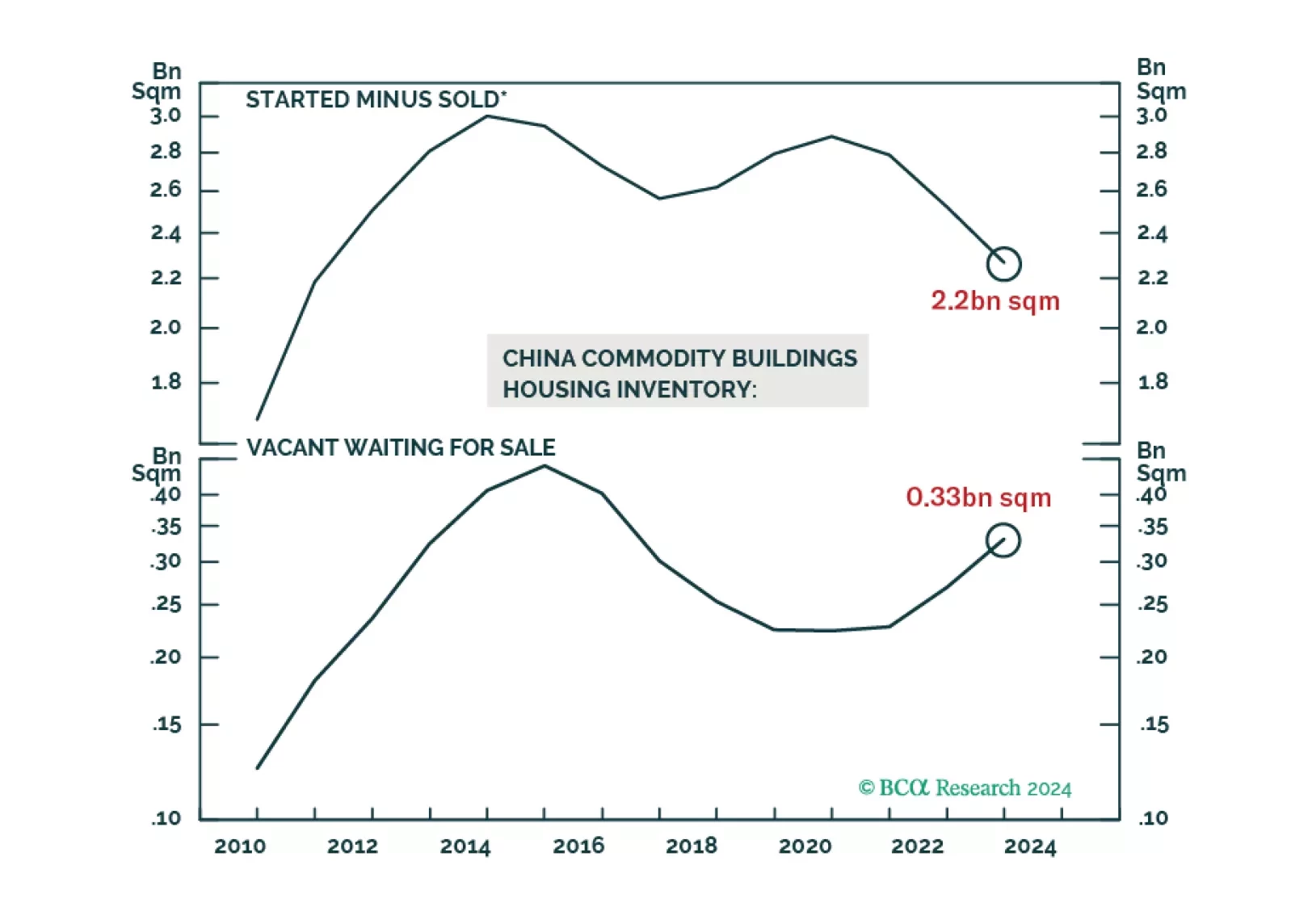

The RMB 500 billion program is small, as it is equivalent to only 4% of property developers' total funding from the past 12 months. This will preclude a recovery in property construction this year. Corporate profits will determine…

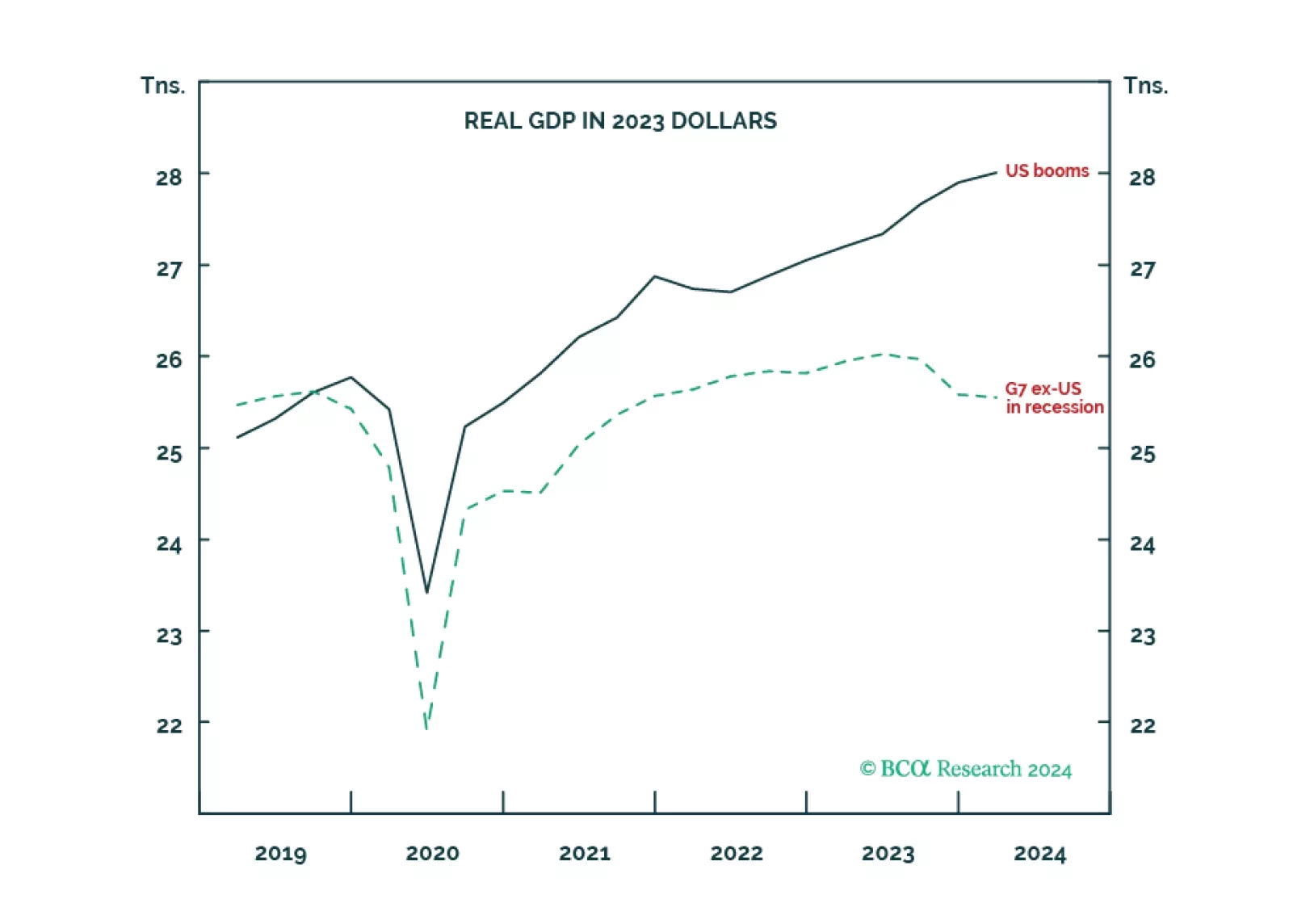

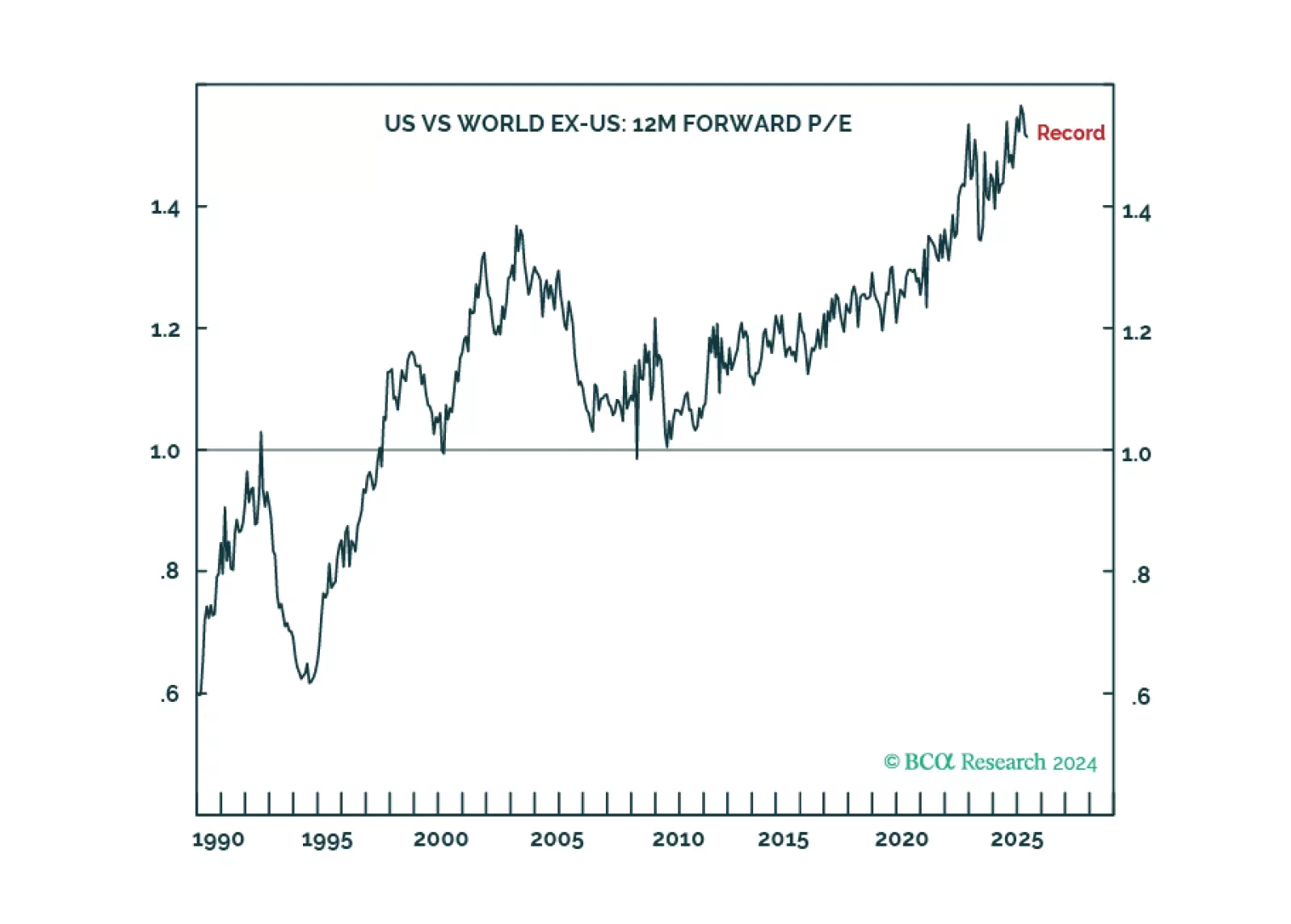

The economic schism in the world economy, between the non-US developed economy in recession and the US in strong growth, is unprecedented during our lifetimes. Now the schism will continue in reverse, as the non-US developed economy…

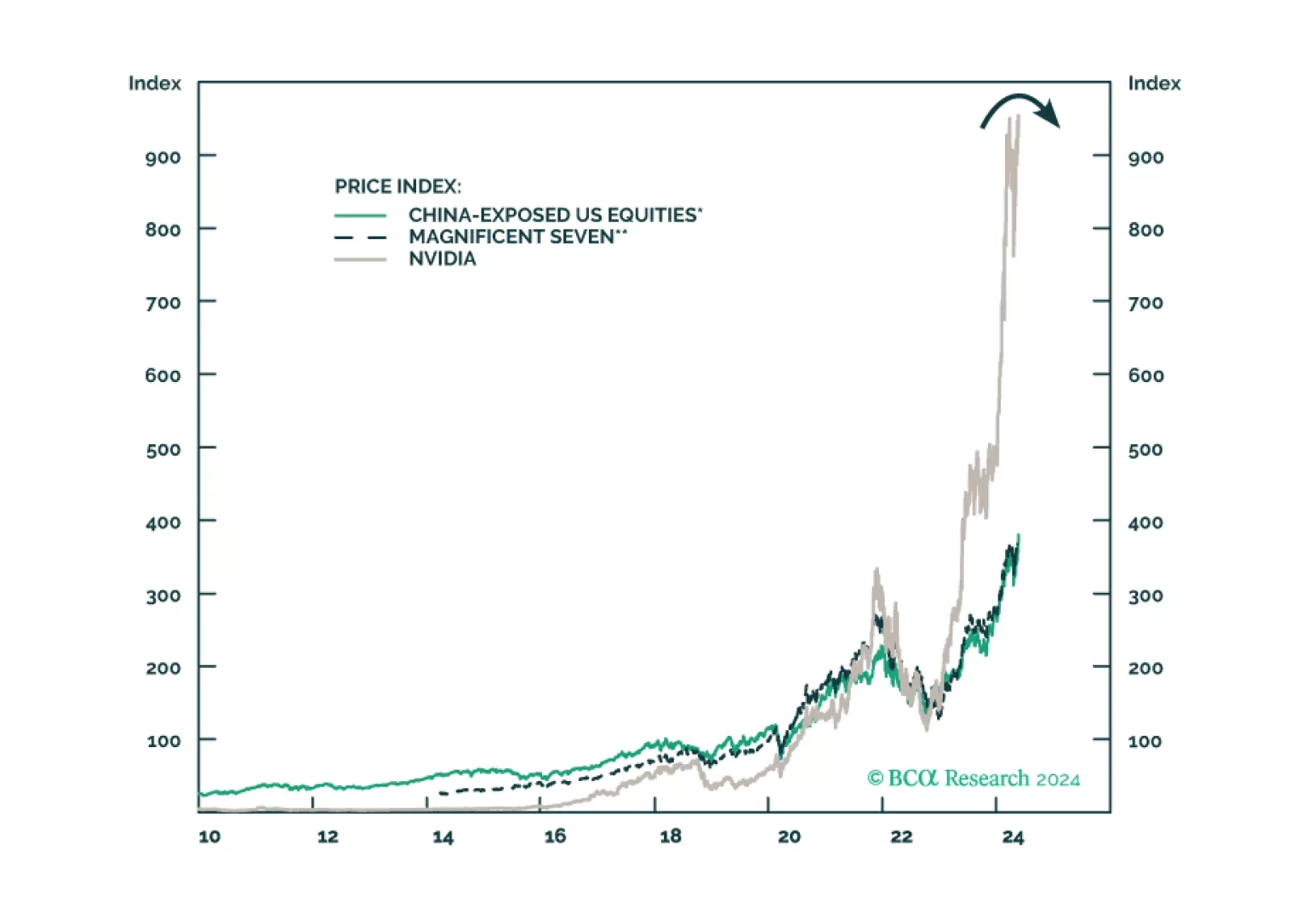

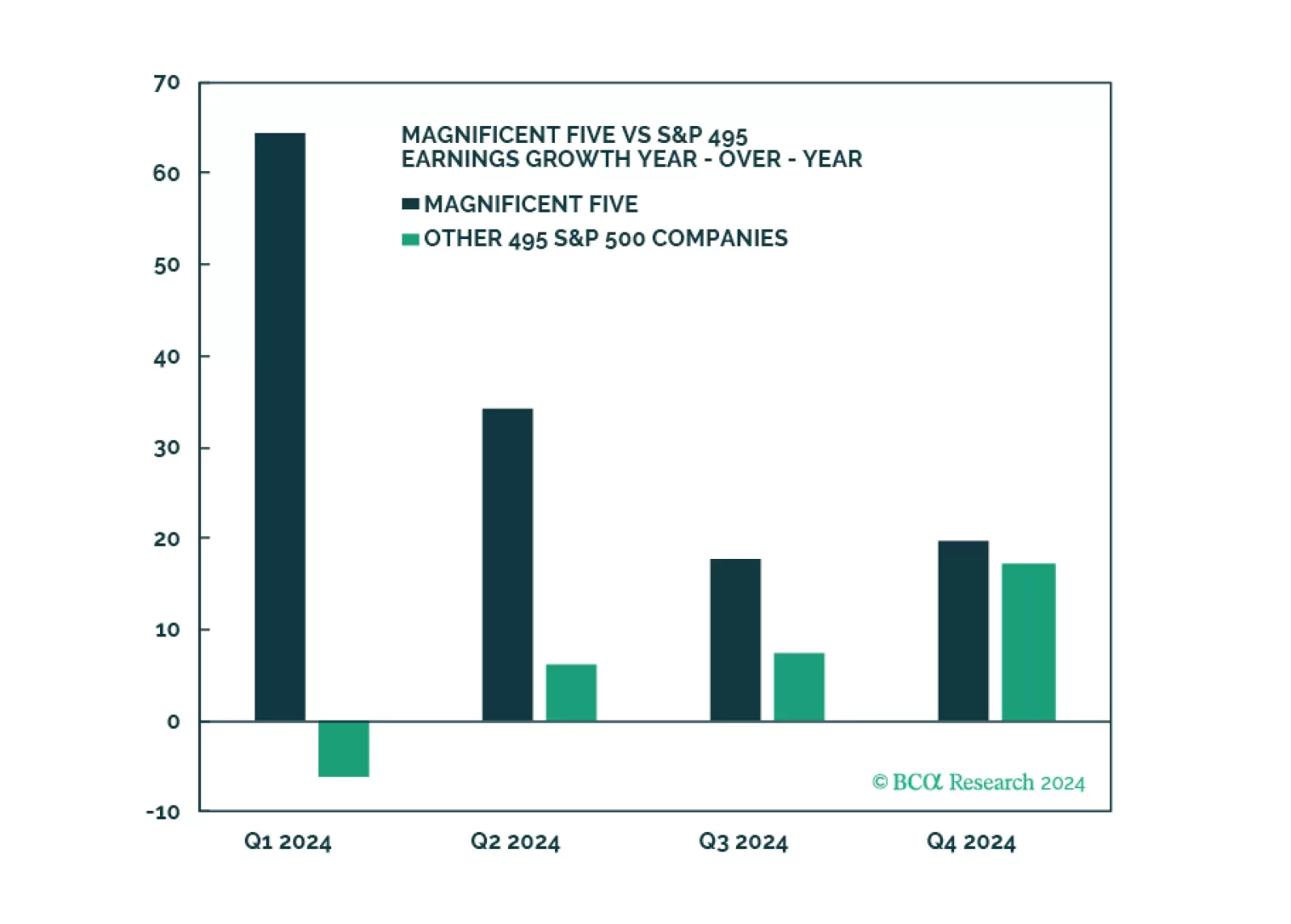

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…

Our updated views on Treasury yields and Fed policy following this morning’s CPI report.

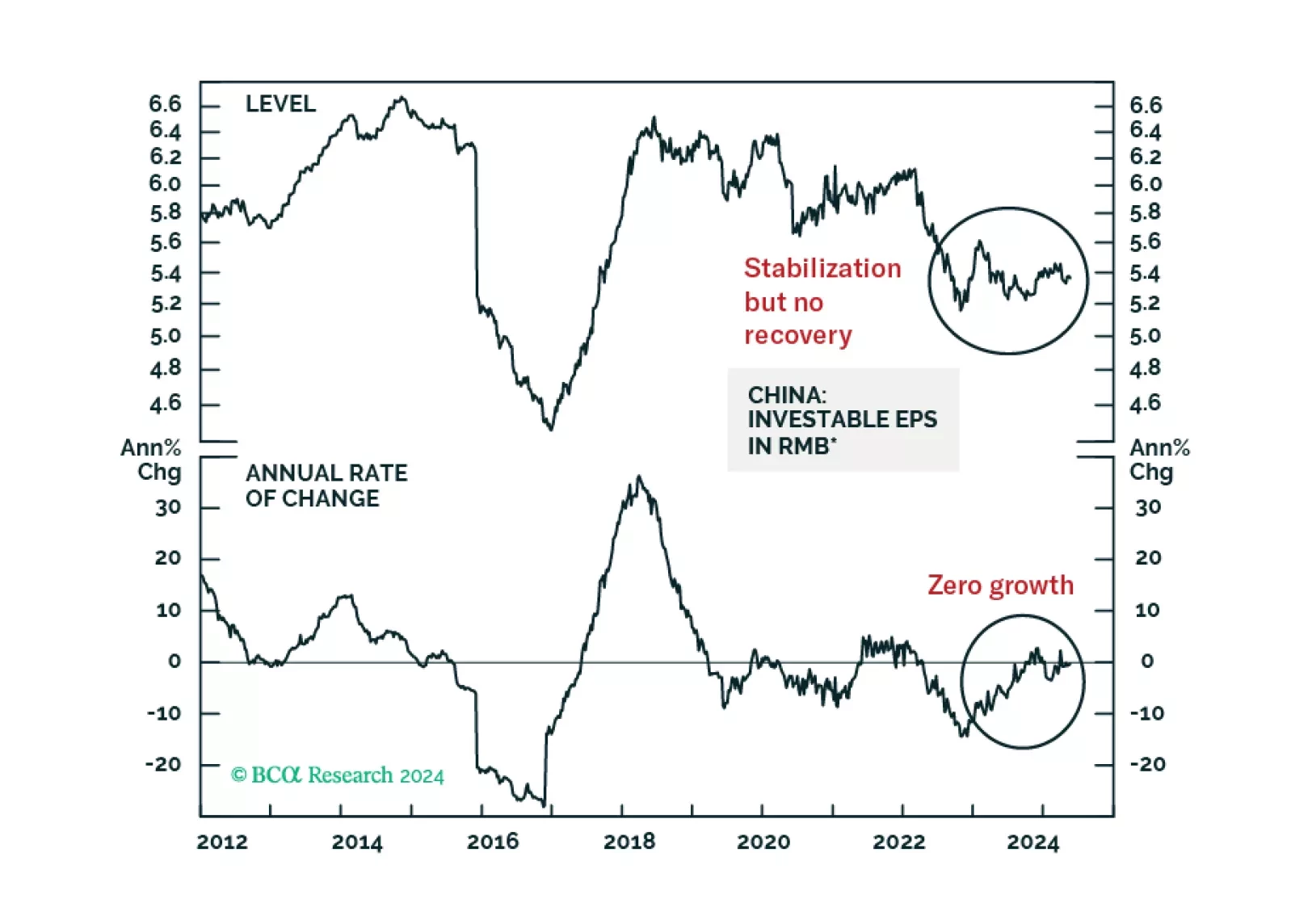

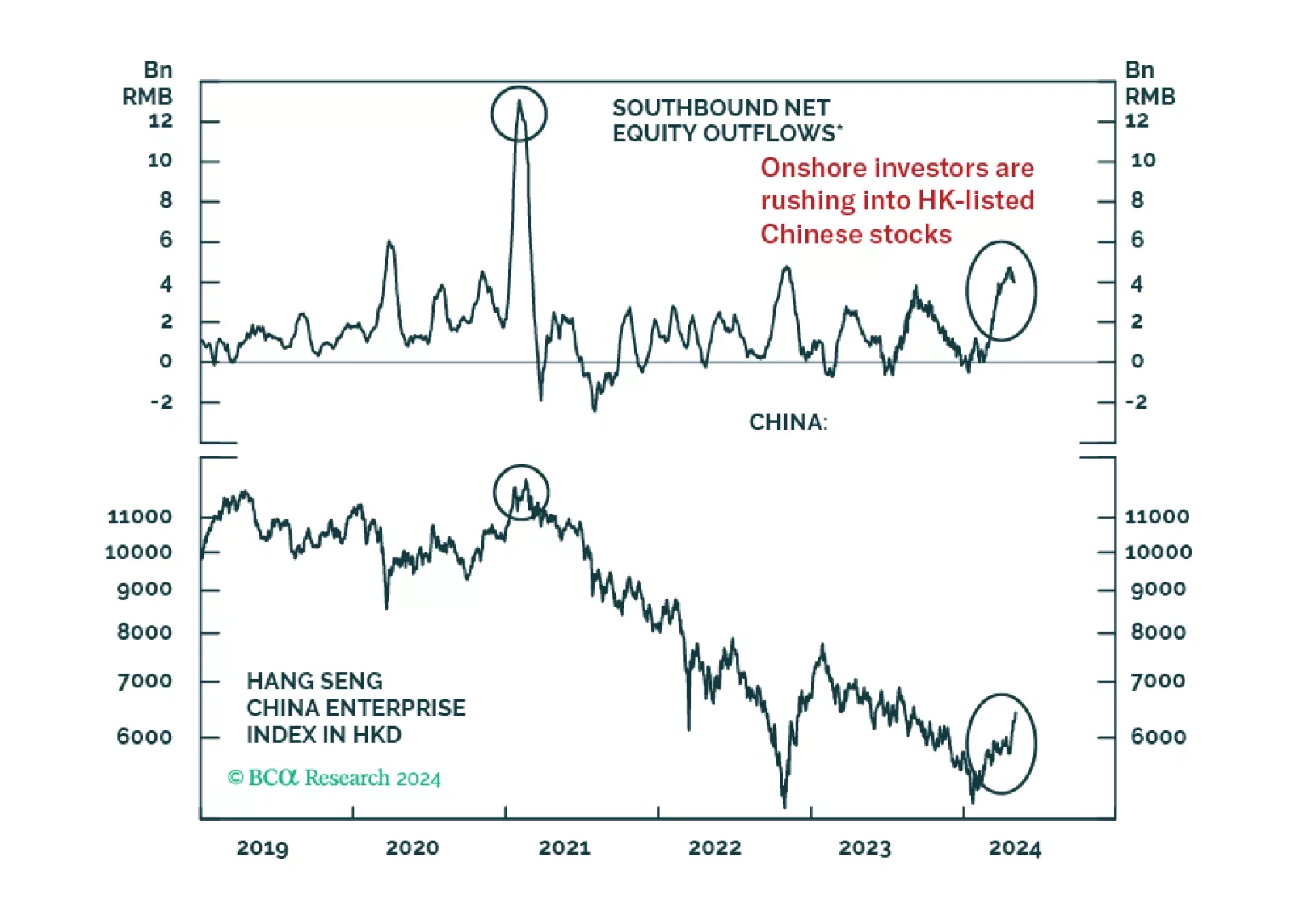

A reality check on credit data and announced property sector support measures indicates that the recent surge in Chinese share prices is unjustified based on the country's economic fundamentals.

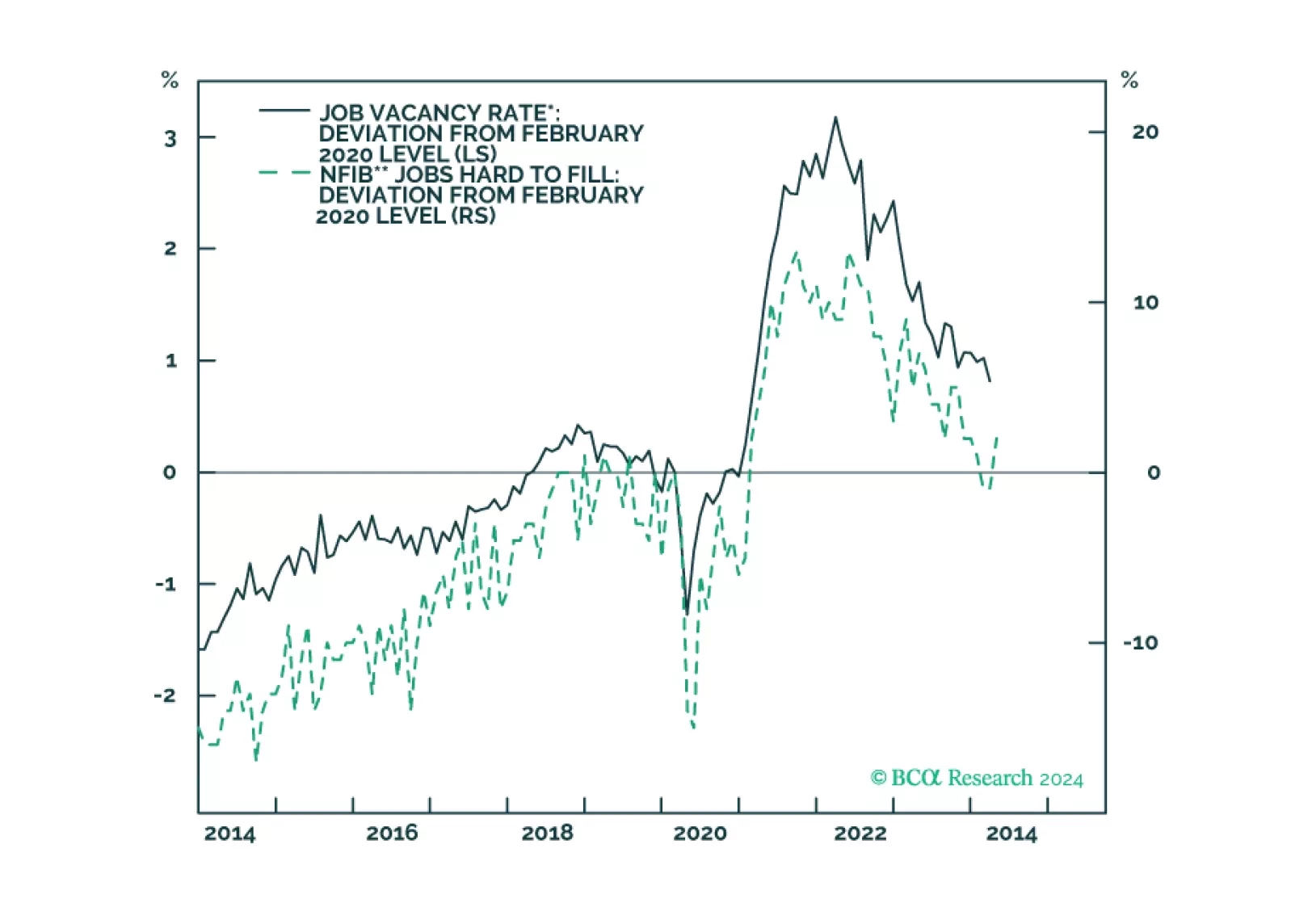

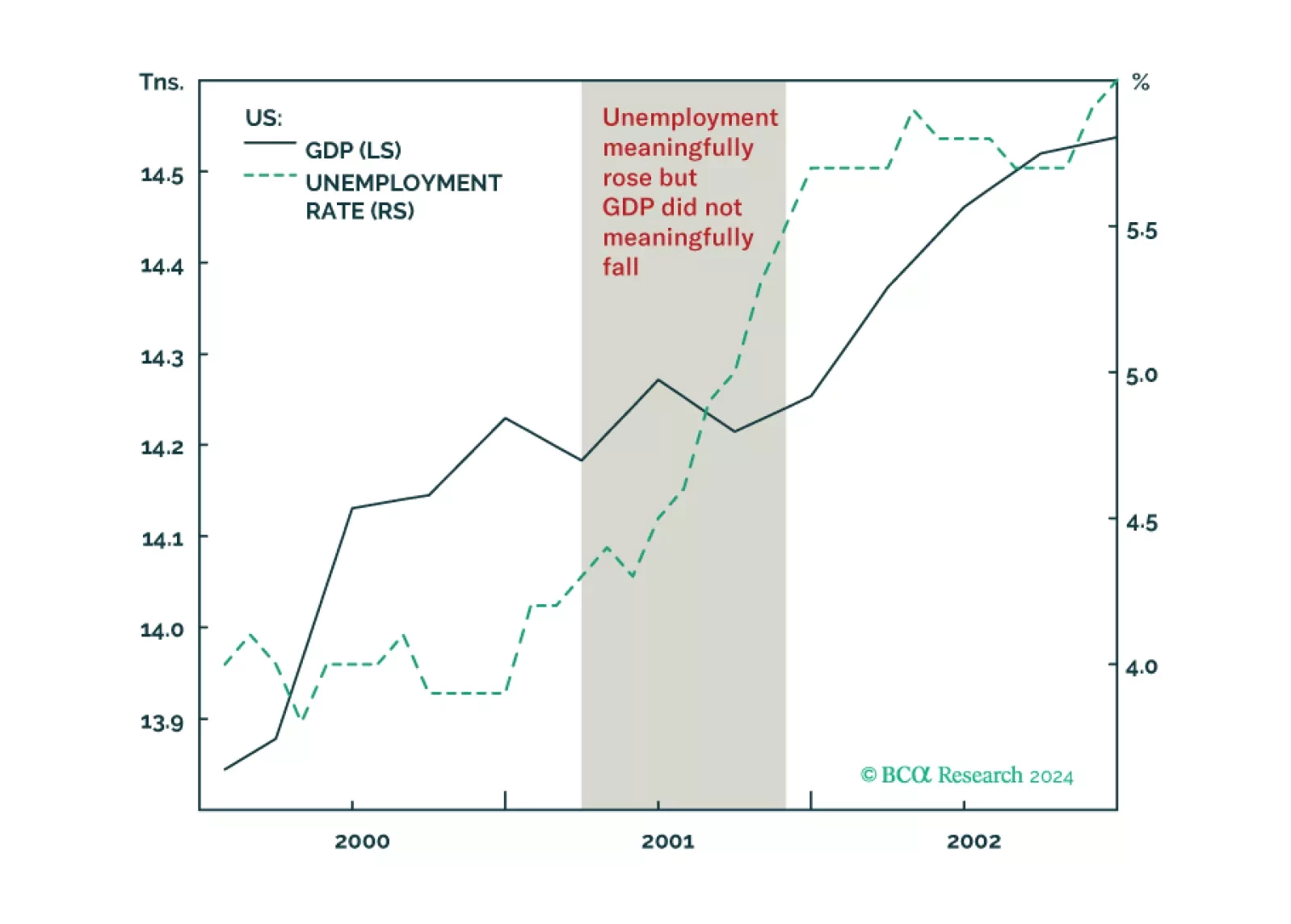

Why the US could get a jobs recession without a GDP recession, as happened in 2001, and what it means for stocks and bonds. Plus, an update on the Joshi rule.

Mainland residents’ investments in gold, other metals, and Hong Kong-traded stocks are a form of capital outflow. Chinese authorities will counter any excessive capital flight with stricter administrative controls. Thus, markets…