Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

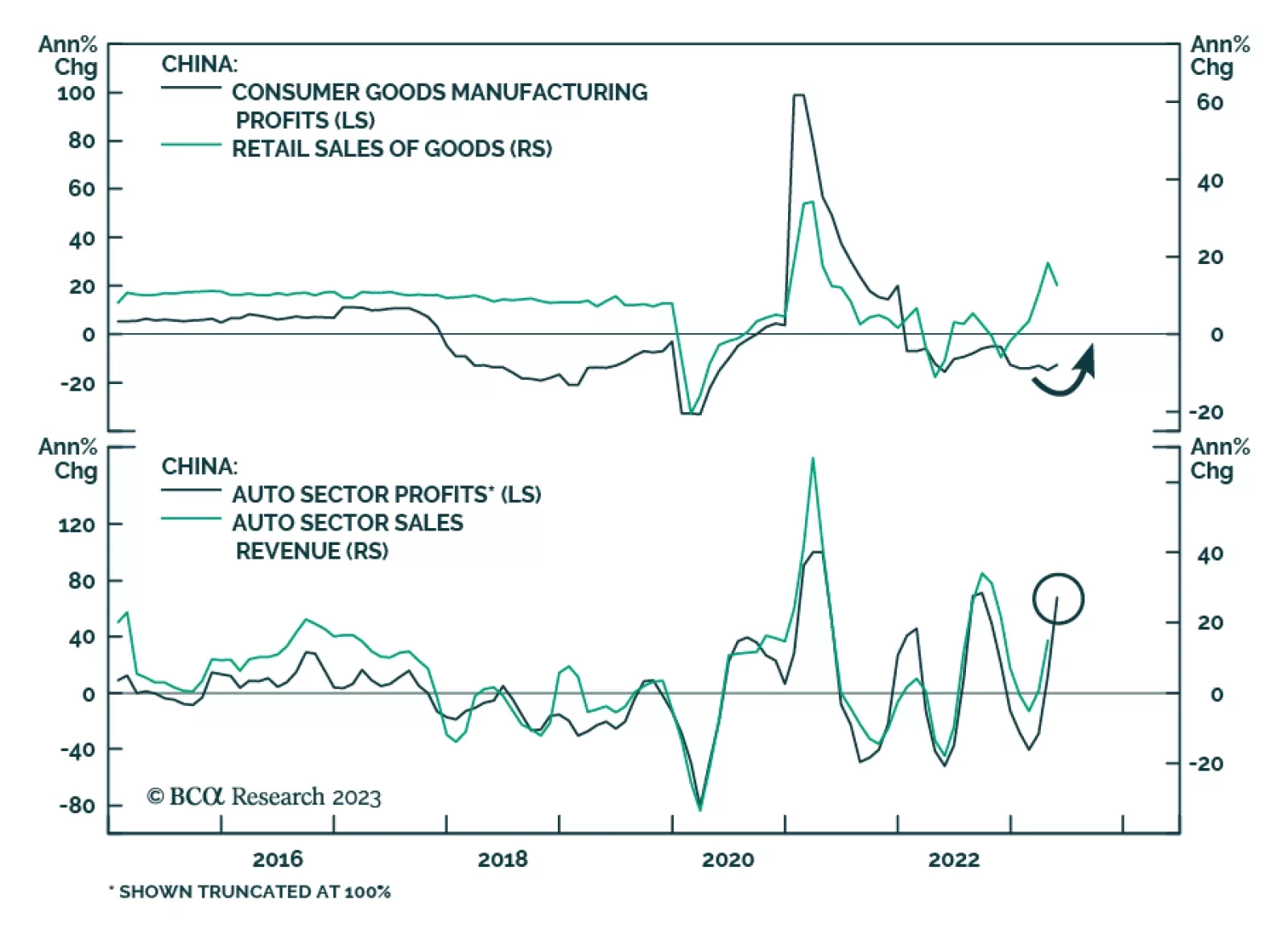

According to BCA Research’s China Investment Strategy service, although the recovery in overall Chinese industrial profits will be subdued, there will be a silver lining among China’s consumer goods producers, autos…

On one hand, China will be exporting deflation to the rest of the world. On the other hand, core inflation is sticky in the US, making the Fed err on the hawkish side. Altogether, these crosscurrents are creating a toxic mix for risk…

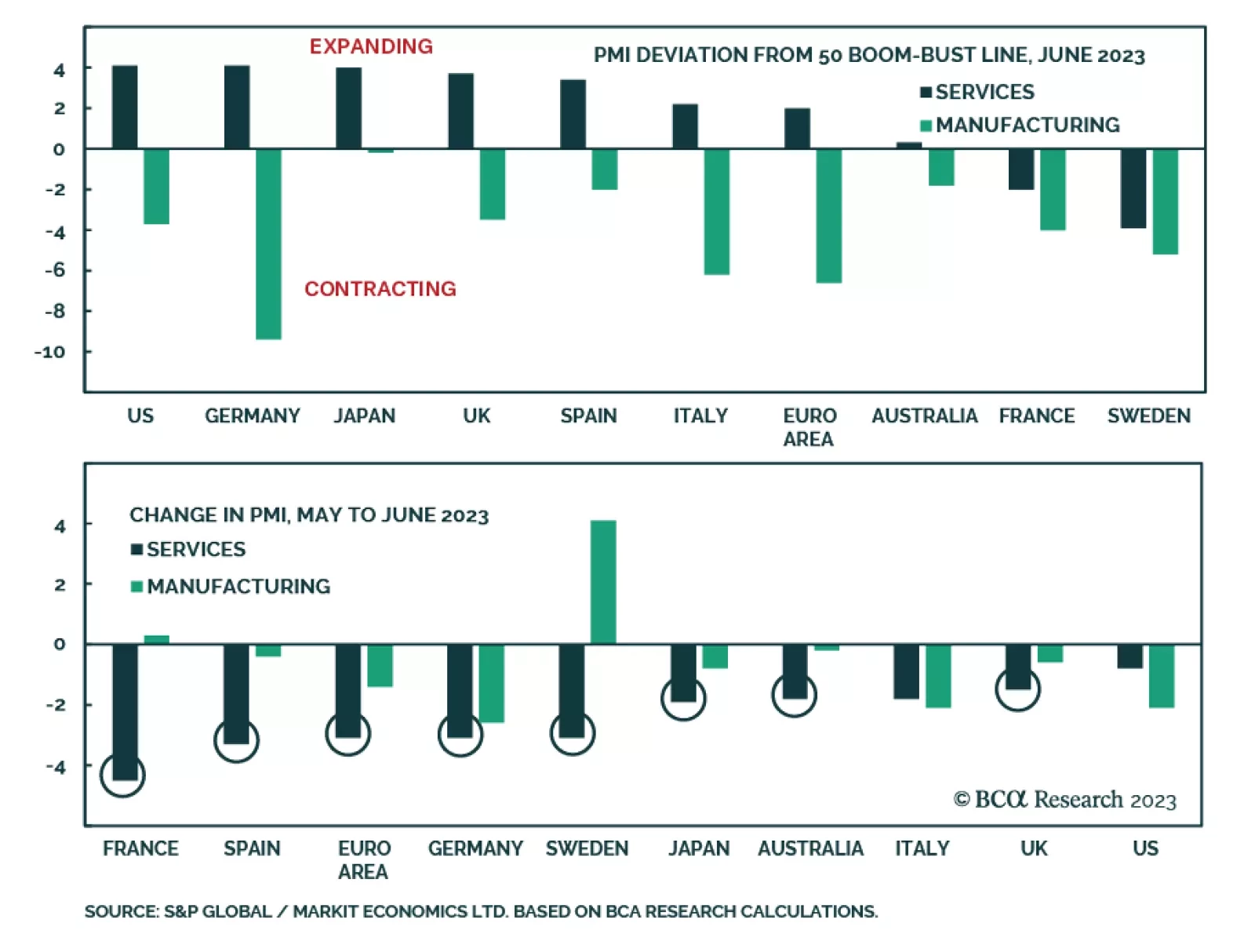

In the past we have highlighted a dichotomy in the global economy characterized by weak manufacturing conditions versus a robust service sector. As goods spending normalized from the pandemic binge, consumption of services…

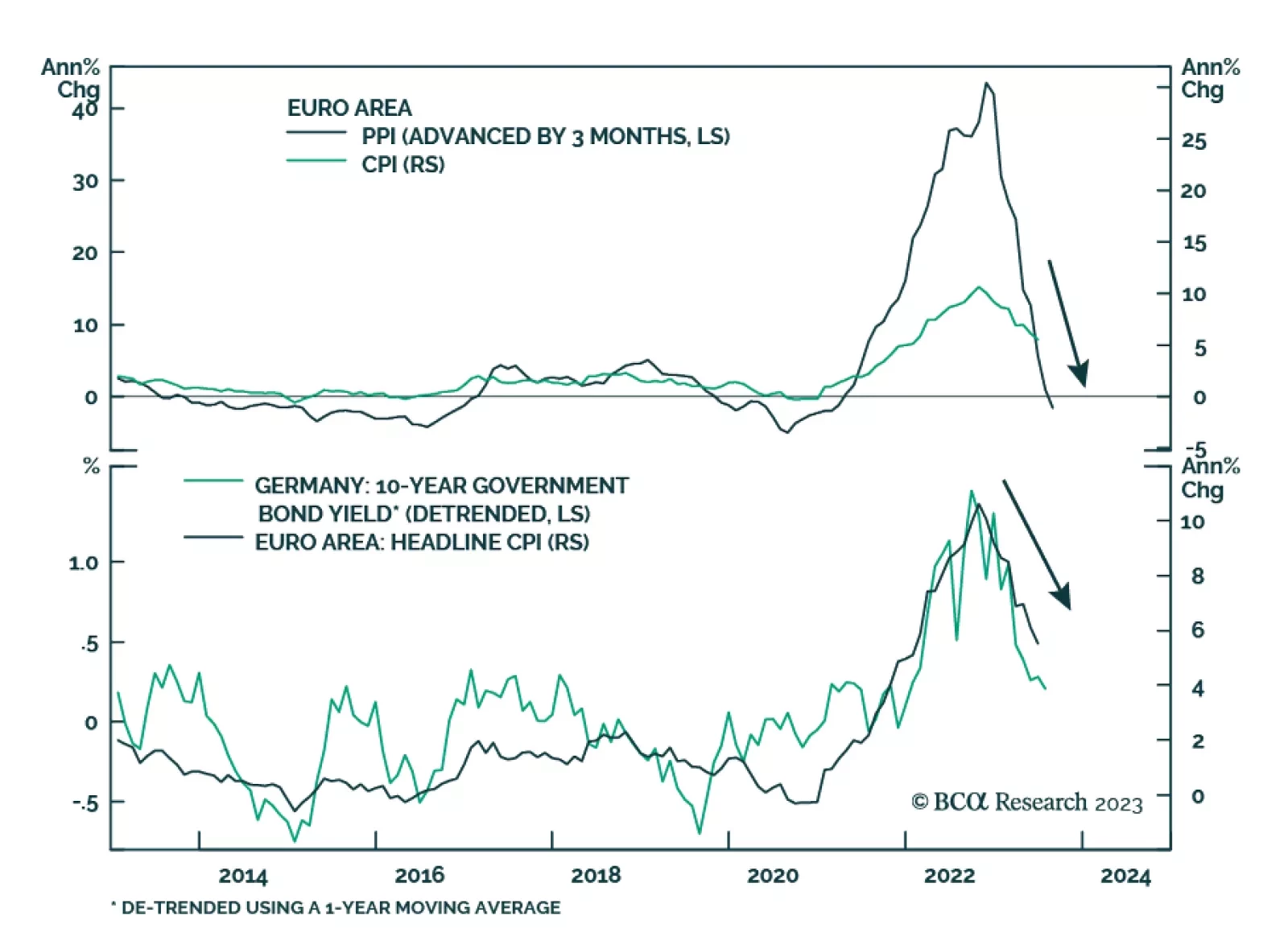

Eurozone producer prices fell by more than anticipated in May. The -1.5% y/y decrease – which marked the first annual drop since December 2020 – was more pronounced than expectations of a -1.3% y/y decline and…

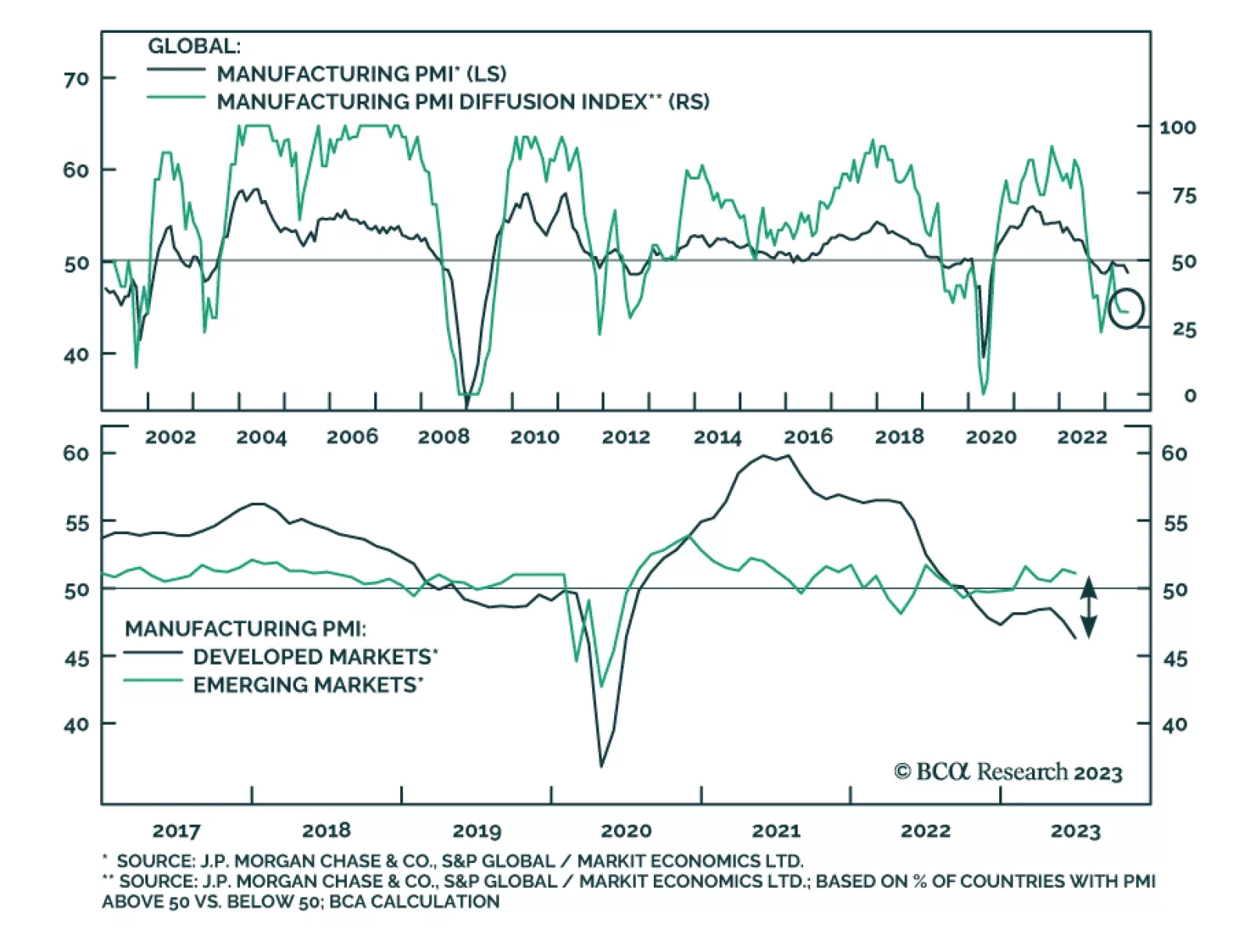

The Global Manufacturing PMI’s 0.8-point decline to a six-month low of 48.8 in June indicates that manufacturing conditions deteriorated at the end of Q2. The forward-looking New Orders and New Export Orders components both…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

The combination of a global manufacturing recession and tight/tightening policy is raising a red flag for global non-TMT stocks. In China, households are entering a liquidity trap, and deflationary pressures are heightening.…

Global non-TMT stocks are at risk of a relapse given worsening conditions in global manufacturing and still hawkish policies from the Fed and ECB. According to the preliminary release, manufacturing PMI new orders for advanced…