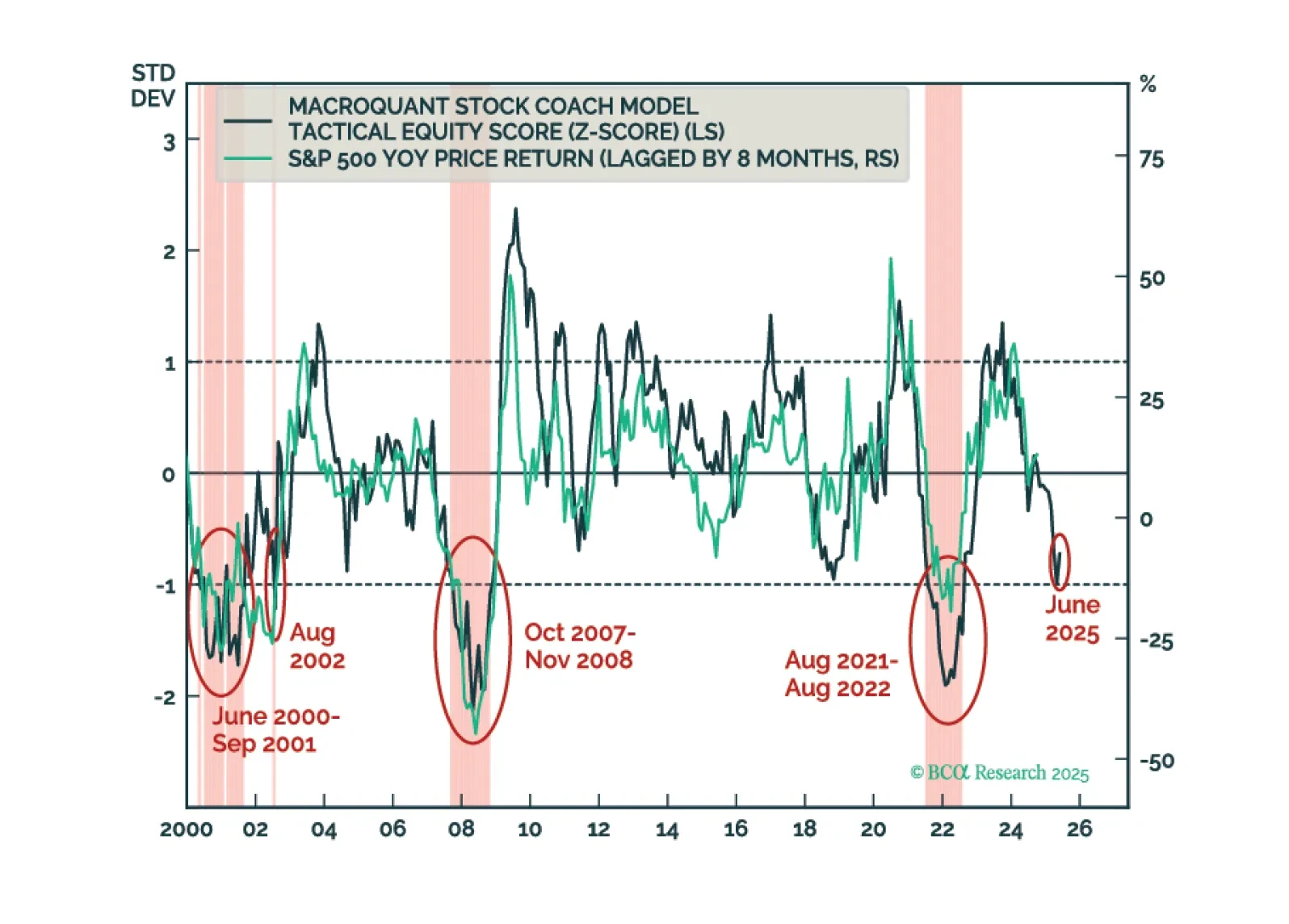

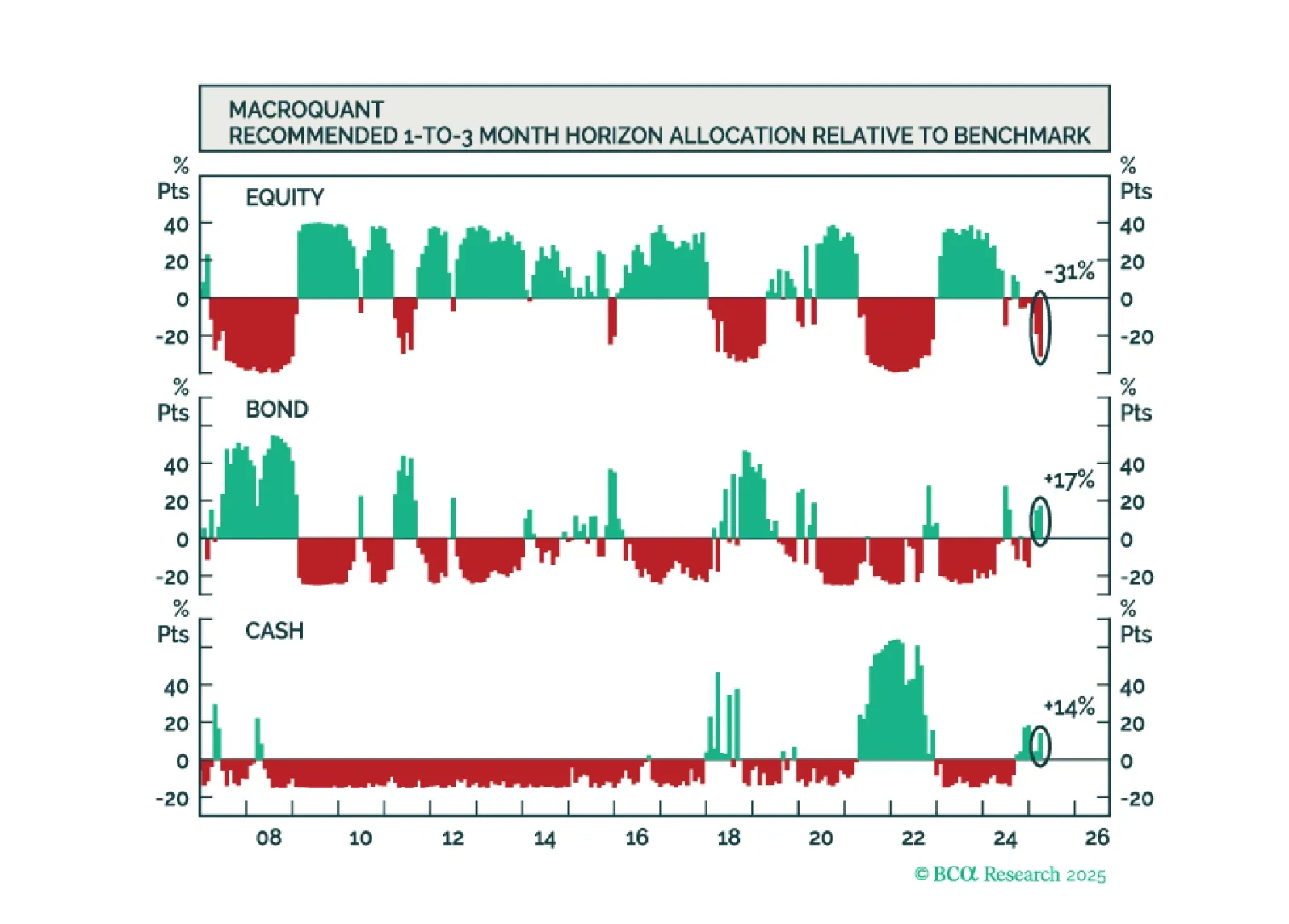

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

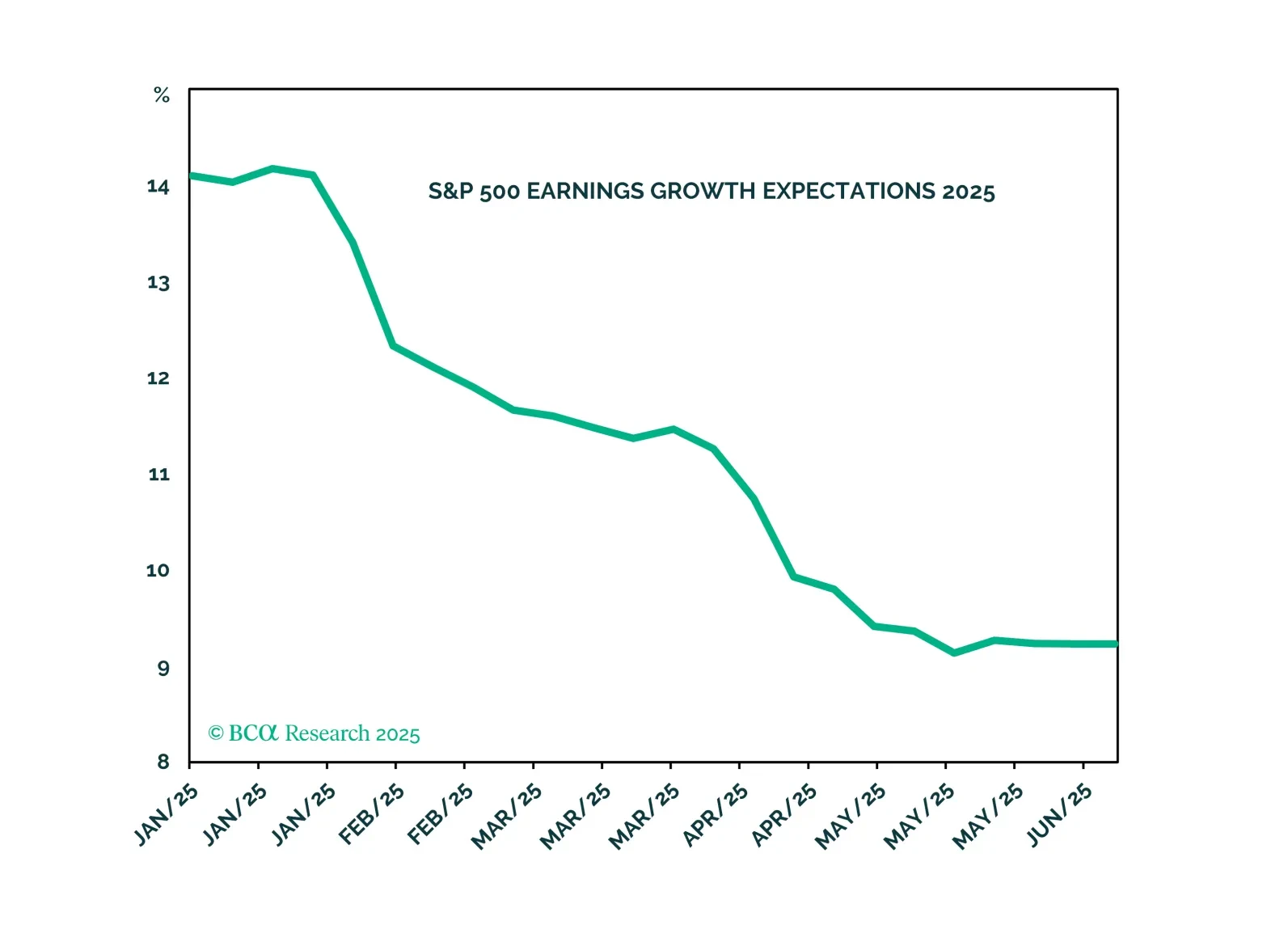

Imminent monetary and fiscal easing, along with resilient earnings growth, support a constructive outlook for equities. However, in the near term, significant tail risks persist. We recommend strengthening downside protection by…

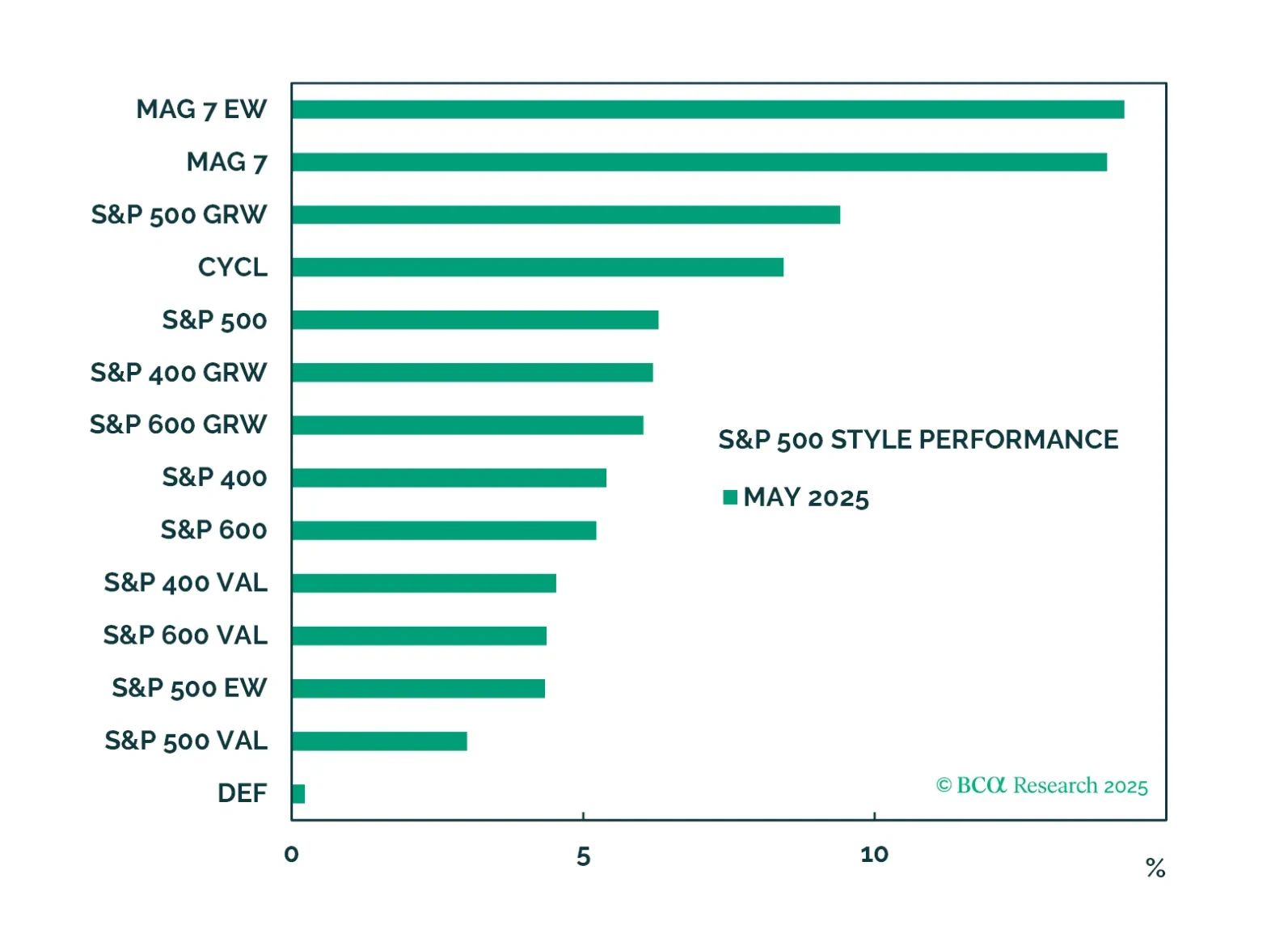

In the front section of the chart pack, we review May’s performance and adjust our portfolio positioning.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

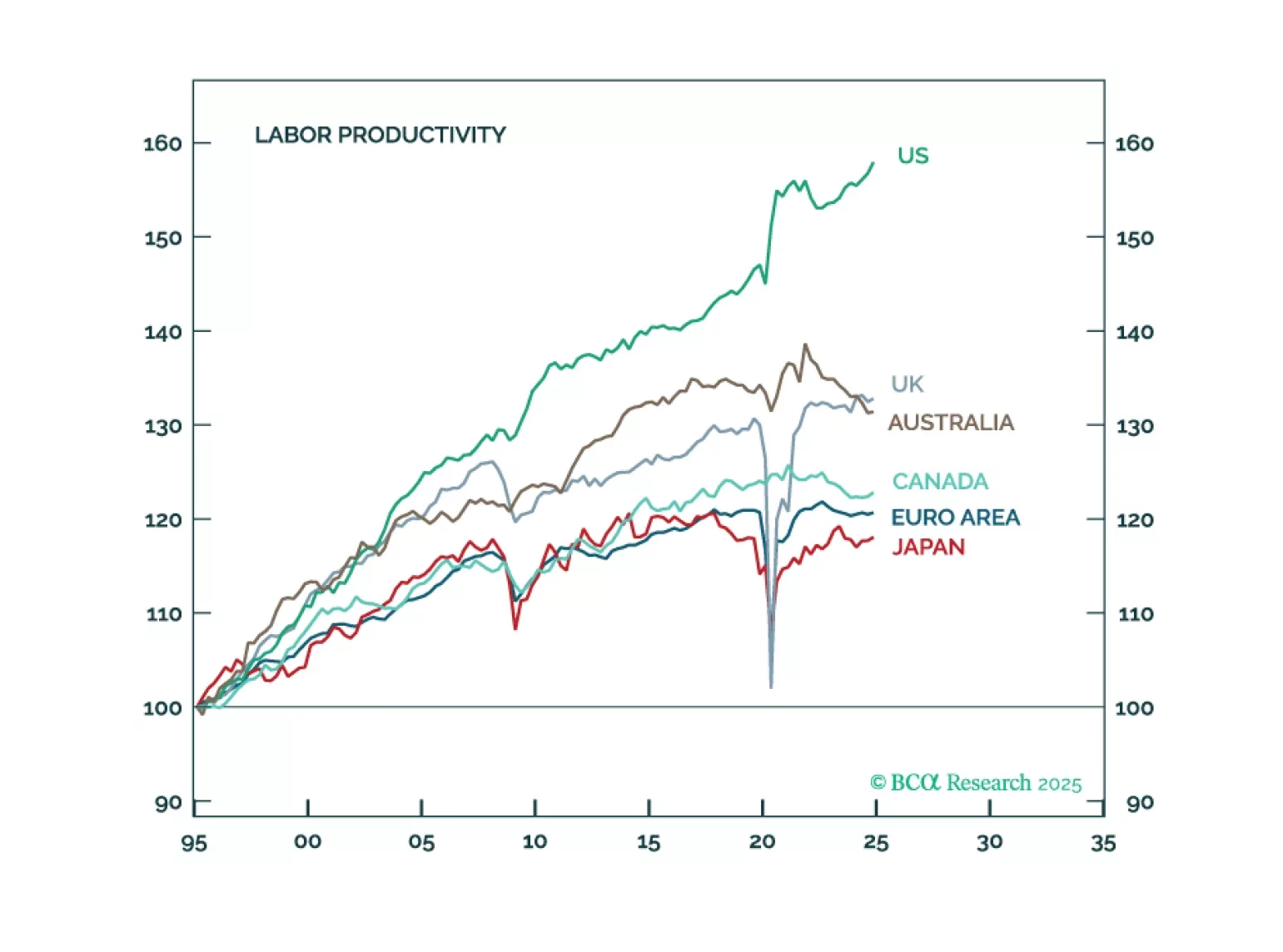

Although the sell-off in the US dollar and relative outperformance of non-US stocks will pause over the coming months as a global recession begins, the fading of US exceptionalism will still cause the dollar to weaken and US stocks…

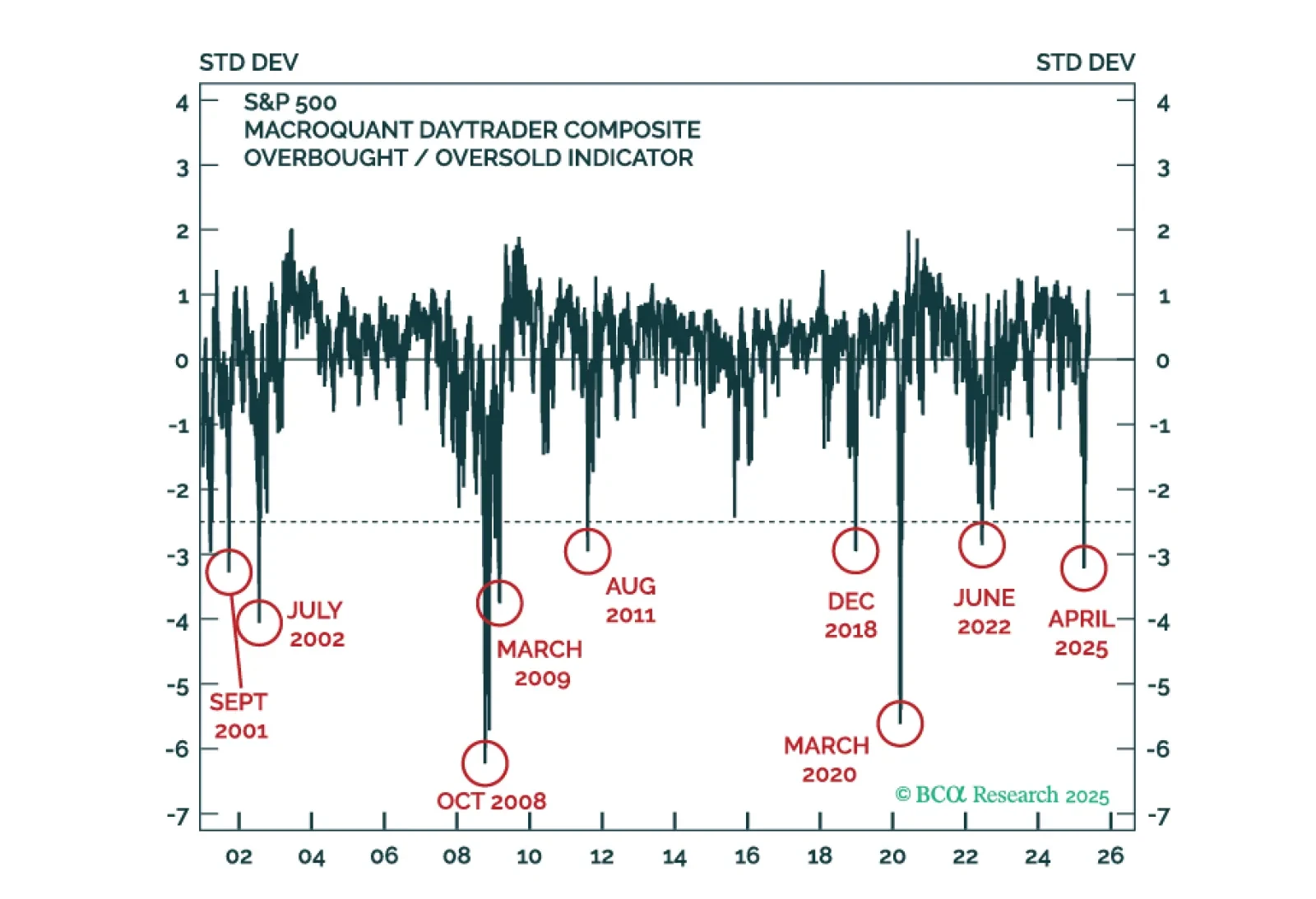

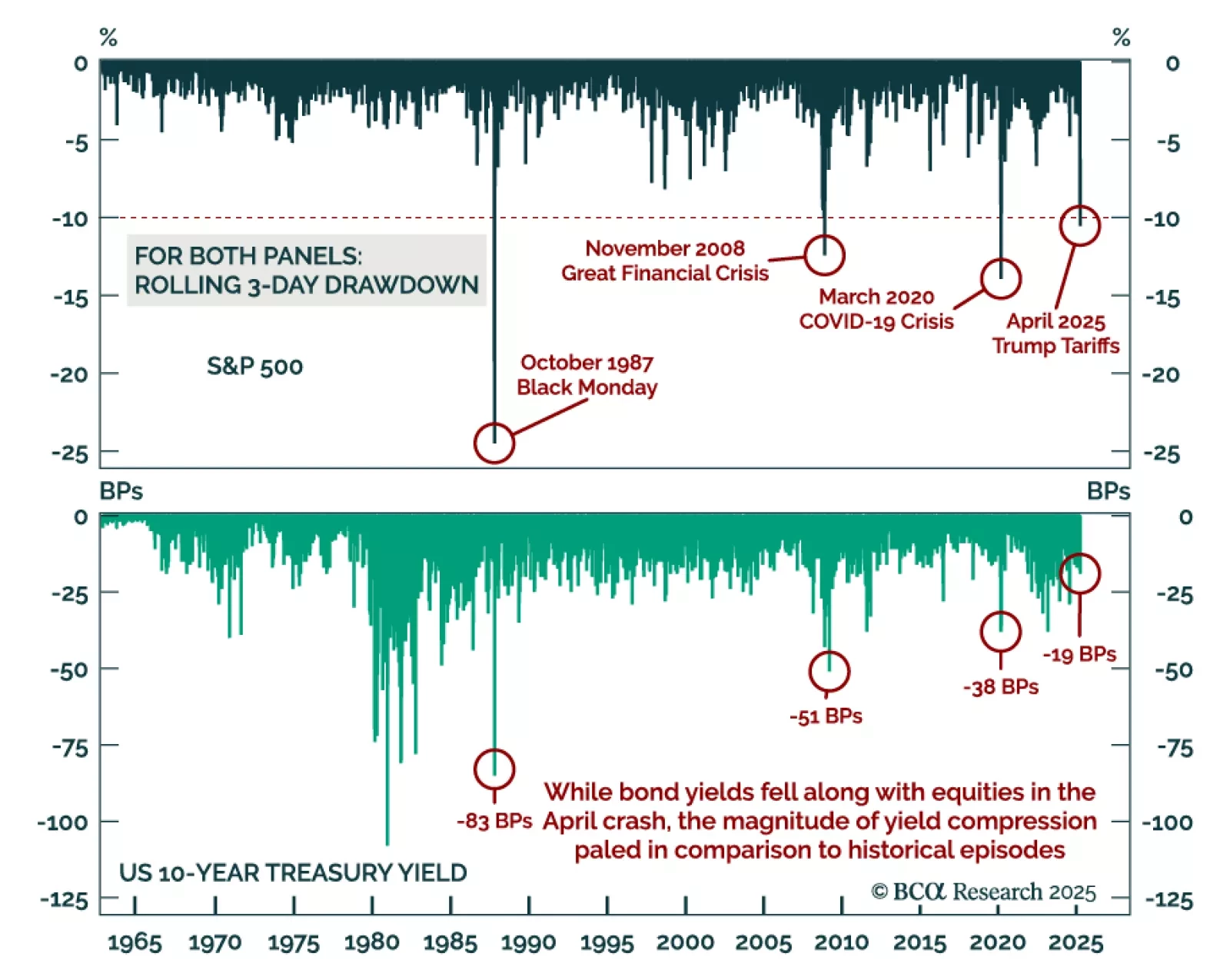

Equities’ post-Liberation Day selloff was historic, but cross-asset signals make it an anomaly. The post-Liberation Day S&P 500’s three-day, 10%+ drawdown joined a list of major episodes that includes the March 2020 COVID-19…

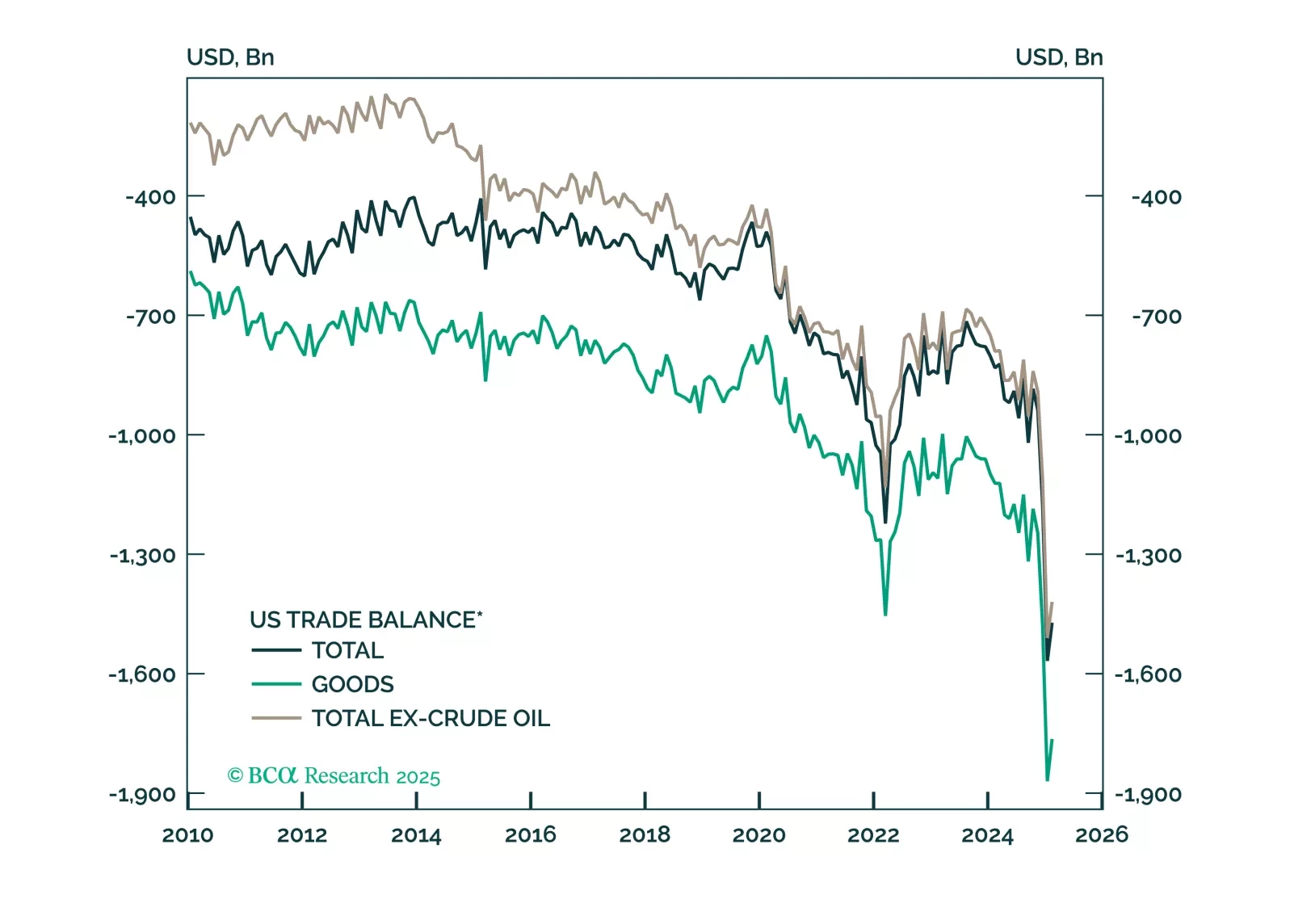

This report looks at the FX implications of the Trump tariffs, and the review of our Q1 trades.