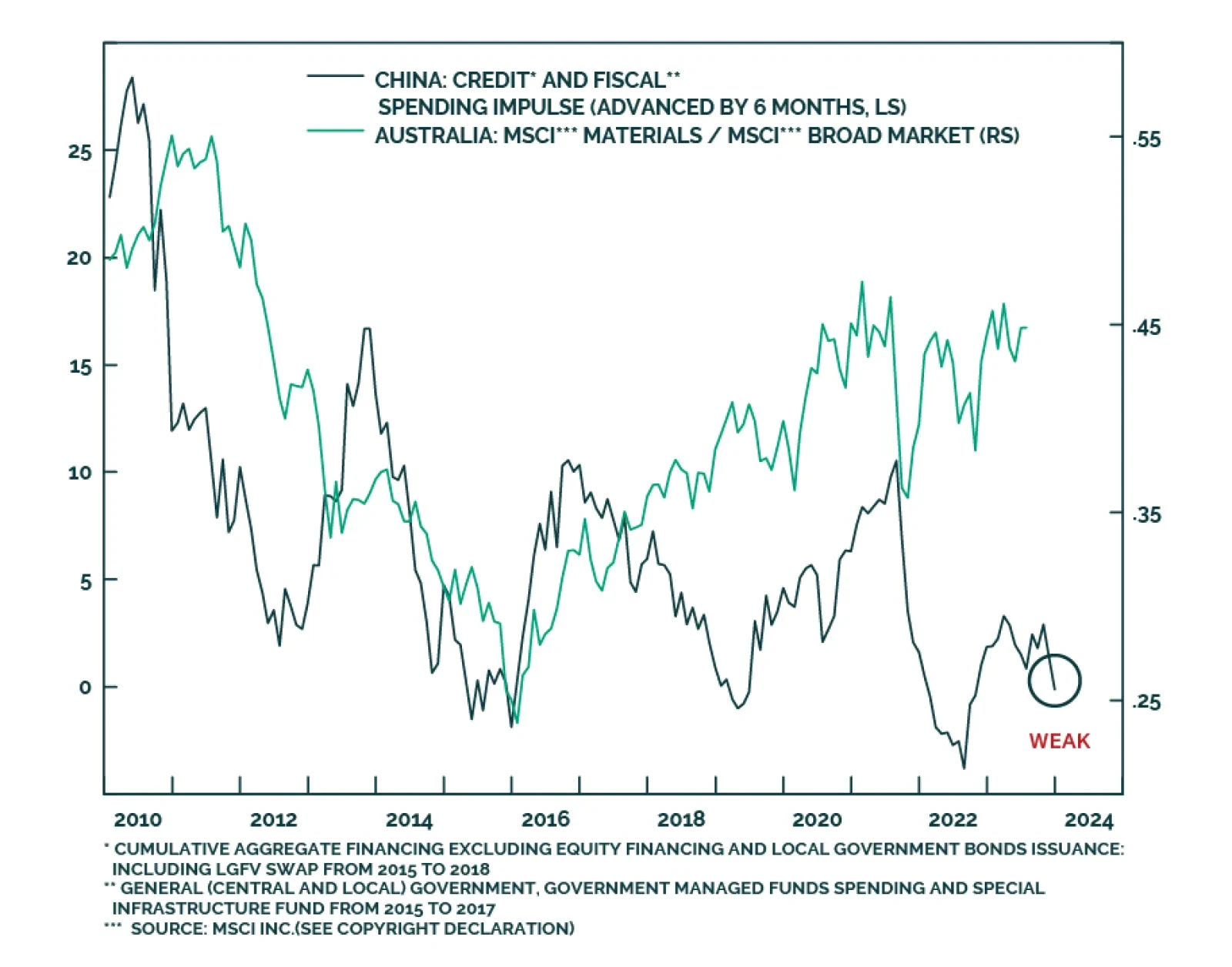

Australian material stocks have been in a broad trading range since the beginning of the year both in absolute terms and relative to the overall market. This stabilization follows a sharp rally in the fourth quarter of 2022 which…

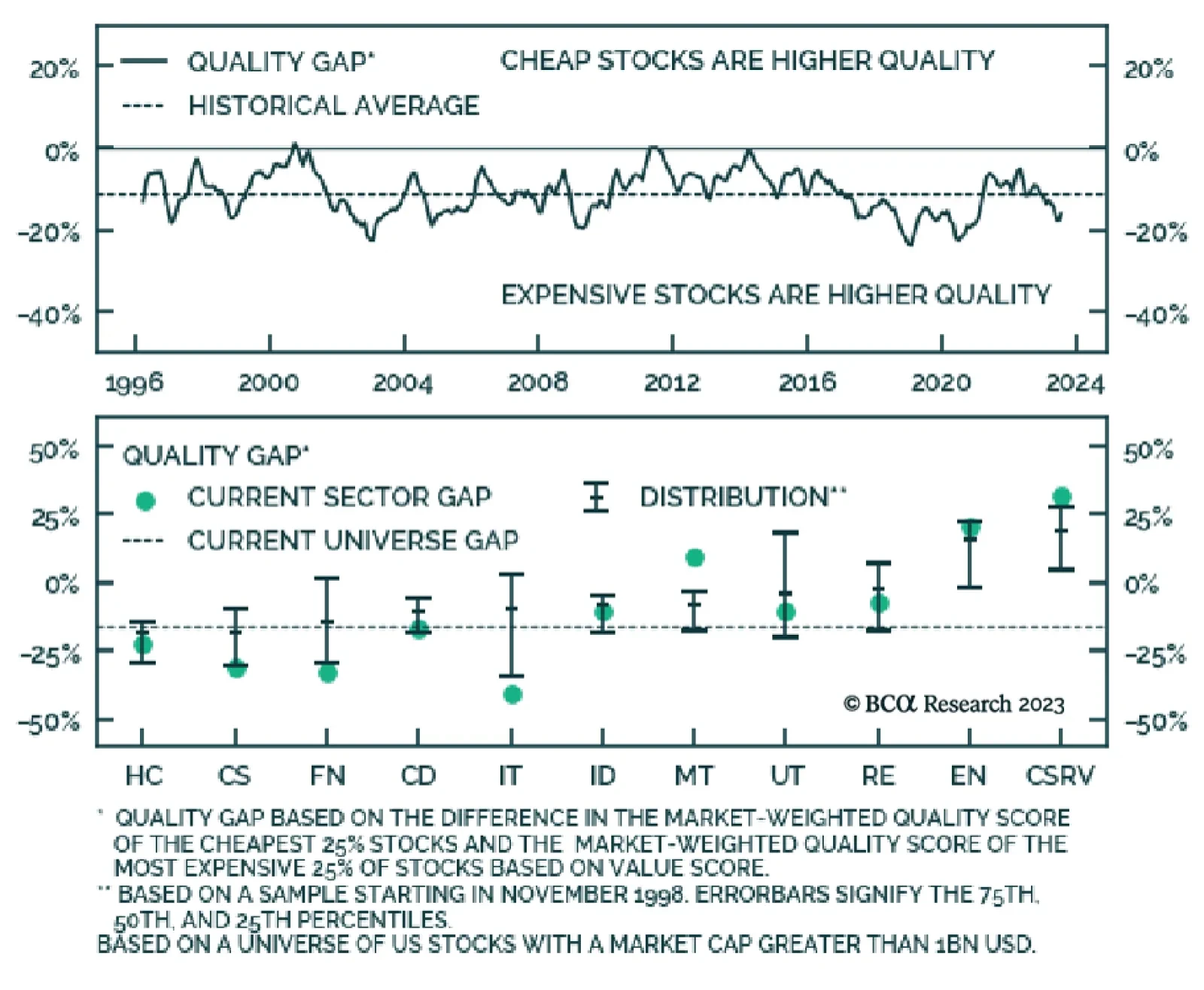

The Equity Analyzer Platform uses a 30-factor model called the BCA Score to help our clients build robust portfolios. Multi-factor models are constructed to avoid the common pitfalls of focusing on one factor dimension, such as…

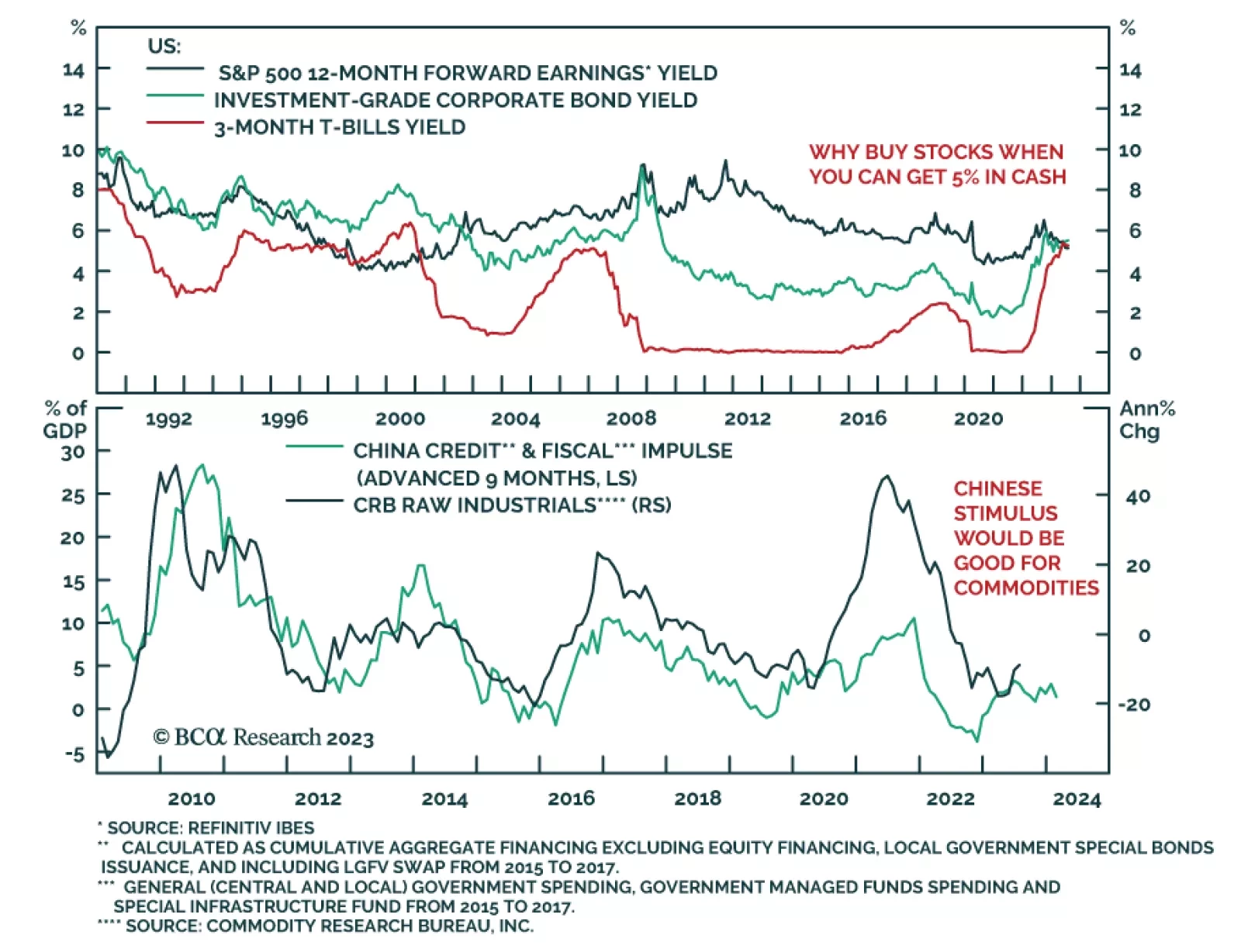

On a 12-month investment horizon, BCA Research’s Global Asset Allocation service recommends a defensive stance: Overweight government bonds, and underweight equities and credit. The US stock market trades on 19x forward…

In June, the rally gained momentum and broadened due to positive economic data, particularly in the housing market. We expect cheaper cyclical sectors and styles to mark a change in leadership as the rally broadens, helped on by…

Recession is on track to start around year-end. Stocks usually peak shortly before recession begins. So, position defensively but be prepared for a few more months of the rally.

Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…

Fertilizer prices will continue to move lower as the natgas price shock touched off by the Russian invasion of Ukraine dissipates. As a result, we expect grain prices to soften another 10% this year. Food-price inflation will move…

We Introduce our new macro models for the Eurozone’s equity earnings, which include sectoral forecasts. Find out what they predict for the next six-to-nine months.