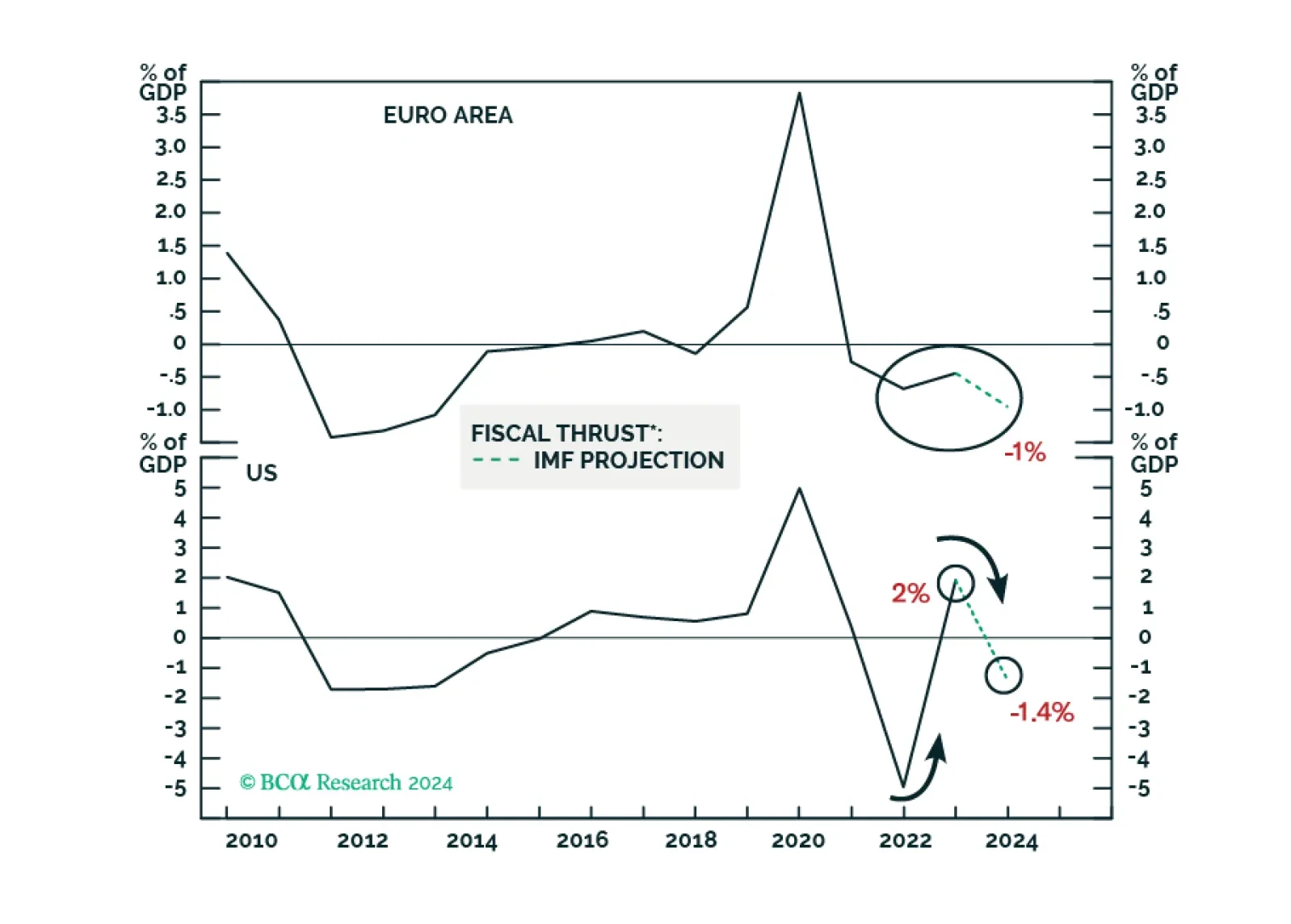

Despite a couple of rate cuts in H2 2024, borrowing costs will remain elevated in real terms amid lower inflation in the US and Europe. This and tightening fiscal policy will hinder domestic demand in advanced economies. Domestic…

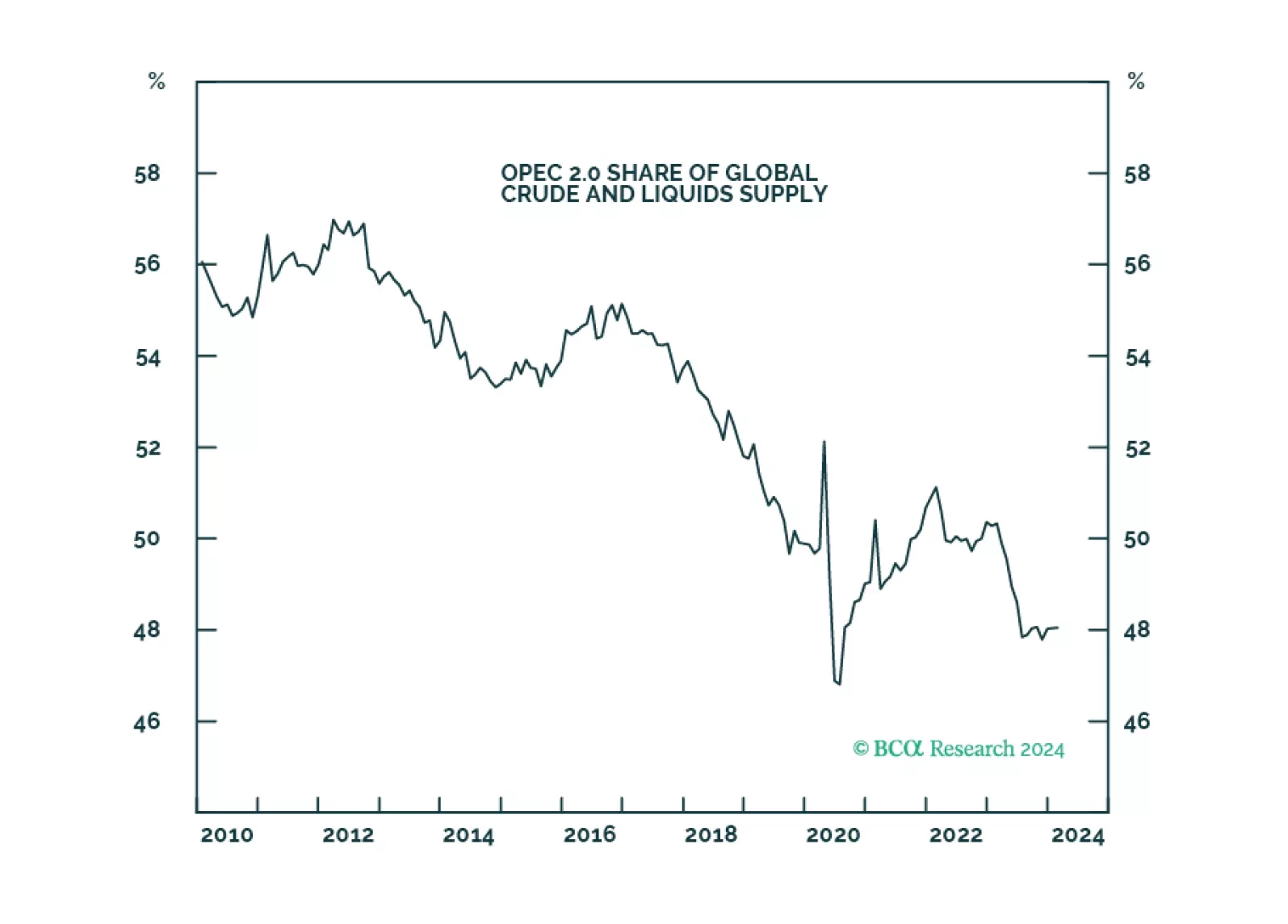

We expect oil-demand growth to increase this year – to 1.7mm b/d from 1.4mm b/d (0.30% of total demand) – and anticipate tighter supply at the margin. Our balances estimates are unchanged, leaving our Brent price forecasts for 2024…

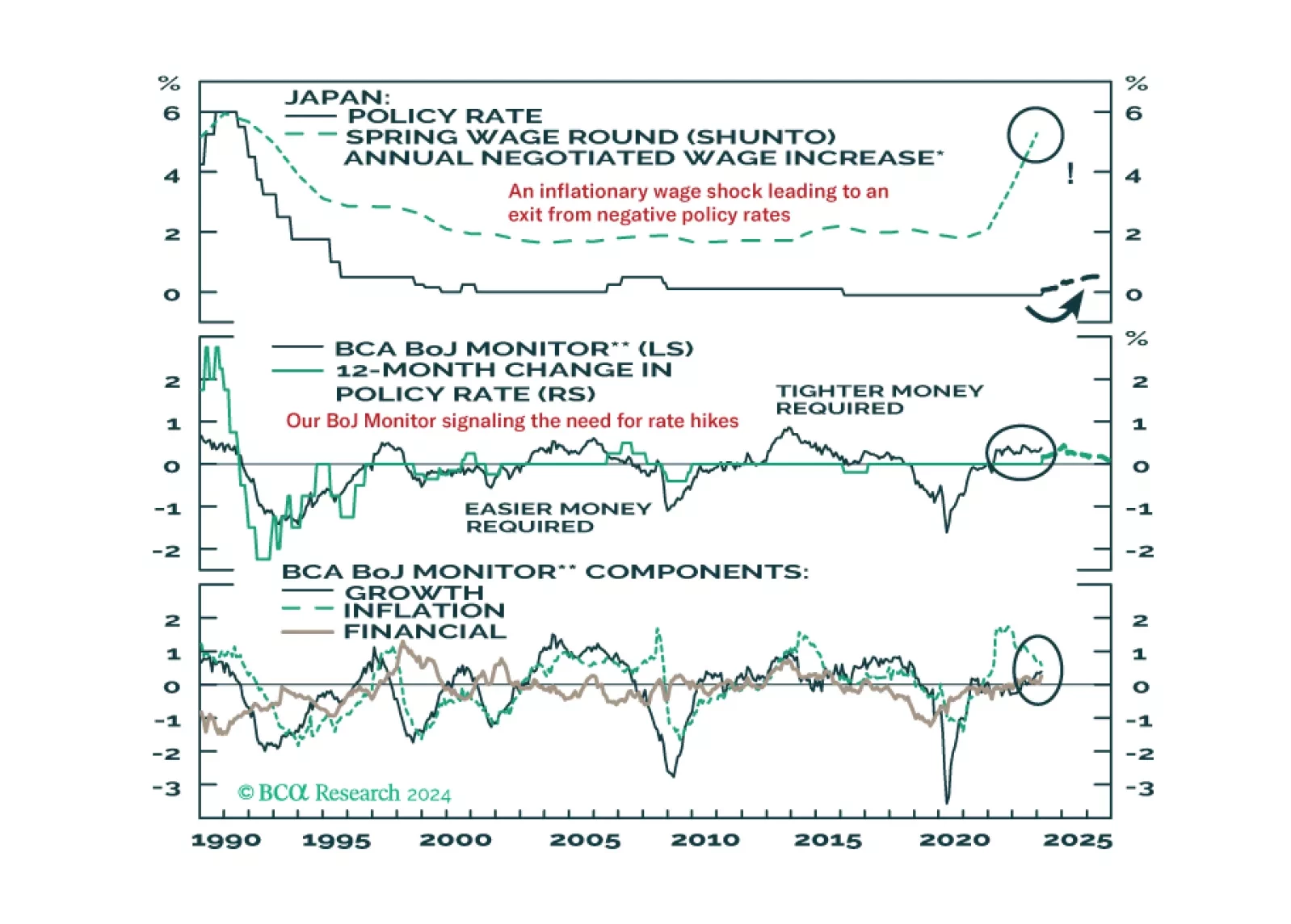

The Bank of Japan delivered a historic policy adjustment this week, ending both negative interest rates and Yield Curve Control. In this Insight, BCA’s global fixed income and currency strategists discuss the immediate implications…

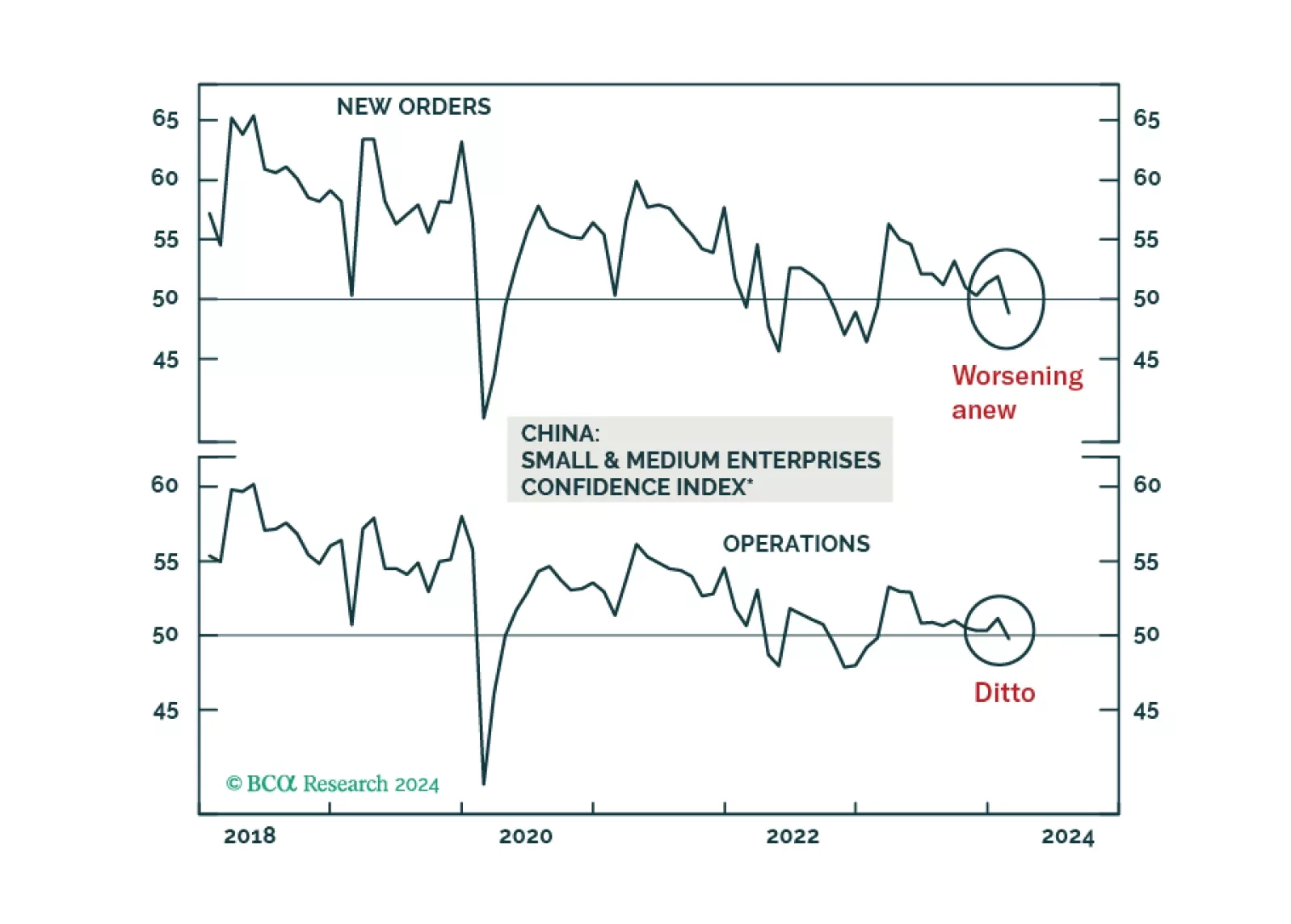

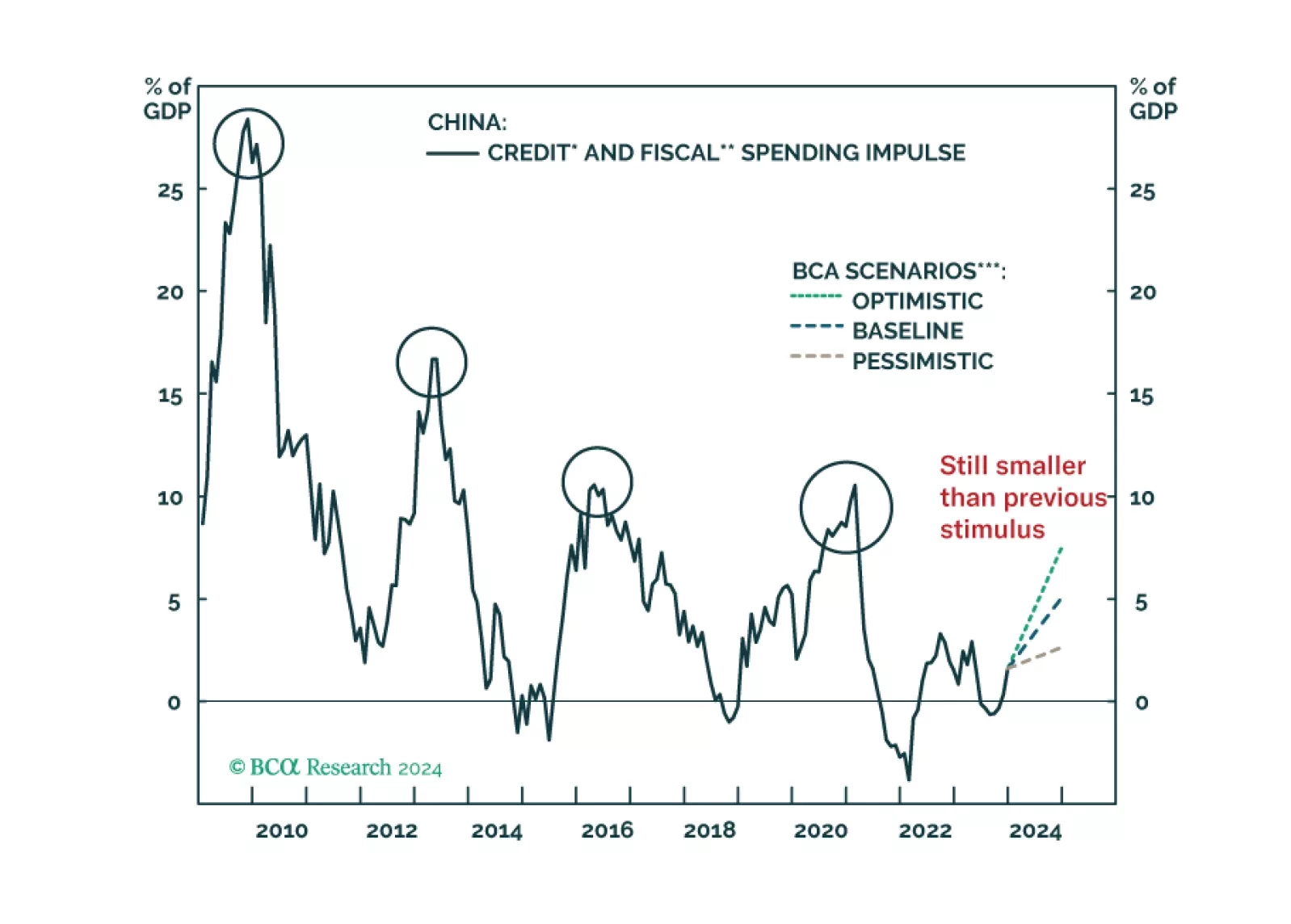

Deflation remains prevalent in the Chinese economy. The longer authorities delay a big bang-type stimulus, the more entrenched deflation will become. Hence, a cyclical upswing in Chinese stocks is unlikely, although there might be…

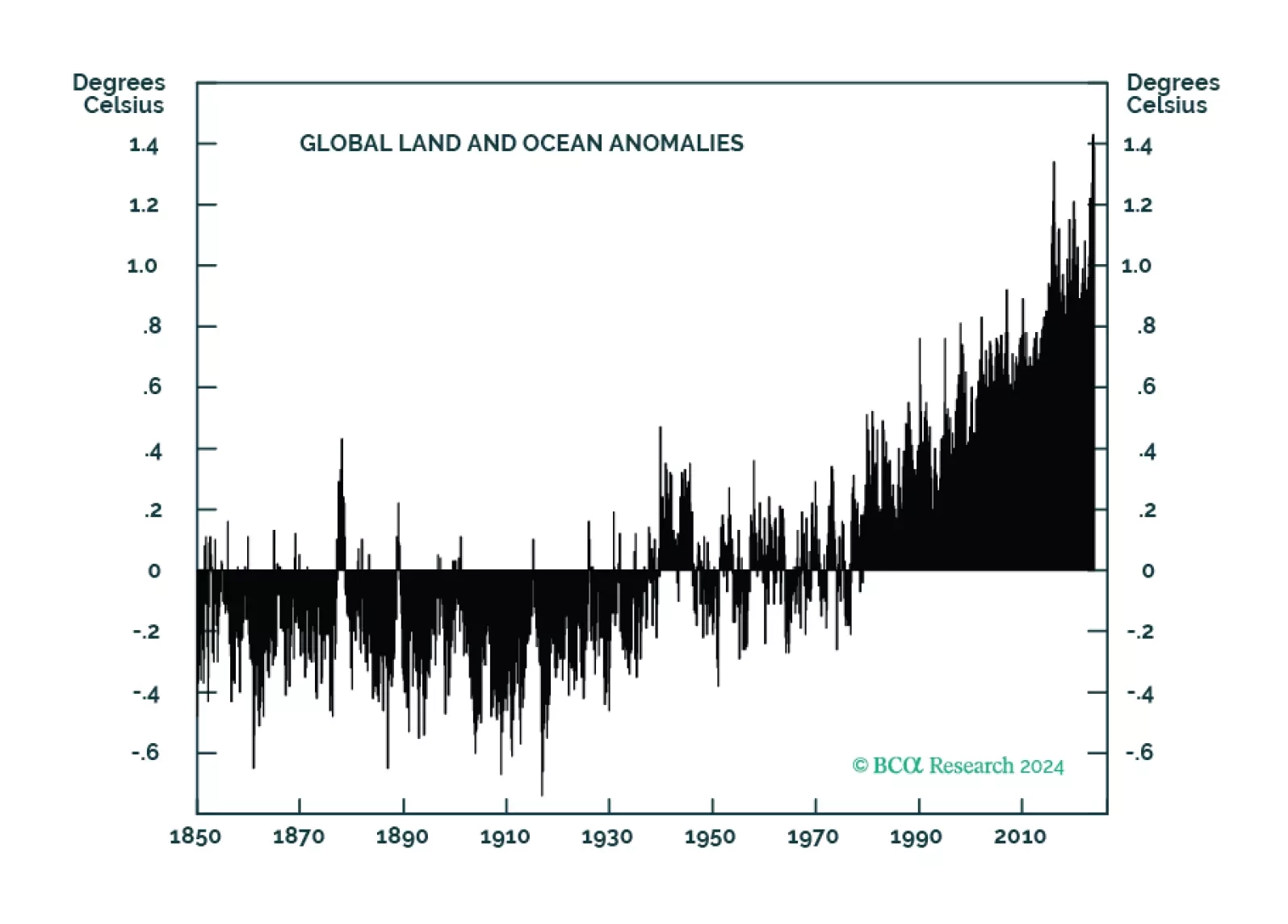

Global ag markets will become more volatile as anthropogenically induced climate change continues to degrade farmland. This will make price signals emanating from these markets less efficient in terms of processing supply-demand…

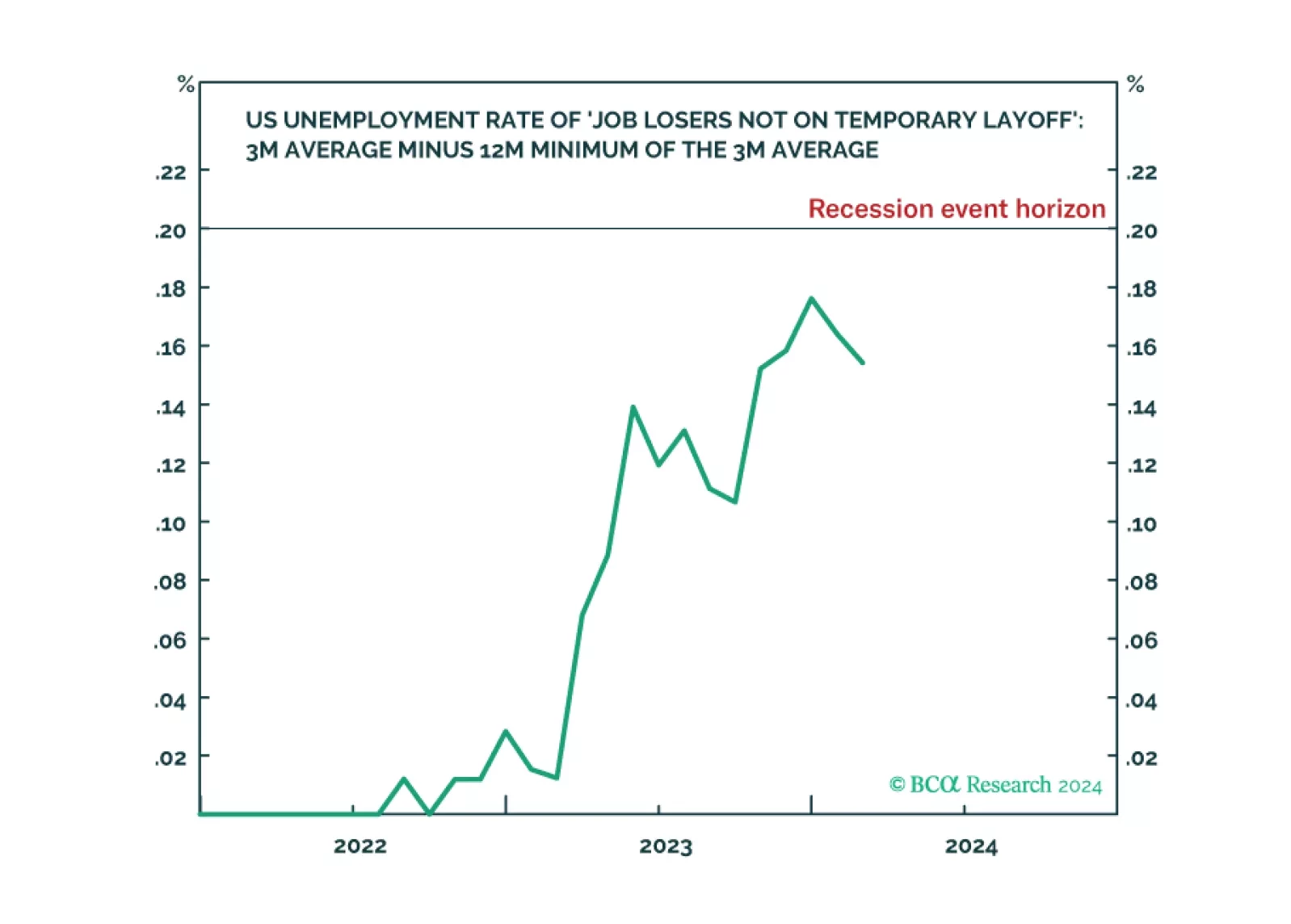

The Joshi rule real-time US recession indicator remains at an elevated 0.154 versus its recession event horizon of 0.200, indicating weakening US labour demand. With the last mile of US disinflation requiring labour demand to ‘catch…

The stimulus measures announced at last week's NPC were not a game changer. As in 2023, we expect aggregate government spending will fall short of the budgeted amount again this year.

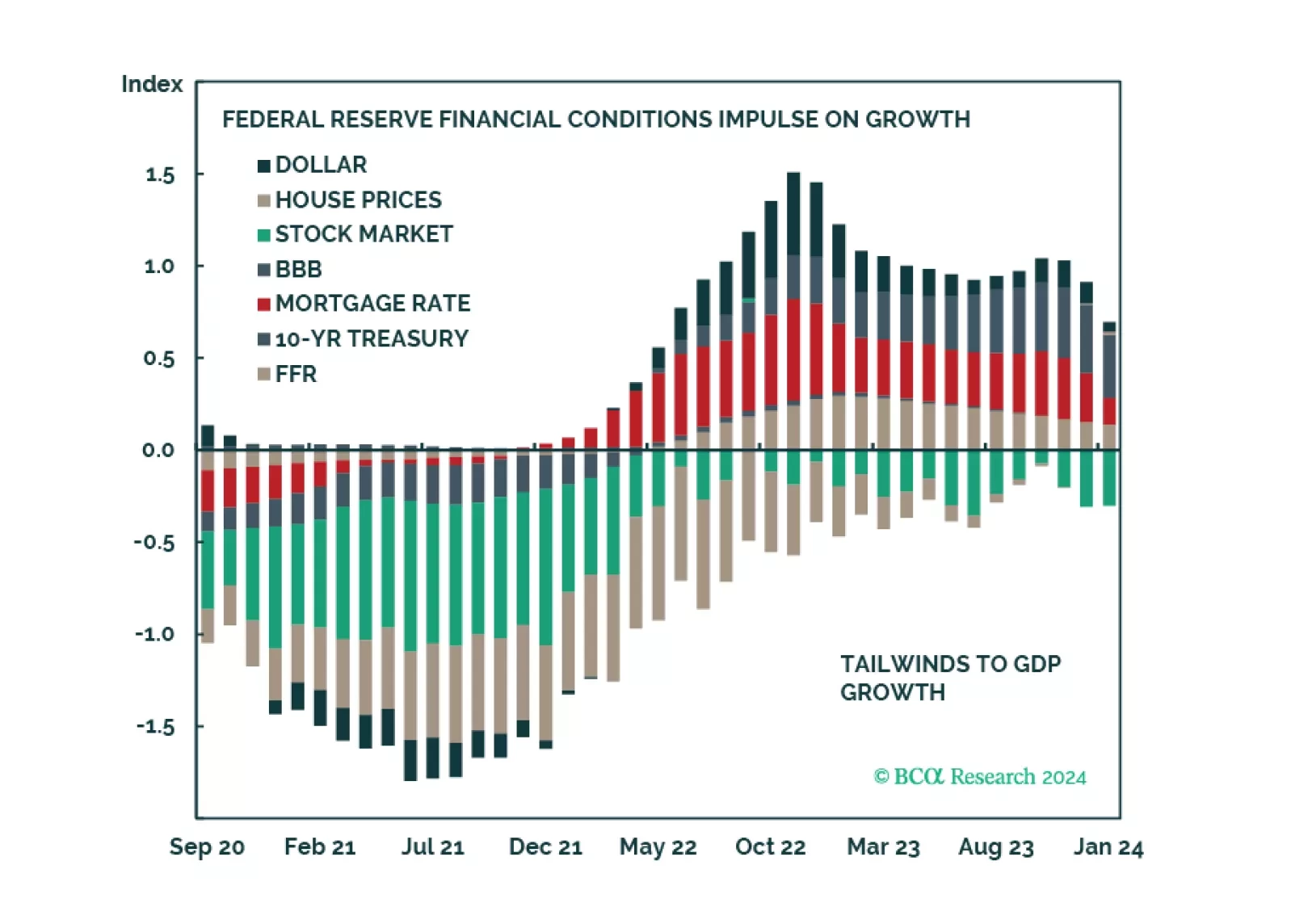

Clients are increasingly more positive about the US economy, but there are no signs of exuberance. The rally could continue as the majority is not fully invested. Financial conditions have already eased, and the Fed is unlikely to…