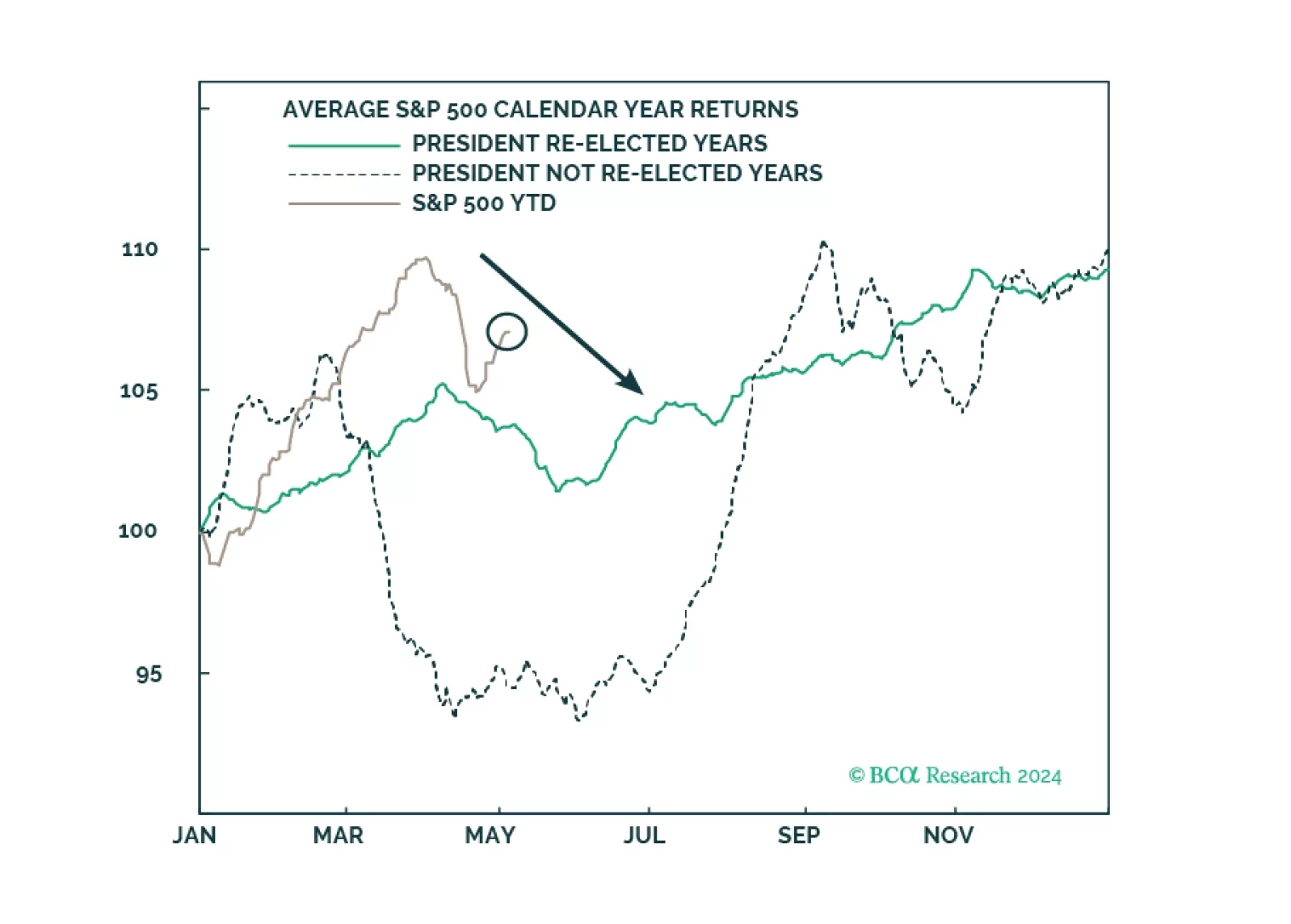

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.

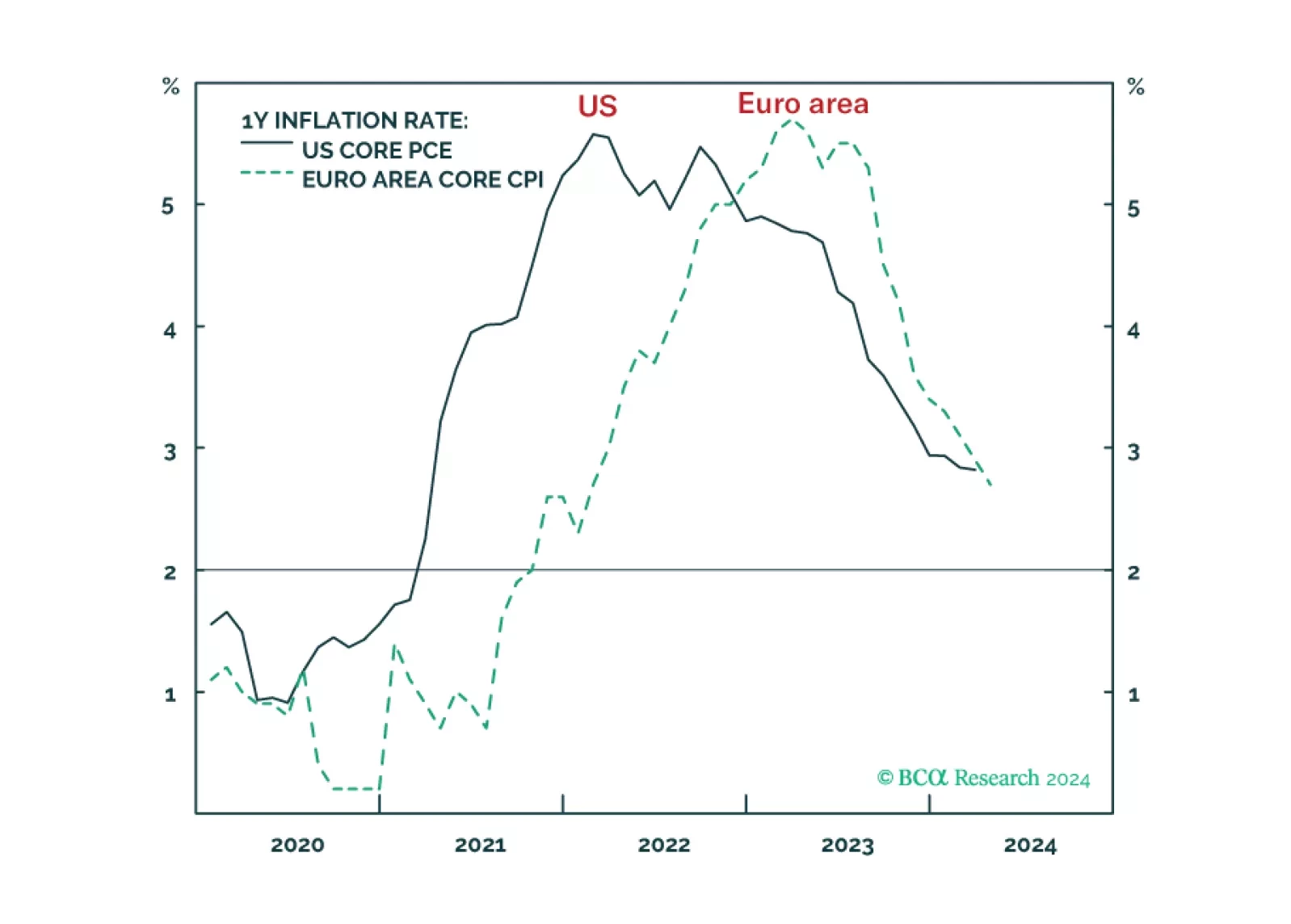

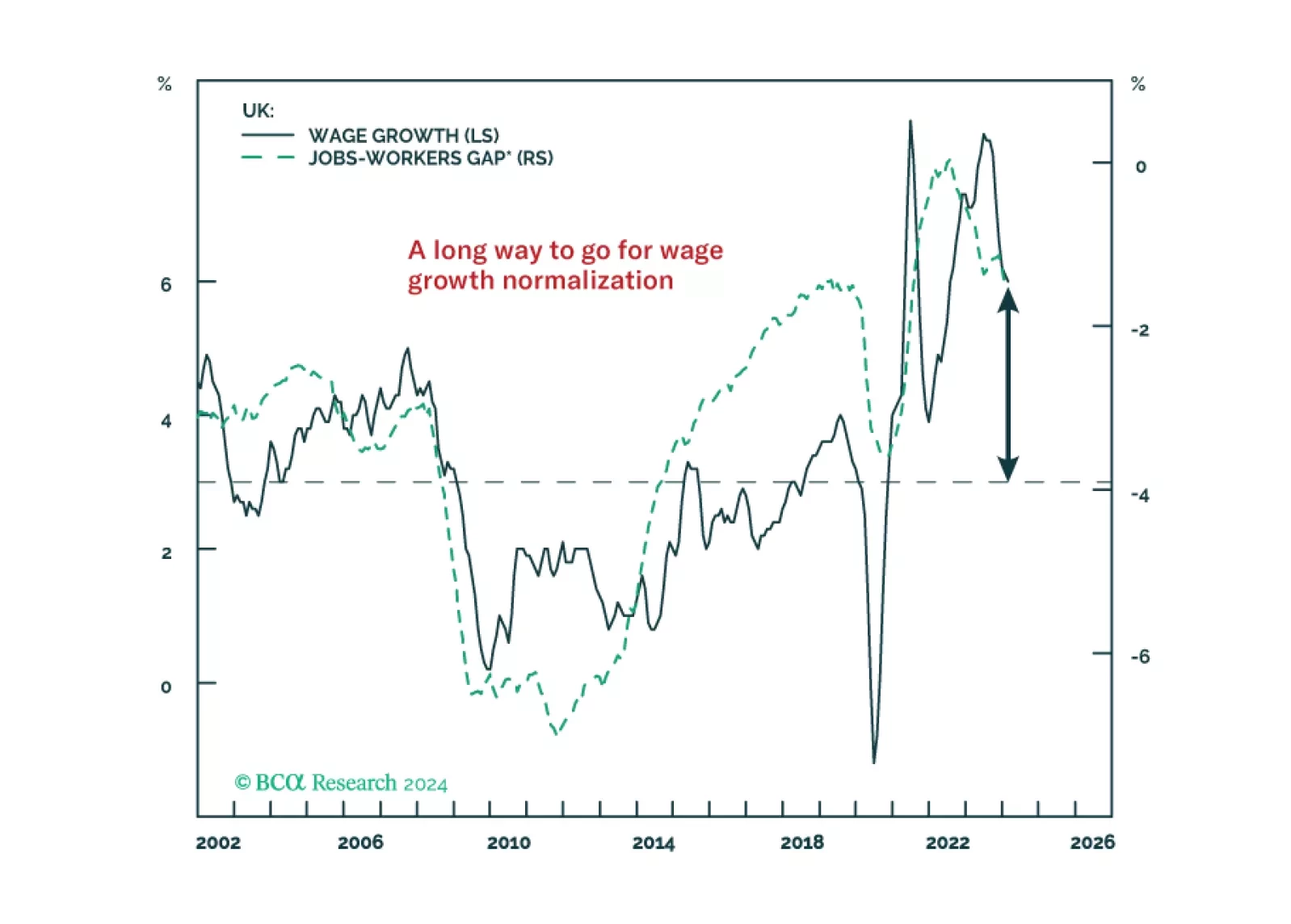

Wild hopes for US rate cuts got shattered, exactly as we predicted. But given the different incentives that the Fed and ECB now face, the relative pricing between the Fed and the ECB could widen further in the coming months. We…

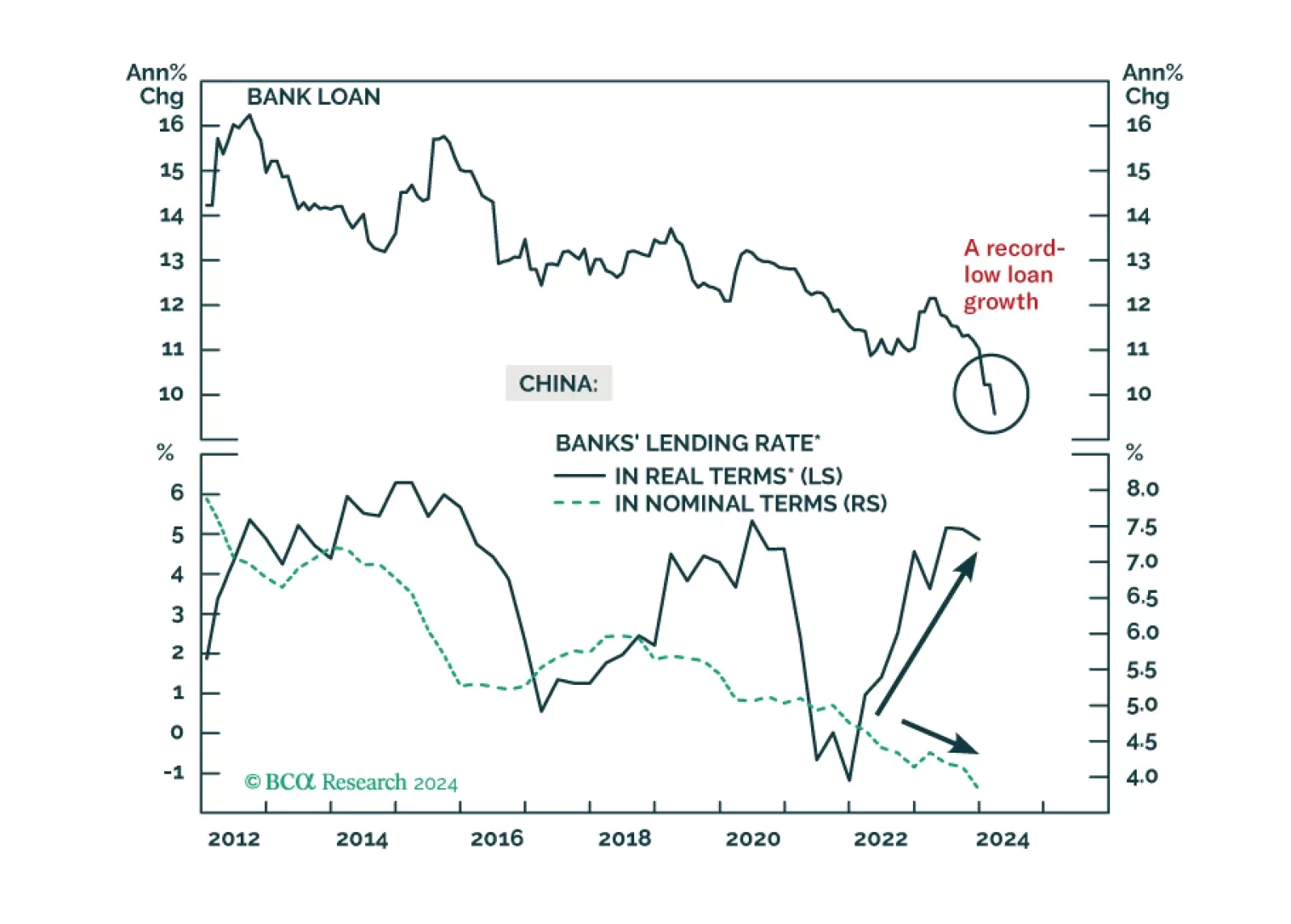

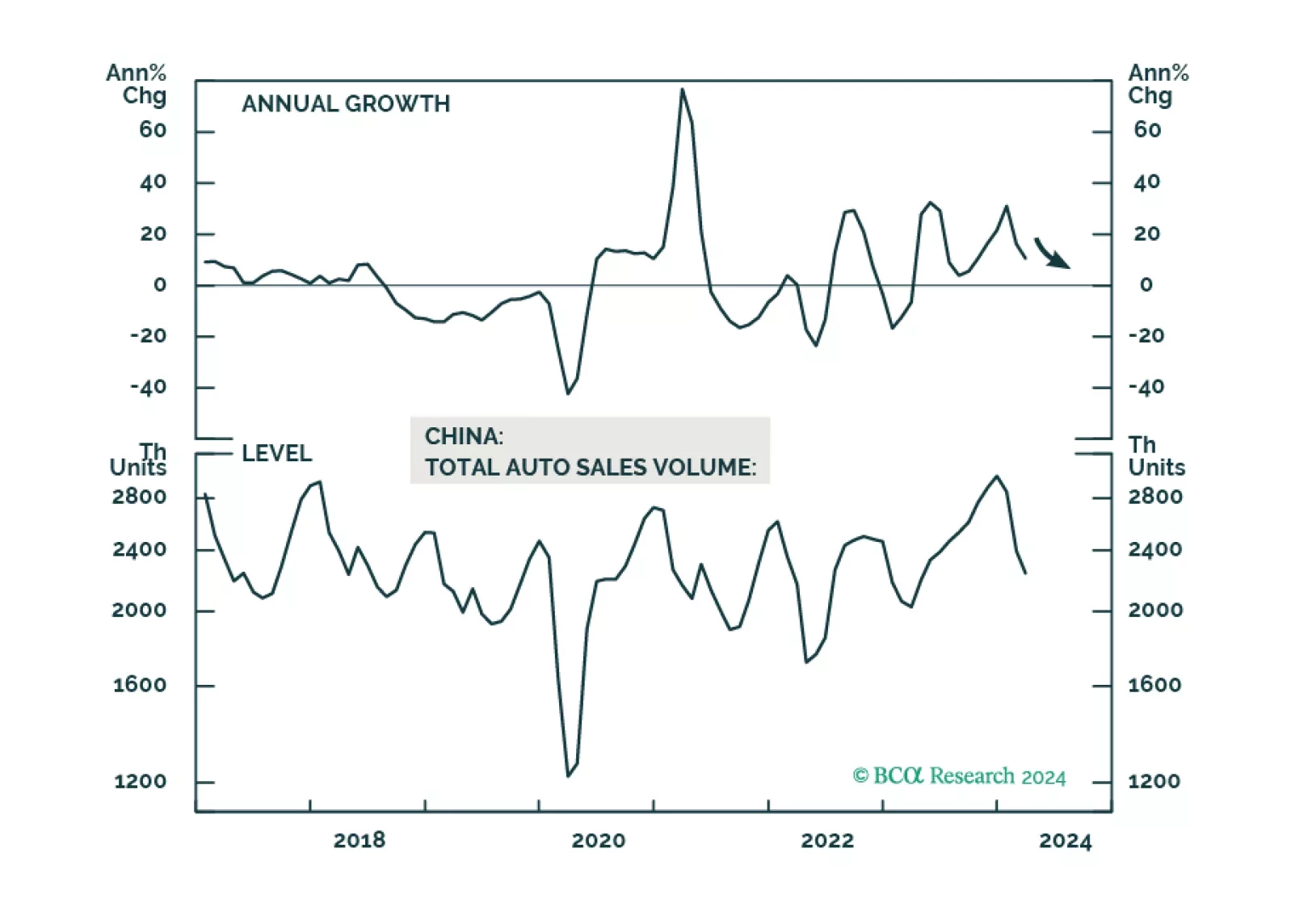

China’s economy is cruising at a very low altitude. The odds are that China’s equity rebound is running out of time. The RMB will continue to depreciate versus the US dollar in the coming months, albeit the pace may be modest.

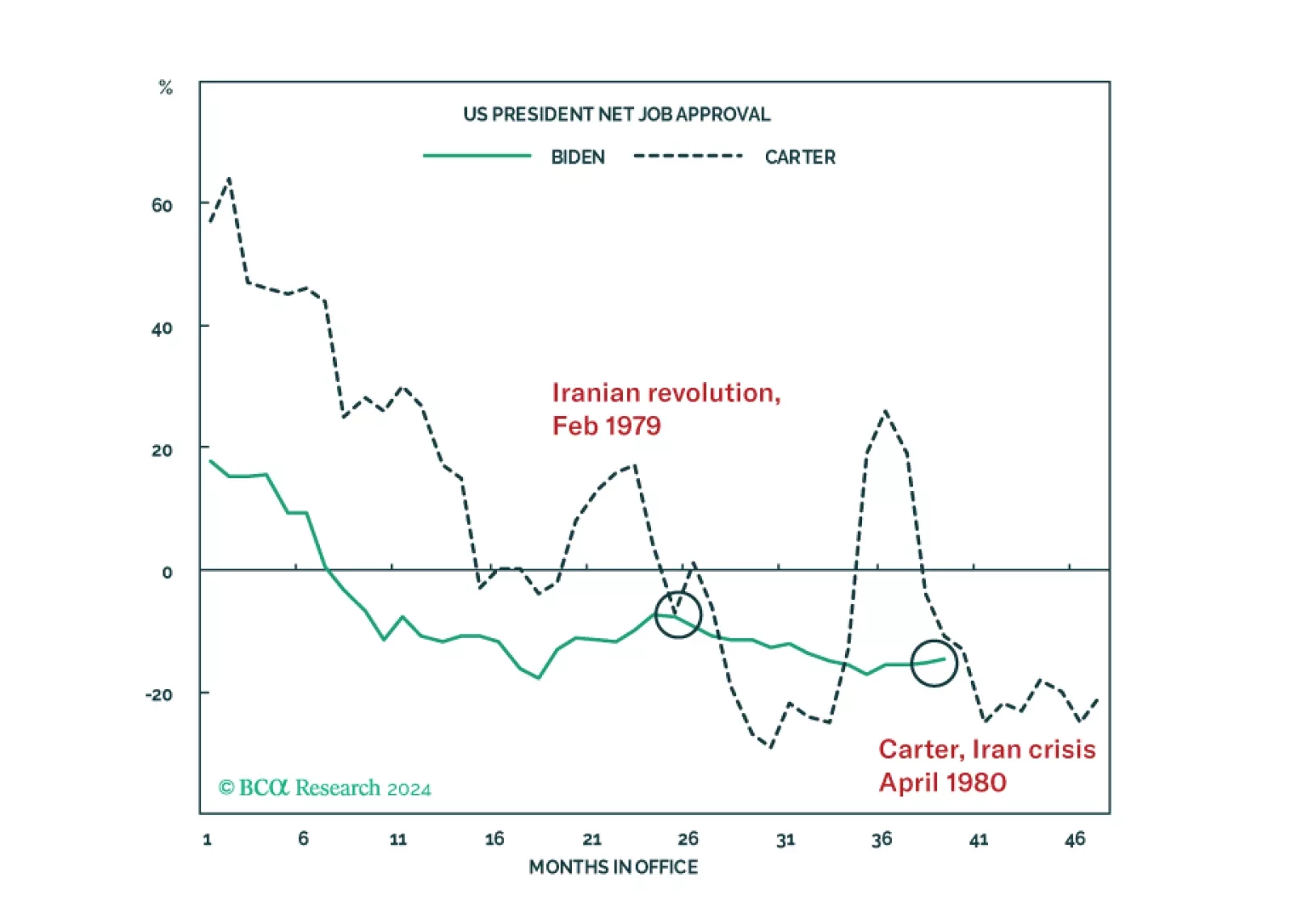

Our quant models suggest Democrats are still slightly favored for the White House. Our Senate model favors Republican control, though Montana and Ohio are the weak links that could deliver Democrats a de facto Senate majority in the…

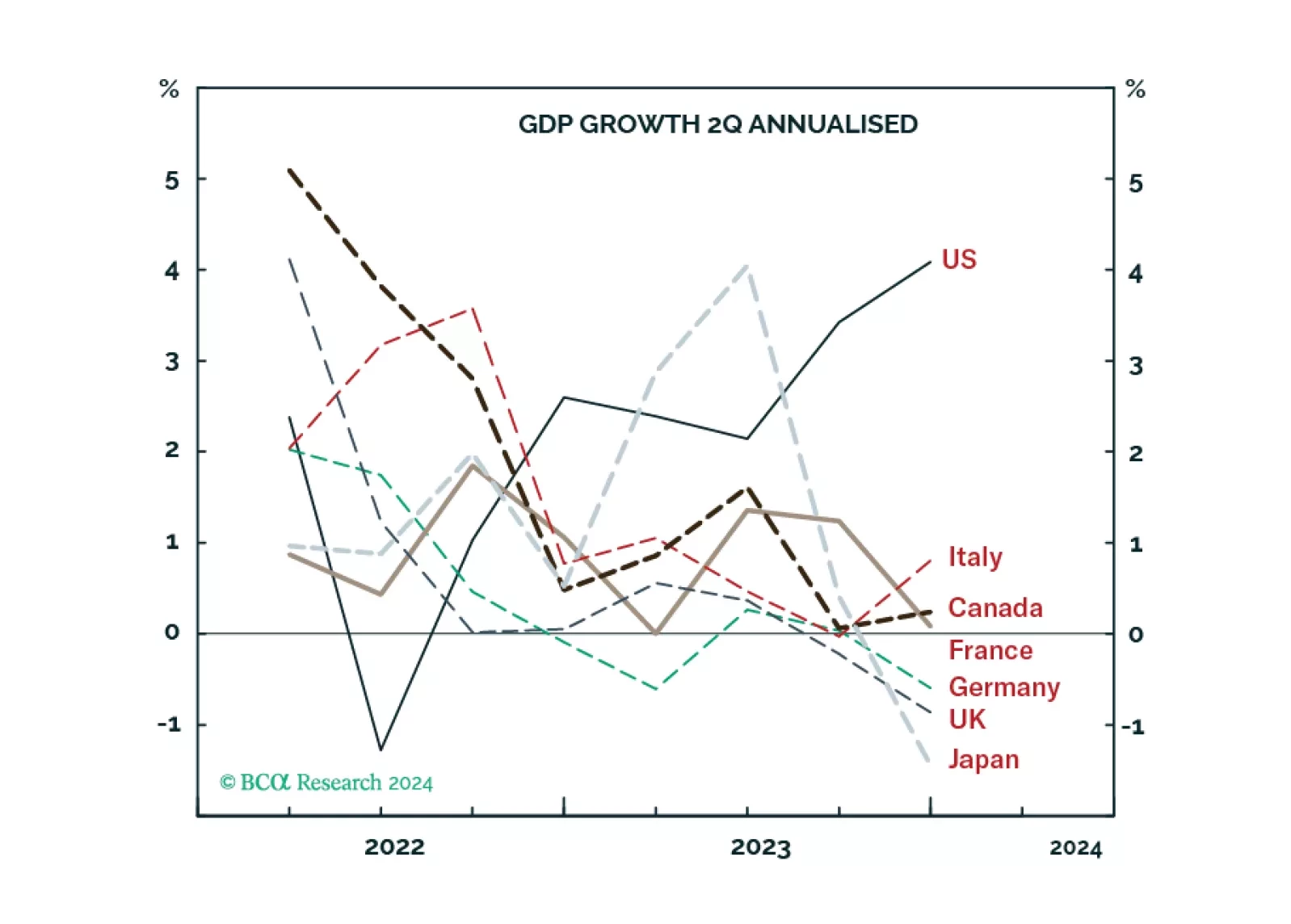

Unlike most advanced economies that are flirting with recession due to weak demand, the ‘inverted’ US economy is motoring along due to strong supply, from a combination of surging labour participation and surging immigration. We go…

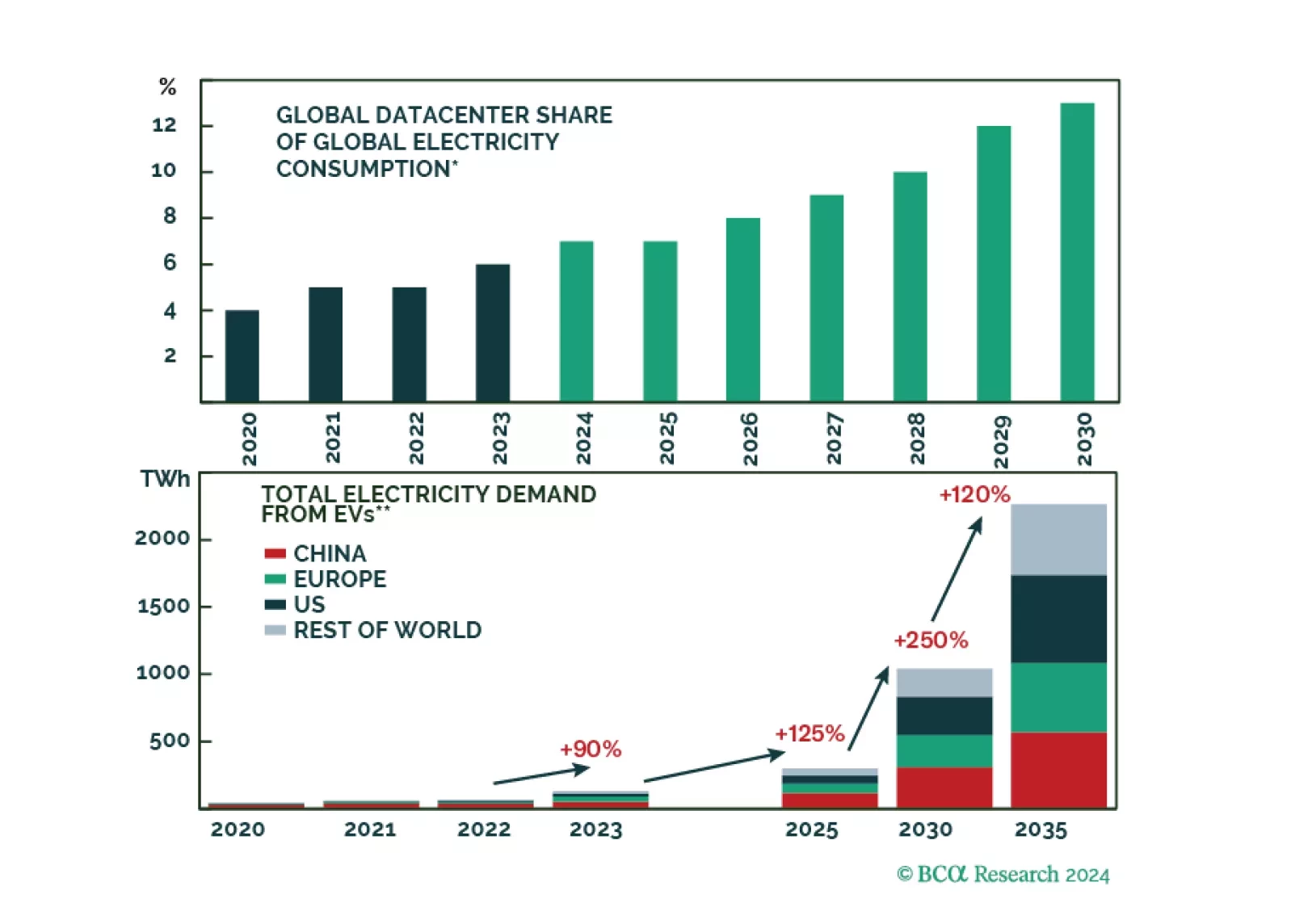

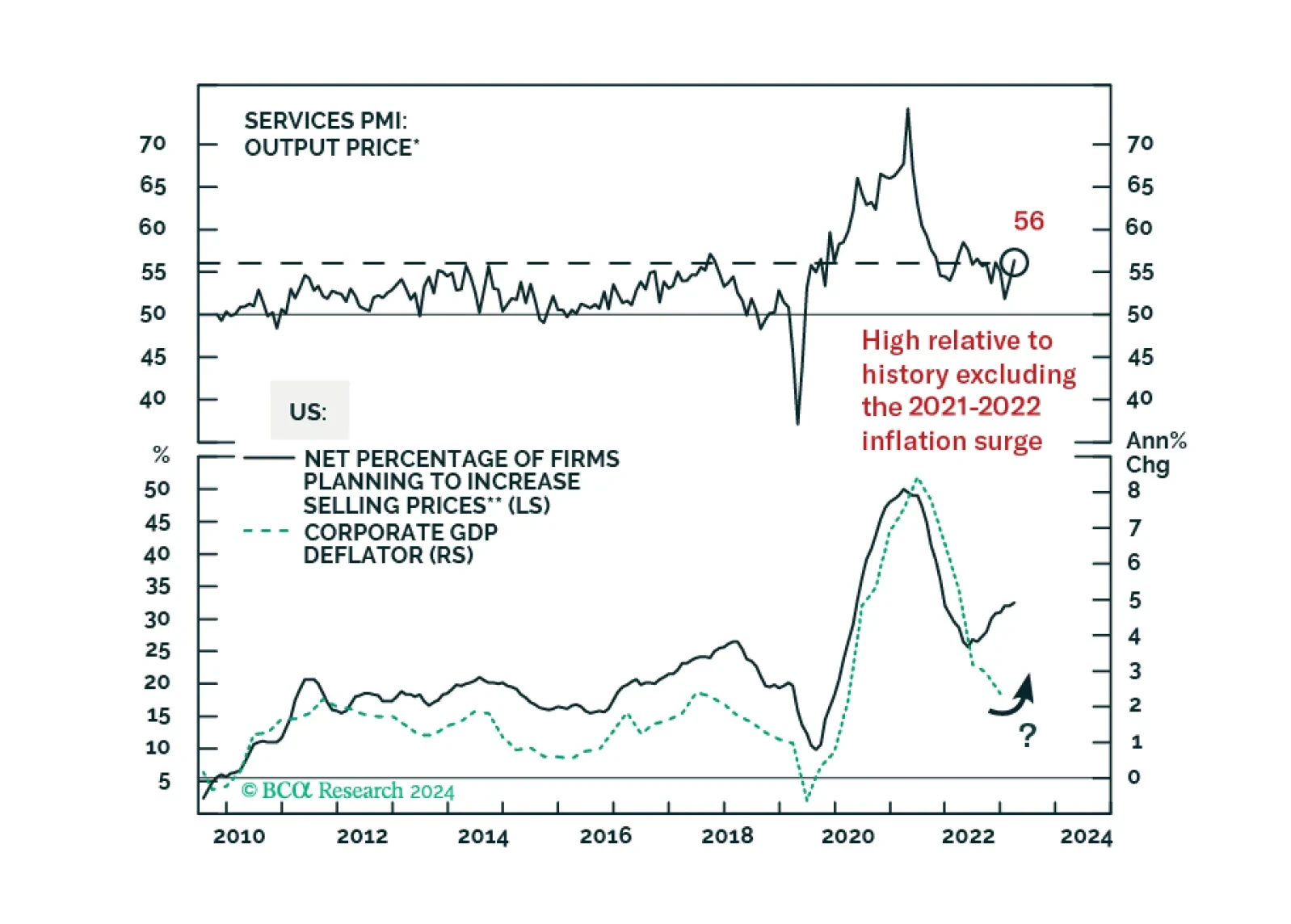

In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.