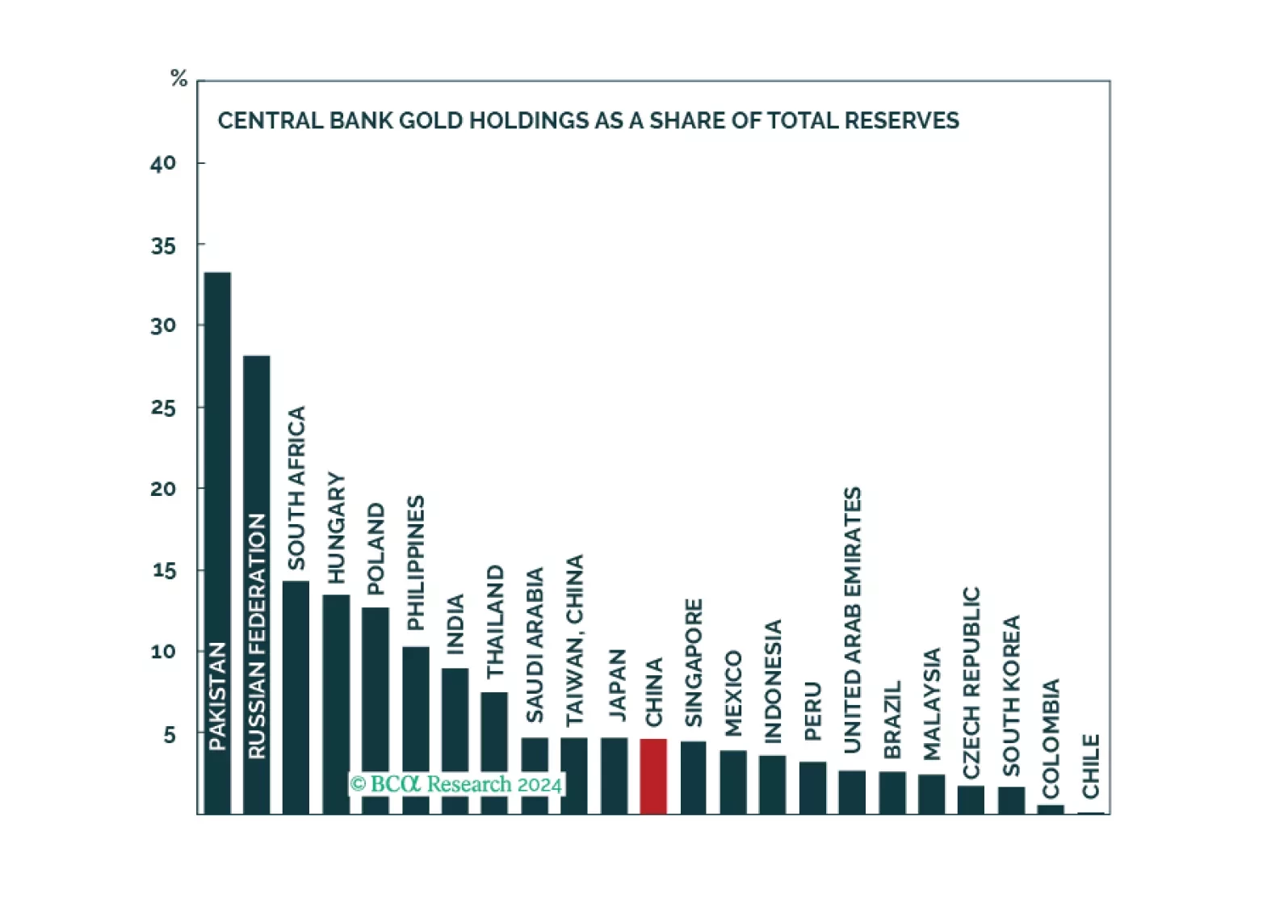

Gold prices might experience a correction or consolidation over the near term. However, cyclical and structural forces will ultimately cause the yellow metal to trend upwards.

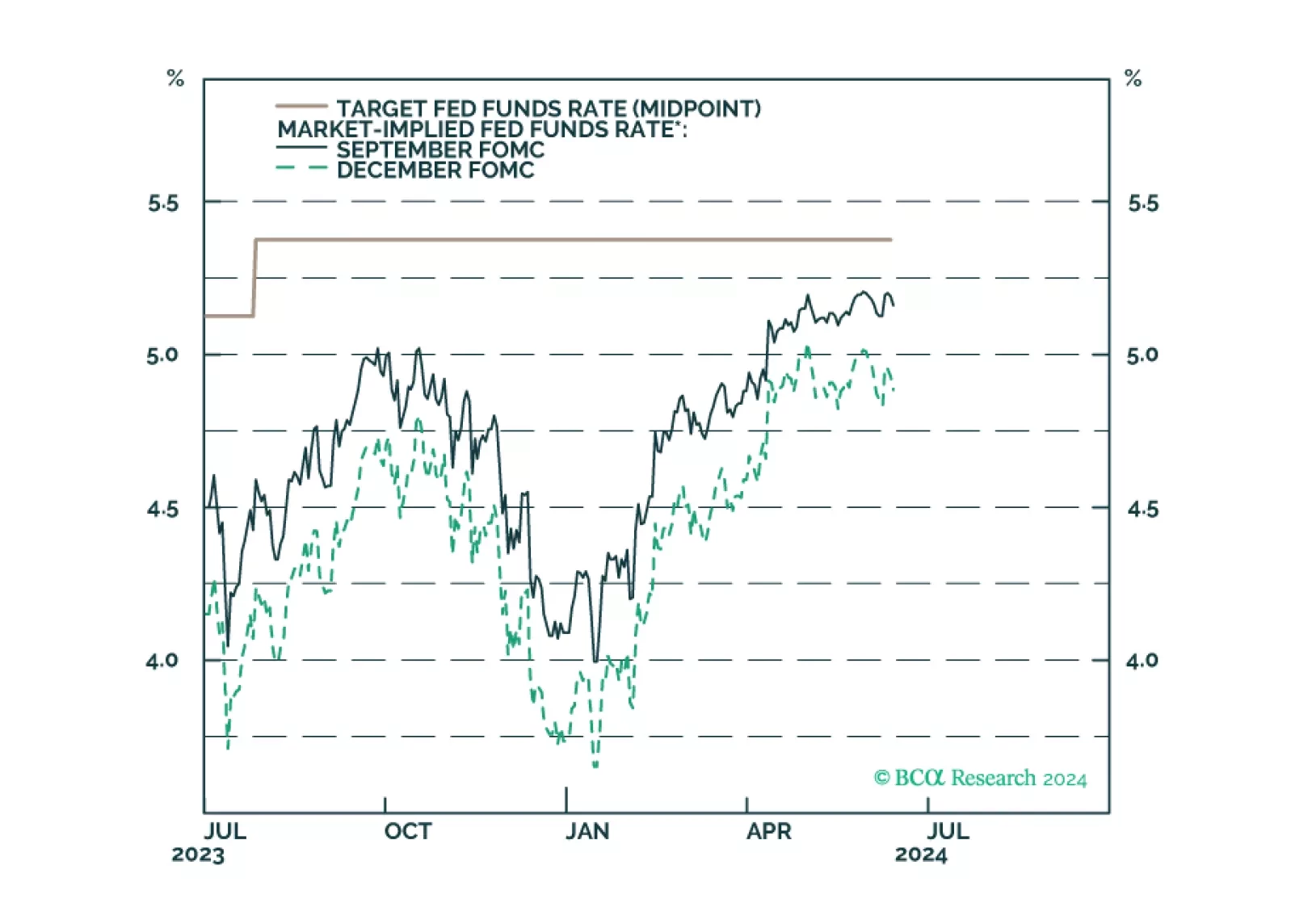

Our reaction to this morning’s CPI report and this afternoon’s FOMC meeting.

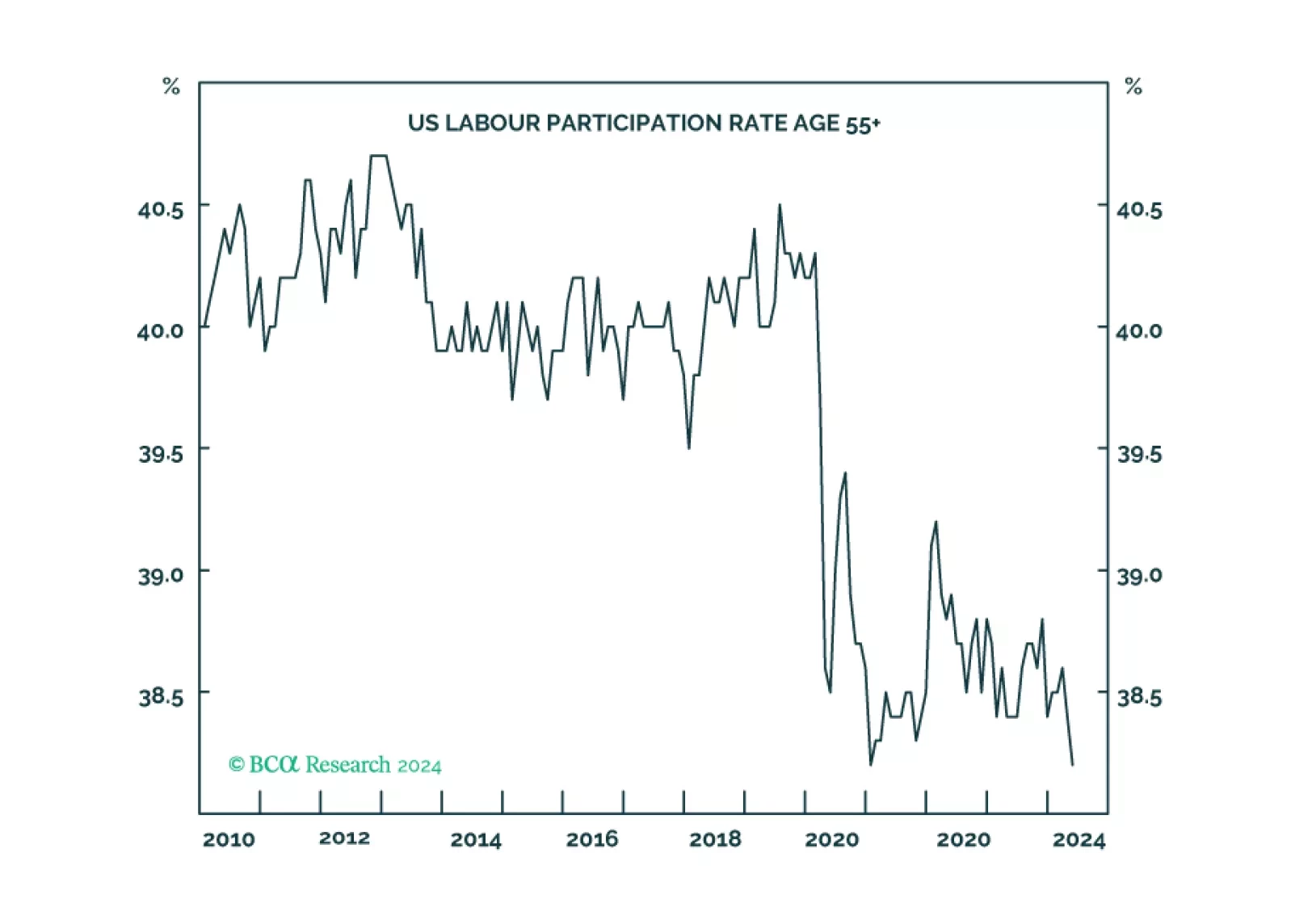

1 in 17 older Americans workers have gone missing either through ‘excess retirements’ or ‘excess mortality’. The consequent dislocation of the labour market means that the Fed’s work is not yet done. We go through some investment…

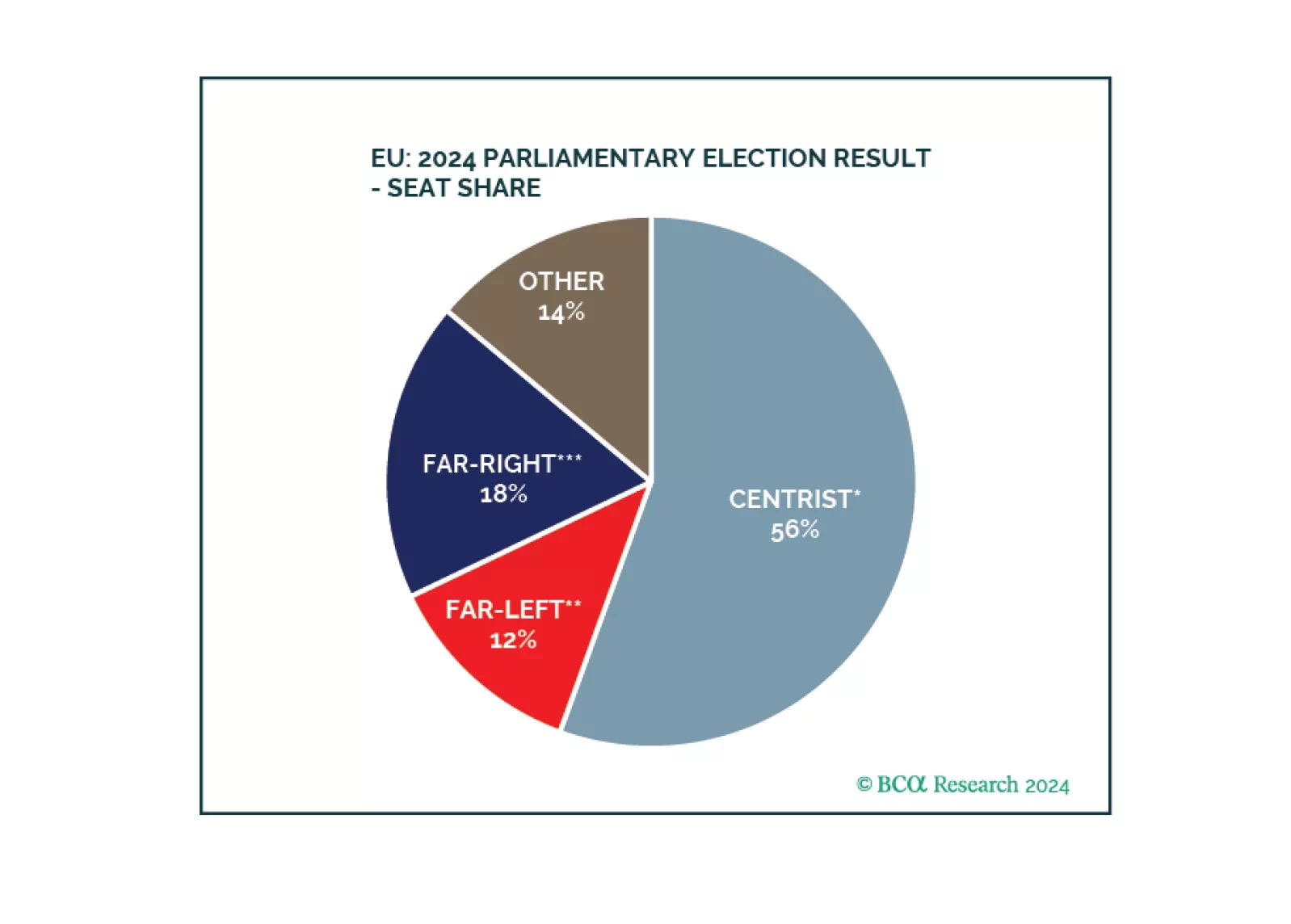

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…

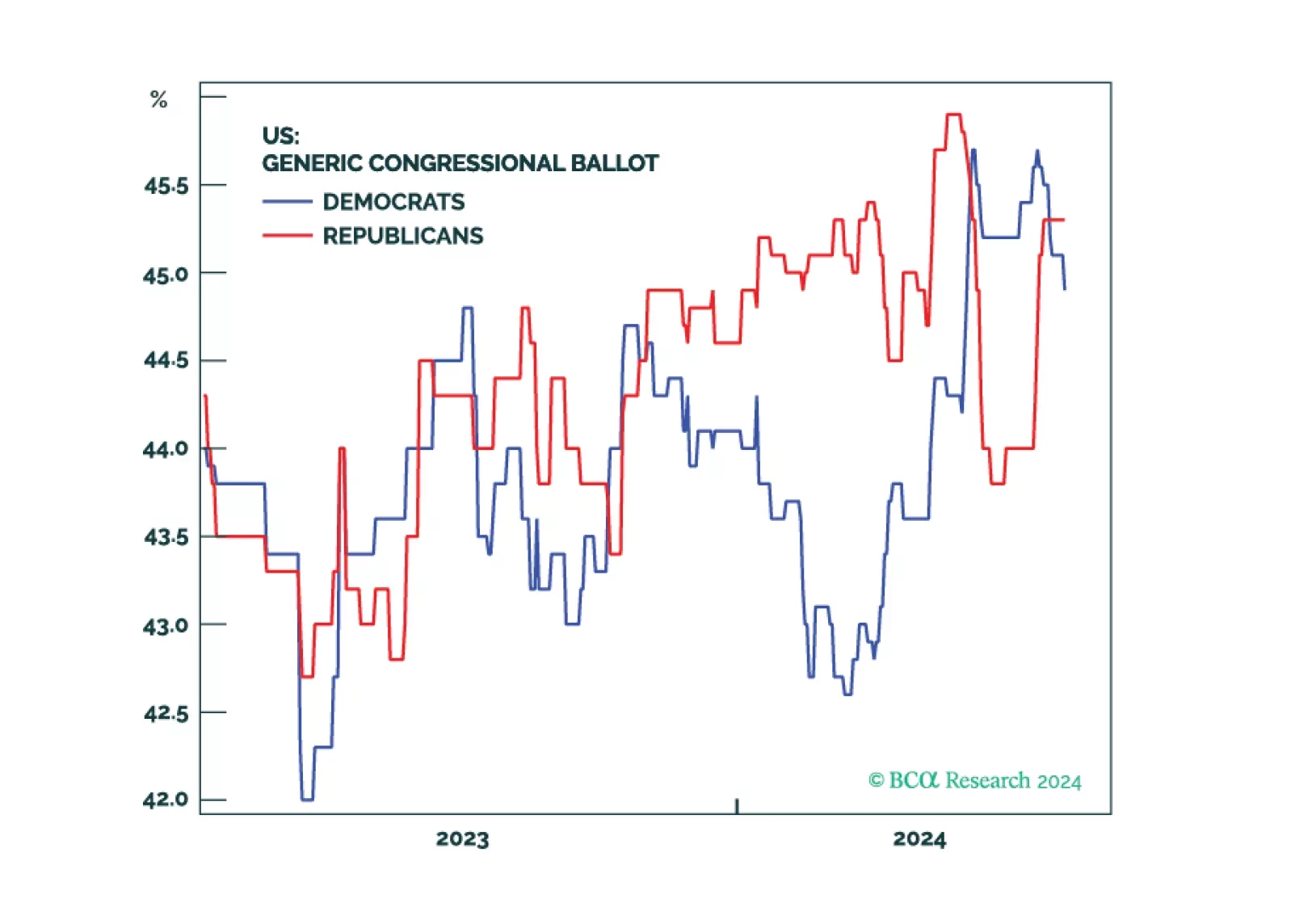

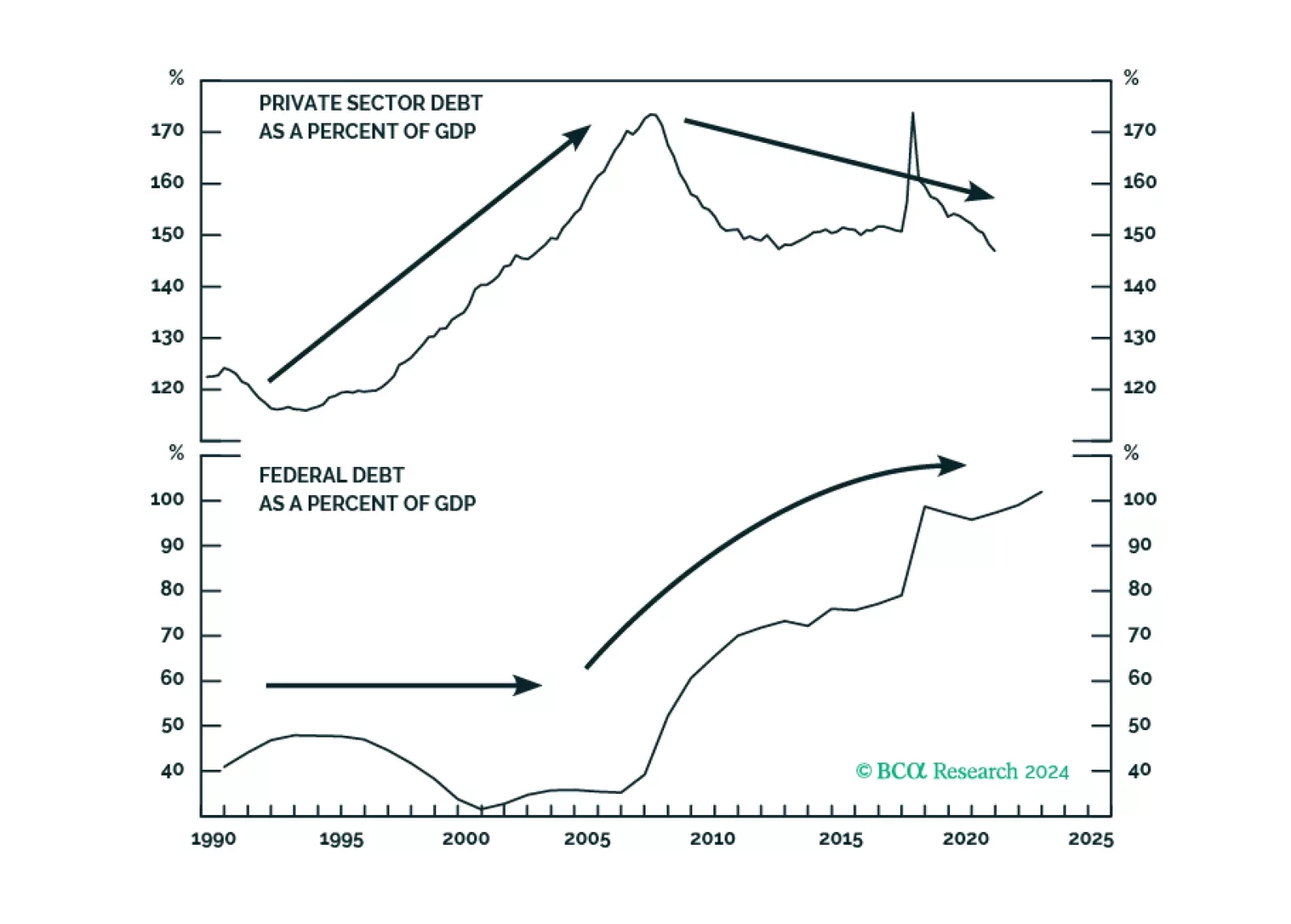

Republicans are favored in the House and Senate even if they do not win the White House. A Democratic sweep is a 20% risk. The policy implication would be inflationary, but not so much as under a Republican sweep. Election…

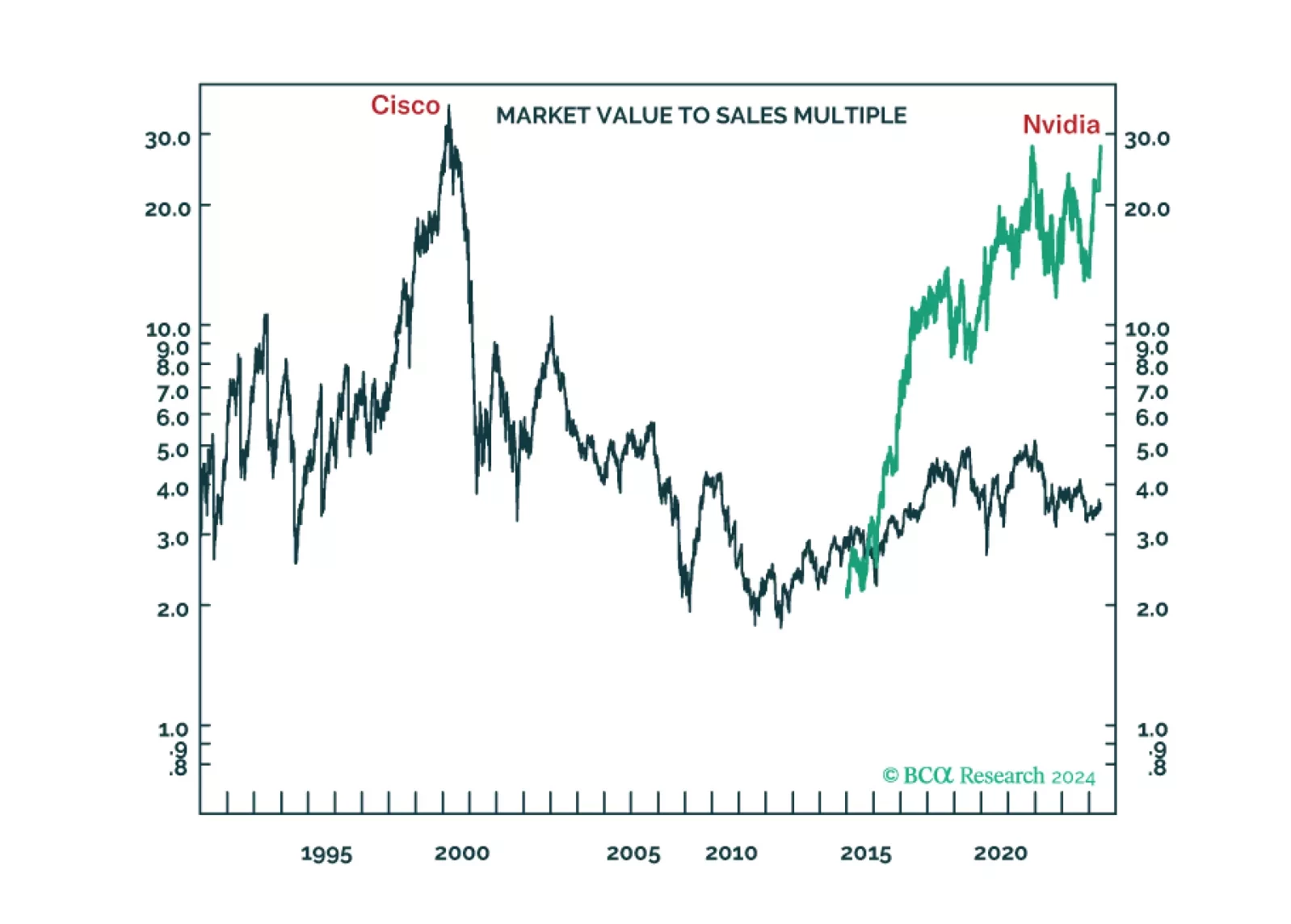

The long-term winners from the generative-AI gold rush are unlikely to be the ‘picks and shovels’ stock Nvidia or the overvalued US superstars of Web 2.0. We discuss the structural investment implications. Plus: time to go tactically…

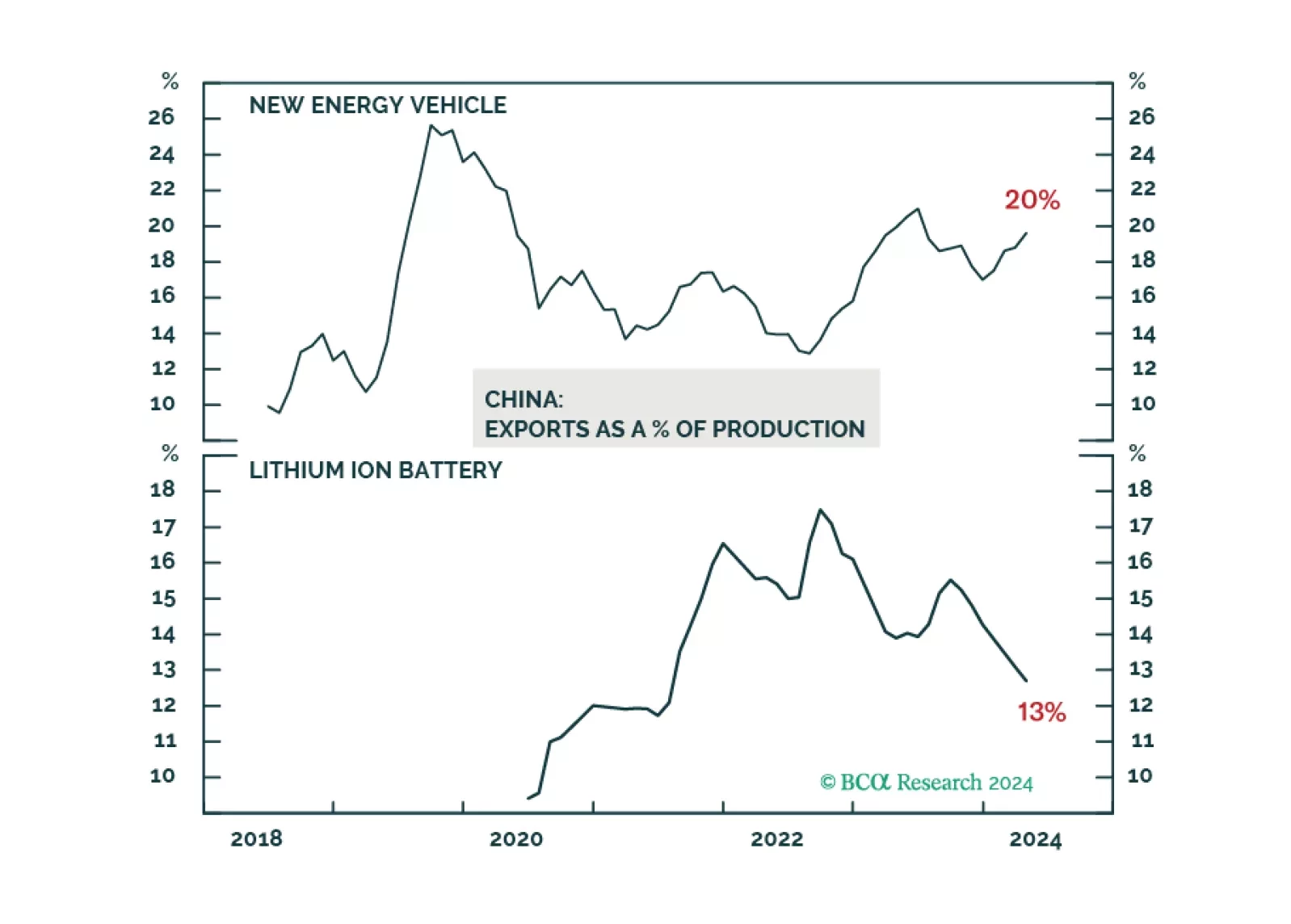

The large buildup in Chinese households’ savings deposits is unlikely to fuel consumption. Poor outlooks on labor market conditions, income, and households’ unwillingness to borrow will hinder consumption through the rest of 2024.