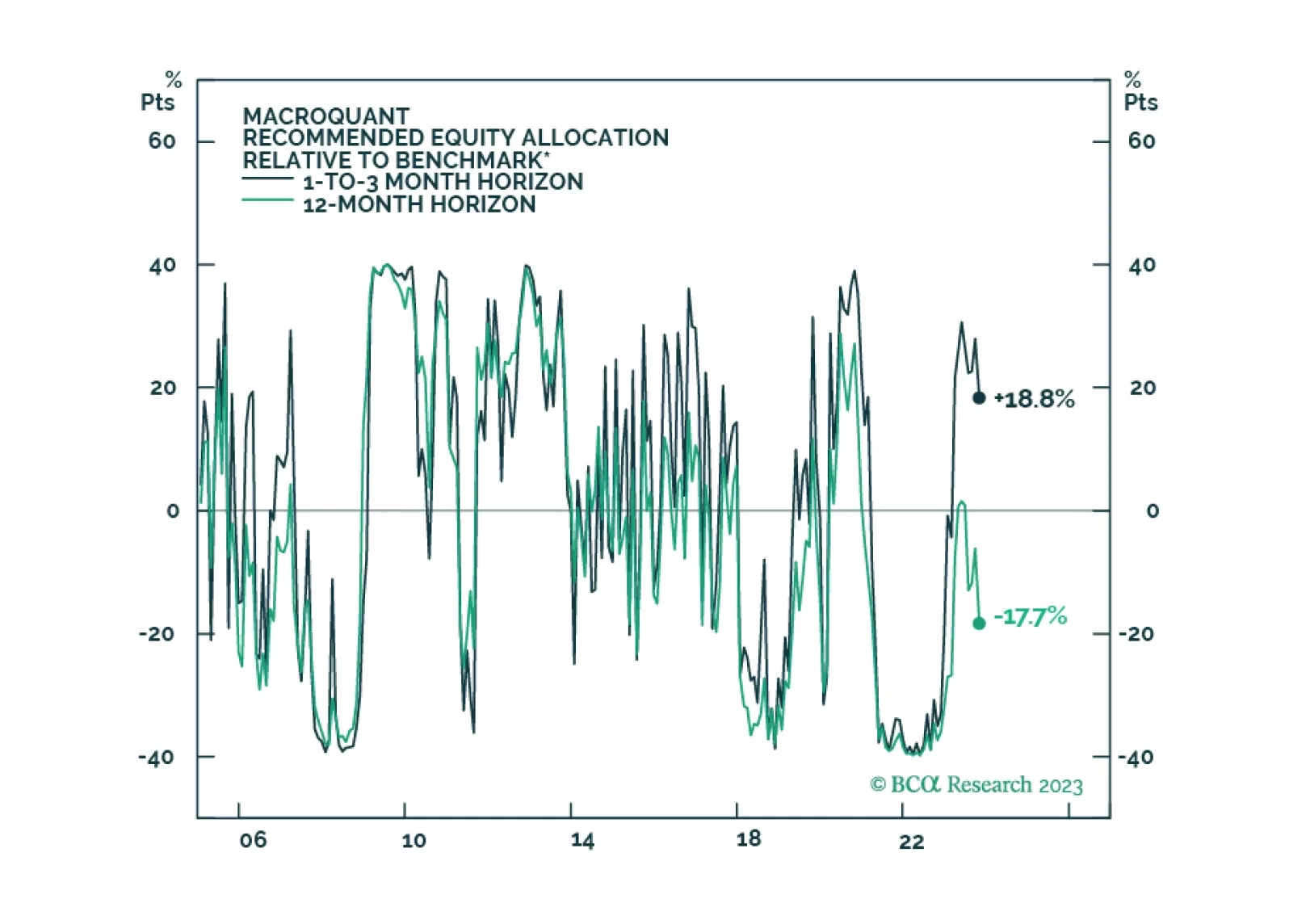

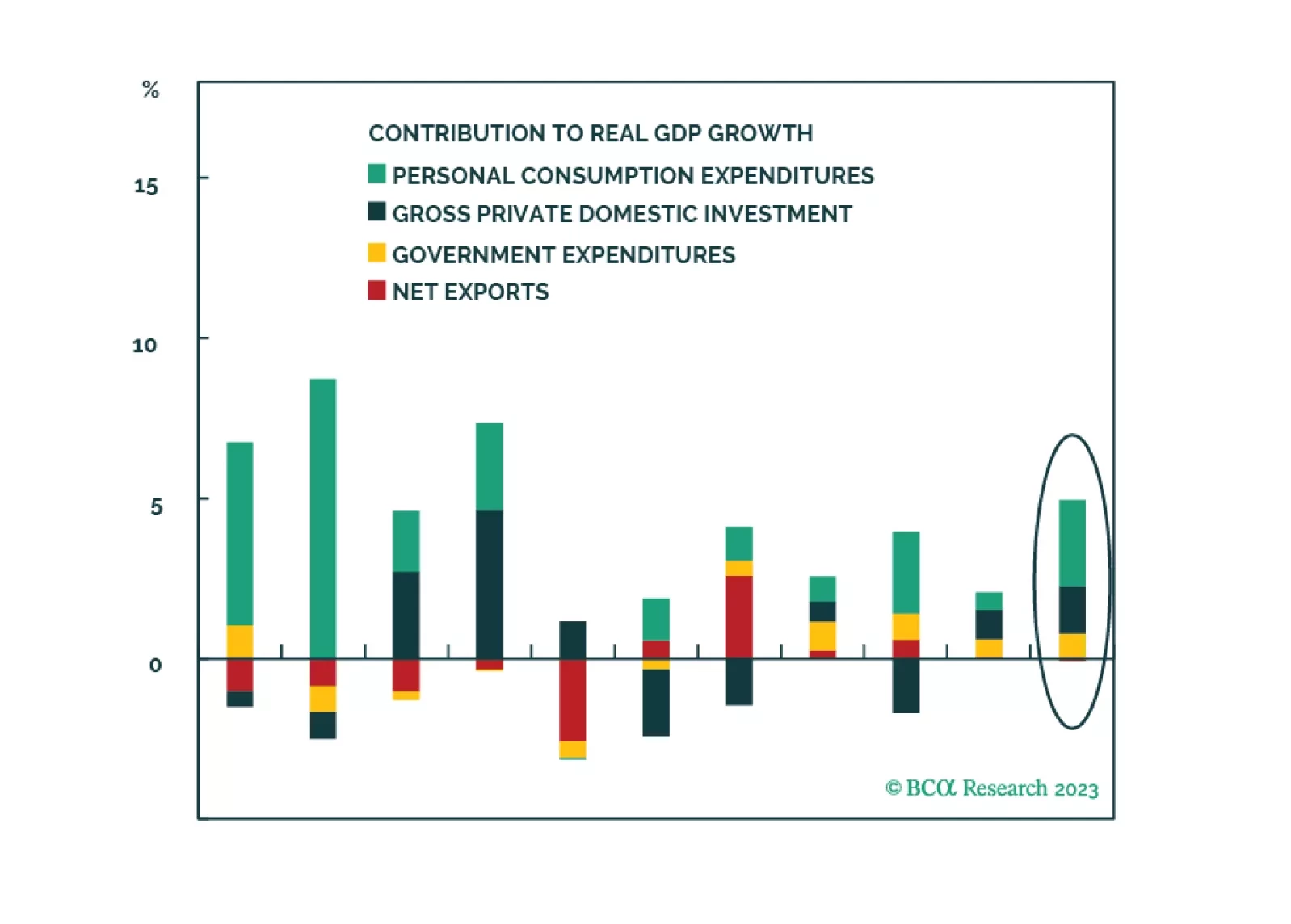

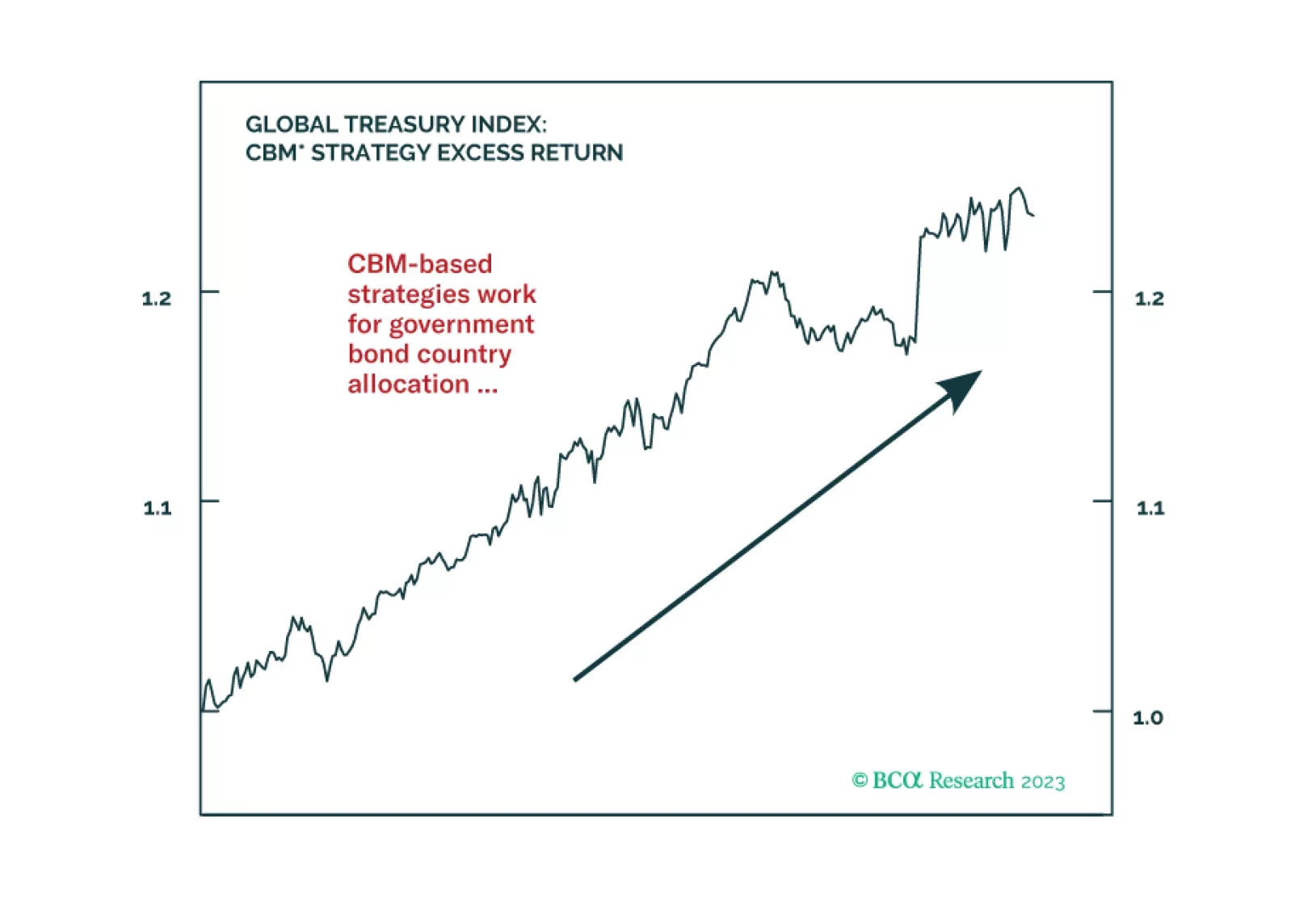

We are approaching another phase transition from boom to bust. Stocks should rally into year-end, but investors should look to reduce equity exposure early next year while increasing bond exposure.

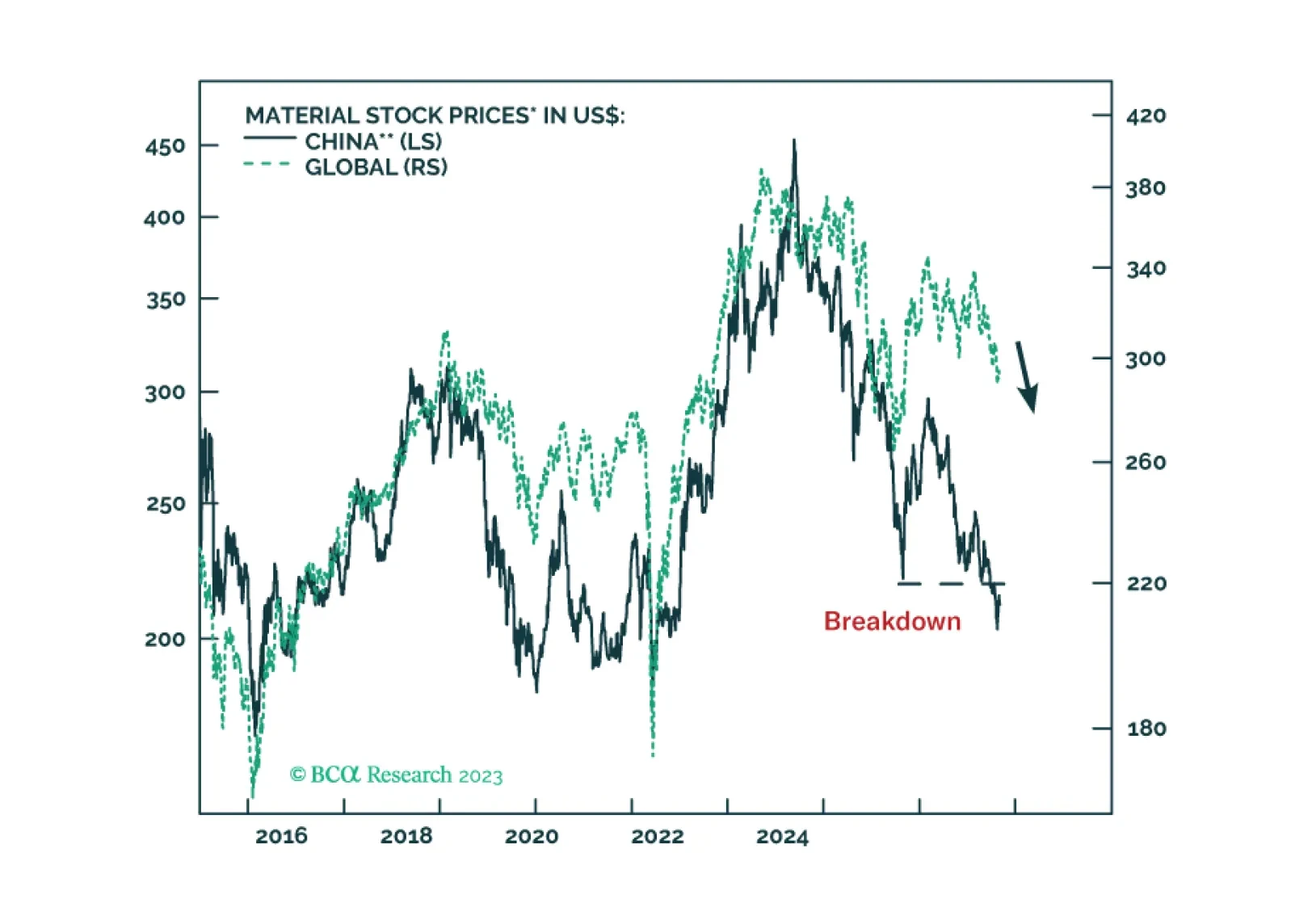

In financial systems, cracks typically begin on the periphery and then expand to the center. Hence, the ruptures on the fringes often act as an early warning. These fissures tend to widen and spread to the core, causing a breakdown…

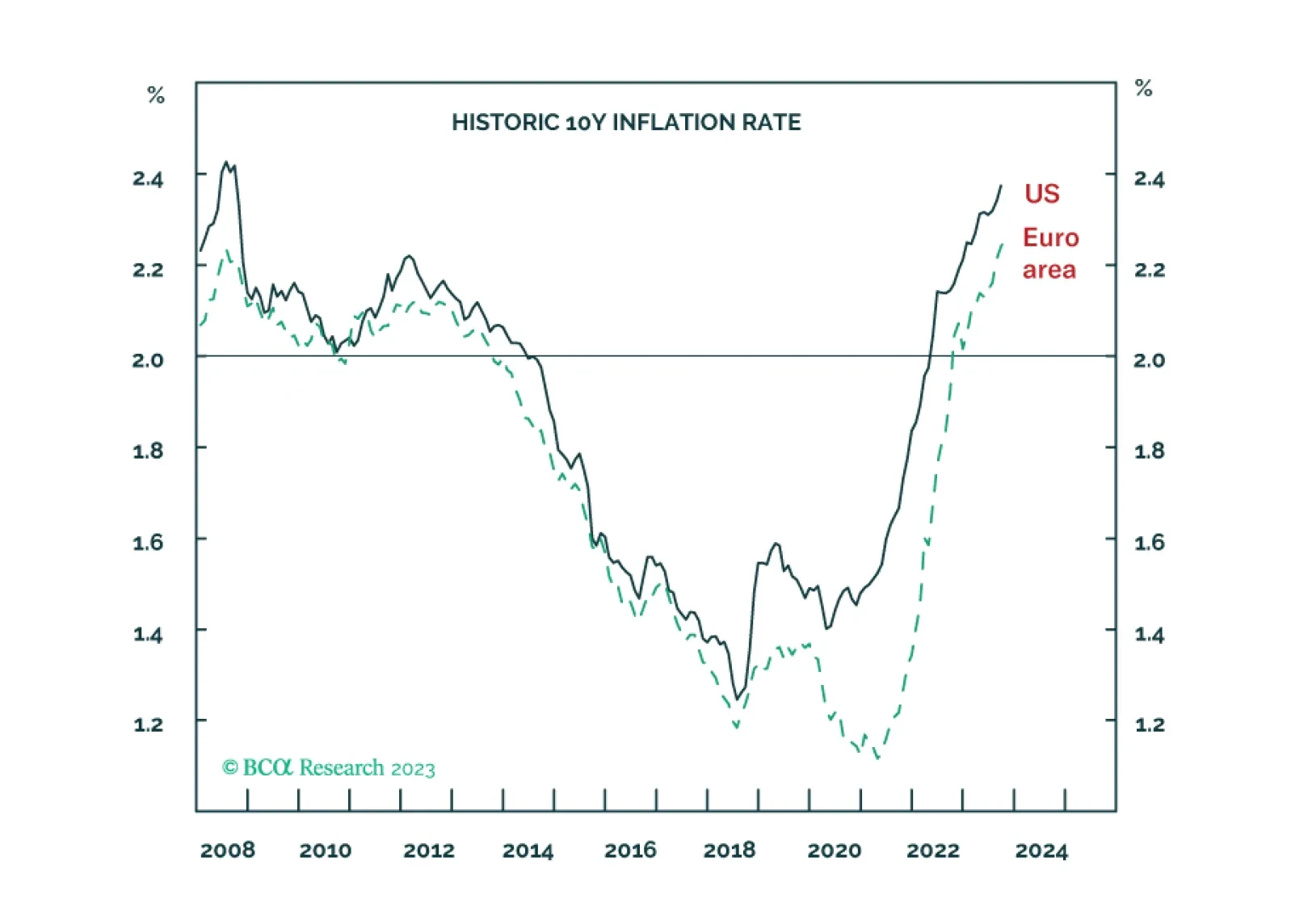

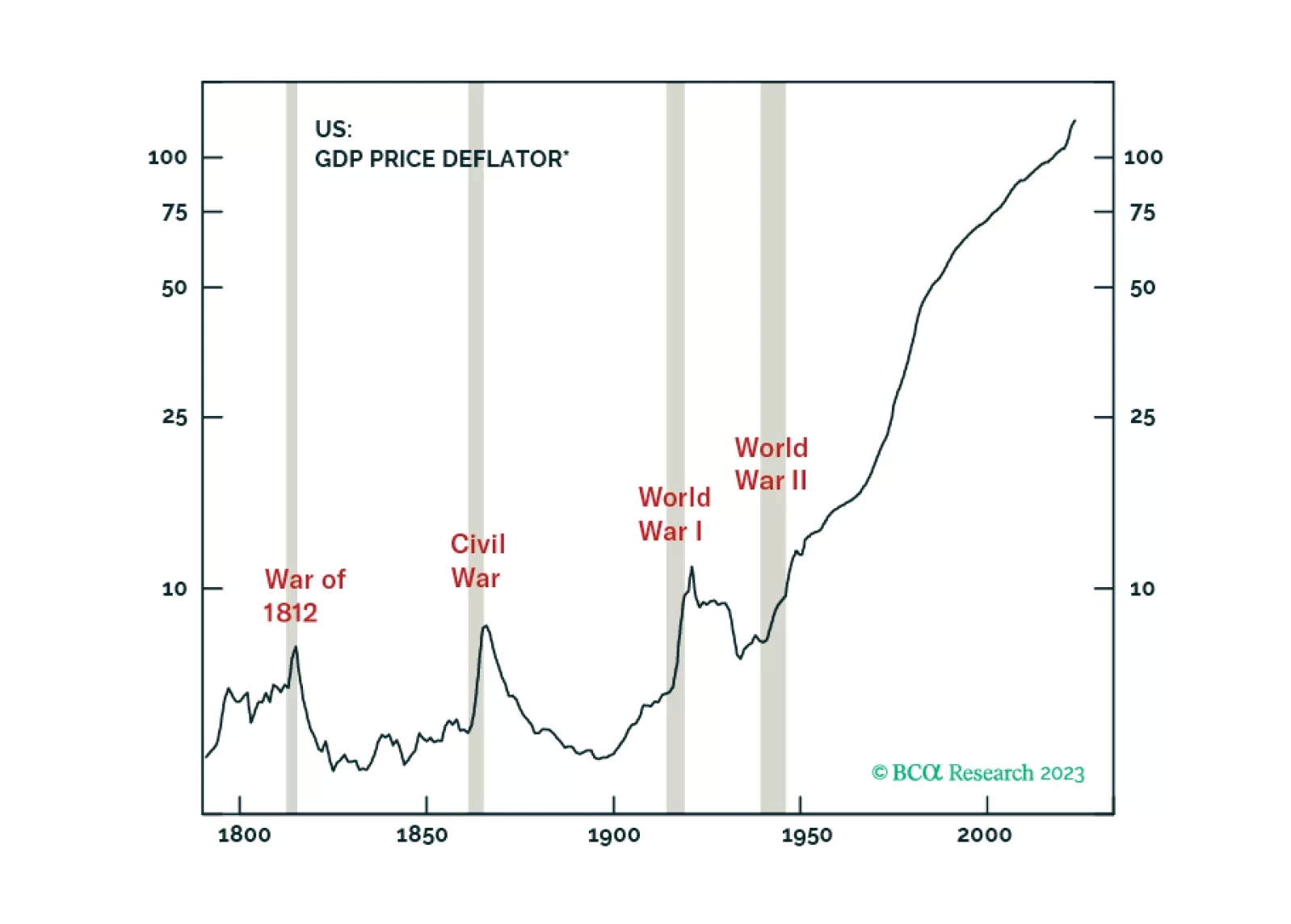

The fundamental component of long-term inflation expectations has climbed to its highest level since 2008 in both the US and the euro area. This means that both the Fed and the ECB will need to engineer inflation to undershoot 2…

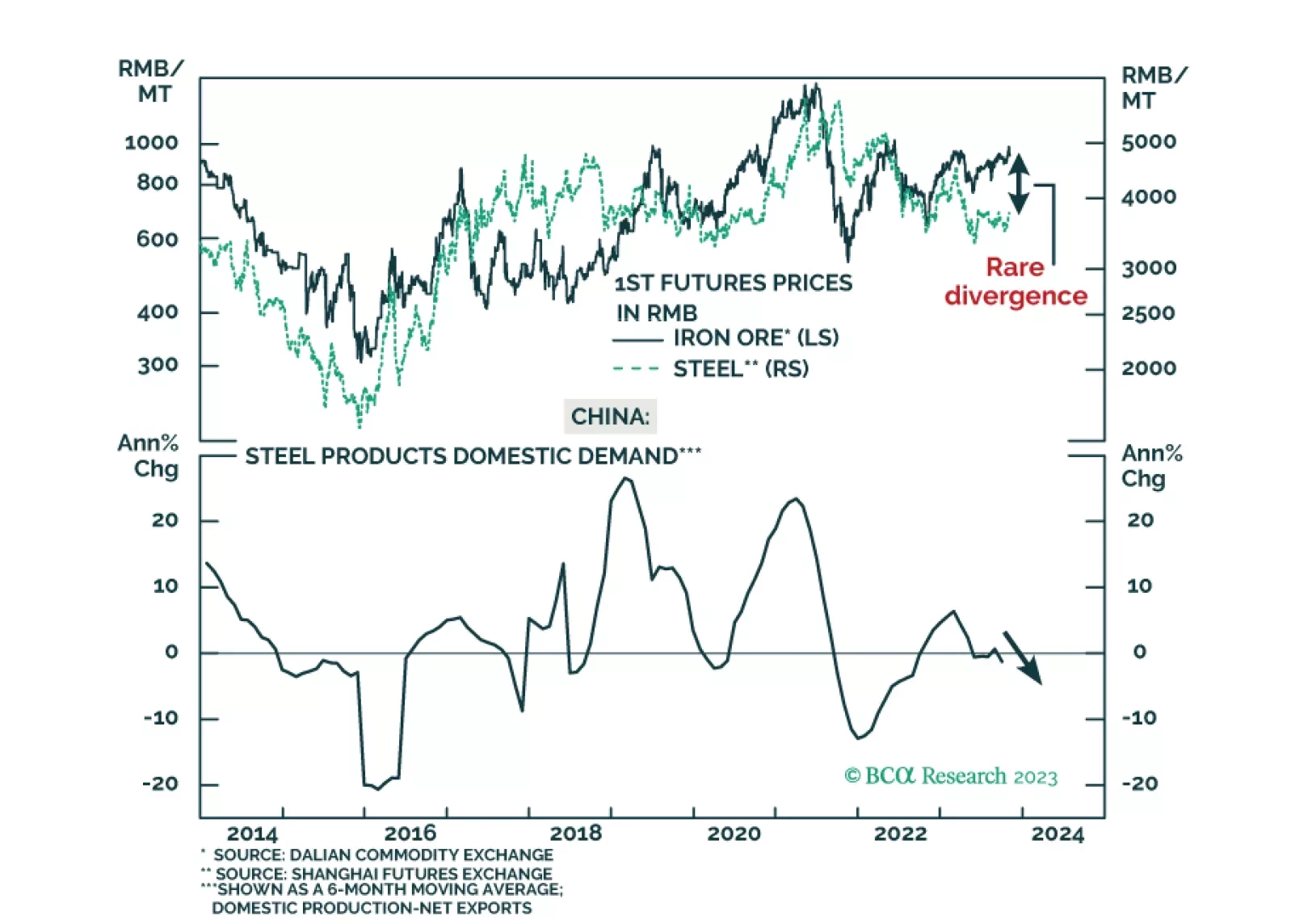

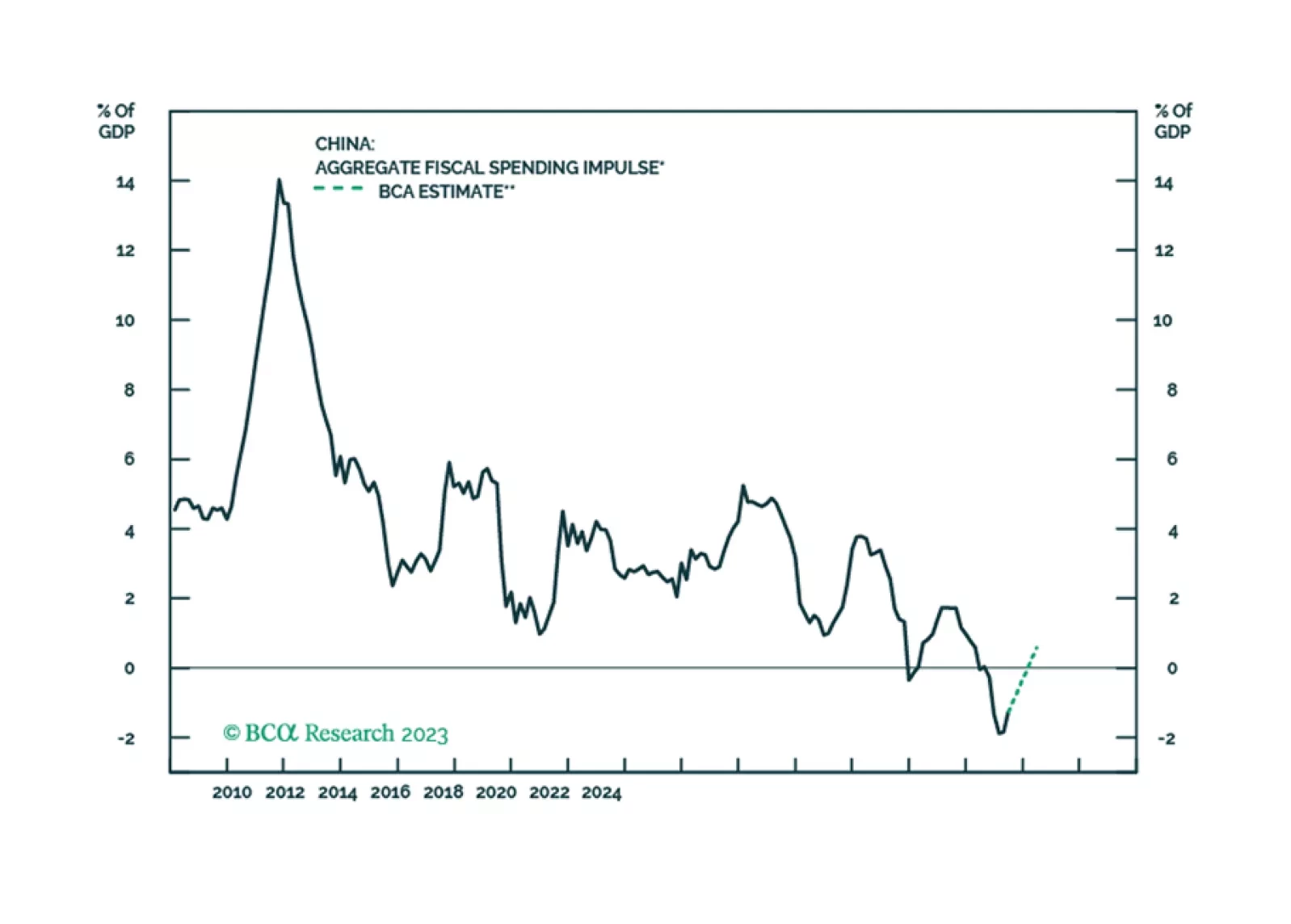

We maintain our view that China’s economic growth in the coming months will remain lackluster. Beijing's recent measures to provide additional financing may help to bridge the gap in government spending in the rest of 2023 and into…

Stronger US growth elicits a response from the House Republicans. But a government shutdown is not devastating to the economy. What is more devastating would be a crisis in the Middle East, Europe, and Asia. Stay long US defense,…

China’s economic growth will stagnate, at best, rather than revive. Lower valuations of Chinese equities are justified, and share prices have more downside. The RMB will continue to depreciate versus the US dollar.