While the media has zeroed in on the newly announced tariffs on Mexico late last week, tariffs on Indian imports and the narrowly avoided Australia trade war front barely made the news. This heightened policy uncertainty has…

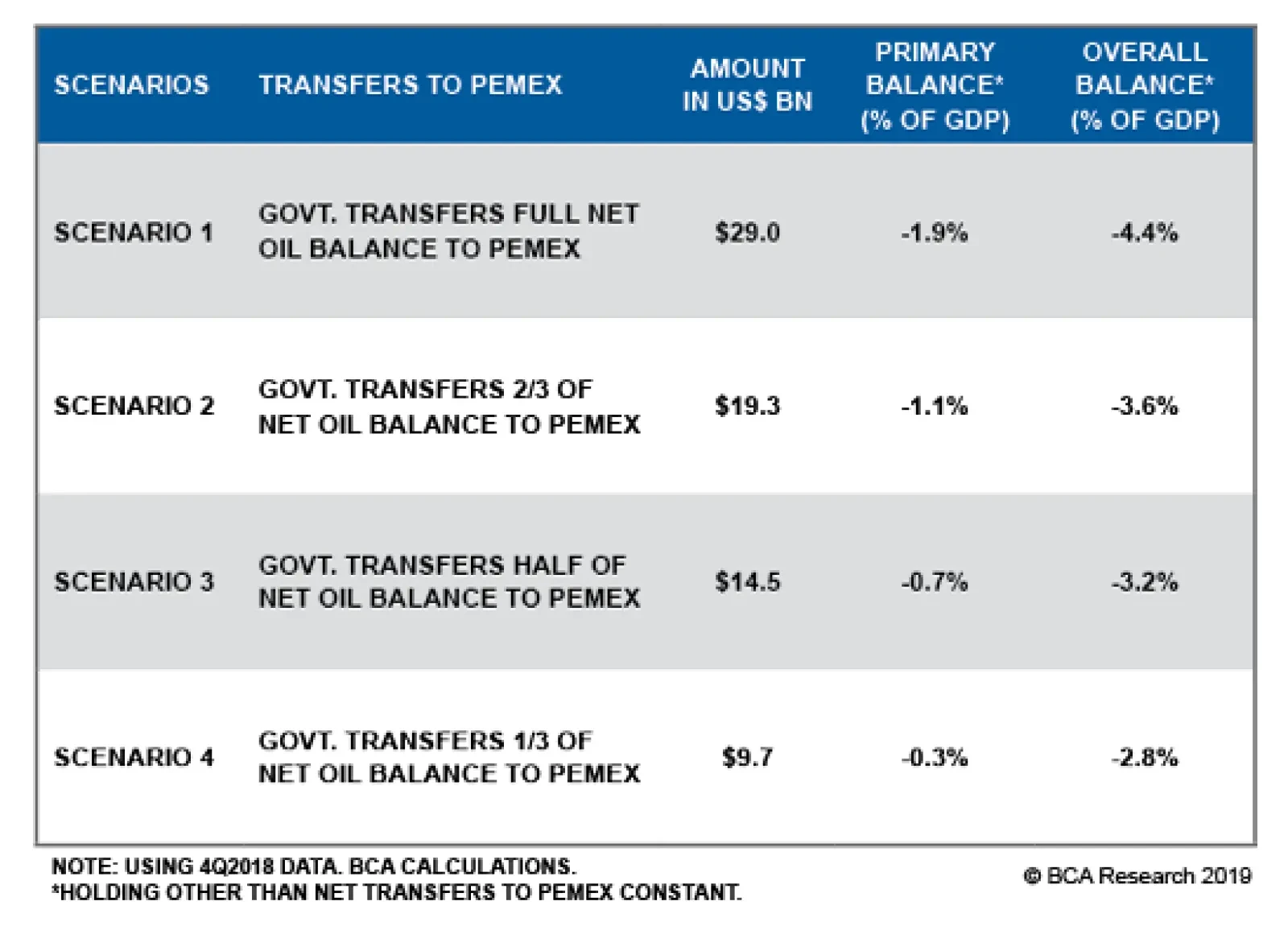

Our Emerging Markets Strategy team performed a simulation including in the public budget, all of Pemex’s payments and all its receipts from the government. While the overall fiscal position deteriorates, it is not…

Our Emerging Markets Strategy team has incorporated Pemex into their budget analysis. The resulting fiscal deterioration is not calamitous. Specifically, international credit agencies estimate that Pemex needs an additional $13…

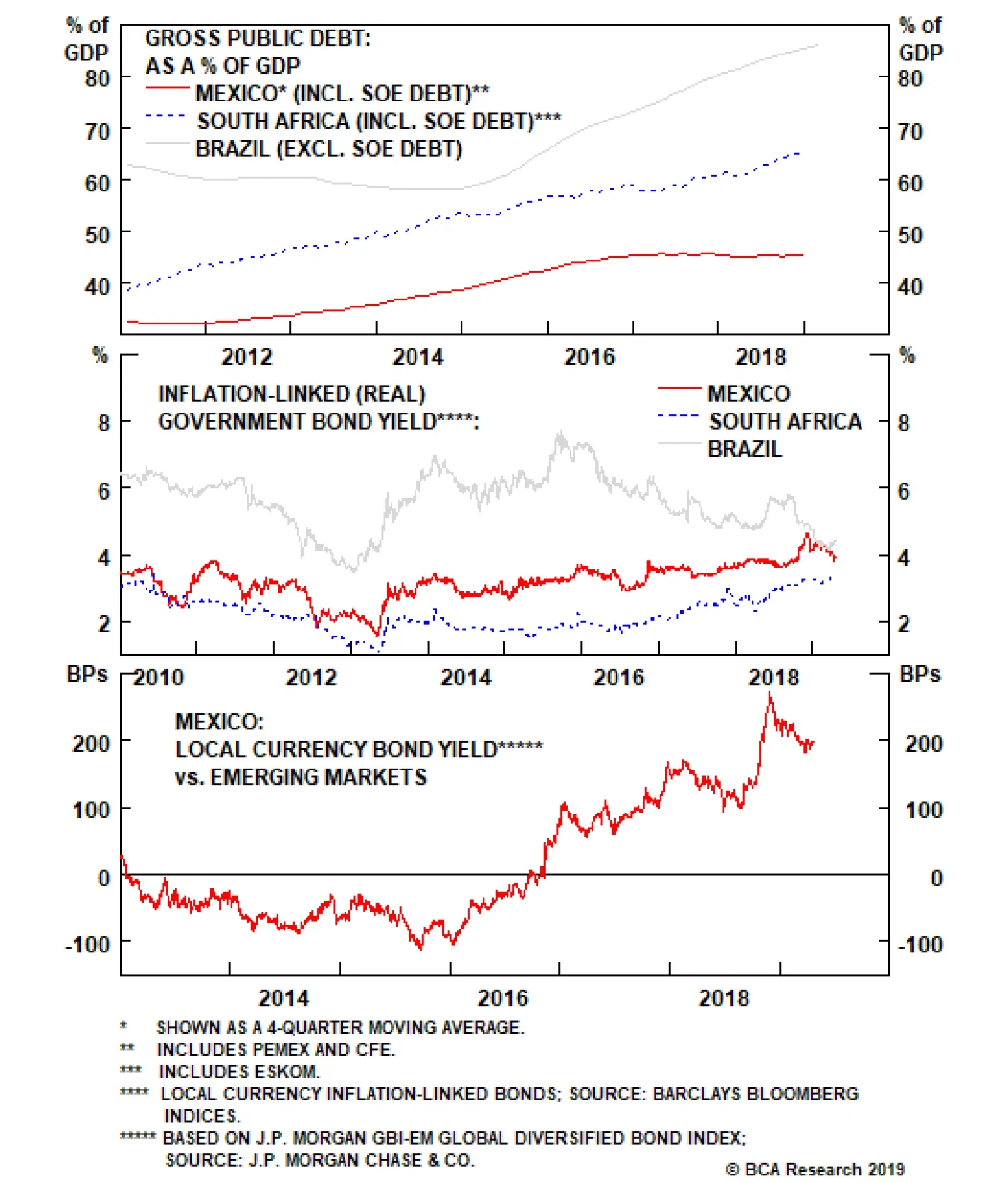

Although, a closer look at debt sustainability in Mexico reveals a different picture. Mexico’s public debt level including the debt of state-owned enterprises is lower than those in Brazil and South Africa. Notably, Mexico…

Highlights We continue to recommend overweighting Mexican local fixed-income markets, the peso and sovereign credit relative to their respective EM benchmarks. A new trade: Sell Mexican CDS / buy Brazilian and South African CDS.…

Highlights Spread Product Valuation: Corporate bond spreads don’t look especially cheap relative to average historical levels. But they are far too elevated for the current phase of the economic cycle. Valuations in other spread…

Highlights Please note that country sections on Mexico and Colombia published below. The policy stimulus in China could produce a growth revival in the second half of 2019, but there are no signs of an imminent bottom in China’s…

Chart II-1Fiscal Tightening In 2019 Mexican financial markets have rebounded, outperforming their EM counterparts since mid-December. This outperformance has further upside because the AMLO administration is proving to be less…

Highlights So What? Global divergence will persist beyond the near term. Why? China’s stimulus will be disappointing unless things get much worse. U.S.-China trade war will reignite and strategic tensions will continue.…