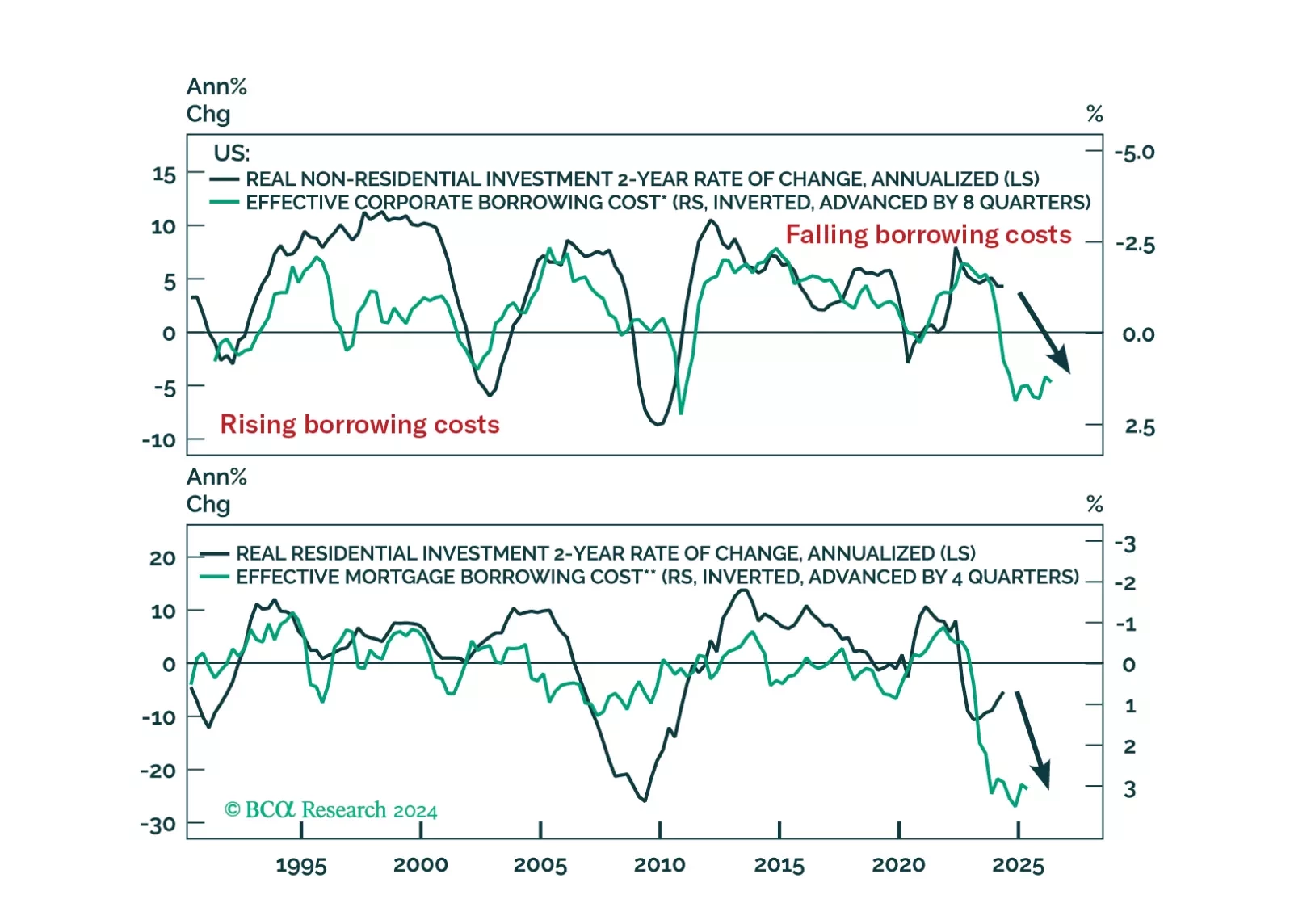

Both the Chinese and US central banks will likely take policy actions in the coming weeks. What is the potential impact of a mortgage rate cut on China’s household consumption and the broader economy? Will the anticipated Fed easing…

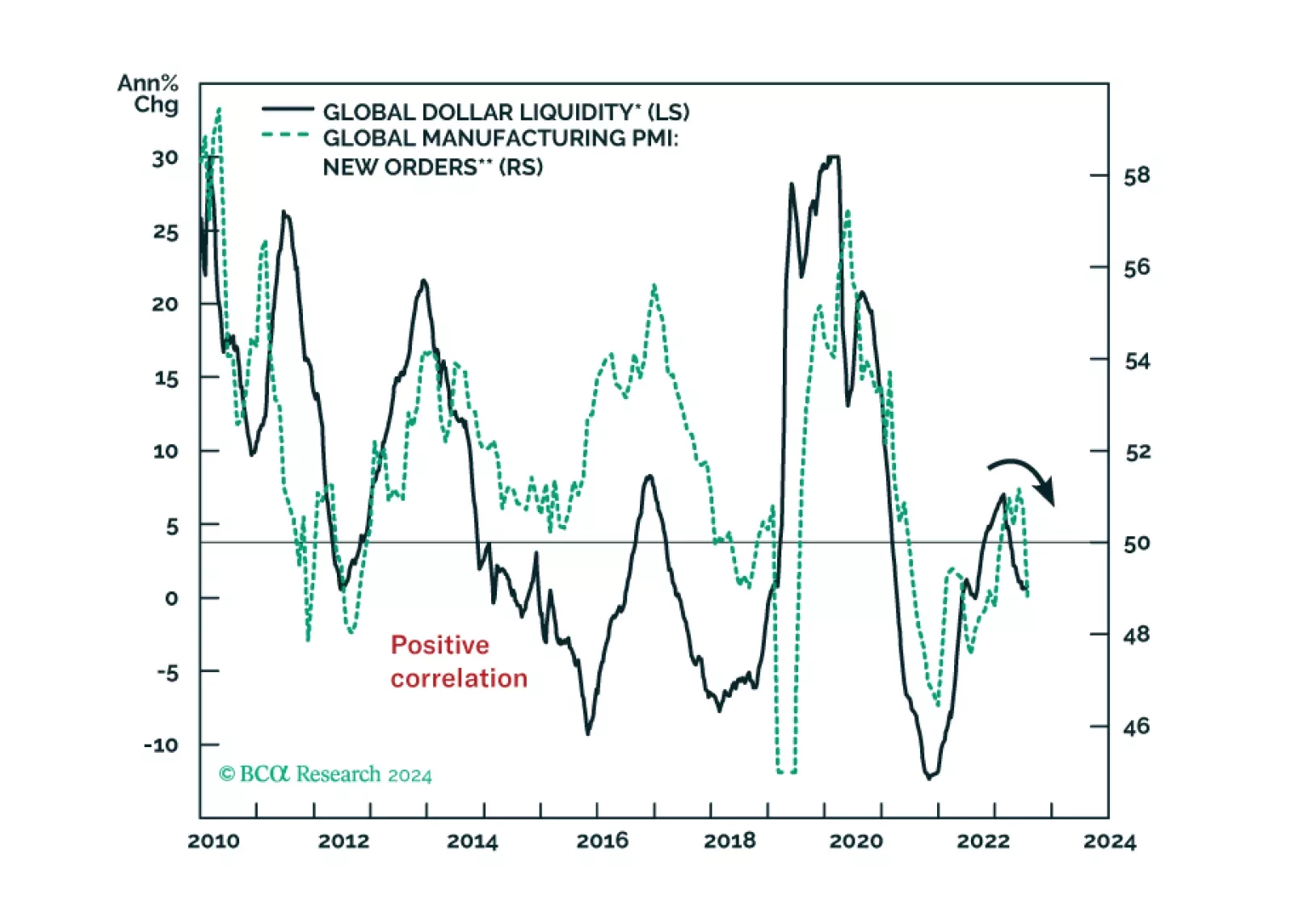

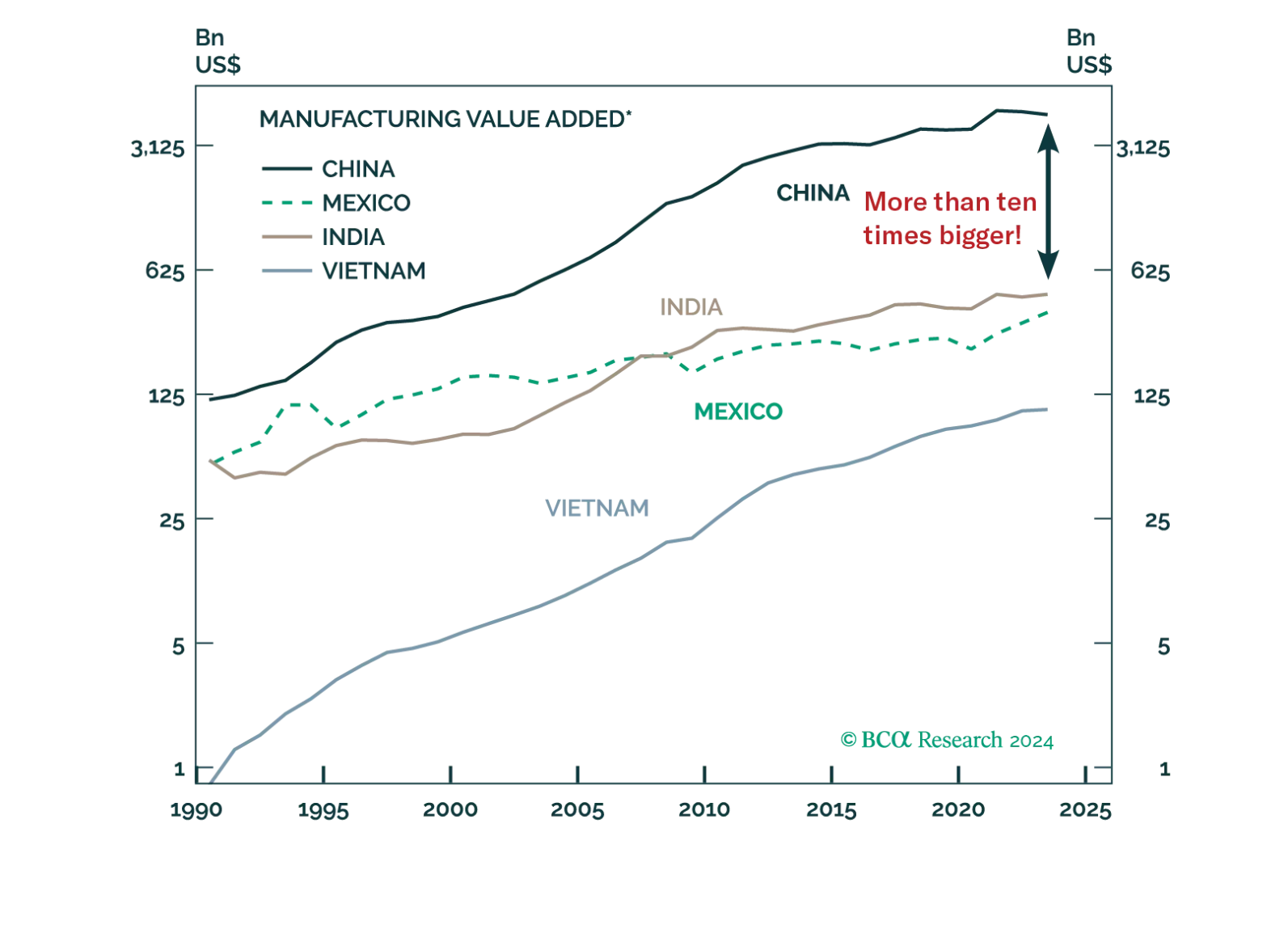

The undercurrents of global financial markets signal deteriorating global growth conditions. There is little cash on the sidelines in the US, the Euro Area, and Japan. If the budding bear market resembles the 2000-2003 one, EM stock…

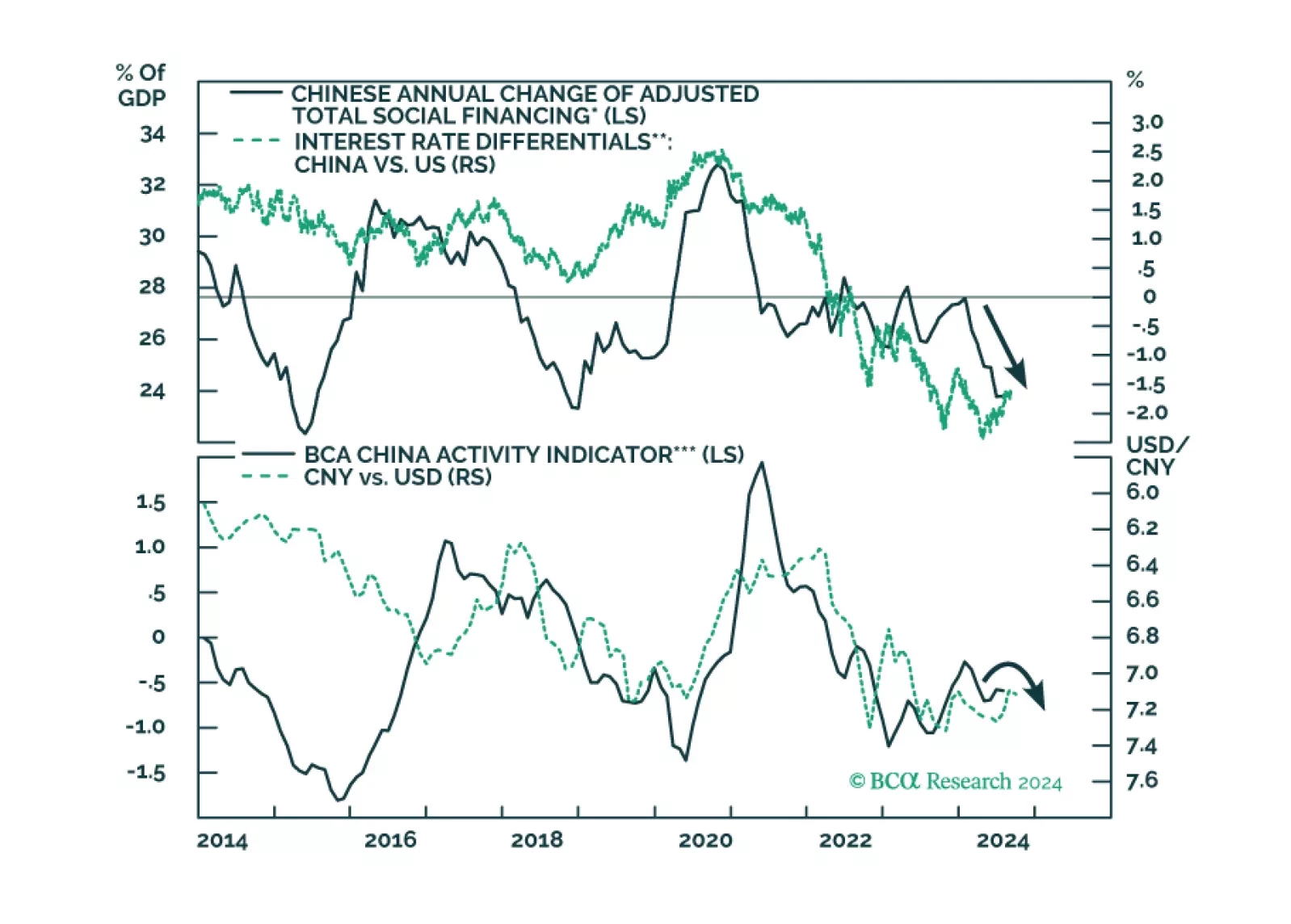

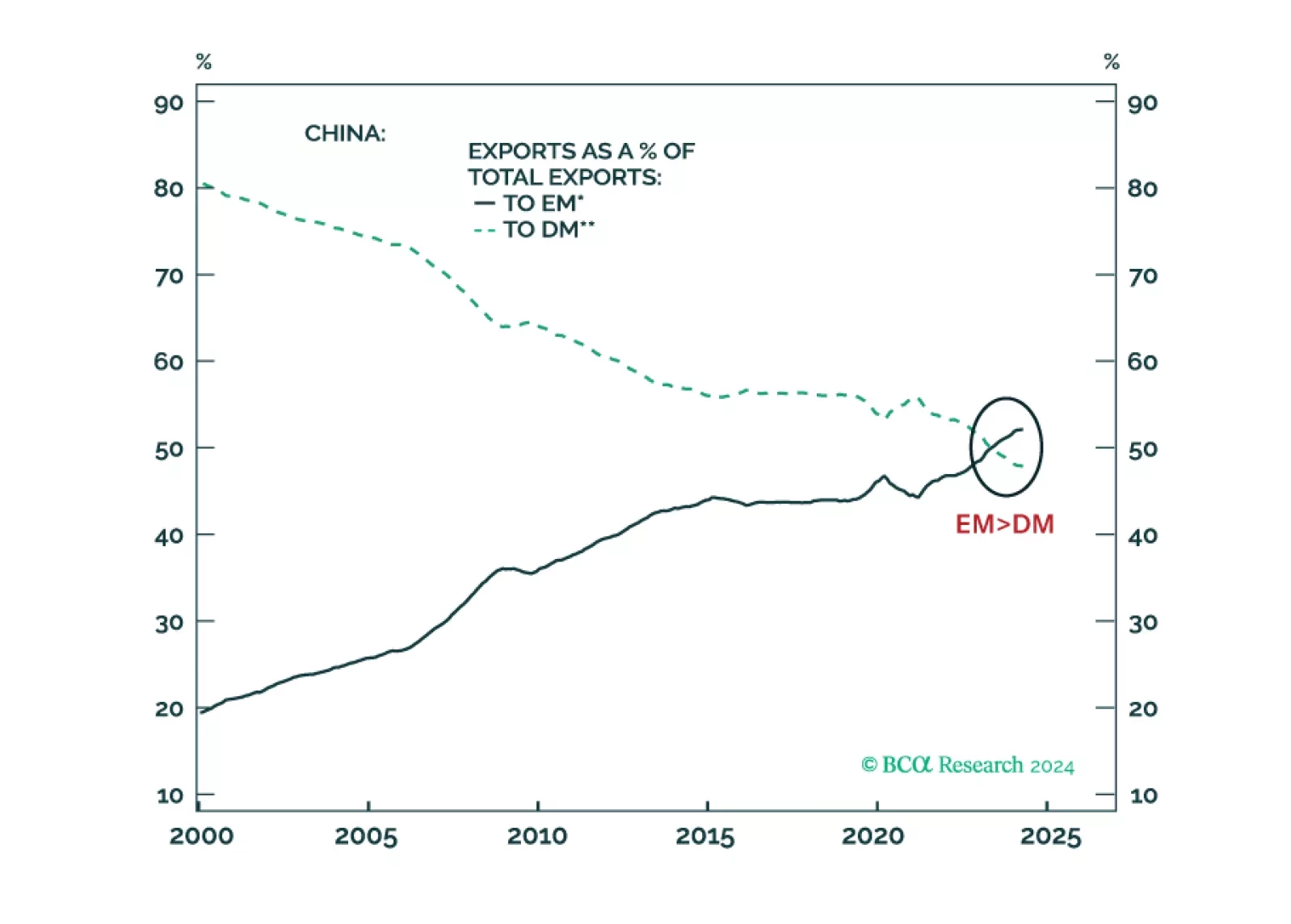

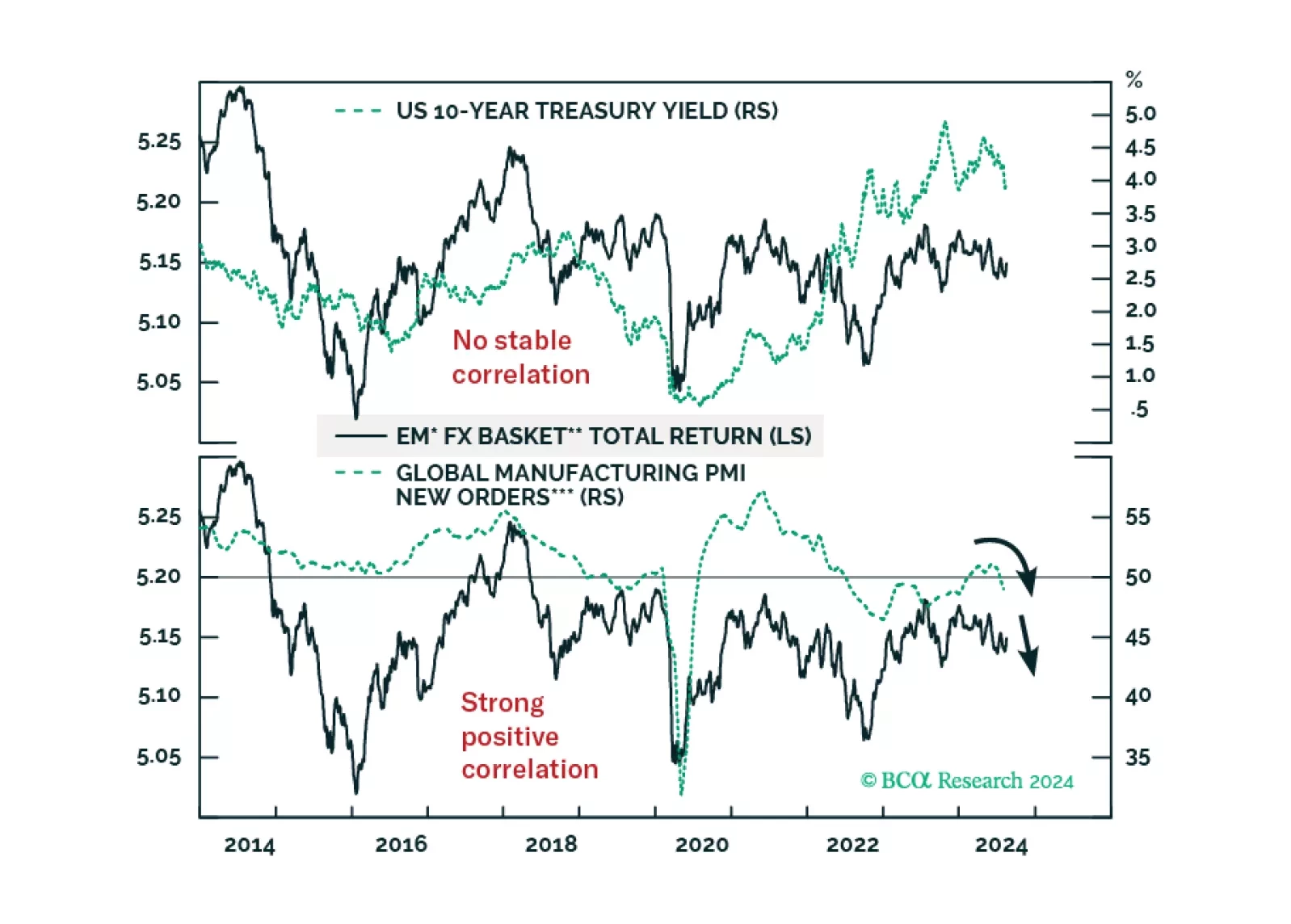

The current Fed easing cycle will likely be a “buy the rumor, sell the news” phenomenon. The basis is our expectation that the US economy is heading into a rough landing. The primary driver of EM currencies is not US interest rates…

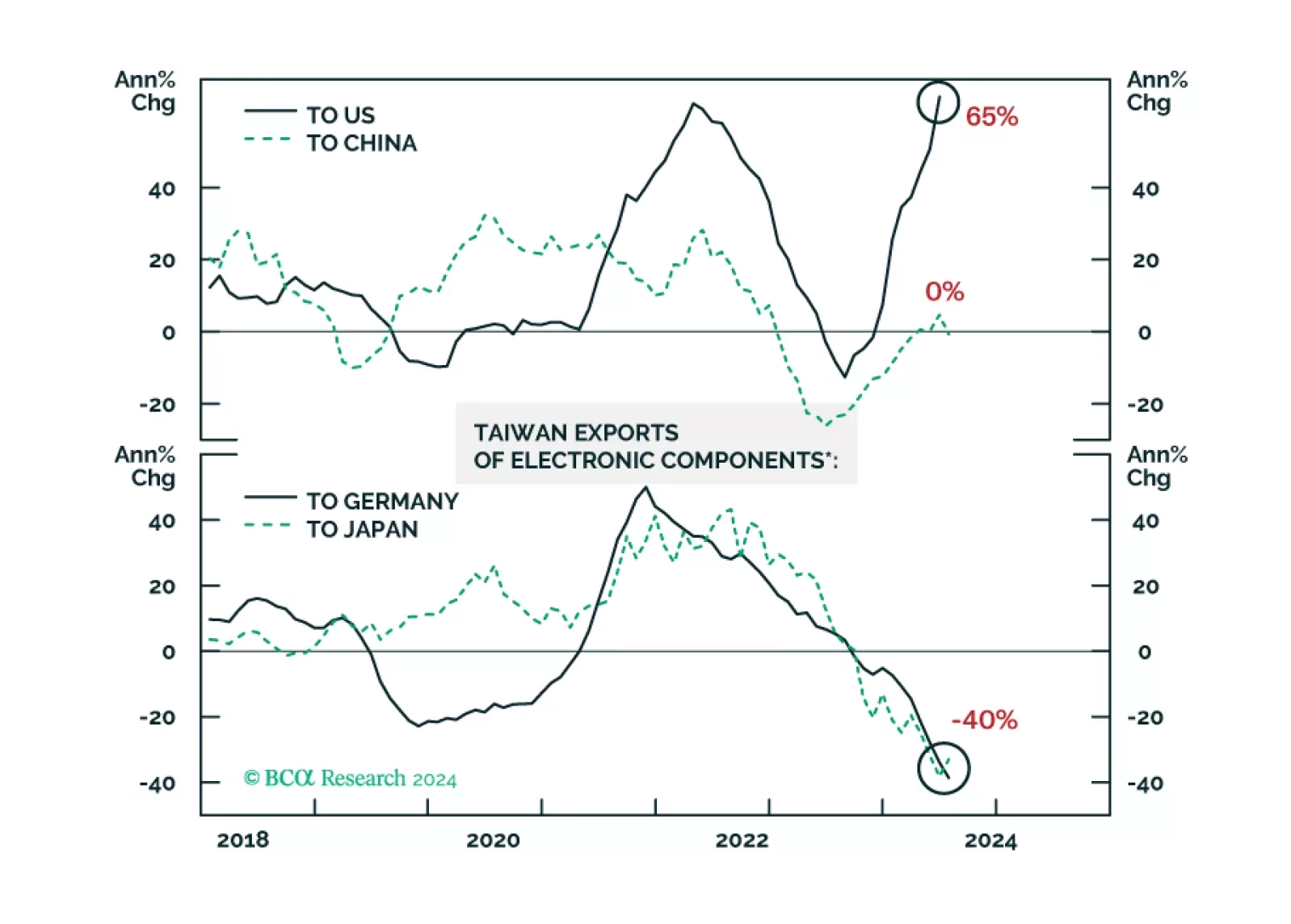

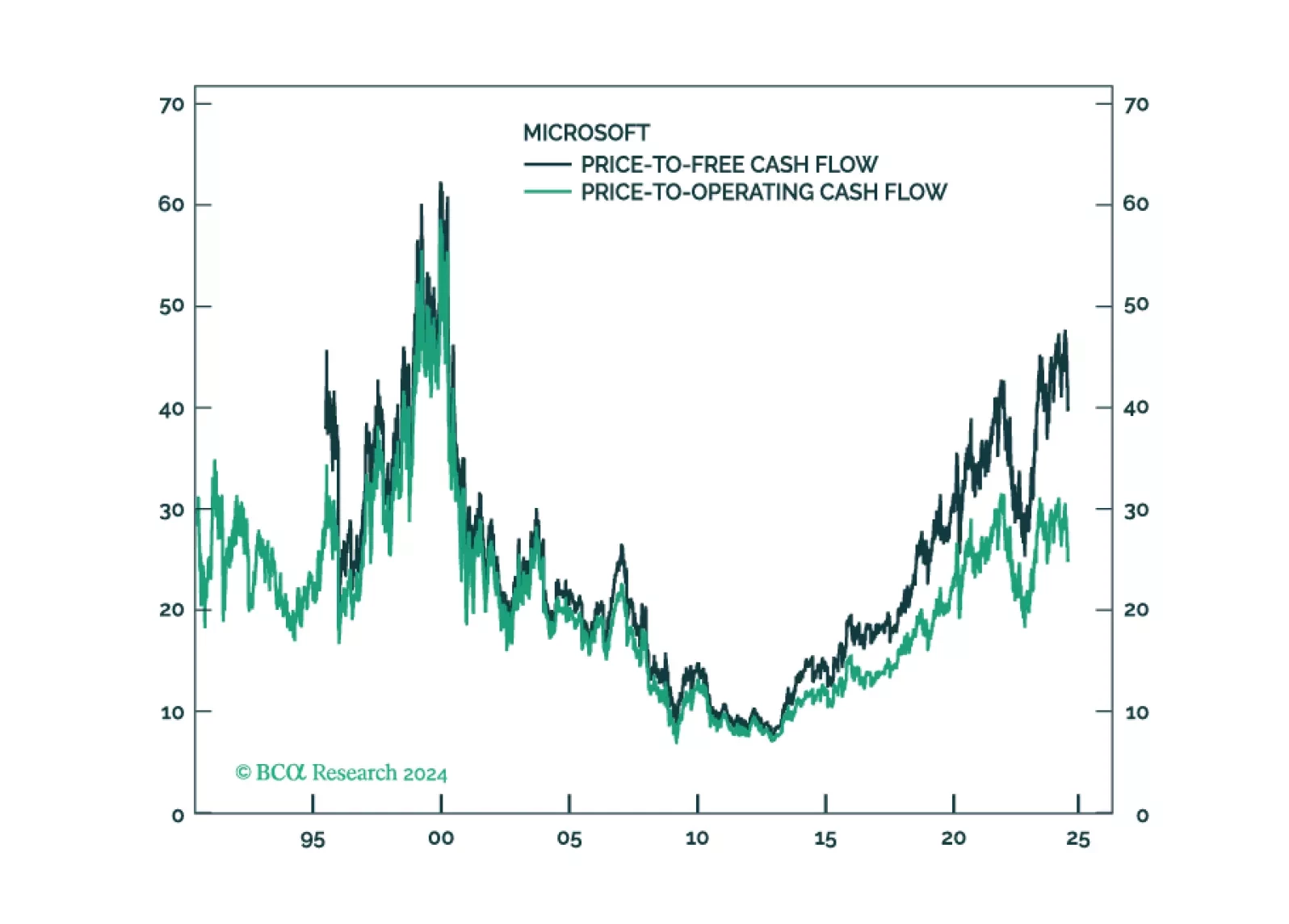

Over the past few weeks, global equities have been hit by rising scepticism over the bullish AI narrative and increasing concerns over global growth. Stocks should stabilize in the near term, but the medium-term direction is to the…

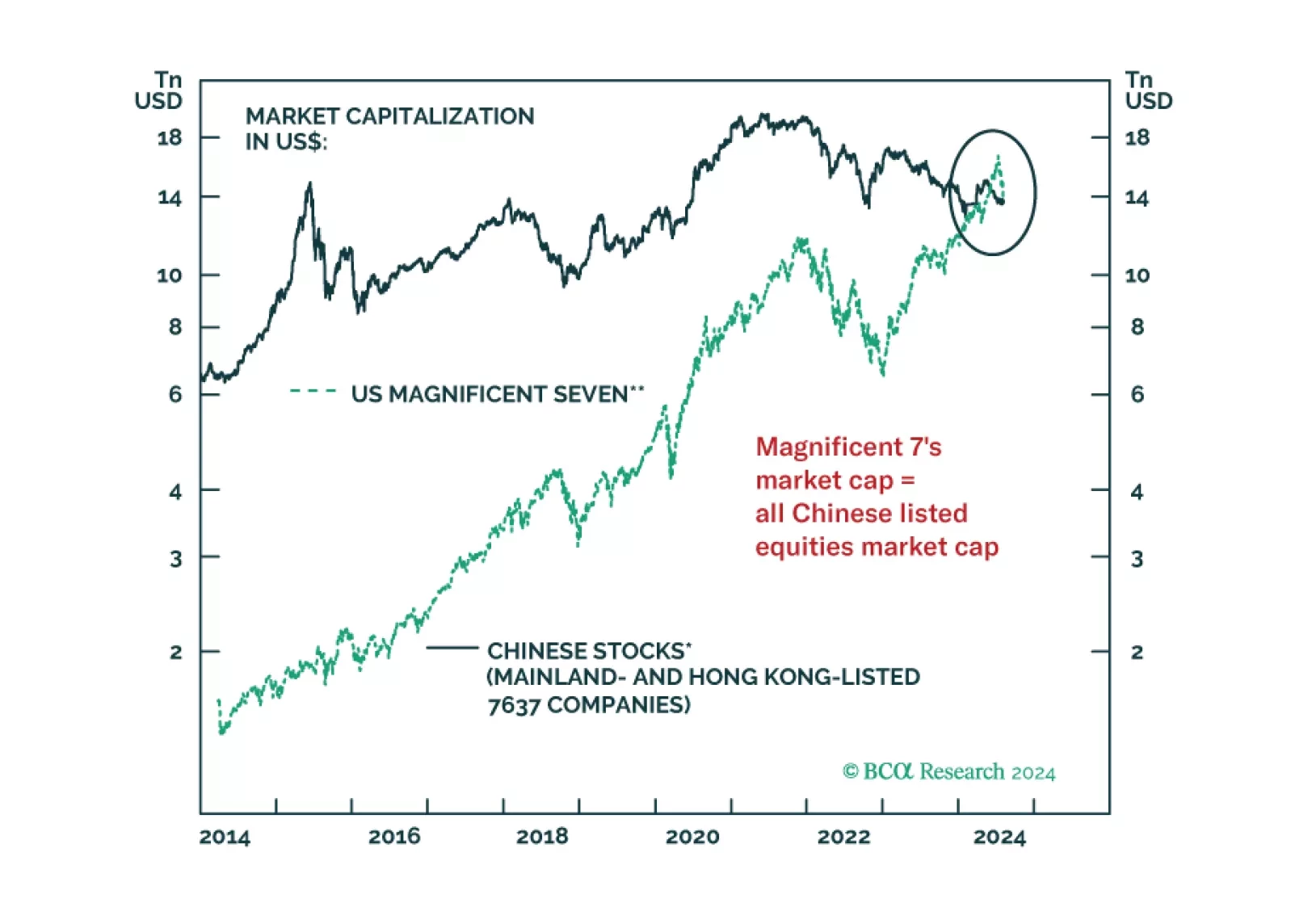

The prices of multiple financial assets have failed to break above their technical resistances. When this occurs, a breakdown ensues. In brief, global risk assets remain vulnerable. We are upgrading Chinese onshore stocks from…