Highlights Investment Grade Sector Valuation: Our investment grade corporate bond sector valuation models for the US, euro area, UK, Canada and Australia show some common messages, as markets have adjusted to a virus-stricken world.…

Yesterday our 10% rolling stop got triggered on the long S&P oil & gas exploration & production (E&P)/short global gold miners pair trade. We are compelled to reinstate this intra-commodity pair trade, despite…

Highlights Portfolio Strategy We remain comfortable with a 3,000 SPX fair value estimate backed up by our DDM, forward ERP and sensitivity analyses. The path of least resistance remains higher for the SPX on a 9-12 month cyclical time…

Highlights Yesterday we published a Special Report titled EM: Foreign Currency Debt Strains. We are upgrading our stance on EM local currency bonds from negative to neutral. Before upgrading to a bullish stance, we would first need…

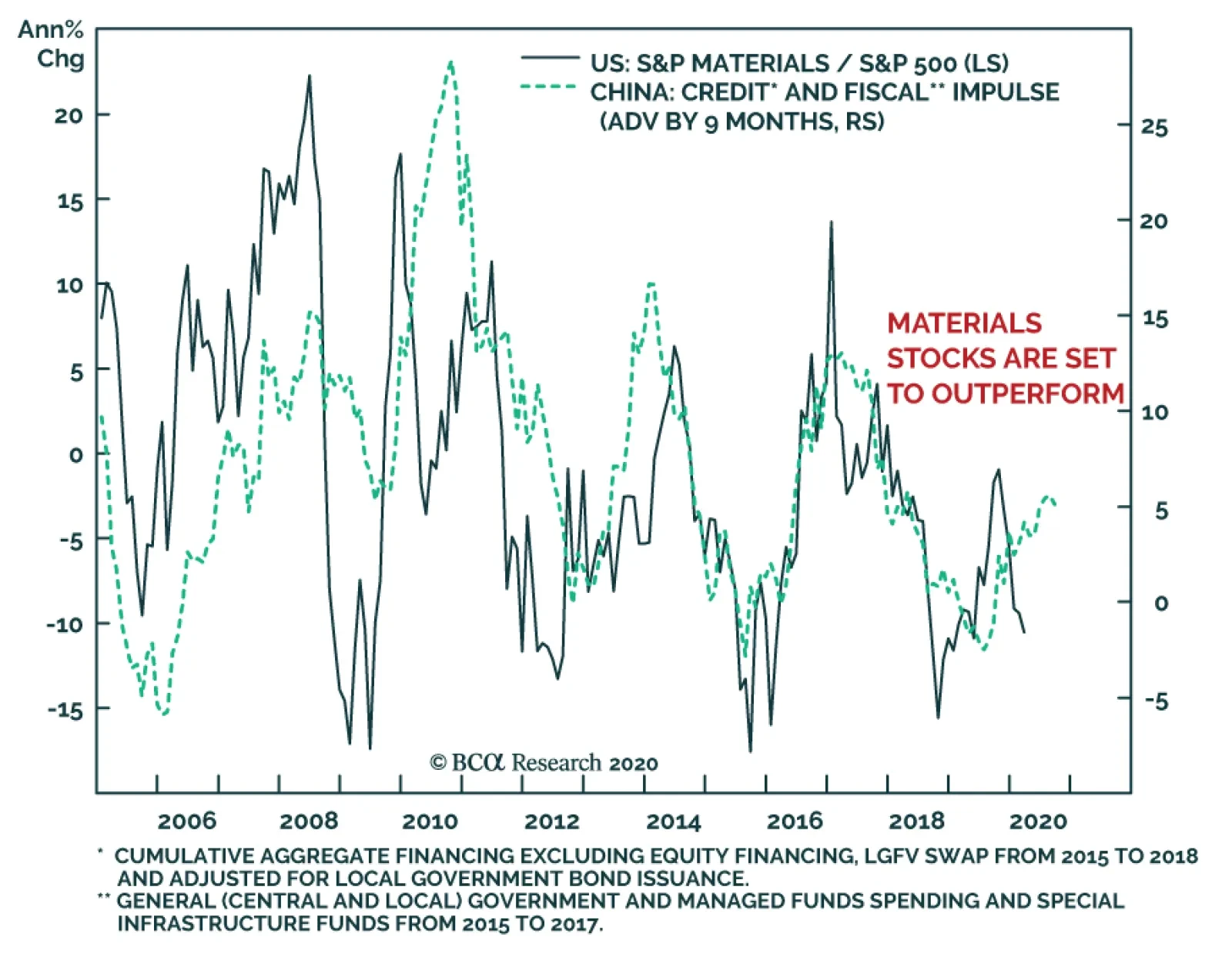

The S&P materials sector is massively oversold relative to the S&P 500, while our valuation index is at a large discount to its normal relationship to the broad market. Moreover, its forward EPS breadth and relative EPS…

Highlights Bulk commodity markets – chiefly iron ore and steel – could see sharp rallies once Chinese authorities give the all-clear on COVID-19 (the WHO’s official name for the coronavirus). These markets rallied…

Cyclical & Secular Underweight We remain underweight the S&P interactive media & services (IM&S) subgroup on both cyclical and secular (ten-year basis) time horizons as increasing regulation will likely deal…