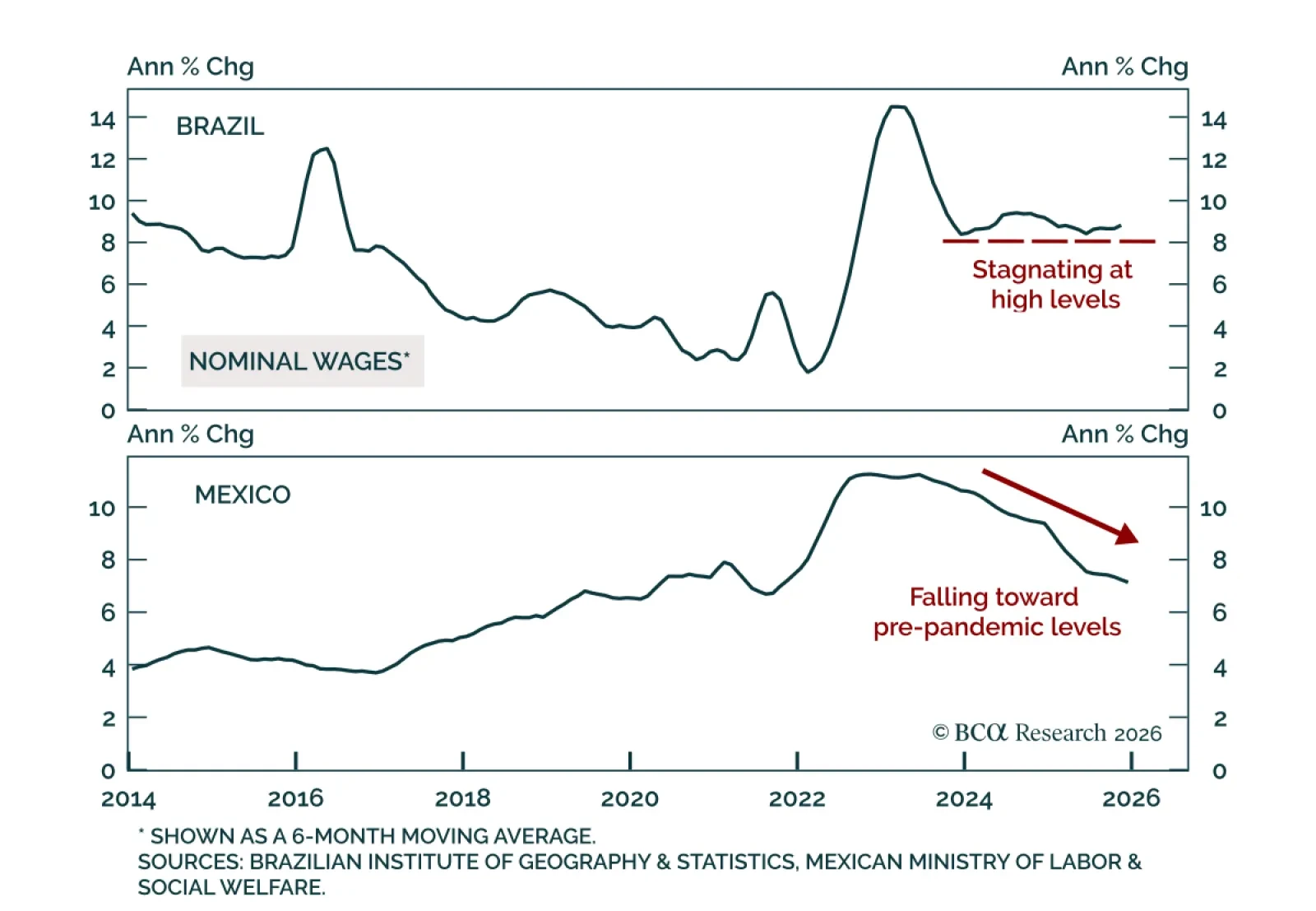

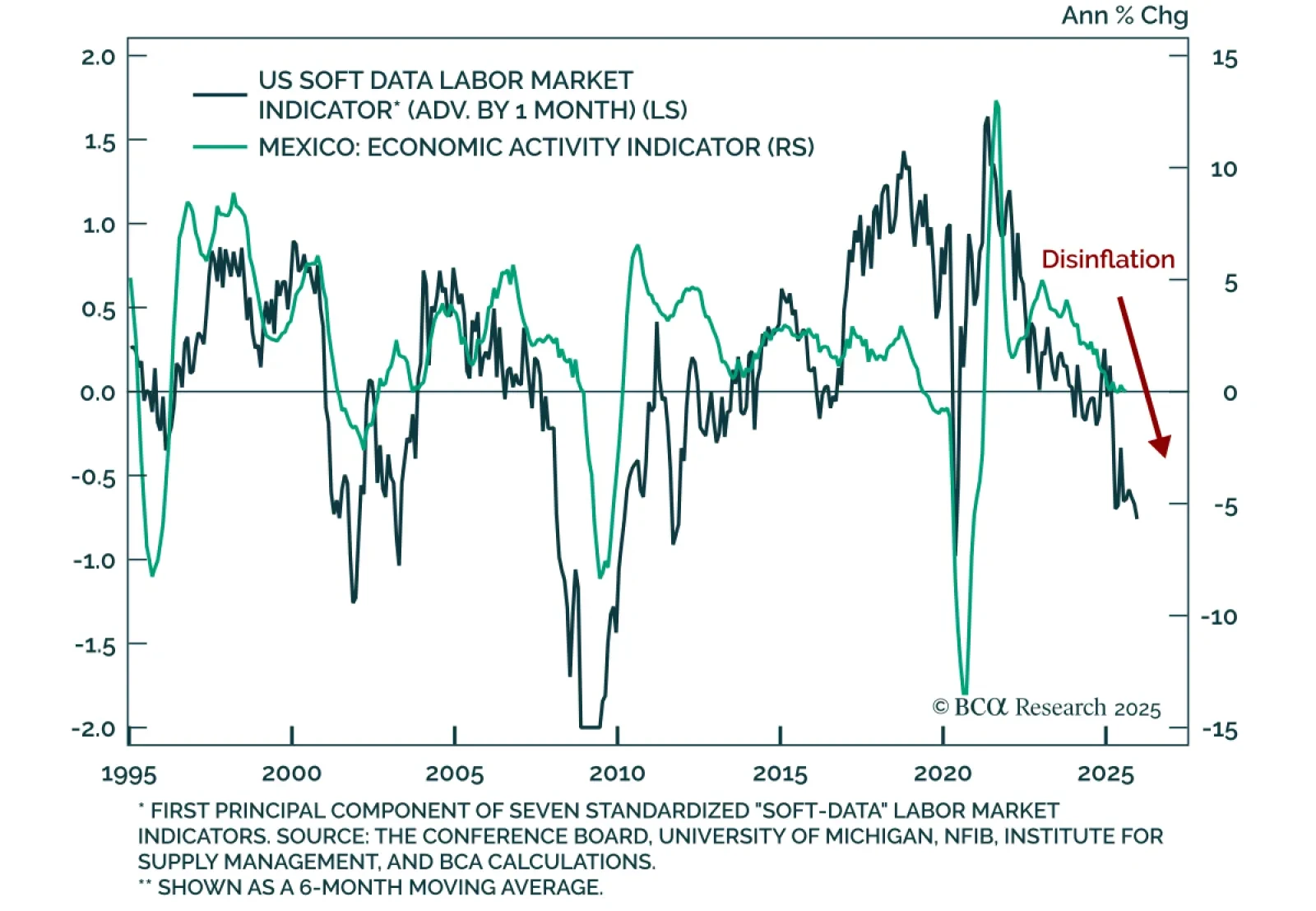

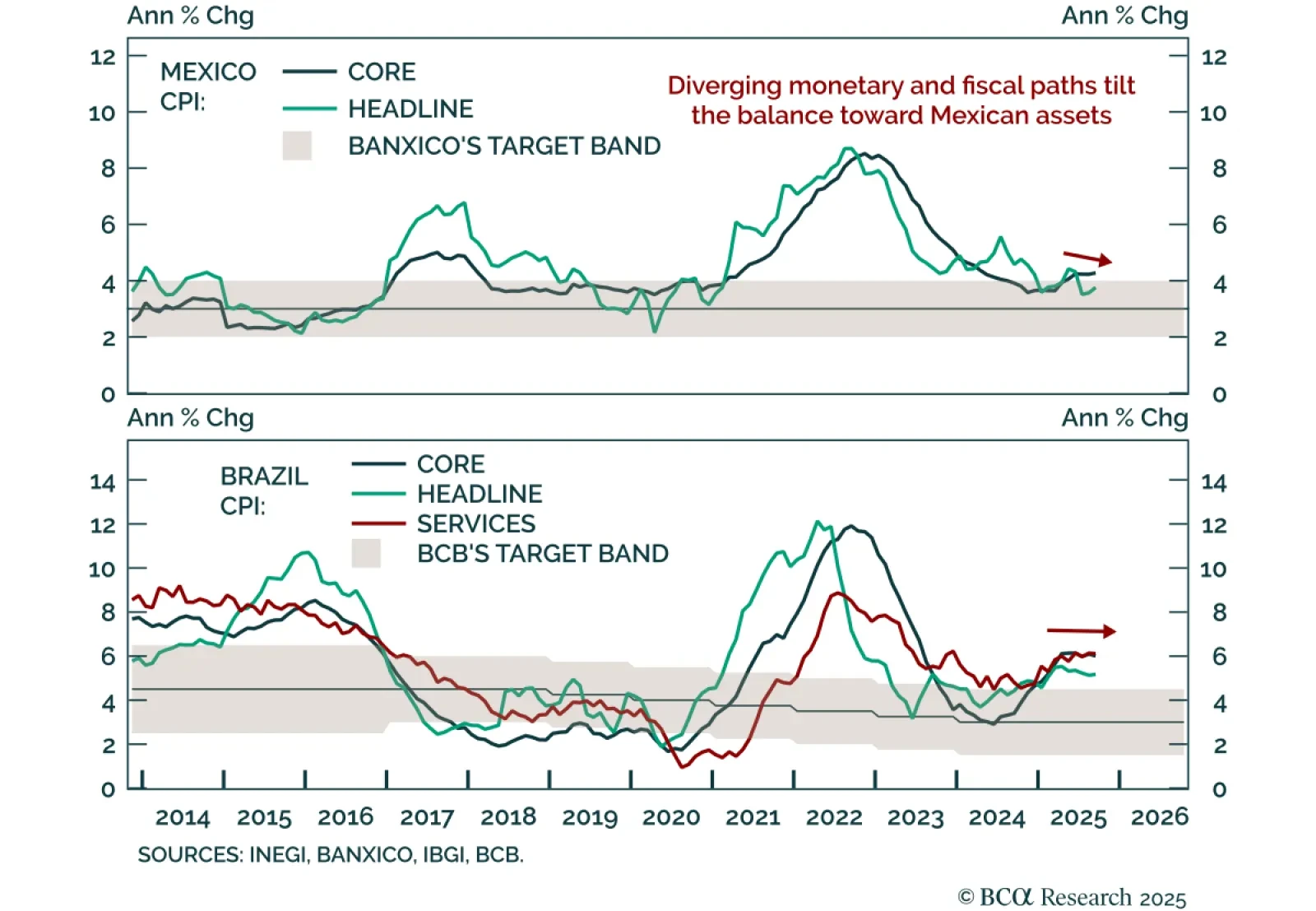

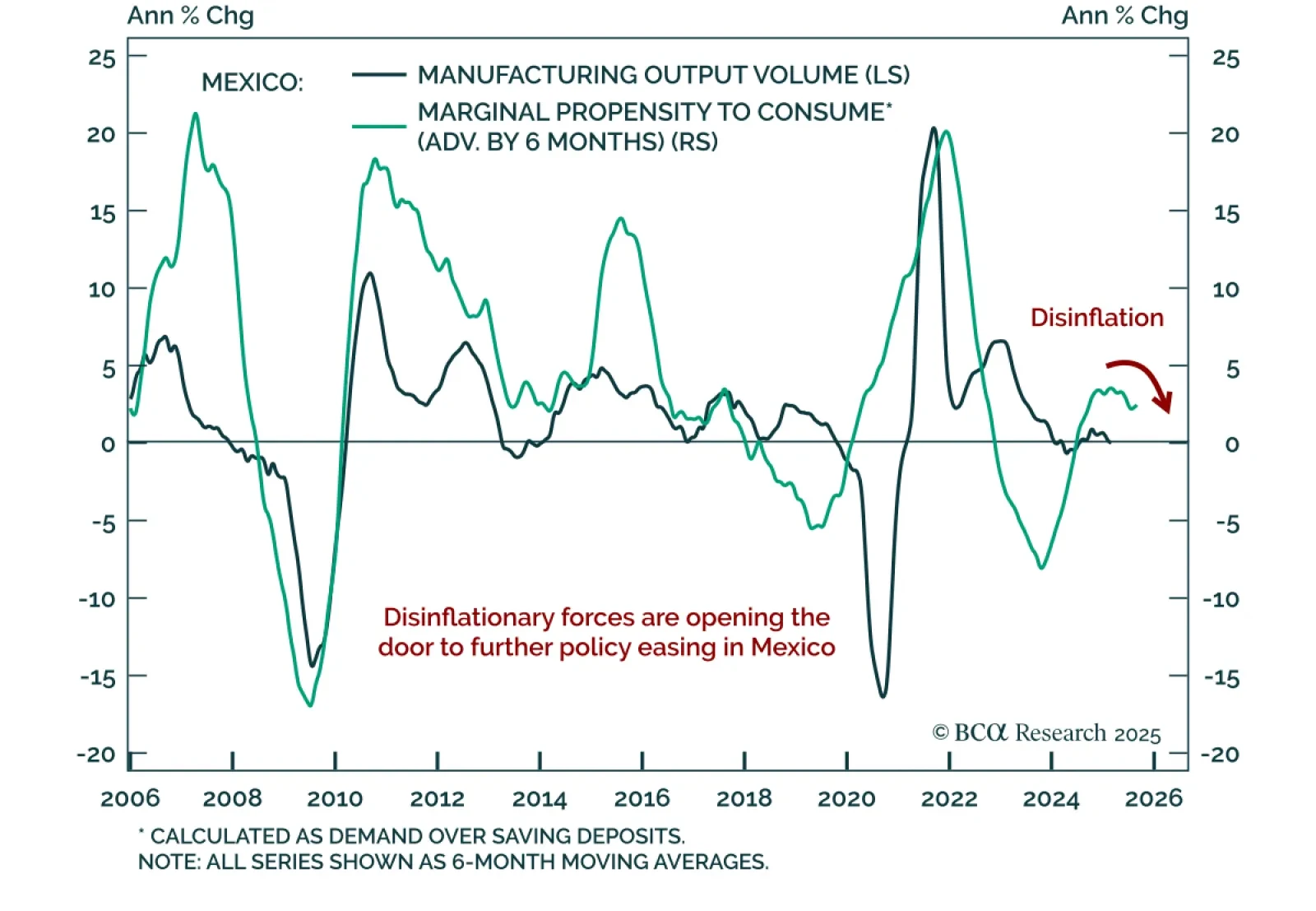

Although inflation has fallen within the upper end of the target range in both of LatAm’s largest economies, our EM strategists are more constructive on monetary easing and financial markets in Mexico than in Brazil. Mexico’s latest…

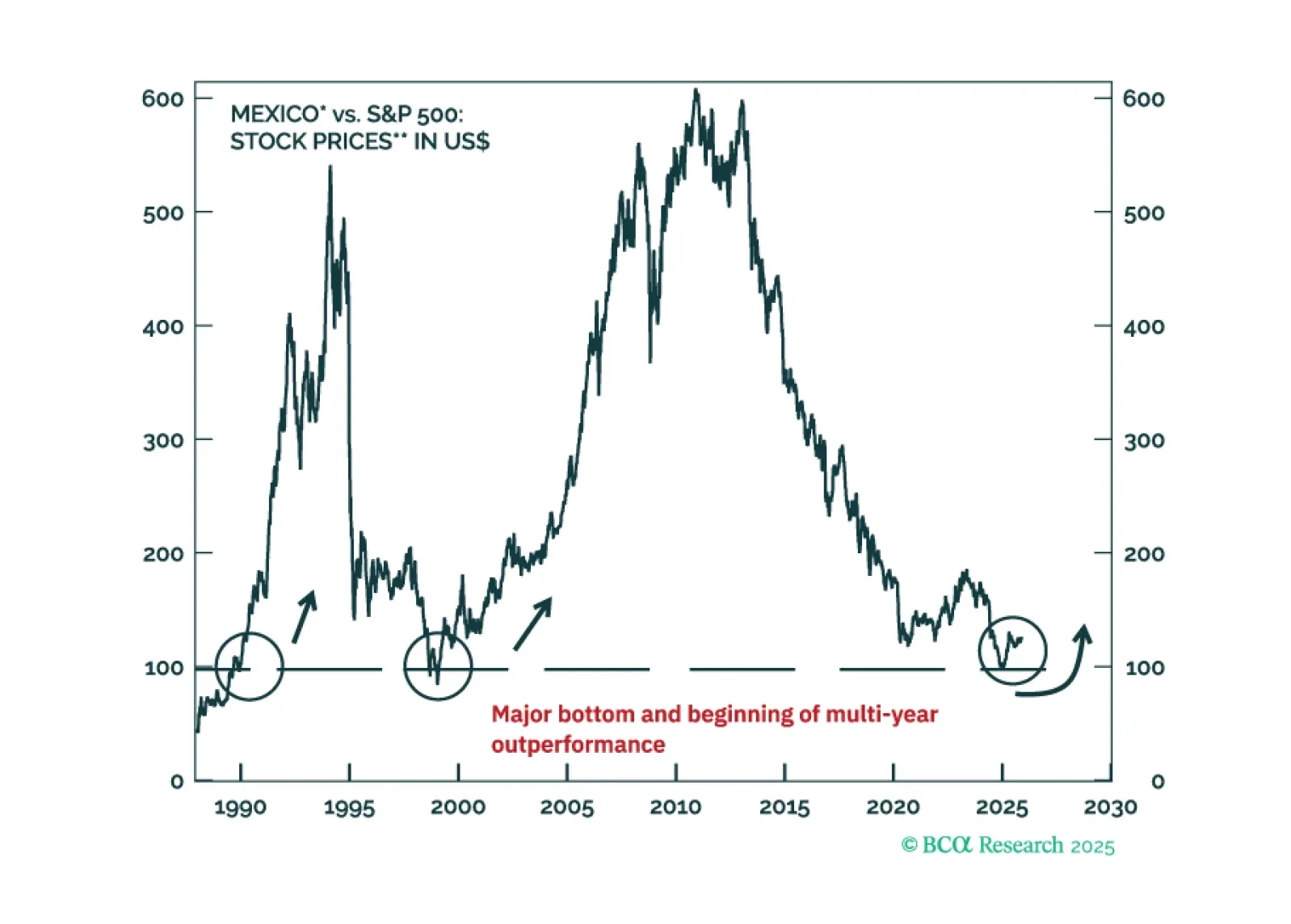

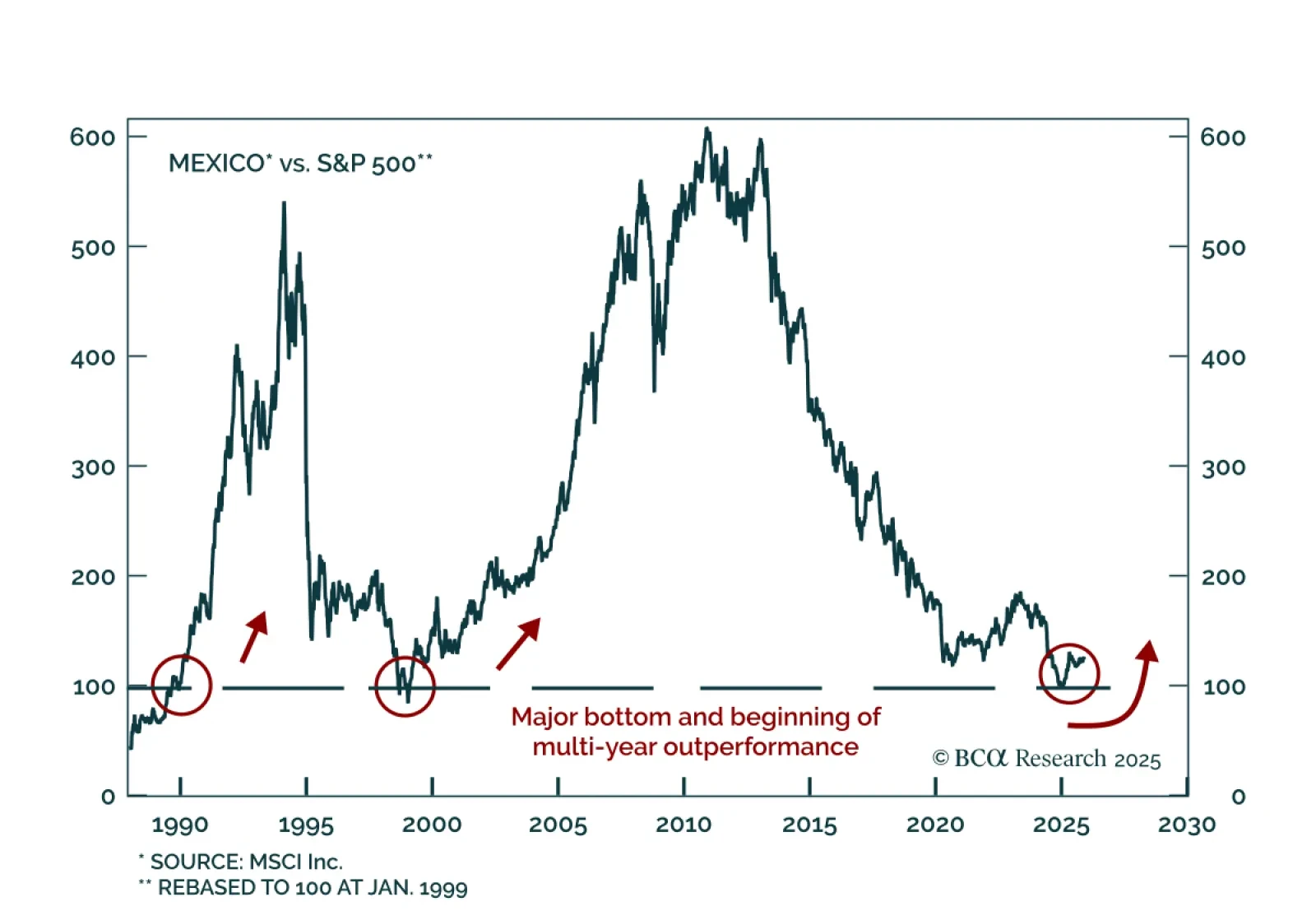

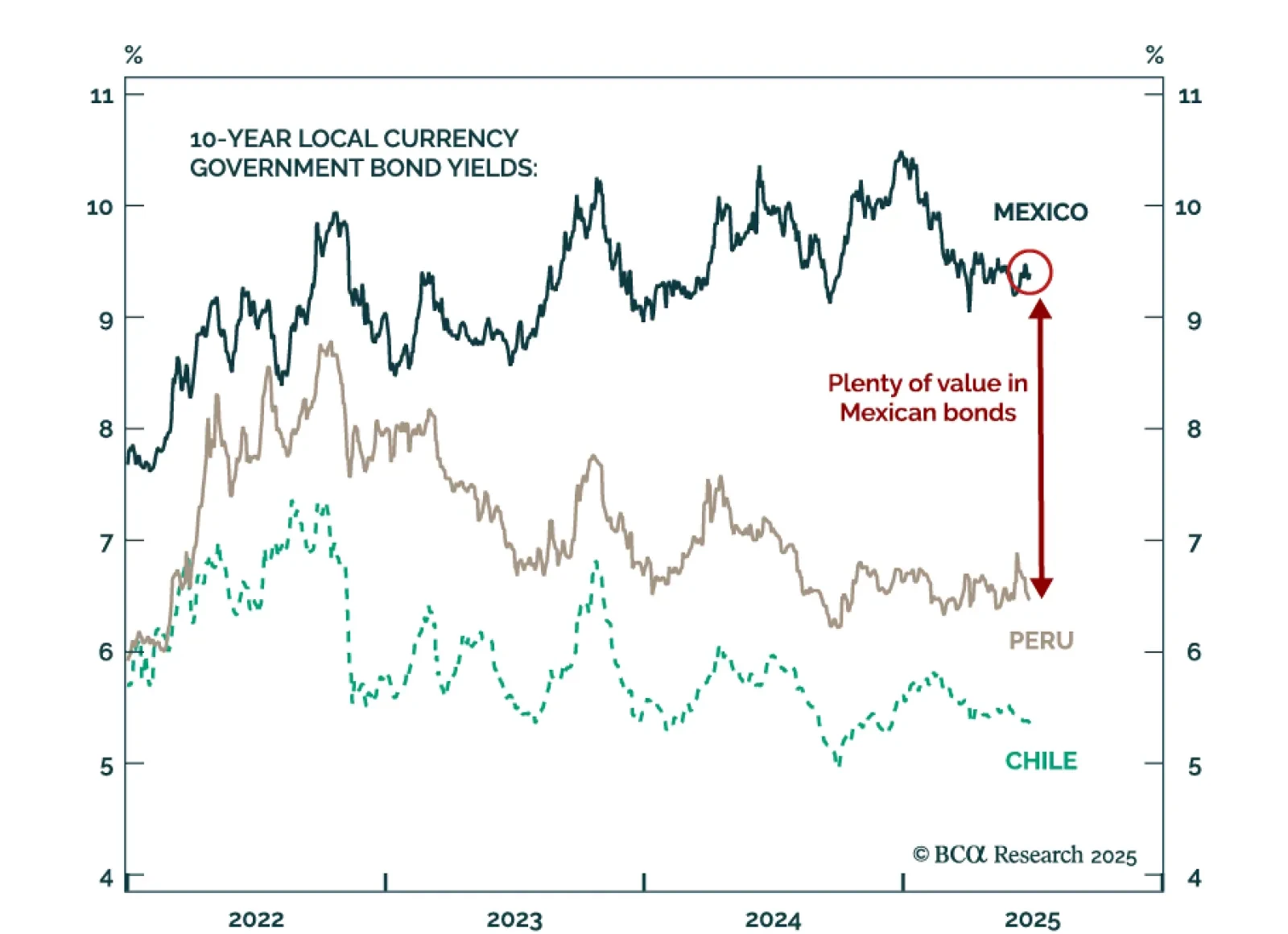

Our Emerging Markets strategists recommend staying overweight Mexico across equities, fixed income, and FX, and introduce a new trade: long Mexican stocks / short the S&P 500. Mexican assets remain well positioned to outperform…

Mexican equity and fixed-income markets will continue outperforming their EM counterparts, regardless of whether global risk assets sell off or not. Also, we recommend a new trade: long Mexican stocks / short the S&P 500.

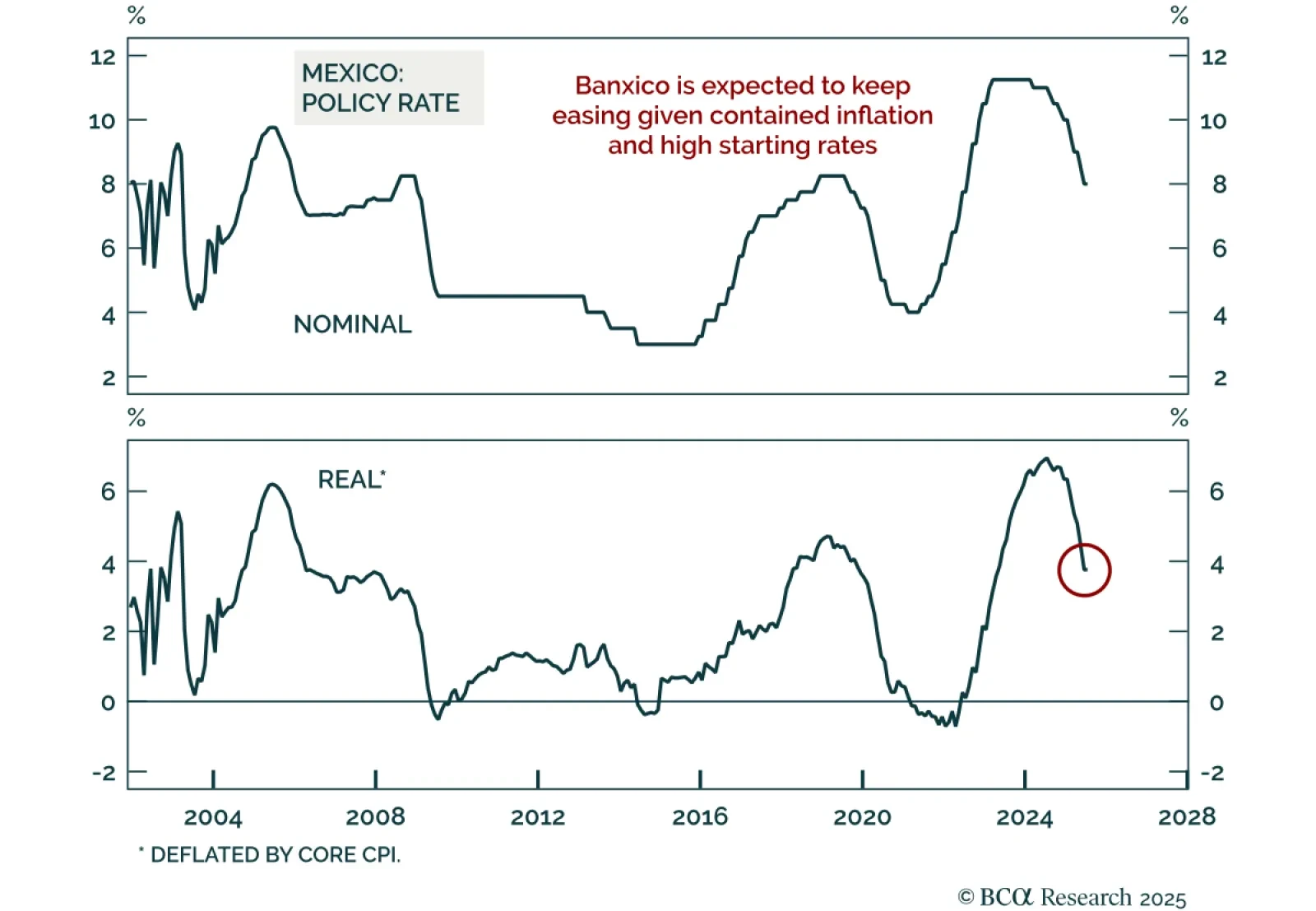

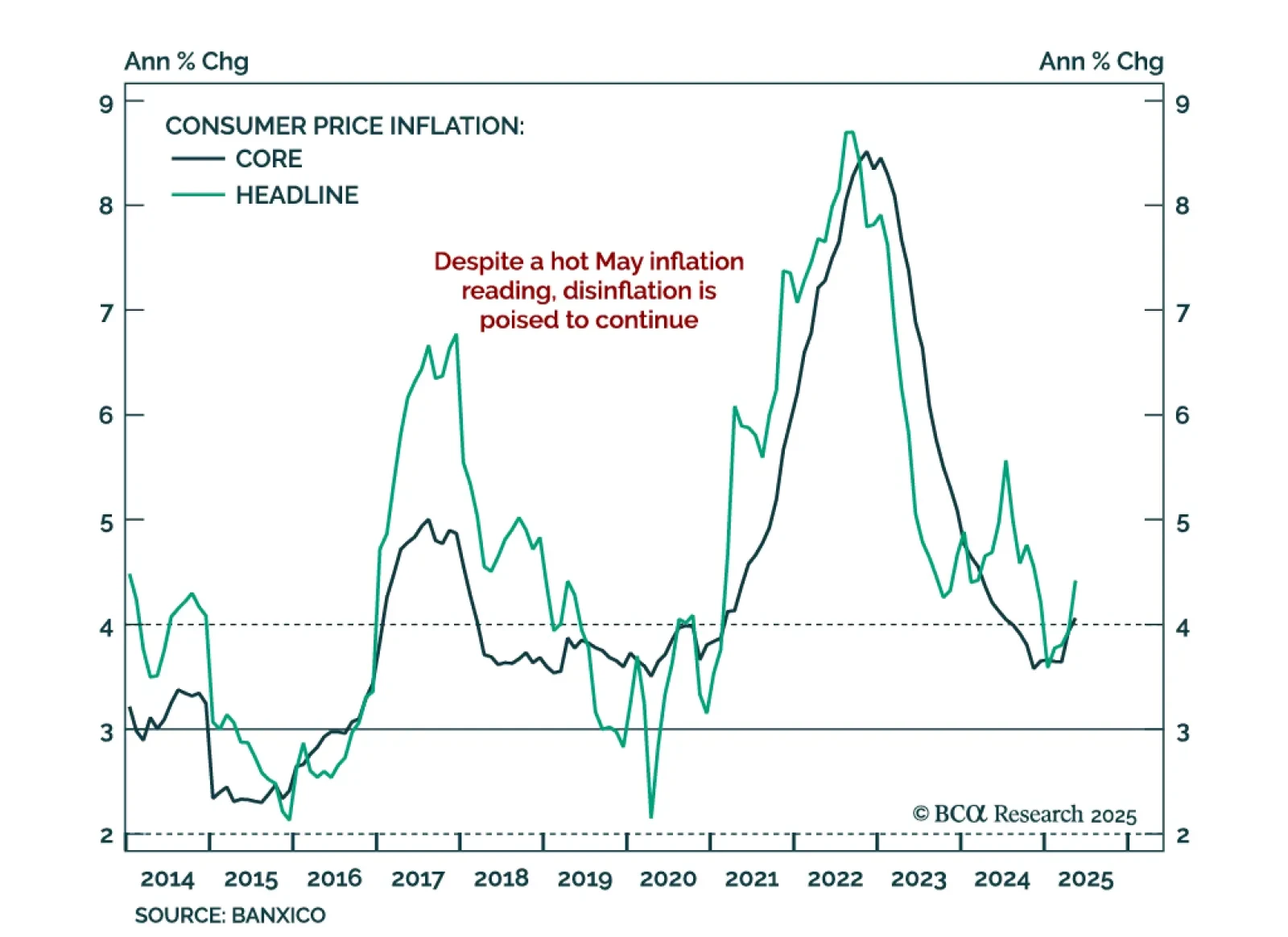

Continued monetary easing supports our view of buying Mexican local currency bonds. The central bank (Banxico) cut rates by 25 basis points to 7.25% for another meeting in a row. Banxico will persist in its rate-cutting…

September CPI releases in Brazil and Mexico reinforce a divergent inflation and policy outlook that supports an overweight stance in Mexican local bonds and currency relative to Brazilian assets. Brazil’s headline CPI at 5.2% was…

Banxico cut rates to 7.5%, reinforcing our call to go long Mexican local bonds and overweight Mexico across EM portfolios. Inflation is within target, giving policymakers space to ease. Sound fiscal management and strong external…

Banxico’s latest rate cut reinforces our bullish view on Mexican domestic bonds. Mexico’s central bank eased policy by another 25 basis points to 7.75%. Investors should bet on further easing. Inflation will continue…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

Banxico’s dovish stance reinforces our bullish view on Mexican local currency debt. The Mexican central bank cut interest rates by another 50 basis points to 8%. The central bank will continue easing monetary policy well…

Hot May inflation should not derail Banxico’s easing cycle; we remain long Mexican local bonds. Headline inflation accelerated to 4.4% y/y from 3.9%, above expectations, while core inflation was roughly flat at 4.1% from 3.9%. The…