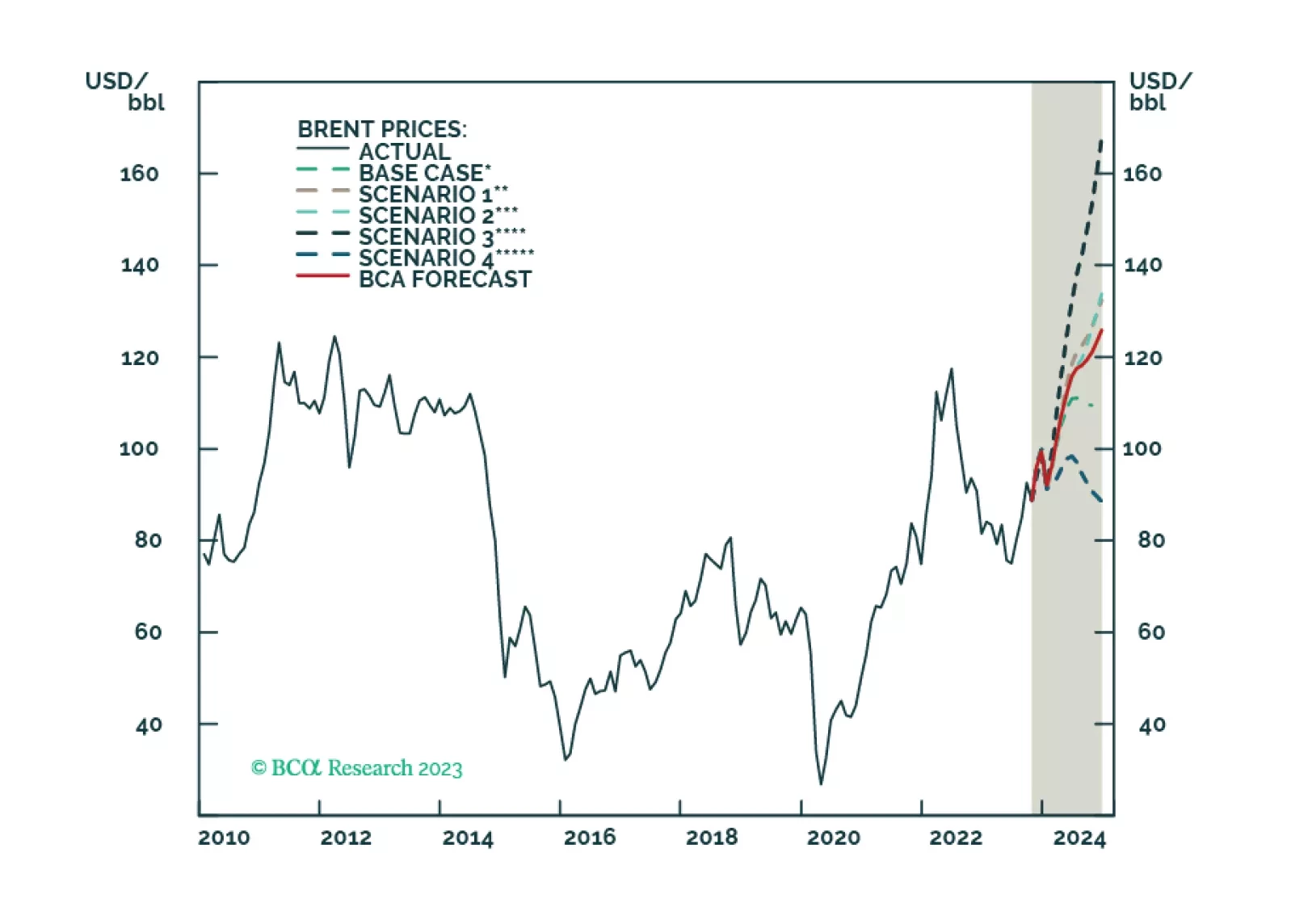

US and Chinese oil-demand strength will offset EU weakness next year. Incremental supply growth from non-OPEC 2.0 producers, coupled with a lower risk of the US enforcing its sanctions on Iranian oil exports, reduces our 2024 Brent…

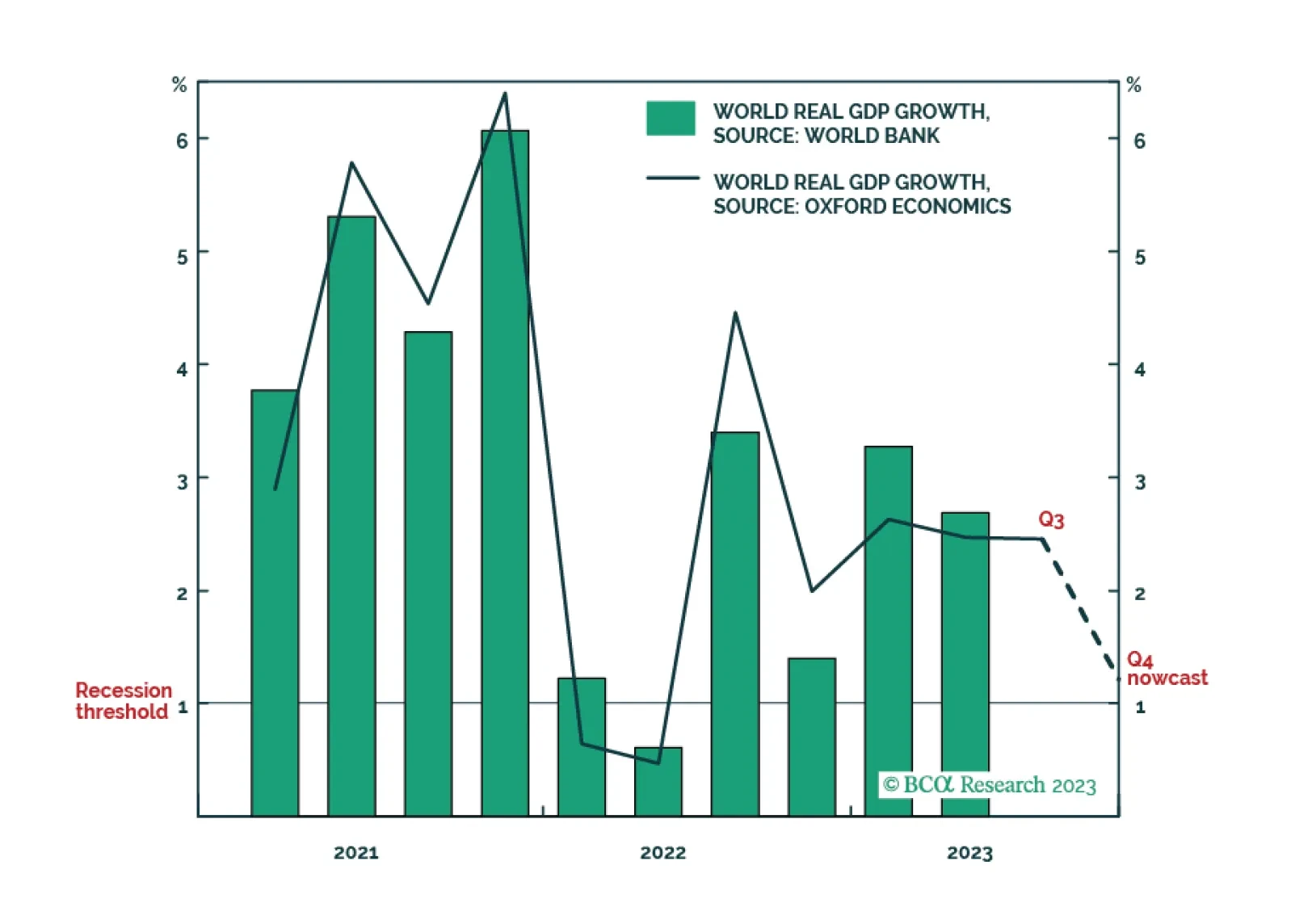

The latest ‘nowcast’ for world economic growth in the fourth quarter has plunged to just 1.2 percent, marking the cusp of another world recession. One important implication is that expectations for oil demand growth and industrial…

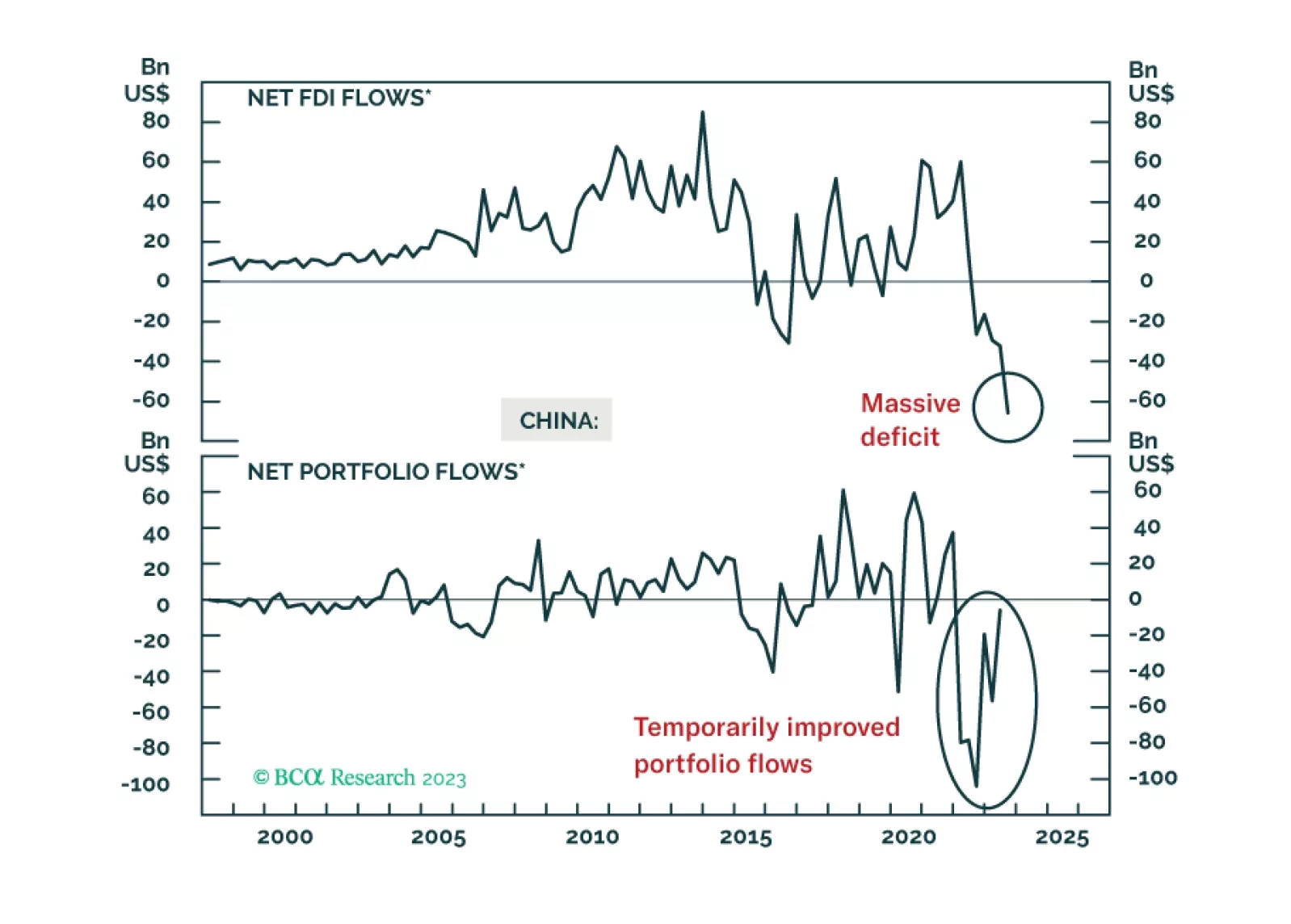

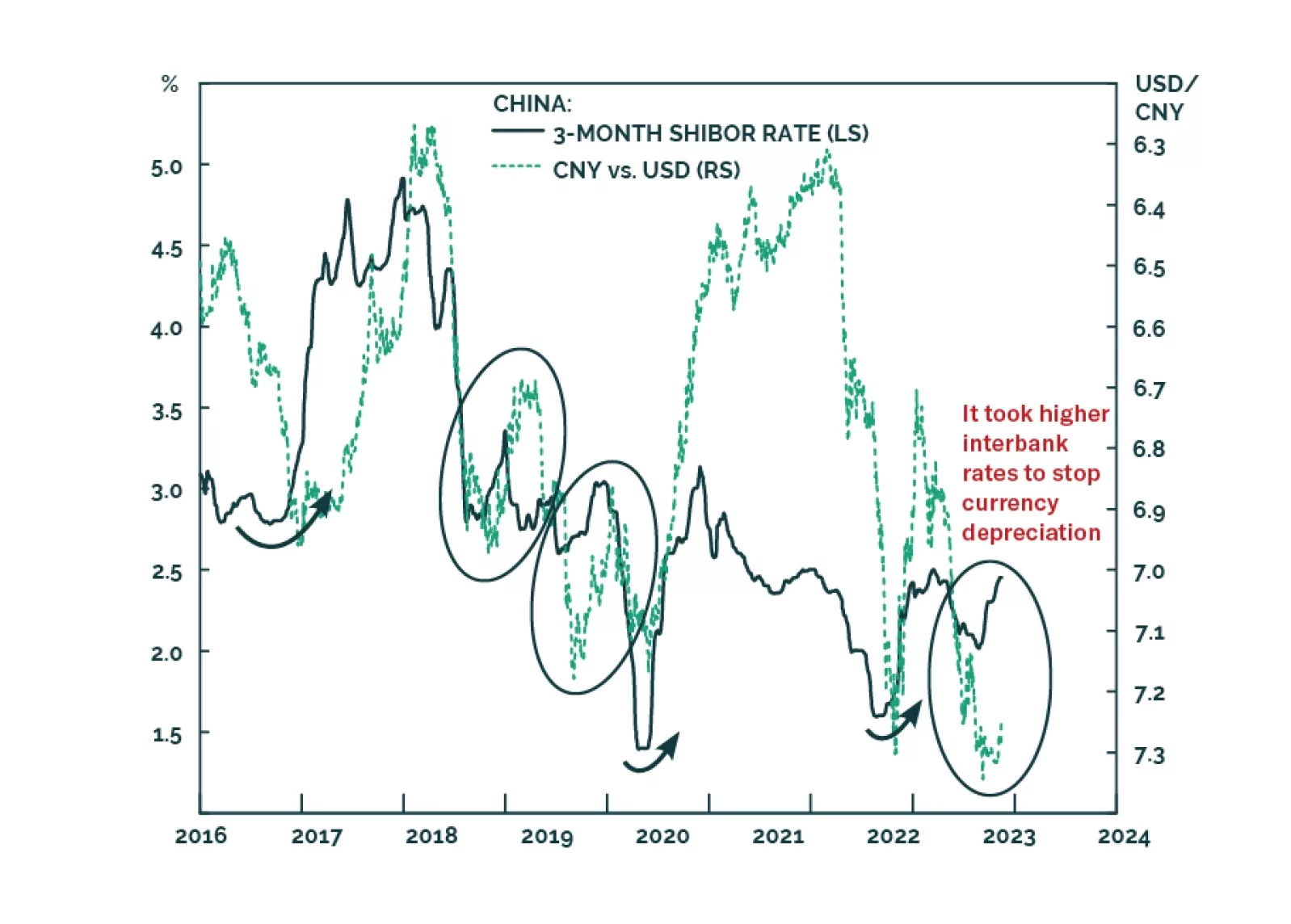

Many commentators have attributed the latest increase in Chinese interest rates to an improving economy, the large issuance of government bonds, the tax payments season, and other technical factors. Yet, these explanations are…

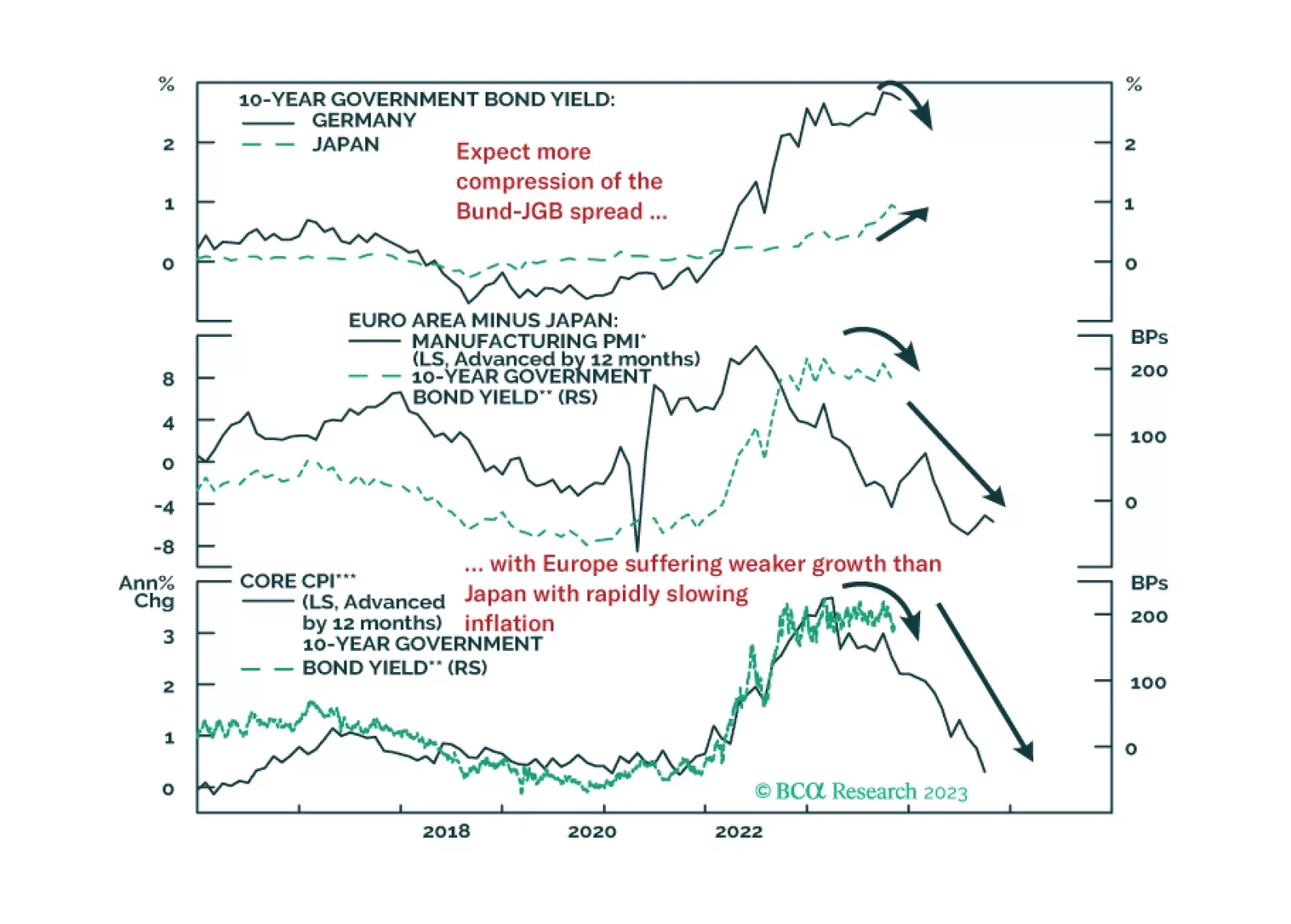

In this Insight, we review the performance and rationale for our current set of tactical fixed income trade recommendations. Our highest conviction positions also happen to be our most successful trades: positioning for a narrowing…

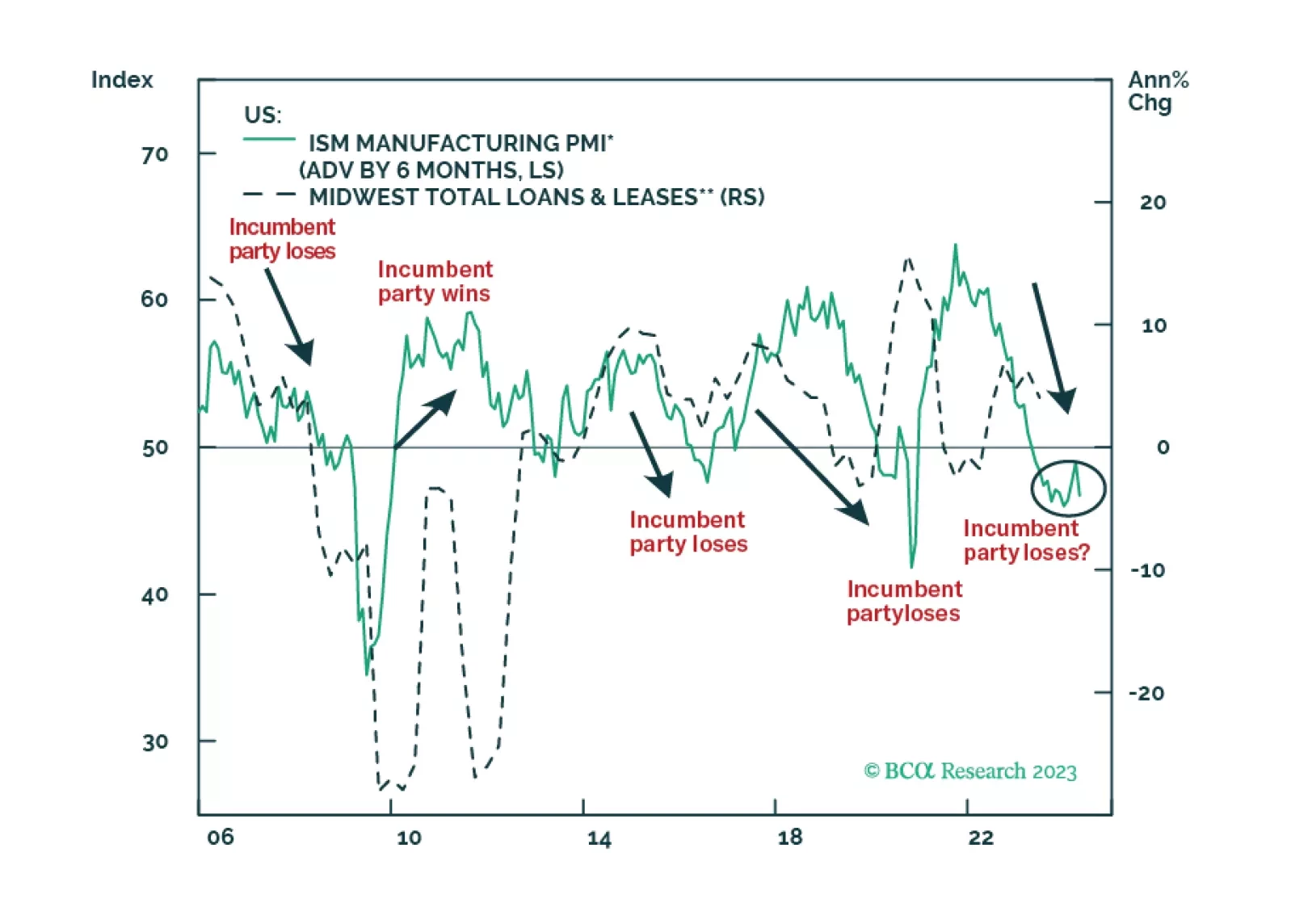

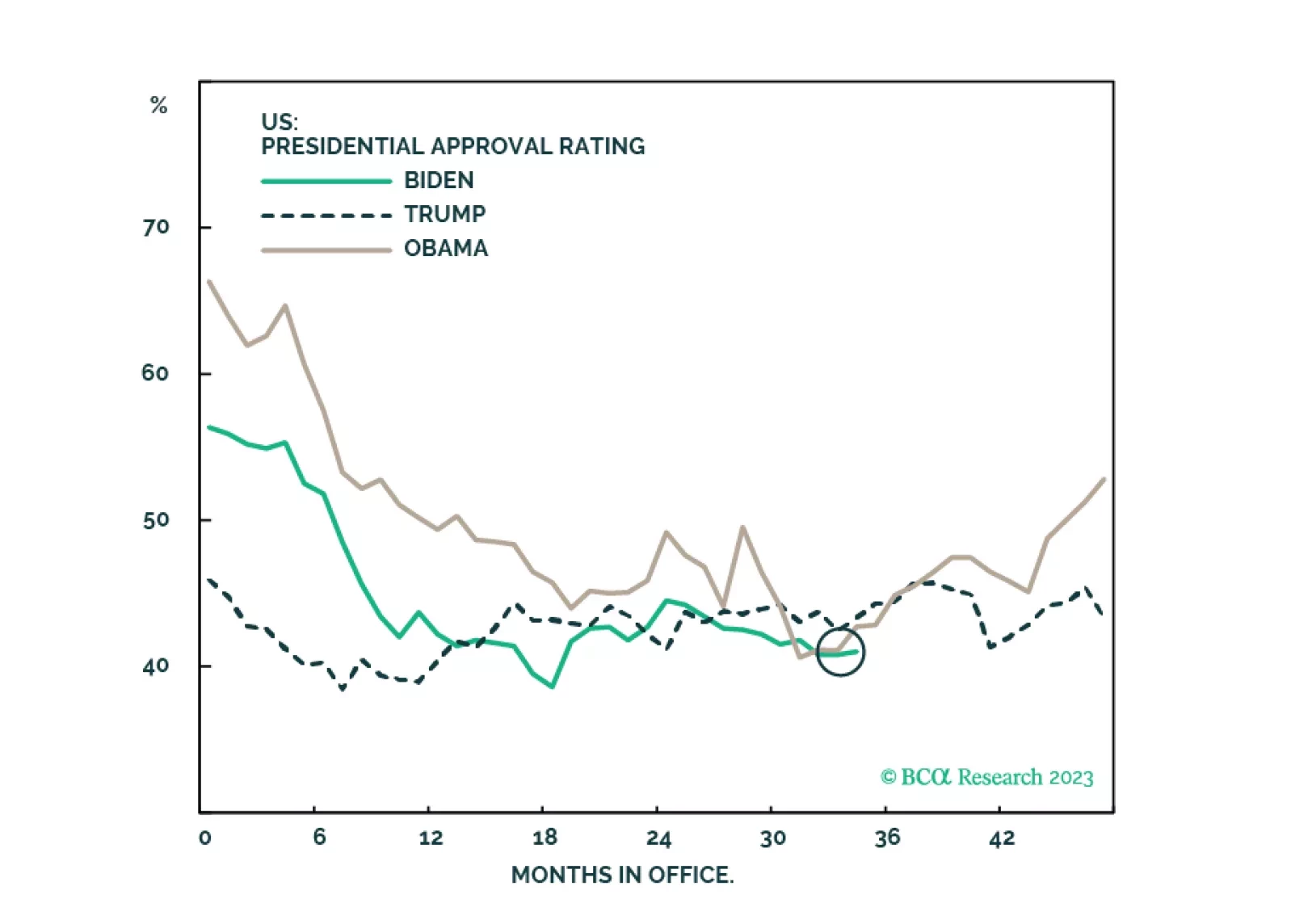

Results from Tuesday’s elections suggest that the Democrats are doing better than what their 2024 polling are showing. While the results are marginally positive for equities, investors should not overrate this off-year election,…

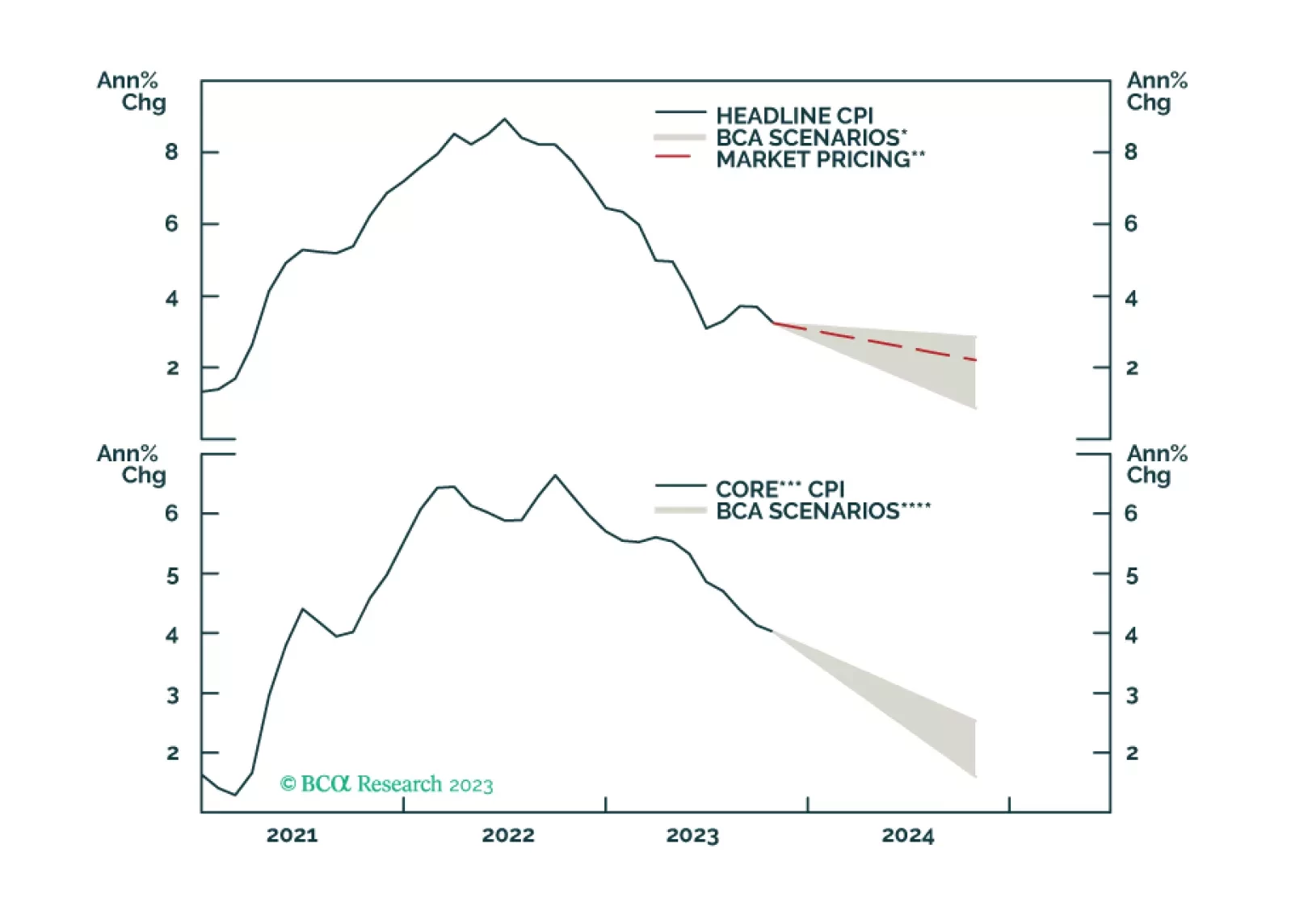

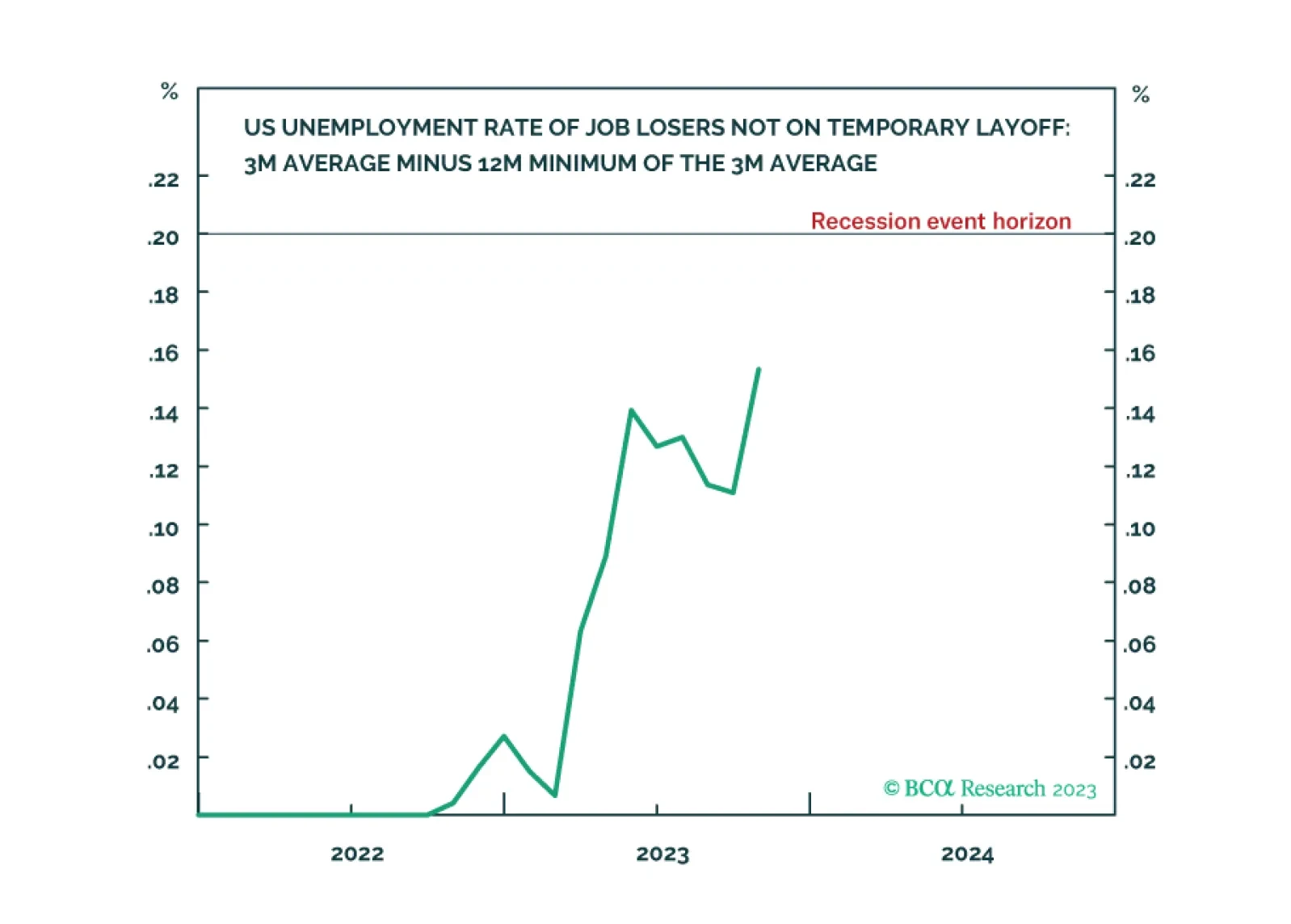

Following the October US jobs data, the ‘Joshi rule’ real-time US recession indicator increased from 0.11 to 0.15, meaning that it is fast approaching its event horizon of 0.20. We go through the investment implications. We also…