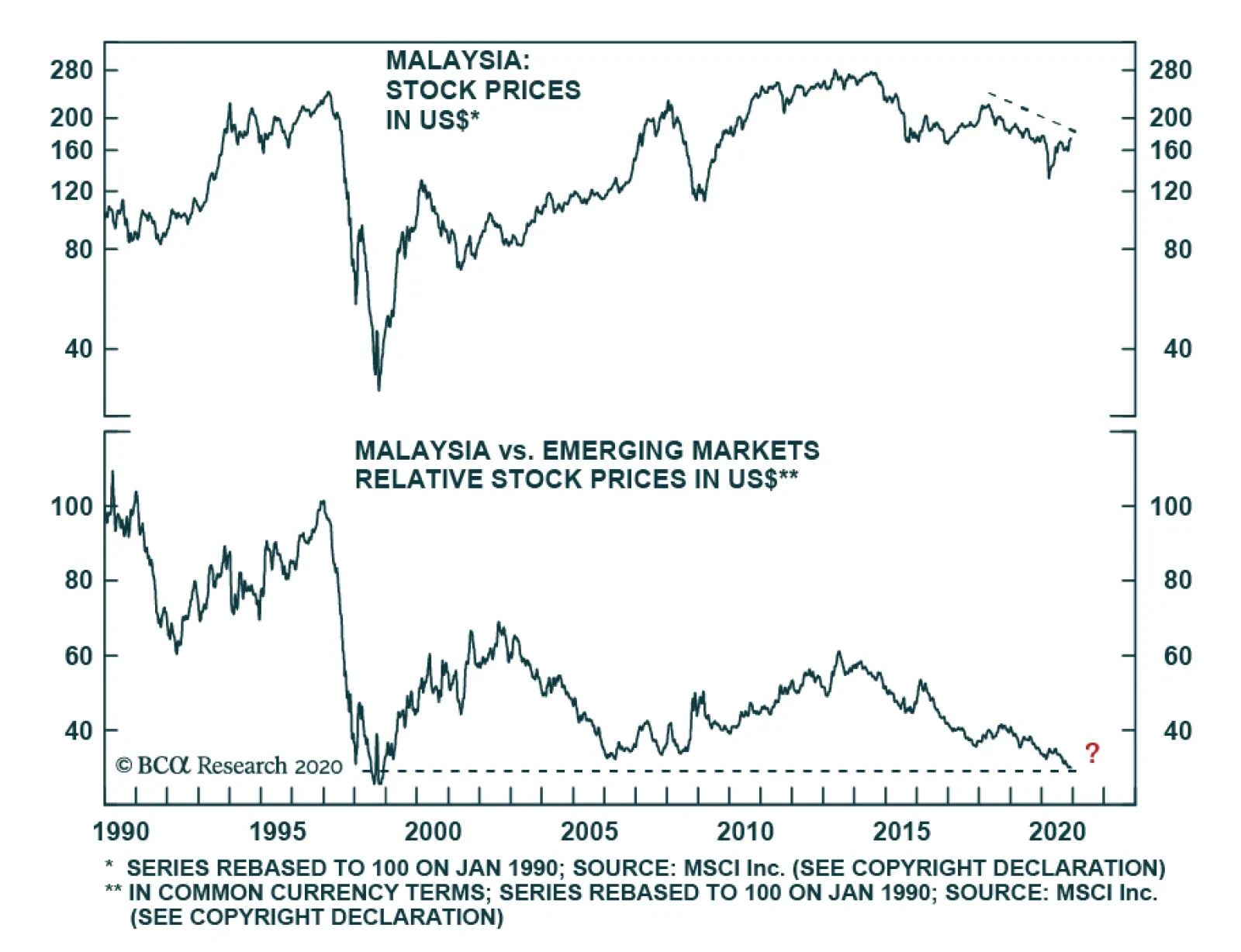

Executive Summary Bull Markets In Malaysian Stocks Are Fully Dependent On Profit Growth The conditions for a major rally/outperformance in Malaysian equities are absent. Profits have been the primary driver of Malaysian…

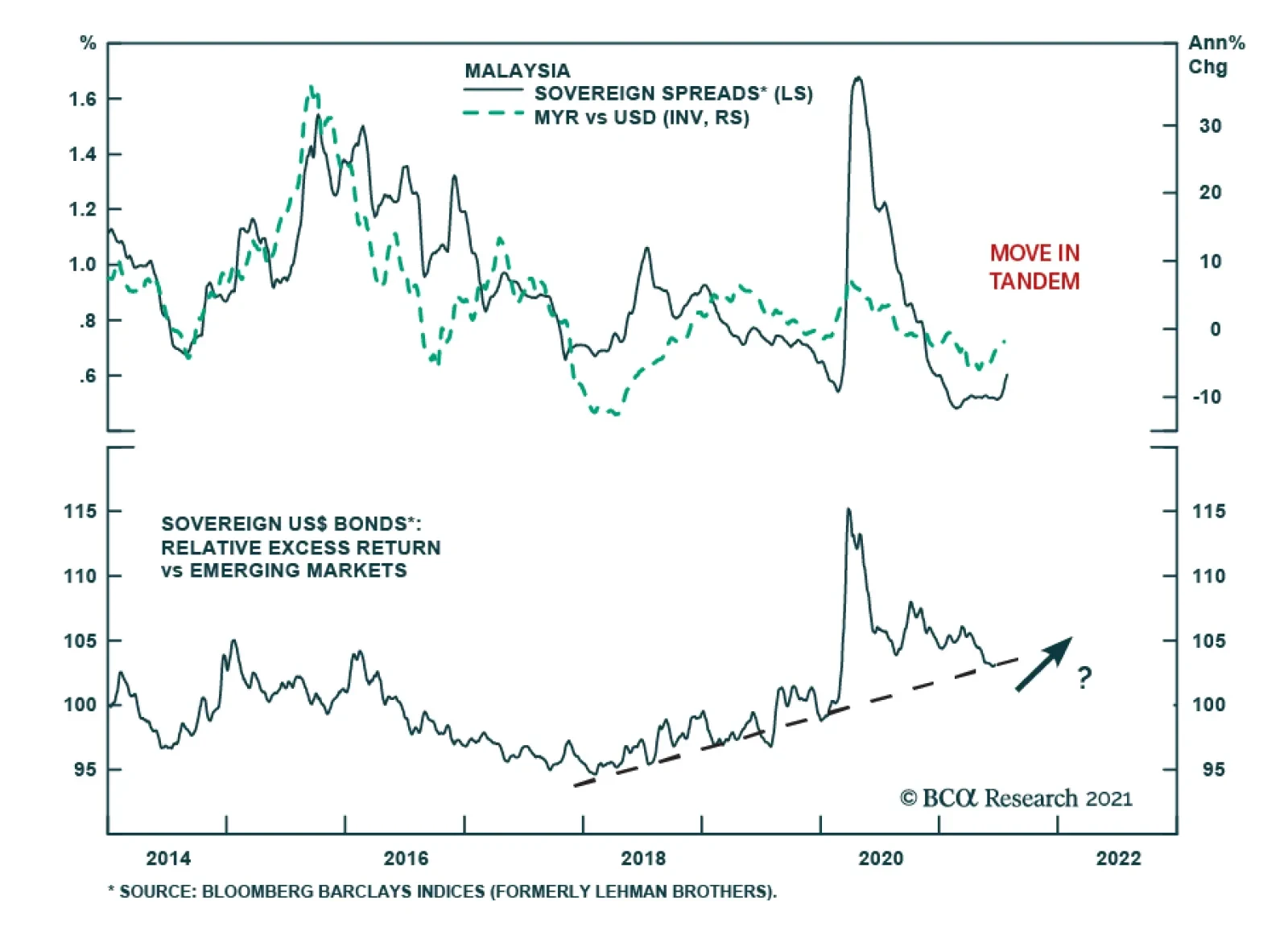

BCA Research’s Emerging Markets Strategy service concludes that dedicated Asian/EM fixed-income investors should continue to overweight Malaysia in both EM local currency and sovereign bond portfolios. First, statutory…

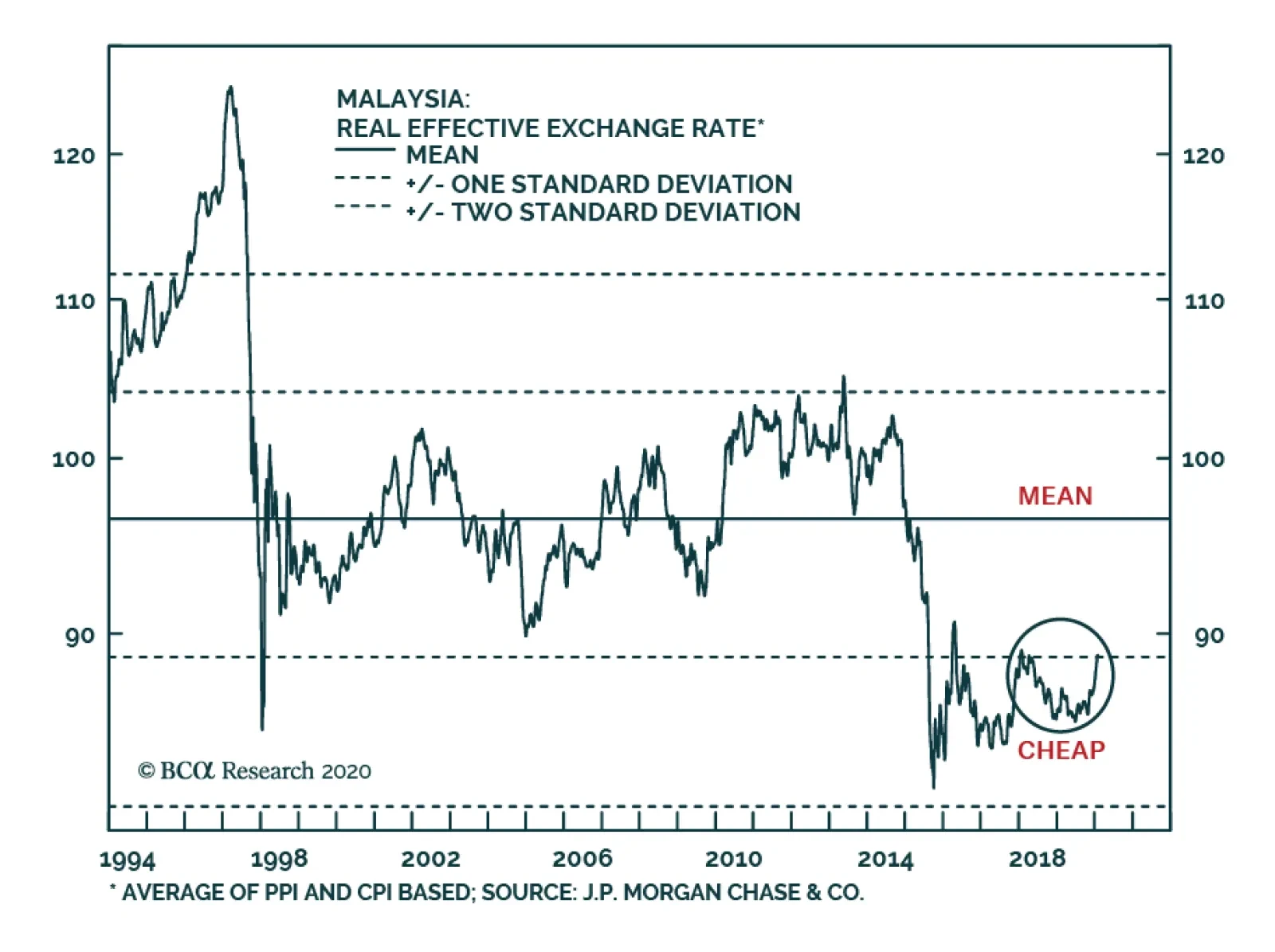

Highlights The Malaysian economy is struggling. The latest surge in Covid-19 cases will further hamper the recovery. Shrinking employment and household incomes are accentuating deflationary forces. Fiscal support will be elusive…

According to BCA Research’s Emerging Markets Strategy service, Malaysian equity underperformance has yet to run its course. Investors should use any rally from oversold positions to downgrade this bourse to underweight.…

Highlights The prolonged bear market in Malaysian stocks is rooted in a subpar, credit-fueled, consumption-led growth. Years of meagre capital investments has robbed its manufacturing sector of any pricing power. Firms’ already…

Feature In this report, we determine which South and Southeast Asian countries are better equipped to endure the COVID-19 pandemic. Answers to this question combined with our macro fundamental analysis lead us to recommend which…

Yesterday, BCA's Emerging Markets Strategy service argued that ongoing deflationary pressures in Malaysia are bearish for the MYR in the short-term. However, the Malaysian currency will sell off less than other EM currencies. Moreover…

Malaysian businesses and households have been deleveraging. The top panel of Chart I-1 illustrates that commercial banks’ domestic claims on the private sector – both companies and households – relative to nominal GDP…

Highlights Malaysian businesses and households have been deleveraging and the economy risks entering a debt deflation spiral. This macro-backdrop is bond bullish. EM fixed income-dedicated investors should keep an overweight position…

Malaysian interest rates appear elevated given the state of its economy. Deflationary pressures have been intensifying and the central bank will be forced to cut its policy rate. To play this theme, we recommend receiving 2-year swap…