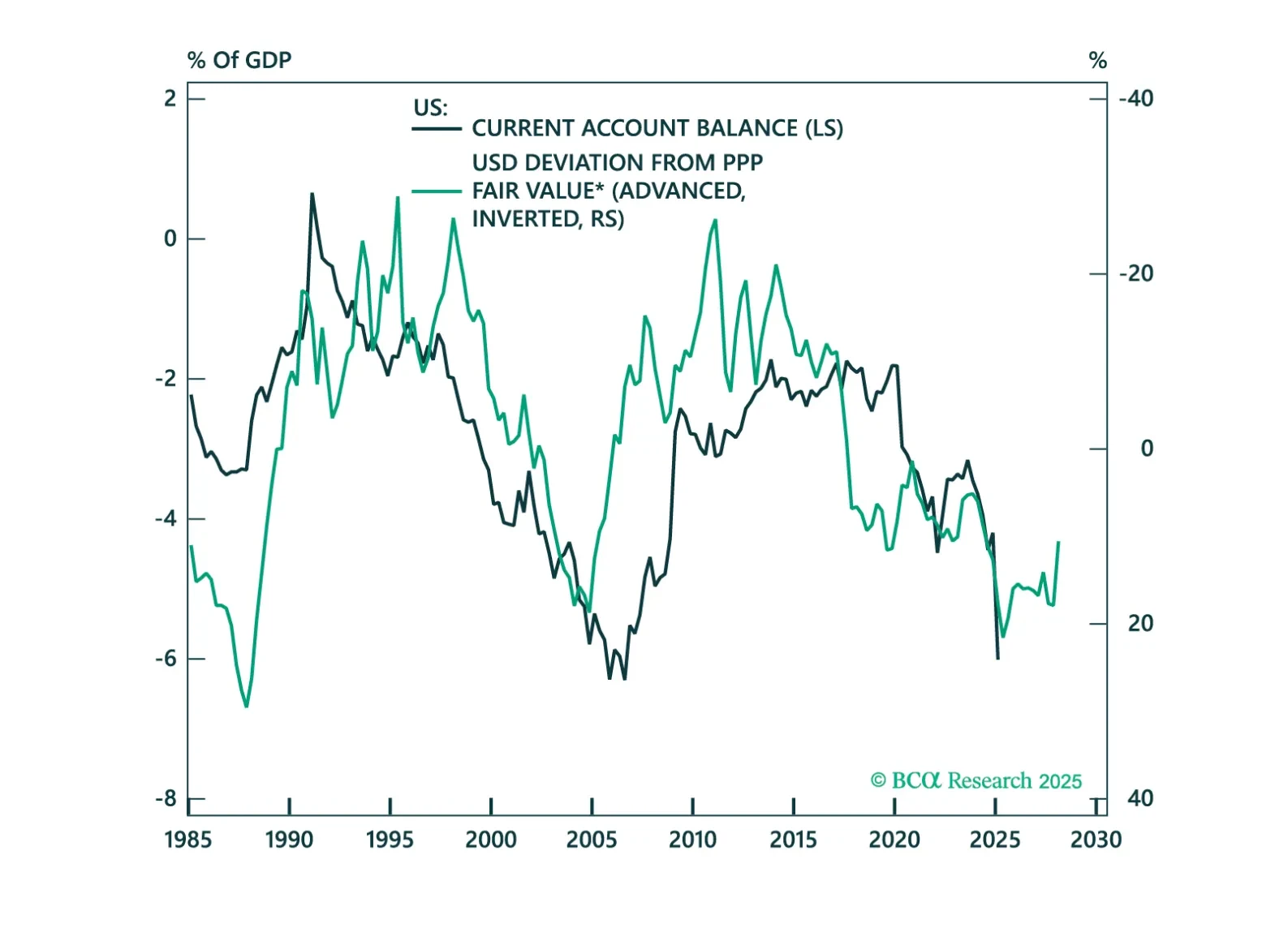

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

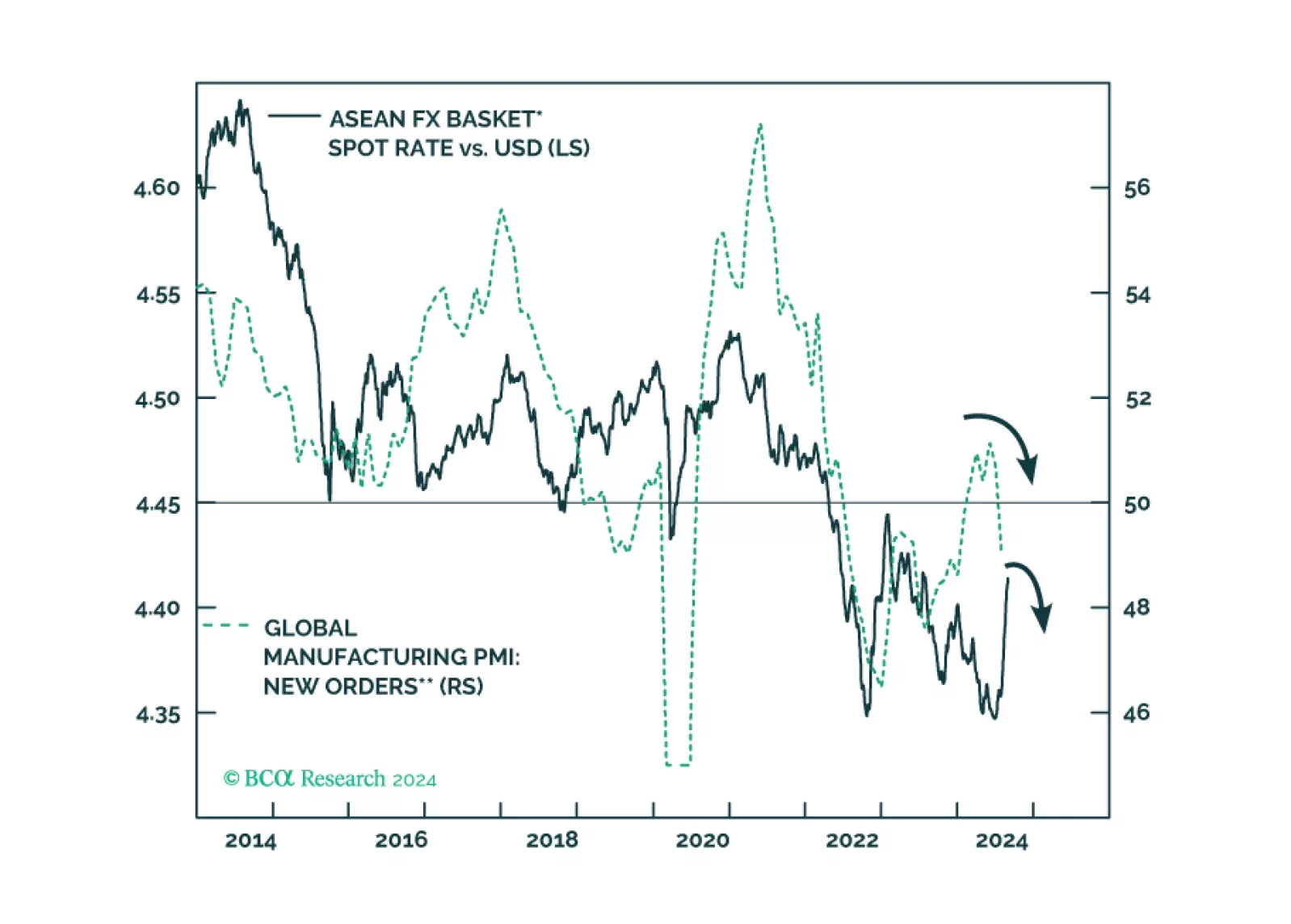

The ongoing rally in ASEAN currencies will fizzle sooner rather than later as they are not supported by fundamentals. The ringgit and the baht, however, will fare better than the peso and the rupiah during the coming global risk-off…

The four ASEAN stock markets (Indonesia, Malaysia, Thailand, and the Philippines) have fallen in absolute terms over the past year despite the powerful rally in the developed markets. They have also underperformed their EM…

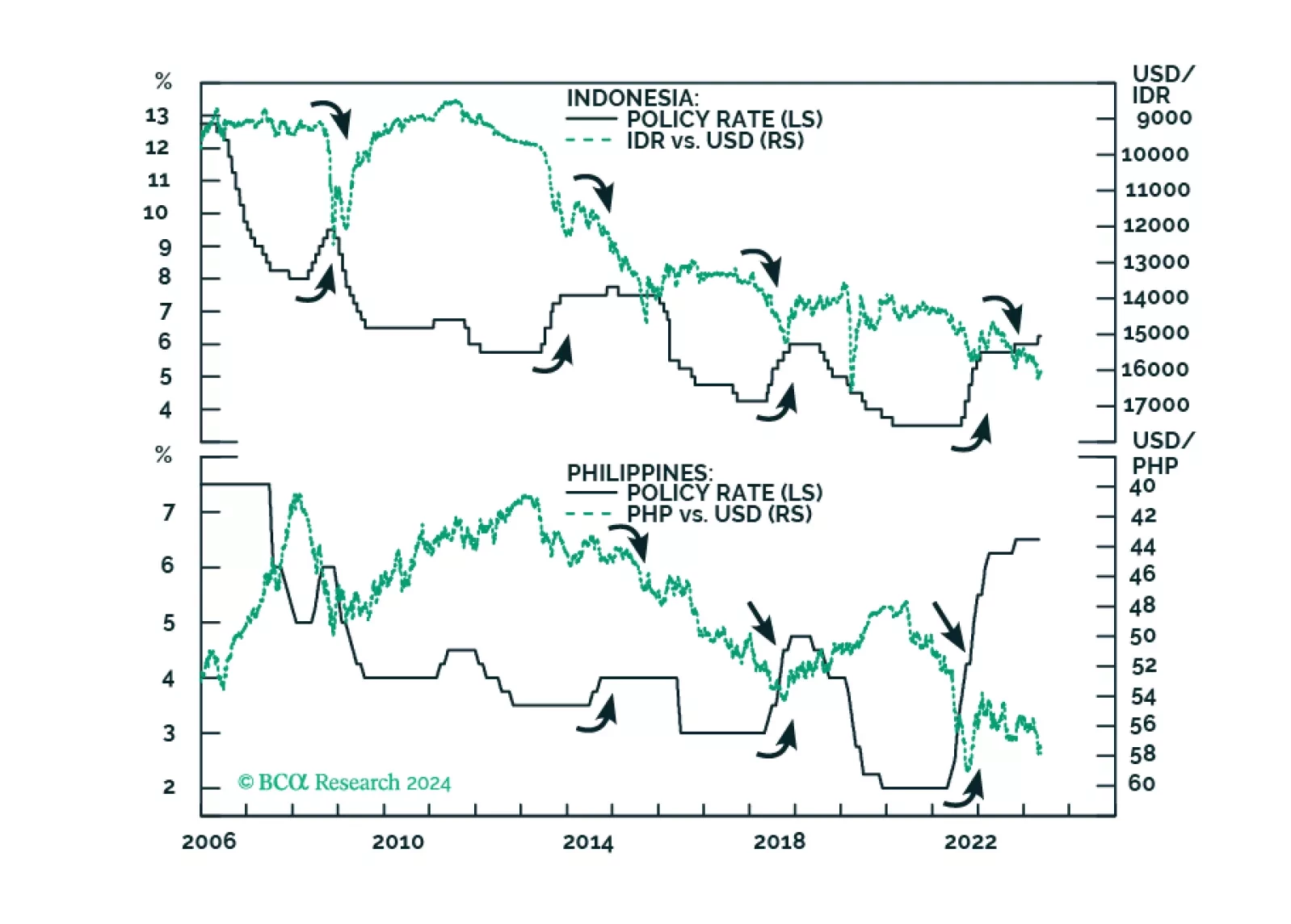

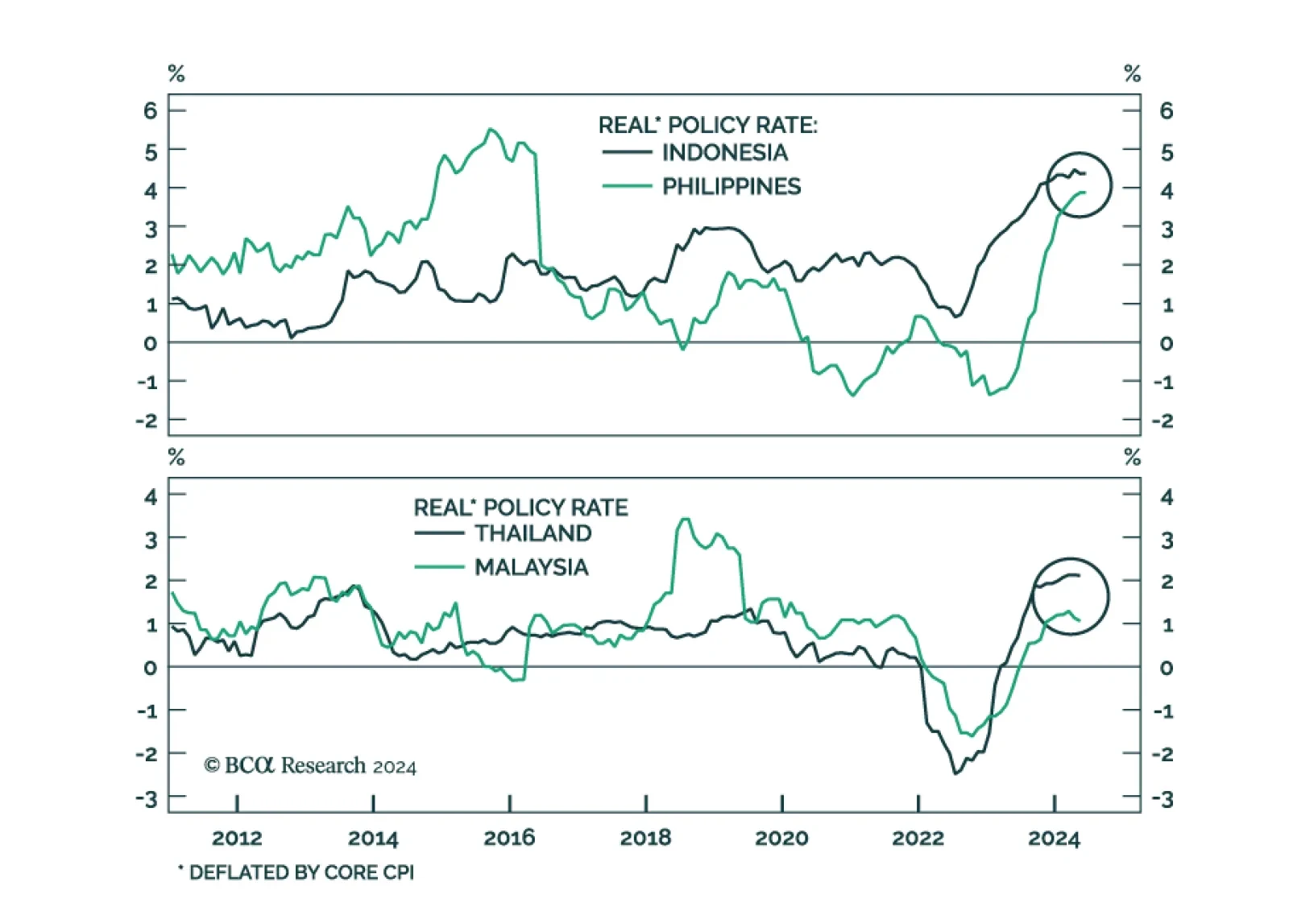

ASEAN stocks and currencies will weaken further as these economies face multiple headwinds. Raising policy rates did not stop a sliding currency in the past, it is unlikely to do so now.

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

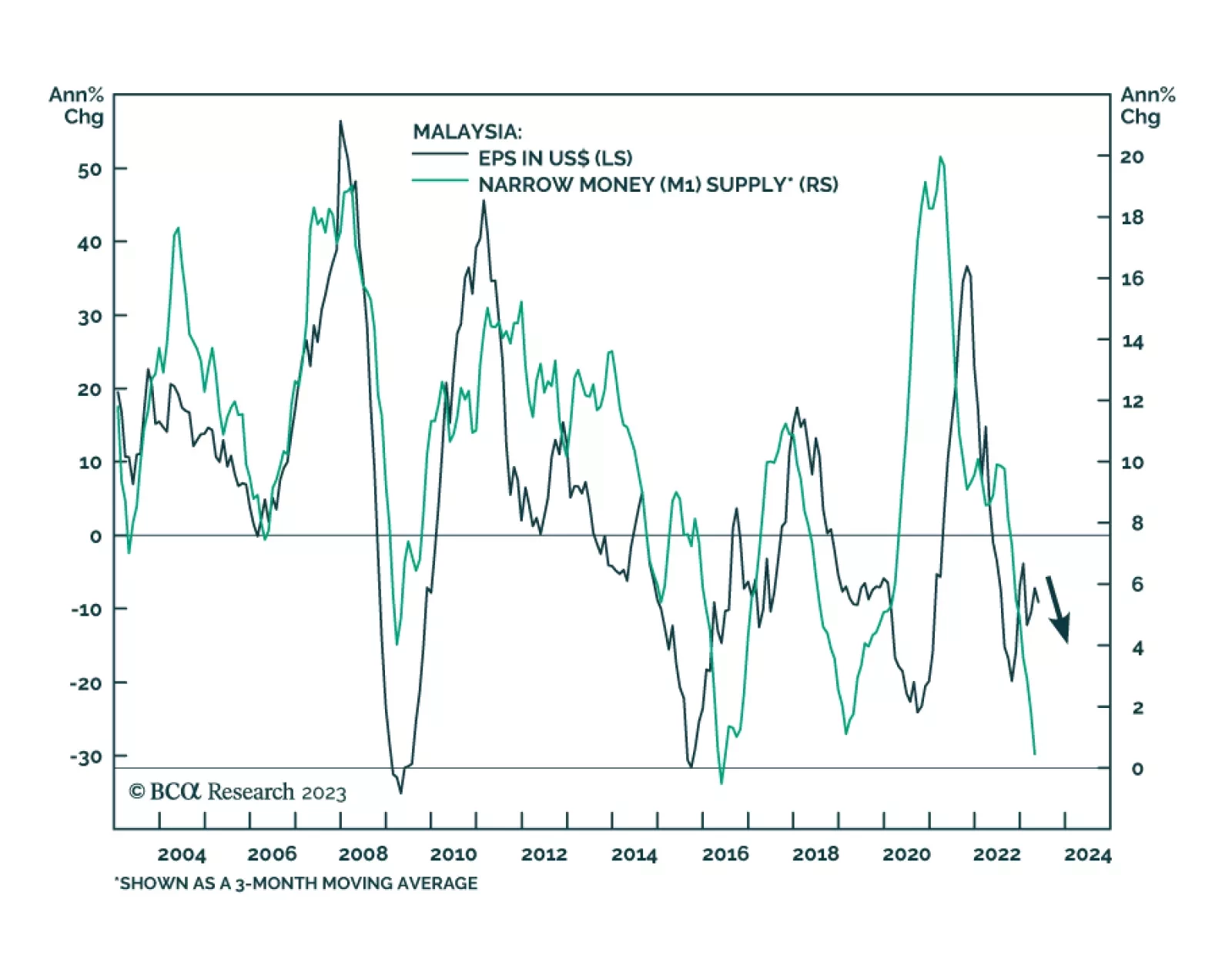

In a recent report, our Emerging Markets Strategy team posited that the bear market in Malaysian stocks will be prolonged. Disinflationary forces have taken hold of the Malaysian economy: money supply has plunged, bond yields…

Malaysian central bank raised policy rates last month. What will it do to Malaysian bank stocks and the overall share market? How about fixed income market?

Executive Summary Profits Collapsed As Sliding Capex Decimated Manufacturing Competitiveness Malaysian stocks’ continued weakness despite the country’s surging trade surplus is symptomatic of a structural…