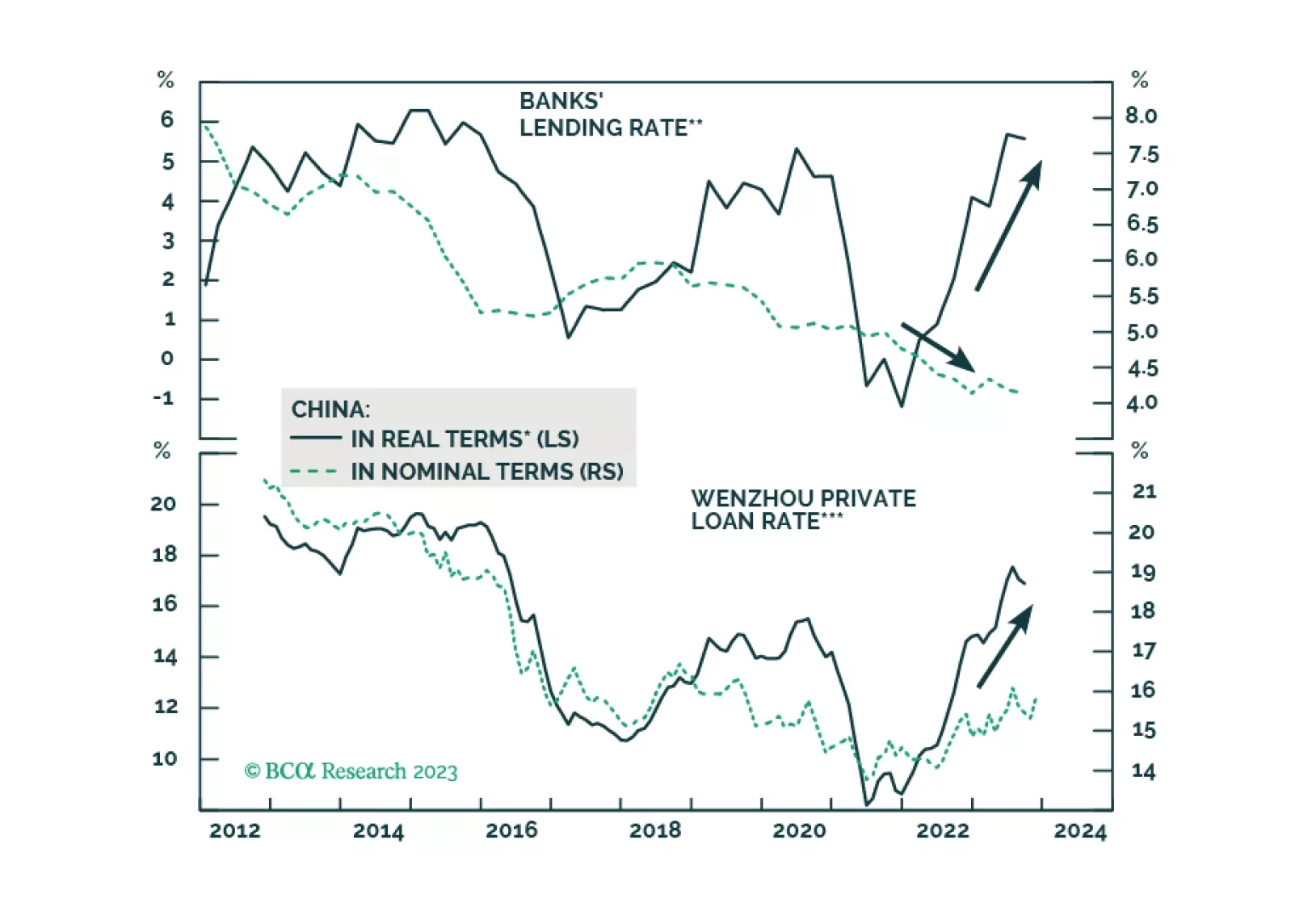

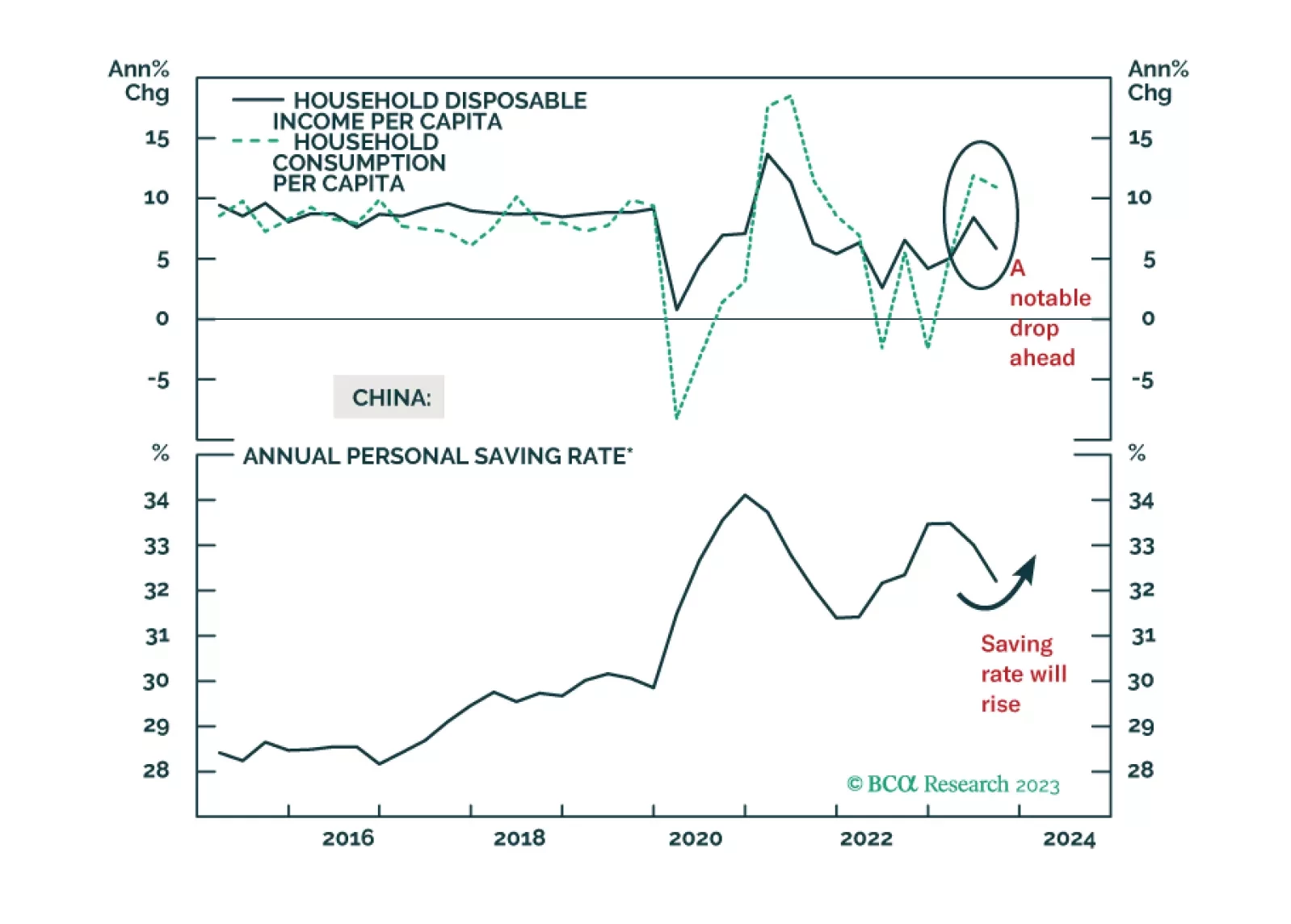

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

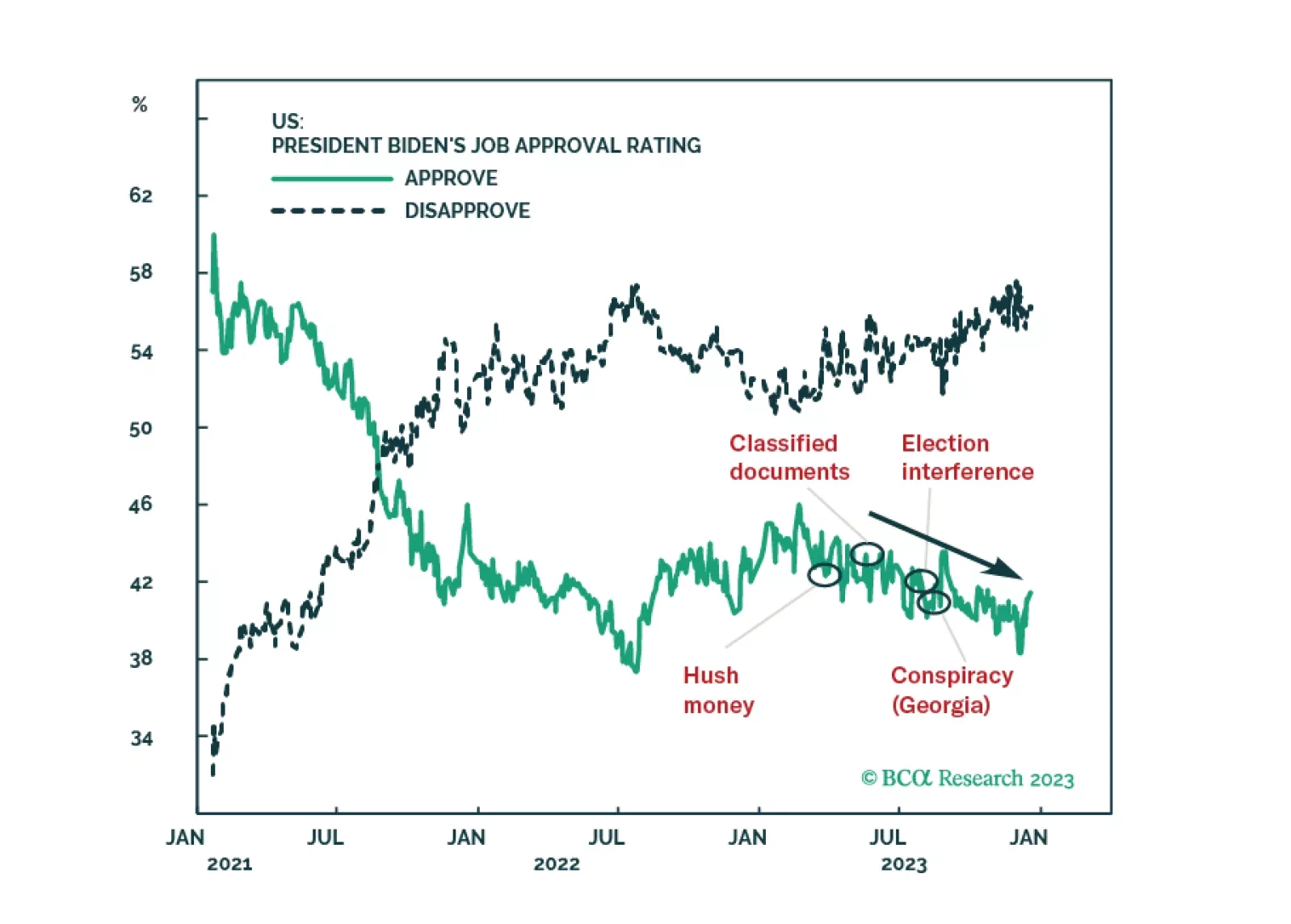

The Republican Party’s odds of winning the 2024 election will benefit, if anything, from state courts’ attempts to exclude President Trump from primary or general election ballots. Higher odds of a change of ruling party will…

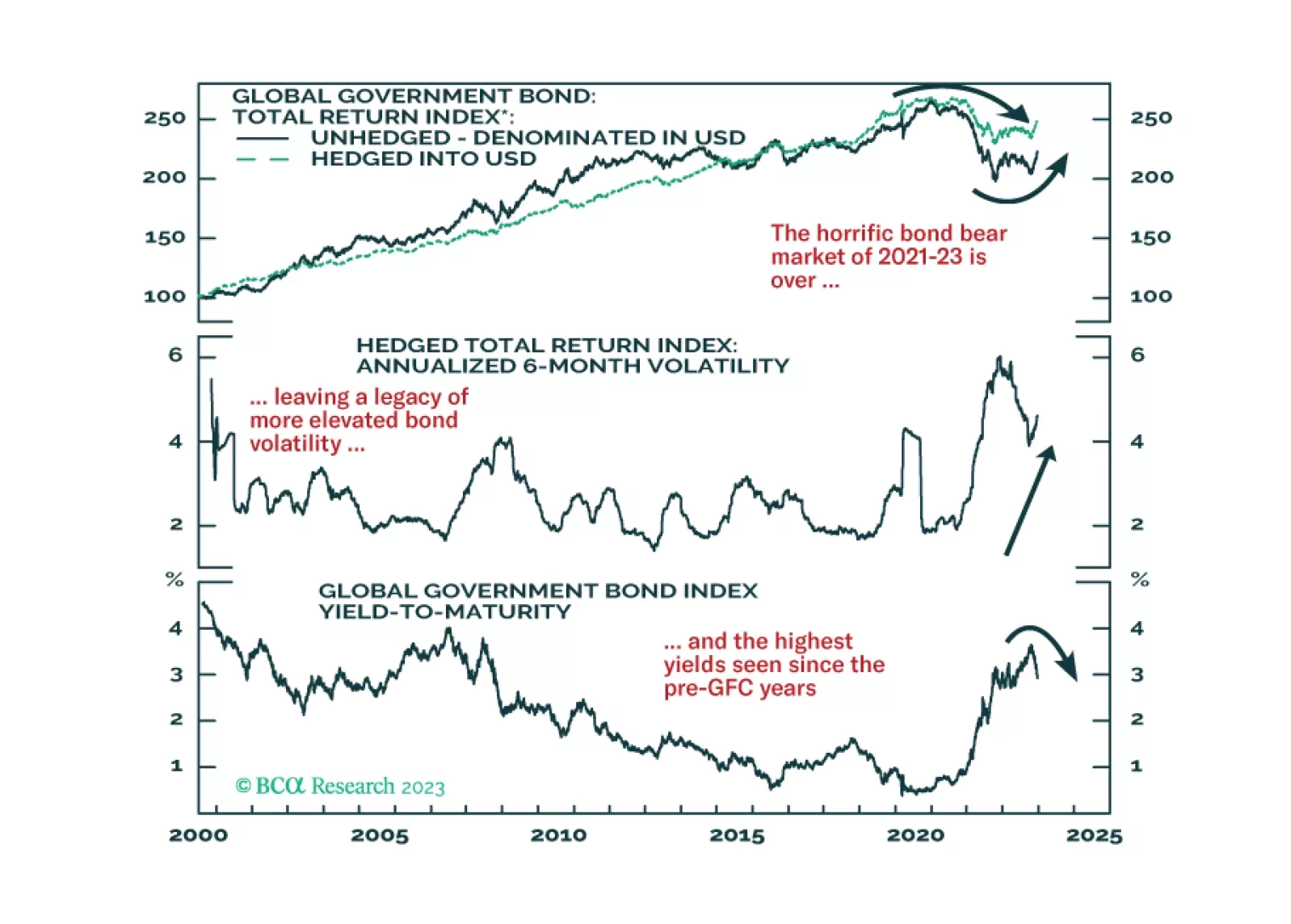

Our US bond team’s thoughts on this afternoon’s FOMC meeting and yesterday’s CPI release.