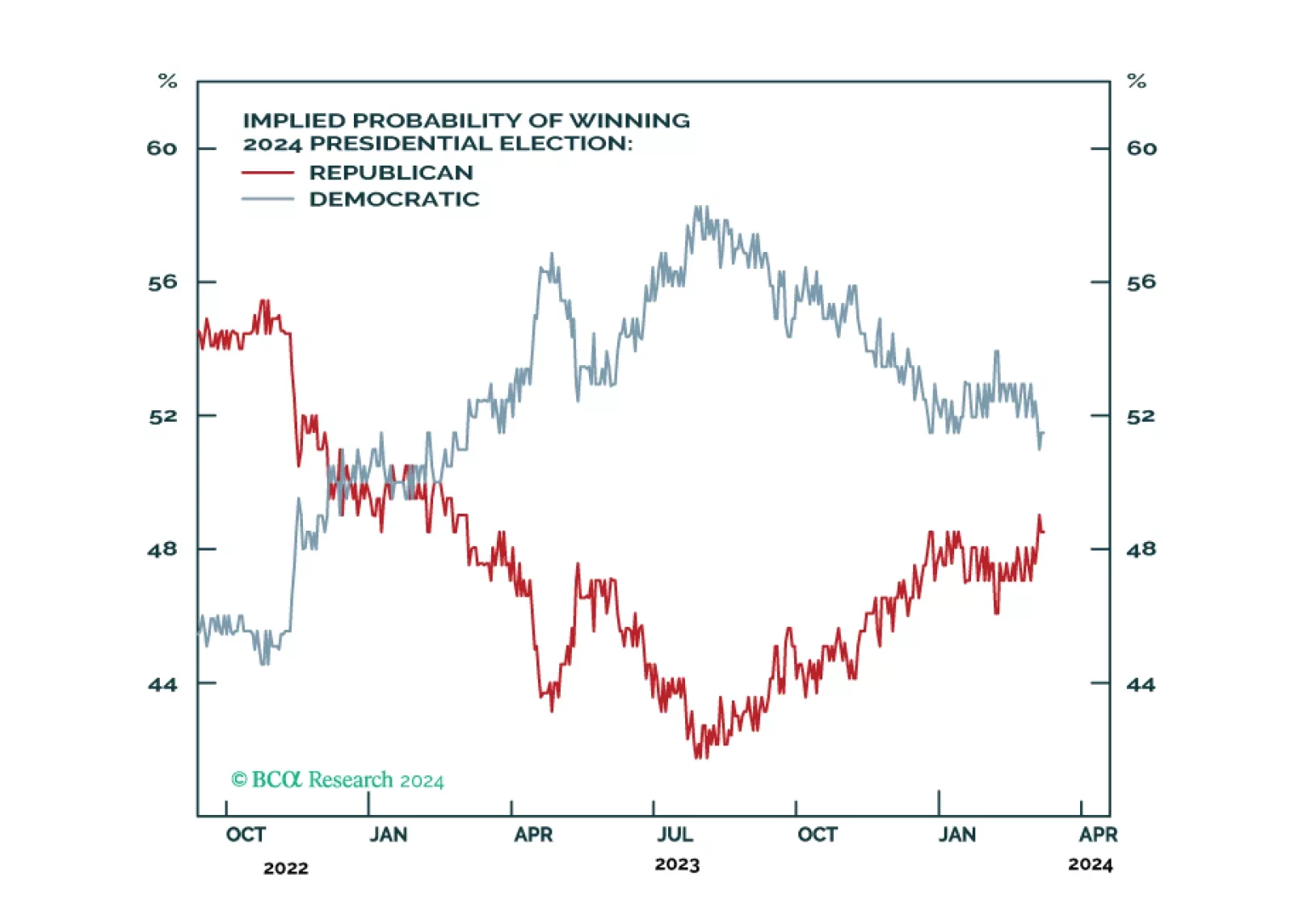

Democrats are still slightly favored for reelection as the incumbent party is presiding over a growing economy. However, Biden’s strong showing in the primary election is not lifting his popular approval yet, and that is a worrying…

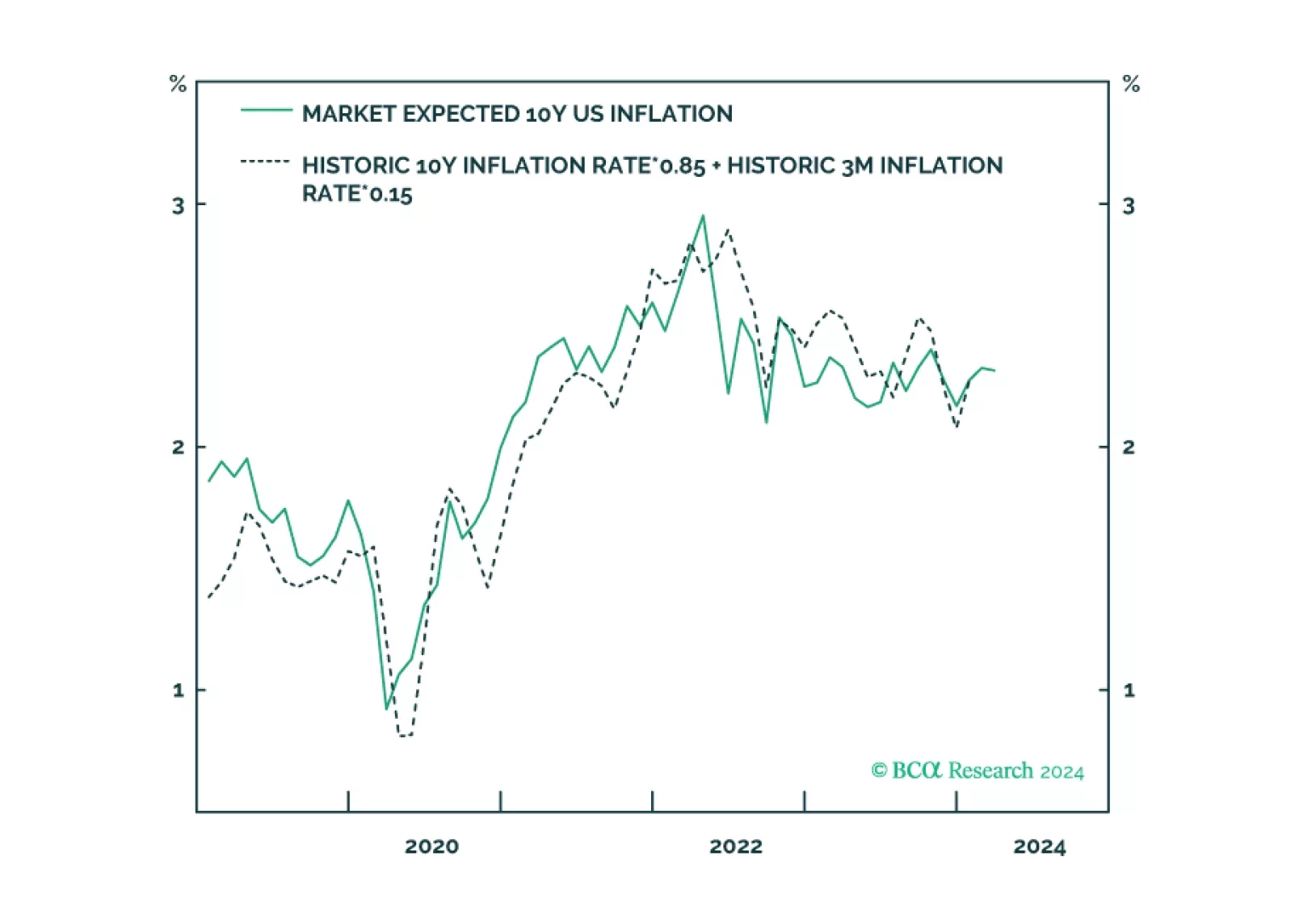

Expected inflation has surged to its highest level in a year. This has surprised many people, but expected inflation is behaving just as expected. Expected inflation is not a prophecy, it is just a mathematical function of delivered…

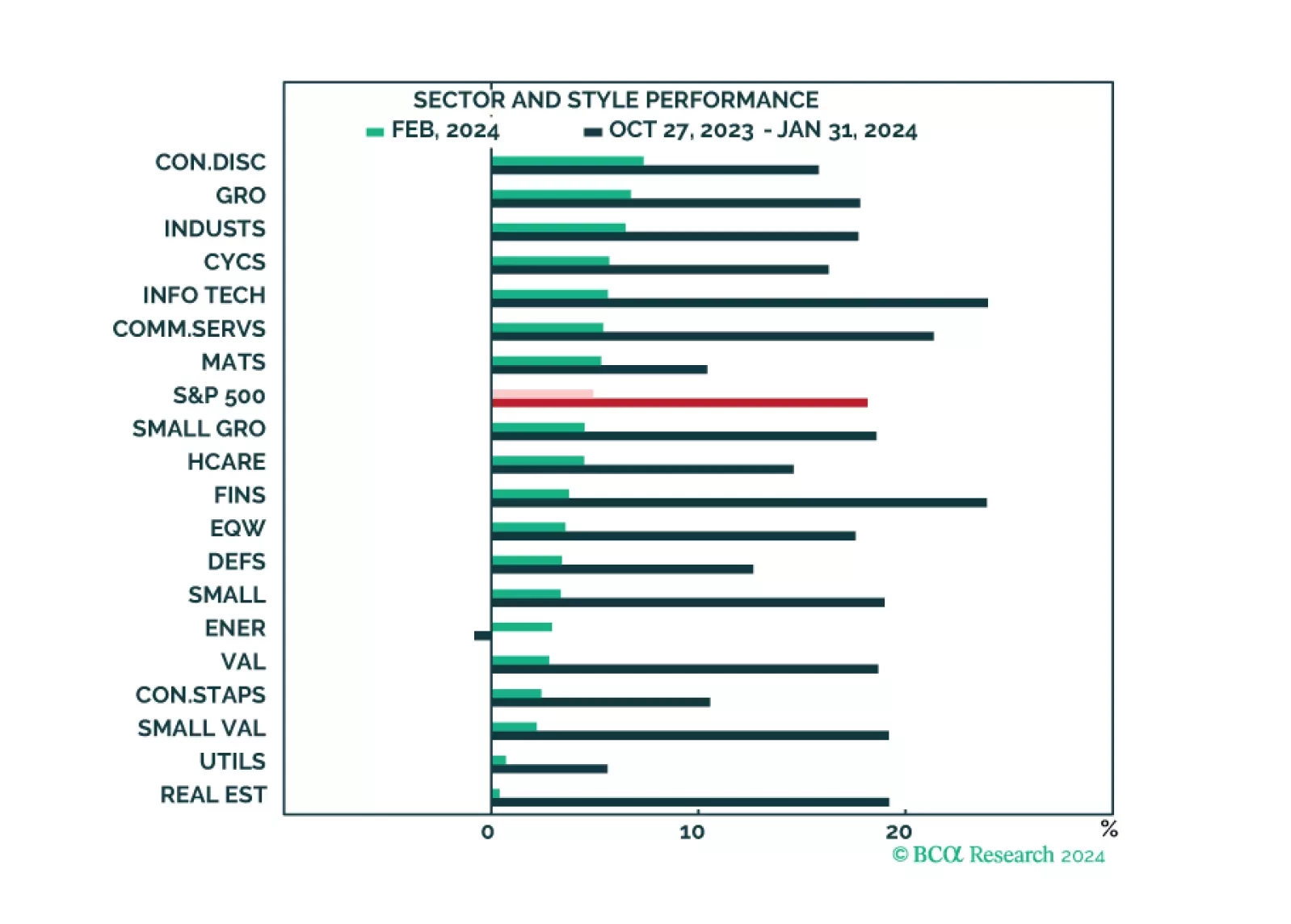

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…

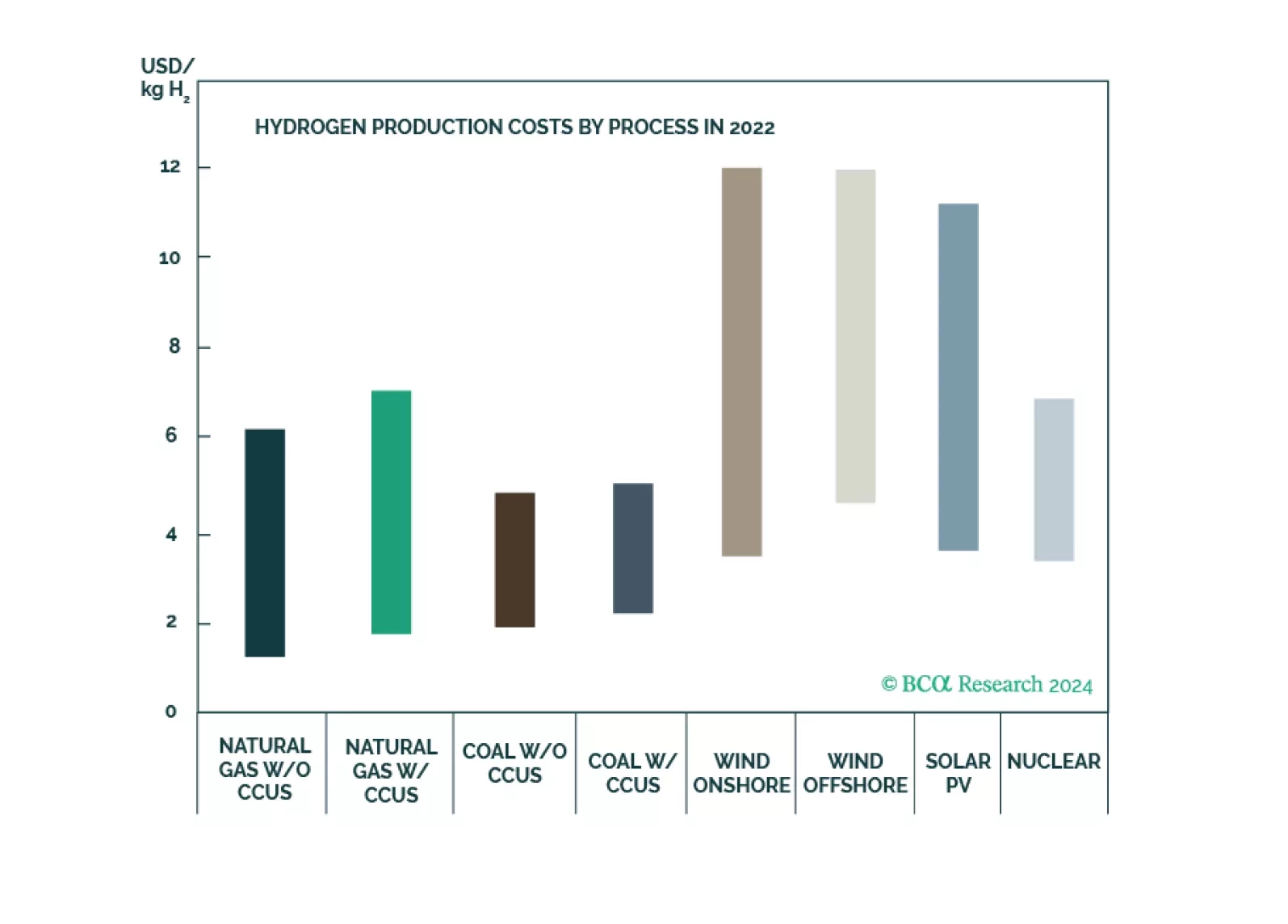

Naturally occurring hydrogen as a clean-energy source has the potential to satisfy significant energy demand growth at low cost. Oil and gas E+P companies and pipelines are ideally positioned to take a leading role in this clean-…

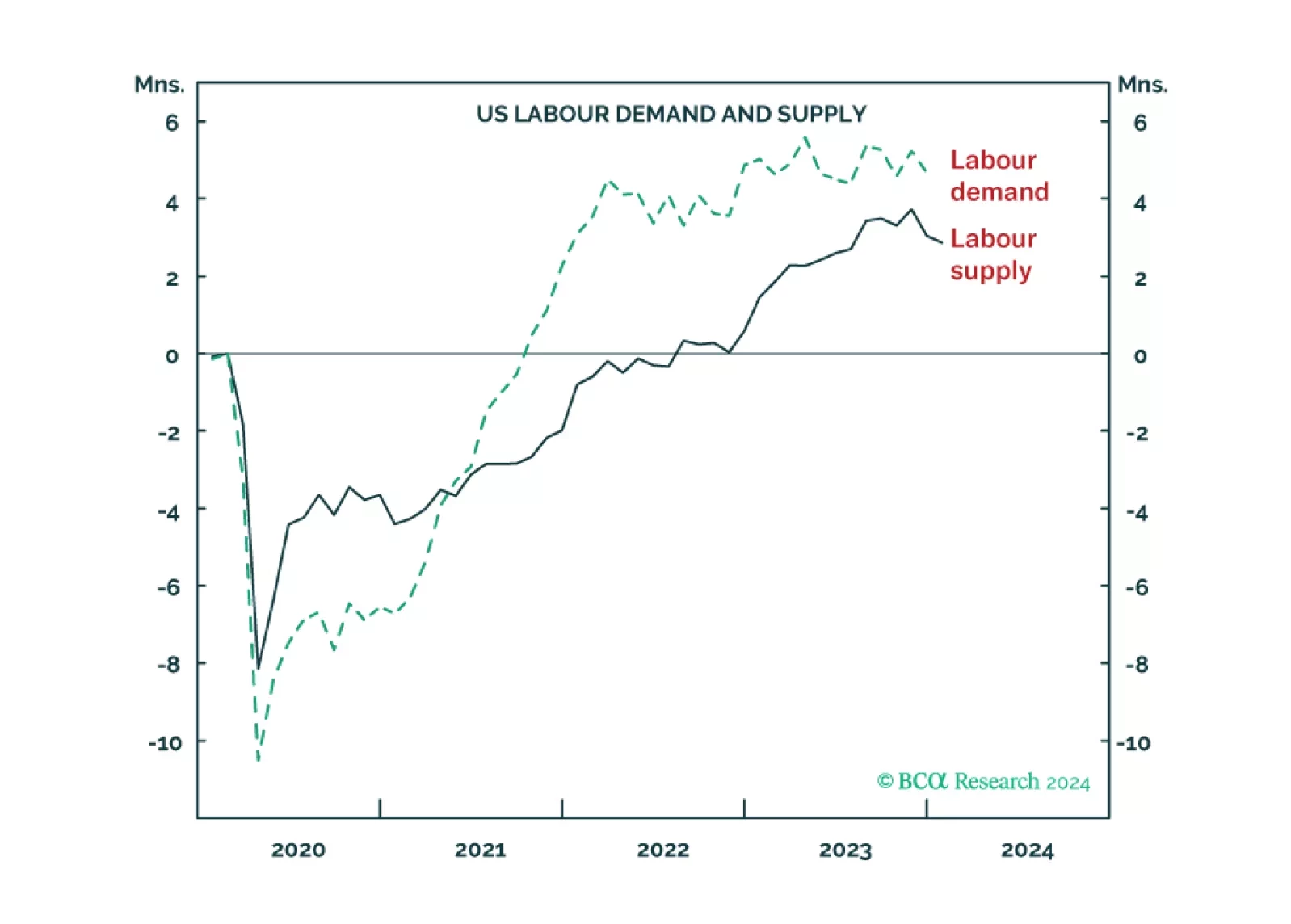

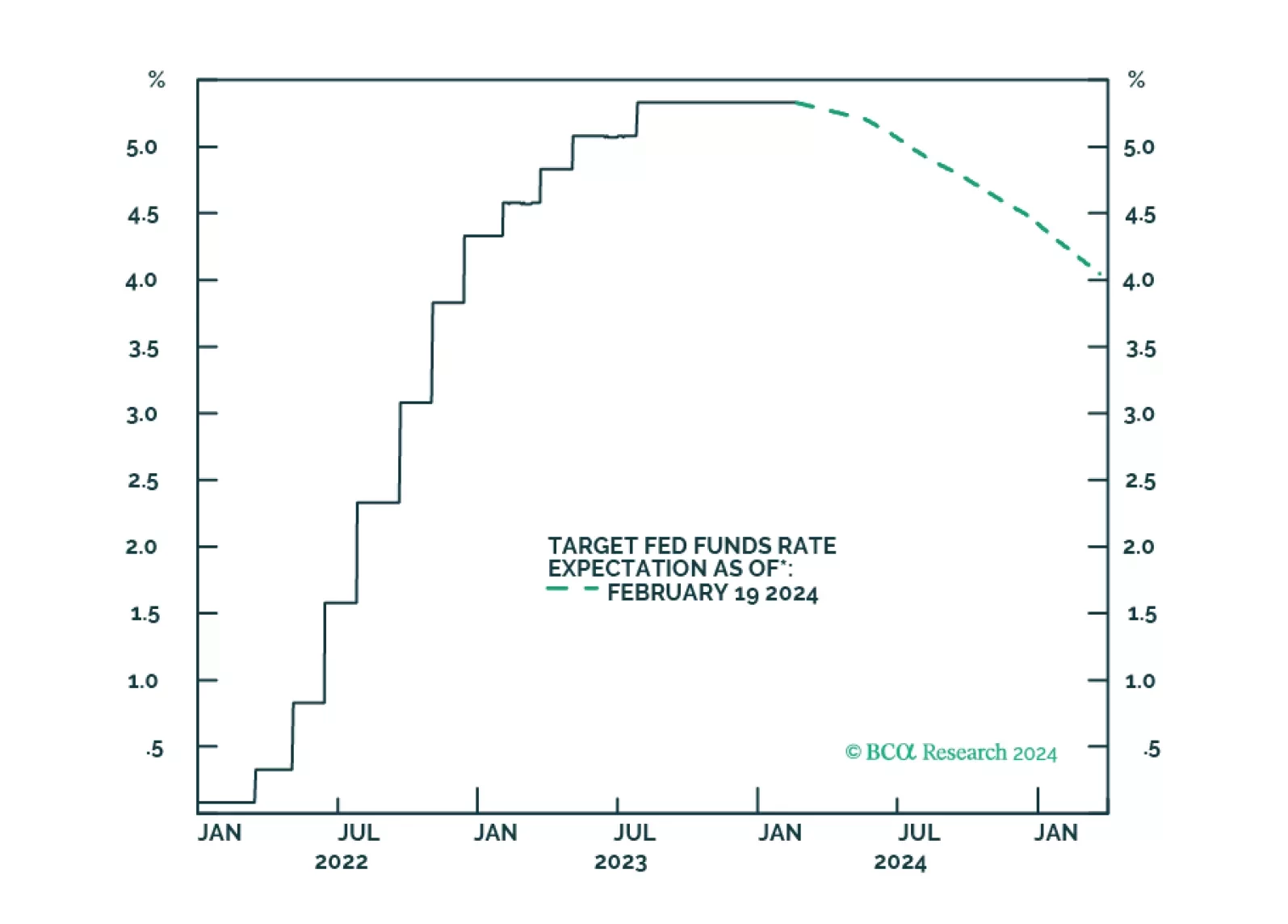

The US ‘immaculate disinflation’ has run its course, given that labour force participation is topping out. This leaves the Fed with a dilemma. Settle for price inflation stabilising at 3 percent, and cut rates early to avoid higher…

Seasonal weather and price variability in the first quarter will dissipate, which will reduce the agita caused by the recent inflation scare. This will increase the Fed’s comfort level in initiating a rate-cutting cycle in June with…

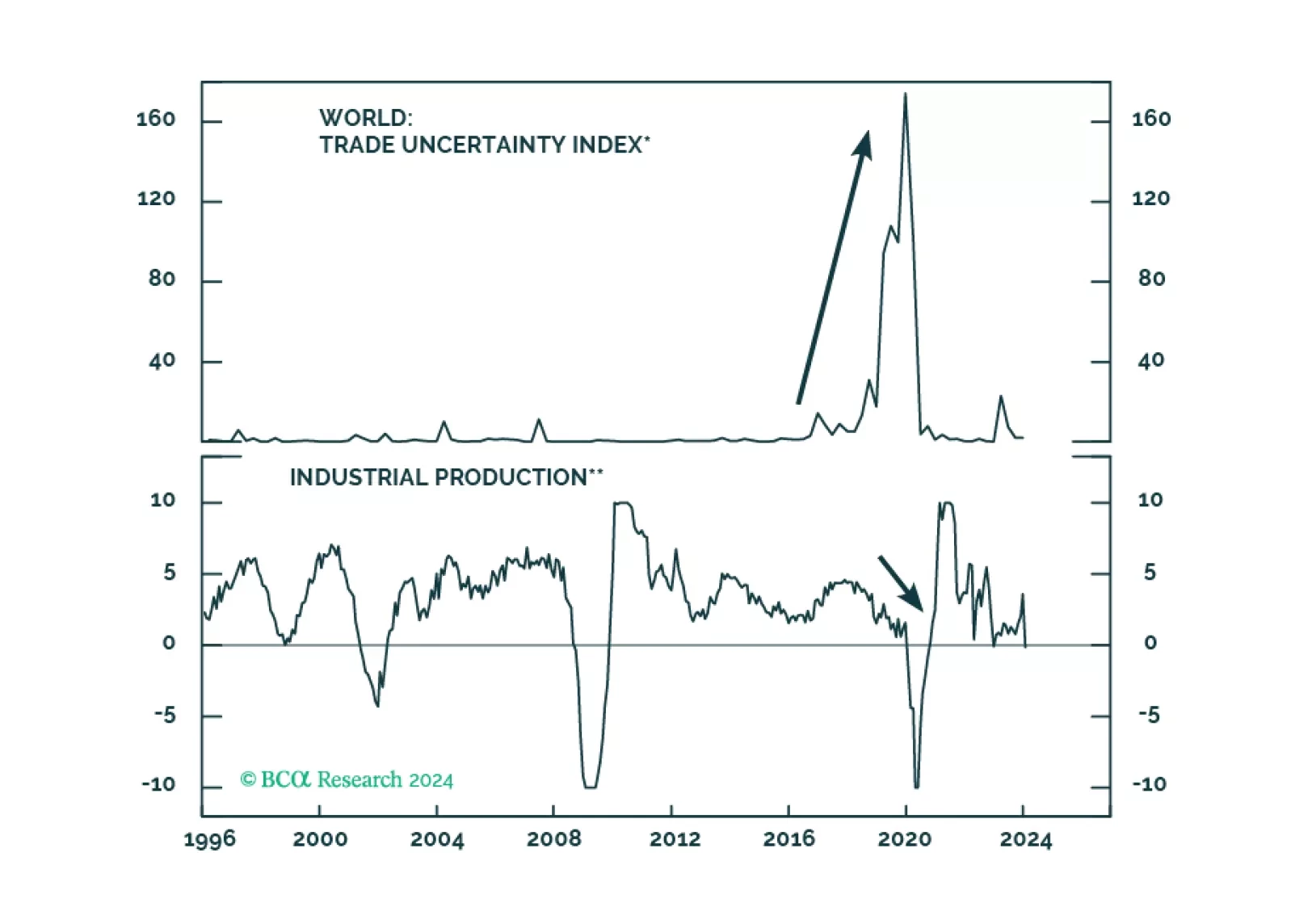

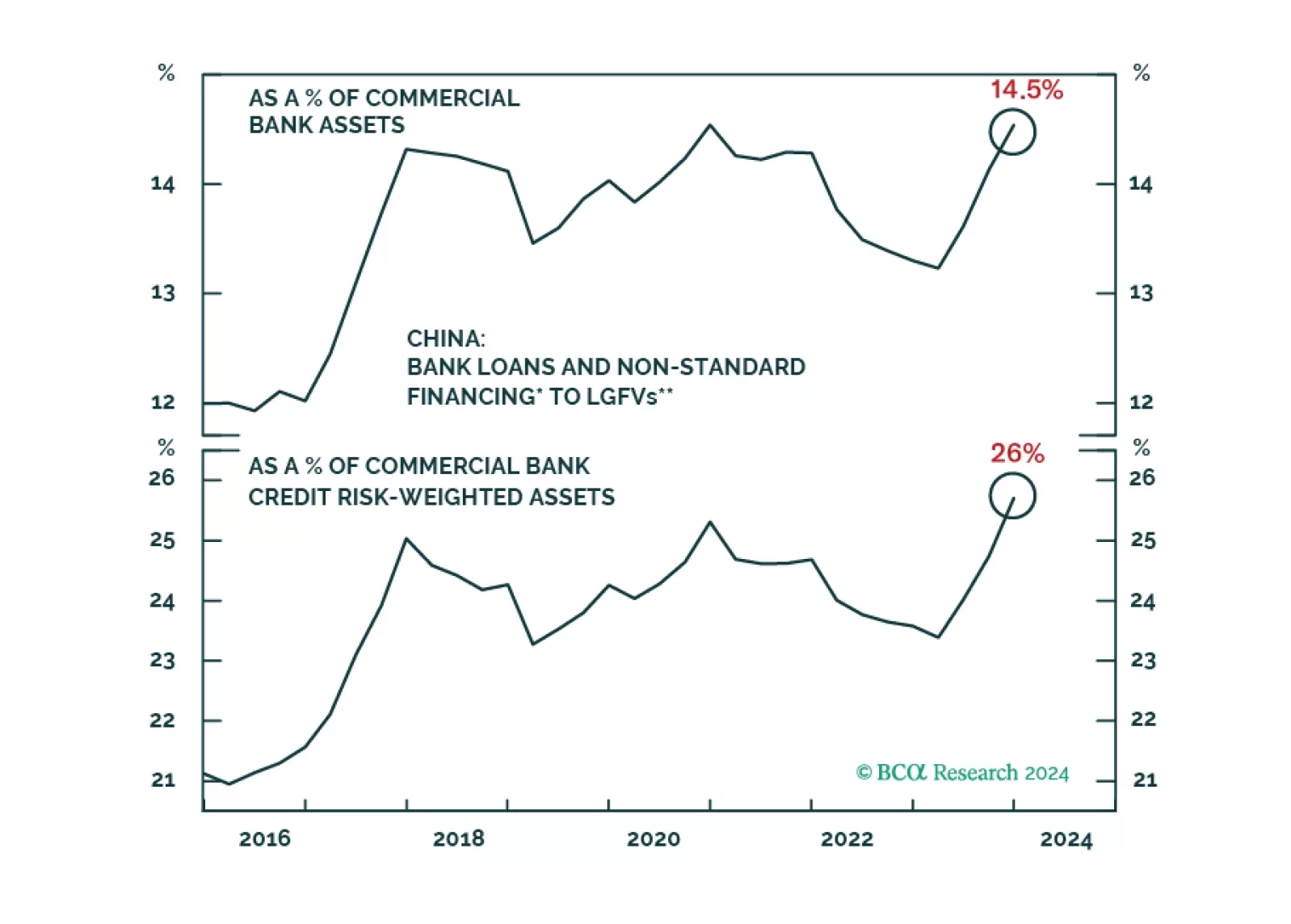

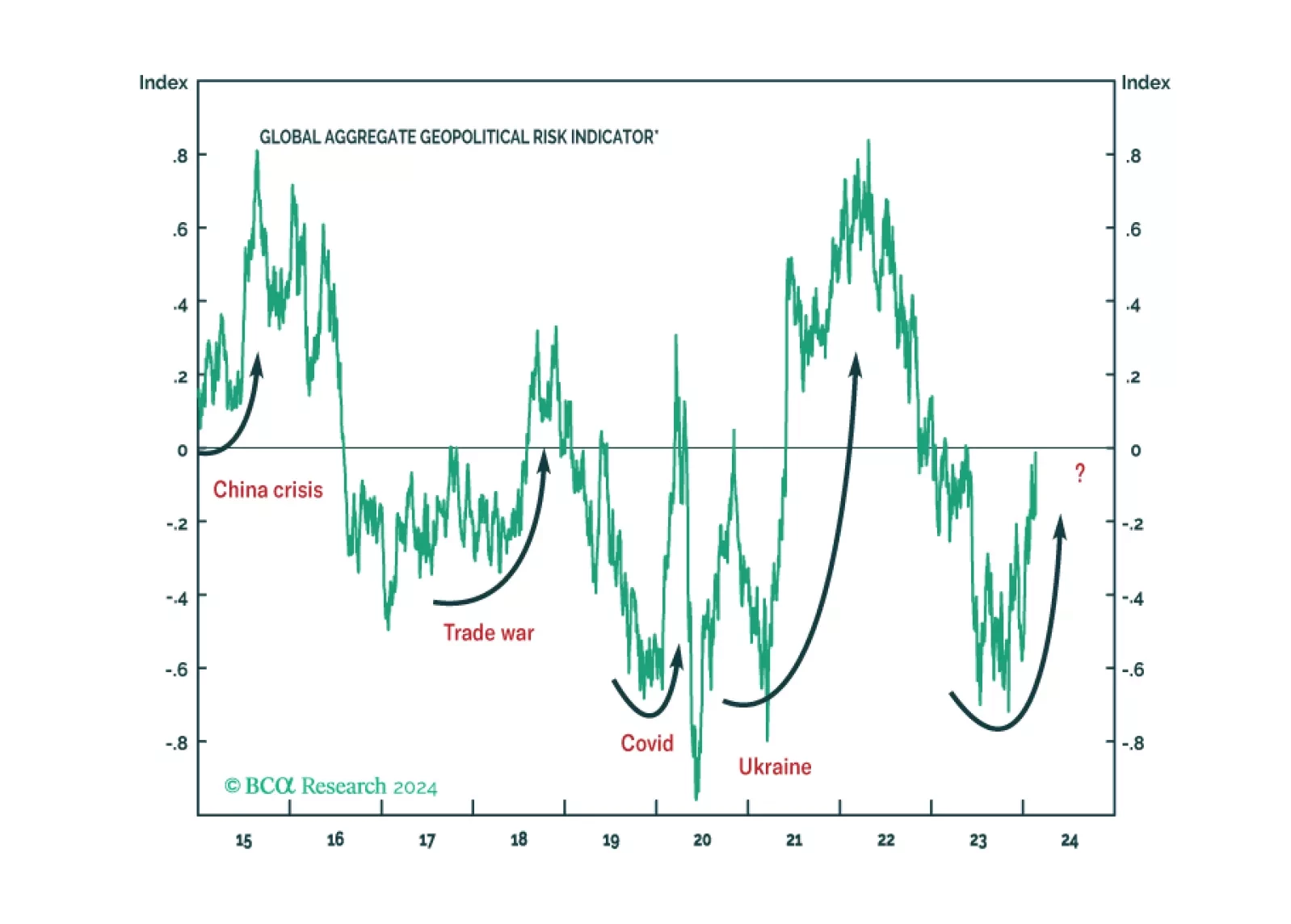

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…