The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

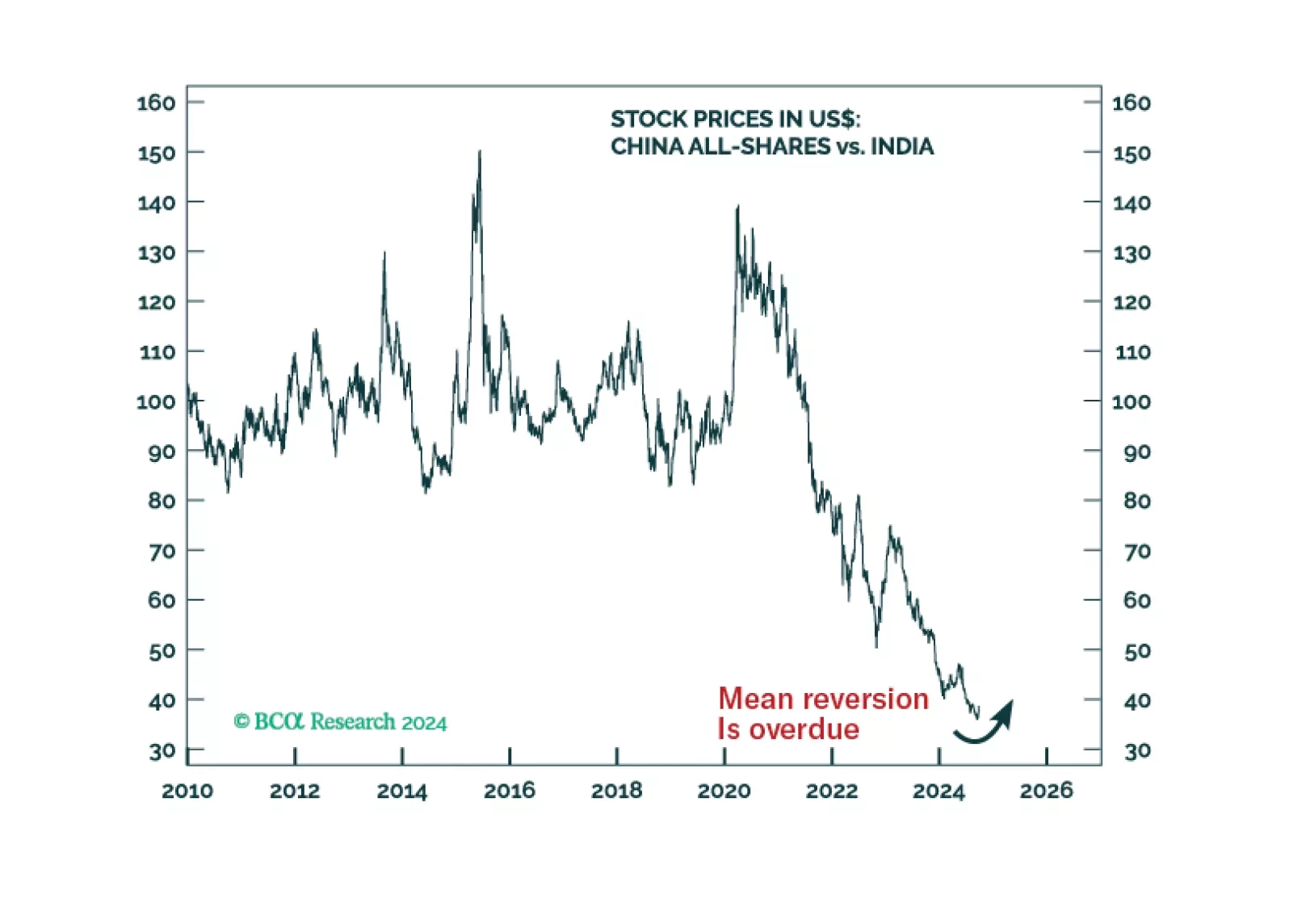

To produce a moderate economic recovery, at least RMB 3 trillion in additional government expenditures is needed in H1 2025. Our bias is that Beijing is not yet ready to launch such a massive fiscal support measure. Hence, volatility…

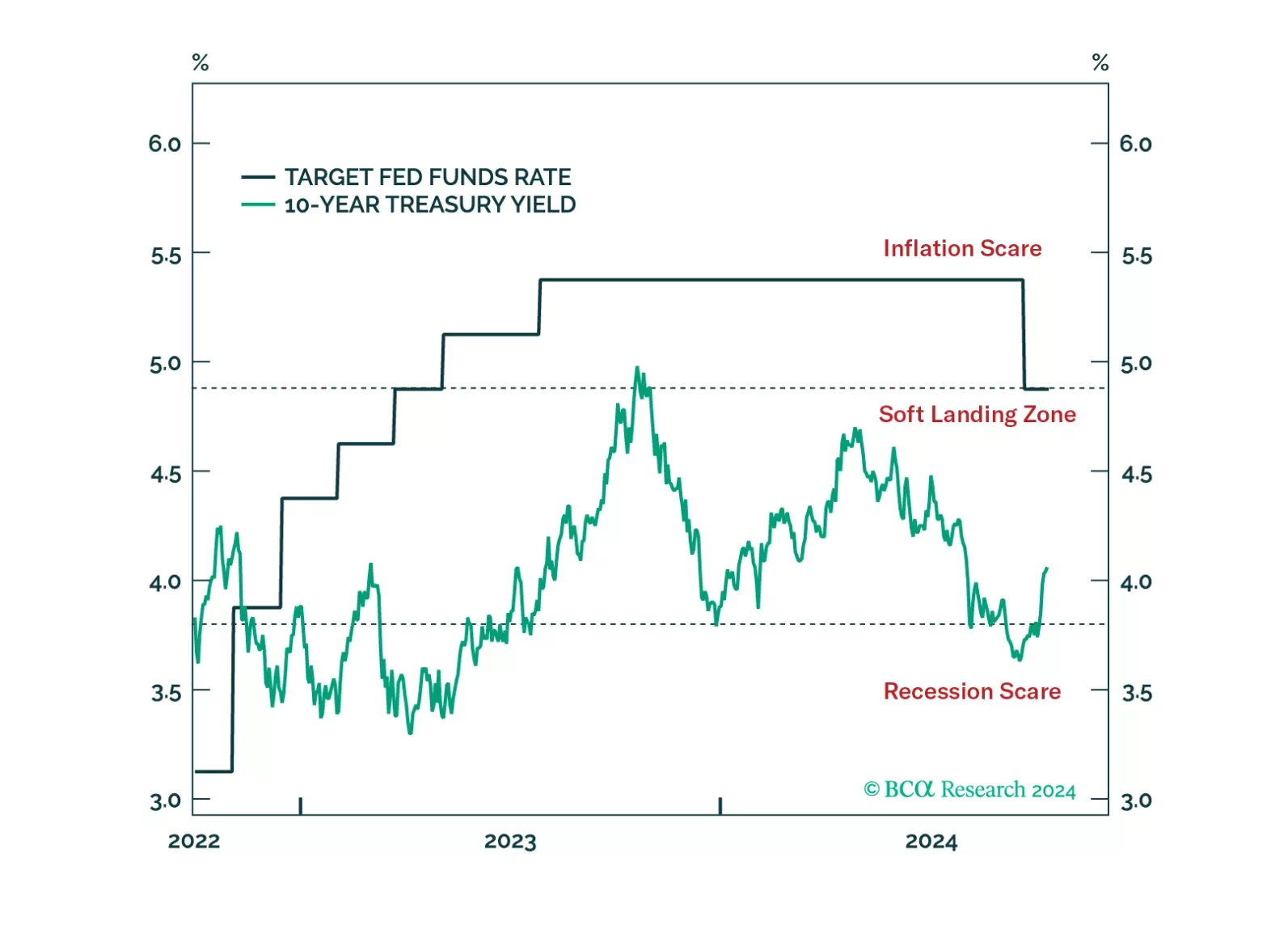

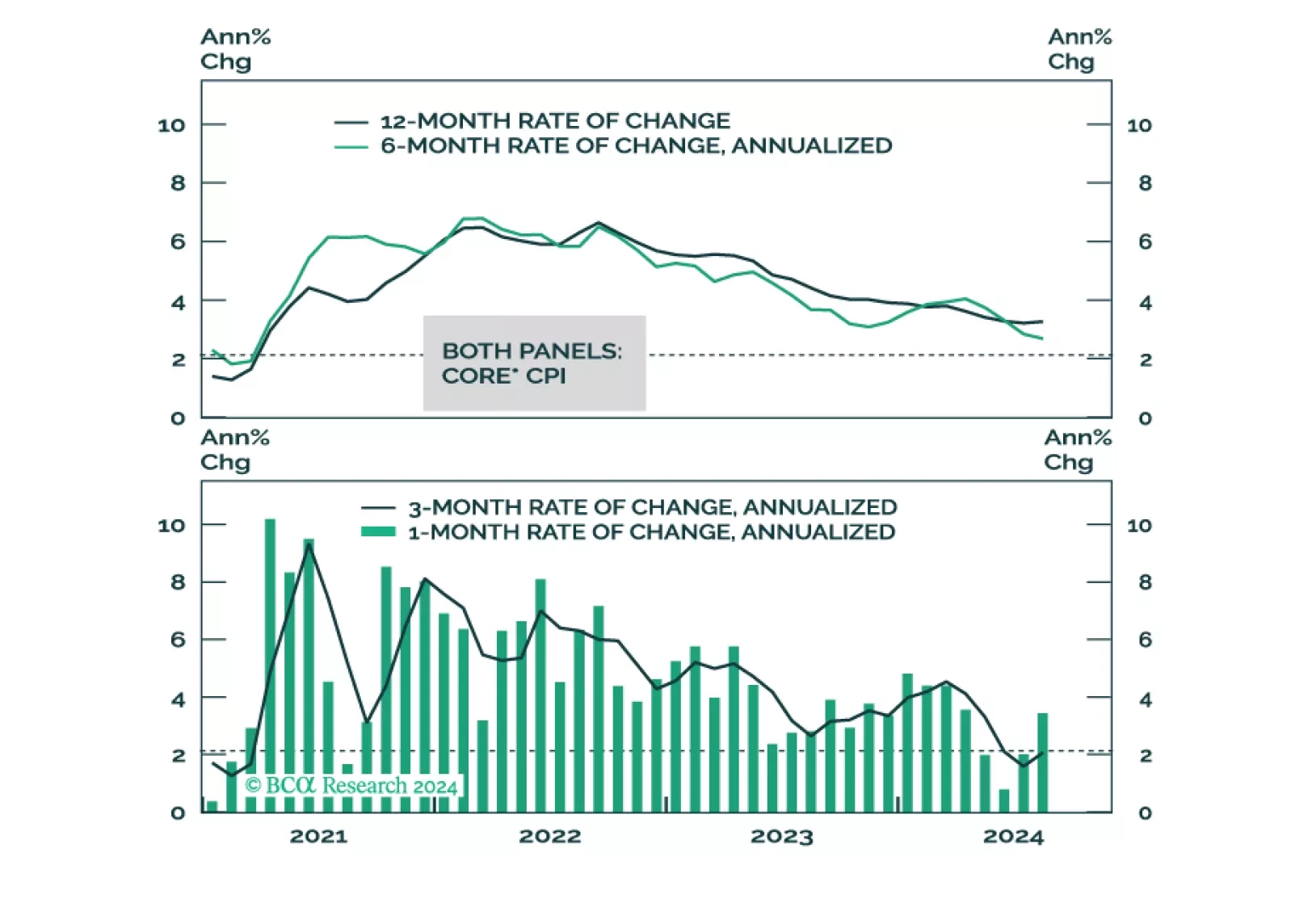

We give our thoughts on this morning’s CPI release and (lack of) market reaction. We also close our short position in January 2025 fed funds futures.

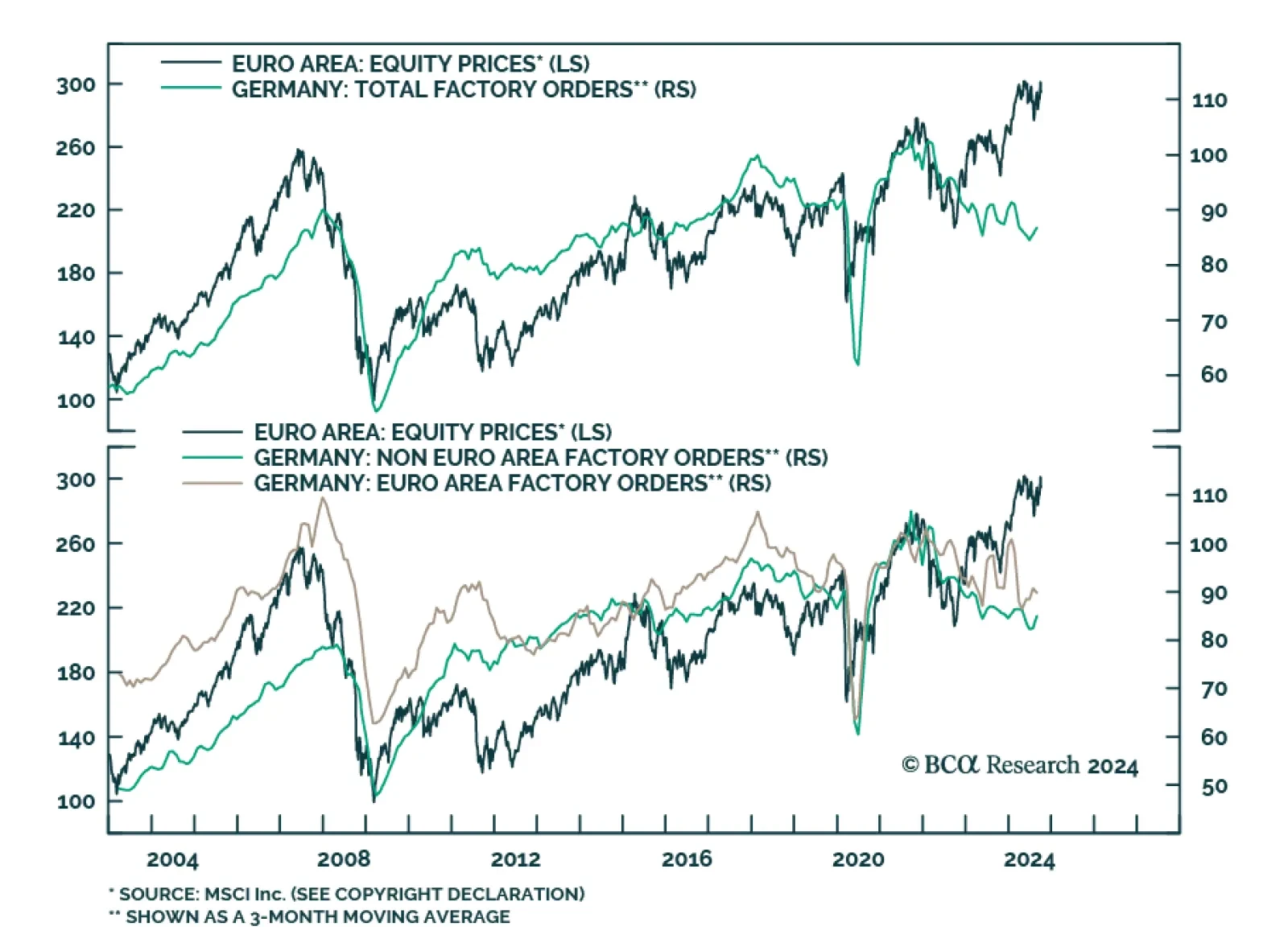

German factory orders contracted by a larger-than-anticipated 5.8% m/m (3.9% y/y) in August, from a 3.9% expansion (4.6% y/y). Domestically, Germany is constitutionally bound to maintain a balanced budget. The emergency…

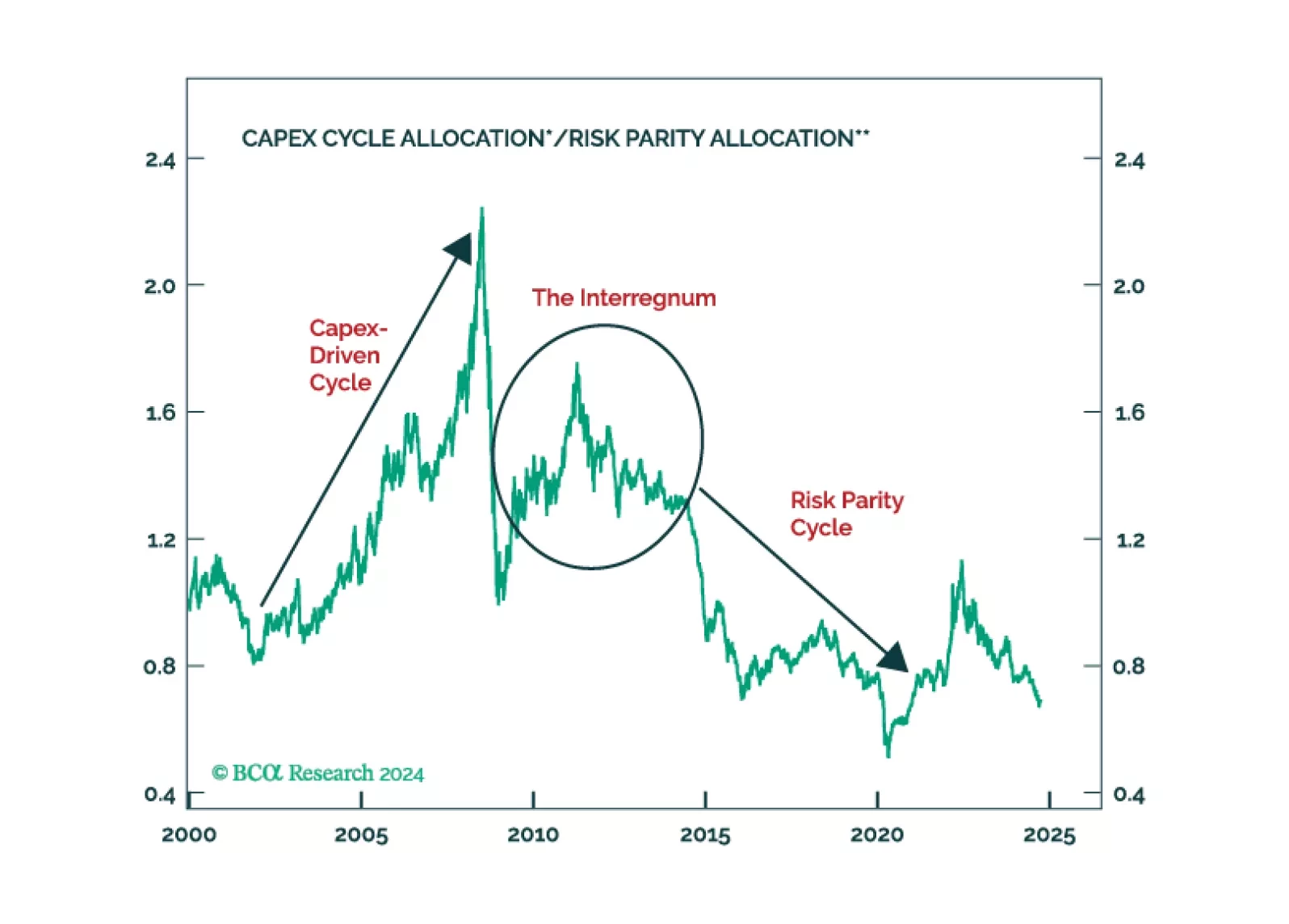

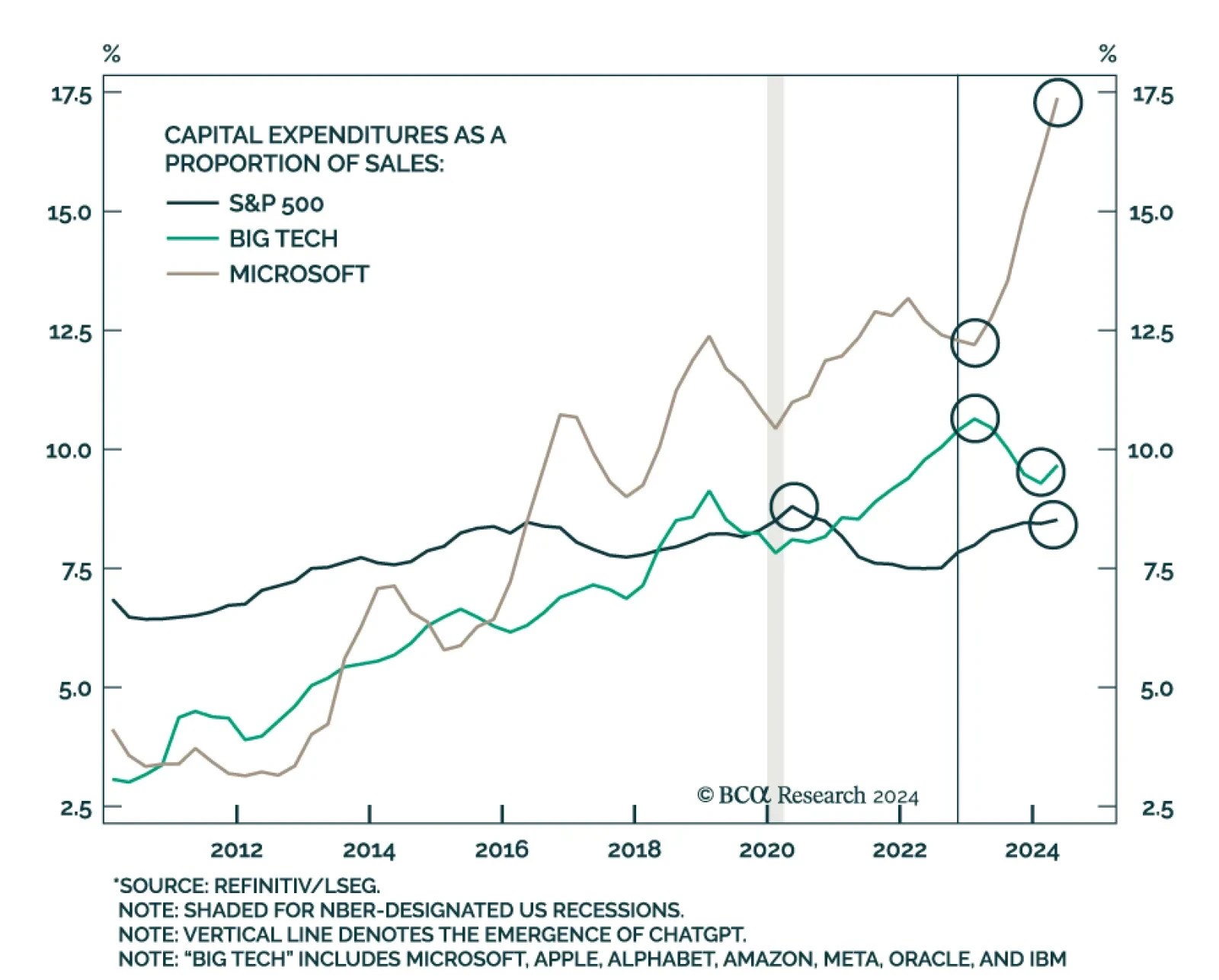

According to BCA Research’s Bank Credit Analyst service, CAPEX does not appear to be especially broad-based even among the largest companies in the US. The enclosed chart presents a bottom-up estimate of CAPEX as…

Western policymakers are pursuing three capital “T” Truths: China is evil, climate change is a major risk, and Russia is… also evil. Pursuing all three priorities at the same time presents a version of the classic “impossible trinity…

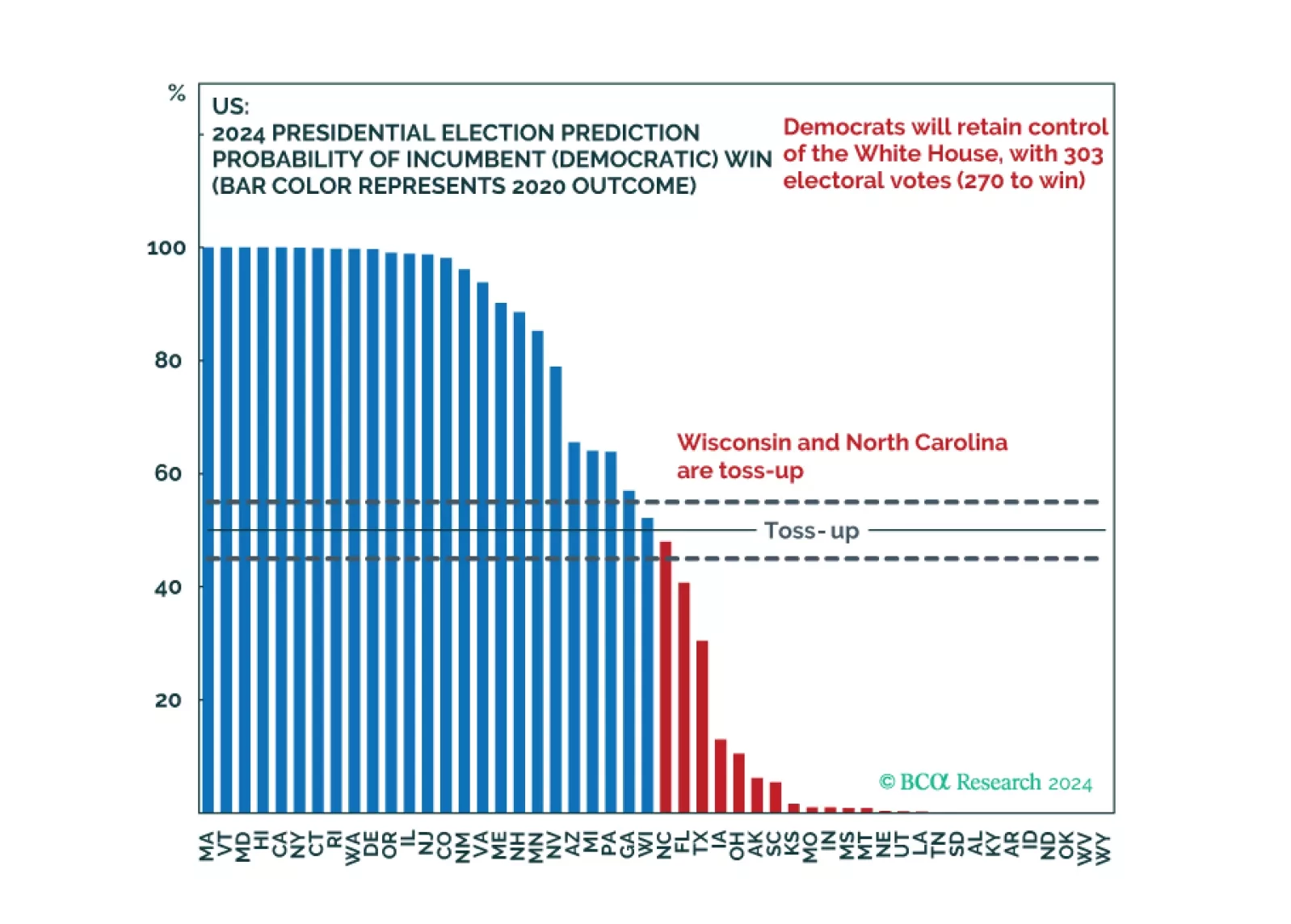

Our quant model shows Democrats winning the election at a 56% probability, with 303 electoral college votes. But swing state economies are slowing and Democrats’ odds in Michigan fell. Trump can win with Georgia, Michigan, plus one…

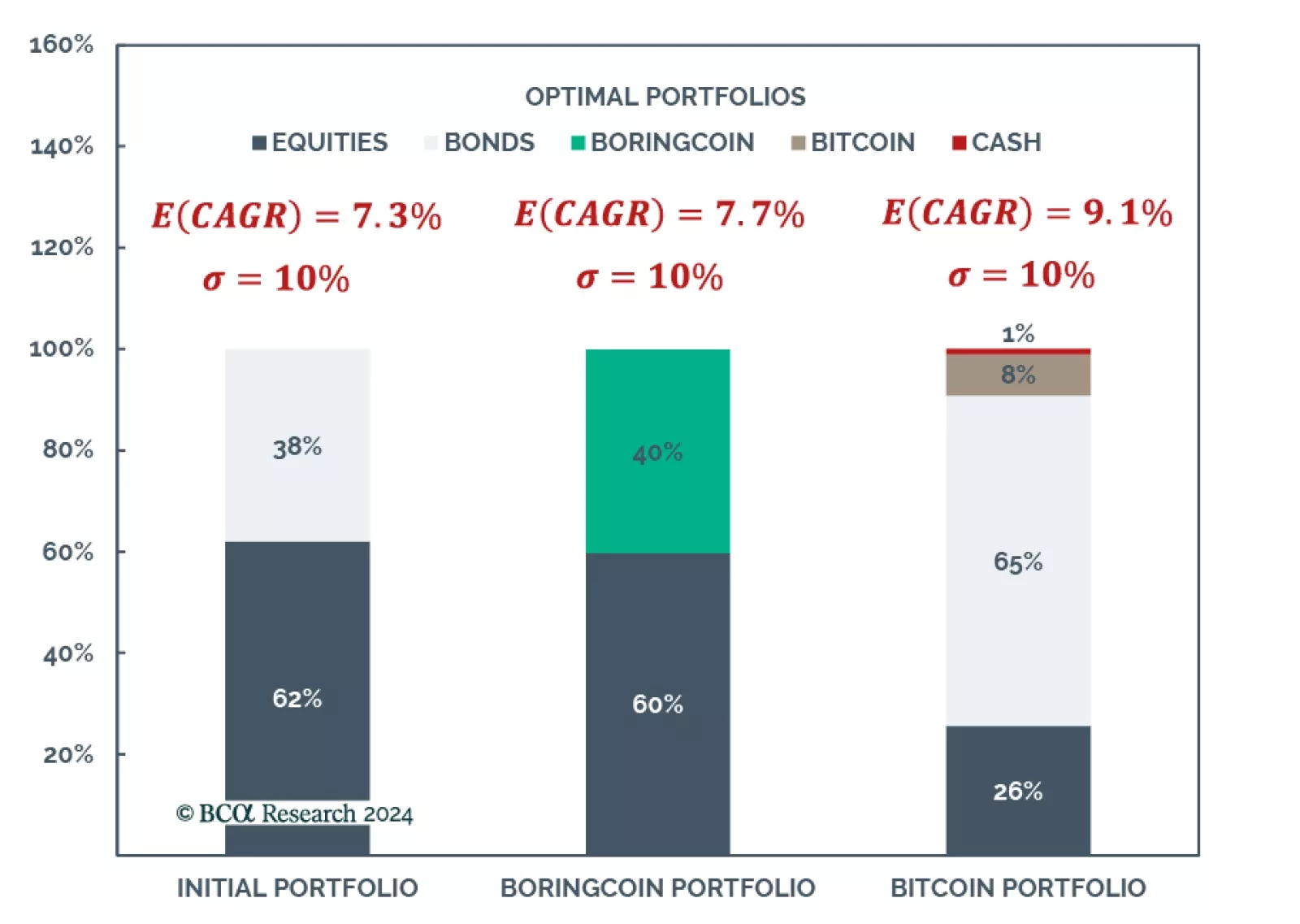

According to BCA Research’s Global Asset Allocation Strategy service, a common objection to buying Bitcoin raised by traditional investors is that it is too volatile. In the past it has been argued that this is irrelevant,…

Our reaction to this morning’s CPI report and what it means for Fed policy.