We will abandon our recession call if US economic data show clear signs of stabilization over the summer months. For now, that has not happened. Maintain a modest underweight to stocks but look to get more defensive if MacroQuant’s…

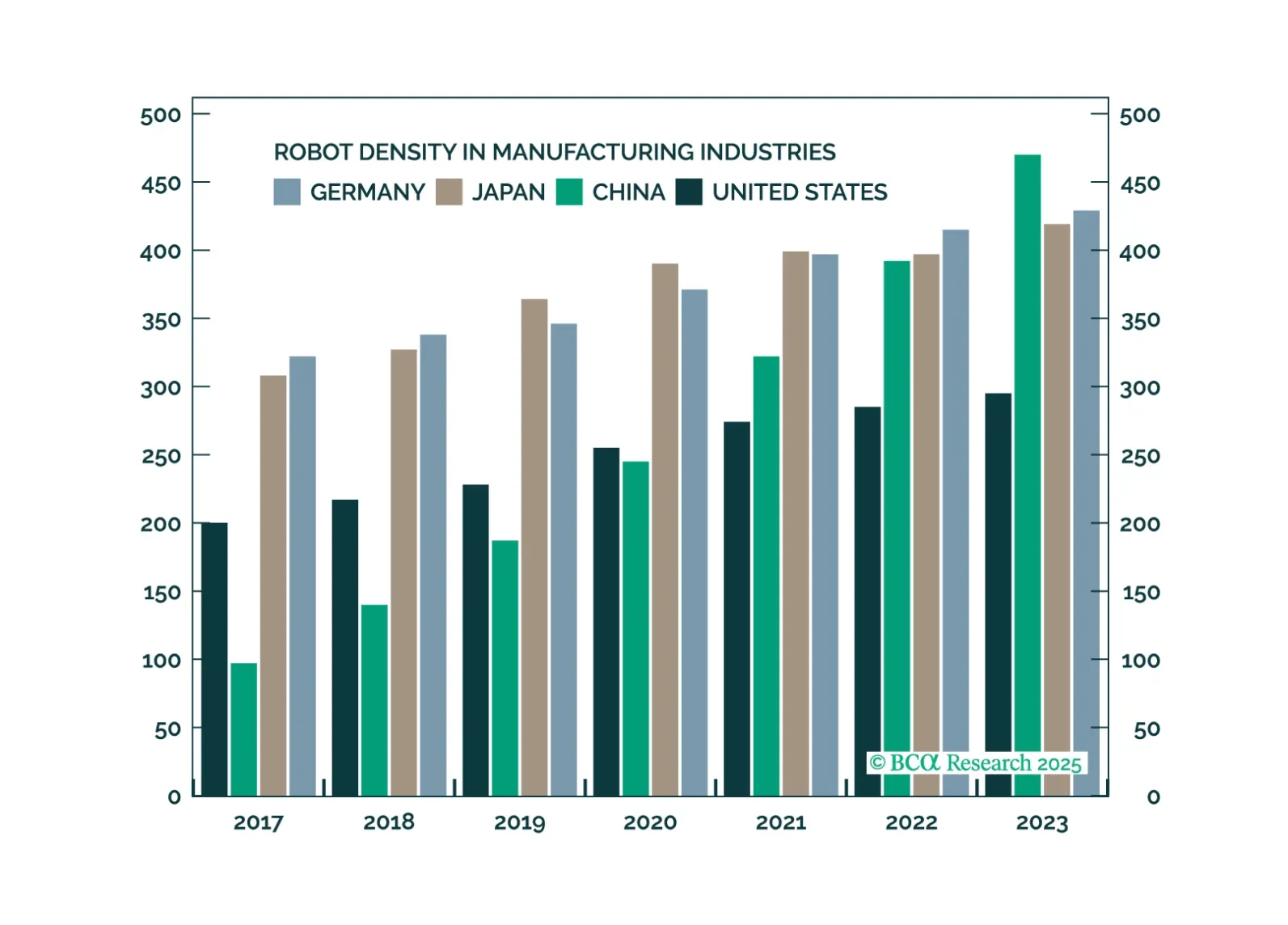

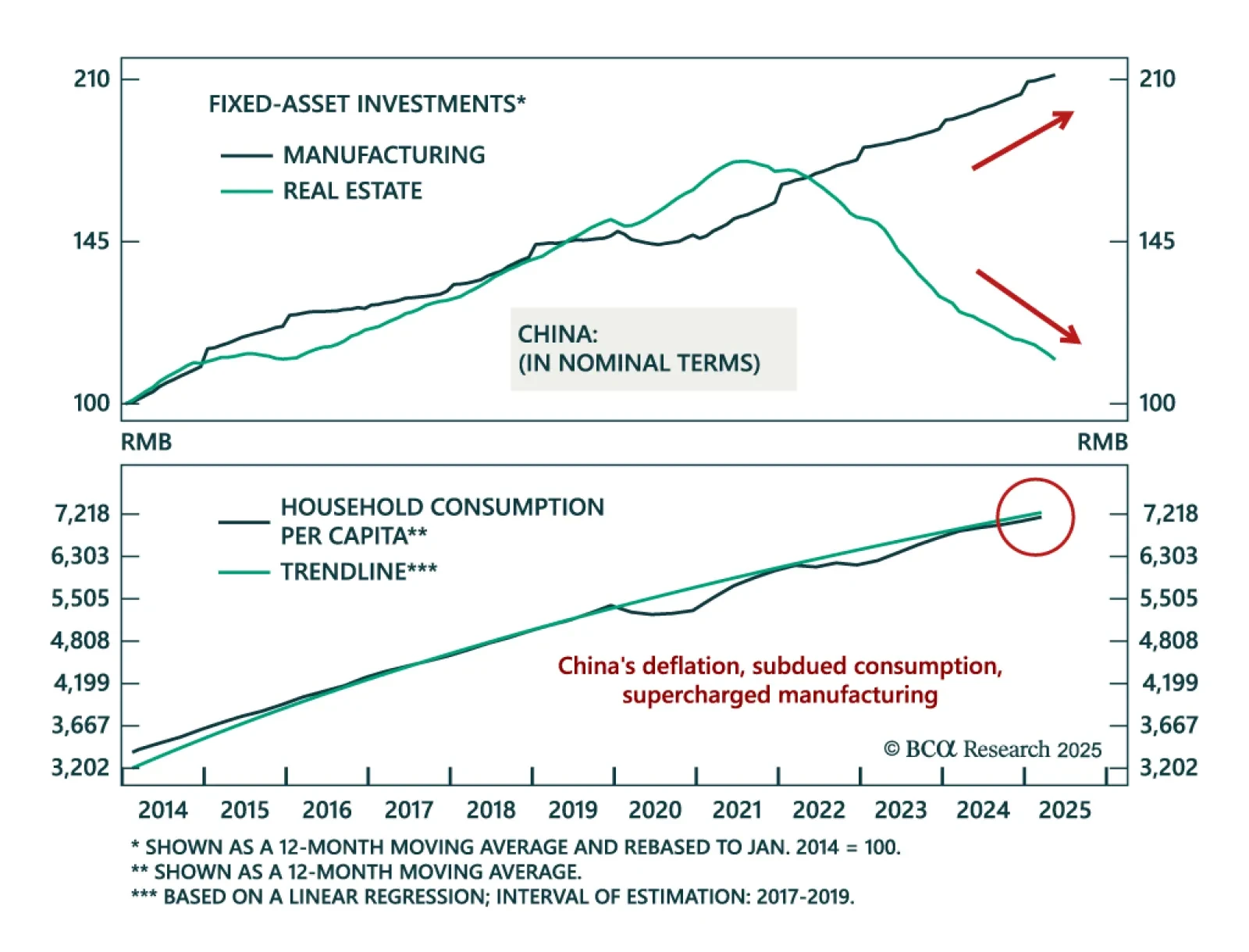

Our China strategists maintain a defensive stance on equities, favoring government bonds and high-dividend sectors as deflation persists. China’s deflationary pressures are supply-driven, with manufacturing capacity expanding faster…

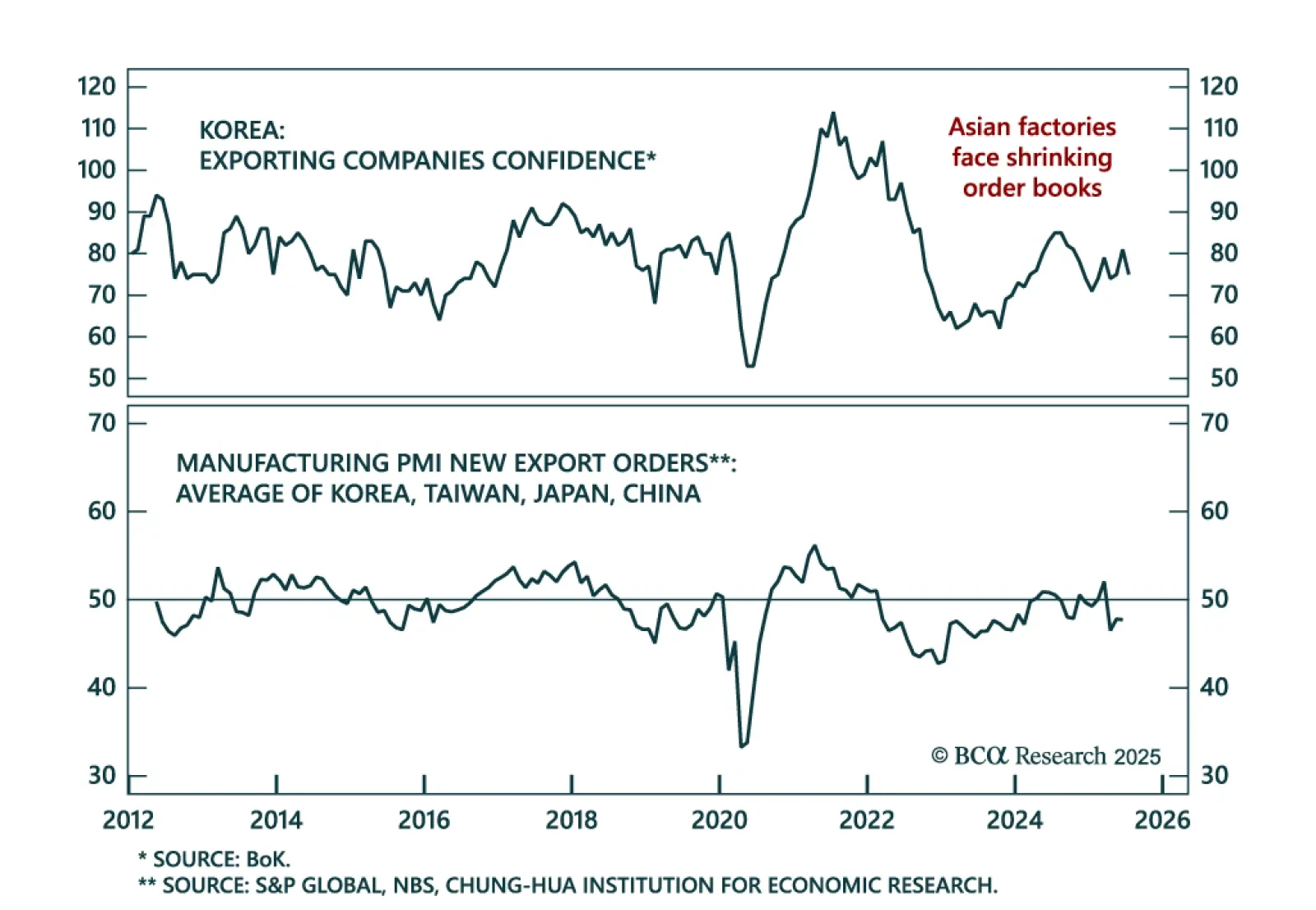

The latest data on Asian exports and manufacturing suggest that the global trade outlook remains downbeat. Korean exports in USD terms grew in June by 4.3% y/y. The three-month moving average is 2.2%. Assuming Q2 export shipments…

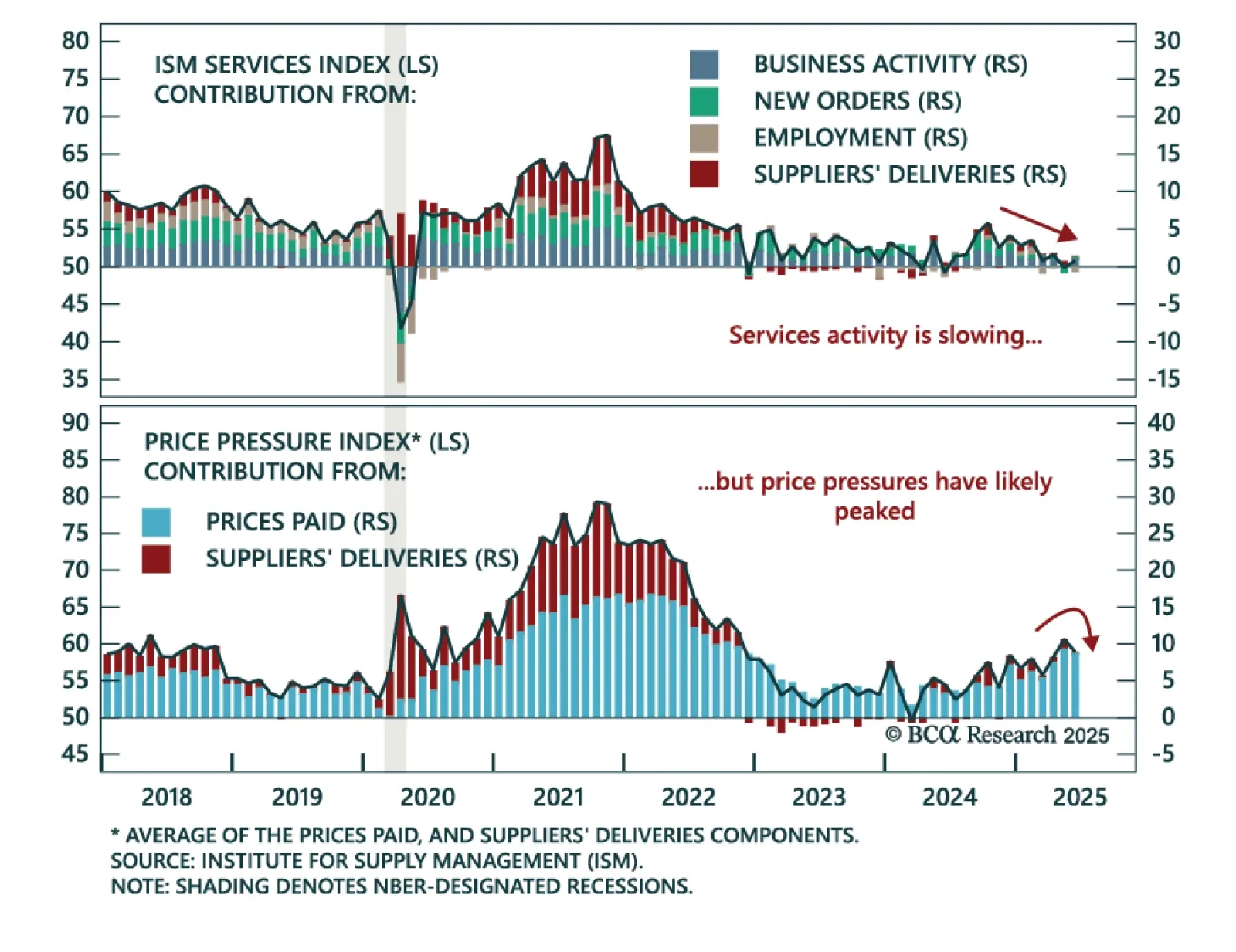

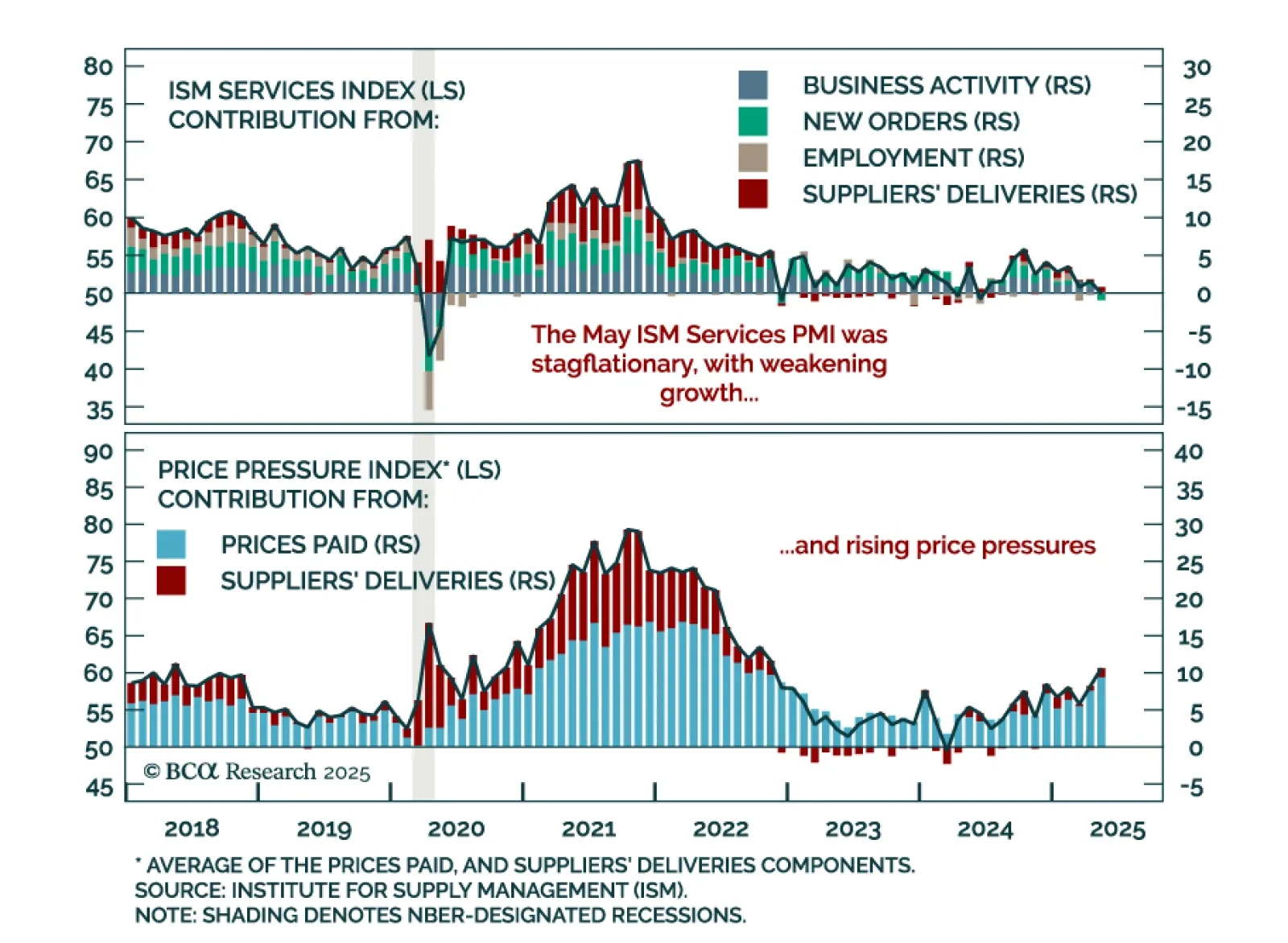

ISM Services data confirm slowing growth and cooling inflation, reinforcing a defensive allocation stance. The index rose slightly to 50.8 in June from 49.9 in May, with new orders rebounding into expansion at 51.3. However, the…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

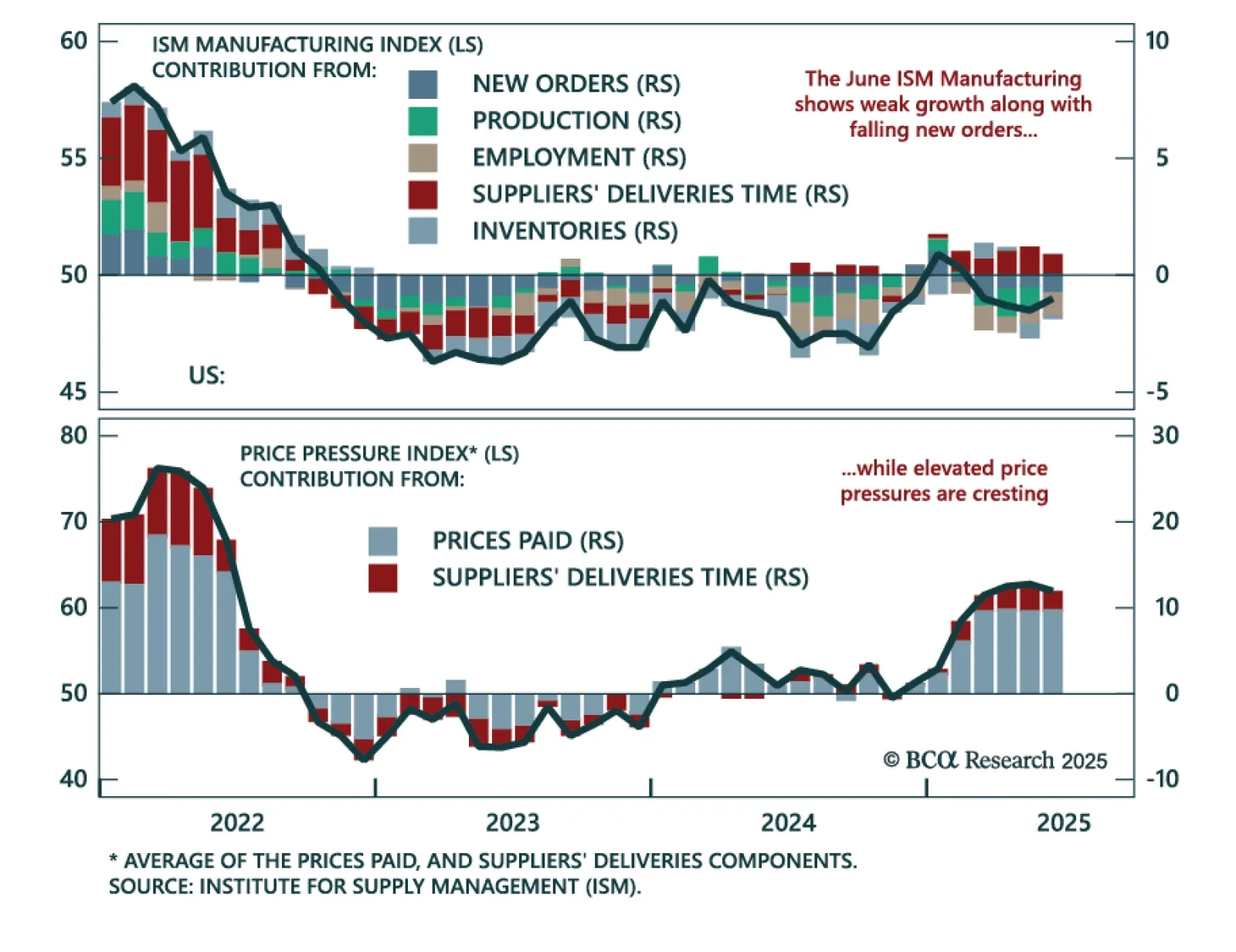

The June ISM points to sluggish US manufacturing and reinforces long duration positioning amid peaking price pressures. The index rose modestly to 49.0 from 48.5 in May, with the rebound driven by slightly higher production and…

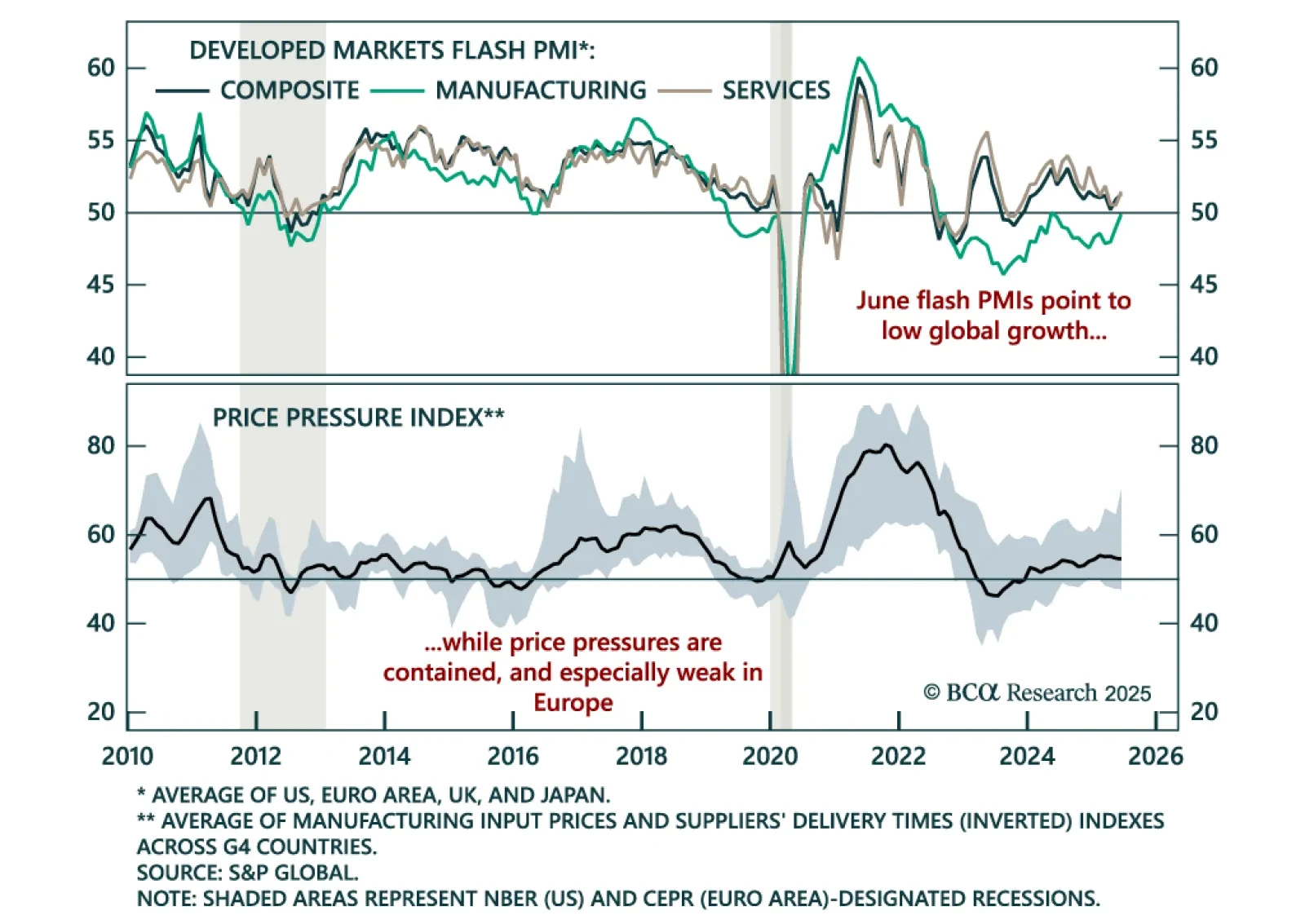

June PMIs confirm low global growth and support a long duration stance as price pressures remain contained. The flash PMIs were mixed across DMs: Sideways in the US and euro area, but firmer in the UK and Japan. Yet the overall…

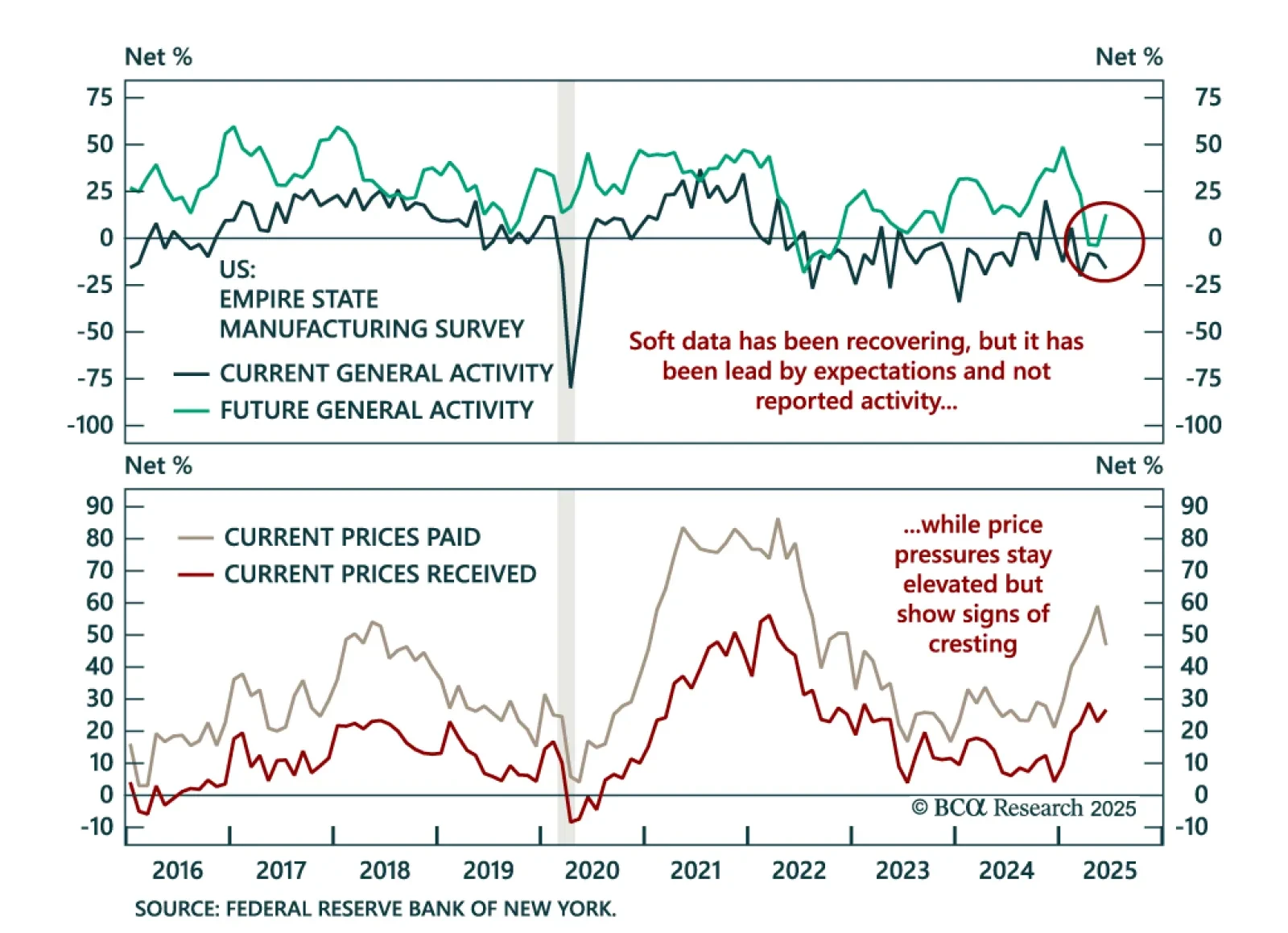

Worsening manufacturing data reinforces our defensive stance as expectations rebound but observed activity continues to deteriorate. The June Empire State Manufacturing Survey fell to -16.0 from -9.2, well below estimates.…

The May ISM Services PMI sent a stagflationary signal, reinforcing the case for defensive positioning. The headline index slipped into contraction at 49.9 from 51.6 in April, missing expectations. New orders collapsed to 46.4 from 52…