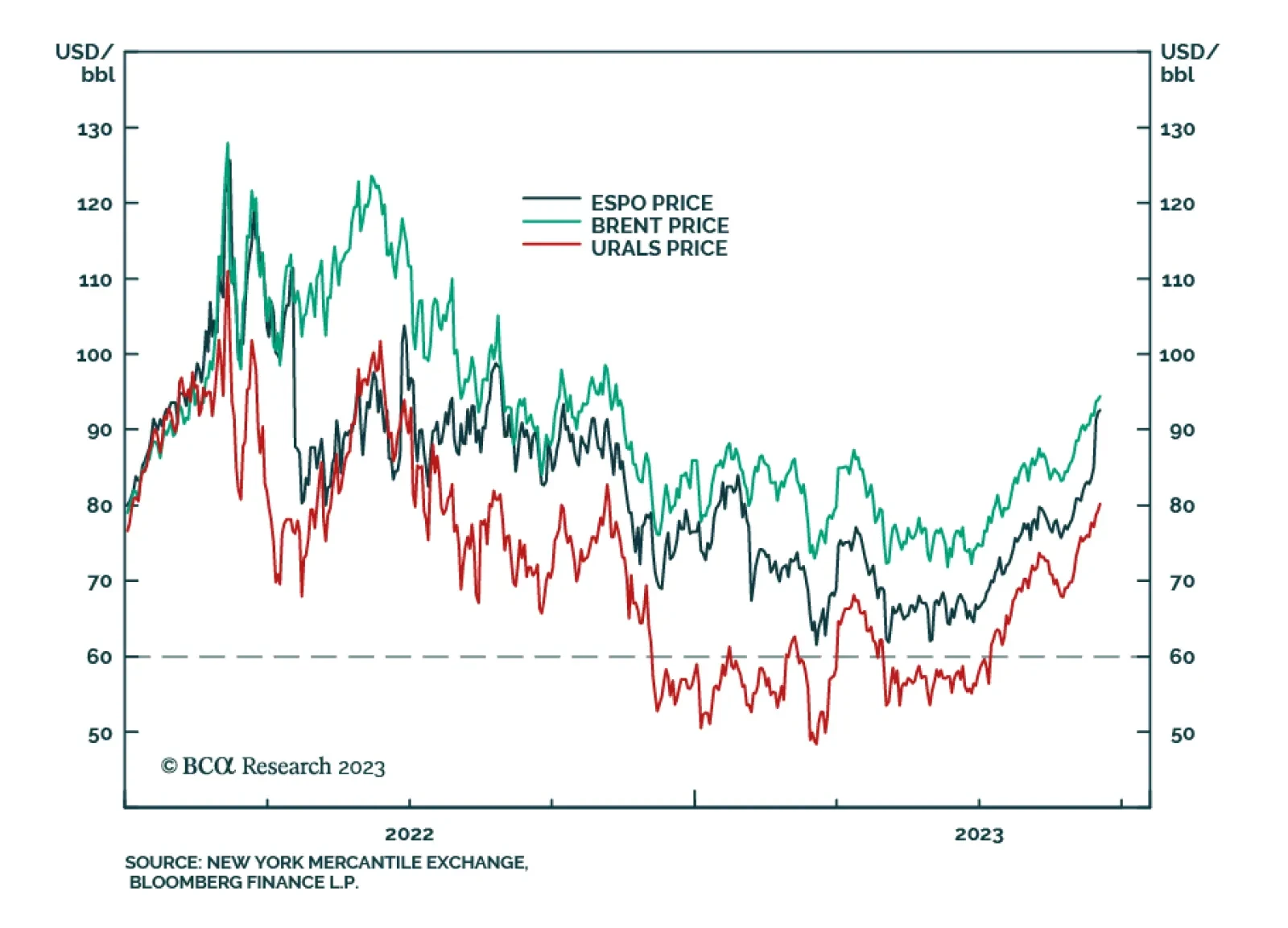

Our Commodity & Energy Strategy colleagues’ once-out-of-consensus call on crude oil prices – i.e., benchmark Brent prices averaging $94/bbl in 2H23 and trading above $100/bbl by December – now is the…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…