Highlights Continued upgrades to global economic growth – most recently by the IMF this week –will support higher natgas prices. In our estimation, gas for delivery at Henry Hub, LA, in the coming withdrawal season (…

Highlights The Biden Administration's $2.25 trillion infrastructure plan rolled out yesterday will, at the margin, boost global demand for energy and base metals more than expected later this year and next. Global GDP growth…

Dear client, In addition to this week’s abbreviated report, we are also sending you a Special Report on currency hedging, authored by my colleague Xiaoli Tang. Xiaoli’s previous work mapped out a dynamic hedging strategy for…

Highlights Market-based geopolitical analysis is about identifying upside as well as downside risk. So far this year upside risks include vaccine efficacy, coordinated monetary and fiscal stimulus, China’s avoidance of over-…

The outlook for the US domestic economy is brightening. The worst of the latest surge in COVID-19 infections is behind us while the rollout of vaccines is gathering pace. This improvement is being registered in the counter…

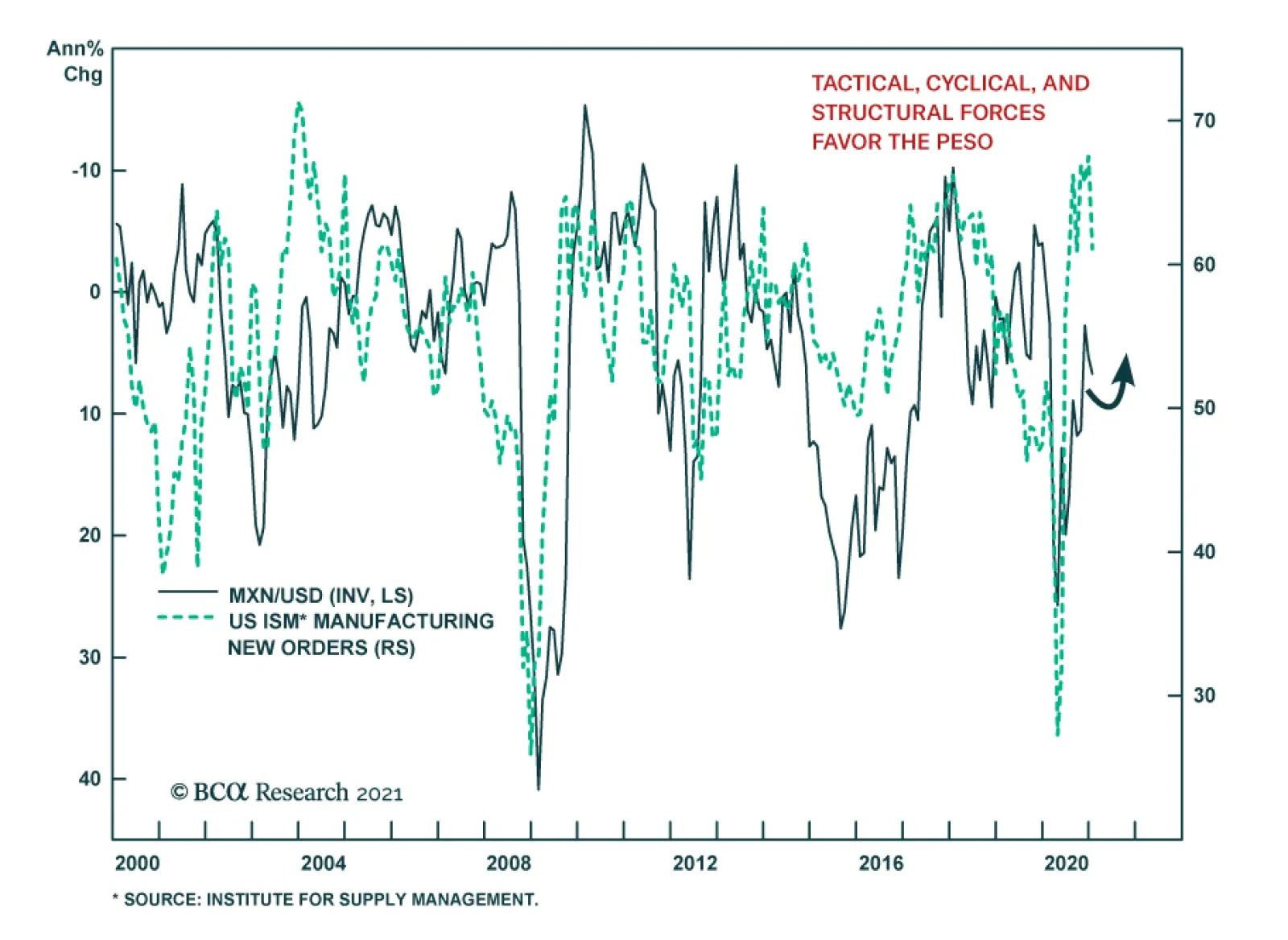

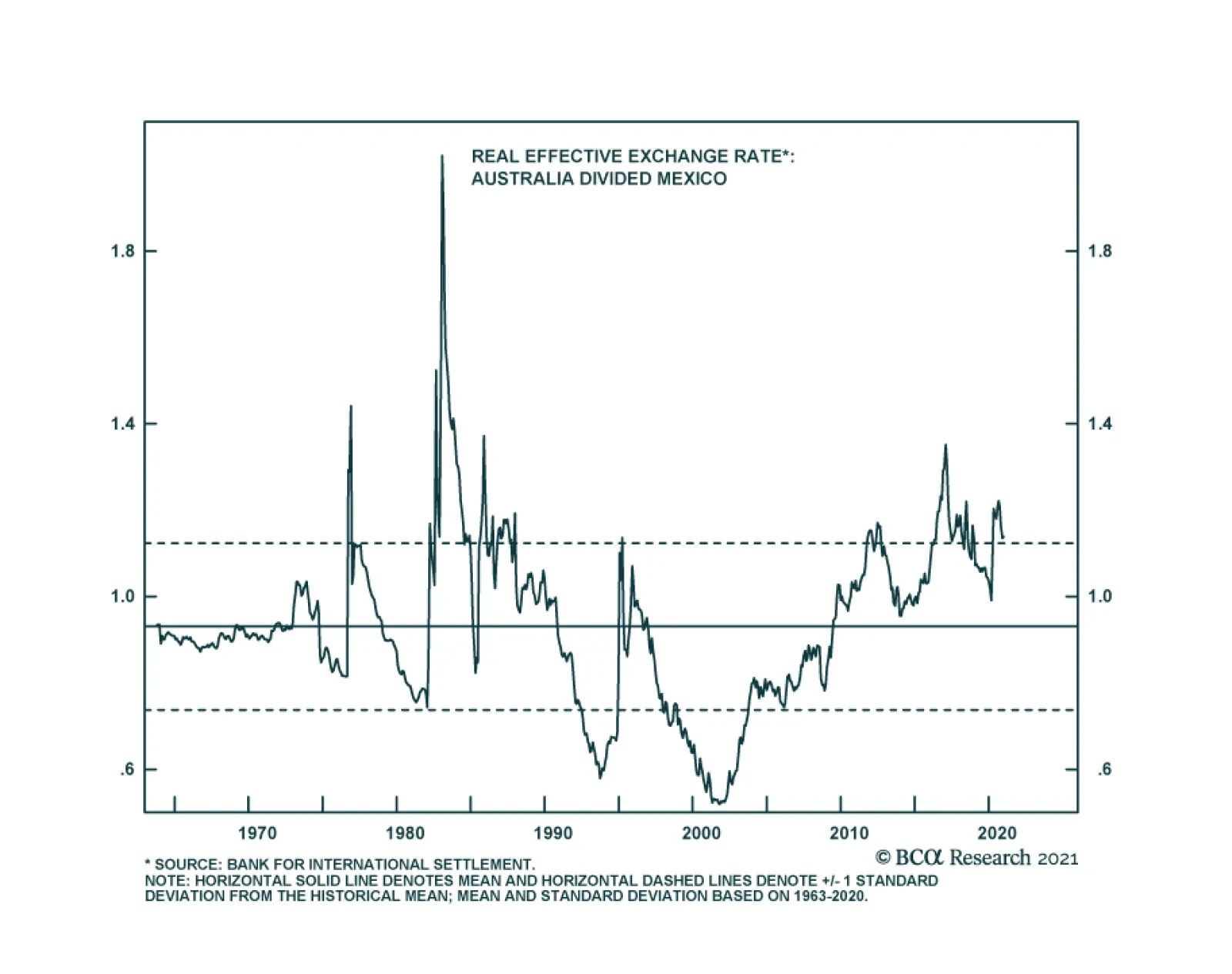

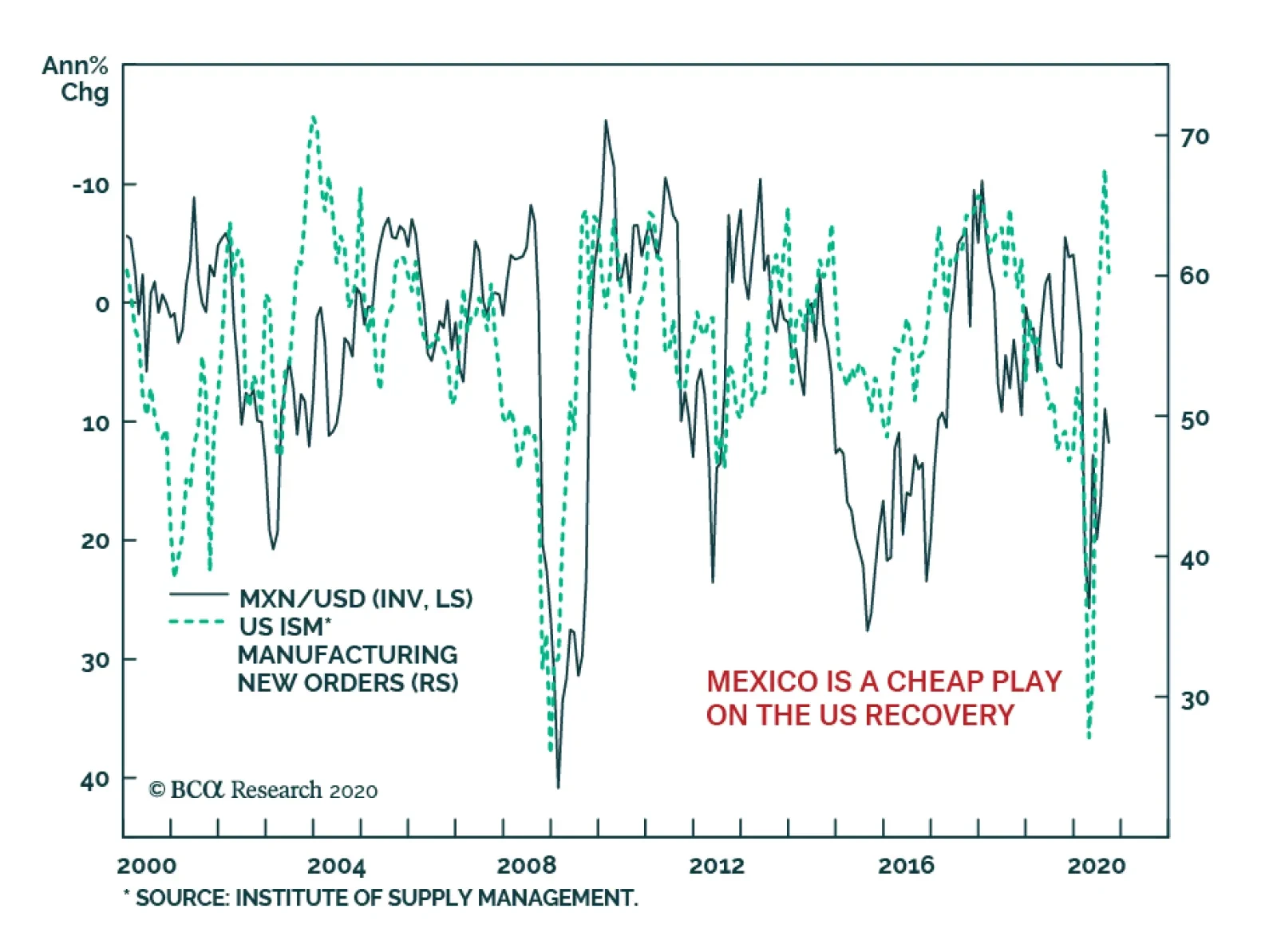

According to BCA Research’s Foreign Exchange Strategy service highlights a tactical opportunity to go short the AUD/MXN cross. Three catalysts underpin this thesis: relative economic activity, valuation, and sentiment.…

Highlights For the month of February, our trading model recommends shorting the US dollar versus the euro and Swiss franc. While we agree a barbell strategy makes sense, we would rather hold the yen and the Scandinavian currencies.…

Mexican equities have steadily underperformed their US counterparts since early 2013, when a large wave of peso depreciation began. Mexican stocks have also underperformed EM equities significantly this year. Could Mexican assets…

We have been overweight Mexican sovereign credit and local currency bonds as well as equities relative to the respective EM benchmarks. Our rationale for this stance has been the fact that Mexico’s macro risk premium relative to…