Democrats remain favored for reelection in 2024, which implies gridlock and policy status quo in 2025. That is not negative for stocks in the near term. However, economic, political, and geopolitical risks will escalate from here,…

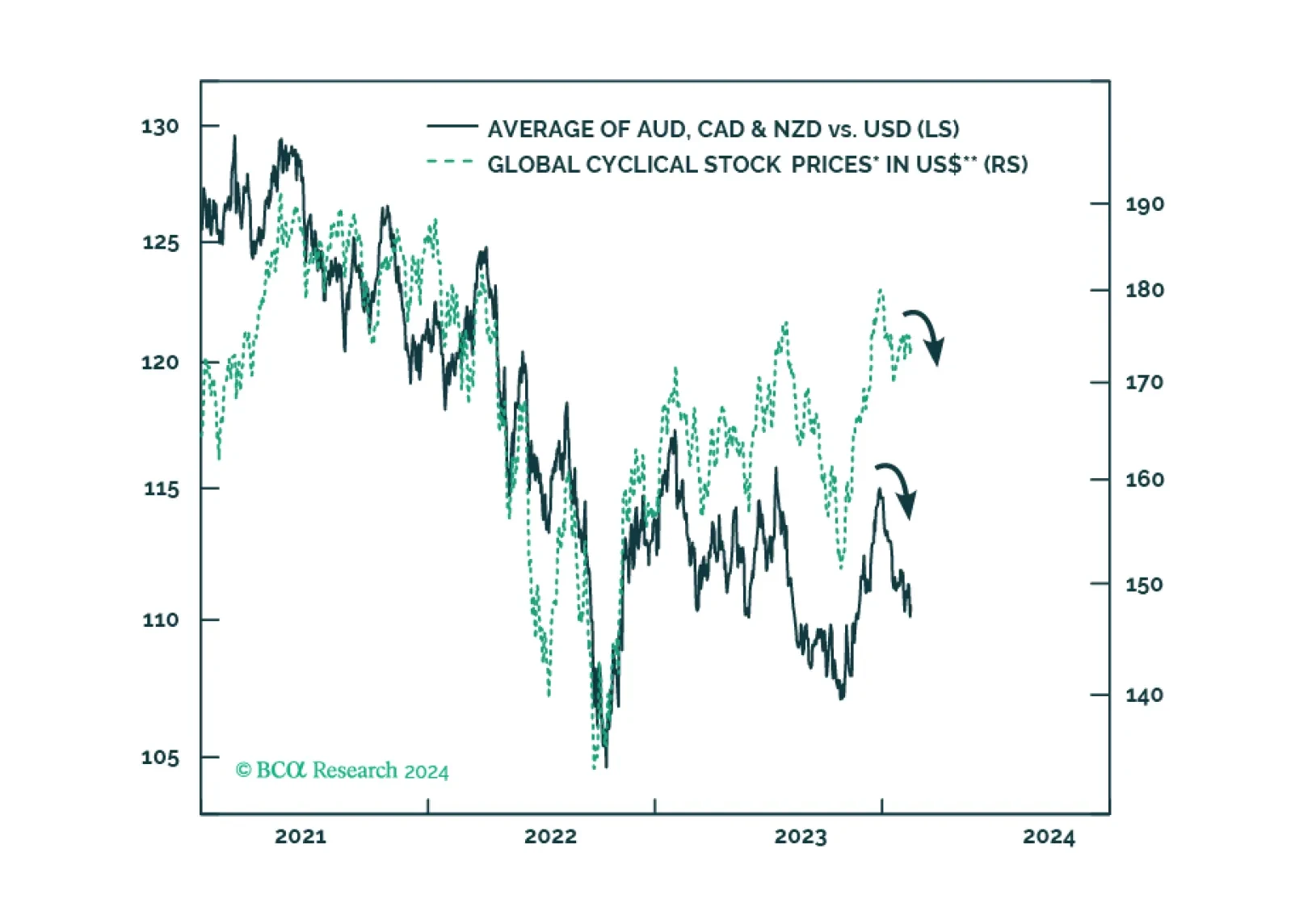

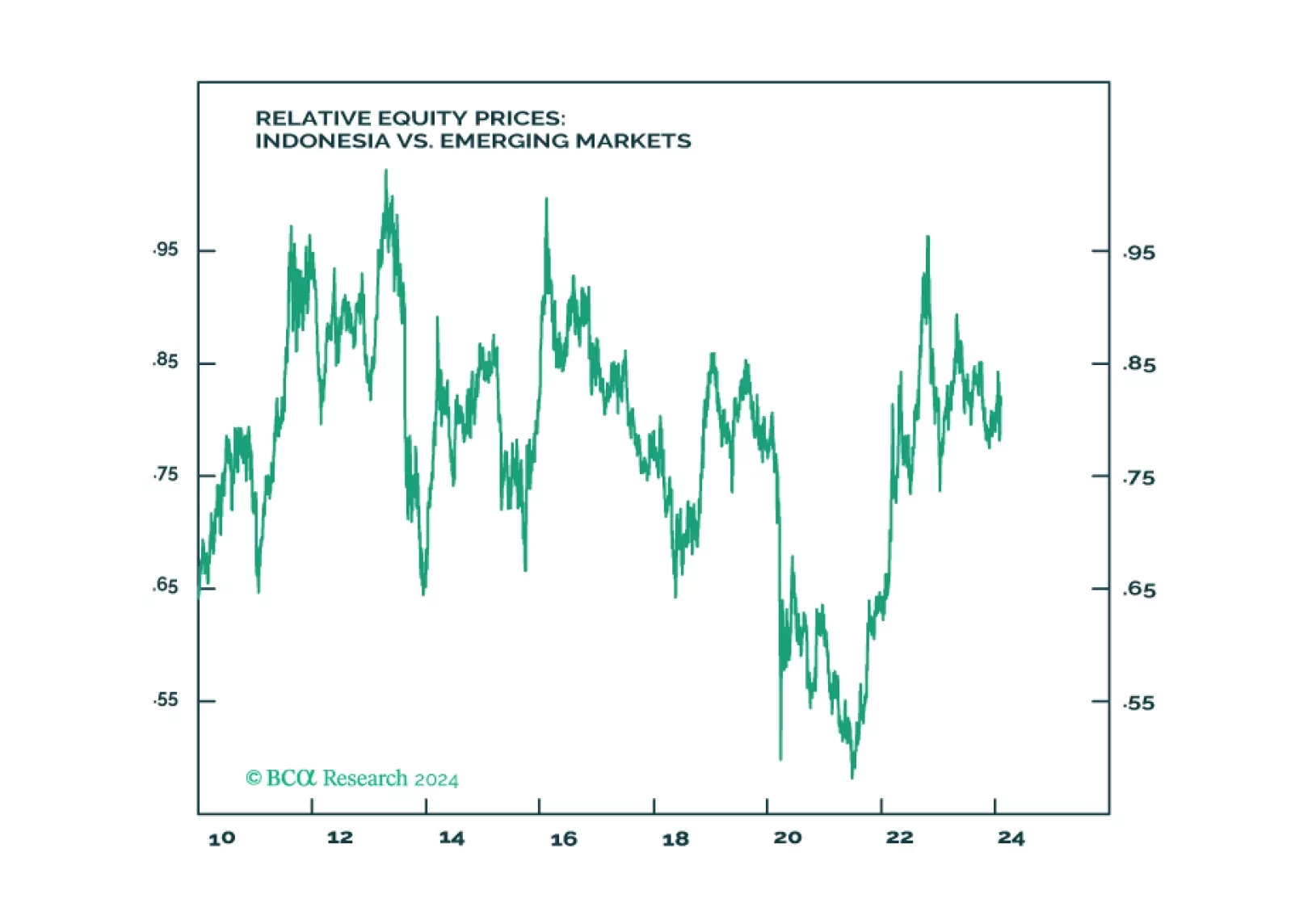

Over the next six months, the deterioration in non-US growth will occur earlier and be more pronounced than in the US. This expectation reinforces our confidence to bet on the strength of the US dollar. As usual, the flip side of the…

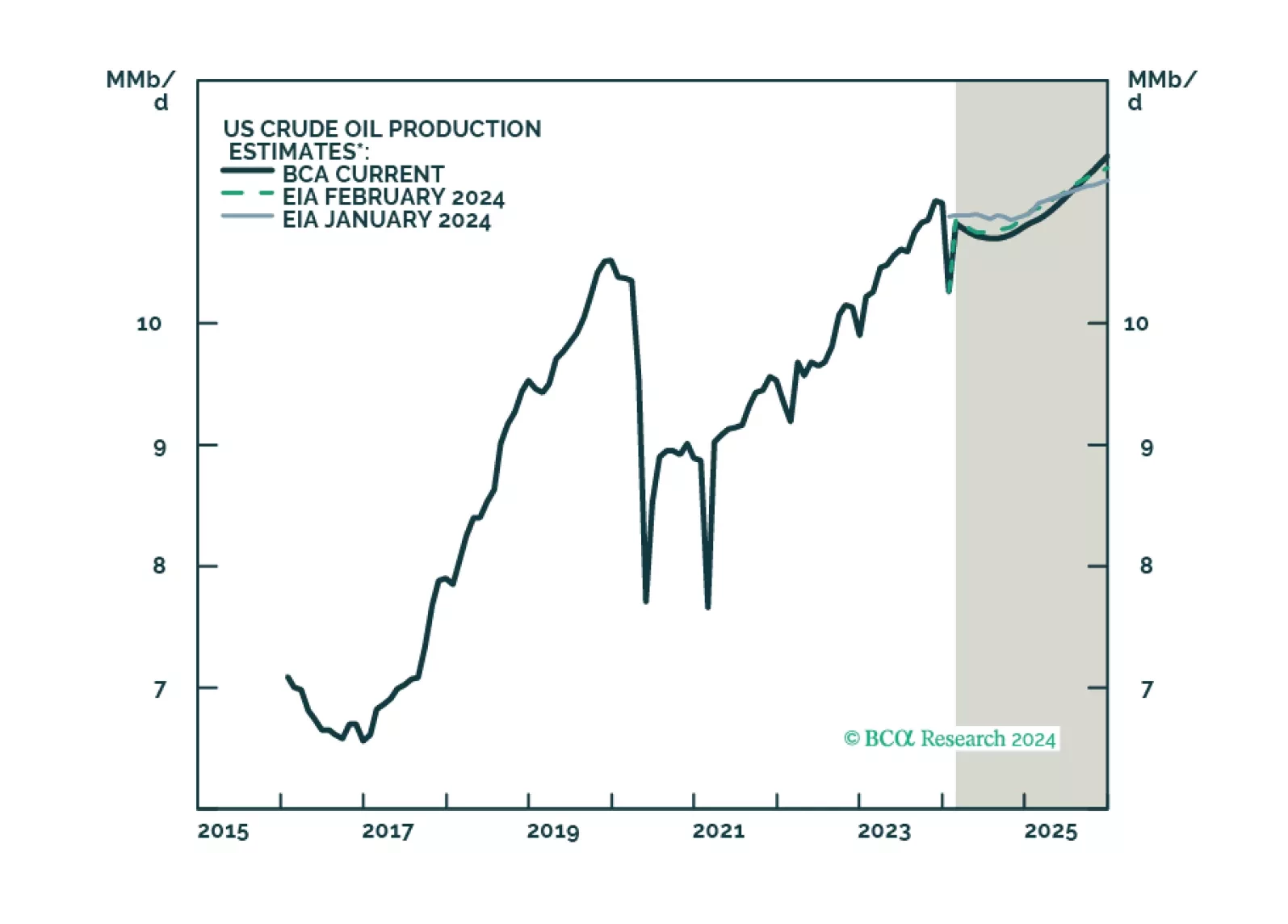

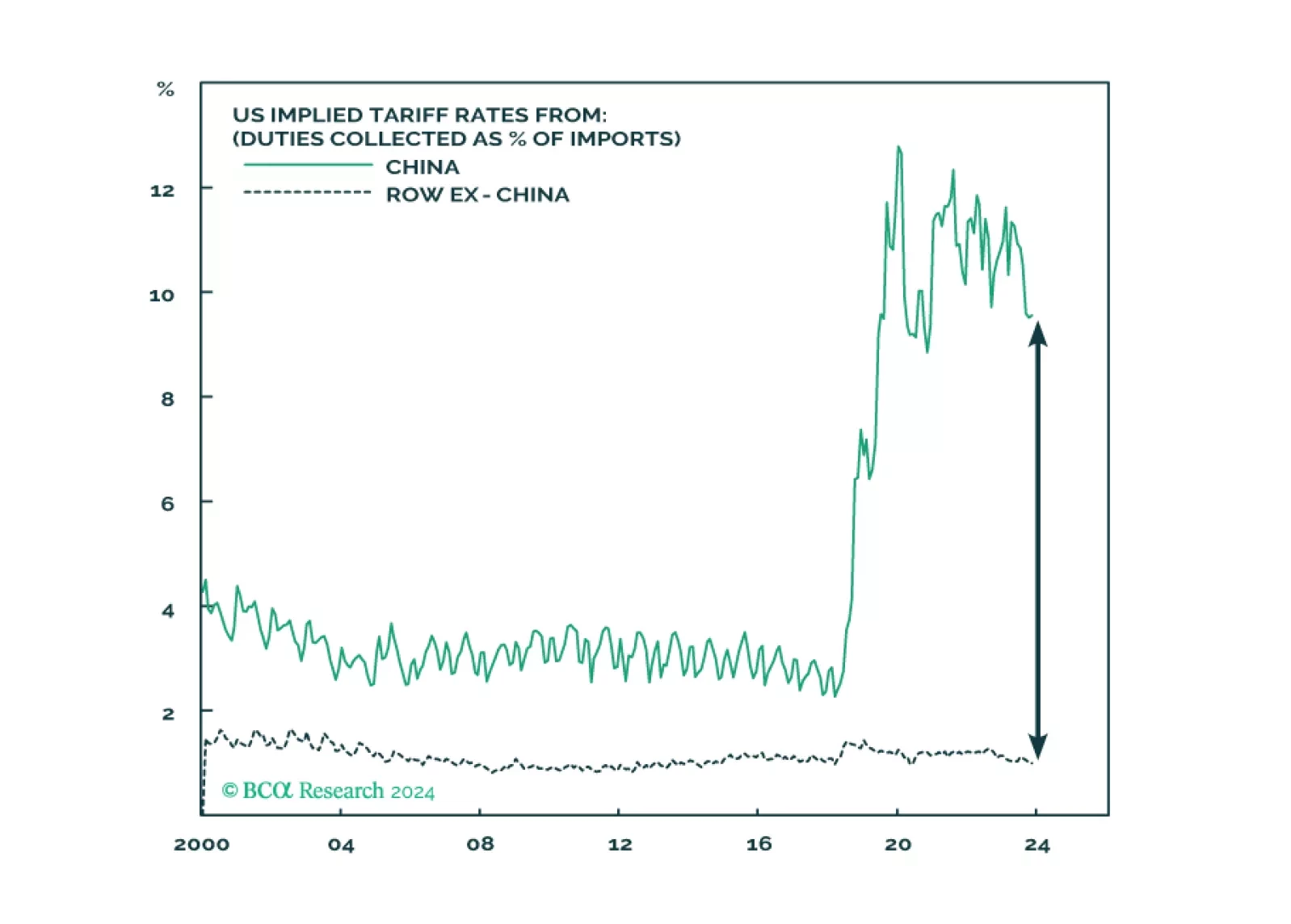

Energy markets are balanced in the short run, which keeps our Brent price forecasts at $95/bbl and $105/bbl in 2024 and 2025. Structurally, we see an upward bias to inflation, as geoeconomic fragmentation fundamentally alters supply…

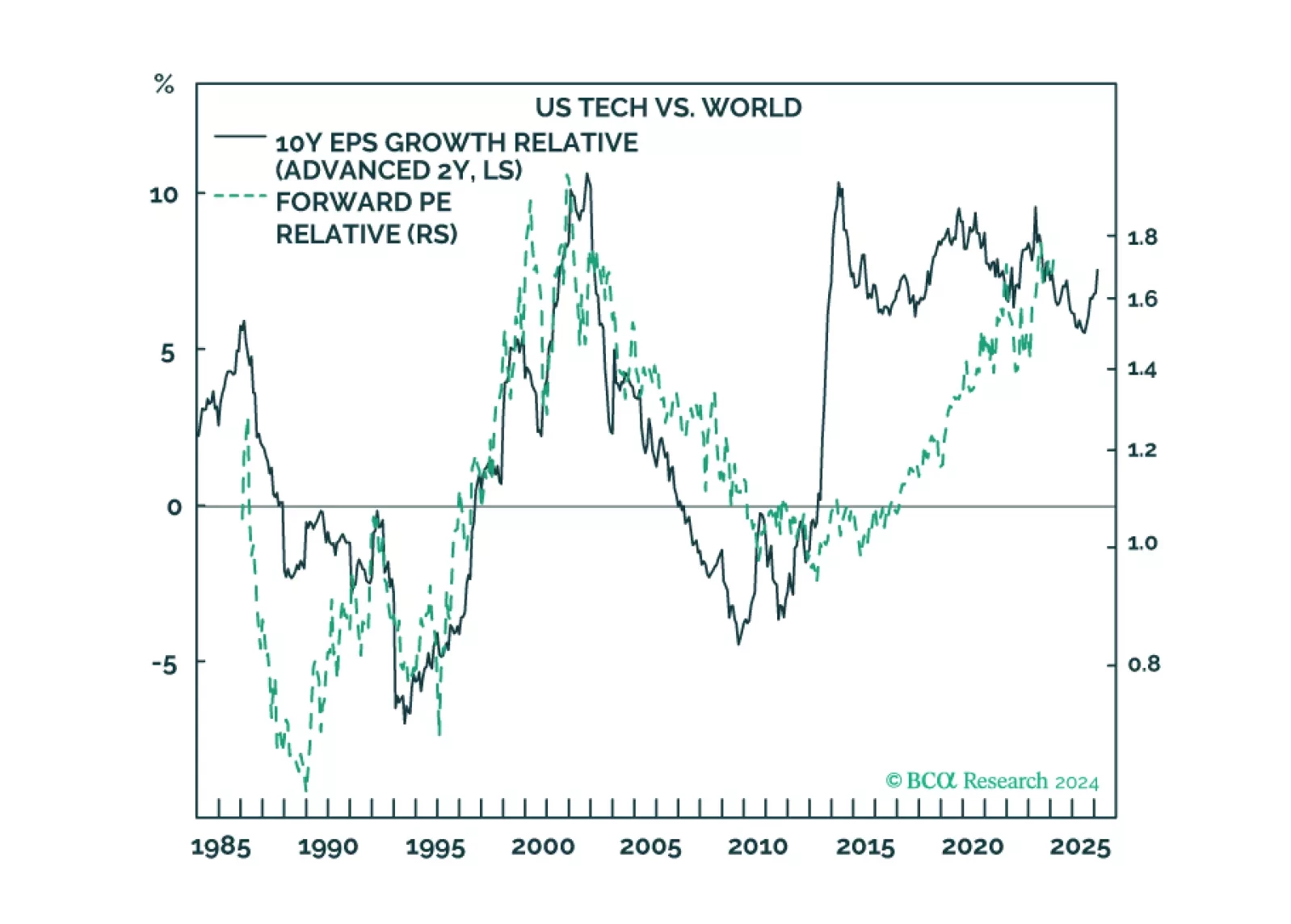

Our Valentine’s Day report is about two love stories: the infatuation with US tech and China’s infatuation with housing. We describe how these love stories will end, and why Europe could be the winner.

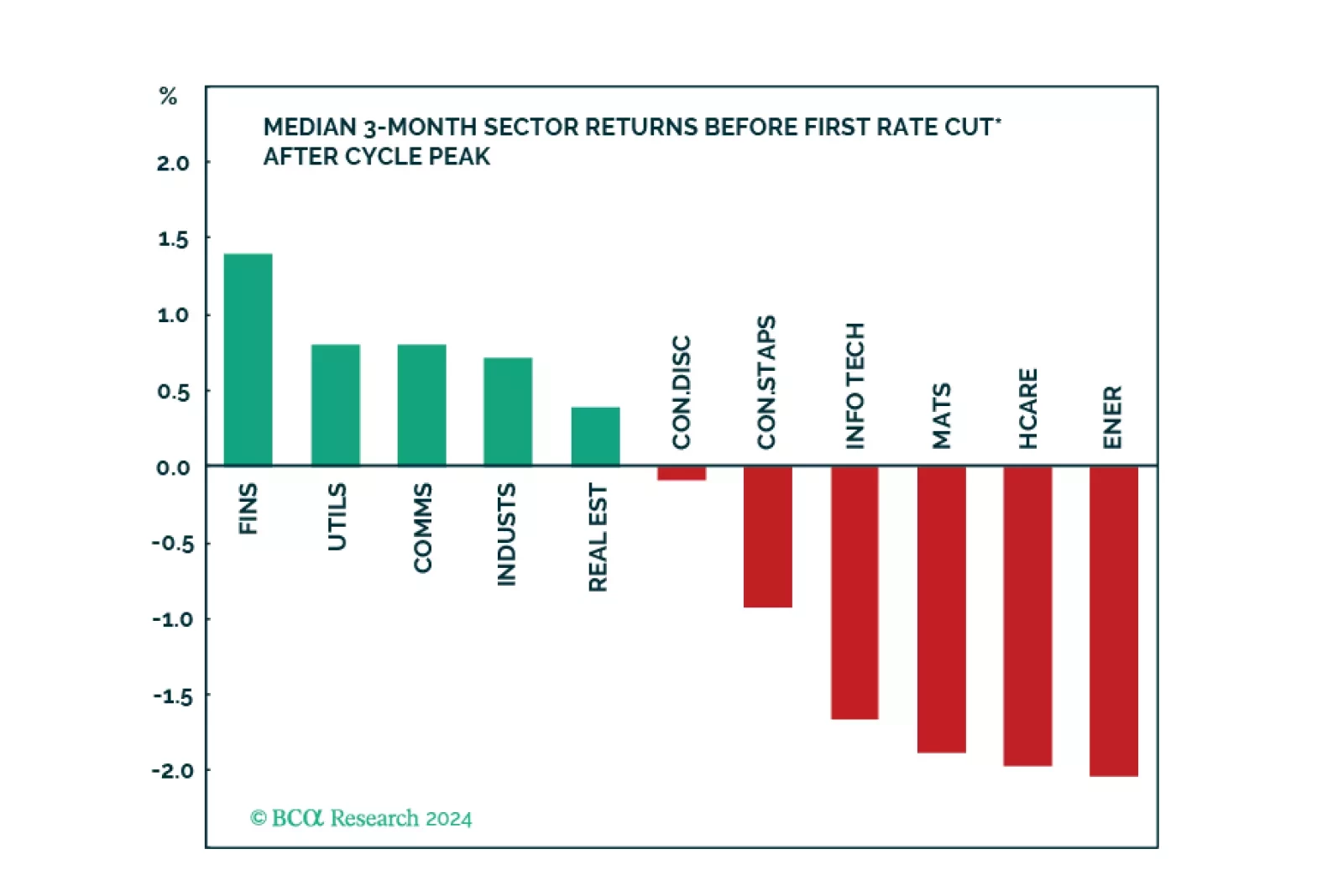

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

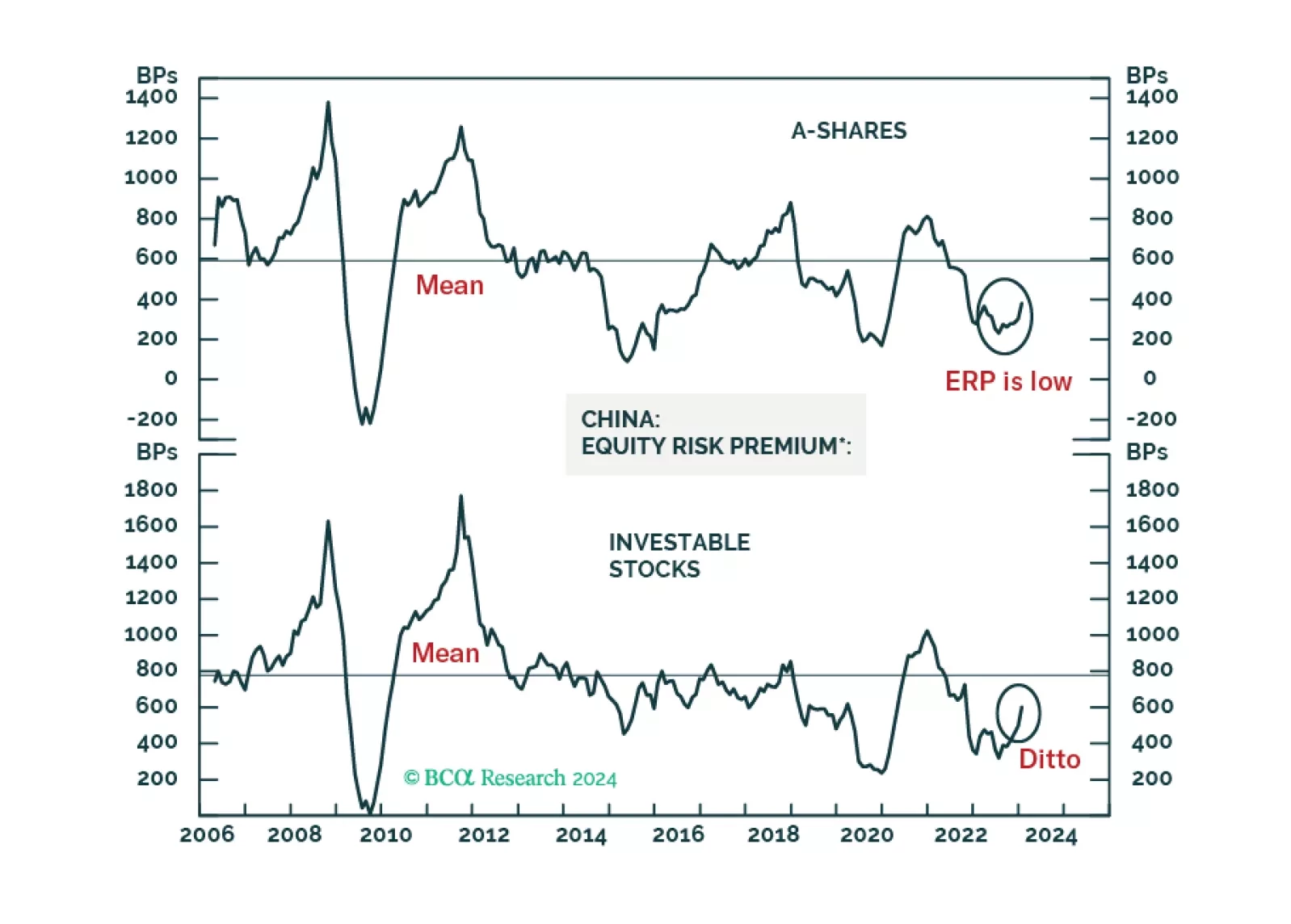

Chinese A-shares will probably begin forming a volatile bottom. The basis is that authorities will likely throw the kitchen sink at the onshore market in an attempt to stabilize share prices. The same is not true for offshore listed…

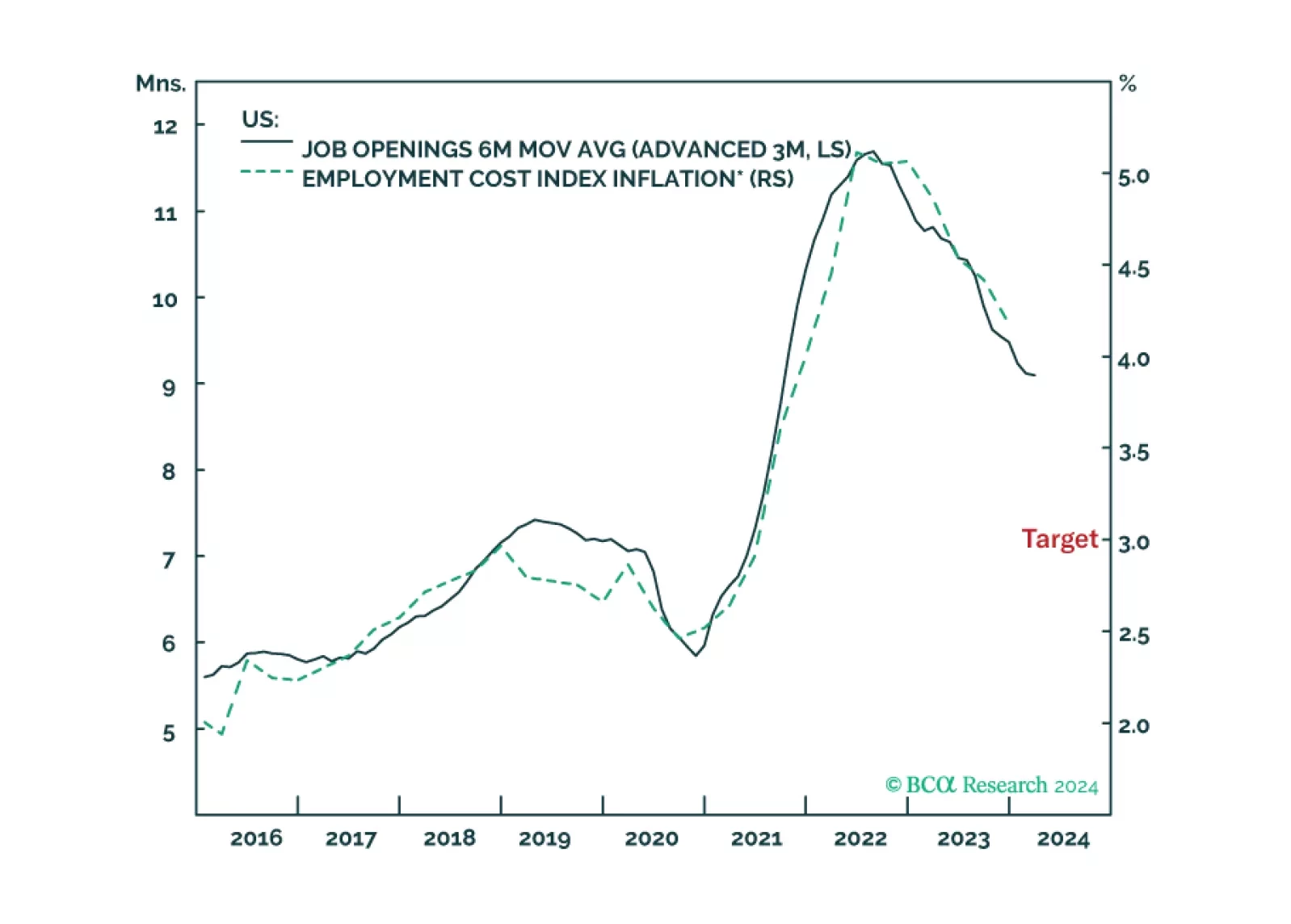

The disinflation to date has been benign because it has come almost entirely from improving supply. But the supply-side tailwind has exhausted, so the last mile of the journey to 2 percent inflation will be the hardest, especially in…

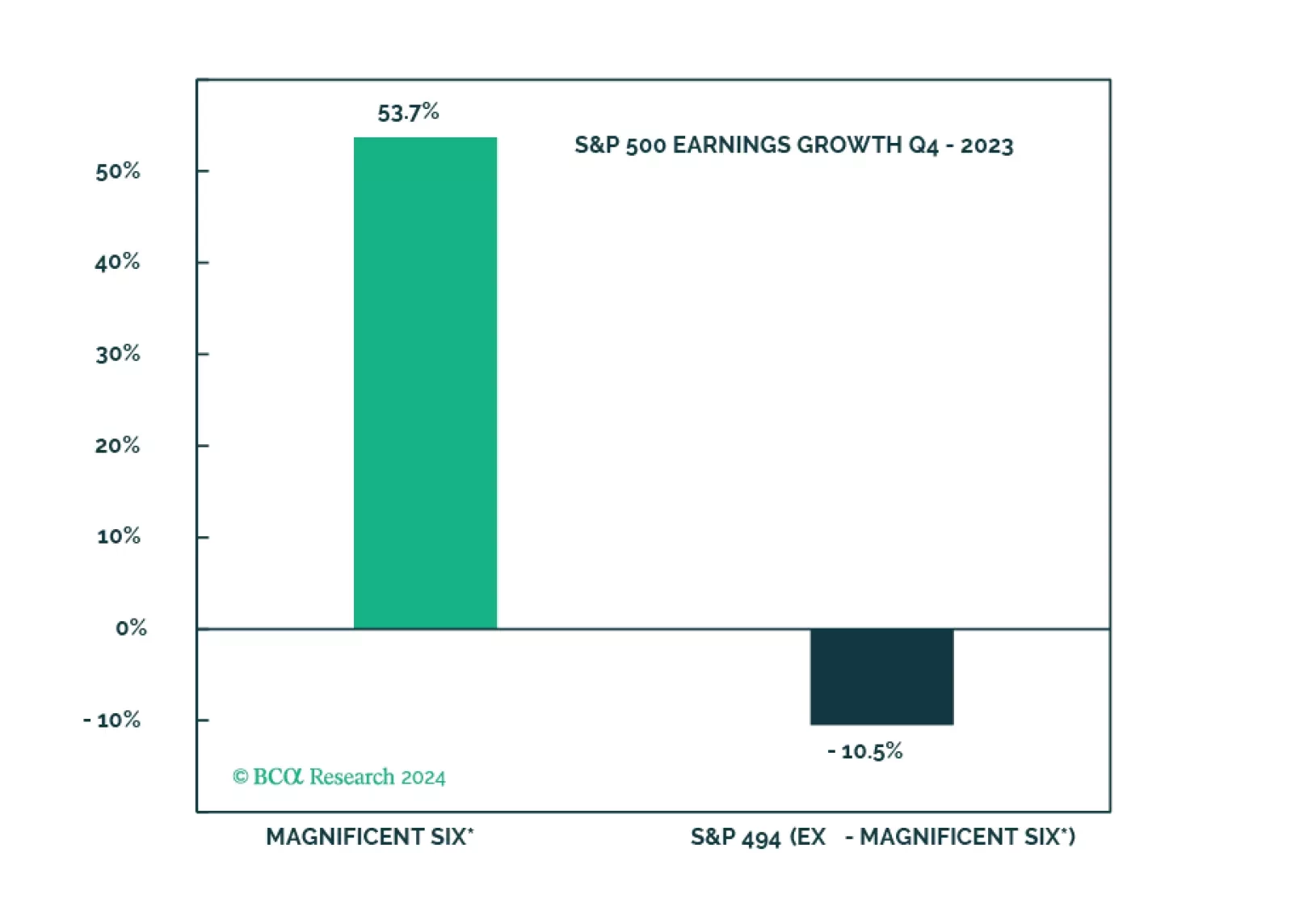

The soft landing and rate cuts narrative is being priced out, and the S&P 500 is overvalued and getting overbought. The Magnificent Seven are about to get a new moniker on the back of performance dispersion. However, without the…